At the time of the acute 2014-2015 fiscal crisis, the Ukrainian government not only raised tax rates but also introduced new taxes. One of these new taxes is the 15% “surcharge” on the pensions of working pensioners. Specifically, if a pensioner earns even a hryvnia in wages, she must forfeit 15% of her pension. That is, irrespective of the earnings amount, the working pensioner had to pay a tax (in addition, if the pension is greater than a certain amount, the pension is subject to income tax). The government contemplates repealing the tax on pensions. This would be the right policy decision as there are many wrongs with such a tax.

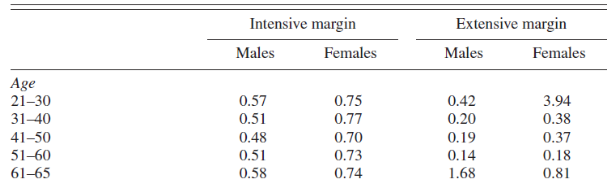

First, the basic principle of taxation is that the government should levy labor taxes on those who have a low elasticity of labor supply and few opportunities to evade taxes. Otherwise, the net effect will be a loss of output without any gain in tax revenues. The elderly is one of the groups with the highest elasticity: for example in the U.S. the elasticity of labor supply for men approaching retirement is 4-6 times higher than elasticity for prime-age men. Indeed, pensioners tend to have a relatively high flexibility in their decision to work or not to work (extensive margin) and how many hours to work conditional on working (intensive margin). Table 1 presents an estimated distribution of labor supply elasticities by gender and age for the U.S. Because welfare loss is proportional to the elasticity, the optimal tax rate policy should be such that tax rate are lower for the older people.

Table 1. Labor supply elasticity by gender and age in the USA (source)

Second, elderly workers tend to have much lower re-employment rates. That is, once an elderly worker loses a job he or she is much less likely to find a new job and much more likely to leave labor force. This means that a short-term gain in tax revenue from taxing earnings or pensions of working pensioners is likely outweighed by the long-term cost of moving a pensioner out of labor force.

Third, the tax surcharge has a flaw in its design such that disincentives to work for pensioners are amplified. The theory of optimal taxation states that the tax surcharges should apply only to incremental income. That is, if a pensioner earns an additional hryvnia in wages, the surcharge should apply only to this hryvnia. In contrast, the existing surcharge applies to pensions — not extra earnings! — no matter how large or small those earnings are. For example, if a pensioner has a 4,000 hryvnia pension and earns 500 hryvnias in labor income, the tax liability from the tax surcharge is 4,000*0.15=600 hryvnias, which exceeds their earnings! This tax liability would be the same even if the pensioner earned only a hryvnia in labor income. Furthermore, the pensioner pays income tax on 500 hryvnia that he earned in wages. As a result, the marginal tax rate on the pensioner who contemplates working or not working is very high: the pensioner loses a part of his or her pension and has to pay income tax.

Not surprising, the dynamics of the labor market is consistent with the strong disincentives for the elderly to work. For example, the labor force participation rate for the prime-aged men and women (30-39 years old) was stable at 85% in both 2013 and 2015. In contrast, the rate for the elderly (60-70 years old) fell from 24% in 2013 to 15% in 2015. Similarly, the employment rate for the prime-aged barely changed from 2013 to 2015 (approximately 79%) but it fell from 24% to 15% for the elderly.

Fourth, Ukraine has a rapidly aging population. This trend puts Ukraine’s Pension Fund under enormous pressure to raise revenue because the pension system in Ukraine is a redistribution of a tax on workers to pensioners and the tax base is shrinking with working age population. A working pensioner generates revenue for the Pension Fund, because the pensioner’s earnings are taxable. Thus, a working pensioner effectively reduces the burden on the social security system because pensioners pay for themselves. By creating disincentives for pensioners to work, the government can exacerbate the fiscal deficit run by the Pension Fund (90 billion hryvnias in 2015).

Fifth, the surcharge creates incentives for working pensioners to conceal their labor income. Since the main idea of the flat tax system is to reduce the size of the shadow economy and wages in envelops, the surcharge is likely to have the opposite effect. It is particularly true for economic systems with weak monitoring mechanisms and problems with law enforcements that Ukraine currently belongs to.

Sixth, Ukraine should have learnt from experience of other European countries. For example, retirement pensions are not liable to tax in neither Hungary nor Lithuania, both of which are flat-tax system countries. Alternatively, a marginal income tax is applied on pensions in the UK: while low-income retirees do not pay any taxes, high-income pensioners could end up paying as much as 45%.

In summary, the government should repeal the surcharge as soon as possible. Taxing pensioners at high rates is inefficient and counterproductive. The times of fiscal emergency have passed and the government should focus on raising the revenue in a more efficient way.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations