We are only a month and a half away from the start of the new political season when the Government approves and passes to the Parliament a draft Law on the 2021 state budget. In the meantime, it is important to analyze the successes and mistakes of the Government’s and Verkhovna Rada’s budgetary policy in 2020 to avoid making these mistakes in the next year’s budget.

It is therefore important to address one of this year’s key issues in public finance: the Government’s ability to finance the record state budget deficit in at least the last five years.

What is going on with regard to financing the state budget, what is helping or hindering the Ministry of Finance in pursuing a prudent debt policy, as has been the case in recent years?

The situation with deficit financing and debt repayment in 2020 is complicated. As over the course of the year, the Ministry of Finance needs to attract a record credit volume in recent years.

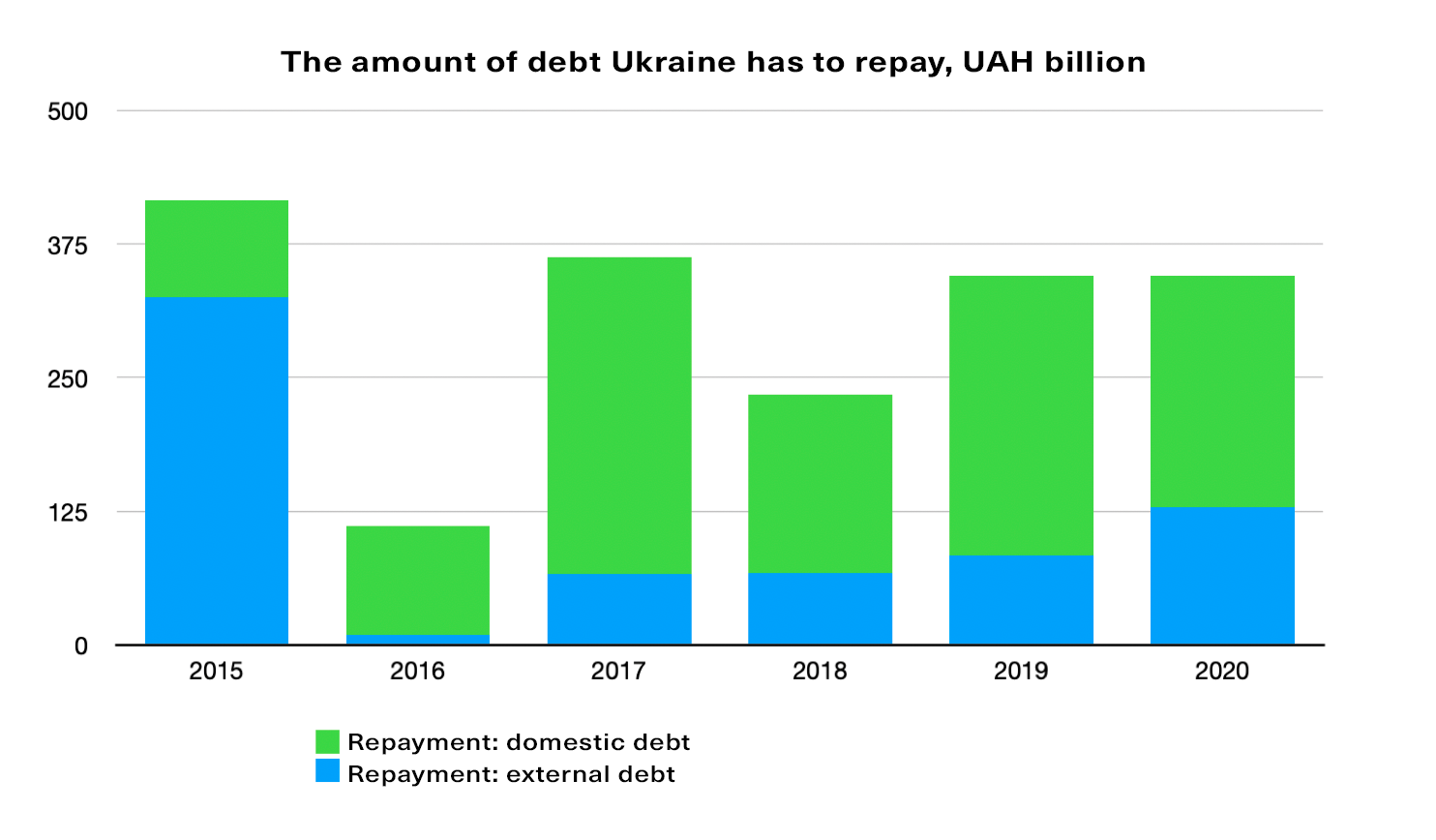

This is due to two factors. First, the repayment of earlier debts. The repayment of UAH 346 billion is scheduled for 2020 (excluding the UAH 145 billion for debt service paid by the state from budget expenditure). Of these, UAH 216 billion is domestic debt and UAH 130 billion is external debt. This amount is comparable to the amount of the repayments Ukraine made in previous years. But it is still large.

Fig. 1.

Source: State Treasury Service of Ukraine

The second factor is the state budget deficit that needs to be financed. The coronavirus crisis reduced budgetary revenue, while spending rose. On April 13, Parliament supported the Government’s proposals to amend the state budget.

The amendments proposed to reduce revenue by UAH 120 billion (to UAH 975 billion), including a reduction in tax revenue by UAH 143 billion. At the same time, spending increased by UAH 82.4 billion (to UAH 1,266 billion). Consequently, the deficit more than tripled: from UAH 96 billion to 298 billion.

Meaning that almost every fourth hryvnia in 2020 state budget expenditure should be financed by new debt (taking into account the local budgets, this ratio will be lower). This is also the largest overall deficit since 2016.

Taking into account the amount of debt repayment and a need to finance the deficit, the Government’s overall need to attract debt financing in 2020 has almost doubled, amounting to UAH 653 billion. Specifically, the planned external borrowing increased from UAH 111 billion to UAH 242 billion, and the planned domestic borrowing – from UAH 231 billion to UAH 372 billion.

How is the Ministry of Finance coping with this task?

So far, the Ministry has managed to implement the plan. The task of borrowing UAH 261 billion for the state’s general fund budget during the first half of 2020 was fully fulfilled.

But it does not come easy.

First, it was possible to attract funding from international partners, primarily the IMF, in the amount of over 70 billion UAH in June 2020. Without them, as of the end of May (i.e. 40% of the budget period), the Ministry of Finance was able to attract only UAH 162.6 billion, or 25% of the total debt financing need for the year.

Second, non-residents investing in Ukrainian debt last year began to withdraw from those investments this year. The volume of GDLBs owned by non-residents has decreased by 18% since the beginning of the year (from UAH 118 billion to UAH 96.5 billion as of July 14, 2020)

Due to the lack of demand, the Ministry of Finance had to cancel a significant number of auctions for the placement of government domestic loan bonds.

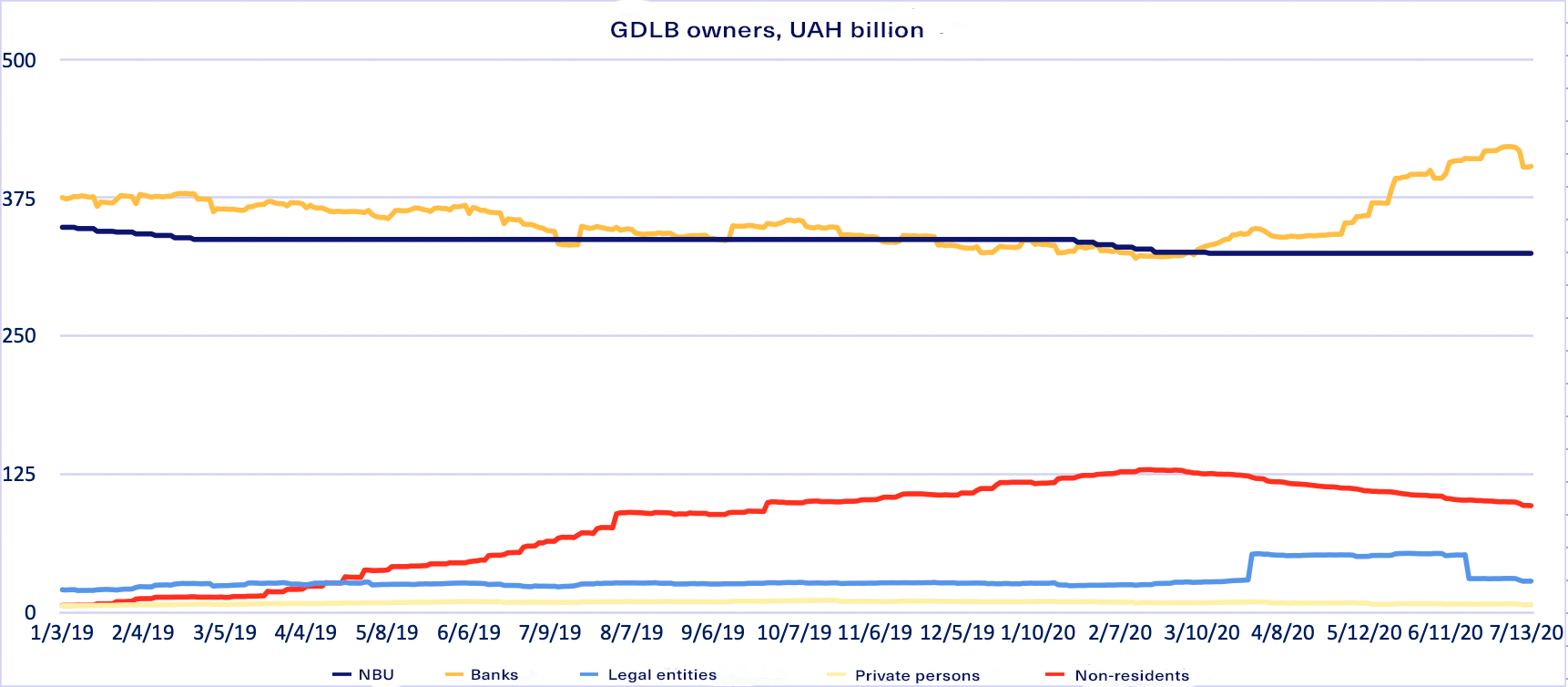

And as for the successfully completed auctions, the Ministry of Finance was helped out by banks (Fig. 2).

Fig.2

Source: National Bank

While all other types of buyers of Ukrainian debt have reduced the volume of government securities owned since the beginning of the year, the banks have increased GDLBs in their portfolios by 20% (from UAH 336 billion to UAH 403 billion). Including starting from April 30, that is, since the onset of the crisis, by 18%. The share of banks owning GDLBs has increased from 41% to 47%.

Third, it will be even more difficult for the Ministry of Finance to attract financing in the year’s second half.

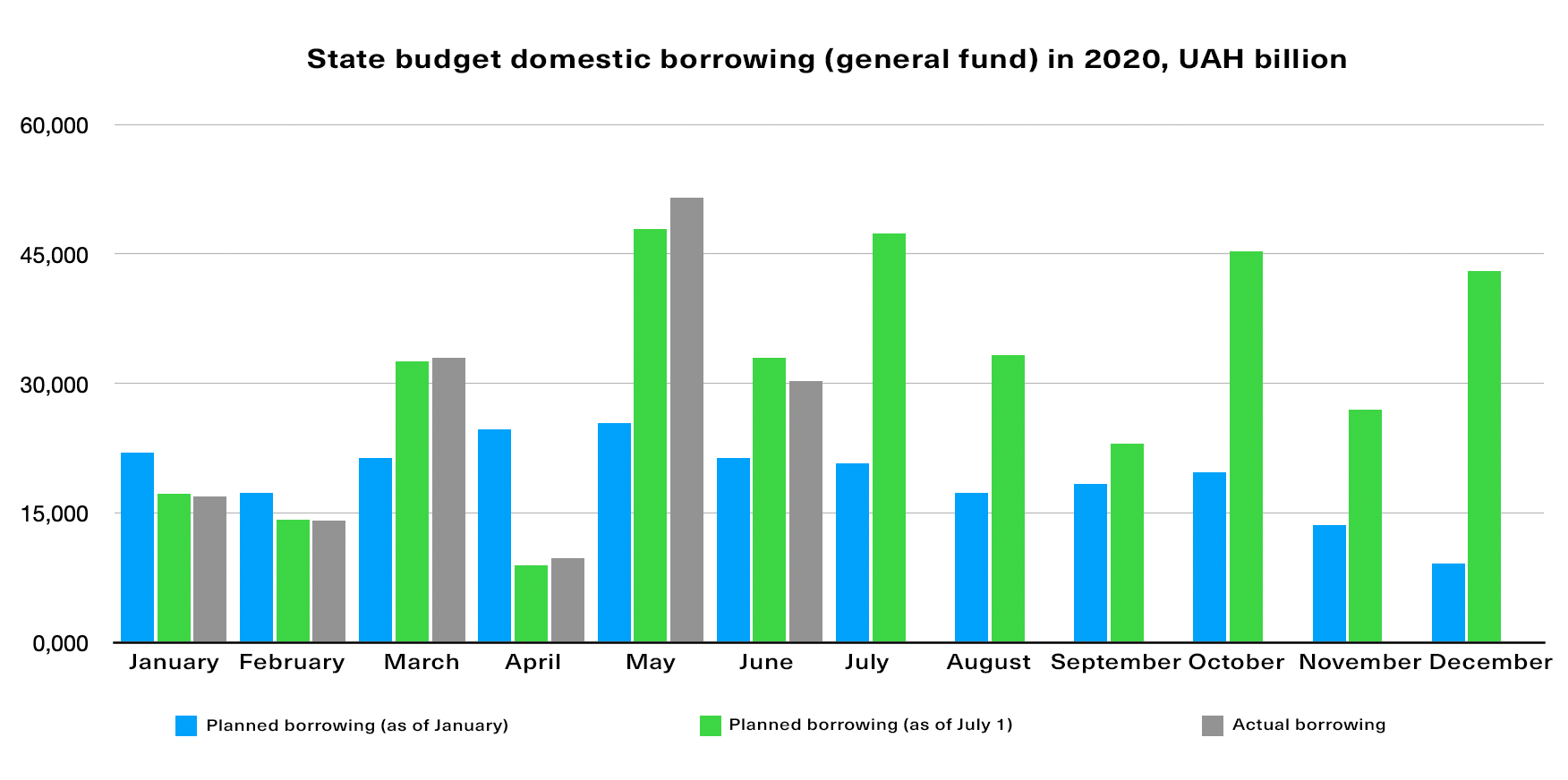

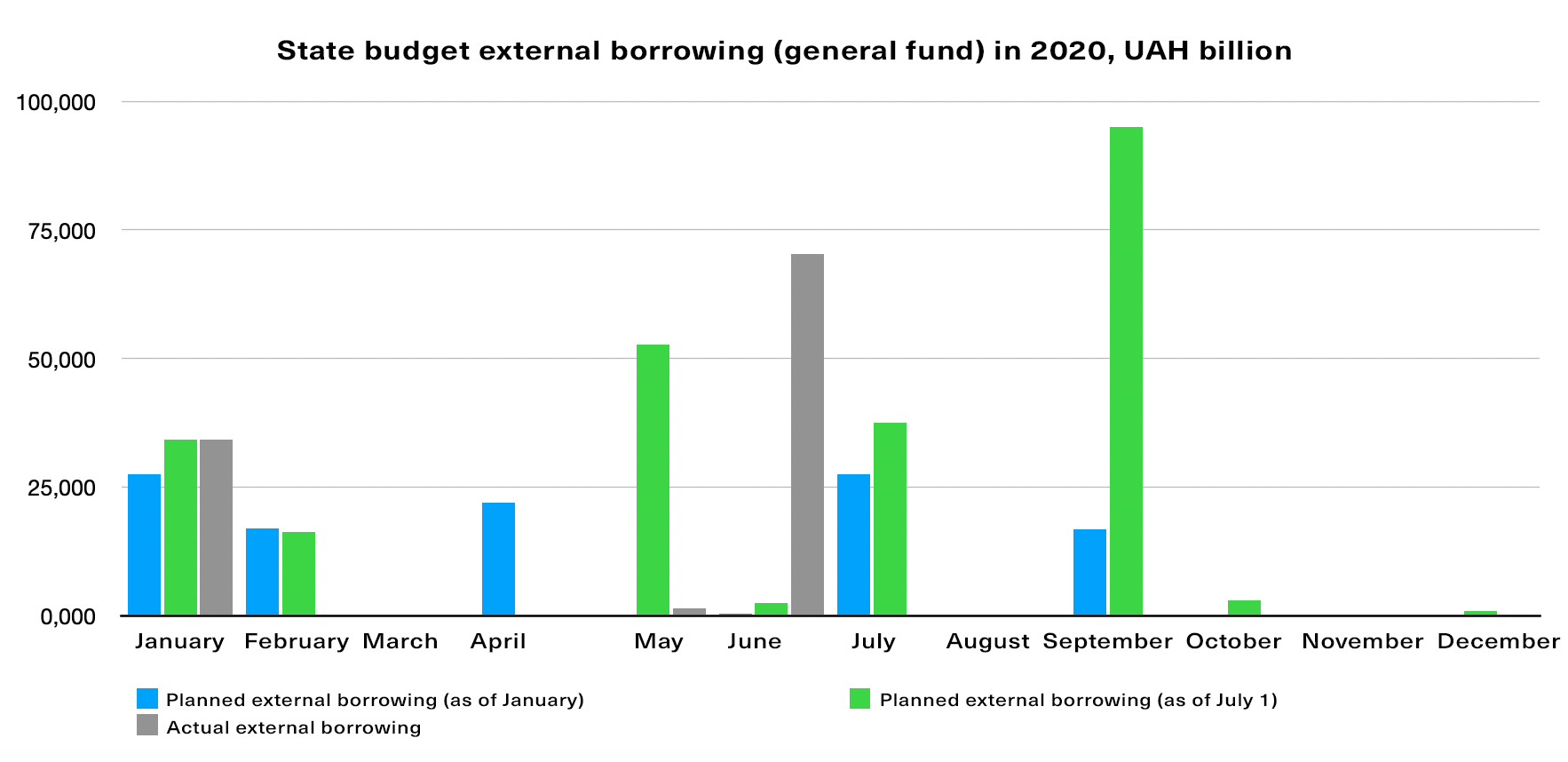

As the highest debt burden is scheduled for July-December 2020. During this period, another UAH 355 billion needs to be attracted, which exceeds the amount of borrowing made in January-June by 36%. (Figs. 3, 4).

Only under these conditions will the Ministry of Finance be able to repay government debts and finance the budget deficit, i.e. expenditure.

Fig. 3

Source: STSU, Ministry of Finance, calculations by KSE Center of Public Finance and Governance

Fig. 4

Source: STSU, Ministry of Finance, calculations by KSE Center of Public Finance and Governance

Will the Ministry of Finance be able to pull it off?

It will depend on several factors.

First, and most importantly, on whether there will be some assistance from international financial organizations and international partners. This will also affect both the Ministry’s ability to enter foreign markets and the cost of domestic borrowing. But this depends not so much on the Ministry of Finance as on the actions by the President, the Prime Minister, the new head of the NBU and the presidential faction in Parliament. Following an unsuccessful attempt to enter foreign markets on July 1, the Ministry of Finance was able to successfully raise USD 2 billion in eurobonds on July 23. Of this amount, more than USD 1.1 billion will go to finance the budget. However, this is only a small part of the borrowing that needs to be made by the Ministry of Finance in the second half of the year to implement the plan.

Second, it depends on the MP’s legislative activities.

In recent years, the Ministry of Finance has had if not an absolute prerogative then, at least, the power of conditional veto on MPs’ initiatives potentially leading to increased expenditure or decreased revenue. However, obviously, this prerogative does not exist today. We see an almost unprecedented flurry of MPs’ initiatives affecting both budgetary spending and revenue.

Most of these innovations make it difficult for the Ministry of Finance to find financing for the deficit: any new reductions, deferrals or increases in the budget expenditure will mean a further increase in the budget deficit and hence a need for additional debt.

It is therefore extremely important that the parliamentarians “not interfere” with the Ministry of Finance’s work, refraining from further increasing the deficit or violating the terms of cooperation with international partners.

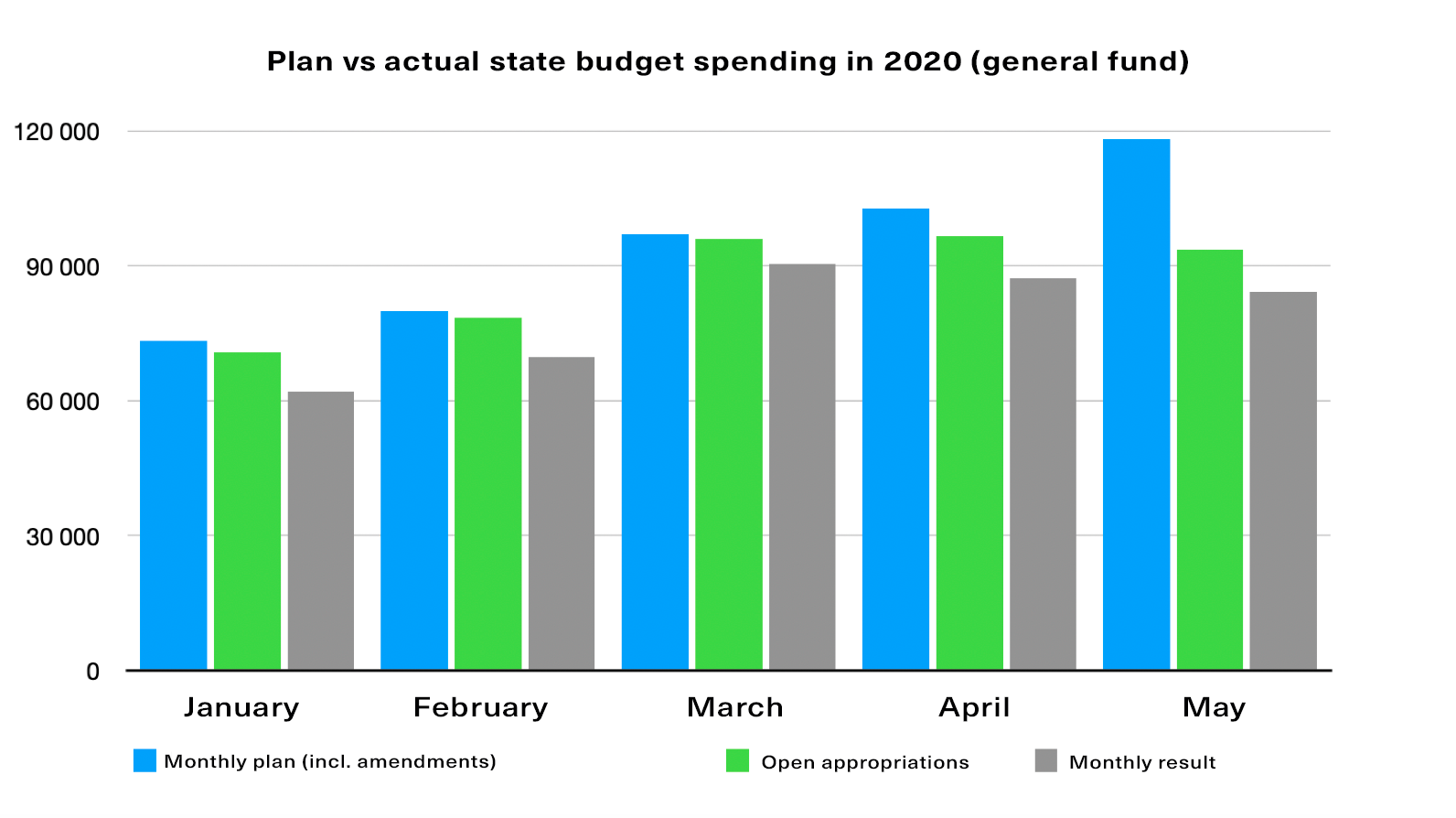

Since the Ministry of Finance will simply not be able to finance expenditure in case of a shortage of funds. Budget expenditure is already being financed at a level that is much lower than planned. While the plan for general fund revenue for January-May was implemented by 88.4%, general fund expenditure was financed only by 83.5% (Fig. 5). As of the end of May, over UAH 70 billion of expenditure planned for that period failed to be financed, including the UAH 35 billion due to the Ministry of Finance’s failure to open appropriations.

Fig. 5

Source: State Treasury Service

This may result in a much higher volume at the end of the year. Firstly, the Ministry of Finance will finance the budget’s protected expenditure items, including salaries, social spending, and public debt service.

While capital expenditure, investment projects such as the construction of roads, airports, etc, will be funded on a remnant basis.

In other words, the Ministry of Finance’s ability to finance politically significant projects, including the Big Construction, depends on whether it will be impeded from attracting as much debt financing as needed, on more or less favorable terms for Ukraine.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations