We analyze the data provided by YouControl, the partner of our study to understand how much worse is the public utilities performance compared to state and private companies and what to do with them.

According to YouControl data, in 2017 there were 5,244 utility companies in Ukraine. Of these, 1360 are monopolies. These are mainly infrastructure companies – TPS, water utilities, natural gas suppliers, transport companies.These monopolies are natural. This means that in these industries, competition is disadvantageous because barriers to entry for other companies (often fixed expences) are high. Instead, a monopolist is more efficient because its large production costs have a relatively low cost per unit. The most striking examples of such markets are water supply, power (electricity) transmission and distribution, and the use of railway tracks.

Are public utility companies more profitable compared to state-owned enterprises and private companies? Does their profitability depend on monopoly status? To answer this question, we used financial data from Ukrainian companies provided byYouControl.

We define profitability as profit divided by equity (how profitable was a unit of equity).

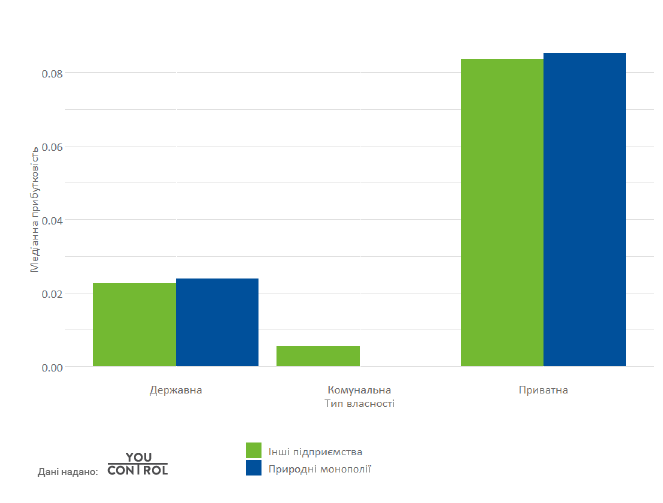

Analysis of the median profitability of enterprises allows us to draw the following conclusions:

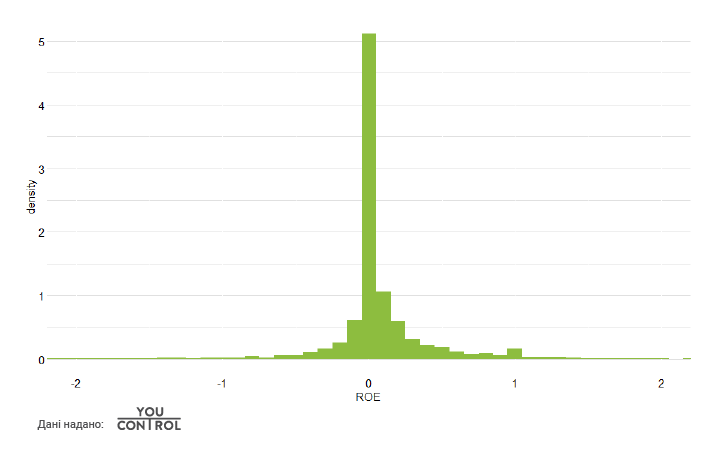

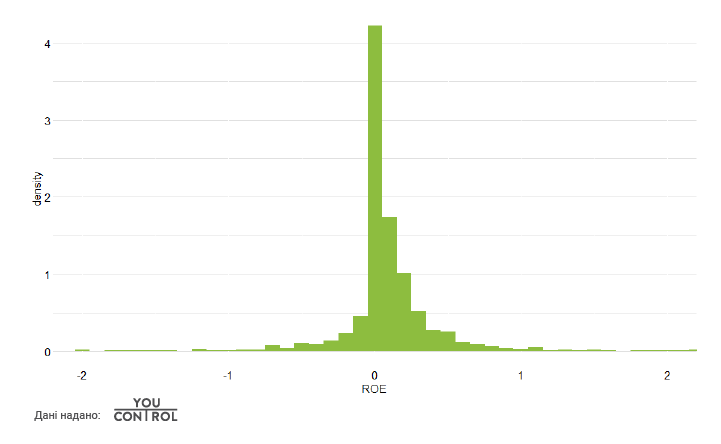

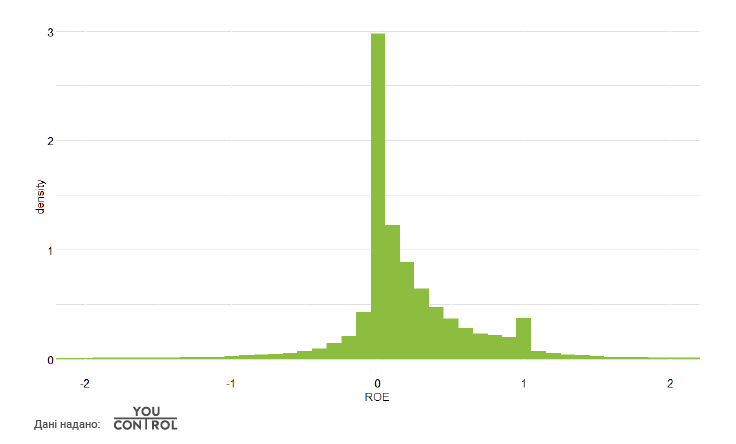

1) Utility companies are the least profitable: their median profitability is near zero. In second place are state-owned enterprises and the most profitable ones are private ones. This can also be seen in the figures showing the distribution of profitability for enterprises of different ownership (Fig. 2-4). Among privately owned enterprises, the distribution is the most “shifted” towards profitable enterprises, while among communal (public) utility enterprises, the distribution is the most symmetric, which means that the number of profitable and non-profitable enterprises among communal ownership is approximately the same.

2) The difference between monopolies and other enterprises among companies of all forms of ownership is not significant. Monopolies among utility companies are less profitable than other enterprises, while among private and public enterprises they are somewhat more profitable (Fig. 1).

Figure 1. Distribution of median profitability by property type and monopoly status

Figure 2. Distribution of profitability among enterprises with communal ownership

Figure 3. Distribution of profitability among state-owned enterprises

Figure 4. Profit distribution among private equity firms

To establish the cause – effect relationship, we performed a regression analysis, namely, the available Feasible Generalized Least Squares method (FGLS). The dependent variable is Enterprise Profitability (ROE), which shows how much net income a single hryvnia brings. The results show that, on average, monopolies do not differ in profitability from other enterprises. This is in line with the results of the graphical analysis in Figure 1.

As expected, when we control other factors by means of regression analysis, private enterprises are the most profitable, in particular, the state-owned enterprises by an average of 3.7 percentage points and the communal utility companies by 5.5 percentage points. A separate analysis of monopoly and non-monopoly enterprises shows that private ownership increases profitability for monopolies and other companies almost equally.Therefore, whether an enterprise is a monopoly, is not so importan,t compared to its form of ownership (there is no statistically significant difference in profitability between monopolies and other enterprises). However, communal utility companies are less profitable than state or private ones (and this difference is statistically significant).

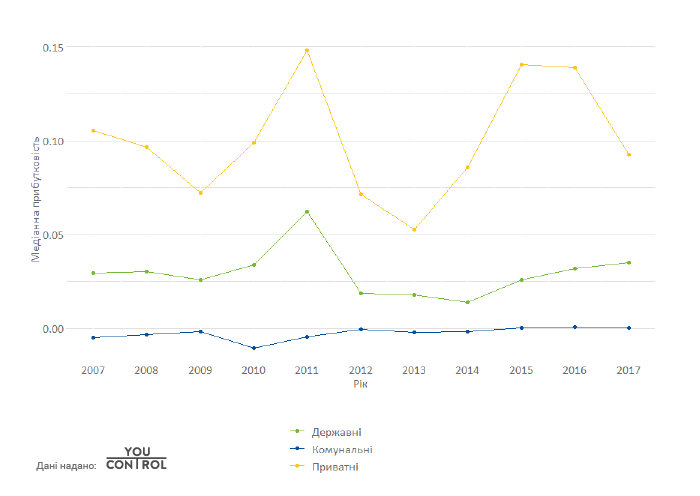

We also examined the profitability of monopolies of different forms of ownership in different years. In 2007–2017, private monopolies were significantly more profitable than state monopolies, which in turn were more profitable than public ones (Figure 5).

Figure 5. Dynamics of median profitability of monopolies by ownership.

The situation with public utilities is more problematic than with state-owned ones. The fact is that although these enterprises are much smaller than state-owned, they are much more of them. That is, the losses from each individual utility company may seem insignificant, but their total volume is greater than at state-owned enterprises. Thus, the total amount of losses of public utiliy enterprises is almost 7 billion UAH (the total profit of profitable utilitie is about 1.6 billion UAH, and the total loss of loss-making enterprises is 8.5 billion UAH), while the state-owned enterprises make a total profit of 44 billion UAH. However, 89% of this $ 44 billion is profit from Naftogaz Ukraine’, whose net profit for 2017 was 39.3 billion UAH.

Big number of public utilities means that the privatization or organization of corporate governance at utilities will take longer than at state-owned ones. Of course, the legislation allows for the establishment of supervisory boards at public utility and improve corporate governance. However, their implementation is the political will of each local government, which complicates the situation even more.

What should the state do with utilities in general and public utility monopolies in particular?

Our results show that all public utility companies – both monopolies and other – are less profitable than state or private enterprises. Therefore, profit cannot be a reason for keeping such companies as communal utility ones. The existence of communal utility enterprises can distort competition due to budget assistance received by them and also to carry corruption risks. Public utilities can overstate their costs via corruption. However, very often they cannot get more revenue – especially if they are natural monopolies, and local or state governance regulates their pricing. Therefore, they become unprofitable and, eventually, to keep them afloat, the local government is forced to assist them.

To our mind, public utility companies should be divided into those that perform a particular social function that cannot be performed by private enterprises and those that do not have such a function. At the same time, given that public utility companies are much less profitable than private ones, we support the privatization of the vast majority of public utility companies. For those enterprises that remain in communal ownership, corporate governance is required. General corporate governance rules should be defined by law. The certain degree of freedom in defining some aspects of these rules should be given to local authorities . At the same time, the following anti-corruption measures should be legislated:

- There should be a ownership policy for each public utility,

- Independent Supervisory Board (elected in open, fair competition),

- High remuneration of supervisory board members,

- Appointment and dismissal of utilities heads by the Supervisory Board,

- Reporting transparency, open data, for large enterprises – independent auditing

- Strict conditions for non-interference in the management of the company by politicians (politicians have no right to appoint or dismiss the management of the public utility company, to press on decision-making by the supervisory board, etc.).

However, as noted before, it is important to remember that about one fifth of all public utilities have a monopoly status. The privatization of such enterprises can be an additional challenge. After all, if a monopoly is private, in order for it not abuse its monopoly position, it must have a strong and independent regulator. Which body is the regulator depends on the industry in which the utility operates, and its size. For small businesses, the regulator is the local government, and for the big ones, the national regulator. However, whatever is the body of the regulator, before privatizing municipal monopolies, it is important to give it independence and protect it from overtaking.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations