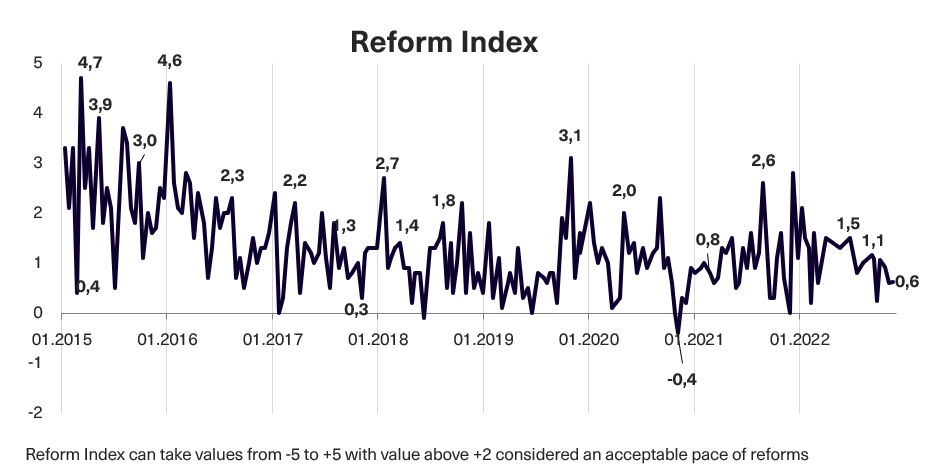

In issue 199 (issue 192 before the audit) of the Reform Index, 5 changes have been included for the period from November 7 to November 20. The Reform Index for this period is +0.6 points, with values ranging from -5 to +5. In the previous round, the Index had the same score.

Chart 1. Reform Index Dynamics

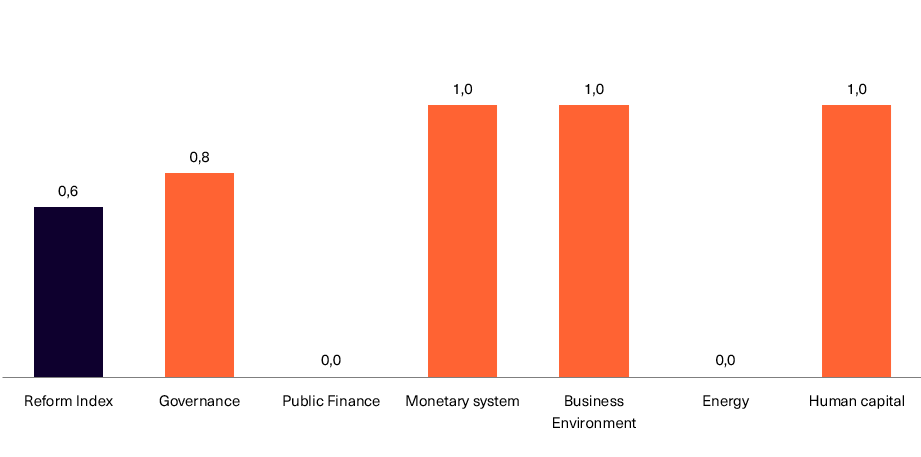

Chart 2. Reform Index and its components in the current round

Law on aligning Ukrainian laws with FATF standards and the EU Directive 2018/843 requirements and on protecting the financial system against aggressor states’ actions, +1.0 point

In November, the President signed Law No. 2736, which is another step in meeting the European Commission’s recommendations on what must be done before Ukraine accedes to the EU.

It implements into Ukrainian legislation the FATF standards (The Financial Action Task Force on money laundering) and EU Directive 2018/843 requirements regarding combating money laundering and the financing of terrorism (in particular, removing the restriction on imposing fines on financial service providers).

Also, the law lists mediators and dealers in works of art and realtors involved with rentals worth UAH 400,000 per month among the subjects of primary financial monitoring (i.e., financial service providers: banks, insurance companies, postal operators, pawnshops, etc.).

In addition, the law limits the ability of Russia and Belarus to influence Ukraine’s financial system through their citizens or legal entities. It prohibits Russian and Belarussian citizens from running entities providing financial services on Ukraine’s territory and includes citizens of Russia and Belarus (except those granted the combatant status in Ukraine), legal entities from these countries, and legal entities receiving funds from aggressor states or using their financial institutions in the list of high-risk clients.

Ukrainian financial service providers must report to the State Financial Monitoring Service the transactions of more than UAH 400,000 if at least one of the participants is in the aggressor country (or any other country failing to meet the requirements of international organizations involved in countering money laundering) or has its citizenship.

Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

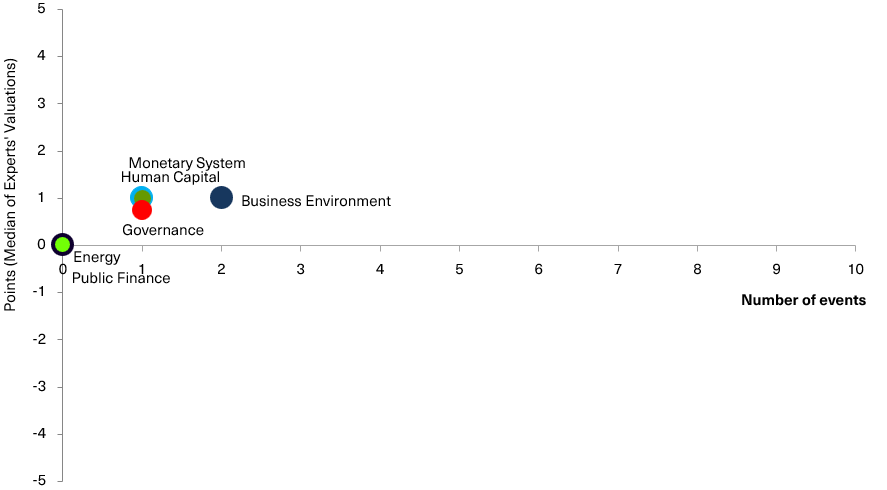

Chart 3. Value of Reform Index components and number of events

Reform Index from VoxUkraine aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in six areas: Governance, Public Finance, Monetary system, Business Environment, Energy, Human Capital.

With the support of

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations