From the beginning of the full-scale russian offensive, the Ukrainian mining and metals industry suffered a devastating blow, both literally and figuratively. Production capacity losses, traditional transport routes’ closures, efforts to stay afloat in export markets, and reduced domestic consumption became part of the challenges local manufacturers had to resolve.

This article considers how the main indicators of Ukraine’s ferrous metallurgy industry have changed and the state and international partners’ efforts to support one of the economy’s key sectors.

For reference: Ukraine’s mining and metals industry comprises mining companies and iron and steel works (ferrous and non-ferrous) connected by a single production cycle. Ferrous metallurgy covers the production of ferrous metals, their products, and related raw materials. Non-ferrous metallurgy includes companies engaged in extracting, beneficiating ore, and manufacturing products from non-ferrous, rare, and precious metals and their alloys. This article will focus on the analysis of ferrous metallurgy, which significantly dominates the structure of Ukraine’s foreign trade (40% share of the iron and steel exports versus 2% share of non-ferrous metals in 2021). You can familiarize yourself with the general scheme of the production process here.

The development of Ukraine’s ferrous metallurgy over the past ten years resembled a race with obstacles. The start of the russian invasion in 2014 and its consequences in the form of the illegal annexation of Crimea and the armed conflict in eastern Ukraine led to the economic crisis of 2014-2015. It significantly impacted the iron and steel industry, which suffered from damaged railway infrastructure, a shortage of raw materials, and the shelling of industrial objects.

With 2016 being a year of recovery, production volumes fell again in 2017 due to the loss of assets of the Metinvest Group in temporarily non-government-controlled territories. In a few years, the domestic industry faced a new challenge of the COVID-19 pandemic, leading to market closures and a drop in consumption.

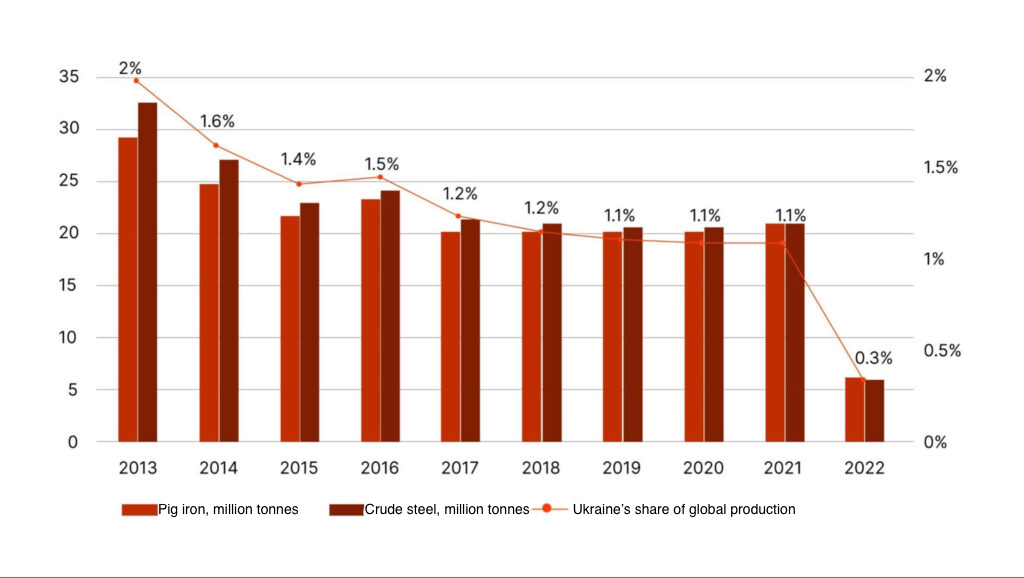

The outlook for 2022 was mixed due to several factors that could play against Ukrainian steel producers. One of these factors was an expectation of an escalation of the conflict with russia, which eventually became decisive. As a result, Ukraine lost about 80% of its steel production compared to 2013 (Figure 1). The most significant losses occurred in 2022 due to the destruction and shutdown of business entities, the occupation of some ports, the impossibility of export by sea, and power outages, which intensified at the end of last year.

Figure 1. Volumes of pig iron and crude steel output in Ukraine, million tonnes

Source: Ukrmetalurgprom, Worldsteel

Shocks for the Ukrainian steel industry

Last year, Ukraine smelted almost 6.3 million tonnes of crude steel, which was only a third of the 2021 results. Moreover, most of it (58%) was produced in the first quarter. The rolled steel products output also suffered losses, decreasing by 72% to 5.4 million tonnes. Ukraine left the top 15 largest steel producers, dropping from 14th in 2021 to 25th in the global rankings in 2022.

Shock one: full-scale invasion, shutdowns, and destruction of assets

Immediately after the onset of russia’s military offensive on February 24, key Ukrainian steelmaking companies announced they temporarily suspended operations in Mariupol, Zaporizhzhia, Kryvyi Rih, and the Dnipropetrovsk region. Over the course of several months, manufacturers gradually resumed operational activities. Still, Metinvest failed to do so at its two factories, Ilyich Iron & Steel Works and Azovstal in Mariupol, which provided 40% of the country’s steel production in 2021, because of losing control over them. During the second half of last year, the surviving facilities continued to operate at reduced turnover.

For reference: Before the full-scale invasion, the Metinvest Group’s asset portfolio included three steelmaking facilities: Ilyich Iron & Steel Works and Azovstal in Mariupol and Kamet Steel in the Dnipropetrovsk region. Currently, only Kamet Steel is operating. In addition, the joint venture Zaporizhstal continues its operation in Zaporizhzhia.

The press office of the Metinvest Group:

“Metinvest is one of the largest employers in Ukraine, especially in one of the country’s most affected cities, such as Mariupol and Avdiivka. After the start of russia’s full-scale invasion, a significant number of the company’s employees suffered material losses (including documents) and/or were forced to move to safer places.”

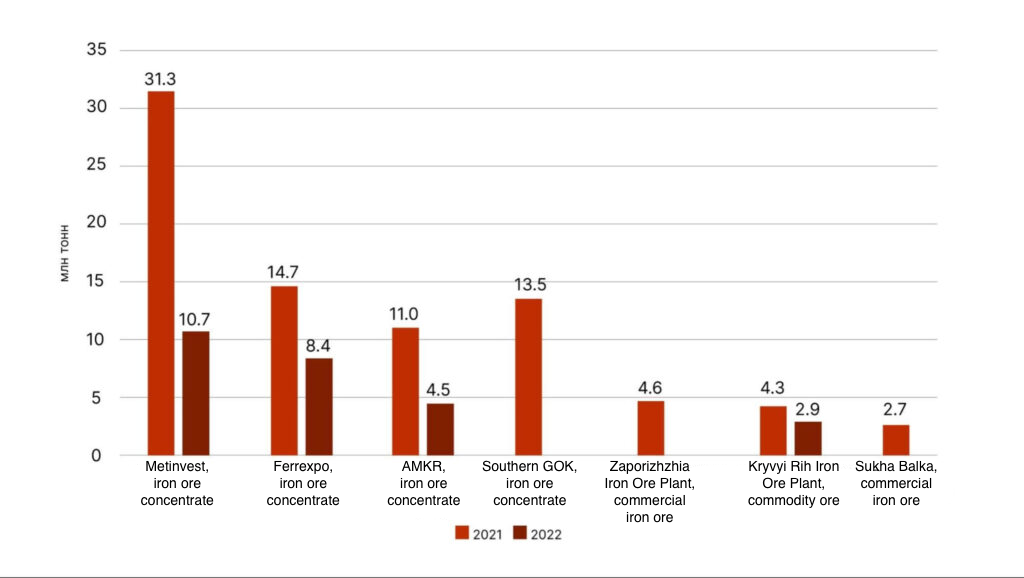

Iron ore production also underwent significant changes (Figure 2) due to disrupted logistics, reduced demand, and increased production costs, forcing companies to suspend production (1, 2). In particular, the mining and beneficiation plant of the Metinvest Group suffered losses of nearly 66%. Last year, the ArcelorMittal Kryvyi Rih mining department produced only 40% of the iron ore concentrate compared to 2021. The largest exporter of iron ore pellets among the post-Soviet countries, the Ferrexpo company last year reduced concentrate production by 40%. Most iron ore production facilities (90%) are now in Ukrainian-controlled territory. Control over the Zaporizhzhia Iron Ore Plant was lost in June last year.

Figure 2. Iron ore production in Ukraine in 2021-2022, million tonnes

Source: Compiled based on company reports published on their official websites

Note. There are no production data for the year 2022 for Southern GOK, Zaporizhzhia IOP, and Sukha Balka.

The second shock: a lack of working capital

After the beginning of russia’s full-scale invasion of Ukraine, refunding VAT to exporters stopped due to the shutdown of the VAT electronic administration system and the Unified Register of Tax Invoices. This resulted in steel industry companies lacking 20% of working capital for three months (in March-May). There were also problems in July. Since their contractors insisted on full pre-payment during the war, metallurgical companies reduced their purchases and production volumes (this partly coincided with the period of suspended production or reduced load due to war risks and a blockade of seaports). Given the general deterioration of business conditions, some companies turned to international credit institutions to fund their operations.

The third shock: logistical constraints

Russia’s attacks on the railway infrastructure, and most importantly, the blockade of seaports, became one of the most serious tests for Ukraine’s steel industry because about 65% of the iron and steel product exports were carried out through the ports. According to industry experts, the blockade of Black Sea ports costs Ukraine $420 million monthly.

Companies were forced to arrange new transport routes using European railways and ports, primarily the Romanian port of Constanta, the Polish ports of Gdansk, Gdynia, and Szczecin, and the Lithuanian port of Klaipeda, instead of the traditional ports of Mariupol, Odesa, and Mykolaiv. However, exporters’ opportunities are limited by rail crossing capacity on the border and different widths of railway tracks, which increased the queues and forced Ukrzaliznytsia to introduce restrictions on transporting iron and steel to the EU.

In addition to quantitative restrictions, the companies also faced an increase in the price of transportation. In July of last year, the Ministry of Infrastructure issued an order increasing transportation tariffs for Ukrzaliznytsia by 70% for all groups of cargo. Overall, the construction of new routes and increased tariffs led to a rise in transport costs for metallurgical companies by 3 to 4 times.

The fourth shock: a shortage of energy resources

The steel industry is one of the most energy-intensive areas of the economy. In particular, the share of metallurgy in total electricity consumption in Ukraine was 23% in 2020-2021, second only to household consumption.

Russia’s massive missile attacks on critical infrastructure facilities brought Ukraine’s power system closer to a complete blackout in November. Not only were household subscribers left without power supply, but also industries. For the second time since the start of the full-scale war, Ukrainian metallurgical companies announced the forced stoppage of the main production processes. As the situation stabilized, iron and steel works continued to operate within the limits of the energy-consumption quotas, turning on maximum economy mode and reducing the load for units. In February 2023, Ukraine’s energy system entered deficit-free production.

Internal market: “more to follow”

The domestic market’s development situation fully reflected the overall state of the industry last year. According to the estimates of trading companies, the domestic consumption of rolled steel products at least halved to 2 million tonnes last year, with prices rising on average by a quarter. Before the full-scale invasion, domestic consumption exceeded 5 million tonnes of steel per year, of which slightly less than a quarter was imported (mainly products not produced in Ukraine). In the total production volume of rolled metal in Ukraine, the share of shipments to the domestic market was slightly over 20%, with exports accounting for about 80%.

Construction companies saw the most profound drop in consumption. The situation regarding demand was slightly better for machine-building enterprises (in particular, the defense-industrial complex) and the agrarian-industrial complex, the production of downstream steel products, in particular for export.

In 2023, market players expect an increase in demand for steel by 10-15% owing to the restoration of damaged infrastructure and demand from manufacturing companies relocated to the west of Ukraine.

In the future, after the war’s end, the domestic consumption of steel will increase several times to at least 15 million tonnes (according to some estimates) since restoring infrastructure facilities and the housing stock will require millions of tonnes of steel.

Global market without Ukrainian metal: operation “adaptation”

Ukraine’s steel industry is export-oriented.

For reference: This article’s analysis of foreign trade considers goods of group 72 (“Iron and steel”) and commodity items 7301-7306 of group 73 (“Articles of iron and steel”) of the Commodity Nomenclature of Foreign Economic Activity (CN FEA) to be metal products or steel. We consider commodity item 2601 of the CN FEA to be iron ore products.

Iron ore. The export of iron ore products ranks within the top three in terms of volume and value in Ukraine’s list of foreign trade goods. If this export item was number one in 2021, providing 10% of the country’s export revenues, last year’s ore shipments gave way to agricultural products (corn and sunflower oil) owing to the “grain agreement.” Since iron ore supplies do not fall under said agreements and Ukrainian seaports remain closed, their exports almost halved to 24 million tonnes in 2022, with foreign exchange earnings dropping to $2.9 billion (7% of Ukraine’s income).

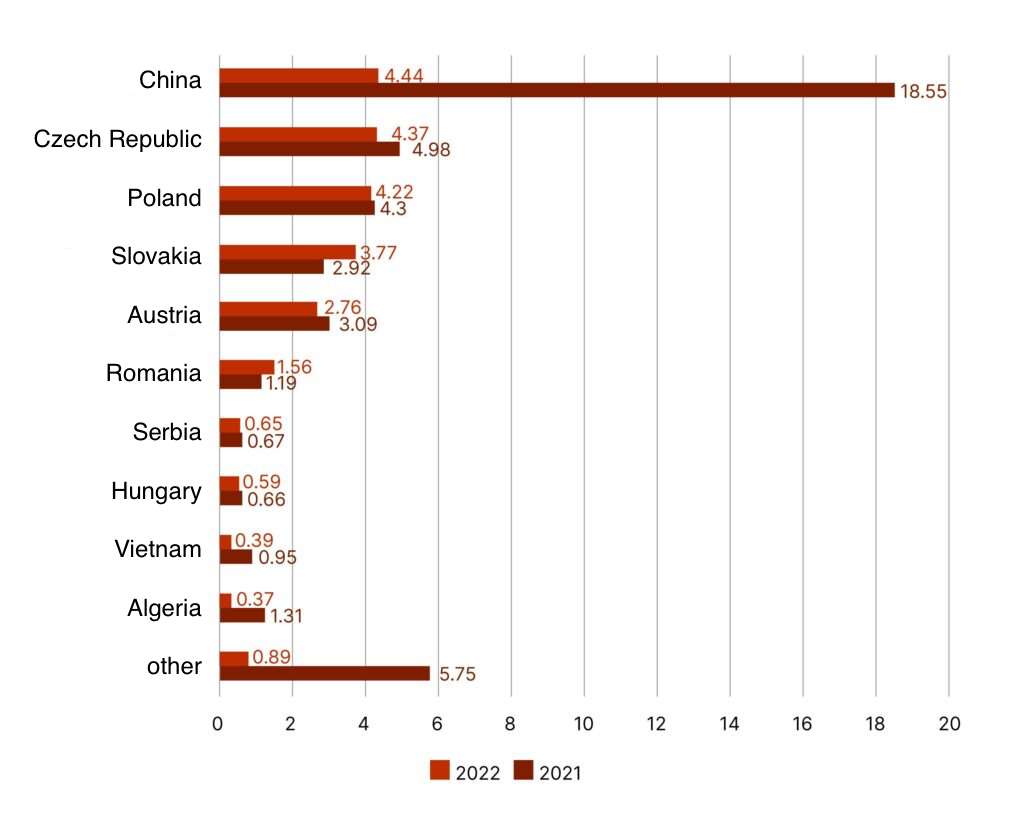

In pre-war times, China was the primary buyer of Ukrainian raw materials. Last year, exports to China were carried out only during the first four months, after which Ukrainian suppliers, in the conditions of blocked ports, redirected exports to the nearest European markets of the Czech Republic, Poland, and Slovakia (Figure 3).

Figure 3. Geography of exports of Ukraine’s iron ore products in 2021-2022, million tonnes

Source: International Trade Center

Given that Ukraine’s share in China’s iron ore imports reached about 2%, the loss of these volumes did not become a problem for Asian producers. However, Ukraine partially replaced the volumes for European consumers previously supplied by russia and “banned” under the sanctions.

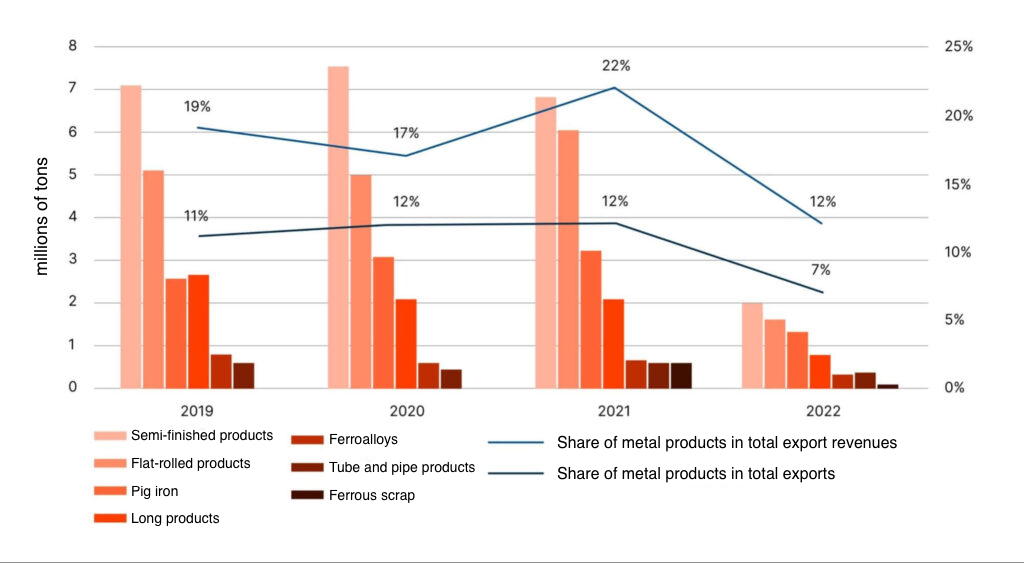

Steel. Metal products exports decreased by 68% to 6.5 million tonnes leading to a drop in export revenues by 65%. In terms of products, ferrous scrap and pig iron exports fell by 91% and 59% respectively in 2022. Semi-finished products exports dropped by 72% (Figure 4). Shipments of flat-rolled products decreased by 73%, and supplies of long steel products fell slightly less (by 64%) as the leading producers (ArcelorMittal Kryvyi Rih and Kamet Steel) continued to operate. Sales of tube and pipe products abroad suffered the least, falling by 34%.

Figure 4. Ukraine’s exports of certain types of steel in 2019-2022, million tonnes

Source: State Customs Service of Ukraine

The war caused problems for the Ukrainian economy and the global steel market, changing traditional trade flows. Although Ukraine cannot be considered an international benchmark such as China (whose market forms world prices for iron ore), Ukrainian producers dominated some foreign markets.

For example, according to International Trade Center, in 2021, Ukraine’s share in Lebanon’s imports of hot-rolled flat products in natural terms was 72%. Ukraine’s portion in the wire rod segment of Senegal amounted to 55% and reached 58% in semi-finished products of the Dominican Republic. Ukraine’s share in imported pig iron in the UAE accounted for 63%. Consequently, left without traditional Ukrainian volumes, foreign trade partners were forced to seek new suppliers.

At the same time, the situation in Europe was the most telling example. On the one hand, Europe faced lesser Ukrainian production volumes. On the other hand, the task arose to break away from import dependence not only on russian gas but also on russian steel. For this purpose, the European Commission imposed (albeit with some reservations) a direct ban on foreign trade operations involving russian steel, while some European importers introduced self-restrictions.

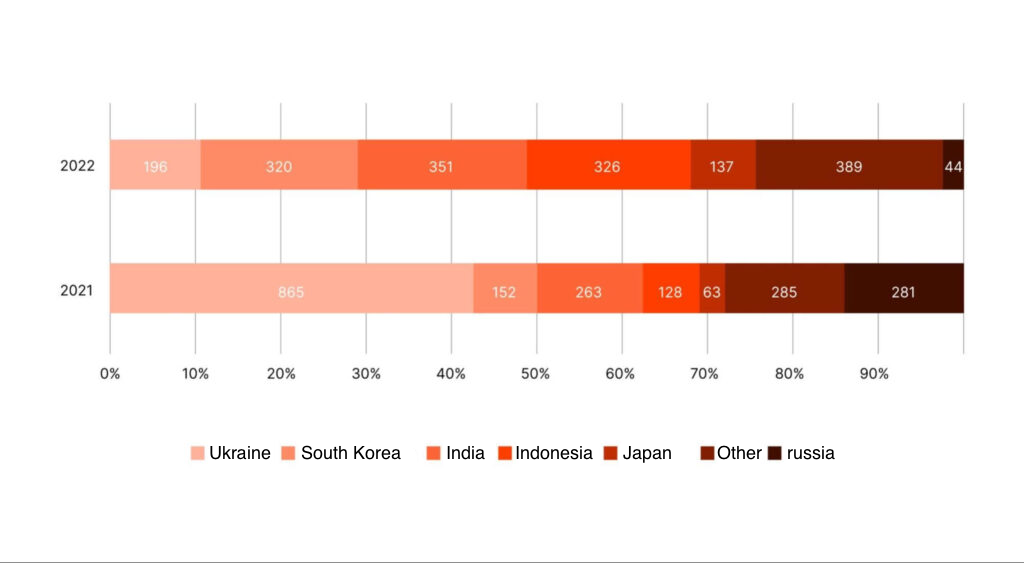

According to Eurofer data, Ukraine provided 43% of the EU’s total imports of heavy plates in 2021 (Figure 5). But due to losing leading suppliers for these products (the assets in Mariupol), Ukrainian exports amounted to only 11% in 2022. In addition, supplies from russia fell to 2%. The deficit was closed by producers from Asia, who provided more than 60% of the block’s imports in 2022.

Figure 5. Geography of imports of heavy plates to the EU-27, thousand tonnes

Source: Eurofer

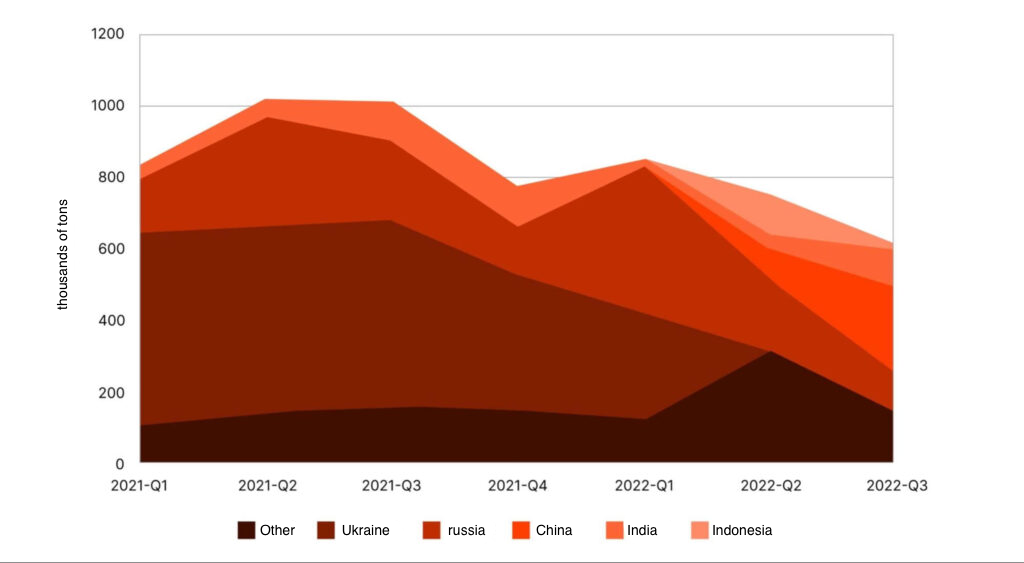

A similar situation occurred in the segment of semi-finished products in Europe, where, in addition to demand from local mills, imports are carried out by companies of the Metinvest Group and russian metallurgical holdings such as NLMK. Metinvest supplies a mill in Bulgaria with square billets for producing long steel products and factories in Italy and Great Britain with slabs (a semi-finished product for making flat-rolled products). Under the EU’s eighth package of sanctions, russia can supply semi-finished steel products until October 2024, until local consumers adapt to new business conditions. However, Chinese and Indian suppliers are already replacing a share of Ukrainian production, e.g., in Italy (Figure 6).

Figure 6. Geography of imports of steel semi-finished products to Italy, thousand tonnes

Source: International Trade Center

Legislative changes

Tax benefits

In the spring of last year, Parliament adopted changes in the tax sphere to allow switching to a simplified taxation system of paying 2% of companies’ turnover instead of income tax and VAT. Some steel producers confirmed the possibility of using such benefits. Still, a limited number did it.

Interpipe’s press service:

“Interpipe had such an opportunity last year. But after weighing all the pros and cons and calculating the effect, we realized it would be more interesting for us to stay with the current taxation system.”

The opportunities to sue the benefits were limited for the largest metallurgical companies of Ukraine: Metinvest Group and ArcelorMittal Kryvyi Rih.

The press service of Metinvest Group:

“Given the amendments in the Tax Code under martial law, Metinvest Group’s key production facilities in Ukraine stayed with the traditional taxation system (income tax and VAT). In particular, our mining and processing plants were not entitled to these benefits. Only a few of Metinvest’s companies switched to a single tax system of 2% of turnover. Overall, the benefits did not significantly impact Metinvest’s operating conditions.”

The press service of ArcelorMittal Kryvyi Rih:

“The integrated steel company ArcelorMittal Kryvyi Rih did not have such an opportunity according to sub-clause 9.3 of clause 9 of sub-section 8 of chapter XX “Transitional provisions” of the Code, saying: “Payers of the single tax of the third group under special taxation established by this clause… cannot be economic entities … that carry out: … extraction, sale of mineral deposits.”

Currently, the Verkhovna Rada intends to cancel said preferential taxation mechanisms to fulfill the obligations stipulated by the new agreement with the IMF.

In early 2023, the Verkhovna Rada passed in first reading draft law No. 8293, providing for a zero rent rate for extracting iron if the ore is used in Ukraine. In this way, lawmakers want to stimulate finished steel production with a higher added value instead of shipping raw materials abroad. The iron ore for export will remain subject to rent payments. If adopted, the law is unlikely to bring significant change since in order to increase the production of finished rolled steel there must also be a comprehensive improvement in economic conditions related to resolving logistical problems, finding product sales markets, and stable production process planning, all of which are difficult to achieve in wartime.

However, producers generally positively assess the prospect of partially easing the fiscal burden.

The press service of Metinvest Group:

“The incentive in the form of reduced rent of 0% for extracting iron, if used for producing steel within the country, alongside with other solutions, will make it possible to slightly reduce the cost of steel, load Ukraine’s metal mining and processing plants, continue to maintain jobs, pay taxes, and help the Armed Forces and civilians affected by the war.”

The press service of ArcelorMittal Kryvyi Rih:

“The company completely supports this initiative and looks forward to its implementation as soon as possible in order to support the mining and steel industry during these challenging times.”

VAT refunds

The previously mentioned VAT reimbursement problems (see the section “Shocks for Ukrainian metallurgy”) were resolved by passing the law No. 2260-IX in May 2022. It revived the process of registering tax invoices and VAT reimbursements. Although with long delays, the steel industry eventually began receiving proper compensation, mainly at the year’s end (e.g., ArcelorMittal Kryvyi Rih received UAH 1.3 billion in overdue debt only in December of last year).

In addition, in March 2022, the Cabinet of Ministers extended until 2027 exemptions from paying VAT on operations with scrap of ferrous and non-ferrous metals, which had been in effect since 2011.

Liberalization

One of the biggest problems was electricity shortages in the fall. Therefore, early this year, the Cabinet of Ministers allowed industrial companies to import electricity from the EU until the end of April. In particular, industrial consumers are guaranteed non-disconnections for the amount of purchased electricity. Metinvest said it had started importing electricity to meet its production needs in February. It allowed the Kamet Steel plant (Kamianske, Dnipropetrovsk region) to increase capacity utilization to 65% after the shutdown in November of last year due to interruptions in the power supply and gradual resumption of operations in late December.

The July correction of the official exchange rate of the hryvnia to the US dollar by 25% (36.6 UAH per dollar) was the key event for exporters last year. This decision to bring the official exchange rate closer to the market rate was welcomed by the business community, primarily the steel industry, for which export is currently the primary source of income.

Restrictions

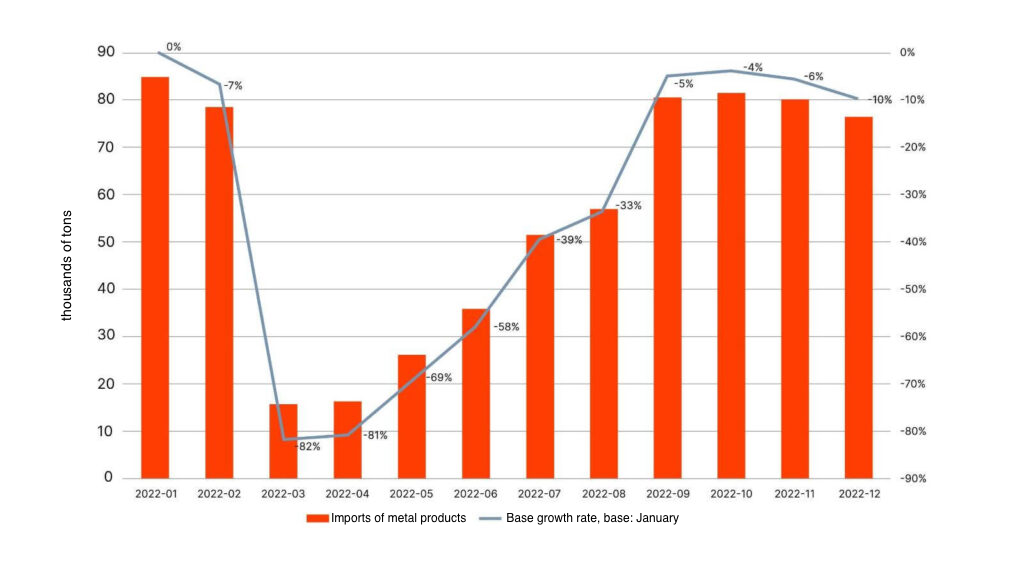

Introducing a list of critical import goods on February 24, 2022, was part of the currency restrictions (to limit currency outflow). The list was revised several times and canceled in July 2022. However, there were restrictions on purchasing certain types of steel from abroad for Ukrainian importers for over four months. The initial resolution did not include steel. Later, the list was expanded and adjusted in line with the market needs and domestic production. The total steel imports fell to 15.6 thousand tonnes in March, reflecting the beginning of hostilities and the introduction of import restrictions (Figure 7). Imports remained low throughout April. After the list was abolished, imports more than tripled compared to March, amounting to 51.4 thousand tonnes in July (60% of the pre-war January volume).

Figure 7. Imports of metal products to Ukraine, thousand tonnes

Source: International Trade Center

In April last year, Ukraine banned all imports from the aggressor country (many goods of russian origin, including some types of steel, had been restricted since 2015). The ban on exports to russia was introduced in September 2022.

In addition, some of the legislative changes concerned mining activities:

- CMU Resolution No. 836 of July 26, 2022, defined changes in the procedure for granting special permits for using subsoil without an e-auction and setting the initial price automatically for the permit and the cost of geological information;

- Law of Ukraine No. 2805-IX On Amendments to Certain Legislative Acts of Ukraine on Improving the Legislation in the Field of Subsoil Use dated December 1, 2022, is part of subsoil use reform aiming to deregulate and digitize subsoil use.

The press service of ArcelorMittal Kryvyi Rih:

“We welcome the simplification of permitting activities, in particular, the transition to the declarative principle of permits in the field of ecology and to the digitalization of cooperation with state authorities. Electronic permits, requests, statements, and official letters have become the norm for official correspondence, facilitating document flow and the company’s operational activities.

International support

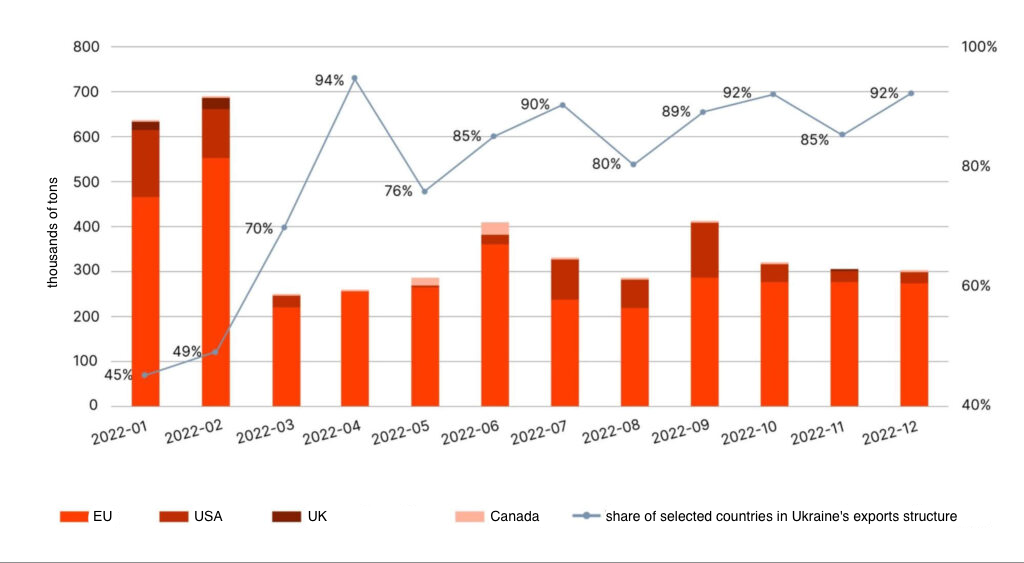

International support for Ukrainian export potential, particularly supplying steel abroad after the start of full-scale hostilities, came primarily from Western countries. The United Kingdom took the first step in April 2022 by announcing the early cancellation of all import duties and quotas starting in May as part of the Free Trade Agreement. Later, the European Union, the United States, and Canada announced their intention to facilitate access for Ukrainian goods to their markets for one year.

In June, the US Department of Commerce’s decision to suspend the import duty of 25% on Ukrainian steel, introduced by the administration of Donald Trump in 2018 as part of Section 232, took effect. In the same month, the Regulation of the European Parliament and the Council 2022/870 entered into force, suspending import tariffs and all trade protection measures on industrial products as well as the Order of the Government of Canada regarding exemptions from import duties on all Ukrainian goods. The Australian government also canceled import tariffs on Ukrainian products in July.

In addition to the measures mentioned above, essential changes for Ukraine’s metallurgical industry included decisions regarding trade protection measures. For the first time in 20 years, Canada allowed importing of Ukrainian hot-rolled products without paying anti-dumping duties in May last year. For nine months (from late August 2022), the United Kingdom suspended the anti-dumping duty on Ukrainian hot-rolled flat products. The latest decision regarding abolishing anti-dumping duties on hot-rolled flat products was adopted by the EU in February 2023.

During the past year, some countries strengthened the protection of their markets by introducing new or prolonging existing restrictions on Ukrainian steel (see Table 1 in the appendix). In June, Egypt extended anti-dumping duties on imports of rebar, wire rod, and other bars and rods from Ukraine for one year, while Mexico decided to extend anti-dumping duty on Ukrainian heavy plates for another five years.

Ukrainian metallurgical companies, particularly Metinvest and Interpipe, positively evaluated trade liberalization. However, the decision of Ukraine’s partners is rather an act of political support since Ukrainian producers have no real chance of significantly increasing exports due to logistical and production limitations.

At the same time, the countries that liberalized trade relations with Ukraine became the main sales destinations. Their share in the structure of Ukrainian steel exports increased from 45% in January last year to about 90% in the second half of the year (Figure 8). Given the short distance, which is crucial in the conditions of the blocked Black Sea ports, the European Union became the primary receiving market. However, due to a drop in production, exports to the EU remain below the average monthly volumes of previous years, even after lifting restrictions.

Figure 8. Ukraine’s metal products exports to selected countries, thousand tonnes

Source: International Trade Center

Conclusions

On the eve of the full-scale russian invasion, metallurgical companies announced ambitious development plans. Still, it became clear over the next month that the main plan for the year was to continue operations at the surviving facilities in conditions of the constant risk of missile attacks, logistical restrictions, and a lack of energy resources. As a result, Ukraine’s metallurgy managed to survive, according to various estimates, at 15-30% of capacity, primarily thanks to Western partners’ assistance, offering their ports, and lowering trade barriers for our products.

The industry representatives emphasize that expanding the “grain agreement” to include steel products is almost the most important in creating the possibility of recovery of the mining and metals industry. However, experts doubt that the ports can be opened before the war ends, given the complicated negotiation process even regarding the grain supply. The most realistic support scenario so far has been the extension of reduced customs duty rates on Ukrainian products, which is what partners in the UK and the EU are talking about.

Appendix

Table 1. Trade protection measures in foreign markets regarding Ukrainian steel as of March 13, 2023

| The initiator | Measure | Rate | Product | Introduced/reviewed | Additional information |

| USA | Import duty | 25% | All steel products | March 2018 | Suspended for Ukraine from May 2022 for one year. |

| USA | Anti-dumping duty | 41.69% | Rebar | December 2018 | |

| USA | Anti-dumping duty | 34.98-44.03% | Wire rod | March 2018 | |

| USA | Anti-dumping duty | 27.80% | OCTG | August 2020 | |

| USA | Anti-dumping duty | 90.33% | Hot-rolled flat products in coils | August 2019 | |

| USA | Anti-dumping duty | 23.75% | Seamless pipes | August 2021 | |

| United Kingdom | Anti-dumping duty | 50.631 pounds per tonne | Hot-rolled flat steel | October 2017 | Suspended for Ukraine from August 2022 for nine months. |

| United Kingdom | Safeguard measures | Quota + 25% duty | Cold-rolled flat products, hot-rolled thick flat products, and bars. | July 2021 | Suspended for Ukraine. |

| EU | Anti-dumping duty | 8.1% – 25.7% | Seamless pipes | October 2018 | Suspended from June 2022 for one year. |

| EU | Anti-dumping duty | 60.5 euros per tonne | Hot-rolled flat steel | October 2017 | Suspended from June 2022 for one year. |

| EU | Safeguard measures | Tariff quota (quota + 25% duty) | All steel products | June 2021 | Suspended from June 2022 for one year. |

| Mexico | Anti-dumping duty | 41% | Rebar | September 2015 | |

| Mexico | Anti-dumping duty | 60.10% | Hot-rolled steel (cut) | March 2022 | |

| Mexico | Anti-dumping duty | 25% | Hot-rolled steel in coils | March 2020 | |

| Mexico | Anti-dumping duty | US$0.1701 per kg | Seamless steel pipes | April 2018 | |

| EAEU | Anti-dumping duty | casing pipes: 18.9%, pump-compressor pipes: 19.9%; for oil-conducting, gas-conducting, and heat-deformed general-purpose pipes with a diameter of up to 820 mm – 19.4–37.8% |

Pipes of small and medium diameter | January 2022 | |

| EAEU | Anti-dumping duty | 4.32–18.96% | Seamless stainless pipes | October 2021 | |

| EAEU | Anti-dumping duty | 37.89% | Hot-rolled steel angles | March 2023 | |

| EAEU | Anti-dumping duty | 23.90% | Galvanized flat steel | January 2020 | |

| Thailand | Anti-dumping duty | 30.45-67.69% | Hot-rolled steel (in coils and not in coils) | May 2021 | |

| Canada | Anti-dumping duty | 15–21.3% | Hot-rolled flat products made of carbon and high-strength low-alloy steel | November 2020 | Suspended from June 2022 for one year. |

| Canada | Anti-dumping duty | 37.40% | Steel pipes | December 2020 | Suspended from June 2022 for one year. |

| Indonesia | Anti-dumping duty | 12.33% | Hot-rolled products in coils | August 2019 | |

| Brazil | Anti-dumping duty | US$52.02 per tonne | Flat thick sheet | October 2019 | |

| Brazil | Anti-dumping duty | $145.26 – 708.6 per tonne | Steel pipes | September 2020 | |

| Taiwan | Anti-dumping duty | 49.29% | Hot-rolled flat steel | August 2018 | Suspended for one year from September 2022. |

| Egypt | Anti-dumping duty | 17.2–27% | Rebar, wire rod, bars | June 2022 | |

| Morocco | Safeguard duty | First year: 25% Second year: 24% Third year: 23% |

Hot-rolled flat steel | May 2020 | |

| Morocco | Tariff quota | The determined volume of the global quota + 550 Moroccan dirhams per tonne | Rebar, wire rod | Reviewed yearly | |

| Morocco | Tariff quota | The determined volume of the global quota + ad valorem import duty of 12.5% in 2023 | Cold-rolled flat products and coated flat products | Reviewed yearly | |

| Morocco | Safeguard duty | First year: 25% Second year: 24% Third year: 23% |

Welded pipes | August 2021 |

This article was prepared with the financial support of the European Union. Its content is the sole responsibility of Viktoriia Ahapova and does not necessarily reflect the views of the European Union.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations