The new government of Ukraine formed after the elections faces two looming crises: most immediate is the risk of a financial crisis, and in the medium term continued lower even negative economic growth. These increase the existential threat Ukraine faces due the Russian occupation in Crimea and its efforts to destabilize the Donbas. It goes without saying that bringing an end to the military conflict must remain a priority of the new government, but that will not suffice to resolve these two economic problems.

True, the military incursion and interference is a key cause of the economic threats, but a reverse causation exists as well: economic weakness and uncertainty has left Ukraine vulnerable to these military actions by Russia. This inter-related set of problems appears to present an extremely complex, hard to resolve situation. This article will suggest that the two economic crises can be addressed very quickly by one policy step – a radical but doable action; a substantial cut in budget expenditures and reduction in government involvement in the economy. Below, we elaborate in turn on the financial crisis, the poor growth performance, and finally describe how a large cutback in budget expenditure simultaneously attacks both problems.

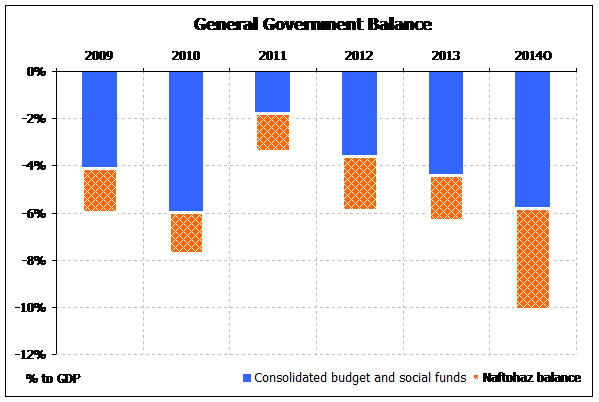

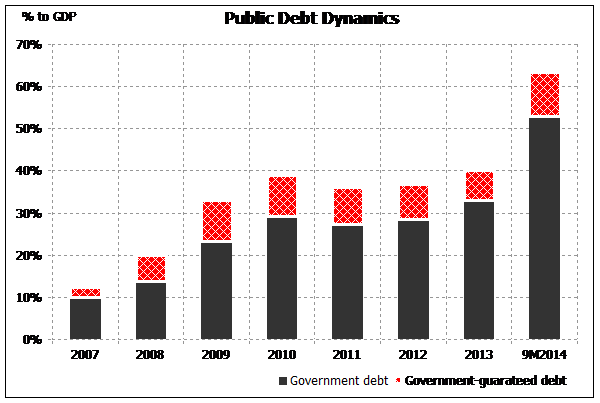

Ukraine’s fiscal deficit has become explosive due to the uncertainties created by the external aggression and the resulting weak economic performance. For 2014, the latest IMF Report assesses the actual size of the deficit at about 5,8 percent of GDP (the other experts tend to larger figures). However, the deficit might even become larger, perhaps approaching 10 percent of GDP if off-budget items are included, as the IMF estimates the financial deficit of Naftohaz alone this year at 4.3 percent of GDP. Such a deficit magnitude cannot possibly be closed by raising already falling tax revenues. Neither can it be closed by non-inflationary financing given the sharp increase in the risk-premium for sovereign debt: further international borrowing is effectively impossible with current short-term interest rates approaching 20%, putting Ukraine into the same category as the top-risk country, Venezuela. As it is, the debt-to-GDP ratio which started the year at a low 40 percent of GDP, would by 2015 reach at least 70 percent of GDP according to the current best-case IMF projection. But that scenario is no longer viable. Given the current existential threats to Ukraine it is surely more prudent to assume the more pessimistic scenarios of the IMF Report, with the Debt-GDP ratio approaching 100% and possibly exceeding 100% in the worst case “shock scenario” of continued conflict and instability. Historically, in cases of such high, unfinancable budget deficits and rising indebtedness, a vicious cycle of deterioration always shows its ugly face: forced domestic financing supported by National Bank monetary expansion, inflation, further depreciation of the exchange rate, lower GDP growth, less government revenue, higher budget deficits… and so on.

Does this sound familiar? Of course – it would be repeat of the first years of independence – surely that lesson has been learned, no? Well it may not have been. There are already early-warning signs of falling into such a vicious cycle: the Hryvnia has depreciated almost twice, inflation is well over the original 9% target, soon approaching 20%, and one institution after another – IMF, Ministry of Economy, NBU, World Bank – put its growth projections on -6-8%.

The new government is left with only one viable option to avoid this financial crisis; cut sharply its budget expenditures. Any return to the populist arguments of the nineties concerning the need to sustain social well-being will only lead to the vicious cycle and the cuts will inevitably occur as they did then, in the worst possible way…revenues will simply not be enough to pay for empty political promises to the people. Does anyone today still believe that such policies reduced social pain in the nineties? It is surely clear they made it even greater, and it is also clear that countries like Poland, Baltics, others in Central Europe, in the end suffered far less social pain that did Ukrainians, precisely because they took the radical steps of cutting their government budgets and moving on economic liberalization early on.

Consider now the growth crisis. While the recent deterioration of growth is due to the military conflict, the poor long-term economic performance which has left Ukraine at an income level one-third that of Poland and other Central European countries which were Ukraine’s equals at independence, is explained by the great lags in economic reforms and hugely excessive government involvement in the economy. With its current budget and off-budget expenditure share of GDP of 53 percent of GDP, Ukraine stands out among comparable countries as having an extremely high government share in the economy. While several countries in rich Western Europe have similar shares they have a far higher level of economic development. The most comparable countries are Central Europe and the Baltic countries that have public expenditures varying about 35 percent of GDP. They also have experienced the highest economic growth in Europe, and despite the lower budget shares the population enjoys far better social benefits than do Ukrainians.

The high budget levels contribute to poor growth performance in several ways. Industrial subsidies, implicit or direct, reduce incentives for efficiency improvements, keep energy usage at the old Soviet inefficient levels making Ukraine continually dependent economically on Russian “generosity”, and motivates enormous levels of corruption. The very large civil service needed to implement such an extensive network of government activity has every incentive to implement and maintain complex regulations, licensing procedures, arbitrary inspections – all of which has created in Ukraine one of the least attractive environments for doing business, accompanied by one of the world’s highest intensity of corruption. A radical cut in the budget means a radical reduction of the bribe-dependent civil service and removal of a critical mass of opponents to the desperately needed deregulation. That in turn will sharply lighten the burden on business and stimulate growth through new production, new investments, and entry of new entrepreneurs on the market, both domestic and foreign.

Thus, to avoid financial crisis with a conjoint debt default, and improved economic prospects, Ukraine must cut its public expenditures sharply. This is not only a matter of finances, but an issue of national survival. Ukraine’s aim in the first 100 days of the new government must be to put in place a program which will in one year cut public expenditures by at least 10 percent of GDP, and continue the reductions until it reaches the norm of similar neighboring countries at the same level of development, at about 35 percent of GDP.

To achieve this there exists fortuitously one stone that kills two birds – a sharp cut in budget expenditures and radical reduction in harmful government intrusiveness in the economy. Arguably there is couple of other birds this single stone may help slay. First rent-seeking and corruption, an economic, social and moral cancer on the body of Ukraine, will decline because it becomes simply less possible to do: in the conceptual extreme if there are no regulations and no regulators – no bribes can be requested. Second, such quick and radical action by the new government will go a very long way to increase its credibility. The population has been clamoring for more action, activists, business people, foreign donors, investors all have expressed the same concern: ”why has so little been done since February?”

But critics and populist populations will argue that such a radical cut in government activity will cause enormous social pain. This is perhaps even more false today than it was when Kravchuk, Kuchma, Yuschenko said it in past twenty years. As already emphasized surely there is no one left today that believes Ukrainians were spared pain by delaying early reforms; in fact the mismanagement and personal interests of previous political leaders, populism and inaction made things worse not better. To be more specific consider some of the specific cuts than can be made and how they affect social well-being.

In the current situation, it is both unrealistic and undesirable to raise public expenditures outside of the most pressing military spending. Instead, the government needs to focus on cutting big and inappropriate public expenditures that can be cut fast. A number of big items stand out. The first is energy subsidies that will probably amount to 7,5 percent of GDP in 2014 according to the latest IMF calculations. This is totally unjustified as such high subsidies make Ukraine weaker in all regards – more dependent on Russian gas, producing less gas itself, and consuming more gas. Instead the Ukrainian government should eliminate these subsidies as soon as possible by normalizing Ukrainian energy prices while giving the poorest half of the population full cash compensation.

The second category of spending that should be checked is public procurement that was the prime boondoggle of the Yanukovych government after energy. With a total public procurement of 8 percent of GDP, half of this amount could be saved if the standard kickback under Yanukovych was 50 percent as is widely reported.

Some savings can be made within the uniquely high public pension expenditures of no less than 17 percent of GDP. Though in short run it is limited by the partial reforms of 2010, there still exists a significantly high level of special pensions of former civil servants and the old Nomenklatura.

Another area of opportunity for cuts is related to superfluous regulation and bureaucracy. If wisely done, the cuts will fall most heavily on areas where corruption opportunities abound. For example, a substantial percentage of superfluous inspection agencies should be abolished and their cadres laid off.

Finally, many expenditure items comprise subsidies allegedly intended to help low-income population, but are highly inefficient because they are also being provided to those with high incomes. Indeed such subsidies are well-known to have the effect of regressive as opposed to progressive budget policy.

While the list above is partial, together these items allow in one year cutting public expenditures of at least one-tenth of GDP without anybody but vested interests suffering. At the same time, one of the benefits would be that the tax-burden-including social taxes – can be reduced considerably with a consequent stimulus to economic activity. And finally of course, these benefits will contribute in a significant way to the security of Ukraine.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations