Ukraine is among the world leaders in the size of its shadow economy. Why do people or companies pay or not pay taxes? Cutting tax rate to perceived “fair” level may not be possible due to budget deficit considerations. But there is also a way to reduce the gap between businesses’ perception of the fair tax rate and reality by increasing quality of government services provided.

In this text we present the results of our study, based on two representative surveys of Ukrainian firms: one done in March 2013 (encompassing 625 firms from all regions of Ukraine, stratified according to region, size and industry)[1] and the other in March 2015 (encompassing 120 firms from Western Ukraine, stratified according to size and industry)[2].

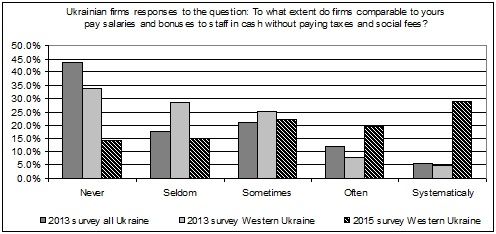

The data from the 2013 survey show that one of the most popular informal practices used by business is the payment of salaries and bonuses in cash. Indeed, 39% of firms admitted making frequent informal, cash payments of salaries and bonuses to avoid paying taxes and social fees, of which 21% used this practice sometimes, 12% used it often and 6% used it systematically. To compare these results with our newer survey we only looked at the results for Western Ukraine. They are quite similar – 38% of firms in the Western Ukraine admitted making frequent informal cash payments of salaries and bonuses to avoid paying taxes and social fees in 2013. Of those firms,25% reported that they used this practice sometimes, 8% reported using it often, and 5% reported using it systematically.

The 2015 results (for Western Ukraine only) show a considerable increase of about one standard deviation in the usage of this informal practice. Almost 71% of firms admitted making frequent informal cash payments of salaries and bonuses to avoid paying taxes and social fees. Of those firms, 22% said they used the practice sometimes, 20% said they used it often and 29% said they used it systematically.

In our opinion, such results indicate a continuing social and economic crisis, which resulted from the nearly defaulted state of the economy due to the military conflict in Donbas and the years of postpoing reforms in many spheres. The situation is pushing many businesses to brink, making tax evasion practices the only option for survival. High taxes and social fees (the corporate profit tax in Ukraine is 18% and the social tax (including payments to the State pension fund) exceeds 40%) combined with a reduced consumer demand for products and services results from in a s has put small and medium-sized companies in an untentble position. Even many large businesses try to evade high taxes by employing people as independent contractors, which reduces the tax burden considerably. Our respondents indicate that, if they were to pay all the required taxes and fees, about half of their employees’ salaries would be taken away as a result. That would demotivate employees and reducetheir productivity and morale. As a result employers try to increase salaries by paying social benefits directly to their staff. In addition, having no formal relationship with employees and/or employing people as independent contractors reduces firms’ interaction with state officials and saves the time needed for managing taxes. Hence, tax evasion is seen as a fair and efficient way of improving productivity and a socially accepted way of increasing the compensation of employees.

We asked businesses about their perception of what tax they consider to be fair.

Interestingly, the responses to this question did not change from 2013 and 2015. Under normal conditions, companies see a corporate tax of 13% as fair, which is not far from applied 18% rate . At the same time, business envisage that the social tax should be about 12% on average, which is more than 70% less than the existing social tax and is below 17% (for most incomes) personal income tax.

Such a gap between business perceptions and actual social tax has immediate consequences for the informal practices used by businesses. One may think that lowering the social tax rate will lead to a loss in the budget (which equals the amount of tax rate reduction). However, simple calculations show that if there is a reduction in the social tax rate (which will make this tax more acceptable to businesses, let’s say 15%), it will not necessarily lead to a reduction in the payment of this tax[3]. Indeed, new tax law adopted in 2015 reduces the social tax burden of businesses to 17%% subject to conditions, but that needs to be done unconditionally and with ban on changing the law in order to be perceived correctly.

Cutting tax rate to perceived “fair” level may not be possible due to budget deficit considerations. But there is also a way to change businesses’ perception of the fair tax rate by increasing quality of government services provided. If a business starts perceiving the government as a credible partner to outsource the social protection of their employees, they may change their tax evasion practices. What needs to be done by government? First, government should pay more attention to the fairness of redistribution of spending financed by social tax: (i) all government spending, including pension fund spending, should be open and transparent; (ii) the gap between the highest and the lowest pensions needs to be reduced considerably; (iii) the effectiveness of the social services (health care, education, etc) provided by the state and local governments should improve. At the same time, government needs to win the and to try to adjust the perception of fairness and overcome populism. Constant communication and a weekly presence in media,Withith clear messages and explanations, can inthe government crease state credibility and change people’s and businesses’ perceptions of fairness of government actions.

Notes

[1] Denisova-Schmidt, Elena; Huber, Martin (2014): Regional Differences in Perceived Corruption among Ukrainian Firms. Eurasian Geography and Economics, 55(1), 10-36.

[2] Denisova-Schmidt, Elena; Prytula, Yaroslav: The Business Environment in Ukraine: New Country, Old Problems, More Hope. Edmond J. Safra Center for Ethics, Harvard University (29 April 2015).

[3] If the state expects to collect X grn of social tax, with current level of tax evasion it collects about 71% less (those who say they “frequently” evade taxes) that is 0.29X. If the social tax would be reduced from approx. 40% to 15% and would be paid by all business (no tax evasion), then the state would collect X*(15/40)=0.375X that is 30% more than 0.29X. So, at least, the state would not lose.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations