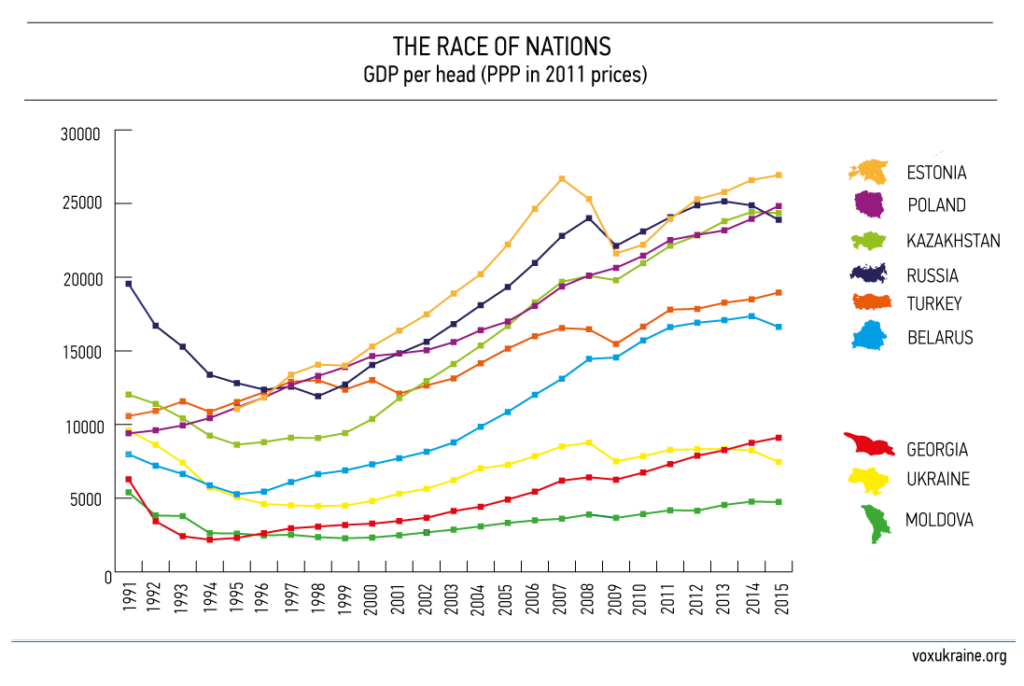

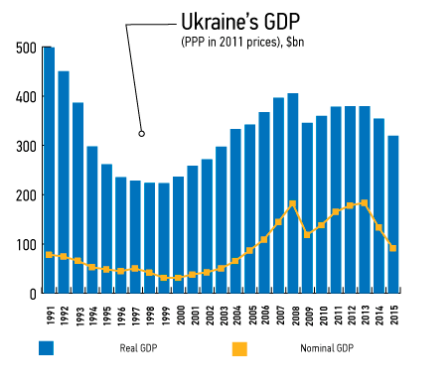

For all it’s resources, Ukraine is an unreasonably poor country. According to the World Bank, in 2015, the gross income per person was equal to $7,450 USD (according to PPP — Purchasing Power Parity).

This is lower than Iraq, Mongolia, Albania and 109 other countries. In the last 25 years, this figure has decreased by 23% and Ukraine has dropped from the 55th to the 112th position in the World Bank index. During this time, all the countries neighbouring Ukraine, except for Moldova, were more successful in their economic development. To answer why, VoxUkraine has researched and discovered the seven most damaging and destructive decisions that Ukrainian government officials have taken in the last 25 years of independence.

A long standing question in the post soviet world is why some Eastern European governments have managed to enrich their populations while others, like Ukraine’s, have faltered. For example, in 2015, the GDP per capita of Poland was 3.5 times higher than that of Ukraine, while the income difference between an average Estonian and an average Ukrainian was 6 times higher. Are these “outsiders” able to leave the “team of losers”? There are many correct answers for this question – speed and profoundness of the reforms, role of personality, quality of the institutions, heritage of the Soviet Union, support of international partners and so on. We decided to focus on the “practical” part of the problem – the quality of the economic decisions.

In the past 25 years, Ukraine has had a rich collection of economic blunders, so to choose the worst of the worst was not an easy task. In creating the list, we were trying to avoid useless definitions, such as “hyperinflation”, “bad investment climate”, or “repressive tax system”, and instead focus on defining the primary action (law, act, etc), to quantitatively evaluate its damage to the economy and to show the evolution of a particular decision into a much deeper problem.

There is no surprise that we went all the way back to the 1990s, which is when the economic DNA of Ukraine was created. In particular, the decisions and laws developed in the 90’s built an oligarchical system, uncompetitive markets, corruption rent, down tax—regulation amongst other problems. The current situation thus became inevitable, and must be rebuilt.

The economical fiasco in Ukraine has no one single author or culpable party. Ukraine’s Presidents, bureaucrats, and elected government officials all played a role. However, from our personal point of view, the role of the parliament was the most important. Main reasons are populism, irresponsibility and lack of competency.

Pocket central bank

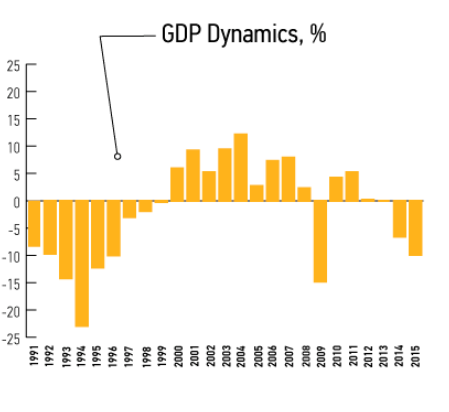

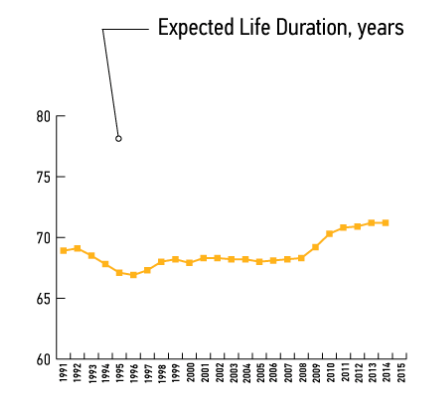

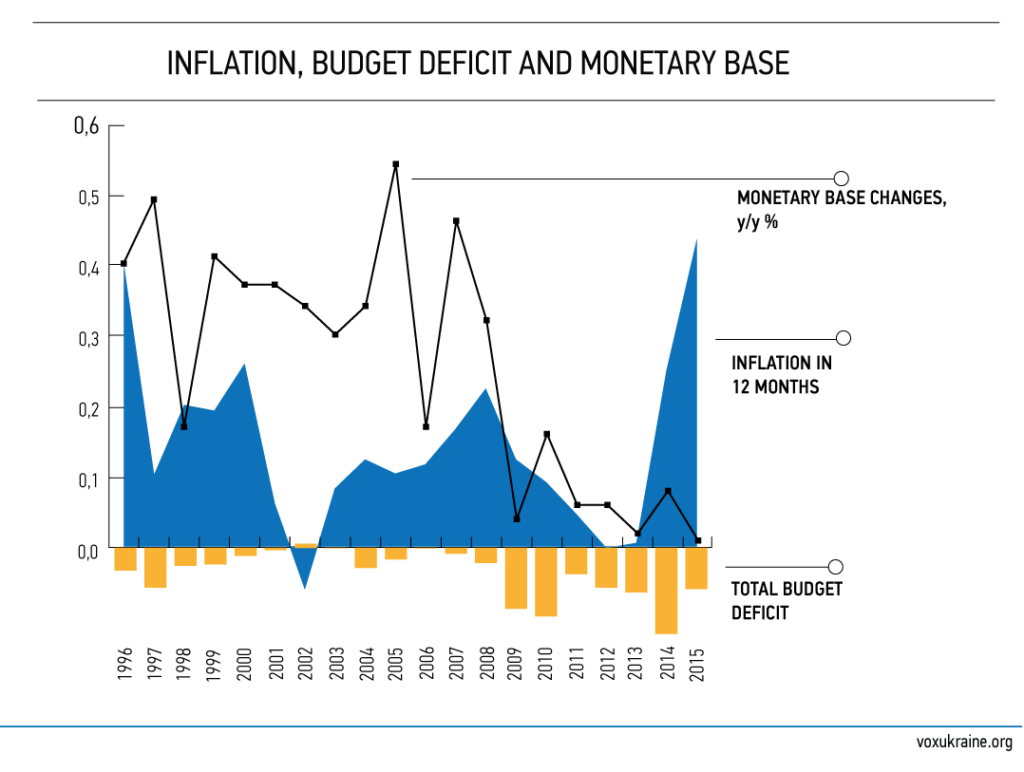

Ukraine did not have an independent central bank in its first 23 years. The National Bank of Ukraine was an active player in the process of Ukrainian hyperinflation in the beginning of the 1990s, which greatly exceeded that of other Eastern European countries. Even up until 2015, the National Bank was helping the Cabinet of the Ministers hide the real budget deficit, which became one of the reasons for complete imbalances in government budgets and the resulting devaluation of the hryvna (uah).

On the 20th of March, 1991, the Parliament of the Ukrainian SSR accepted the law on banks and banking activity, which defined the rules of the banking system for the next 8 years – including after independence. This law is important because it particularly defines the role of the central bank [the future National bank of Ukraine].

According to research, the more independent a central bank is (i.e. ability of management to make politically independent decisions), the more effective it can be in fighting inflation. This is why there is a correlation between independent central banks and future GDP increases. In Ukraine, the independence of the National Bank of Ukraine, which became the legal successor of USSR central bank, was never even a consideration.

Everything was completely controversial according to the new Law. In Article 14 of the new law, it was determined that, “The National Bank, through the banking system, organizes and fulfils cash execution of the state budget of the republic. On the decision of the Parliament of Ukrainian SSR, the National Bank may provide the credit for the Ministry of Finances of Ukrainian SSR on general conditions”.

Thus, this law subjected the central bank of Ukraine to the Ministry of Finances and the Parliament. That subjugation in particular became one of the main causes of hyperinflation in the beginning of the 1990s. This hyperinflation had a destructive influence not only on the economy of the young country, but also on the well being of its citizens and the psychological security of many Ukrainians.

What exactly happened?

At the time of the separation of the Soviet Union, an economic crisis was rapidly developing, leaving tens of thousands of governmental enterprises with no governmental orders and broken delivery chains. Producing and selling goods during this time became very problematic. Incomes decreased enormously and there was no money to pay for raw materials, salaries for employees and taxes for the government. In the ensuing chaos, there were large scale payment and budget crises within the country.

Leonid Kravchuk, the first President of Ukraine, alongside the first Parliament of an independent Ukraine were trying to solve the problem, taking the sources from governmental budget and the National Bank of Ukraine. Their first move was to get the Ministry of Finances to provide subsidies from the government’s budget to government enterprises (mostly from agrarian and energy (gas and coal) sectors). In 1992, the volume of subsidies reached 8.1% of GDP. By the following year in 1993, it was at 10.8% of GDP – writes Anders Aslund, the famous American explorer of post—soviet transformation, in his book “Ukraine: what went wrong and how to fix it”.

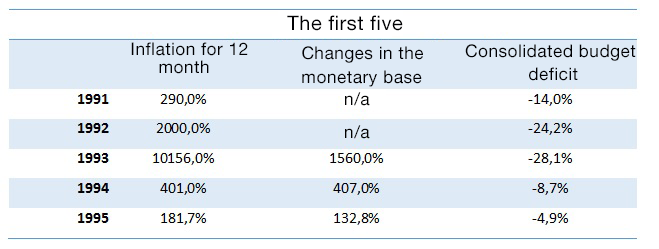

A blistering increase in the budget deficit was a direct consequence of the President and Parliaments politically motivated intervention in the markets. In 1991, the budget deficit was equal to 14% of GDP. And although the forecast for the following year, 1992, was set at no more than 2%, it increased enormously to 29% [1]. The National Bank was obliged to cover the deficit.

Secondly, the National Bank had to provide credits with very low interest rates to the different sectors of the economy.

In 1992 net gross credits provided to the enterprises were worth no less than 65% of GDP, while in 1993, it dropped to 47%, writes A. Uslund. For example, during the summer of 1993, The President Leonid Kravchuk signed an order to provide unlimited lines of credit for agricultural enterprises. Even though hyperinflation already existed in Ukraine, the interest rates for these credits were equal to only 30%.

Printing money was also occurring because of the regular increases in minimum salary rates at the time. Those salary increases were designed to protect Ukrainian citizens from the collapsing economy. However the Parliament, by its own decision and contradictory to active protests by the Cabinet of Ministers, had been regularly increasing the social standards without taking into account the inability of the government budget to meet the increases.

For example, in October 1994, the Parliament of Ukraine decided to increase the minimum salary rate. However, with hyperinflation and a drastic budget deficit causing harm to the economy already, both the President and the Cabinet of Ministers were against it. “Increasing of the minimum salary rate in Ukraine, which is currently being discussed at the session of the Parliament, can “blow up” the situation in the country” – Leonid Kuchma, the President of Ukraine. Quote taken from “Zerkalo Nedeli” newspaper.. “After each increase of the minimum salary level during the past several months, the real salary level continues to decrease. We have seen this several times already just this year”, Victor Pinzenyk, First Vice—Premier—Minister explained, and added fuel to the flame of the developing hyperinflation and permanent devaluation of coupon—karbovanets. In November 1990, with the collapse of the Soviet planned economy, the Ukrainian SSR introduced one—time coupons (karbovanets), which were distributed to Ukrainian residents. The coupons were needed in addition to Soviet rubles in order to buy groceries and living essentials.

“Up to 5 trillion Karbovanets were added to the monetary market in Ukraine. This is the result of emission, which has been provided during the II and III quarters of the year and is going to be conducted in the IV as well according to the decision of the Parliament,” – Mykola Melnychuk, Vice—head of currency regulation department, the National Bank of Ukraine, 1994

Neighbourhood inflation

Was the situation in Ukraine unique? The method of additional money printing to cover deficit was used by almost all of the countries of former USSR. But the problematic difference of Ukraine is the scale of the deficit, and the resulting monetary emission which caused hyperinflation. “During the first year after the removal of controls on prices, the prices increased up to 7 times in Poland, up to 26 times in Russia and more than 100 times in Ukraine” – states an IMF report dedicated to post—soviet countries. Hyperinflation in Ukraine reached 2,730% in 1992 and 10,155% in 1993.

Accordingly hyperinflation was the main reason of industry collapse, it destroyed economic life and demoralized society, Uslund writes.

The countries which built independent central banks were able to come back to economic stability faster. For example, Poland passed a law in 1989 creating an independent central bank whose main task was “strengthening the Polish currency”. In Czechoslovakia, a similar step was taken in 1990. “Countries like Bulgaria, Romania, Russia and Ukraine, which were not able to create independent central banks, had to go through a second round of stabilization” IMF report says.

Path to freedom

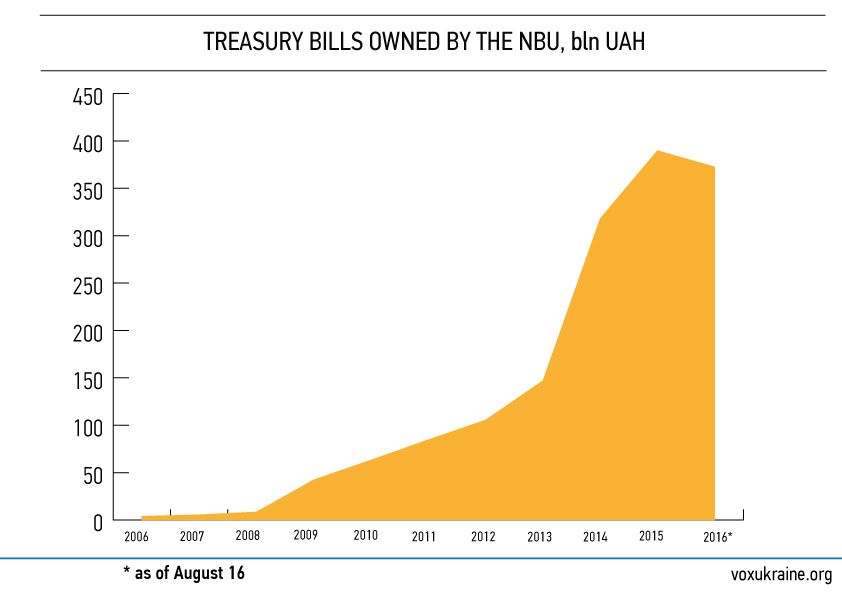

The path to independence for Ukraine’s central bank was long. The efforts to fix the situation and strengthen the independence of the National Bank started as far back as the 1990s. For example, In Memorandum on economic politics in 1995 (in partnership with the IMF) it is mentioned that the government gave parliament a draft of the law on the central bank, which proposed increases in the autonomy of the regulator. But it took 4 years to see any progress before the law “On National Bank of Ukraine” was finally passed in 1999. However, the law didn’t become a panacea from political interference into the work of the National Bank of Ukraine. In reality, from the time of the financial crisis in 2008—2009, and during the entire period of President Yanukovich’s governance from 2010—2013 up to the first year of the Revolution of Honour, the National Bank of Ukraine was being led by the cabinet of Ministers It was even covering part of the government’s budget deficit via monetary emission (buying state obligations). Statistics speak volumes and from 2008 until 2014, the volume of domestic government loans in the National Bank’s portfolio increased up to 70 times (from 5,6 mlrd UAH till 389 mlrd UAH).

In 2015, after Parliament accepted changes to the law on the National Bank, the decreasing volume of monetary emissions became one of the key reasons for macroeconomic stabilization in Ukraine.

Manual Prices and Export Regulation

Leonid Kuchma’s and Yukhym Zvyahilsky’s governments tried to combat inflation through administrative means. They restricted prices and markups, imposed licenses and quotas on export. As a result, stimuli contraction and production decline followed, and the development of barter schemes began. Other destructive effects were the creation of a rent economy, and the concentration of a significant fraction of capital in the hands of an oligarchic minority.

In Ukraine, independence and hyperinflation came simultaneously. By the end of 1991, prices had grown by 290 percent. In 1992 coupons were put into circulation and the inflation rate jumped to over 2,000 percent. Instead of instituting strict monetary policy, the government of the young country decided to fight the 20—fold rise in prices by transitioning to manual pricing.

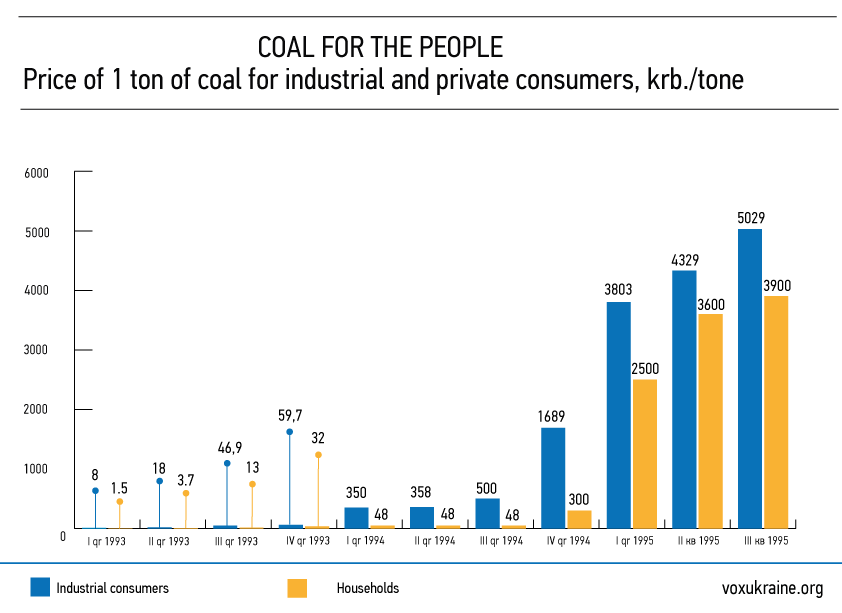

At the end of 1991, on December, 27, the Cabinet of Ministers of Ukraine under the control of the first vice—premier Constantine Masyk adopted the bylaw №376, “On the national economy and consumer market pricing system”. The document was aimed at liberalizing the lion’s share of the economy’s prices. Nevertheless, the government of a 5—month—old country didn’t dare to “free’ all prices and by the same bylaw imposed regulations on a long list of goods and services. For example, it established “a ceiling’ for coal, oil, gas—condensate, natural and liquefied gas, electric energy and heating, transport services, specific kinds of bread, etc. But despite the aforementioned list, these were very liberal months. However, the next 2 years of the country’s pricing and trade regulation would be getting more and more rigid. By December, the government would would make its most anti—market decisions.

Caution, the market is closing

In December of 1992, the Cabinet of Ministers headed by Leonid Kuchma, adopted by law №175 “On Price Regulation”. It established a limit on price increases in coal, electricity and connection services. Also, the bylaw gave local governments the right to regulate markups in public catering chains and prices on about 10 kinds of goods and services, including vegetables and potatoes. The Ministry of Industry was granted the opportunity to regulate coke, the production of metal as well as chemical industry prices. The Ministry of Economics was able to regulate gas, running water etc.

In a year Ukraine would be deprived from the rest of the free market. In December of 1993, the government of the acting premier—minister Yukhym Zvyahilsky would absolutely reject the concept of “free prices’ and adopt bylaw №987 “On Prices and Tariffs Arrangements”. It obligated the central and local governments to “strengthen the price establishment and usage control regimes”, imposed sanctions on economy subjects that “groundlessly overestimated expenses” and extended the list of regulated goods even further.

“Each industry, transport, communal service and amenities enterprise tries to increase income by the easiest means, by overstating prices on their production,” Mr. Zvyahilsky stated in the article “Let’s Be Realists”, published in “Government’s Courier” on 7 September, 1993. “We should fight by administrative, public and economic means against any efforts to gain income by increasing prices instead of increasing production.”

How Rent Was Created

At the same time that it began artificially restricting domestic prices, the government started to actively regulate and restrict exports.

In January of 1993, the Cabinet of Ministers the decree № 6—93 on goods (works and services), export quotas and licensing. This introduced a general “framework” for export restriction and a small range of licensed goods. During the next year Kuchma’s and Zvyahilsky’s governments adopted thirty more bylaws that either restricted exports or provided some specific enterprises with the right of preferential export.

Almost the whole raw materials export: non—ferrous metals, iron ore, raw oil, petroleum gas, crops, flour etc. – fell within the restriction. Licenses on export were distributed by the Ministry of Economics. On the request of this ministry, the Cabinet of Ministers could provide specific enterprises and even local governments with the right for free—of—charge export. For instance, “Donetskcoal” (“DonetskVugol”) and Olevs’k district administration.

Shortly afterwards, the results of these policies became apparent when a huge gap formed between Ukrainian domestic and international prices. The fruits of the gap were collected by the minority of companies that were allowed to participate in international trade. It was a classic instrument of an extra—active economy.

We can make judgments about the extent of the distortion and rent, which was received only by chosen (and choosing), by looking at the numbers provided by Anders Aslund in his book: “In 1992 raw materials composed 40 percent of Ukrainian exports and their average market price composed only about 10 percent of world market prices. Namely, the export rent composed about $4.1 billion or 20 percent of country’s GDP in 1992”.

“Clever Zvyahilsky understood that regulation meant rent for the privileged, literally – for him and his friends. He regulated prices and international trade, letting state subsidies cover the gap between controlled prices…Controlled international trade licensing and earned income on the arbitrage between low energy resources, metals and chemicals domestic prices and much higher international prices”. – Anders Åslund, Senior fellow at the Atlantic Council in Washington and author of the book “Ukraine: What Went Wrong and How to Fix It”

The issue is not only that this money was concentrated in the pockets of a few people, but also the fact that this money did not enter into the economy during a deep crisis. Understated prices deprived enterprises from incentives to work and fostered the rise of unemployment. But probably the most destructive effect of this policy was the generation of the first Ukrainian oligarchs. “By 1994 Ukraine had already become familiar with the concept of oligarchs”, — wrote Aslund.

The Return of The Market

Finally in 1995, after pressure from the International Monetary Fund, the Ukrainian government adopted liberalized exports. The following year, in May of 1996, the right to restrict markups on bread, flour and flour products was taken away from the heads of the provinces. By the end of 1996, the list of products whose prices needed to be declared in advance was totally eliminated with the only exception being pharmaceuticals. However, in Ukraine there is still a list of commodities being monitored and regulated on both central and local levels.

Voucher privatization

The idea of a nation—wide and rapid privatization in Ukraine was badly distorted by its ill—conceived design and interventions of the Parliament (Verkhovna Rada) during the implementation phase. As a result, investors could not become real owners of meaningful state assets because the shares of the majority of the population were uselessly anchored in trust funds. Consequently, voucher privatization cemented the position of many “red directors” and facilitated access to state assets for businessmen with close ties to authorities. This combination created a fertile ground for the development of the oligarchy.

On April 21, 1994, President Leonid Kravchuk signed the Decree №178 / 94 regarding, “The introduction of privatization certificates into the turnover of cash. This was the kick off point for voucher privatization in Ukraine, which was perhaps was the most controversial stage of denationalization of state assets.

After the collapse of the Soviet Union, even the most “leftist” parties of the Verkhovna Rada realized that Ukraine would have to build a new, more market—oriented economy, which would not allow a state monopoly in all sectors. The budget of the young state simply could not afford that number of loss—making state—owned enterprises.

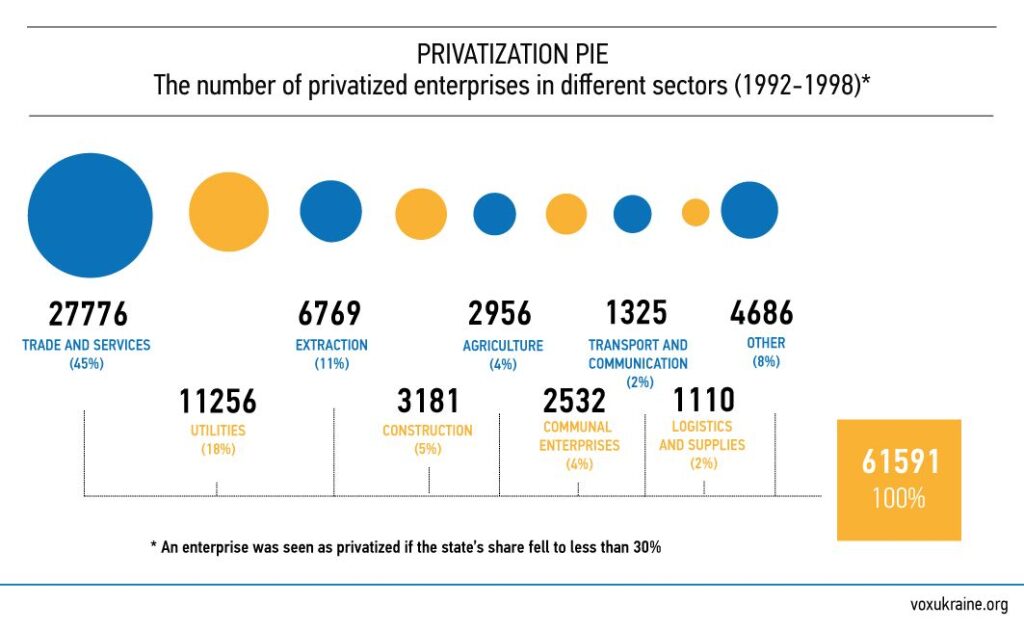

Back in March 1992, the Parliament adopted the law “On the privatization of state property” (for large industrial facilities). It also adopted the law on the privatization of small enterprises. In July of 1992, the State program of privatization of state enterprises was approved, which identified priority objects for privatization and the method of payment for them. Together, these laws laid the foundation for the process of denationalization.

Around 12,000 enterprises were privatized between 1992—1994. The privatization was chaotic, through the purchase of enterprises by insiders (staff and directors), who had favorable terms for privatization. About 80% of all companies were privatized during that period, according to the World Bank (World Bank, 1997. Between State and Market: Mass Privatization in Transition Economies). This privatization was conducted in an noncompetitive manner, and constrained access to state enterprises for strategic investors.

In the early 1990s, the government witnessed a struggle between the supporters of privatization through cash repayment and through the issuing of privatization certificates for assets (PCA). The main supporter of cash—based privatization in the government of Witold Fokin (April 1991 — October 1992) was Mr. Viktor Salnikov, the Minister for denationalization and demonopolization of property. The lobbyists for PCAs were Vice—Premier Mr. Vladimir Lanoviy and the Chairman of the Parliamentary Committee on Economic Policy and Reform Mr. Vladimir Pilipchuk, according to Roman Speck, who took the post of Minister for denationalization in 1992.

The supporters of PCAs won.

Quickly and to everyone

There were several goals of the voucher privatization process. Firstly, to boost the transfer of state property into private hands on a more open and competitive basis. Secondly, to create a class of proprietors. Thirdly, to improve the efficiency of the management of enterprises and finally, to lay the foundations for the market of capital.

According to the Decree №178/94, beginning in 1995, PCAs became one of the major forms of payment for the objects of privatization. Over the next two years, every citizen of Ukraine was expected to receive a certificate. The deadline for voucher privatization was projected to be the end of 1996. This was eventually postponed twice.

The results however were far from what was expected. Later, President Leonid Kuchma named the period of voucher privatization as the “policy of creeping privatization and corporatization.”

“Ukrainian voucher privatization collapsed. As a matter of fact, it exacerbated the deformation processes in the field of proprietorship and seriously damaged people’s confidence in the government, politicians, market and further reforms”, – Anatoliy Halchinskiy, the author of “Notes of President’s Advisor: 10 years with the President Leonid Kuchma”

Interim result

Firstly, the number of privatized companies fell far below what was expected. From 1995 to 1998, the form of ownership changed for about 50,000 objects (40,000 small and 8,000 medium and large size enterprises). The number of fully privatized enterprises was even less: according to the Center for Economic Development, only 30% of medium and large enterprises had sold more than 70% of their shares (in 1995). In fact, the state remained the principal owner of the majority of privatized facilities.

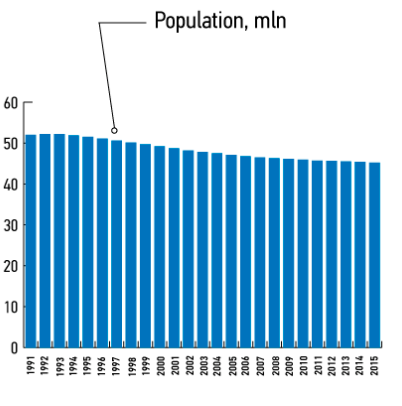

Secondly, because of the complexity of the procedure, nearly 7.8 million people did not participate in the voucher privatization (5.3 million people did not receive privatization certificates, and 2.5 million did not use them). [4] Out of the 46 million people who actually received certificates, only 19 million people were actually owners of shares.

Thirdly, much of the privatized assets were concentrated not in the population or end—investors, but in the hands of financial intermediaries and current management as well as in political nomenklatura and the criminals supporting them.

What went wrong

“The privatization was carried out during circumstances in which the population had too much temptation to sell their certificates for sausages,” — says Sergey Terekhin, who was the Deputy Minister of economy in 1993.

The government tried to avoid this scenario by designing the PCA to be a personal certificate, which was not subject to turnover. That, however, did not stop the further sale of PCAs.

The owner of the individual voucher could either buy shares in direct exchange for PCAs, or entrust PCAs to intermediate companies, who, in turn, were authorized to invest these certificates into privatization.

Formally, it looked like a citizen exchanged a voucher for a share in an investment or trust fund, or simply in trusts, but in practice it was just a sale of a certificate.

“Someone up there decided that a certificate should be exchanged only for shares. In contrast, people decided that it is better to get real money. That is why we have introduced this service”, — the essence of converting PCAs was described in 1994 into cash by Sergey Oksanych, the President of “Quinto” company.

Almost half of all “active” vouchers remained at the disposal of trusts. Thus, by the end of 1996, financial intermediaries concentrated about 20 million certificates, more than 14 million of them were invested into the privatization of objects.

Such a scenario could have been avoided. According to a study by CASE Ukraine, the process of privatization in the Czech Republic illustrates a better system. In that country, voucher privatization was also conducted but financial intermediaries were involved in the process of denationalization only if the shares of the enterprise were not in demand from large investors. In another example, the resale of vouchers on the secondary market was authorized in Russia, and because of this investors were able to buy these vouchers in bulk directly from the population.

In Ukraine, because of the strong position of the “left” parties in the mid—1990s, the introduction of the right to sell vouchers on the secondary market was not possible.

Red directors and Rada vs Investors

Many Ukrainians felt cheated because they did not have real chance to participate in the privatization of more or less attractive enterprises.

The Parliament, line ministries, local authorities, and above all — the directors of enterprises themselves did everything possible to prevent investors from taking control of their companies.

“From the insider’s (manager’s— Ed) point of view, the people seeking to maintain control over their enterprises had the following order of preferences in the available mechanisms of privatization: the most preferred was privatization by an insider, then followed privatization to a varied group of external investors, and the least desired option was privatization by a concentrated group of outsiders” – Oleksandr Pyvovarskiy, economist, author of the study “How does privatization work?”

For example, privatization by investors was significantly slowed down by a long—term right to lease, which was provided to the staff but in practice it was only available to a small group of insiders. Later, they were granted the right to transform the lease contracts into contracts for the redemption of enterprises, according to Pyvovarskiy’s study.

The Rada also played a role. Parliamentarians did everything possible to prevent state—owned companies from engaging with real investors. The disadvantage of the privatization process was that the Rada could intervene into the pace of privatization by establishing a list of objects on a yearly basis. The list was the source of real battles — MPs actively “edited” the list of enterprises that were not subject to privatization. During the middle of 1994, the Parliament issued a decree “On improving the mechanism of privatization in Ukraine and strengthening control over its execution,” which put a moratorium on privatization until December. That month, the Parliament approved a list of 5,400 state—owned enterprises excluded from privatization. Later, this number was increased to 6,000.

Sad result

In summary, the privatization did not assist in the emergence of a class of investors, or affect the ownership and modernization of industries in Ukraine. “Privatization had little impact on the quality of management in the enterprises, mainly because the majority (85%) of the shares were issued to actual managers and staff through the mechanism of preferred share allocation within restricted subscription”, as stated in the IMF report on Ukraine, issued in October 1997.

At the same time, there were almost no practical regulations in place for securities trading, transfer of ownership, registration of shareholders and the activities of intermediaries. The protection of the rights of minority shareholders of joint stock companies was also virtually non—existent. At the beginning of 1995, the activity of joint—stock companies was regulated by only 25 articles in the law on commercial companies, and a separate law on joint stock companies was only adopted in 2008.

A bevy of abuse, fraud and property misappropriation schemes emerged in this environment. This allowed company directors and their major shareholders to capture full control over their companies and financial flows.

Many trusts that collected PCAs from the population were not able to concentrate large stakes in companies and thus could not participate in the management and control of these companies. As a result, any subsequent certificates distribution ended up diluting citizens shares to microscopic sizes and therefore the majority of Ukrainians have never benefited from the payment of dividends.

SEZ’s and TDP’s

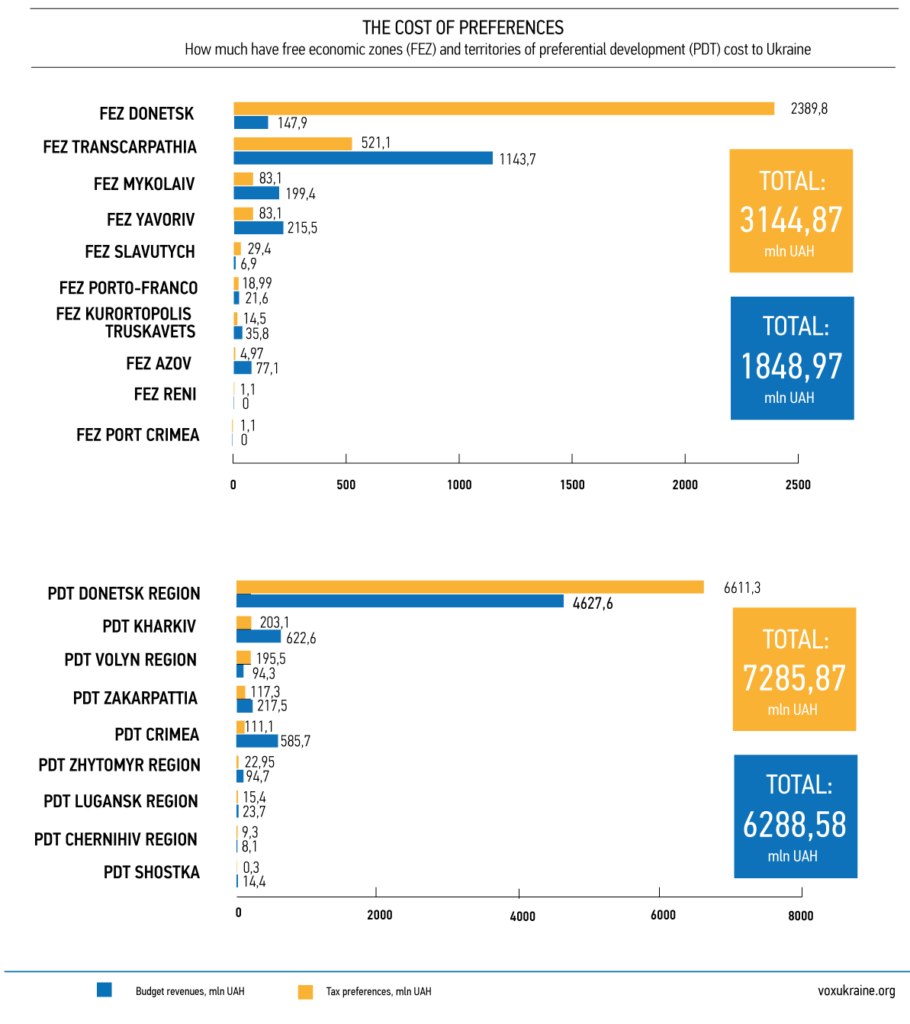

One of the most persistent and destructive economic mistakes there is. Almost throughout the entire history of independence, the Ukrainian business landscape was catastrophically disproportionate. A few select companies and economic sectors received tax exemptions and significant preferences which cost the country tens of billions of hryvnias, while the rest of the business world struggled under the weight of exorbitant taxes. The state then used that tax revenue to compensate the losses of the few chosen companies.

One of the key drivers of the inequality were the special economic zones (SEZ’s). In the Ukrainian experience, they became the ultimate mechanism to escape from taxation and paradoxically stood in the way of the inflow of foreign investments.

In October 1992, Ukraine’s parliament accepted the law “On the general principles of the creation and functioning of special economic zones”. This law created the principles for special economic zones as, “a part of Ukraine’s territory where a special legal regime of economic activity is established.”

By the end of 1990’s, SEZ’s had become one of the key instruments to minimize taxation in Ukraine. Finally, during the middle part of the 2000’s, SEZ’s lost the right for any special legal status because they failed to live up to expectations.

However, it took more than 12 years and billions in material losses to come to this conclusion.

When the SEZ’s were created, many had hoped for them to be an economic panacea. The government was counting on them to bring several benefits including; attracting foreign investments, motivating the development of certain territories, increasing the export of goods and services, attracting new technologies and speeding up the social—economic development of the entire country. To help make this happen, SEZ’s received the right to, “preferential customs, monetary, tax and other conditions of economic activity of national and foreign legal entities and individuals.”

Unsuccessful cloning

On their own, SEZ’s were not a Ukrainian innovation. Similar zones appeareded in the USA during the Great Depression and actively started to spread throughout the entire world after the Second World War. In the 1970’s there were only several of these zones in the world, but by the middle of 1990’s, according to the World Bank, 500 zones were functioning in 73 countries.

In many countries, special economic zones have become the locomotive of growth. Thanks to them, GDP, exports and employment increased, amongst other major benefits. China’s success, for example, is mostly tied to the creation of five SEZ’s during the 1980s.

Ukraine chose to follow the worldwide trend by accepting the corresponding law in 1992.

Within the first 6 years of its implementation, only one SEZ had been created. That SEZ was developed in Crimea according to the decree of the President “On North Crimean experimental economic zone ’Sivash” of June 1995. A subsequent boom in the creation of SEZ’s began in 1998. During the next four years, 11 special zones were launched in Ukraine: Azov, Donetsk, Transcarpathia, Inter—port Kovel’, Kurortpolis Truskavets’, Nikolayev, Porto Franko Odesa, Crimea Port, Renny, Slavutych and Yavoriv. A separate law was created for each zone which defined how it would work, which regime it would operate under, and which taxes would be levied upon it, amongst other things.

The reason behind the boom

Yet another parliamentary election took place in 1998. According to the research of Razumkov Center, a record number of entrepreneurs had earned positions in parliament. They became the second biggest group in the parliament and composed 21% of the deputies (in the previous election they only composed 8.9%). One of the reasons for such significant growth in the number of businessmen entering parliament was the fact that half of the deputies were elected via the proportional system. Candidates did not need to hold an election campaign in a constituency but simply make a contribution to earn their place on a party list.

After this occurred, the creation of SEZ in the parliament was put on conveyer belt. For businessmen, this was the perfect opportunity as SEZ and TOR essentially brought customized taxes. By 2003, the territories of SEZ and TOR had grown to 1/10th of Ukraine’s area. [6]

Iron experiment

At the same time, the parliament created new privileges for the metallurgical industry. On July 14th 1999, the parliament adopted a law “On leading an economic experiment in companies of the mining and metallurgical complex (MMC) of Ukraine”. The experiment was supposed to last from July 1 1999 to January 1 2002 and brought a lot of privileges for companies in the MMC. In particular, taxes on profits decreased from 30% to 9% and the ecology tax rate decreased by 70%. In addition to that, the government had written off the debts of companies which were part of the experiment during the period of time before July 1 1999.

Together, these two approaches to tax incentives had resulted in controversial consequences for the economy, which gives the reasons to count them as substantial mistakes of Ukraine’s economic policies of the time.

The results of the experiment in MMC were good for the industry and the financial indicators of MMC companies visibly improved. In particular, throughout the period of 1999 to 2002 the cost of sales went down from 1,01 to 0,83 UAH. Profitability increased from —1% to 16.6%, the volume of barter transactions decreased from 48% to 12.2%. The list of profitable companies increased substantially from 20 to 34 and their profits increased from 768 million UAH to 3,14 billion UAH over just a couple of years.

But the good news ended there because these privileges did not stimulate modernization.

Only 10% of the funds which had been received as benefits of the experiment were directed towards the upgrade of the general funds of MMC companies. In reality, the companies had used the experiment to gain more profit and transfer funds into offshore accounts.

Furthermore, the experiment helped the companies decrease the net price of their products in a non—market method. In response to this, a series of anti—dumping investigations were launched from the side of all key importers including the EU, Russia, Canada, Mexico and China.

“I know how metal is exported. Everything is supplied to the offshore zones, then it is sold in the offshore zones, and the differences stays in the offshore zones.” – Leonid Kuchma, second President of Ukraine

Bottomless SEZ

The results of the functioning of SEZ’s look even more uncertain.

“Tax incentives aimed at the development of industrial production and attraction of foreign investments in Ukraine had an unsuccessful design,” was stated in the 2003 report of the IMF on Ukraine.

According to statistics provided by Ukrainian researchers Valeriy Geyets’ and Volodymyr Semynozhenko in 2006, the strategy managed to bring in only 12.2% of the investments it planned to (goal — $17.7 billion, reality — $2.1 billion attracted over the years of SEZ) and only 35.5% of the jobs were completed (137.7 thousand vs 387.4 thousand). At that point only 25% of investments were foreign, the rest were reinvested profits of domestic companies.

“There isn’t a lot of evidence that the zones have contributed to the improvement of economic activity in Ukraine,” – an investigation led by World Bank in 2005

In reality, SEZ’s were most actively used to evade taxation and to smuggle goods. “Tax holidays, which are common in economic zones, create strong incentives for enterprises that pay taxes to engage in economic ties with those working within the SEZ’s which do not pay taxes. This is done in order to shift their taxes to the latter through the mechanisms of transfer pricing,” the IMF stated in the study, — A large volume of commodities which are not related to the realization of investment projects (e.g. meat and other products) are imported to Ukraine via economic zones.”

The duty—free import of materials, which was allowed for SEZ’s, caused significant damage to the economy. The IMF noted this in a World Bank study and said that such imports contradicted the main mission of SEZ’s, which was to promote the development of technologies, production and to attract foreign capital. Also, according to the investigations of the World Bank, SEZs decreased the level of investments outside of the zones, and stimulated corruption among the government administering the zones. The corruption occurred because it was the government of the SEZ’s that influenced the choice of the investment projects.

The roots of tax evil

However, the most negative effect of the existence of SEZ’s and the subsequent experiment with companies in the MMC was the influence it had on the tax system in general.

Almost immediately, the public finances of the newly independent Ukraine faced a problem with a very distorted tax legislation. On one hand, the general regime of taxation in the country was punitive for businesses, which is why a big number of companies moved into the shadow economy. [7] On the other hand, the tax laws were stitched through with a significant number of tax incentives, which became very costly to the state. For example, the VAT exemption in the middle of 1990’s brought about material losses exceeding 2% of GDP.

According to IMF estimates (Report №03 / 173 of July 2003), during 2001, the metallurgists “earned” $1 billion USD by underpaying taxes on profits. SEZ and TPD cost the state budget 600,000,000 to 800,000,000 UAH in uncollected taxes. All together, it was about 1% of GDP per year.

But that’s not all. Taking into account other tax benefits, total budget losses for VAT and income tax in 2001 alone amounted to 3.4% of GDP. For comparison, the total budget revenues from these taxes accounted for 9.2% of GDP (IMF, 2003).

This means that for every three hryvnias of tax income into the budget, one hryvnia stayed in the enterprises as a benefit. Furthermore, the introduction of tax incentives significantly leveled the efforts that the government directed at reducing distortions in the field of VAT. From 1998 to 2000, the total amount of benefits of VAT has been reduced from 3.7% GDP to 2.1% GDP. At the same time, the payments of income tax doubled (from 0.8% of GDP to 1.6% of GDP). [9]

Vicious circle

The key negative consequence of this policy was, and partially still is, that the decrease in budgetary income is compensated for by taxpayers.

“Ukraine’s tax system has become more bent than those of other transition economies. High tax rates have become inevitable because of a narrow base,” stated a study composed by the IMF in 2003.

An example of this was Ukraine’s failure to implement an agreement with the IMF in 1997 to reduce the marginal rate of personal income tax from 40% to 30%. Six years after it was signed, the reduction had still not been achieved. In turn, high tax rates led to a general deterioration of the investment climate in Ukraine. For this reason, even during the mass creation of SEZ’s in 2000, the IMF strongly opposed such practices.

“IMF believes that we have failed because after the creation of SEZ the budget revenues have significantly decreased,” this was how Kuchma’s economic advisor Anatoliy Galchinsky had described the Fund’s claims in 2000.

SEZs are closing

It took Ukraine 5 years to “come to an agreement” with international creditors. In March 2005, Yulia Tymoshenko’s government received support from parliament for the draft law “On making amendments to Ukraine’s law on the state budget of Ukraine for 2005 and several other policy documents of Ukraine.” The draft law canceled all favorable customs and tax regimes of entrepreneurial activity on the territories of SEZ. With this decision the parliament hadn’t liquidated SEZ’s, but it had changed their purpose and they were deprived of any special legal regime.

This cancellation was a prerequisite for obtaining a loan from the World Bank, the terms of which committed Ukraine to reducing the volume of industrial benefits by at least 55% in comparison to January 1, 2002. As for the experiment with MMC, the government themselves cancelled it during President Kuchma’s time. Still, for quite some time, the government and the Ukrainian parliament would go back to the practice of tax benefits for particular industries who had powerful lobbies in parliament.

In 2011, the state budget failed to receive 58.8 billion UAH, or 4.5% GDP, in revenue due to tax benefits. At that moment, more than 15 industries were receiving tax benefits.

A decisive step in the elimination of sectoral exemptions was finally taken in December 2014. By the beginning of 2017, Ukraine will need to get rid of the last sectoral exemption which is the special regime of taxation in the agricultural sector. The volume of indirect support to this sector amounted to 18 billion UAH in 2015, according to the statistics provided by the Ministry of finances.

Pension Reform: Wrong Time, Wrong Way

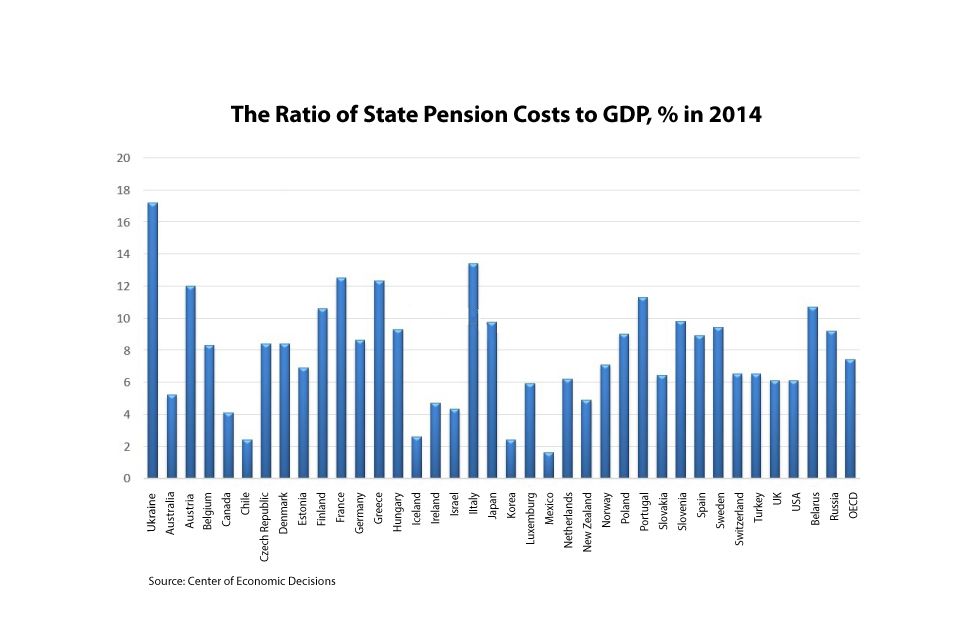

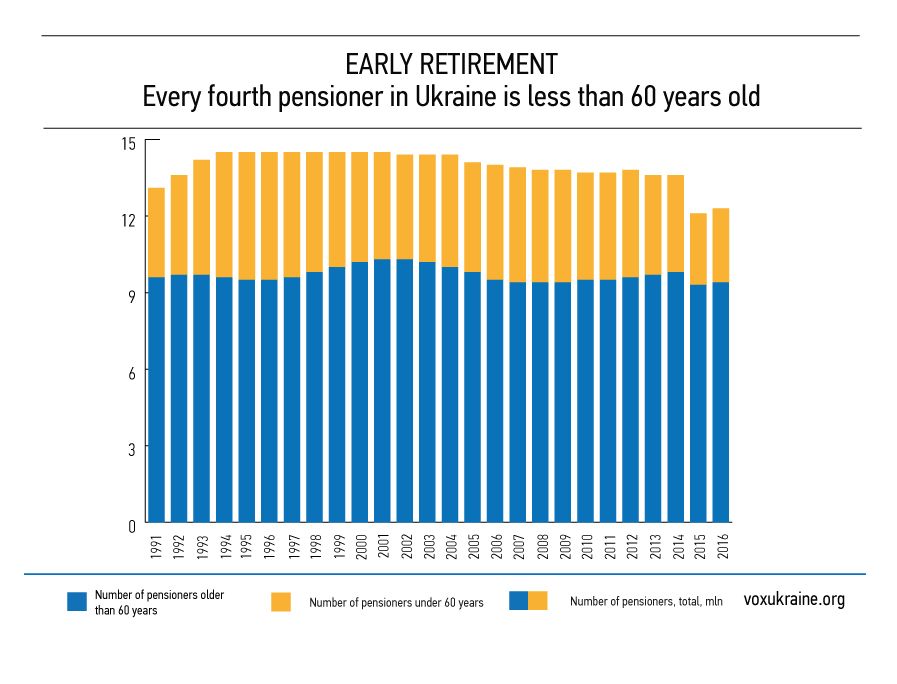

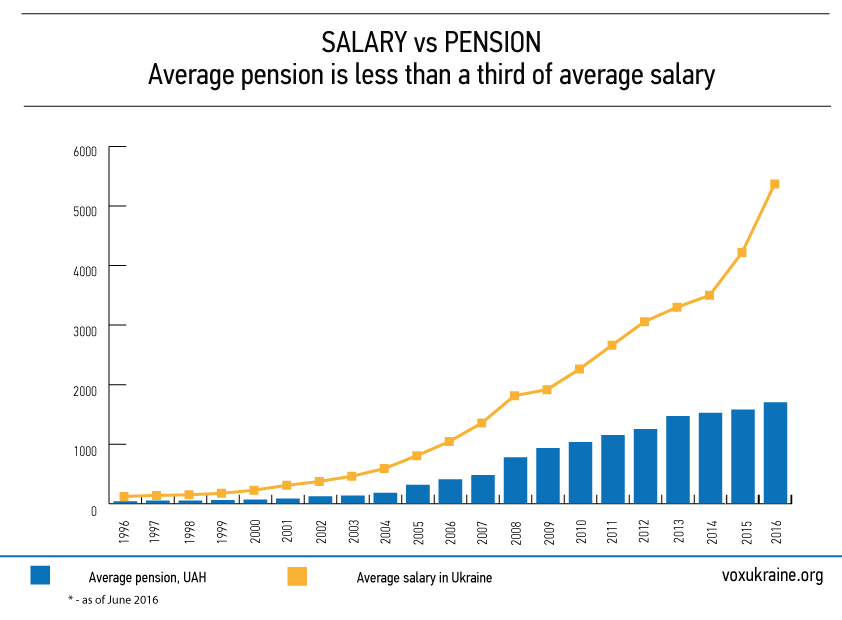

For 25 years, the Ukrainian government has not dared to implement any true reform of the state pension system. As a result: working Ukrainians don’t have any incentives to contribute to the retirement fund; a chronic deficit of the Pension Fund is over—burdening the state budget; at the same time, the Ukrainian government spends one of the highest shares of GDP (%) in the world on public pensions; until recently, Ukraine had very high taxes on labor, which pushed businesses into shadow operations.

More than 13 years ago, on July 9, 2003, the Verkhovna Rada approved the law on Mandatory Pension Insurance. It was expected that the law would become a turning point for resolving the pension issue. The new law demanded structural public pension reform and the development of a mandatory Pay As You Go (PAYG) system, combined with an individually funded mandatory plan, and a voluntary (private) plan outside the state pension system. Also, the pension benefit was tied to an individual’s earnings and the number of years they’d worked.

In order to understand why this happened, let’s look at the history of pension system reform in Ukraine.

Expensive Pension Benefits

Viktor Ivankevich, the Deputy Minister of Social Security Policy, has been involved in work on the pension system for more than 20 years. He says that the discussion regarding pension insurance and an individually funded mandatory pension plan started as early as 1994.

“In 1996, USAID helped to create a group that would develop the reform. The group included people’s deputies, representatives from the Cabinet of Ministers, Pension Fund officials, as well as Ukrainian and foreign experts. To boost productivity, the group was sent to a luxury resort area in Koncha Zaspa, near Kyiv. They were working around the clock to develop the reform plans,” says Ivankevich. “The plan was even approved for Parliament hearings, but was rejected and sent for modifications.”

In 1998, as a part of the IMF program titled “Extended Fund Facility”, Ukraine formally agreed to implement pension system reform.

“By the of end—1998, in cooperation with the World Bank, we intend to further develop a comprehensive reform program that would include a fully funded pension component and a gradual increase in the pension age,” stated the IMF Program in August, 1998. The reform was overdue however because the pension debt was critical and the pension system did not meet the needs of the social protection.

Back in the early 1990s, the Pension Fund of Ukraine had a surplus. Later, the ratio of the employed people contributing to the retirement fund compared to the number of pensioners who profited from the retirement fund began to steer off balance. During “the wild 90’s”, a large number of businesses began to operate in the shadow economy thereby avoiding both taxation and contributions to the Pension Fund, according to the research of World Bank “Pension Reform, Growth, and the Labor Market in Ukraine”(Michelle Riboud and Hoaquan Chu). In just two years, from 1991 to 1993, the ratio of wages to GDP decreased from 45% to 23%. This accelerated and aggravated the negative demographic and economic trends.

As a result, in 1993 the Pension Fund shortfall was equal to 1% of GDP and by 1996 it had risen to 2.6% of GDP (World Bank methodology of measurement), according to the research “Ukraine: Reforming the Pension System” by Cheikh Kane, 1996.

By 2000, due to a number of successful interventions by the government, the Pension Fund situation had improved and revenues exceeded expenses yet again. However, structural problems in the pension system did not disappear. Small pensions alongside a lacklustre relationship between earnings and the amount of the future pension distributions discouraged contributions to the Pension Fund.

President’s Attempt

“After retirement, Ukrainians lose on average 2/3rd’s of their income. Those who earned large salaries lose 90% of their income after retirement. At the same time in the EU, on average, after retirement you lose no more than 40% of income,” says President Leonid Kuchma in his address to Verkhovna Rada in 2001.

President Kuchma admitted that to resolve these problems, it would be necessary to reform the solidarity—based PAYG state pension system and also have available an individually funded mandatory plan and a voluntary (private) plan. Back in 1998, the Cabinet of Ministers submitted the first draft of the “Law on Mandatory State Pension Insurance”. “If Ukraine had made a few unpopular steps back then, it would have still been able to afford the simultaneous implementation of both an individually funded mandatory plan and a voluntary (private) plan”, — says Roman Shpek, Head of the National Agency for Development and European Integration at the time.

Later, it was the People’s Deputies’ turn to have their word. The fate of this law was truly dramatic and the draft law was granted “Urgent Status” 5 times by the President. It was amended four times, and the newest amendment, made in 2000, introduced a clause to increase the legal pension age to 60 for women, and to 65 for men. The draft law was rejected several times by the committee, and it did not get enough votes in the Parliament. The final version of the law was approved in 2003, 5 years after the first draft was submitted. The law became active in January 2004.

Unlucky Law

When this unlucky law was approved, it was too late, and almost impossible, to use it as a base for building a sustainable pension system. Here is why.

1. During the parliamentary debate, the important clause about the gradual increase of the legal pension age to 60 years for women and 65 years for men was removed, which made the pension system unsustainable.

2. This draft law did not resolve the issue of preferential pensions. “VIP—retirees” continued to receive very high pensions (grossly unproportional to VIP—retirees’ contributions to the retirement fund). [3] Nor did this law resolve the problem of unreasonably high labor tax necessary to support the Pension Fund.

3. The implementation of the second level of the pension reform (mandatory state insurance), was postponed indefinitely, until the approval of the law on individually funded mandatory pension insurance. “When it was time to approve the reform, the Communist Party was presiding over the Pension Reform Committee. They had an understanding that the “second level” of the individually funded pension system was necessary, but this step did not fit into their political agenda and they could not accept such a “capitalistic” tool a the mandatory contribution system,” continues Ivankevich.

13 years have passed since the approval of the pension system reform, but it was never implemented.It has become a victim of political games in Ukraine.

It has become a victim of political games in Ukraine.

Populism Galore

During his second term as President, Leonid Kuchma declared his support for the pension reform.

However, in the face of the presidential elections in 2004, once again the Ukrainian government’s self—serving interest prevailed over economic efficiency. As the pension reform was known to be unpopular with the electorate, it was abandoned.

During 2004, the government of Viktor Yanukovich significantly raised PAYG pensions. In January 2004, the minimum pension was 102.8 UH per month. Nine months later, it was already at 294.6 UH. The subsequent “orange” government continued the trend. “The past increases of the pensions paid from the PAYG, the pillar of the mandatory state pension insurance, have outpaced GDP and wage growth in real terms. From 2003 — the year of the passage of the pension reform bill — until 2005, Ukraine’s real GDP increased by 15% while the minimum wage increased by almost 30% and the average wage by 78%. However, the real minimum pension increased by almost 190% according to the research conducted by Aleksandra Betliy and Lars Handrich.

This generosity had ruined an important precondition for the proper functioning of a mandatory individually funded pension insurance; the sustainability of the Pension Fund. “The current imbalances of the PAYG pension system have effectively terminated the ambitious pension reform of 2003,” stated Bentliy and Handrich. Expenditures[A1] of the pension fund had grown from 8% GDP in 1996 to 15%GDP in 2005.

Governmental transfers that helped to cover the deficits of the Pension Fund increased from 0% in 2003 to 3.7% in 2005.Buying the electoral power of the retirees has become a tradition.

Between 2002 and 2010, the minimum pensions increased by 9x in real terms, while the average wage, which is the basis for pension contributions, increased by only 3.4x in real terms.

Ukraine found itself in the middle of a financial death spiral as increasing any pension expenditures would increase the Pension Fund deficit. Ukraine’s unfavorable demographic outlook also reduced the number of options available to resolve the problem. The longer this is delayed, the more painful it will become to enact the necessary steps to revive the pension reform and its second pillar: an individually funded mandatory plan.

Welfare state

In 2010, according to the Ministry of Finance, the Pension fund expenditures accounted for an outrageous 17.7% of GDP. It was the largest rate ever seen in any available country statistics.

That same year, the government of Mykola Azarov tried to reform the pension system and increase the retirement age for women from 55 to 60 years of age. It improved the situation a little bit and by 2012, spendings on the pension systems lowered to 16.2%. However, the following year saw Pension fund expenditures increase to 17.1% of GDP after another minimum pension level increase by President Yanukovych.

At the beginning of 2015, Ukraine had a Pension fund deficit equal to 77 billion UAH, which was offset at the expense of the state budget. According to the Ministry of Finance data, total expenditures on the pension system constituted 13.5% of GDP in 2015. Direct state budget expenses for pension financing were 4.2%. The problem worsened after the reduction of the unified social tax (“labor tax”) to 22% in 2016. Now the Pension fund lacks 140 billion hrn.

Due to the gravity of the situation, the pension reform has now become a cornerstone requirement for continued cooperation with the IMF. Nevertheless, Ukrainian leaders are still postponing difficult and potentially unpopular steps, thereby enabling a worsening of the situation.

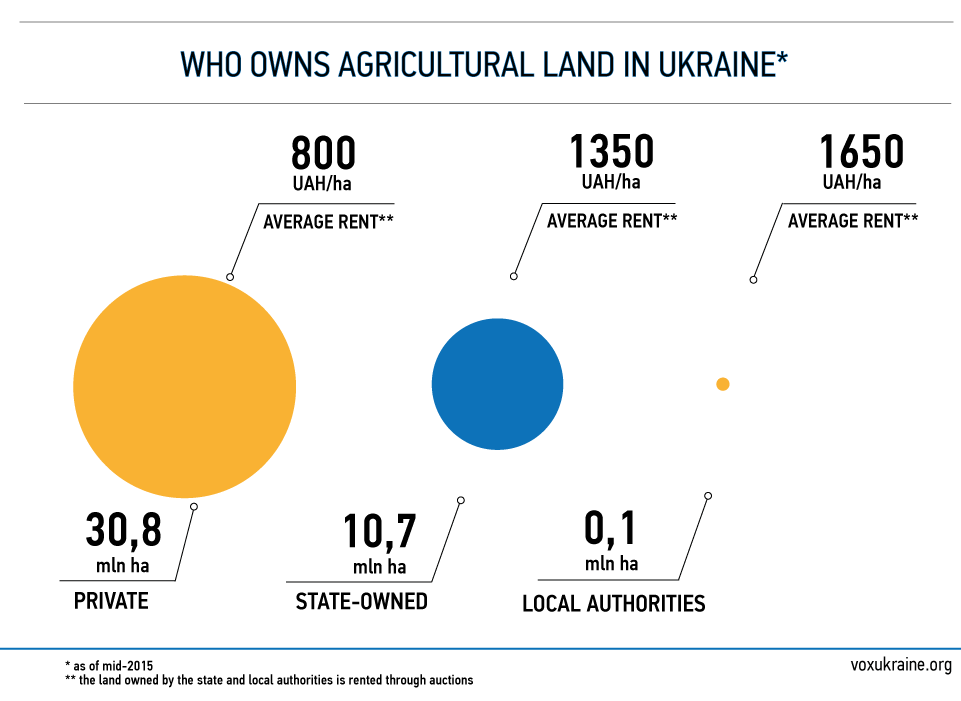

Land reform: moratorium

The moratorium on agricultural land sales not only proved harmful to the state economy, resulting in lost revenue of up to USD $40—50 billion, but it was also an egregious violation of the property rights of Ukraine’s own citizens. For the past 16 years, seven million Ukrainian citizens haven’t been able to dispose of the land they own.

The parliament of Ukraine voted for the introduction of a temporary moratorium on the sale of citizens land shares on January 18, 2001. This move was planned as a temporary solution that would protect the Ukrainian market from a situation in which a few landlords accumulated all the available land. At this point, this “temporary solution’ has been in place for almost 16 years. The moratorium is dangerous because it hinders the development of the agricultural sector, the creation of an organized land market, as well as the associated debt and long—term investment in the development of this part of the economy.

Land. Beginning

The first attempt to control the land market was initiated by the Cabinet of Ministers of Ukraine in 1993 when they adopted the resolution, “On State Taxes”. This resolution introduced a variable tax rate on the sale of land which depended on the time the land was cultivated by the owner. If the land was sold within one year after privatization, the seller would pay 80% of the contract price; but if the land was sold after 6 years, the sales tax would be reduced to 5%. The reform was never implemented because of strong opposition from the Verkhovna Rada.

The next attempt to run the land market was made by the government in October 1996 when the Cabinet of ministers sent parliament a new draft of the Land Code. At that time, and still today, the launching of the land market was a condition for the continuation of international support programs for Ukraine. However, despite pressure from the World Bank and the IMF, the project was rejected by the Rada in March 1997.

Between 1998—1999, the government and the President found a different way to begin land denationalization. The order of land division and transfer was enacted by the Presidential Decree number 720 of 08.08.1995 “On the order of the division of land transferred into collective ownership of agricultural enterprises and organizations.“ Collective and state farmland was divided into shares then transferred into the ownership of “members of collective agro company, agro cooperative, agro joint stock company, including retirees who formerly worked in it” (Art. 2 of the Decree № 720). During this period, the land sale began. This relatively free land market only existed for a very brief period, ending in 2001.

In January 2001, Anatoly Matvienko, an unaffiliated MP at that time and ex—governor of the Vinnytsia region who is currently an MP in President Petro Poroshenko’s party, suggested to his colleagues in the Parliament the introduction of a temporary moratorium on land sale. Right after the Christmas holidays and without discussion, MPs supported his initiative, passing the Law “On the agreements related to the exclusion of a land share (share)” on January 18. Most of those who voted for the law were representatives of the Communist Party (106) and “Revival of regions’ group (later the Party of Regions) (29 votes). “The land was distributed to shareholders, and MP’s were afraid that the rich people will buy it up, which, of course, can not be excluded”, said an expert on the agricultural sector, Oleg Nivevsky.Kateryna Vashchuk, the chairman of the parliament profile Committee of Agrarian Policy at the time of the voting, explained that the moratorium was “to prohibit the transfer of land shares up to the Land Code of Ukraine.”

Sevenfold moratorium

The draft of the Land Code was submitted by the government of Victor Yushchenko in October 2001 and passed by the Parliament.

The document “actually created the premise for the implementation of the third stage of reform — the creation of an effective land market”, — says the economist Anatoly Galchinskiy in his book “Notes of the President’s Advisor: Ten years with Leonid Kuchma.

“However, there were problems. For example, when considering the draft in Parliament, the Agrarian Policy Committee lead by Vashchuk made changes that not only enabled the moratorium to continue but also made it subject to all agricultural land.

What was supposed to be a temporary solution, actually became a permanent situation for the country.

In October 2004, the moratorium was extended for the first time until January of 2007. Communists, Socialists and also “Our Ukraine” voted for it. Even the leader of “Our Ukraine”, the newly elected president Viktor Yushchenko, upheld the decision to extend the moratorium.

The second time it was extended was in late 2006. The vote for the extension of the moratorium was supported by left wing parties, as well as by the largest parliament parties of the time — the Block of Julia Tymoshenko and the Party of Regions. This time, President Yushchenko vetoed it, but the parliament was overturned the veto. After that, the moratorium was prolonged five more times: in 2008, 2010, 2011, 2012 and 2015. The last vote extended the moratorium until January 1, 2017.

Elusive law

As of today, 96% of agricultural land is off the market, because of the moratorium. The majority of this land, 68%, is owned by shareholders.

Will the moratorium be extended this fall? This is not a very important consideration because according to the Land Code of Ukraine, it doesn’t have to be extended again. This is due to a prerequisite which says that in order to lift the moratorium, a new law on the turnover of agricultural land must first be introduced. This law should create a “procedure for exercising the rights of citizens and legal entities to land (share).

“However, in the 16 years since the introduction of the moratorium, this type of law has never been adopted by the Verkhovna Rada.The closest to adoption was the draft law “On the Market of Land”, submitted by MP Gregory Kaletnik, representative of the Party of Regions. In 2011, the draft law passed the first reading in Parliament, but it never went further.

According to the latest law on the moratorium, the Cabinet of Ministers had until March 1, 2016 to submit a draft law on the turnover of land to the Parliament. However that has not happened yet (although a relevant law was prepared back in 2013 by the State Service for Geodesy, Cartography and Cadastre).

So why do MPs and the government persistently ignore the issue of establishing a market in agricultural land?

Electorally not attractive

One of the main reasons this hasn’t happened is due to societal distaste for the idea of a land market, believes Andrei Martyn, the vice—president of the Land Union of Ukraine. The authorities, in their rhetoric and actions, simply follow the electoral mood of the majority of citizens.

“No decisions on the moratorium may be taken before we understand all the nuances of dealing with land. Otherwise, this will be a terrible situation”– Volodymyr Hroysman, Prime Minister of Ukraine, June 2016

While four presidents and the members of six convocations of Parliament have debated the moratorium for the past 16 years, Ukraine has lost and continues to lose immense opportunities for economic development, the improvement of its own agricultural sector efficiency and the welfare of the rural population.

The cost of the moratorium

First of all, the ban was instituted to prevent wealthy individuals from buying up the land, but that idea was discredited long ago. Now, a simple Google search provides instructions from a bevy of lawyers on how to legally bypass the moratorium in order to buy agricultural land.

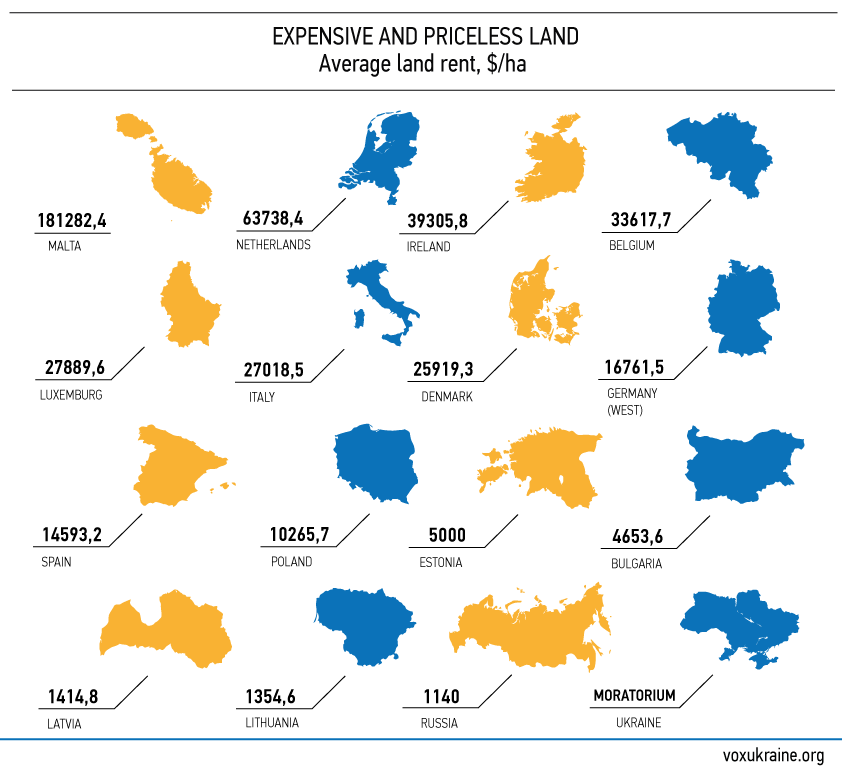

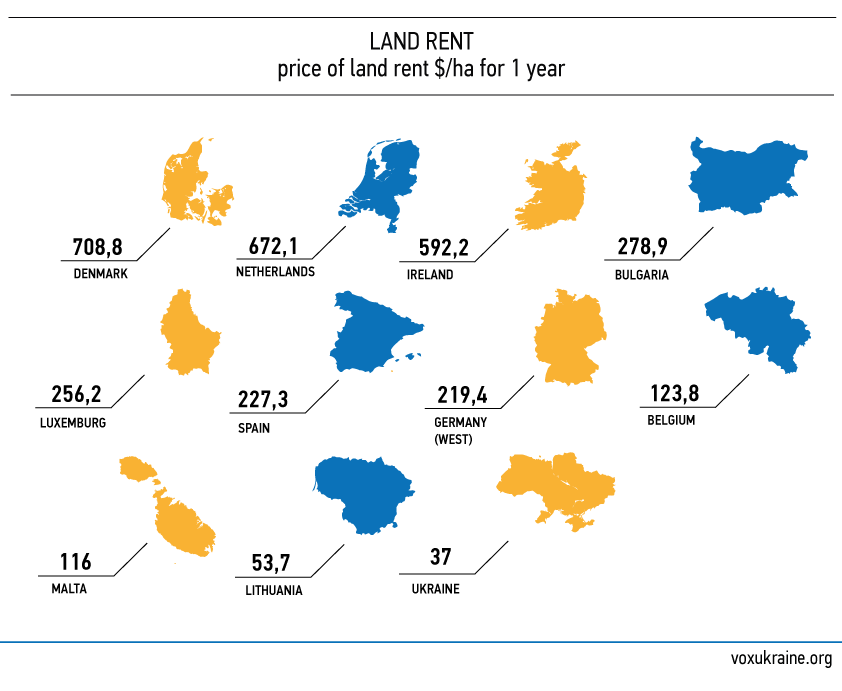

Secondly, the owners of the land are forced to lease it out at rates 5—11x lower than its true value.

Now, the turnover of land exists mostly on the rights of lease. Oleg Nivevskiy and Denis Nizalov, both experts in the agricultural sector, say that the cost of agricultural land lease in Ukraine is over 10 times lower than it could be if distortions in the land market were eliminated and other production factors such as poor access to capital, moratorium on the sale of land, fragmentation of land ownership were fixed. Additionally, not only those who wish to sell their share would benefit from the opportunity to freely dispose the land, but also those who choose to keep their land.

In particular, the researchers estimated that about 60% of the agricultural land in use is farmed by tenants who lease land from the owners of the shares. The average lease payment amounted to $37 in 2015. At the same time, if the the markets operated normally, the rent would amount to $ 455 per ha, or 11 times higher.

The fourth factor is a significant limitation of access to credit resources for farmers, as Denis Nizalov, Kateryna Ivinska, Sergei Kubakh and Oleg Nivevsky write in their article “Moratorium on land for dummies and not only.“

The creation of a land market will immediately launch the use of land as collateral. “The emerging of land as collateral will untie bank’s hands and will give a new powerful impetus for lending,“ — says Zuzak. According to his calculations, even if some land sells at a 50% discount, due to its close location to the conflict zone or the Polissia region, drylands, or other factors, the minimum amount of high—quality collateral will be about $9—10 billion. With the help of lending, the money will be directed into the economy, and the positive impact on the economy will be much higher due to the bank multiples.

“It is also important to remember that the launch of the land market will enable small and medium—scale farmers to receive loans secured by land and improve the quality of the equipment and technology, thereby increasing the efficiency.“ – Serhiy Zuzak, head of SCM business development department

According to estimates by Andrii Martina, as a result of the moratorium and inability to use land as collateral, Ukraine’s economy has already missed out on receiving from $40 to 50 billion dollars.

The fifth negative effect of the moratorium is how it stalls the development of rural areas and farming. The latter prevents the reallocation of land resources from less efficient owners and producers to those who are more effective as well as drives rental prices down and decreases incomes of owners.

Finally, the moratorium raises very important moral and social issues. Landowners are deprived of the possibility to use their land effectively while its rental price is undervalued dramatically and it is not possible to sell it. More importantly, more than a million Ukrainians will never be in a position to sell their land. According to estimates by a project of “The price of the state,” nowadays 1.6 million landowners, or to put it another way, 23% of all owners, are individuals older than 70 years. At the same time, from the time the first moratorium took effect around 1 million landowners passed away. Accordingly, they have never made use of their possessions: they have not assigned successors, or the latter have not exercised their rights thanks to the high costs associated with the succession procedure.

Gas tariffs: it could have been painless

For 24 years Ukraine has been applying economically unjustifiable gas and heating tariffs. The result have been devastating and include, the creation of gas oligarchs, Ukraine’s energy dependence on Russia, stagnation in domestic production as well as tens of billions in hidden subsidies granted to the Naftogaz. All of these consequences undermine the financial system of the country.

History of tariff

By 1998, when the company Naftogaz was founded, the gas market had been decentralized and companies involved in the import of gas were required to obtain a relevant licence. From 1996 – 1997, only 8 companies were granted licenses; the largest of which were UESU, Ukrgazprom, ITERA. From 1998 onwards, Naftogaz gradually consolidated the market, leading it to become the sole importer and monopoly in the gas market until 2003.

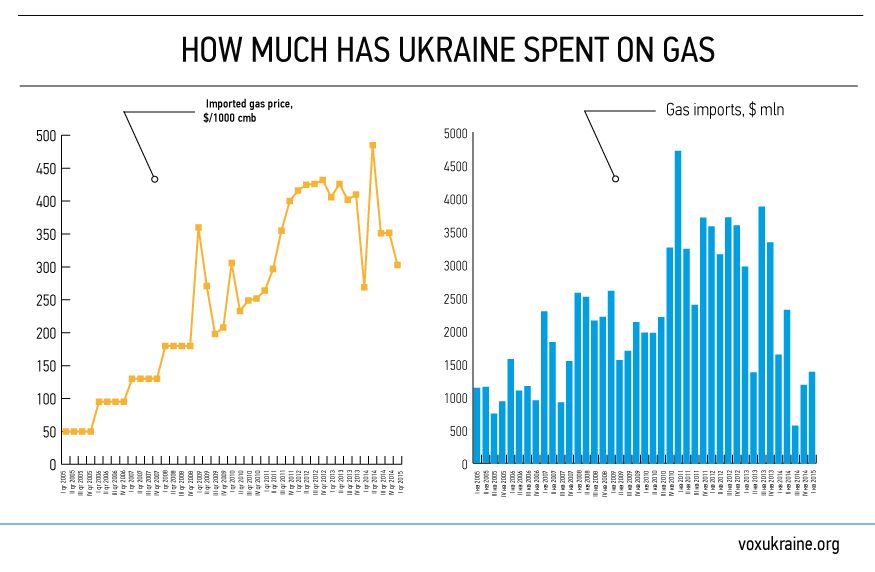

As early as 1999, in one of the documents concerning reforms in Ukraine, the World Bank pointed out the necessity of raising gas and heating tariffs to an economically reasonable level (to their actual cost). At that time, gas was relatively affordable ($50 per cubic meter, while the average price was in fact even lower thanks to the use of barter transactions), and a quasi—fiscal deficit caused by indirect subsidies granted to level off the difference in tariff was not an issue. What did give rise to concern were unpaid gas bills. After the transformational crisis, the hyperinflation of the early 1990’s, the financial crisis and the 1998 devaluation of the hryvnia, Naftogaz received only 34% of the total amount of the payments which it was due, according to the World Bank’s research in “Ukraine, challenges faced by the gas sector” (2003). Individuals and enterprises simply did not pay their bills. Recognizing the paramount importance of the payment discipline, the Word Bank opined that tariffs should be raised, but it would only be useful if effective measures addressing non—payments are put in place so that the increase in tariffs would be efficient.

Throughout 1999—2000 Naftogaz managed to significantly increase the amount of gas payments received to around 90%. It was at that time that the issue of tariff substantiation once again gained overriding importance.

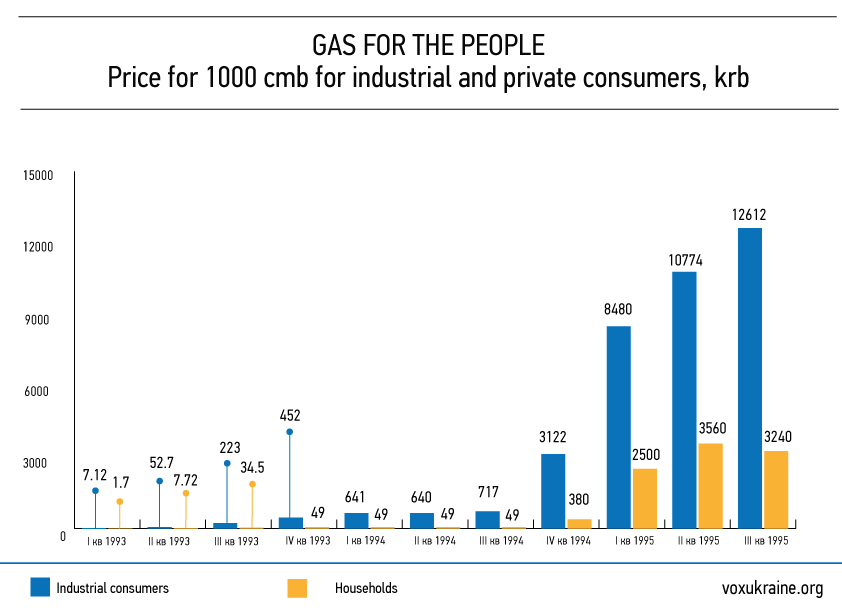

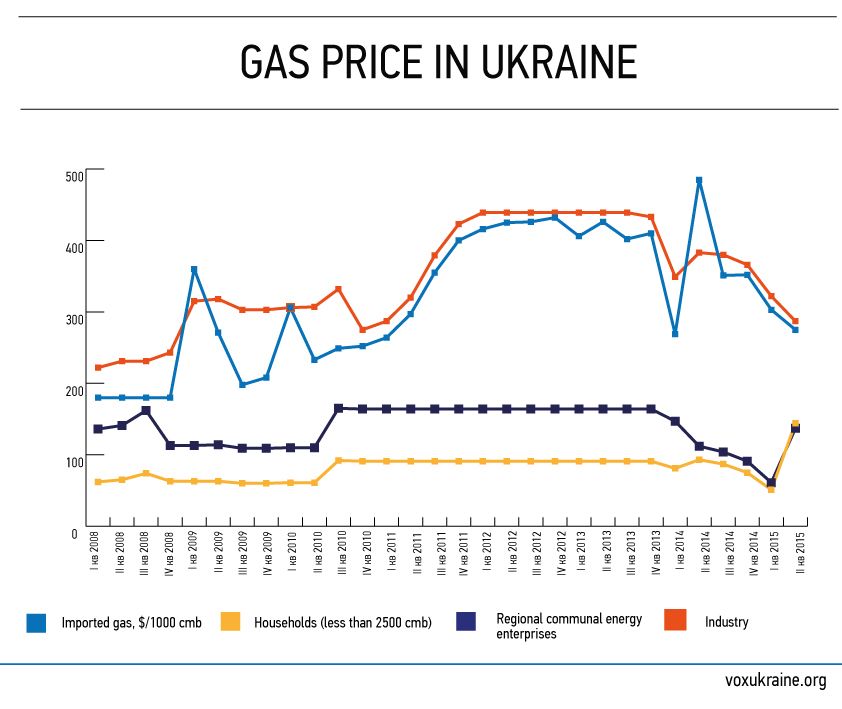

Whereas in accordance with the agreements concluded with Russia and Turkmenistan, Ukraine imported gas for approximately $50 per thousand cubic meters (what was 3—5 times less than the price in Europe), a weighted average tariff for the population was about $19 per thousand cubic meters. Community energy enterprises paid $28 per thousand cubic meters. In reality, it was only the industry that paid around $50. Thus, in the early 2000’s a weighted average tariff for all categories of consumers was approximately $40 per thousand cubic meters.

This $10 difference, exacerbated by moderate non—payments and technological losses, led to a hidden deficit in the gas sector amounting to 0.5—2.5 % of the GDP each year.

It is fair to note that together with the politically stable price for imported gas, a gradual increase in tariffs and the improvement of the payment discipline which took place in 2003—2005 helped to remove this deficit in the gas sector, drawing it down to 0 – 1.5 % of the GDP. It was at that time that the government failed to take advantage of the political opportunity of reforming the tariffs.

“In 2005—2007 not only did the government enjoy support in society but also the revenues and wellbeing of the population were rising. This was a very favourable situation for raising tariffs to the level of their actual cost. It would not be burdensome for the population to pay a bit more” – Andriy Gerus, the former (2014—2015) National Energy and Utilities Regulatory Commission member

There flaws were also exacerbated by international financial organizations (IFO). After the significant increase in tariffs by the government in 1990’s and up until the crisis in 2008, IFO’s hadn’t raised the tariff—issue. For example, IMF’s project Stand—By (2004) oddly promised to enhance the transparency of Naftogaz and create an energy sector subsidies’ monitoring system, whereas a traditional IMF monitoring report (Article IV) issued in July, 2008 only superficially discussed tariffs and Naftogaz.

Since 2006 the situation has worsened as Russia became a distributer—monopoly to Ukraine by putting all the gas in Middle—Asia under contract. After the 1st gas war in 2006, Russia increased gas prices to $95 in 2006, $130 – in 2007 and $180 – in 2008. After the 2nd gas war in the beginning of 2009 the price was designated every quarter and had reached on average $200—300 (with all discounts) until the middle of 2011 and about $400 in 2012—2013.

The devaluation of the Hryvnya from 5 to 8 hryvnyas per US dollar exacerbated the problem. As long as the imported gas was paid for in dollars, but tariffs remained in hryvnyas, then tariffs for the population and heating supply services became even smaller. The partial tariff increases in 2008 and 2010 insignificantly compensated for the influence of the devaluation. Even though the deficit of Naftogaz rose up to 2.5 percent of GDP in 2009, it plunged to 1.7 percent in 2010. It was a complex reform of the gas sector, including the increase in tariffs, that was demanded by both 2008 and 2010 IMF programs. However, Julia Tymozsenko’s and Nikolai Azarov’s governments ignored the requirements. At that time the difference between the tariffs for the population and the price of imported gas was already five—fold and the issue was electorally obnoxious.

This means that Ukraine missed an opportunity to smoothly reform the tariff system during the mid 2000’s. Every subsequent failure to increase tariffs was a political decision, exploited for PR purposes by politicians. At the same time, corruption rent was earned by those closest to the government’s gas businessmen.

Penalty: low tariff’s price

Such pricing and the system of indirect subsidization compensated for the lion’s share of gas prices for poor, wealthy and very rich Ukrainians. The state taxpayers didn’t have the opportunity to increase efficiency by more precisely targeting subsidies.

After decades of low prices, the population became addicted to energy paternalism and politicians became accustomed to speculating on gas issues as well as the resulting PR. During periods of low pricing, there were no incentives to create energy—effective technologies, account for individual gas or curtail consumption.

The differentiation in tariffs’ between households and industry grew 3x — 10x between 2007 and 2010 and created a stiff base for arbitrage (reselling households’ gas to industry entities). The resulting corruption rent was like a river.

Naftogaz was persistently approaching bankruptcy and the financial hole in the state monopoly was estimated to be in the tens of billions in hryvnyas (UAH). In 2014, after the Revolution of Dignity, when the financial position of Naftogaz became unclassified, the company’s fiscal deficit (gas sector) was 5.7 percent of GDP (around 90 billion UAH), which exceeded Ukraine’s entire budget deficit (4.6 percent GDP). Monetization of this deficit by “issuance’ resulted in pressure on the hryvnya’s exchange rate.

After the Revolution in 2014, an abrupt leap was made in solving the problem. Whereas the consolidated loss of the group of Naftogaz companies amounted to $1.7 billion in 2013, there is now an expectation to profit $0.7 billion in the fiscal year 2016 (pure Naftogaz’ profit, as of an individual entity, was 21.8 billion UAH in the first 6 months). This is the result of an increase in tariffs for the population, industry and Naftogaz’ operational activity improvement.

However, the victory is a hostage of the macroeconomic stability of Ukraine. “Tariffs are not the major problem, it’s devaluation. For example, in 2014 there was a graph on how to increase tariffs to the market level in three steps. But when an abrupt devaluation appears, the solution to the problem evaporates and tariffs once again need to be increased”, — said Gerus, the former (2014—2015) National Energy and Utilities Regulatory Commission member. Naftogaz’s financial soundness depends not only on its management, but on the recovery of the Ukrainian economy and its long—term robustness, which, in turn, is contingent on investment appeal and investment flows. Without this, Ukraine is doomed to endure permanent hryvnya devaluation, which will make a constant rise in tariffs’ inevitable.

With participation of: Lubomyr Humaniv, Anna Gusak.

We are grateful to Olena Mazhuha, Faina Kaplan, Olena Doroshenko, Yulia Reshitko, Kateryna Berezovska, Taras Kovalchuk, Kvitka Perehinets, Alex Derkach, Nina Shulyak, Yulia Reshitko, Olena Zuikova for help in translating this article.

Notes:

[1] Anders Aslund Ukraine: What Went Wrong and How to Fix It

[2] https://www.imf.org/external/pubs/ft/scr/1997/cr97109.pdf

[3] Pension reform in Ukraine. Comments on the main features of the current Draft Law. Oleksandr Betliy, Ricardo Giucci, February 2011

[4] A. Fedorchuk Frozen Archive – ZN.UA, December, 21, 2012

[5] Estimations of the World Bank and IMF are different. World Bank (2003) Ukraine: Challenges Facing the Gas Sector и IMF (2005) Country Report No. 05/20: Selected Issues

[6] IMF. Report № 03/173, July, 2003

[7] Memorandum of Ukraine’s economic politics, 1995

[8] The same

[9] IMF. Report № 03/173, July, 2003

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations