The Ukrainian authorities have fallen victim to their own hopes. By placing loans in the national budget from international organizations, cooperation with which was suspended due to the actions of the Ukrainian side, the government actually signed for the impossibility to finance all expenditures. Will the Ministry of Finance be able to close the 100 billion budget gap without the IMF?

The authorities did not hide from the beginning the fact that the implementation of the state budget in the crisis year 2020 will depend on Ukraine’s international partners.

“In this budget, we have invested resources from international financial organizations, including direct budget support from the IMF. The support of our international partners is very important, because it allows us to fully finance all necessary expenditures, first of all doctors’ salaries, social protection, infrastructure expenditures”, —socuk commented Finance Minister Serhiy Marchenko on the adoption of the April amendments to the state budget.

This year, Ukraine has a record budget deficit for the last 5 years. In order to finance all expenditures in the conditions of the Corona Crisis, the deficit was set at UAH 274 billion. Every fifth hryvnia out of the planned UAH 1.27 trillion was to be borrowed (net borrowing was planned at almost UAH 300 billion and gross borrowing — at UAH 643 billion).

Due to the slippage of the government’s dialogue with international partners, primarily with the IMF, the Ministry of Finance failed to implement the borrowing plan on which the “covidious” budget was based, which provoked the budget crisis.

This year, Ukraine has a record budget deficit for the last 5 years. In order to finance all expenses in the conditions of the corona crisis, the deficit was set at UAH 274 billion. Every fifth hryvnia out of the planned UAH 1.27 trillion was to be borrowed (net borrowing was planned at almost UAH 300 billion and gross borrowing at UAH 643 billion).

Due to the slippage of the government’s dialogue with international partners, primarily with the IMF, the Ministry of Finance failed to implement the borrowing plan on which the “coveted” budget was based, which provoked the budget crisis.

According to the pessimistic forecast, the actual budget deficit will amount to UAH 152 billion, according to the optimistic one — UAH 200 billion. Therefore, the lack of funds to finance expenditures and lending from the budget will amount to UAH 114 billion or UAH 65 billion, respectively.

In addition to the difficulties in obtaining borrowings, cost savings and the inability of the authorities to absorb the funds provided for them will “help” to reduce the budget deficit, compared to the planned one.

How much is unspent compared to the plan?

Formally, in December the Government needs to finance UAH 103 billion of expenditures, of which 93.3 billion hryvnias are general fund expenditures. But taking into account unpaid expenditures in previous periods, the amount of expenditures to be financed should be twice as high — UAH 215 billion. Including UAH 194.7 billion for the general fund of the budget.

However, it can be expected that the real needs of fund managers will be lower — either due to deliberate savings, or due to the inability of managers to absorb the entire planned amount of funds.

In 2017-2019, the average level of funds non-use by managers of the general fund of the state budget was 1.5% – 3%, for the special fund — about 20%. To maintain this trend, managers will not have time to use funds to finance expenditures of up to UAH 66 billion (UAH 34 billion — for the general fund, and UAH 32 billion — for the special fund).

At the end of October 2020, fund managers were not able to accomplish the planned expenditures of UAH 94.4 billion or 10% of all expenditures planned for this period. No funding at all has been started for 77 budget programs provided by the law on the state budget for 2020, for UAH 19 billion.

However, there are currently no resources to finance even reduced needs. At the expense of budget revenues, the Government will be able to finance only a third of the total unfunded at the beginning of December expenditures — about UAH 60 billion (for the general fund) with a plan of UAH 55 billion for December. Another part of the expenditures can be paid at the expense of hryvnia and foreign currency balances of the treasury single account. As of December 1, the amount of hryvnia funds on the TSA amounted to UAH 19.8 billion. The rest (over UAH 100 billion) needs to be borrowed.

Will the Ministry of Finance be able to borrow enough funds in December?

First of all, it will depend on whether the Government will be able to receive a clear positive signal from the IMF to continue cooperation. If so, the Ministry of Finance has a chance to get loans from other international partners by the end of this year, as well as successfully enter foreign borrowing markets.

Under the pessimistic scenario — without positive news from the IMF and money from international partners — the Government will be able to rely solely on domestic borrowing, which will require a significant increase in their value (and hence — “instantaneous” increase in debt service costs already in 2021).

In any case, the Government needs to give up non-priority expenditures and expenditures that managers do not have time to cope with properly. And thus reduce the need to attract debt.

Is there a demand for Ukrainian debt?

Due to problems in cooperation with the IMF and a significant budget deficit, investors are reducing the demand for Ukrainian debt, even despite the excess money in the world market. Therefore, it is more and more difficult for the Ministry of Finance to implement the borrowing plan. The same problems delayed Ukraine’s receipt of the first tranche of a new macroeconomic assistance program from the EU.

In order to repay all debts and finance budget expenditures in full, in 2020 the government had to borrow UAH 642.7 billion, of which 96% (UAH 624.3 billion) was to be borrowed from the general fund of the state budget.

Starting from July 2020, the Ministry of Finance has failed to implement the plan of attraction of both external and internal borrowing. The government planned financing for active operations (i.e. borrowing minus repayment, taking into account adjustments) for July-November at UAH 139 billion. But in fact they were negative in the amount of UAH 14 billion, i.e. the Government paid UAH 14 billion more on debts than it borrowed.

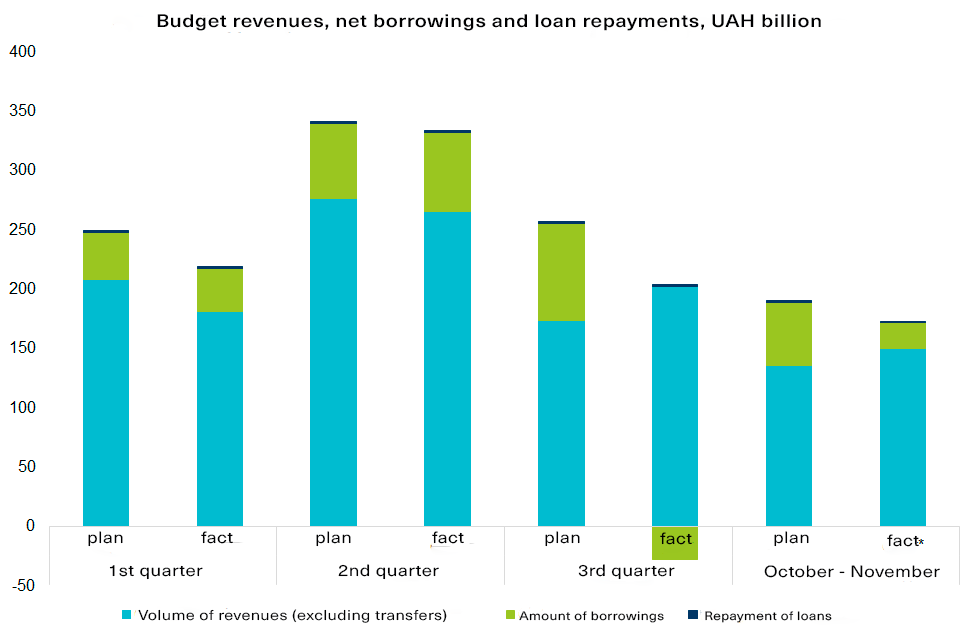

In November, when planning to borrow UAH 25.6 billion (from the general fund) to finance the deficit, the Government was actually able to borrow only UAH 9.2 billion (34%). In October, the situation was similar: in the plan — UAH 31.3 billion, in fact — UAH 13.4 billion (43% of the plan). (Fig. 1).

Figure 1. The total financial resource available to finance budget expenditures in 2020. Plan and actual level of implementation.

Source: Data from the State Treasury Service, Ministry of Finance lists, calculations of the Center of Public Finance and Governance KSE

*for November, the actual amount of debt repayment is calculated according to the Ministry of Finance on the basis of planned debt repayments on 01.11.2020

How much do we lack?

In order to finance the budget deficit at the planned level for the year, to cover the non-fulfillments of the borrowing plan for the previous period and to repay debts due in December, during the last 4 weeks of the current year the Ministry of Finance needs to borrow at least UAH 100 billion to the general fund of the state budget. But during the first auction in December, they were able to borrow only 2.7 billion hryvnias.

Therefore, the only real opportunity to close the “hole” in the budget is to establish cooperation with international partners.

For purely procedural reasons, Ukraine will not have time to receive the second IMF tranche by the end of 2020. But recently, the Ministry of Finance stated that they had agreed with the Fund on a draft budget for 2021. This gives hope for the revival of cooperation with the IMF. And thus, to unlock support from other international partners. In particular, the government can still “fight” to obtain a macro-financial support loan from the EU (EUR 600 million), the World Bank (USD 300 million) by the end of this year, and to place Eurobonds.

According to this, the most optimistic scenario, the Government will be able to attract about UAH 98 billion in December. Subsequently, to finance about 130 billion UAH of expenditures in December.

If the “miracle” does not happen and the situation follows a pessimistic scenario, in December the Government will be able to attract only domestic debt financing in the amount of up to UAH 50 billion (this year it is the highest amount of borrowings per month), with a significant increase in borrowing rates.

This will directly affect the amount of expenditures that the government will not be able to finance. In the first case, the formal amount of expenditures for which there is a lack of funding, compared to the plan, will be reduced to about 65 billion UAH by the end of the year.

In the second case, the total underfunding of expenditures for the year will be about 114 billion UAH.

The real amount of underfunding in both cases will be lower due to savings / non-fulfillment of the plan by the authorities themselves (by fund managers).

Another source of financing the deficit is privatization, but even at the very rapid pace that has been taken by the State Property Fund this year, the proceeds from the sale of state property are disproportionate to the Government’s need to finance its expenditures.

The cost of borrowing will increase

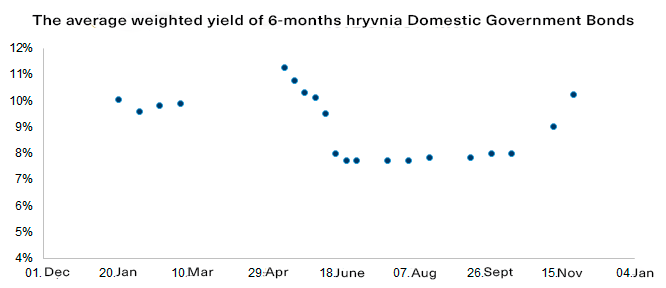

In order to rectify the situation at least a little and attract funds to refinance (repay) previous debts, at the end of November the Ministry of Finance has already started to significantly increase the cost of borrowing, especially of “short” ones (Fig. 2).

Figure 2. The cost of short-term hryvnia borrowings for the Ministry of Finance.

Source: Ministry of Finance of Ukraine

But to borrow even more in the domestic market, the Ministry of Finance will have to further increase the yield of Domestic Government Bonds.

Meanwhile, expenditures on public debt service (i.e. on interest payments on already made borrowings) are already the second largest item of expenditures in the draft budget-2021 after pension payments and they amount to UAH 160.5 billion or 12% of all budget expenditures.

Planned, but not implemented, from 65 to 114 billion hryvnias of expenditures this year would not be superfluous (let’s recall that the Covidious fund is 66 billion hryvnias). They could be used to support the unemployed or businesses affected by the crisis, to finance medicine and other expenses. But this requires consistency in both planning and budget execution. In particular, in the issue of cooperation with international partners. Otherwise, it is necessary to reduce expenditures in the period when they are most needed.

Photo: depositphotos.com/ua

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations