According to the estimates, from 32% to 46% of the Ukrainian economy is «in the shadow». At the same time, 40% of Ukrainians do not know how much taxes they pay. The problem of tax evasion often sparks the domestic economic debate. However, the question “why?” is often left out. Why do citizens and entrepreneurs prefer salaries in envelopes and working in the shadows. In this article, we will look at behavioural economists ‘research findings and international experience to answer what determines citizens’ tax liability and how to raise it.

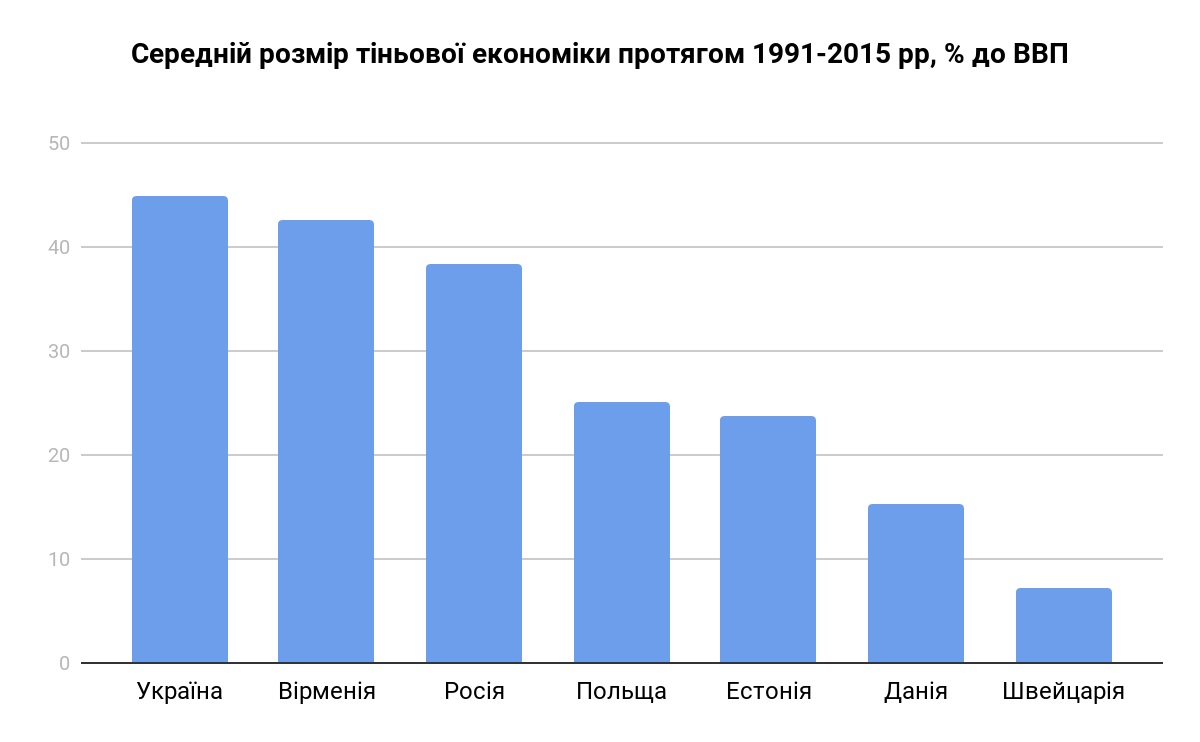

According to international estimates of the size of the shadow economy in the countries of the world, Ukraine occupies a disappointing position. According to the IMF, from 1991 to 2015 the average annual indicator of the shadow economy of Ukraine was 44.8%, while it was at 25.1% in neighbouring Poland, 38.4% in Russia , 7.2% in Switzerland.

Source: IMF

Domestic data is more optimistic. In 2018, the Ministry of Economic Development and Trade estimated the size of the shadow economy in the country at 32%. And this is the lowest percentage in the last 8 years. Compared to the “rich countries club”, Greece is the counterpart of the shadow economy in OECD countries, with a 21.5% GDP ratio. At the same time, Greece was one of the founders of the international organization OECD (Organization for Economic Co-operation and Development), which calculates this rating.

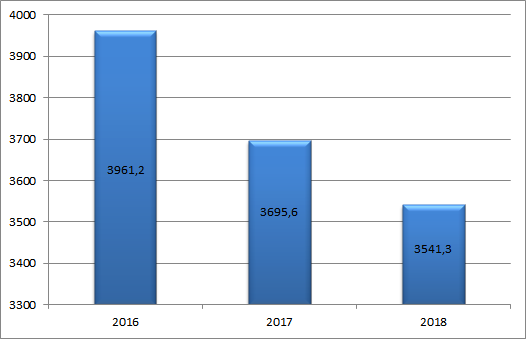

The labor market situation is also disappointing. In 2018, there were 21.6% of informally employed workers in Ukraine. That’s about 3.5 million people. Even though the number of unofficially employed people is getting smaller, the amount of underpaid taxes remains significant. According to the Ukrstat methodology, informal employment includes all employees who are not legally or in fact subject to national labor law, income tax and social protection. Such activities are outside the scope of the legislation, as they are not regulated at the legislative level, or legislative rules exist, but are not implemented in practice or are too burdensome.

Informally employed population aged 15-70 years, thousand people

Source: State Statistics Committee

Let’s try to figure out why people are evading taxes and how different countries solve this problem.

Why people evade paying taxes

Beliefs about the rationality of economic agents and the predominantly controlling nature of taxation policies may suggest that citizens and businessmen by default are unwilling to pay taxes, interested in evading them, and leaving much of their income to themselves. However, the causes can be very different.

Back in 1998, economist James Andreoni insisted on the importance of psychological factors in his research on tax compliance. He argued that emotions such as guilt, shame or obligation, as well as demographic, social and moral factors, should be integrated into traditional economic models. Subsequently, many researchers began to do so, finding more and more factors that influence the tax behaviour of citizens. Let’s talk about them in more detail:

Political activity. The stronger the political and legal participation of citizens, the greater their sense of tax responsibility and morality. This was the conclusion reached by scientists Werner Pommerene and Hannelore Hannemann, explaining Switzerland’s high tax discipline. They have shown that the ability of citizens to actively participate in the adoption of laws (in particular through referendums) and the size of fiscal payments affect the formation of high tax morale. By taking part in determining the policy of the country, the Swiss can more clearly understand the link between tax compliance and their own well-being.

Quality of public services. When the quality of public services and public goods is poor, taxpayers perceive tax payments as unfair. The lower the average return on social benefits per capita (budget expenditures), the lower the level of tax liability of citizens. The same applies to the significant difference in tax rates between payers. People who are obliged to pay more may find it unfair and therefore avoid payment.

The approach to payers. When tax authorities view citizens as potential fraudsters, people are distrustful of the authorities, so there is an increased risk of tax evasion. Vienna’s professor of economic psychology, Erich Kirchler, criticizes the fiscal policy of several countries. He argues that instead of approaching the tax process, “robbers and police officers”, the “customer and service” approach should be practiced. If taxpayers perceive government as a provider of services to the public, they consider filling the budget their responsibility. In this way, the author demonstrates how cross-cultural interaction between government and the population is related to different levels of tax culture in different countries.

Taxes. Economist James Alm has shown that other things being equal, higher tax rates can lead to a reduction in tax discipline. He also found that the extension of tax discipline is not conducive to increasing the severity of penalties for tax evasion and excessive control by tax authorities.

Culture and norms. Tax responsibility and citizens’ inclination to bribe can also be influenced by the country’s cultural environment and behaviour. This was shown by researchers Abigail Barr and Danilo Serra in their behavioural experiments. Studying the impact of the national factor on tax payments, they conducted a laboratory game on bribery for students from 34 different countries. The authors confirmed the link between student behaviour in the experiment and the level of corruption in their countries of origin. People’s inclination to bribe, in particular for tax evasion, depends in part on the values and social norms that prevail in the societies where they are raised.

Shadow economy. Tax evasion increases the size of the shadow economy, and the growth of the shadow economy, in turn, increases the tax pressure on the formal sector. In countries with high levels of shadow economy, governments often offset budget deficits at the expense of taxpayers. It can also exacerbate the free rider problem when consumers of public goods avoid paying for them, especially when they watch others do. This may be accompanied by increased tax pressure or increased tax rates for honest taxpayers. In any case, this can only exacerbate the problem of evasion and reduce the level of tax discipline.

Tax experiments: what to do to make citizens pay their taxes

To understand what contributes to tax compliance, let’s look at the results of tax experiments conducted by foreign researchers and describe some of them.

Strengthening audit control. In experiment, the researchers divided the participants into two groups. The first group sent letters warning them to carefully review their tax records. The other group got nothing. As a result, low- and middle-income taxpayers increased the reported income in their reports, while the high-income group did not. The authors show that the effect of the warning letter varies depending on the ability of the payers to evade, as well as their income. Similar studies were conducted in Sweden. Prior to filing the tax return, small business representatives were sent similar warning letters. One group was informed that they would first and foremost check those who declare low incomes, and another that they would be randomly audited. As a result, the declared income for the year increased by 20% for the first group, by 11% for the second and even by 9% among those who did not receive a single letter.

Accountability to third parties. Subsequently, other researchers have shown that increasing accountability makes paying taxes more responsible. Payers subject to third-party reporting have virtually ceased tax evasion, compared to the most self-employed, most evaded.

Conformity and tax letters in the “human language”. Michael Holsworth conducted two large-scale sampling experiments in the UK. It turned out that tax filings for late payment were more effective when compared to other taxpayers. For example, the following was used: “Nine out of ten people in the UK pay their taxes on time. You are currently in a very small minority of people who have not yet paid. ” Thereafter, taxes increased 5.1% compared to the group receiving regular communications. Reminders with commonplace comparisons stimulate tax revenues more than interpreting judicial rules and laws. This is why messages like “Most people in your area pay their taxes on time” or “Most people with tax debt like yours already paid it” really make a person more aware of his or her tax liability. Therefore, making choices and alternatives is important.

Reasonable penalties. Experiments on the effect of fines on tax liability differ. Some studies show that fines improve taxes, some show that the effectiveness of fines is highly dependent on the likelihood of a penalty, while others report no significant effect. James Alm emphasized that fines are only effective in combination with effective audit controls. Also, the level of fines should be carefully scrutinized by the government and optimal: high enough to deter evasion and low enough to avoid a sense of injustice on the part of the authorities and regulators.

From science to politics: how governments use the behavioural economy

Using a behavioural economy, governments have created new models of fiscal policy. One of the most well-known – the Australian Taxation Model – was created in the late 1990s and was based on the concept of a taxpayer’s “motivational position”. It divided taxpayers into 4 groups depending on their tax behaviour. For people who have consistently refused to pay taxes, the model has suggested that court charges and increased scrutiny be used. Audit controls with or without penalties were applied to those who were simply reluctant. Real-time audits were applied to taxpayers, but not always. In addition, the system includes support for tax liability through educational initiatives, accounting convenience and the convenience of the tax system. This is the basis of a tax policy that is required even for those who regularly and fairly pay their taxes.

The tax authorities of Denmark, New Zealand and the United Kingdom use the BISEP model or various variations thereof. The peculiarity of this model is in its focus on a deep understanding of taxpayer behaviour. The model develops strategies to encourage taxpayers to take desirable actions and limit the factors contributing to tax evasion.

Also, in the UK fiscal service there is the Behavioral Insights Team. It studies tax behaviour, ways to stimulate fiscal payments, and how to build social tax rules. The taxing experience of the Netherlands is also interesting. The Horizontal Monitoring model establishes agreements between taxpayers and the tax administration. Their goal is to work together and build mutual trust.

The Right from the Start (STA) model, adopted by the Swedish Tax Agency (STA), is an example of government tax prevention to create a more holistic view of the country’s tax system. The approach includes educational concepts, active interaction between tax authorities and taxpayers. It builds trust in the administration and a positive tax culture.

The findings of numerous behavioural economics studies and the practices of several developed countries, taking into account their findings in tax policy development, show that strict administrative methods are not required to fill the budget and encourage taxpayers. In some cases, even simple SMS reminders work well, in others — improving tax service servicing as opposed to punishment and control oriented ones. Special attention is paid to the fairness of the tax system and the return of taxes to citizens in the form of quality public goods. If the tax rates are too high, corruption is widespread in the country and a rooted culture of evasion, honest taxpayers are at a loss. Taking into account the causes of evasion and the peculiarities of taxpayers’ behaviour can contribute to the creation of a better tax system, which does not reduce incentives for entrepreneurship and allows to reconcile the objectives of filling the budget with the interests of payers.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations