On the 27 August the outline of the tax reform, that has been named one of the priorities by the National Council of Reforms, is expected to be presented. The aim of this article is to analyze what options for the reform are available, what acute problems it is supposed to solve and which reform path is likely to be selected.

According to the results of the Ministry of Finance industrial communications platforms with various industries, the business community considers the following issues to be the main problems with the Ukraine’s tax system:

– large shadow economy and non-uniform levels of taxation for different companies, depending on their ability to operate in the shadow and/or to use the simplified small business taxation system for tax evasion;

– high labor taxes;

– unstable and hard to predict tax laws and rules;

– non-transparent administration of taxes, VAT refund arrears or incomplete refund for exporters.

These issues have been reiterated in the past and are not new. Certain insights can also be gained from the Doing Business rating, which shows that the amount of time per year required for a typical mid-sized business to pay taxes is very high in Ukraine (350 hours, the second highest in Europe and close to Latin American 365 hours), suggesting cumbersome process of tax administration.

Consequently, the stated priorities of the reform are as follows:

– making changes to the tax system that would stimulate de-shadowing;

– making taxation more uniform;

– lowering the effective rate of labor taxation;

– improving administration of taxes and making it less onerous;

– fixing the ‘rules of the game’, up to a moratorium on changes to the Tax Code.

To understand how these goals can be accomplished let’s look at the main proposals for reforms in the main areas of taxation.

Corporate profit tax

Revenue: 2.6% of GDP in 2014 (6.5% of general government revenue)

Essentially, there are two major alternative choices in this area:

– retaining the CIT with its administration, which is responsible for most of interaction between businesses and tax officials, and thus for most of corruption and administrative burden in the tax system;

– getting rid of regular CIT and only imposing a ‘corporate income to personal income’ legalization fee to retain at least some revenue.

If the first option is selected, there are two ways to make the tax more investment friendly while sacrificing some revenue – allowing full deduction of fixed-asset investment as expenditures or switching to an Estonian-style distributed profit tax with inspections of expenditures to stop the shareholders from using corporate expenses for personal consumption.

Talking about the current situation, a law passed in 2014 eased the administration of CIT for businesses significantly, while a moratorium on inspections of companies with less than 20 million UAH in revenue (95% of companies) is still in effect. Thus, currently the administrative burden of CIT has been seriously reduced. CIT was the main cause of high administrative burden of taxation in Ukraine, which was related to the ability of tax officials to act in a discretionary fashion (impossible to eliminate in CIT due to inherently conventional nature of income).

There is a risk that, once inspections resume and discretionary administration returns, the State Fiscal Service (SFS) will once again increase the administrative burden of CIT on businesses by diluting the simplifying effects of the 2014 law via its own regulations.

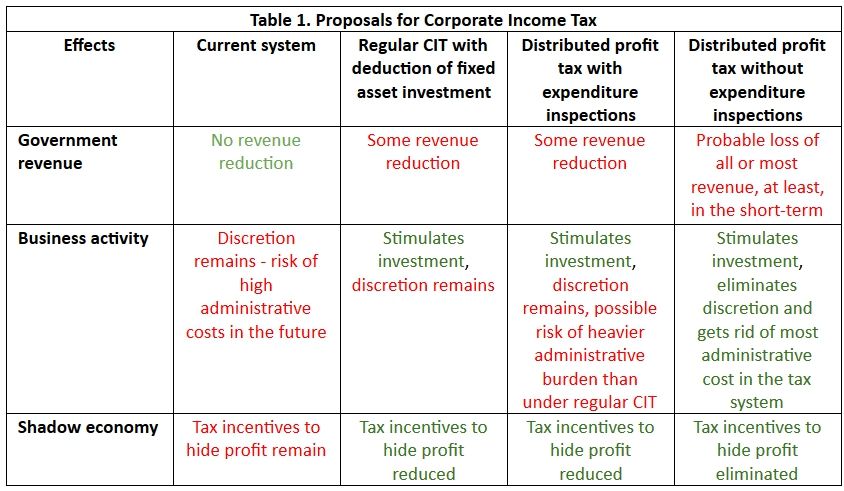

In short, the main CIT reform proposals are as follows (summarized in the Table 1):

- Retaining the current system, possibly with minor changes.

- Allowing full deduction of fixed assets investment as expenditures which would eliminate the taxation of investment into fixed assets.

- Switching to taxation of dividends and other forms of profit distribution to shareholders rather than taxing income at corporate level. Retaining inspections to check whether corporate expenditure is being used by shareholders for private consumption. This model is used in Estonia but there, the distributed profit tax provides only 5% of state budget tax revenue compared to 14% of CIT state budget tax revenue in Ukraine in 2014.

- Switching to taxation of dividends and other forms of profit distribution to shareholders rather than income at corporate level. No checks on whether corporate expenditure is being used by shareholders for private consumption.

This model essentially transforms the CIT into a ‘legalization fee’ for shareholders who need to transform their share of corporate profit into personal income for whatever reason. Otherwise, taxation of profit can be avoided entirely by shifting shareholders’ personal consumption into corporate expenses.

Realization of this model would imply a drastically lower rate of capital taxation in Ukraine, which could cause tensions due to regressive distributional effect of this approach. This can be compensated by other forms of capital taxation (i.e. direct taxation of assets), or turned into Ukrainian ‘specialty’ designed to stimulate capital investment. This model also eliminates most of deadweight losses related to administrative burden and corruption in the tax system by eliminating much of discretion exercised by the officials.

Labor taxes (Personal Income Tax and Single Social Contribution)

Revenue:

PIT – 4.8% of GDP in 2014 (12% of general government revenue)

SSC – 11% of GDP in 2014 (25% of general government revenue)

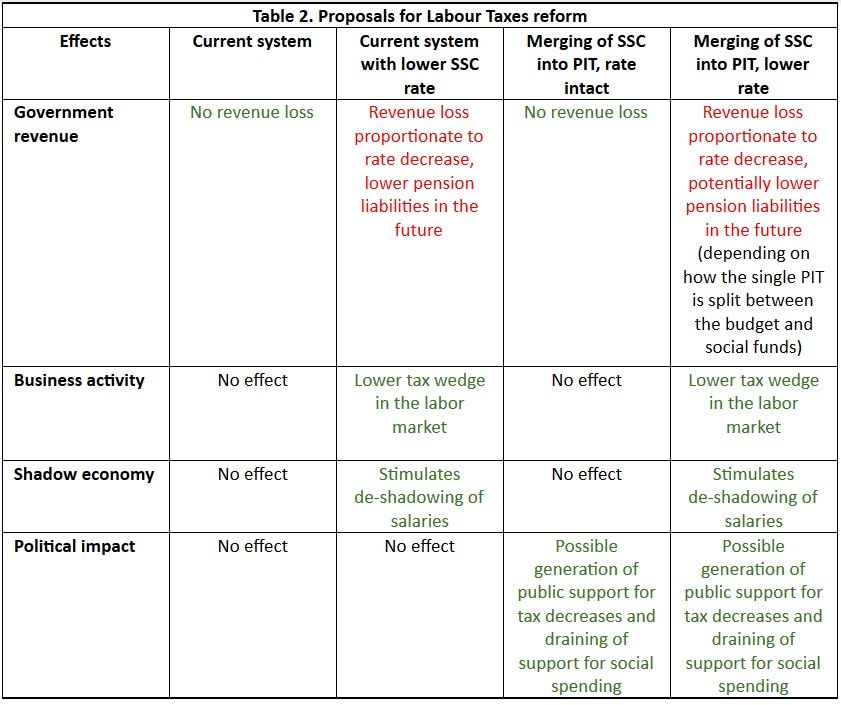

The two main reform alternatives for labor taxation are:

– keeping the current system with separate PIT (goes to state and local budgets) and SSC (goes to social funds) collected at the level of the employer;

– merging them into single PIT collected directly from salaries (though likely administered by the employers during the first years) and then distributed between the state and local budgets and social funds.

Combined with proper communication (e.g. legal obligations for employers to provide their employees with information on the amount of tax taken away from their salaries), the second approach could create better understanding among the employees of the amount of money taken away from them via taxes and thus better understanding of ‘taxes vs. social benefits’ policy tradeoffs among the citizens. This could have beneficial political implications in the future.

Lowering the effective labor tax rate, irrespective of the system chosen, would enhance Ukraine’s international competitiveness and deal with one of the main issues the business community has with the current tax system. Ukraine ranks fifth in the “Doing Business” by the rate of labor taxes and contributions for a typical mid-sized business, almost two times higher than the average for OECD high income countries: 43.1% vs. 23%. It would also stimulate de-shadowing of salaries, which could potentially lead to revenue from lower rates exceeding the revenue from current high rates. Nevertheless, there’s no guarantee that this second effect would be large enough or would happen fast enough to cover the revenue loss from lower rates. Ukraine’s Pension Fund already runs deficits, that are financed by the central government – a drop in revenues would make those deficits larger. Thus, this proposal requires compensators in the form of hikes in other taxes or reduction in relative expenditure levels (Table 2).

Value-added tax

Revenue: 9% of GDP in 2014 (22.4% of general government revenue)

As acknowledged (or, rather, reminded) by the Ministry’s communications platform, untimely and partial VAT refund to exporters is one of the major problems of the tax system. The budgeting process of the Ministry of Finance treats incoming VAT as revenue and refund as one of expenditure items, and the budget is planned accordingly. Whenever applications for refund from exporters are higher than planned – as in 2015, due to high inflation and devaluation – this leads to refund arrears to some exporters. This in turn creates problems of discretionary ability of the State Fiscal Service to refund VAT to certain businesses and not refund it to others, which leads to corruption and unfair competition. Also, the state can use this tool to increase its revenue base at the expense of businesses at its own discretion.

Solution to this problem is for the state to start treating only the incoming VAT net of refund as its revenue, but this has to have credibility, which can only be generated quickly by a certain guarantee mechanism (or by the Ministry of Finance holding its side of the bargain, but it would take several years to credibly demonstrate that). One of the proposed mechanisms is to have a separate account where incoming VAT would be netted out with VAT refund claims and only then the funds would be transferred to the Treasury account and used for budget purposes.

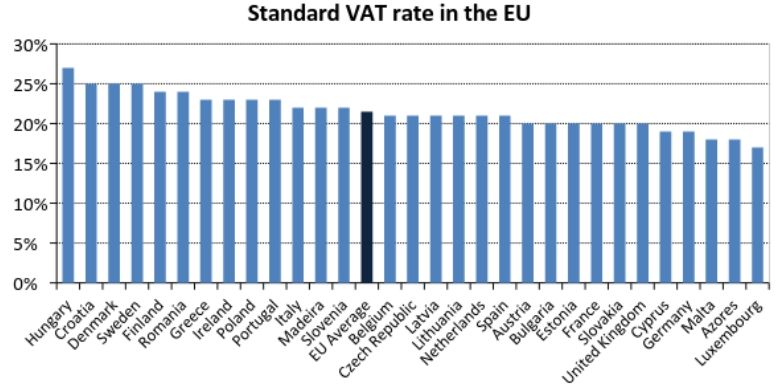

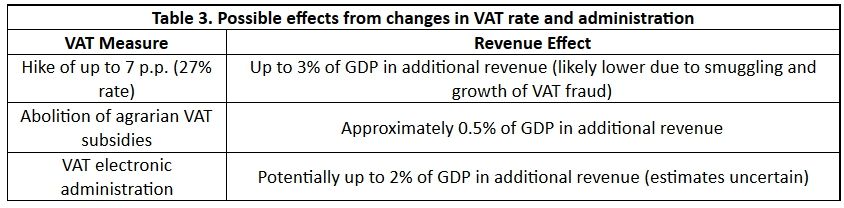

Ukraine’s 20% VAT rate is a bit lower than the average EU standard VAT rate and can be raised somewhat to compensate for a drop in revenues due to CIT reform or lowering of the effective labor taxation rate. The EU average for standard VAT rates is 22%, though in countries like Denmark and Hungary it reaches 25-27%. While the EU has special lower VAT rates that can be applied to certain categories of goods (Ukraine also has a special VAT rate of 7% for certain medical goods), in both Hungary and Denmark their application is quite limited – thus Ukraine’s case would not be atypical among European countries, even if the rate is raised by 5-7 p.p., which could yield up to 3% of GDP of additional revenue and allow to reduce the effective labor tax rate by up to one fifth (11 pp if we count the “overhead” effective tax rate, 7 pp if we count it as deductions).

Nevertheless, such move could be politically hard to implement, as the VAT hike would lead to an increase in prices. In the case of labor taxes, it would also partially offset the effect of lower labor taxation on competitiveness, as inflationary pressures would cause salaries to rise. Finally, one of the arguments against using VAT hike as a compensator for CIT or labor tax reform is that it would increase the discrepancy between businesses operating legally and those which are able to profit from VAT fraud, pushing the former to resort to fraud themselves to stay in business. The hike would also stimulate smuggling.

Additional way to raise revenue from VAT is to abolish the VAT subsidies in the agrarian sector, as planned by the cabinet for 2016 (the agrarian companies get to keep the VAT they generate for themselves rather than pay it to the state), which amounted to 1.2% of GDP in 2014. Nevertheless, this system of subsidies is combined with the regime of zero VAT refund to grain exporters which was introduced in 2012 to cushion the effect of VAT subsidies for the budget, and which will likely be abolished along with the subsidies. The overall effect would thus amount to only about 0.5% of GDP. Also, some political backlash is to be expected, as the agrarian industry has a strong parliamentary lobby and agrarian companies and farmers tend to be well-organized and capable of staging protests.

Apart from that, some additional revenue will probably be generated by the introduction of VAT electronic administration in 2015 that makes it possible to stop a lot of VAT fraud schemes. Some experts have estimated the potential revenue growth at up to 2% of GDP (Table 3) (calculations by Evgen Oleinikov, expert of the Reanimation Package of Reforms).

Simplified small business taxation system

Revenue: 0.5% of GDP in 2014 (1.2% of general government revenue)

Simplified small business taxation system is a major point of contention. On the one hand, it works as an internal offshore, creating cheap ways for businesses to move money to and from the shadow cash economy and to minimize tax liabilities (particularly on labor taxes). On the other hand, it allows small businesses to operate with minimal interaction with tax officials thus avoiding requests for bribes, and keeps the effective rate of taxation of small firms low stimulating self-employment and job creation in this sector.

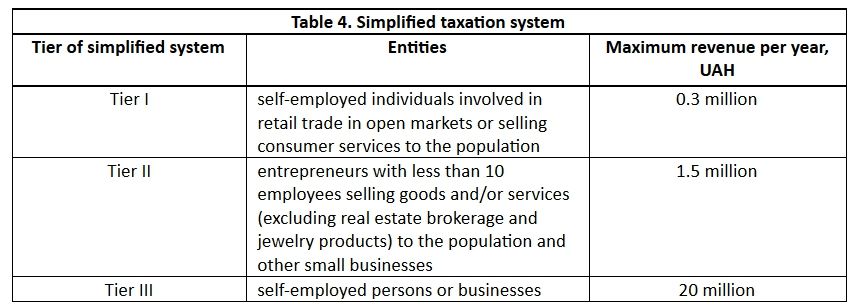

The simplified system currently consists of three tiers (Table 4). There’s also the fourth, but it is reserved for the agrarian sector companies.

Tiers I and II pay fixed monthly taxes based on minimal wage and set by local governments (up to 10% of minimal wage for tier I and up to 20% for tier II). Tier III pays either 4% of annual revenue or 2% of revenue and the VAT.

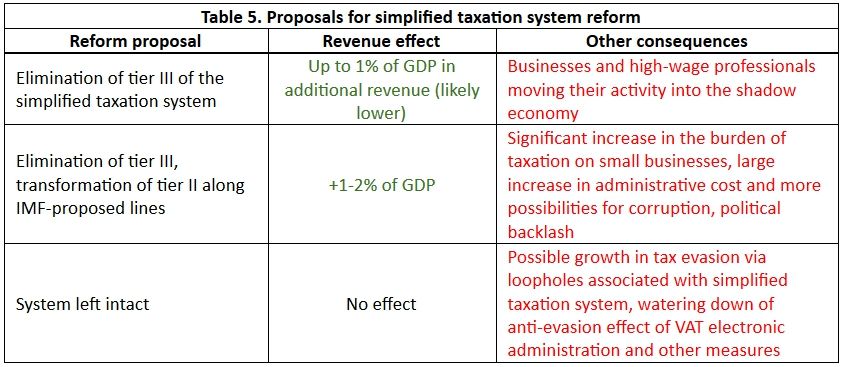

Tier III seems to be the most controversial, as it creates large loopholes for tax avoidance, particularly for high-wage professionals who can use the system to minimize their labor taxes. Raising the tax rate for tier III to the level of CIT rate could close many of those loopholes and yield up to 1% of GDP in additional revenue (calculations by the MP Andriy Zhurzhiy), although actual increase in revenue will likely be smaller due to firms with significant expenses switching to regular CIT, while other firms and high-wage professionals moving their activity into the shadow economy.

According to the information revealed in Ukrainian media, the IMF experts propose to reform the simplified system by eliminating tier III and transforming tier II – making it available to entrepreneurs earning UAH 0.3-2 million per year who would have to keep track of their income (revenue minus expenses) and pay PIT and SSC based on this income. According to preliminary calculations revealed in the media, such reform could yield 1-2% of GDP of additional revenue in 2016.

Such transformation would imply a significant increase in the burden of taxation for all small businesses earning more than UAH 0.3 million per year. It would also require much stricter control from the tax authorities and, consequently, imply much higher administrative cost and more opportunities for corruption. Such transformation would also meet very significant political backlash.

Some experts propose to leave the simplified system intact, for both economic and political reasons. According to them, overall positive effects from low cost of simplified tax administration for small businesses exceed the size of tax subsidies they receive under the simplified system and tax evasion losses, while most of the tax evasion happens in the realm of big businesses. The simplified system also fosters and stimulates the development of independent middle class, which is the major supporter of reforms and development in Ukraine (Table 5).

Other taxes

One proposal is to compensate losses associated with the introduction of distributed corporate profit tax with an asset tax, which would be levied on the book value of fixed assets. According to calculations based on the official book value, at the rate of 2% for fixed assets and 1% for movable assets such tax could yield up to 4-5% of GDP in additional revenue. In reality though such numbers are unlikely to be achieved, as the official book value is extremely distorted in Ukraine and has little relation to actual economic value of assets. Consequently, many enterprises with supposedly high book value of assets would be unable to pay the tax, while the burden of taxation would be distributed in a very non-uniform fashion among various companies and industries. Attempts to manipulate book value of assets are also likely, which could raise administrative cost and corruption.

An alternative to this approach could be a simple hike in taxes on land and real estate value. Nevertheless, especially for real estate, this could also be highly distortionary due to the absence of high-quality valuation for these assets. Moreover, as a part of the decentralization process, the taxes on land and real estate have been transferred to local governments which would be able to change rates on them and thus compete with each other in terms of tax regimes. Attempts to raise additional revenue from these sources nationwide would interfere with this goal.

Finally, excise tax hikes are the usual way to compensate for revenue shortfalls in other areas. While this instrument can provide some additional revenue, it is likely to be limited, as the excise taxes in 2014 provided only 2.9% of GDP in revenue (7.3% of general government revenue) and raising them stimulates smuggling and black market activity, which limits the amount of revenue that can be raised this way.

Conclusions

While potential maximum fiscal space of more than 7.5% of GDP that might be generated for the reform by VAT and excise tax hikes, abolition of agrarian VAT subsidies and a crackdown on simplified small business taxation looks impressive on paper, it is associated with significant uncertainty and downside risks. A full package of these measures is also highly unlikely to be politically feasible.

Most likely, whatever fiscal space can be mustered (if any at all) will be used to lower the effective rate of labor taxation, which would preclude the radical CIT reform and make improvements in the tax administration mostly dependent on the changes within the State Fiscal Service, rather than the tax system itself. Despite this, the sheer size of the share of labor taxes in general government revenue (37%) makes it unlikely that the rate reduction can be large.

In this regard the revenue-side tax reform is hurt particularly strongly by the absence of similar scale expenditure-side reform which could free up additional fiscal space. Introduction of means-testing into the pension and social support systems, stricter and more efficient allocation of funds by the state budget, comprehensive efforts to cut waste in the general government spending and other expenditure-side measures could go a long way towards freeing up the resources necessary for a radical and comprehensive tax reform.

The same logic applies to the efforts to attract the shadow business into the formal economy and to make taxation more uniform between the fully legal businesses and those that use tax evasion schemes. Success or failure in this area is heavily dependent on the level and quality of property rights protection and on the credible commitment by the government not to ‘hold up’ the businesses once they show their real incomes, which are in turn dependent on irreversible institutional reforms in the legal sphere. If such reforms do not materialize on time, the willingness of businesses to move out of the shadow – and, consequently, the success in one of the key areas of tax reform – would be significantly lower.

This suggests that a more synergistic approach to reforms – including better timing of related reforms – might enhance their successfulness.

As it is now, the success of the tax reform depends more heavily on reforms in the area of tax administration than on the changes to the tax system itself. Even if the crackdown on the simplified taxation system coupled with the effects of VAT electronic administration succeed in raising sharply the cost of shadow tax evasion schemes, burdensome tax administration and corruption at the SFS could undermine this success. In fact, it could make the situation worse by strengthening the ability of SFS officials to provide tax evasion services and removing the competition from other tax evasion schemes

Tax Reform Week

Pavlo Sebastianovich: Medium and Small Businesses Displaced From the Legal Field of High Tax Rates (Pavlo Sebastianovich, Civic Platform “Nova Kraina”)

Vladimir Dubrovskiy: 1-2% of GDP in Additional Revenues as a Result of a Crackdown on Simplified Taxation are Unrealistic Figures (Vladimir Dubrovskiy, RPR expert)

Tetyana Prokopchuk: Business Believes that the Priority is to Simplify the Administration of Taxes (Tetyana Prokopchuk, Vice President of Policy of the American Chamber of Commerce in Ukraine)

Robert Conrad: Tax Reform is not Simply Changing the Law (Robert Conrad, Duke University)

Anna Derevyanko: Cosmetic Changes will not Work for the Society (Anna Derevyanko, Executive Director, European Business Association)

Ukraine Needs a Radical but Sensible Tax Reform (Anders Åslund, Senior fellow at the Atlantic Council in Washington and author of the book “Ukraine: What Went Wrong and How to Fix It”)

Roman Zharko: Core Problem of the Ukrainian Tax System is Practice of Discretionary Use of Fiscal Mechanism to Reach the Established Revenue Targets (Roman Zharko, PhD, Tax Manager, Baker Tilly)

Tax Reform in Ukraine: How to Accomplish the Impossible (Vladimir Dubrovskiy, expert of the RPR group)

Tax Reform in the Light of Macroeconomic Stability: the NBU Perspective (Dmytro Sologub, Deputy Governor at National Bank of Ukraine, and Serhiy Nikolaichuk, Director of monetary policy and economic analysis department at NBU)

Macroeconomic Implications of the Tax Reform (Yuriy Gorodnichenko, UC Berkeley, co-founder of VoxUkraine)

Tax Reform in Georgia: Lessons for Ukraine (Olena Bilan, Chief economist at Dragon Capital, member of the Editorial Board of VoxUkraine)

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations