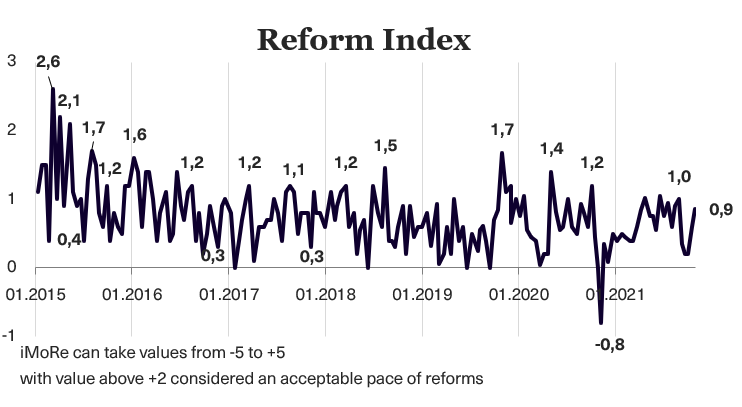

Reform Index is +0.9 points for the period from September 19 to October 10, 2021, with possible values ranging from -5.0 to +5.0. In the previous round, the index was +0.6 points.

Chart 1. Reform Index Dynamics

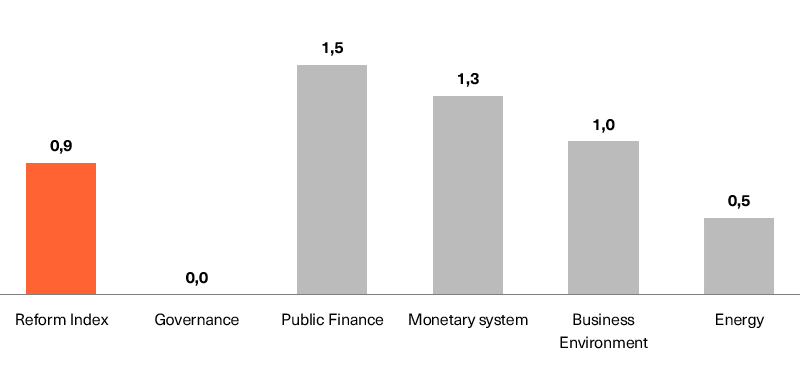

Chart 2. Reform Index and its components in the current round

Requirements that non-banking institutions disclose information on consumer loan terms, +2.0 points

Non-banking institutions often attractively advertise consumer loans. However, this information can be misleading for borrowers. Ad information can be incomplete, with important terms laid out in the small print or being vaguely worded.

To tackle this issue, the National Bank adopted Resolution No.100 of October 5, 2021, obligating non-banking institutions to disclose the full cost of consumer loans, including insurance and tax expenses, and the cost of notary services, etc. Financial institutions must post complete information on their websites and inform the borrowers accordingly when issuing a loan.

The NBU introduced similar requirements for banks in January 2020. Back then, the NBU could not apply the same requirements to non-bank financial institutions because it was not their regulator at the time. The National Bank gained such powers in July 2020 after adopting the “split law” and abolishing the National Commission for Regulation of Financial Services Markets. Since then, the rules of overseeing the banking and non-banking sectors have been harmonized.

Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

Changes to rules governing bank secrecy, +1.0 points

The legislation explicitly regulates access to banking secrecy. However, the restrictions were in place, which prevented banks from providing information even if the bank account holders were willing to grant access to it.

Now that problem has been solved: the NBU adopted Resolution No. 98 of October 4, 2021, outlining the procedures for disclosing bank secrecy with the account holders’ permission.

New law on industrial parks, 0.0 points

The Law on Industrial parks has been in effect in Ukraine since 2012. However, no progress has been made so far in launching such parks that would become economic growth points in the country or region. Therefore, the Verkhovna Rada decided to change the rules for creating and operating technology parks to give the law a “second wind.”

The new rules provide the following additional incentives for industrial parks:

- full or partial compensation for the interest rate on loans for activities within the park,

- the reduced minimum area (from 15 to 10 hectares), and the increased maximum area (from 700 to 1000 hectares),

- state budget funds (non-returnable) related infrastructure (highways, communication lines, heat, gas, water and electricity supplies, utilities, etc.).

Bills (5688, 5689) on granting tax benefits to companies located on the territory of technology parks are currently under consideration in Parliament.

Expert opinions on this law differ. The law received negative reviews from some experts because its implementation may result in ineffective budgetary spending.

Chart 3. Value of Reform Index components and number of events

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas: Governance, Public Finance, Monetary system, Business Environment, Energy.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations