In Ukraine, where tax evasion is a norm rather than a deviation, honest taxpayers are at a disadvantage. Institutional weakness of Ukraine requires a tax system that is as simple, straightforward and non-discretionary as possible – argues Volodymyr Dubrovskiy, expert of the LEV USAID project and the RPR.

Tax system at a glance

At the first glance, current Ukrainian tax system looks like a “European” one, in a sense that it is composed of the same main taxes as in the majority of EU countries. Moreover, tax laws were written under scrutiny, if not supervision, of the Western advisers. Perhaps, only simplified taxation for small and micro business (hereinafter – simplified taxation) stands alone constituting the main difference.

So, when asked about a reform advice, a surface Western consultant (as, for instance, the ones that were involved in drafting of the Yanukovich program of reforms and the Tax Code adopted in 2010) usually recommends making cosmetic changes to the general system and curtailing or emasculating of any special regimes, primarily the simplified taxation. In this sense, the article ‘One Proposal for Ukrainian Tax Changes – An Initial Evaluation’ by Robert Conrad and Michael Alexeev published in the VoxUkraine is quite typical, although certainly not the only one in this row [1]. However, in fact such assessment, as well as advice that stems from it, is superficial, and mostly wrong. In reality, “general” tax system is non-performing in all dimensions and requires deep changes that are much more urgent and potentially beneficial for the country’s economy than any improvements of the special regimes.

On the fiscal side, acting tax system fails to secure budget revenues due to pervasive tax evasion/avoidance. The state responds with permanent struggle for “mobilization” of taxes. The surveyed CEOs [2] of the firms using this system normally name taxation among the main impediments for running their firms. Discretionary and burdensome administration of taxes is usually considered an even worse impediment than high fiscal burden, and it also makes tax liabilities unpredictable. High discretion embedded into the system is widely used for privileging the cronies and mowing the markets for them, for raiding, for punishing the supporters of political opponents, and for mere extortion. And, of course, those who reportedly comply with the law, primarily foreign companies, feel disadvantaged because their competitors can save on taxes – mainly due to their better informal corrupt connections with the authorities.

“Burdensome administration” and other “implementation problems” hide the fact that the whole system is essentially grounded on blackmailing, which is the main tool for “mobilization of taxes” according to planned targets and to large extent regardless of the law. For example, the Ukrainian firms were forced to pay “in advance” UAH 26 bln by September 2014 allegedly as their corporate income tax for some future times. But without such a barbaric methods acting tax system would fail to collect a significant share of current volume of revenues. In fact, the “general” tax system works like a medieval confiscatory taxation. Ironically, the only part of the Ukrainian tax system that makes a difference, and actually operates along normal European lines of impersonal treatment, voluntary compliance in strict accordance to the law, and straightforward rules is… simplified taxation.

So why do the laws that were once developed with a help of international advisers and mostly correspond to the European practices work so badly in Ukraine? The most general explanation is that in Ukraine the “European” laws generally do not always work as they should. Of course, Ukraine is by no means unique in this sense: as North, Weingast and Wallis [3] put it “similar [formal] institutions work differently in Limited Access [Social] Orders (LAO) than in Open Access Orders (OAO)” – and this is exactly the case. Thus, the problem is much deeper than just (as one may suggest) “poor implementation” of otherwise well-tailored laws; therefore it can not be cured simply by a fiscal service reform.

In fact, there are fundamental reasons why acting Ukrainian tax system became a vivid illustration to the above quoted general principle of institutional economics. To put it short, this is a typical but not unique example of the “European norms” that became a tool for selective privileging and punishment when transplanted onto the ground of a “blackmailing state”. In this particular case, two components that together created a drop of poison that spread through the whole system were:

(a) complex and inherently opaque nature of the net incomes (or profits) as a tax base – which necessarily implies quite high degree of discretion; and

(b) deep-rooted tradition of selective implementation (enforcement) of impracticable law, inherited from the Russian Empire.

Under this system a law is deliberately drafted in such a way as to provide for enormous administrative discretion in practice, which, in turn, serves as the main tool for limitation of access in the formally lawful state of Ukraine. In particular, this turned seemingly “European” taxation of corporate profits into one of the main pillars of the LAO.

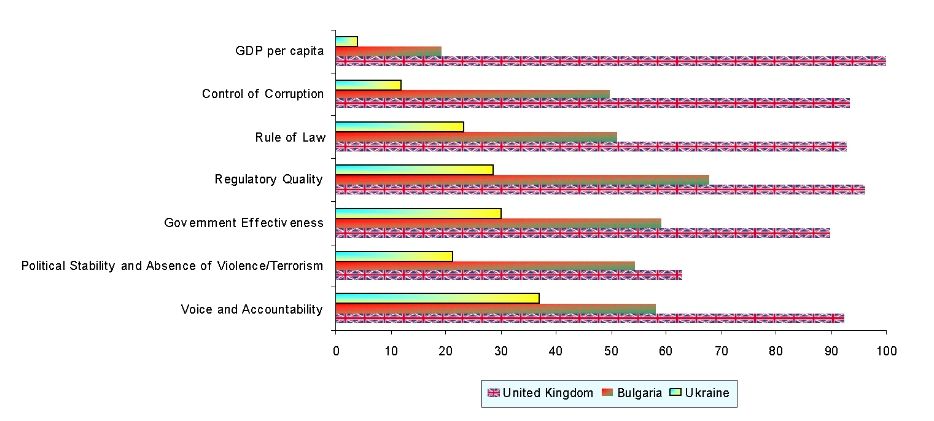

All of these (and many other) problems that Ukraine faces are exacerbated with remarkable institutional weakness of the country. Figure 1 below plots the World Governance Indicators and the GDP per capita for Ukraine against the ones of an “old” EU member, the UK; and Bulgaria, the poorest EU country. One can see that Ukraine is behind Bulgaria by roughly as much as the latter lags behind the UK. But doesn’t it mean that “we need just to improve the governance” by structure reshuffling, training, fighting corruption, and so forth?

Of course, improving the governance is always a good idea, however it is not so easy to implement. Rampant corruption and lawbreaking themselves are just the most notorious revelations of institutional weakness, not its causes. No secret that the most of “bureaucrats” in Ukraine at least in the spheres that directly interact with business, took their position – in many cases for million-dollar bribes – not in order to serve the people, but to make money on their formal and informal opportunities of discretional decision-making. In fact, the most of government officials in Ukraine that contact with people and, especially, the business people should not at all be called bureaucrats – the people use to call them “nachal’niks”, literally “the chiefs” due to discretionary power they enjoy. Tax authorities are #1 in this anti-rating with 25% of the business representatives who have faced corruption there during the last six months – followed by notorious Agency of Land Resources with just 7.1%. Just to compare, the odious State Traffic Inspection has got five times lower score.

Therefore, the only way for improving the governance is through at least temporary elimination of all formal and informal discretion opportunities to the most possible extent, and focusing all (still quite limited) controlling capacities of the civil society on balancing of the residual. Among other things, it would allow to cut the staff of many dozens of currently acting government inspections (hopefully, many of them in total), and increase the salaries for the remaining personnel. Only then one can expect more or less clean and benevolent public servants to come and replace those who will go to jail for corruption, or resign because their positions will fail to generate rents any more.

Figure 1. Comparison between the UK (“old” EU member), Bulgaria (the poorest EU member) and Ukraine in the GDP per capita and the quality of state governance

In this regard, the tax system requires a fundamental reform. This is especially evident if we take into account that the Revolution of Dignity that Ukraine is undergoing is by many dimensions a typical bourgeoisie revolution, akin to English revolution of the 17th century. Just to remind: that revolution was essentially an upraise against confiscatory taxation. In a way, the task is to design such a tax system that could not be used as a tool for the limitation of access to economic opportunities any more. It is, of course, challenging but, hopefully, still not impossible.

As with a highway, fixing the surface can be endless with little or no effect unless the fundamental is duly made according to certain standards. Notably, it is not a particular technology but the result that matters: technology should be adjusted to specific soils and landscape. Back to the issues of the Ukrainian taxation system it means that flexibility, sophistication and maybe some other good things should be sacrificed in favor of simplicity and straightforwardness. For instance, because under weak institutions direct taxes generally perform badly (and maybe even generally are worse for growth [4]), it is recommended to shift to the indirect ones, and the taxes on imputed incomes (including property taxes and simplified taxation), even in spite of their deficiencies. Therefore, direct parallels with the EU norms and practices should be taken with a grain of salt (although, of course, the reform should not violate direct EU regulations as long as Ukraine is going to implement the Association Agreement) – generally speaking, “European” norms should be subdued to “European” principles, unless they are obligatory (as with the VAT). Instead, an optimal tax system for Ukraine at least at this stage of its development should be sought as a combination of non-discretionary European best practices with the ones adopted from the countries with rather similar institutional performance. Huge variety of all of them and vast experience of their usage provides a creative reformer with abundant choice of ideas, out of which one can select the most appropriate ones for Ukraine; and after spicing them with some innovations tailor a tax system workable even under such extreme conditions.

Such a reform is being developed by the team of the Reanimation Package of Reforms (RPR) in which author is proud to take part. In the following series of articles the problems of Ukrainian tax system along with their causes will be explored in greater details, and the proposed changes will be presented.

To be continued…

Endnotes

[1] See also, for example, the materials of the German Advisory Group 1, 2

[2]See the World Economic Forum’s Global Enterprise Opinion (GEO) survey (the results annually published at the Global Competitiveness Index). Note that the surveys that cover predominantly small businesses (as the BEEPS) that mostly use simplified taxation provide different results.

[3]Douglass C. North, John Joseph Wallis, and Barry R. Weingast. Violence and Social Orders: A Conceptual Framework for Interpreting Recorded Human History. Cambridge University Press, 2009

[4]Arnold, J. (2008), “Do Tax Structures Affect Aggregate Economic Growth?: Empirical Evidence from a Panel of OECD Countries“, OECD Economics Department Working Papers, No. 643, OECD Publishing, Paris.DOI

Застереження

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations