Do citizens consider the pension system fair, and what would they like to change? How well do Ukrainians understand the pension calculation formula and the factors that affect the pension sum? How confident are citizens that the pension system will be able to provide them with a decent life in old age? What do people think about the introduction of mandatory funded pensions? We can answer these and other questions with the results of a nationwide survey on social policy in Ukraine.

This study was conducted in January 2024 by the KSE Institute in partnership with the research agency Info Sapiens at the request of the Ministry of Social Policy and with the support of UNICEF Ukraine. A total of 2,047 people (1,157 women and 890 men) over 18 participated in the survey.

Number of pensioners and pension sums in Ukraine

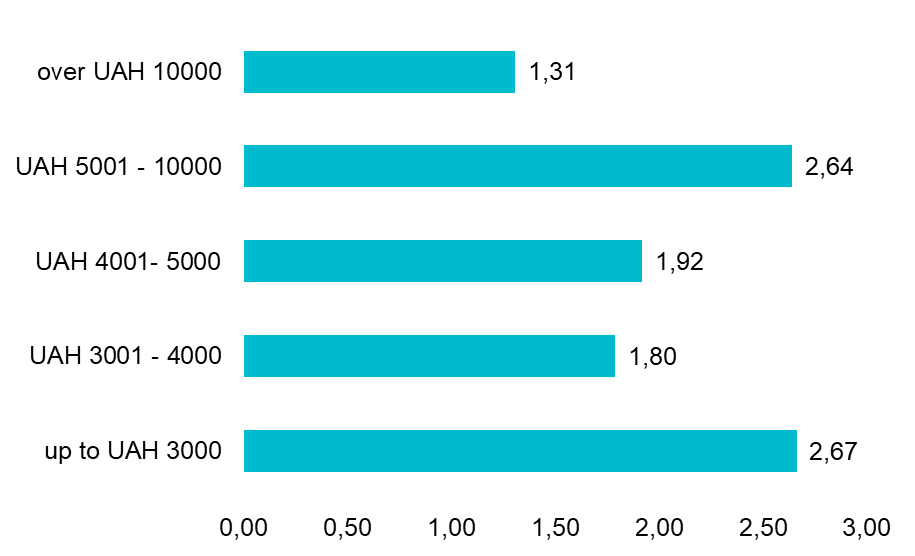

As of October 1, 2024, according to the Pension Fund of Ukraine (PFU), the total number of pensioners in Ukraine was 10.3 million, with an average monthly pension of UAH 5,852 or USD 147.3. The minimum pension is UAH 2,361 or USD 59.4, corresponding to one subsistence minimum for those unable to work, while the maximum pension can reach UAH 23,610 or USD 594.4 (10 subsistence minimums, excluding special cases defined by law). Approximately 30% of pensioners receive a pension not exceeding UAH 3,000 or USD 75.5, with an average of UAH 2,762 or USD 69.5. The number of pensioners receiving more than UAH 10,000 or USD 251.8 is almost three times lower, and their average pension is UAH 15,354 or USD 386.6 (Figure 1).

Figure 1. Distribution of pensioners by the sum of monthly pension as of October 1, 2024, million persons

Source: Pension Fund of Ukraine

Most pensions are funded through social security contributions (SSC) paid by employers, self-employed individuals, and individual entrepreneurs. Employers pay SSC for their employees at a rate of 22% of the payroll fund from their own funds. Of this 22%, approximately 86% is allocated to pensions. Self-employed people and individual entrepreneurs pay SSC independently, based on the minimum wage, if they do not have employees.

Due to the full-scale invasion, about 14.2% of the population is unemployed. The number of officially employed people in Ukraine declines. According to the Pension Fund of Ukraine, the number of insured persons (SSC payers) decreased by 103,000 during January-June 2024, reaching 10.7 million as of July 1. As a result, the ratio of insured persons to pensioners has reached 1:1, meaning one working person supports the pension of one retiree (this ratio has remained at a low level—around 1.1—for more than a decade).

The reasons for the problematic support ratio include, on the one hand, a shortage of workers due to high unemployment and a reduction in the workforce caused by the full-scale invasion. The war resulted in emigration of predominantly working-age individuals, death and disabilities of a part of the working population. On the other hand, some people tend to avoid paying SSC: firstly because they do not believe that they will receive pension covering at least basic needs in the future, and secondly since they have opportunities to avoid paying it. Few people will voluntarily pay taxes and SSC if they can avoid it.

Structure of the pension system and main conditions for pension entitlement

According to Article 2 of the Law “On Mandatory State Pension Insurance”, Ukraine’s pension system has three levels:

The first level is the pay-as-you-go system, wherees working population contributes to the Pension Fund, which pays pensions to current retirees. The Pension Fund provides old-age pensions, disability pensions, and subsistence pensions. There are also special pensions for certain categories of people paid from state or local budgets.

The second level is the mandatory funded pension system, which involves mandatory individual contributions to the state accumulative fund or non-state pension funds to receive payments upon reaching retirement age.

The third level is the voluntary funded pension system, which includes contributions from citizens or employers to form additional pension benefits.

Ukraine has the first and third levels of the pension system, while the government is still considering the introduction of a mandatory funded pension system. The main challenge is financing pensions during the transition period when pension payments remain at the same level, but the amount transferred to the Pension fund will decrease due to allocation of a part of SSC to individual retirement accounts. Additionally, there are very few assets in Ukraine suitable for investing pension savings, and the risks associated with such investments are high, especially during wartime.

Ukrainians are eligible to old-age pensions after reaching a certain age if they have worked a required number of years:

- At age 60 with at least 31 years of SSC payments (the required working period increases by 1 year annually and will reach 35 years by 2028);

- At age 63 if an individual has paid SSC for at least 24 years;

- At age 65 with at least 15 years SSC payments (if a person has less work experience, they will receive a subsistence pension).

Old-age pensions before age 60 are granted to individuals who worked in particularly hazardous and arduous conditions, mothers with more than three children, mothers of children with disabilities, combat veterans, family members of the deceased, those dismissed shortly before retirement age, victims of the Chornobyl disaster, and those who helped minimize its consequences.

The sum of old-age pension in Ukraine is calculated for each person based on the duration of SSC payments by this person and the salary on which these contributions were based. The calculation is made using the ratio of a person’s salary over their working years to the average wage in Ukraine for the last three calendar years at the time of retirement.

The formula for calculating the old-age pension:

P = AS × IEC, where

P is the pension amount in the national currency (UAH),

AS is the average salary used for calculating contributions (determined in accordance with Article 40),

IEC is the insurance experience coefficient, which reflects the number of years and months contributions were made.

The insurance experience coefficient (IEC) indicates the portion of the average salary a pensioner will receive. It is calculated using the formula:

IEC = (ME × VE) / (100% × 12), where

ME is the number of months of insurance experience,

VE is the value of one year of insurance experience (1% for PAYG system).

The maximum insurance experience coefficient (IEC) cannot exceed 0.75 (75% of the average salary). However, for individuals who worked in underground or hazardous conditions, it can be as high as 0.85 (85%).

How do respondents evaluate the pension system?

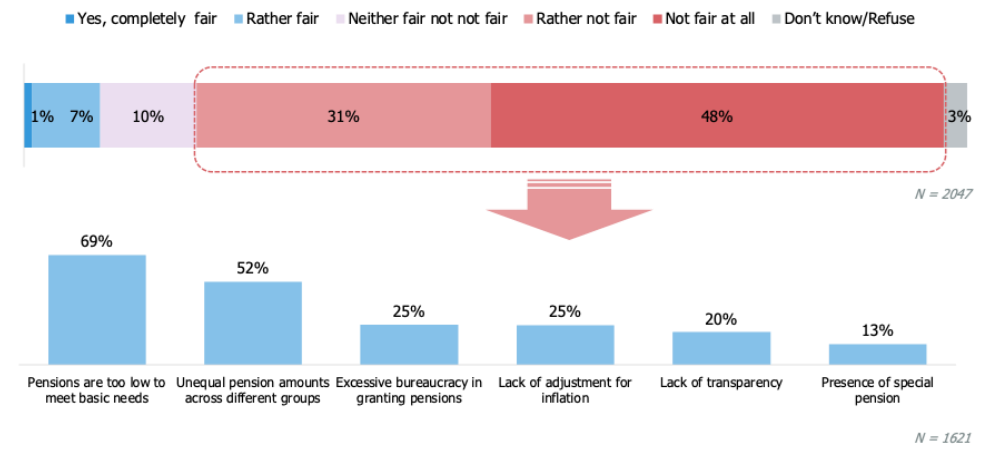

79% of respondents consider the pension system unfair (see Figure 2), citing low pensions that do not cover basic needs as the main reason (69%). This indicates that citizens do not view pensions as a matter of fairness in the context of equality or proportionality but rather focus on whether pensions cover their basic needs. This factor was especially important for young people aged 18-29 (85%) and those aged 30-44 (76%), while respondents over 60 mentioned it less frequently (53%). Another important reason for perceived unfairness, according to more than half of the respondents (52%), is the significant inequality of pension sums among different individuals, a factor more often cited by people aged 45-59 (57%) and those over 60 (60%).

Figure 2. Evaluation of the pension system and factors of such assessment (respondents could choose up to three factors)

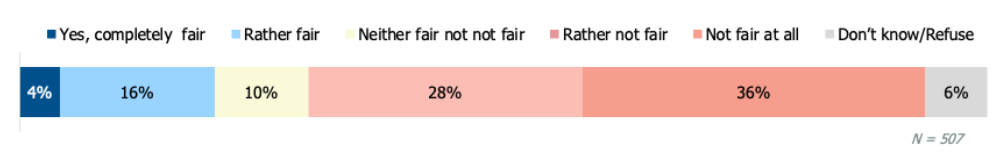

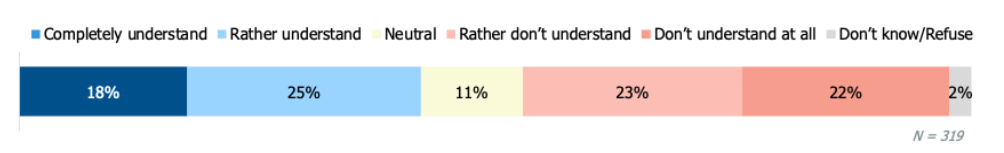

The majority of pensioners (64%) indicated that the size of their pensions is unfair (Figure 3), while only 20% are satisfied with the size of their pensions. Almost half of the surveyed pensioners (45%) do not know how the sum of their pension payment was calculated (Figure 4).

Figure 3. Respondents’ assessment of the fairness of the received pension

Figure 4. Respondents’ awareness of the calculation of their age-based pension amount

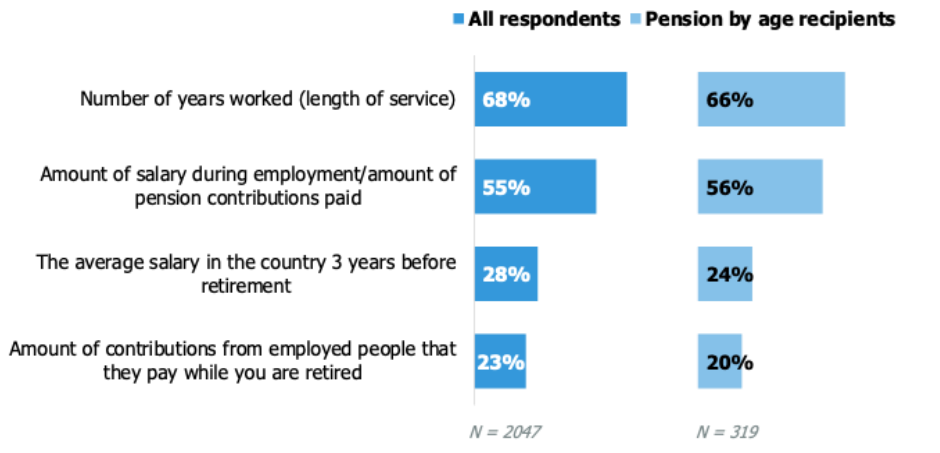

People are only partially aware of the factors affecting the size of their pension. The majority of respondents (68%) believe the size of the pension depends on work experience, while 55% consider the level of salary or the amount of contributions paid as important factors. One-third of respondents note that the pension is affected by the average wage in the country for three years prior to retirement (Figure 5).

Figure 5. Factors which respondents believe determine the size of the pension*

*Respondents could select all options they considered applicable. Among them, 3.5% indicated other factors, and 8% did not know or refused to answer.

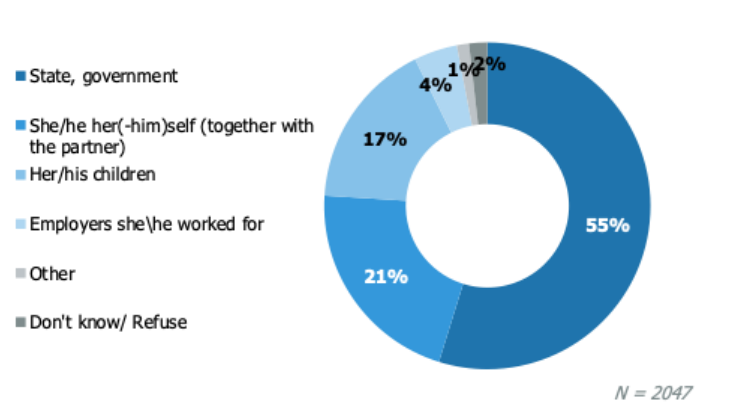

The majority of respondents (55%) believe that the state should be primarily responsible for providing for a person of age. 21% levy this responsibility on children, while 17% state that individuals themselves or together with partners should be primarily responsible for that (Figure 6).

Figure 6. Who should primarily provide for a person of age?

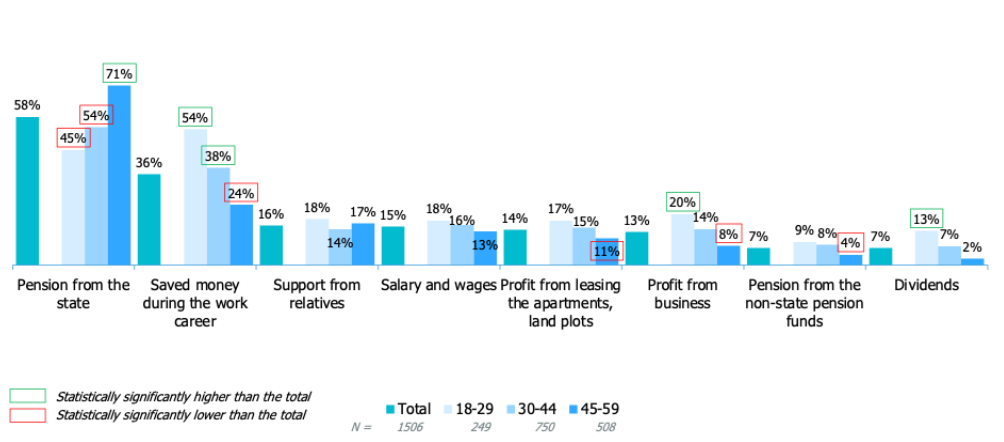

More than half (58%) plan to rely on state pension payments, and 36% on savings during retirement (Figure 7). The highest reliance on pensions is among people aged 45-59 (71%), while younger respondents aged 18-29 (54%) and 30-44 (38%) are more focused on savings. One in six plans to receive support from relatives, and 15% expect to rely on salary. Investment income was mentioned less frequently (14%).

Figure 7. Sources of income respondents aged 18-59 plan to rely on in old age

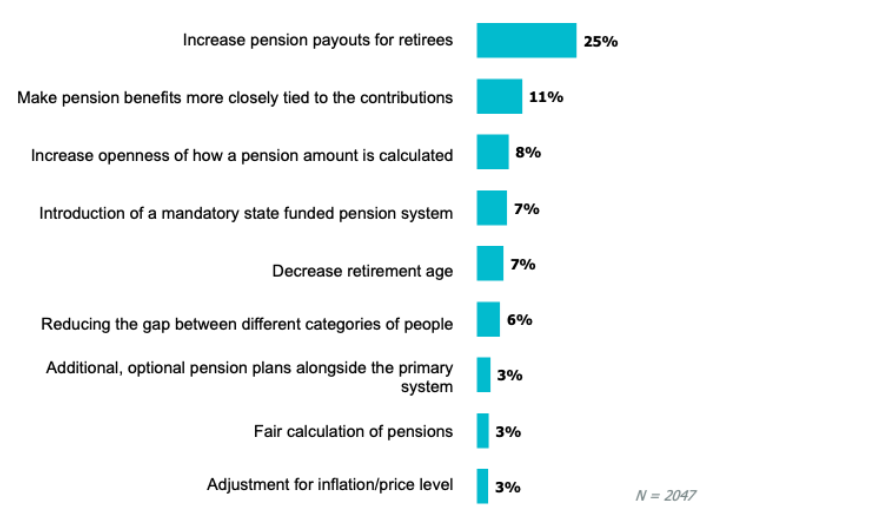

How can the pension system be improved? Respondents’ suggestions**

To improve the pension system in Ukraine, 25% of respondents propose increasing pension payments. Other suggestions include a tighter link between pensions and the amount and duration of social contribution payments (11%), enhancing the transparency of pension calculations (8%), and lowering the retirement age (7%). Additionally, 7% advocated for introducing a mandatory funded system (Figure 8).

Figure 8. Suggestions for improving the pension system in Ukraine*

*Respondents were not provided with predefined answer options. The interviewer independently classified respondents’ answers into categories that best matched the content of their responses.

Respondents aged 18-59 were specifically asked about their support for the introduction of the second level of the pension system. 61% of them support its introduction, while 18% do not. The highest level of support for such a system is among respondents aged 18-29 (70%), whereas only 31% of people aged 45-59 support it.

Conclusions

79% of respondents consider the Ukrainian pension system unfair, primarily due to low pension amounts. Additionally, 45% of pensioners do not understand how their pensions are calculated—possibly because they have not sought this information, even though it is available on the PFU website.

To increase public trust in the pension system, it is crucial to actively explain the mechanisms of pension calculation and the factors influencing pension amounts. Specifically, the relationship between salary, SSC payment, and pension size needs greater attention, since 51% of respondents did not identify SSC as a key factor in determining pensions. For most citizens, pension will serve as the primary source of income during retirement. However, nearly 70% of respondents state that pensions are too low (indeed, 60% of pensioners receive less than UAH 5,000 per month).

The prolonged war and demographic crisis have exacerbated instability of Ukraine’s PAYG pension system. The rising number of forced migrants, declining birth rates, and aging population create conditions where one working individual supports one pensioner. Therefore, urgent measures are needed to adapt the pension system to these new realities and ensure its sustainability.

A mandatory funded pension system could be an effective instrument. There is significant support for it among Ukraine’s working-age population aged 18-54 (61%), reflecting willingness to secure their financial future. However, current economic conditions pose substantial challenges to implementing the second level of the pension system. These include the need for additional state budget funding due to reallocating expenditures from other needs to pension payments, underdeveloped financial markets and a lack of long-term investment assets, relatively high inflation rates, etc. Therefore, we advise to focus on long-term planning and gradual preparation for implementing a mandatory funded system. Prerequisites should include economic stabilization, reduced inflation, determining an optimal SSC rate, and establishment of clear operational rules for funded pension funds.

Simultaneously, Ukraine needs to develop a savings culture. This can be achieved by promoting investments in the third level of the pension system, which allows citizens to build pension savings through voluntary contributions. Savings in private pension funds can provide an additional source of income for retirees.

Promoting investment in government securities, such as domestic government bonds, could help cultivate saving habits and offer additional future income streams.

KSE Institute expresses gratitude to UNICEF Ukraine for their support. UNICEF Ukraine is not responsible for the content of this document. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of UNICEF Ukraine.

Photo: depositphotos.com/ua

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations