US/EU-Russia relations have always been quite sensitive with numerous ups and downs in recent decades. The latest crisis in these relations occured in February 2014 due to unrest in Ukraine, which led to US/EU sanctions on Russia. The sanctions were imposed to create uncertainty for investors and lower their confidence leading to drop in stock prices and trading volumes. But did this expectation become a reality?

The end of 2013 brought about new tensions between US/EU and Russia. These tensions persist and they will have prolonged effects with political and economic consequences for all countries involved. Suspension of the implementation of the association agreement with the EU by Ukrainian President Viktor Yanukovych led to protests and revolution in Kyiv resulting in overthrew of the government. At the same time, pro-Russian protests in the southern and eastern parts of Ukraine resulted in wider unrest in Crimea , leaving interim Kyiv government struggling with Russian influence. The beginning of 2014 brought about accusations by the US and the EU that Russia had provoked the situation in Crimea.heir answer to Russian behaviour came in the form of sanctions. The level of sanctions was revised several times while the most severe sanctions were introduced after the Russian annexation of Crimea.

The US was the strongest advocate for imposing sanctions on Russia. Its position was based on the thought that effects of sanctions would have severe consequences on Russian economy, which would result in a switch in Russian behaviour and diminishing of Russian influence in Ukraine. Based on that thinking, the US, and later the EU, decided to impose gradual sanctions meaning that restrictive measures would be introduced in additional rounds subject to the change in Russian behaviour. In Table 1 all rounds of sanctions have been depicted and as it can be seen certain rounds of sanctions were also introduced by other countries throughout the world since the EU and the US wanted to impose as much pressure as possible on Russian economy.

Table 1. Sanctions timeline

| Who introduced the sanctions? | What sanctions included? | |

| Round 1: 17.03.2014 |

US, EU, Australia, Canada, Albania, Iceland, Montenegro, Moldova, Ukraine |

Travel bans Freezing US assets |

| Round 2: 28.04.2014

23.07.2014 |

US/EU

EBRD |

Travel bans

Cessation of new investment activity |

| Round 3: 31.07.2014 | US/EU | Trade restrictions |

| 12.09.2014 | US | Financial, energy and defence sectors

Limited access to the US debt market |

| 18.12.2014 | EU | Investment in Crimea

Trade restrictions |

| 16.02.2015 | EU | Trade restrictions

Travel bans |

The first channel through which sanctions presumed to hit Russia were financial markets. The expectation was that the imposed sanctions would create a shift in investor behaviour and shake their confidence, thus impacting stock prices as well as stock trading. The first irst assumption was that stock exchange market in Russia would be severely affected by restriction measures (freezing of assets, restricted access to US debt market and uncertainty for investors). The second assumption was that Russian companies listed on foreign stock exchanges would suffer from drops in stock prices and hence quite limited trading volumes. But did these assumptions become a reality?

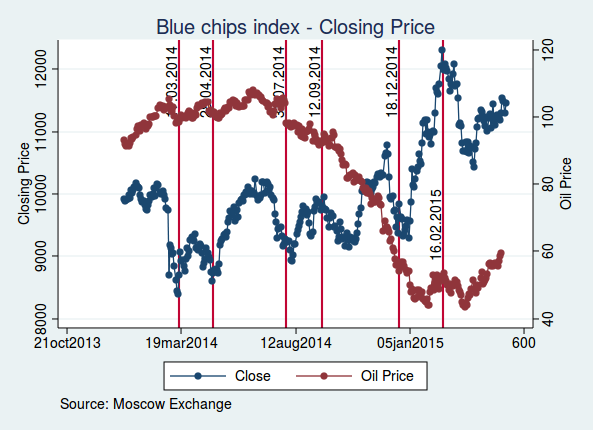

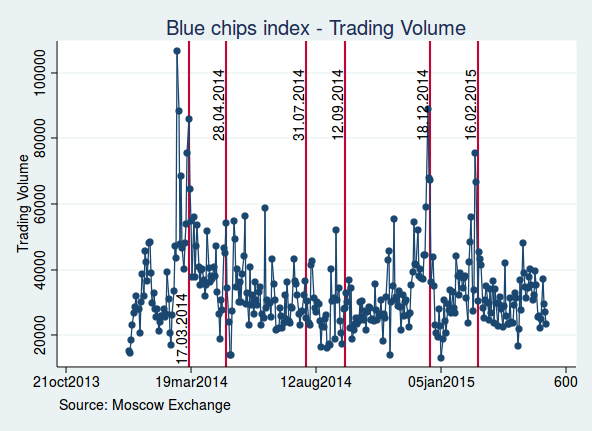

Figures shown below seem not to support reality based on those expectations. The data on closing prices of Moscow Exchange – Blue chip index imply that each announcement of sanctions created a “drop window” after which the index recovered quite rapidly. Figure 1 also shows that each time one day prior to announcement of sanctions or on the day of announcement a higher trading volume was observed. This can be explained by the fear of investors of a drop in stock prices and the possible effects of sanctions on individual stocks, especially those of the companies that could possibly be on entity restriction lists. In addition, some information leaks before the official announcement of entities that will be on restriction list could significantly contribute to the observed increase in trading volumes.

Figure 1. Russian Stock Market: Index and Volumes

|

|

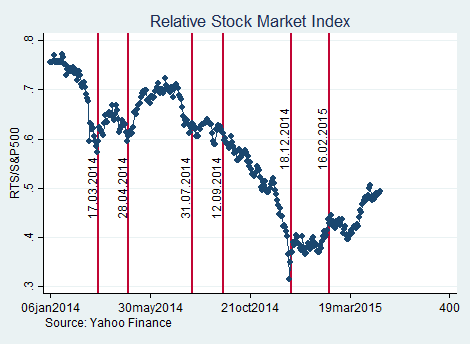

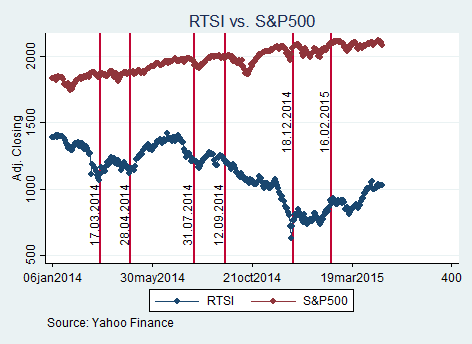

The data also imply that oil prices had the prevailing effect on stock markets and that the oil prices correlate with stock prices. Figure 2, where we have portrayed the performance of Russian and US stock markets, corroborates this finding. In the last quarter of 2014 the downward trend in oil prices had a prevailing impact on Russian stock market. Moreover, the Russian stock market started recovering in the first quarter of 2015 as a result of limited effects of imposed sanctions as well as the high impact of oil prices movements on the overall stability of Russian stock market. We can also conclude that after the announcement of individual restriction measures there was a drop in stock prices, but that prolonged and/or profound effect of these restriction measures on stock prices cannot be observed.

Figure 2. Relative Stock Market Performance: Russia Trading System Index (RTSI) vs. S&P500

|

|

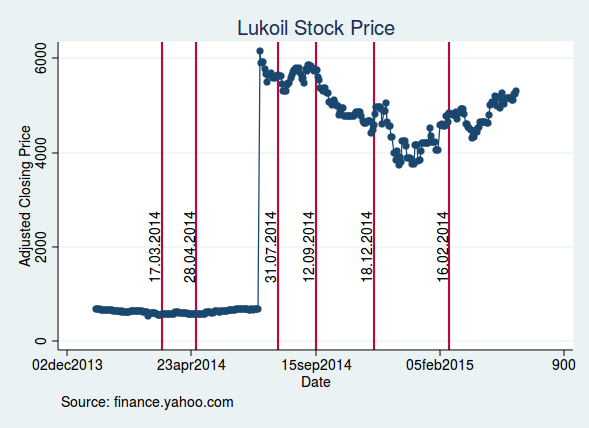

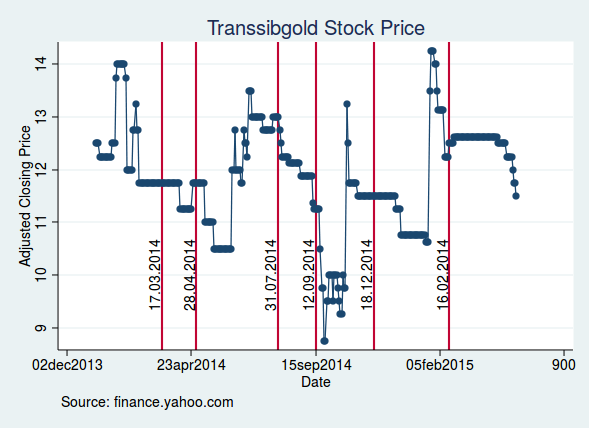

If we check for the effects of sanctions on stock prices of individual Russian companies listed on some foreign stock markets we will come to a similar conclusion. Figure 3 shows the absence of any kind of pattern in stock price behaviour of two Russian companies listed on London Stock Exchange implying very limited effects of sanctions, if they at all existed. Therefore, sanction effects do not transpose and do not affect Russian companies listed on foreign stock markets as long as these companies stay out of the restriction lists.

Figure 3. Russian Stock at London Stock Exchange

|

|

All the above stated implies that effects of sanctions on Russian stock market were quite limited so far and that additional time is needed as for the real effects of sanctions to be revealed.

Disclaimer: This article does not present or reflect any kind of political views or standings.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations