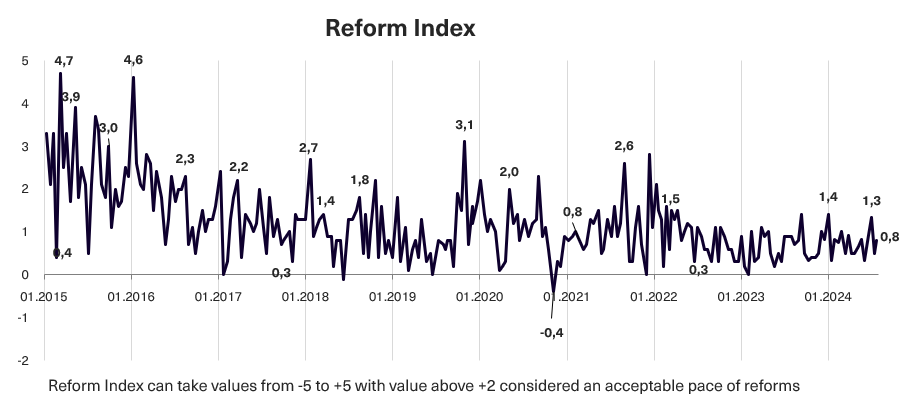

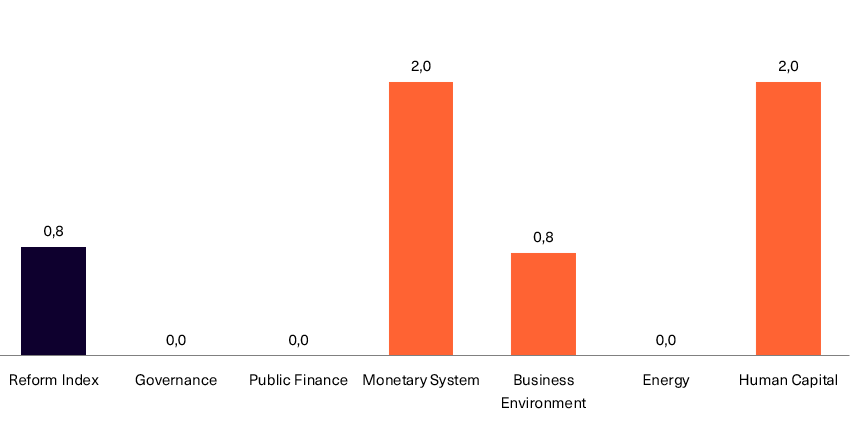

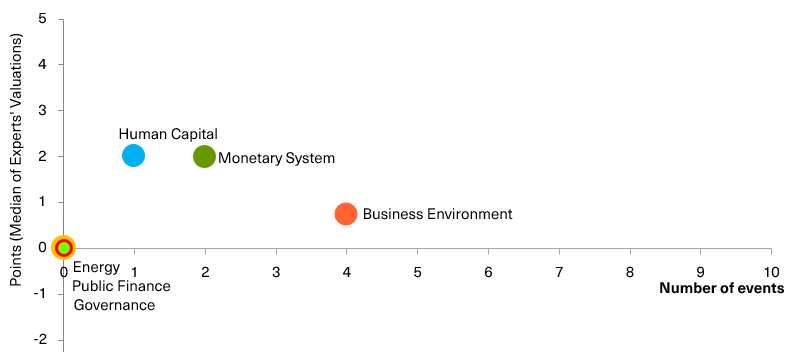

The 243rd issue of the Reform Index, covering the period from July 15 to 28, includes seven regulations, with the Index value reaching 0.8 points. For the first time in quite a long period, we recorded an anti-reform measure, which turned out to be the law on the “White Business Club,” providing special conditions for responsible taxpayers. In the previous issue, the Index value was 0.5 points.

The law on the “White Business Club,” -1.5 points

Law 3813-IX on taxpayers with a high level of voluntary tax compliance sets criteria for identifying the most responsible enterprises and offers preferences for them. These preferences will include a moratorium on certain document audits and reduced timeframes for audits related to budget refunds, faster provision of tax consultations, and the assignment of a dedicated compliance manager. The State Tax Service of Ukraine will publish the list of responsible taxpayers quarterly on its website.

The criteria for inclusion in this list include not only the absence of debt on the payment of the Unified Social Contribution (USC) and significant tax debt but also the amount of taxes paid. Specifically, to be included in the list, legal entities must pay corporate income tax at least equal to the industry average for the last year. The salary level at such enterprises must be at least 10% higher than the industry average in the region where the taxpayer is registered. The list will also include Diia.City residents who pay taxes not less than the average among platform residents. Individual entrepreneurs (IEs) can take advantage if they pay taxes higher than the industry average, have at least five employees, and pay salaries at least 10% higher than the industry average in the region where they are registered.

These requirements essentially describe not honest tax compliance but rather the size of the enterprise, where larger taxpayers receive preferences, while smaller businesses have no chance of entering the “White Business Club.” Experts of the Reform Index rated the law negatively, as instead of ensuring the rule of law, predictability of actions, and creating equal rules for everyone, the state is establishing special conditions for certain enterprises.

Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

Reform Index from VoxUkraine aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in six areas: Governance, Public Finance, Monetary system, Business Environment, Energy, Human Capital. Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

Photo: depositphotos.com/ua

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations