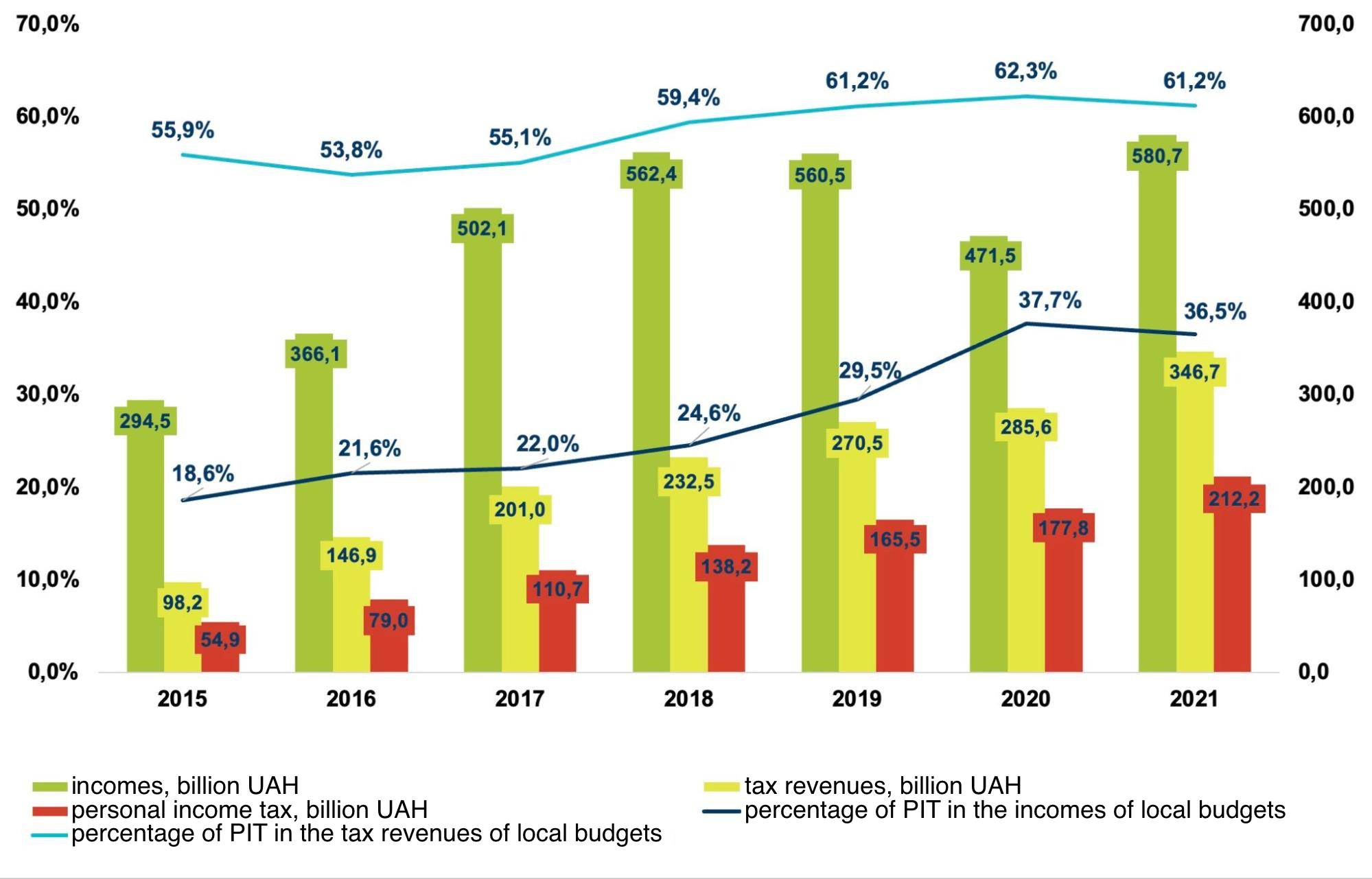

The personal income tax (PIT) plays a key role in the formation of local budgets (see Figure 1). It accounts for over half of tax revenues and 20-40% of all local budget incomes. Therefore, attention to the fiscal role of PIT is entirely justified. However, equally important and interesting is the issue of a tax discount on this tax—a mechanism for partial compensation of the paid salary PIT for the expenses incurred by the taxpayer, the list of which is determined by Article 166 of the Tax Code of Ukraine (see the box). Often, citizens are unaware of this possibility, which gives them the right to partial reimbursement of expenses incurred during the year. In this article, we explain the mechanisms for calculating and obtaining a tax discount.

Throughout the years 2015-2021, the share of PIT in local budget revenues was not less than 53%, reaching as high as 62.3% in 2020. In the total revenues of local budgets, the weight of PIT did not drop below 18.6%, and in 2020, it accounted for 37.7% of all local-level budget incomes. In absolute figures, the revenue from this tax ranged from UAH 54.9 billion to UAH 212.2 billion annually.

What was the volume of tax discounts received by citizens in 2015-2021? For which expenses did they receive discounts, and how many individuals, in total, exercised this right? Most importantly, how do the compensation amount and the amount of personal income tax paid to local budgets correlate? We will address all of these questions further.

Figure 1. Revenues of local budgets and the share of personal income tax in them (2015-2021)

Source: Data from the portal openbudget.gov.ua.

Note: PIT shares in tax and total revenues are shown on the left scale, while budgetary tax and total revenues are on the right scale.

A tax discount is a documented amount of expenses incurred by an individual – the PIT payer, as a result of purchasing goods, services, or works during the reporting year. This amount is allowed to reduce the individual’s overall annual taxable income, which they earned during the year as wages or dividends.

The right to receive a tax discount applies to those PIT payers who receive wages or dividends and have incurred the following expenses during the year:

- Payment of interest on a mortgage housing loan.

- Construction or purchase of affordable housing, including repayment of preferential mortgage housing loans and associated interest.

- IDPs’ rental payments for housing, provided that such housing is the sole residence of the family.

- Donations or charitable contributions to nonprofit organizations of up to 4% of the total annual income.

- Payment for one’s own education or the education of close relatives in educational institutions.

- Payments made for medical treatment services for the taxpayer or their close relatives, including expenses on medicines and other medical products.

- Payment of insurance premiums for long-term life insurance contracts.

- Payment for reproductive services or adoption-related expenses.

- Costs related to converting a vehicle from using gasoline to using bioethanol, biodiesel, other forms of biofuel, or compressed or liquefied gas.

- Purchase of shares (or other corporate rights) issued by a legal entity that is a resident of Diia City.

However, under certain circumstances, the right to a tax discount may not apply or may be significantly limited:

- It may be granted exclusively to residents.

- The amount for which an individual can claim the discount cannot exceed the size of their annual post-tax income (after PIT payment).

- The discount for expenses related to the purchase of shares issued by a resident of Diia City cannot exceed the amount of dividends received.

- The discount is forfeited if the taxpayer does not use the right to claim it during the following year after the reporting year.

In order to exercise the right to a tax discount, individuals need to contact the tax authorities (either in person or online through the taxpayer’s electronic account) within the year following the reporting year. They should submit an annual income declaration along with documents confirming their expenses (receipts, invoices, income cash orders, copies of contracts specifying the cost of goods, services, or works, as well as their payment deadlines).

The compensation amount depends on the amount of paid salary PIT and the total sum of expenses incurred by the taxpayer.

Example calculation of a tax discount:

Monthly income in 2022 (remember that in 2023, we calculate the discount for 2022) was UAH 12,000. The annual income amount (salary) would be:

UAH 12,000 X 12 months = UAH 144,000

The amount of PIT paid on this income:

UAH 144,000 X 18% = UAH 25,920

Income (wages) after taxation:

144,000 (income) – 25,920 (PIT) = UAH 118,080

Confirmed expenses (e.g., for the education of the applicant or their close relatives) for the year 2022 were UAH 150,000.

The amount of expenses exceeds the taxpayer’s income after taxation:

UAH 150,000 > UAH 118,080

Therefore, the compensation for the paid PIT will be paid not from the entire sum but from the portion that does not exceed the annual income after PIT:

UAH 118,080 (the amount for which PIT will be refunded) X 18% = UAH 21,254.4

This amount, UAH 21,254.4, is the compensation that the taxpayer will receive for the expenses incurred for education in 2022, even though the total PIT paid on their education expenses was UAH 27,000.

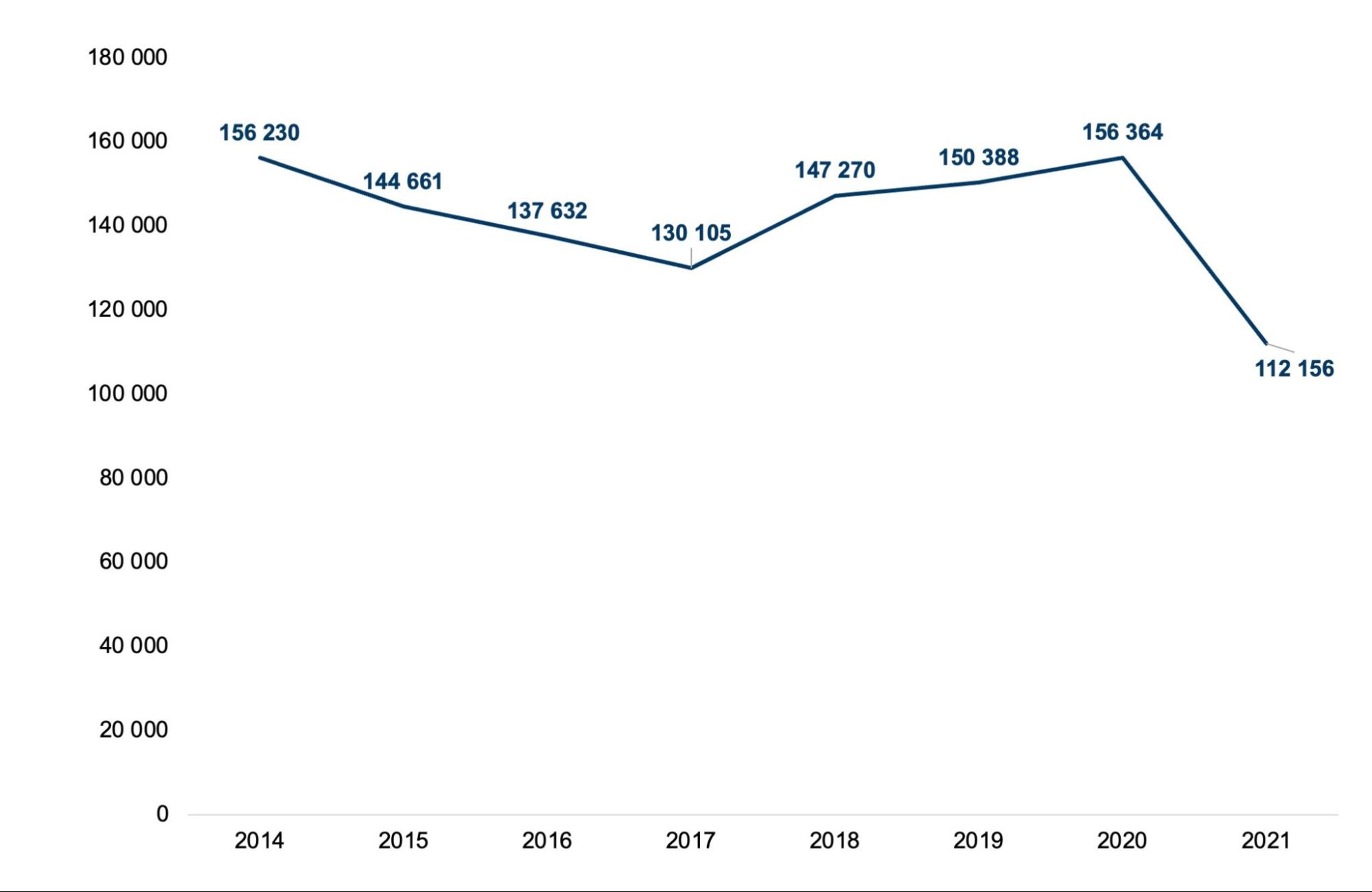

During the years 2015-2020, an average of 130-150 thousand individuals per year received the tax discount (see Figure 2). The lowest number of applicants was in 2021, with 112 thousand individuals, while the highest number was in 2020 and 2014, with 156 thousand individuals. This represents approximately 1% of Ukraine’s employed population, which, as of 2021, numbered 15.7 million). Data for 2022 are currently unavailable since the right to apply for a tax discount extends throughout the entire year following the reporting year. Therefore, the actual number of individuals who applied for a tax discount and the amounts of such compensation for 2022 will not be known until early 2024. At that time, the number and amounts of discounts received by Diia City residents will also become known because this provision was added only starting from 2022.

The sharp decrease in the number of individuals who applied for a tax discount in 2021 could indeed be attributed to the full-scale war. Many people might not have had the opportunity to submit the necessary documents for compensation to the tax authorities in 2022 due to the ongoing combat operations and the occupation of parts of Ukraine.

Figure 2. Number of individuals who used tax discounts from 2014 to 2021

Source: Data from the State Tax Service of Ukraine

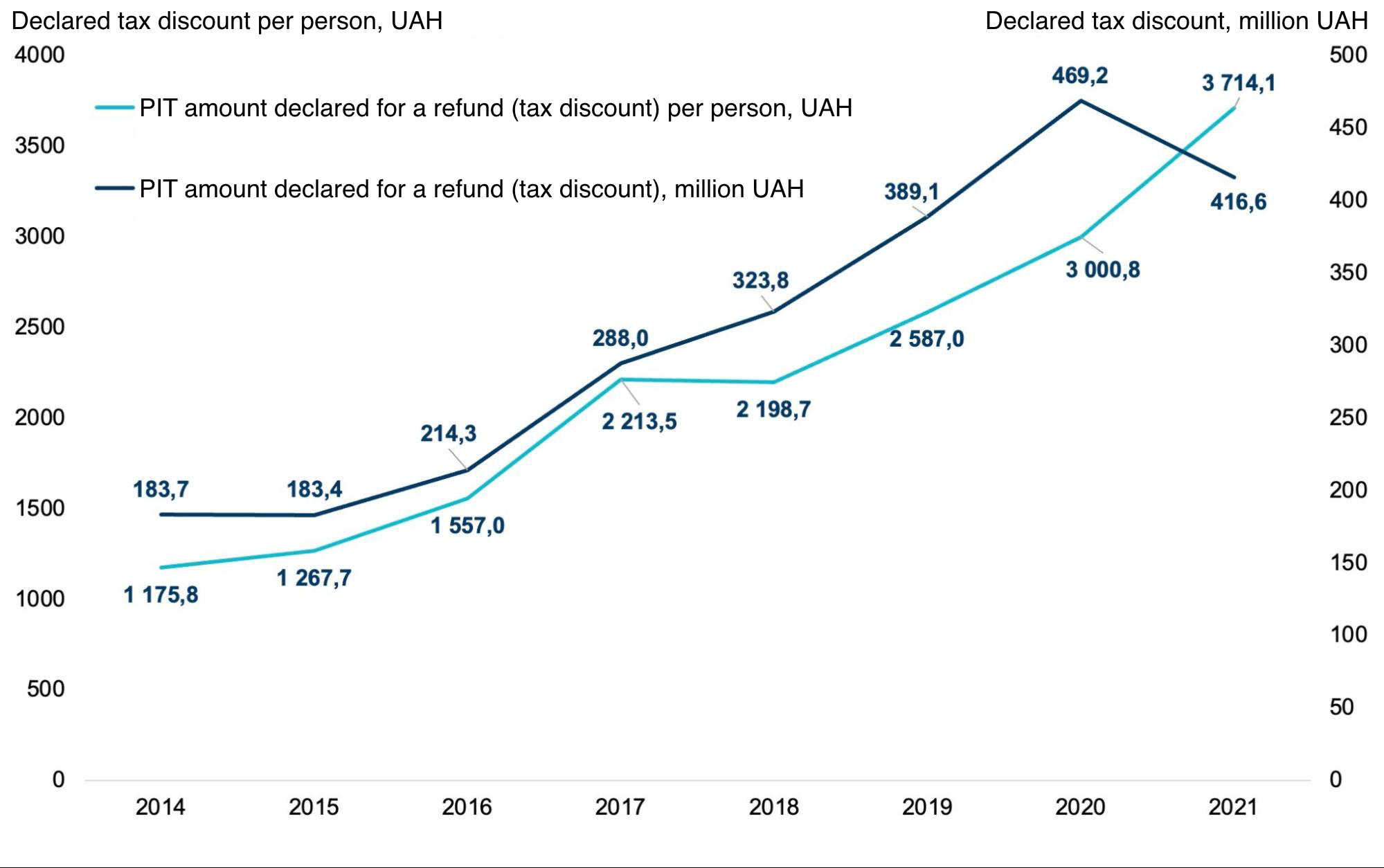

In total, individuals in this category received UAH 2.5 billion in compensation over the entire analyzed period (2014-2021). There is a consistent increase in both the total PIT compensation and on a per-person basis (see Figure 3). The compensation amount per person grew more than threefold over the eight years under consideration. This is understandable since the compensation amount depends on the cost of services purchased by the taxpayer and the minimum and average wages, which have also been increasing year by year.

Figure 3. Total amount of tax discounts compensated to citizens from the personal income tax (million UAH) and per capita (UAH) for 2014-2021.

Source: Data from the State Tax Service of Ukraine.

Note: Declared tax discount per person (UAH) is shown on the left scale, and the total amount of tax discount (million UAH) is on the right scale.

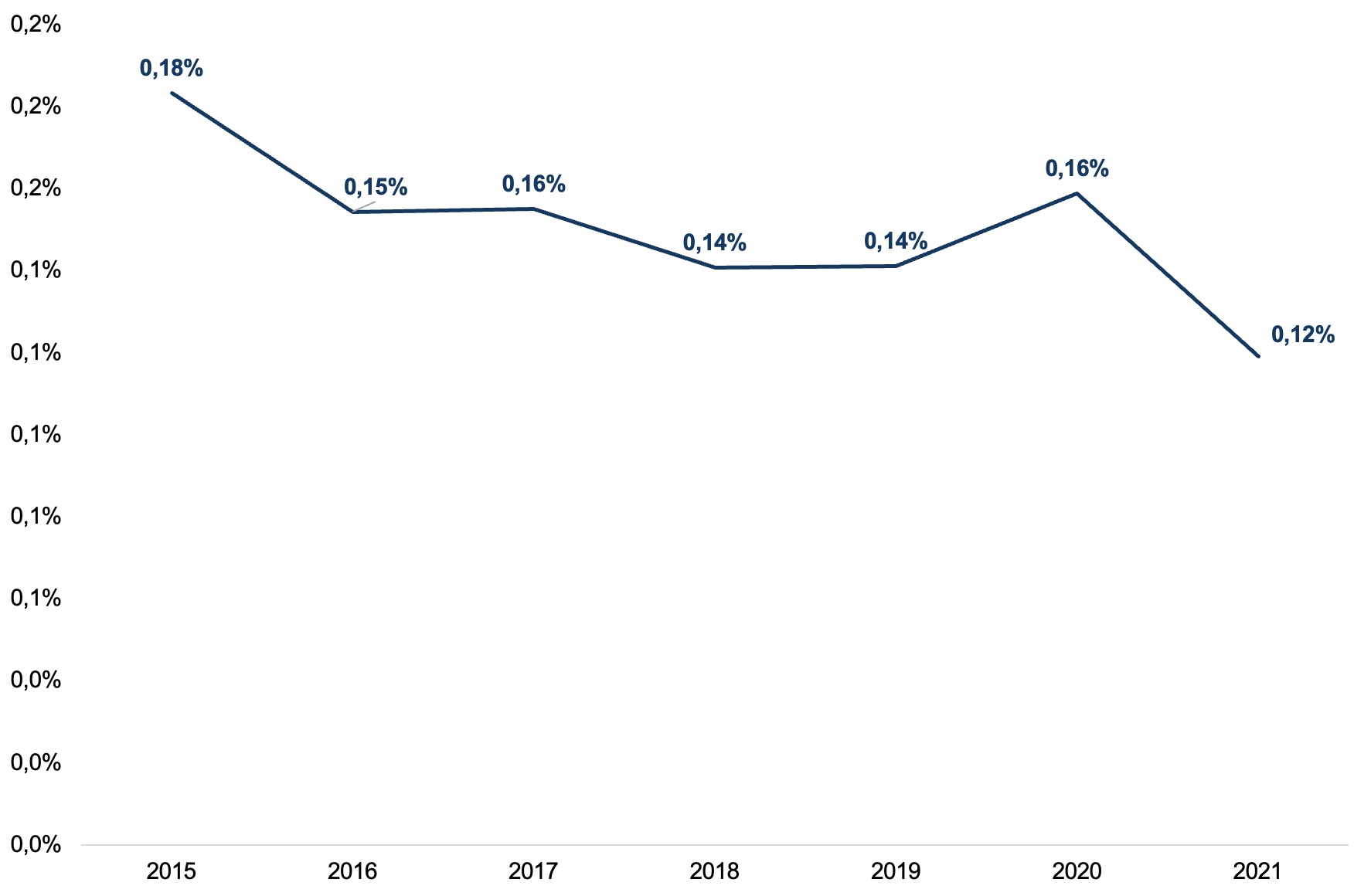

The compensation amount in the form of a tax discount is quite small compared to the amounts of PIT citizens paid to all levels of budgets. The highest ratio of the compensation paid to the amount of taxes paid was in 2015, at 0.18%, while the lowest was declared before the refund in 2021, at only 0.12% of the paid PIT (see Figure 4).

Figure 4. Share of tax discounts compensated to taxpayers in the total amount of paid PIT in 2015-2021, %.

Source: Data from the State Tax Service of Ukraine

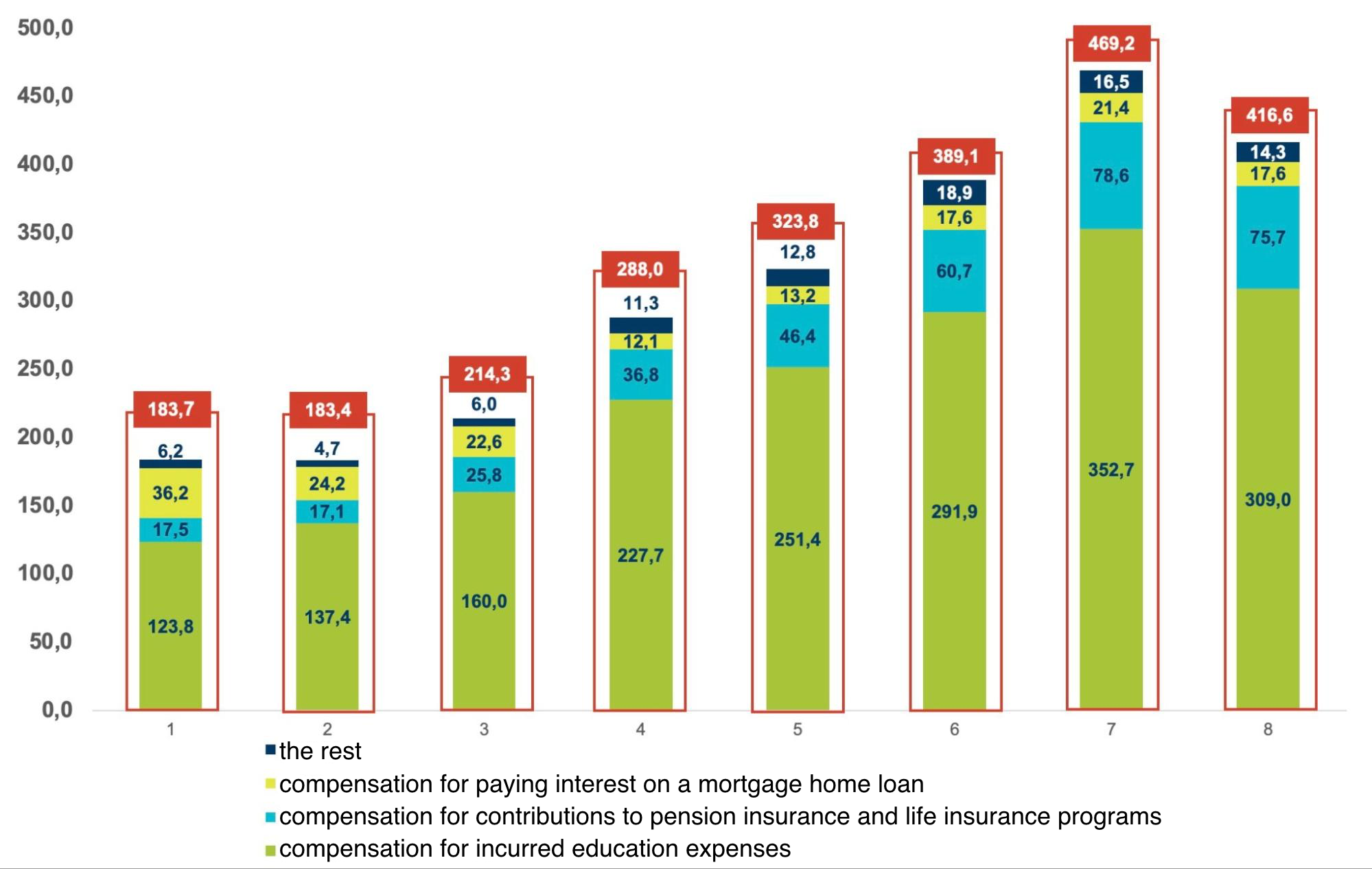

The state compensated the most for expenses related to education, private pension contributions, and private medical insurance (see Figure 5).

Figure 5. Sizes of tax discount compensation in total and for the most significant categories, million UAH

Source: Data from the State Tax Service of Ukraine.

Detailed data on recipients and amounts are provided in Table A1 in the appendix.

This trend persisted throughout the entire analyzed period. In 2020, the highest amount of compensation was provided for education, totaling UAH 352.7 million. In 2021, it was slightly less at UAH 309 million. Participants in non-state pension and medical insurance funds also received the most compensation in 2020, amounting to UAH 78.7 million.

On the other hand, individuals who spent money on housing rental for IDPs received the least tax discount. For example, only 31 individuals received it in 2020, totaling just UAH 339,000. There were no applications at all for tax discounts for healthcare expenses.

Overall, the tax discount is not very popular among the citizens of Ukraine. Apparently, a large number of taxpayers either do not know about it or do not want to file the necessary declarations. For example, in 2021, over 655,000 individuals were studying on contract terms, but only 12% of them (78,000) chose to claim the tax discount for education expenses. In other words, practically only one in eight students took advantage of the right to receive a tax discount.

Therefore, one of the tasks for the tax authorities and civil society should be educational efforts to explain the provisions of the current tax legislation, including the specifics of administering the personal income tax. This would enable many citizens to take advantage of the tax discount and receive a “pleasant bonus” in the form of compensation for a portion of their paid taxes.

The small amounts of PIT refunds for specific categories of expenses may also indicate the underdevelopment of certain activities. For example, very few citizens have mortgage loans, participate in non-state pension insurance programs, or enter into life insurance contracts. These areas have the potential for growth in Ukraine.

However, if more people start using tax discounts, it could potentially create challenges for local budgets. This is because the tax discount is paid out from the local budget based on the individual’s registered place of residence, while a portion of the PIT collected goes to the local budget based on the place of registration of the tax-paying entity (employer). Therefore, it often happens that the tax goes to one budget while the compensation payment comes from another. This issue can be particularly significant for territorial communities located around large cities. Residents of these communities often work in the city (thus, their PIT goes to the city’s budget), but they live in the community (so the tax discount will be paid by the respective community).

We can see two ways to address this issue. The first is to link tax discounts not to an individual’s registered residence but to the location where they pay their income tax (PIT). This way, the employee would receive the compensation from the same budget through their employer. However, a more logical solution to eliminate this problem is to introduce the principle of “tax follows the taxpayer,” meaning that PIT is paid to the budget of the community where the taxpayer is registered.

Tax discounts serve as both a tool for social support (e.g., when provided for education or medical expenses) and an incentive for desired behavior (e.g., supporting charitable contributions and pension savings). However, their potential is not fully realized due to a lack of knowledge among the population and the underdevelopment of certain areas where compensation is possible. Nevertheless, reviewing the mechanism of PIT calculation and discounts is necessary to prevent imbalances between budgets.

Appendix. Table A1. Number of individuals that received PIT compensation and amounts of tax deductions for 2015-2021.

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | ||||||||

| Recipients | Discount size (thousand UAH) | Recipients | Discount size (thousand UAH) | Recipients | Discount size (thousand UAH) | Recipients | Discount size (thousand UAH) | Recipients | Discount size (thousand UAH) | Recipients | Discount size (thousand UAH) | Recipients | Discount size (thousand UAH) | |

| Payment of interest on a mortgage loan | 6,318 | 24,209 | 6,016 | 22, 599 | 3,436 | 12, 083 | 3,657 | 13, 199 | 2,165 | 17,563 | 2,375 | 21,442 | 1,848 | 17,555 |

| Donations or charitable contributions to nonprofit organizations | 390 | 746 | 202 | 666 | 479 | 2,835 | 571 | 3,221 | 333 | 3,077 | 393 | 5,170 | 251 | 4,912 |

| Education expenses | 119, 598 | 137, 405 | 109, 545 | 159, 952 | 102, 525 | 227, 720 | 113, 391 | 251, 377 | 112, 582 | 291, 901 | 114, 052 | 352,710 | 78,718 | 309, 000 |

| Contributions to pension insurance and life insurance programs | 17,077 | 17,070 | 20,564 | 25, 784 | 21, 848 | 36, 843 | 27, 574 | 46, 378 | 33,744 | 60,710 | 38,150 | 78,588 | 30,340 | 75,685 |

| Payment for reproductive services or adoption-related expenses | 530 | 1,660 | 631 | 2,948 | 1,048 | 5,254 | 1,219 | 5,912 | 906 | 7,346 | 870 | 7 861 | 649 | 6,462 |

| Conversion of vehicles to alternative energy sources | 311 | 680 | 265 | 572 | 260 | 661 | 283 | 729 | 175 | 493 | 135 | 465 | 69 | 184 |

| Expenses for the construction or purchase of affordable housing, including preferential mortgage lending | 437 | 1,621 | 409 | 1,767 | 509 | 2,591 | 575 | 2,981 | 472 | 7,888 | 368 | 2,808 | 250 | 2,422 |

| Expenses for housing rent by an internally displaced person | – | – | – | – | – | – | – | – | 11 | 78,0 | 21 | 166,2 | 31 | 339,0 |

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations