On September 15th, the government submitted the second budget for a state of war to the Verkhovna Rada. What are the anticipated revenue increases and decreases? What expenditure priorities are outlined? How much is Ukraine’s national debt expected to grow in 2024? And what are the primary budget execution risks?

Key findings:

(1) The budget draft for 2024 aligns with the principles established in 2023, with similar priorities focusing on defense, security, and social protection. It anticipates support from international partners and is based on an optimistic assessment of the country’s macroeconomic situation (according to the Ministry of Economy’s forecast, real GDP is expected to grow by 5%).

(2) Expenditures in the defense and security sector remain a priority throughout the entire year of 2024. However, the planned expenditures for Ministry of Defense programs, totaling UAH 1164 billion, correspond to figures recorded during the period of January to August 2023. Therefore, if the trends from 2023 persist, active military operations continue until the end of 2024, and no additional funding is secured, the Ministry of Defense budget will again require a review in the fall of 2024.

(3) The main sources of revenue for the state budget in 2024 are projected to be external borrowing – nearly UAH 1.8 trillion, tax revenues – UAH 1.5 trillion, and domestic borrowing – UAH 421.6 billion. Net external borrowing is expected to finance 47.4% of all expenditures in the state budget for 2024, while own sources will cover 52.6%, surpassing the planned figure for 2023. Net domestic borrowing is projected to be zero.

(4) The planned volume of tax revenues in 2024 is projected to be 28.6% higher than in the current 2023 plan. This growth is anticipated across all key taxes. The main precondition for this projection is an optimistic macroeconomic scenario for the 2024.

(5) A significant innovation in the 2024 budget proposal is the reallocation of the military PIT from local budgets to the special fund of the state budget. As a result, PIT revenues in the state budget are planned to be 73.6% higher than in 2023.

(6) The government anticipates continued significant financial support from international partners in the coming year. This includes UAH 1,033 billion from the U.S. government and other official creditors, UAH 370 billion from the EU, UAH 224 billion from the IMF, and UAH 83 billion from the World Bank. Meanwhile, internal borrowing is planned solely for servicing domestic debt. Considering that in the first eight months of 2023, 100 billion UAH more was raised on the domestic market than was paid out, so there is room for maneuver in the budget for 2024.

(7) There is a planned increase in the state and state-guaranteed debt to 110.7% of GDP by the end of 2024. This level of debt is significantly higher than the Maastricht criteria (60% of GDP) and the “safe” level (which does not hinder economic growth) of 64% for developing countries. Clearly, after the conclusion of the war, there will be a need for fiscal consolidation, which will be challenging due to the necessity of financing economic recovery. Therefore, the government should negotiate debt restructuring with the potential write-off of a portion of the external debt.

(8) Potential revenue reserves in 2024:

- The expected profit of the National Bank of Ukraine (NBU), which is to be directed to the state budget in 2024, may be significantly higher than currently planned. The final amount of such funds will be disclosed by the regulator in the spring of 2024.

- Increased domestic market borrowing: The planned volume of domestic borrowing through the issuance of government bonds in 2024 corresponds to the planned repayments throughout the year, and the average borrowing rate is expected to be overly conservative at 19%. However, since the NBU is reducing the key interest rate, it is likely that government bonds rates will also decrease during 2024.

Details

General

(1) In the formation of the Budget draft, the government used a baseline scenario for the macroeconomic forecast. This scenario includes cautious estimates of the current year’s outcomes and a high degree of uncertainty and unpredictability in the security domain due to the changing situation on the frontlines, the intensity and geography of hostilities, and their consequences. In these conditions, the probability of deviations in actual indicators from planned ones remains high. However, there is also a high likelihood that the size of planned expenditures will be subject to revision. So, if the war continues throughout 2024, there may not be sufficient funds for defense spending.

(2) In the macroeconomic forecast an optimistic nominal GDP for 2024 is set at UAH 7.8 trillion. Real GDP growth in 2024 is expected to be 5%. The average annual inflation is projected to be 13.8%, roughly in line with 2023 figures. The increase in the minimum wage will contribute to raising the average monthly salary to 21.9 thousand UAH, which is 20.6% higher than in 2023. According to the statements from the Minister of Finance, it is evident that the exchange rate of the hryvnia to the US dollar is assumed to be UAH 41.4.

(3) This year, due to the state of war in the country, the Ministry of Finance did not develop a Budget Declaration. However, starting from next year, the restoration of the norms for medium-term budget planning for budgets at all levels is expected. This is part of Ukraine’s commitments to the IMF.

(4) The Draft Budget for 2024 takes into account potential amendments to the Budget Code, which include:

- Redirecting military PIT revenues, previously allocated to the general fund of local budgets, to the special fund of the state budget. These funds will be used for the purchase of specialized equipment and the development of the defense industry complex.

- Funds that traditionally contribute to the Road Fund will be fully allocated to the general fund of the state budget in 2024.

- The Draft Budget for 2024 continues the suspension of certain provisions of the Budget Code to account for a significant budget deficit and the need to make rapid decisions in the conditions of war.

(5) The government identifies significant fiscal risks that may impact 2024:

- Continuation of the war and uncertainty about its future development, which is a key risk to Ukraine’s economic and financial capacity in 2024.

- Damage and destruction of infrastructure, including production and housing facilities.

- The risk of non-return of refugees from abroad (approximately 6.2 million people as of July 2023 according to UN data), creating a shortage of skilled labor, slowing economic development, and reducing tax revenues.

- Insufficiently rapid implementation of reforms. In the coming year, budget support from international partners, critical for covering the deficit, will depend significantly on progress in reforms.

- Non-receipt of financial aid from international financial organizations and governments (a key risk for covering the budget deficit).

- The risk of non-compliance with obligations by representatives of small and SMEs, as well as sub-loans by municipal enterprises within joint projects with microfinance institutions.

- Reduction in external trade volumes (a trade balance deficit can disrupt exchange rate stability, lead to inflation, and impact tax revenues).

- Renewed increases in prices on global energy markets, which may lead to inflation growth, reduced purchasing power, and consequently, slower economic growth and reduced tax revenues.

(6) The key sources of revenue and financing for the state budget in 2024 are expected to be external borrowing, amounting to nearly UAH 1.8 trillion (1.3% lower than planned for 2023), and tax revenues, totaling UAH 1.5 trillion (28.6% higher than planned for 2023). The budget for 2024 will be covered by 93.9% through net external borrowing and tax revenues, with the former accounting for 47.4% and the latter for 46.5%. The state budget’s own resources (tax and non-tax revenues and transfers) are expected to cover 52.6% of expenditures in 2024.

(7) Key spending units are increasingly integrating gender aspects into their budgets. However, this integration has yet to significantly impact the effectiveness of expenditures and the improvement of the population’s living standards.

Budget Revenues

(1) The Draft Budget for 2024 includes revenues amounting to UAH 1.7 trillion, which is 25.6% higher than the current 2023 plan. The growth in revenue can be attributed to two factors: the redirection of military PIT from local to the state budget and an optimistic macroeconomic forecast.

(2) It is planned to collect UAH 940.2 billion or 53.8% of all 2024 budget revenues from payments controlled by the Tax service and UAH 597.6 billion or 34.2% of all 2024 budget revenues from customs duties.

(3) The structure of tax revenues in 2024 does not undergo significant changes compared to the plan for 2023. Indirect taxes are the primary source of income for the budget in 2024, accounting for over 54% of total revenues. Value added tax (VAT) is expected to contribute 43.1%, while excise tax will contribute 11.2%. Among direct taxes, the largest contribution to the budget is expected from personal income tax (PIT), which, along with the military fee, is expected to provide 17.9% of total revenues. Additionally, the corporate income tax is expected to contribute 9.9% of all revenues.

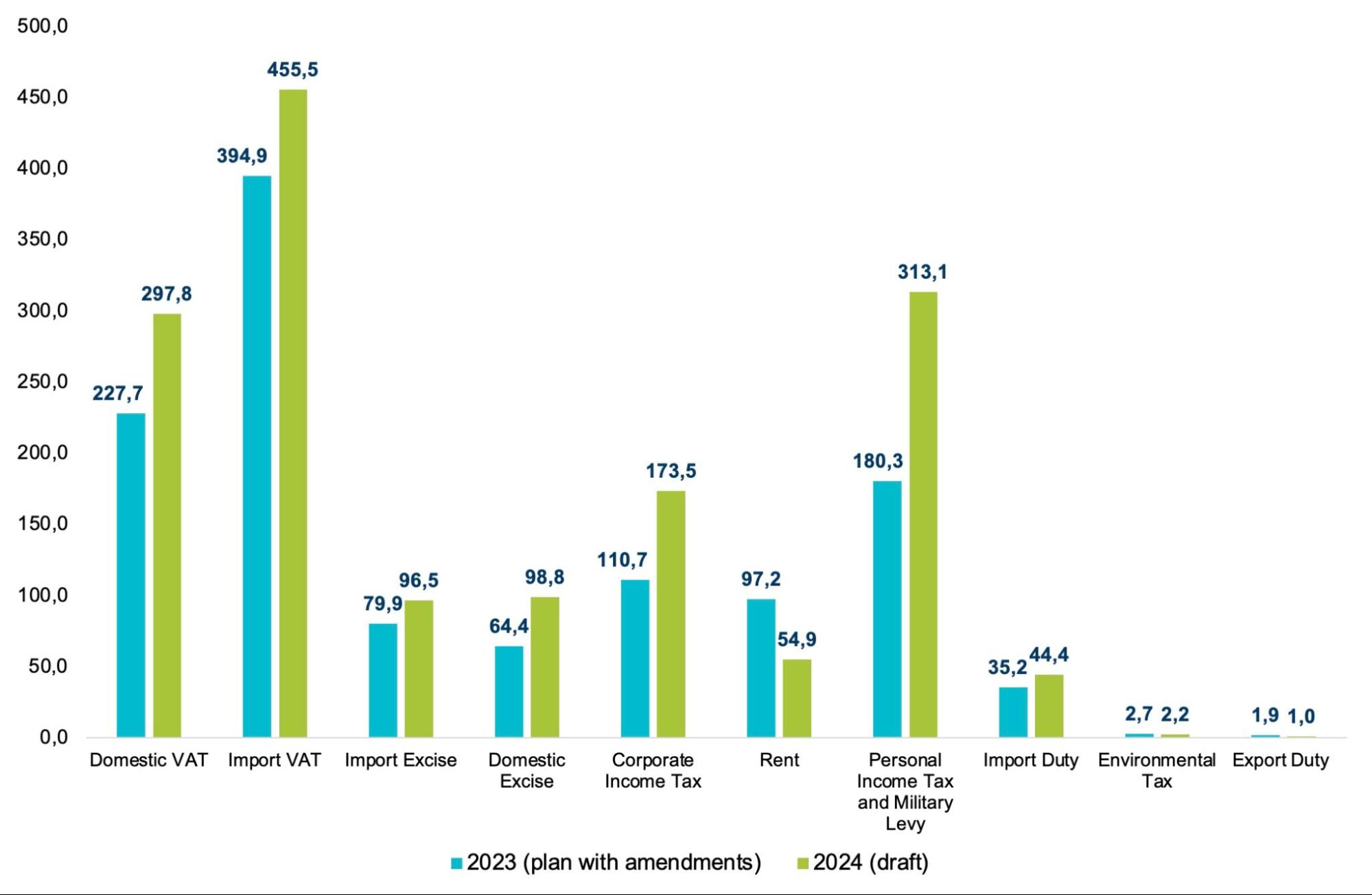

(4) The revenue plan for major taxes in the state budget (Figure 1) is as follows:

- Value dded tax (VAT, domestic and import) – UAH 753.3 billion (+21% compared to the current 2023 plan). The main reasons for the growth include inflation expectations in 2024, increased import volumes, rising consumer spending, and national currency devaluation.

- Personal income tax (PIT) – UAH 313.1 billion (+73.6% compared to the current 2023 plan). The main driver of increased PIT revenues in 2024 is the inclusion of UAH 135.4 billion of military PIT, of which UAH 96.3 billion will be allocated to the special fund of the state budget for the first time. Additionally, the minimum wage will double twice in 2024, and there is an expected increase in the average wage from UAH 18,000 in 2023 to UAH 21,900 in 2024.

- Excise tax (domestic and import) – UAH 195.3 billion (+35.3% compared to the 2023 plan). Factors contributing to the growth include increased excise tax rates and minimum tax liability for tobacco products, the return to pre-war taxation on fuel by excise tax, potential fuel price increases, and increased domestic production of excisable goods.

- Corporate income tax – UAH 173.5 billion (+56.7% compared to the 2023 plan). Despite the expected increase in business activity and the cancellation of the 2% tax in 2023, such a significant growth compared to the current year’s plan appears optimistic.

Figure 1. Planned tax revenues to the budget in 2023-2024, billion UAH

Source: State Budget for 2023 (with amendments), State Budget Draft for 2024

(1) The least amount of revenue compared to the 2023 plan is expected to come from:

- Rent payments – UAH 54.9 billion (-43.5% compared to the 2023 plan), which may be due to significantly lower forecasts for rent payments for the extraction of natural gas (UAH 34 billion in 2024 compared to UAH 74 billion in 2023), the destruction of enterprises engaged in the extraction of minerals, and a general reduction in extraction. An important factor in the reduction of forecasted rent revenues is the halving of the base price of gas for “Naftogaz.”

- Export duty – UAH 1 billion, or 51.1% of the 2023 plan, which is likely related to a decrease in production and export of metals due to the destruction of production facilities and logistical difficulties.

- There are no expected revenues from rent payments for the transit transportation of ammonia through Ukrainian territory, which was halted with the beginning of Russia’s full-scale invasion of Ukraine.

(2) According to the plan, the National Bank is expected to transfer at least UAH 17.7 billion to the state budget as a portion of its profit for distribution. This amount is 75.1% less than what was planned for 2023. However, the final amount of the National Bank’s transfer to the state budget will be known in the spring of 2024 after an audit.

(3) Grants are planned at UAH 2.4 billion. However, as demonstrated by the experience of 2023, the amount of received grants throughout the year can be significantly higher. In the first eight months of this year, UAH 316.7 billion (!) was received, which is 410 times more than planned. Currently, in the 2024 budget draft, most of the international support is outlined in the form of loans, with plans to borrow UAH 2,195.8 billion in 2024.

(4) The 2024 budget is expected to incur significant losses due to the operation of tax preferences, totaling UAH 94.5 billion. Nearly a third of these preferences have a defense purpose (including the volume of VAT exemptions for defense-related products in 2024 expected to be 12.8% higher than in 2023). This contributes to enhancing the country’s defense capabilities. However, given the overall size of tax preferences, it is worth reviewing them.

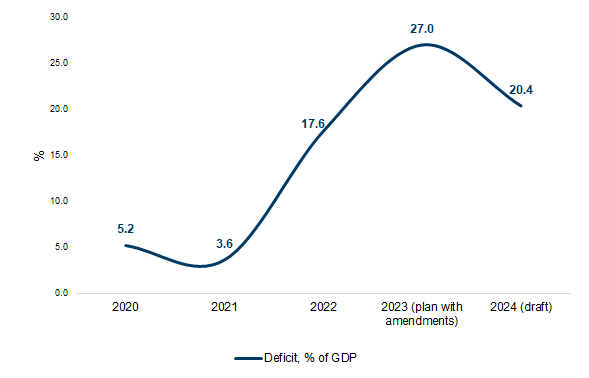

Budget Deficit

(1) For the third consecutive year, the budget deficit has exceeded one-digit numbers and is planned for 2024 at 20.4% of GDP due to the need to finance defense expenditures, slow economic recovery, and limited possibilities for increasing tax revenues (Figure 2). In 2023, the planned budget deficit was increased from 20.6% to 27% of GDP. Consequently, by the end of 2024, the expected level of the national debt will reach 110.7% of GDP, compared to 97% of GDP in 2023 and 78% of GDP in 2022.

Figure 2. State budget deficit as a percentage of GDP

Source: State Budget for 2023 (with amendments), State Budget Draft for 2024

(2) The ability to raise domestic debt has increased, while borrowing at market terms abroad remains impossible. Due to higher interest rates for government bonds on the domestic market and the National Bank of Ukraine’s (NBU) motivation for banks to acquire domestic government bonds for their required reserves, there has been increased domestic demand for government debt. Banks have increased their portfolio by UAH 73 billion since the beginning of the year, while individuals and legal entities have increased it by UAH 33 billion. The NBU has not financed the state budget deficit and has no plans to do so in 2024. Access to international capital markets remains closed. In 2024, the two-year deferral period for payments on Eurobonds under the terms of the restructuring conducted in August 2022 will expire, as well as for government derivatives (GDP-linked warrants) for which investors agreed to no payments for 2023. Therefore, there is a possibility of increasing government borrowing by the Ministry of Finance beyond the amounts set in the budget, potentially for further restructuring of GDP-linked warrants, including the possibility of exchanging or repurchasing them.

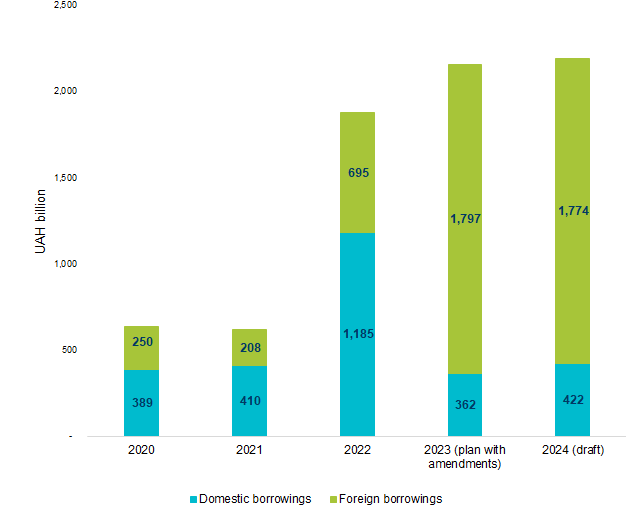

(3) Similarly to the previous year, the majority of the debt (80% or UAH 1,774 billion, equivalent to USD 43 billion) is planned to be raised abroad from international financial institutions (IFIs) or bilateral partners (Figure 3). 3% (UAH 62 billion) of these funds will come from existing credit and investment development projects with the World Bank, EIB, EBRD, and others. The remaining funds are expected to be obtained from the EU (UAH 372 billion or equivalent to USD 9 billion), IMF (UAH 224 billion or equivalent to USD 5.4 billion), World Bank (UAH 82 billion or equivalent to USD 2 billion), and the largest portion from the US government and other official creditors (UAH 1,033 billion or USD 25 billion). External debt servicing costs will be minimal, so net external borrowing constitutes nearly 90% of the total borrowing or UAH 1,589 billion (equivalent to USD 38 billion).

(4) In 2024, debt growth is planned only through external borrowing. Domestic government borrowing (UAH 421.6 billion) will be carried out solely to ensure payments for domestic government bonds repayment, possibly due to the expected high cost of domestic debt (19.0%). However, actual borrowings may be higher. The need for additional financing may arise due to the necessity of banks recapitalization or increasing the liquidity of the Deposit Guarantee Fund in case of banks withdrawal from the market, but the likelihood of such a need is low, considering the significant operating profit of banks in 2023.

Figure 3. Volume of domestic and external borrowings, UAH billion

Source: State Budget for 2023 (with amendments), State Budget Draft for 2024

(5) The share of external debt in the total debt (both direct and guaranteed) will significantly increase compared to the pre-war period: by the end of 2024, external debt will account for 80%, while internal debt will be 20% of GDP. A substantial portion of foreign currency debt makes the national debt more sensitive to the devaluation of the national currency. The cost of new borrowings (excluding existing loans) in 2024 is expected to be relatively low, although it increases compared to 2023: UAH 1,712 billion from international financial organizations and bilateral partners at an average weighted interest rate of 5.5%; UAH 421.6 billion from domestic government bonds at an average weighted interest rate of 19.0% (compared to an expected 16.8% in 2023). The average weighted interest rate in 2024 is likely to be lower than indicated in the budget draft, as the National Bank of Ukraine has started a cycle of reducing the key interest rate.

(6) For 2024, the maximum amount of state guarantees issued based on government decisions is set at 3% of the planned revenues of the general fund of the state budget, specifically UAH 47 billion. Additionally, up to UAH 39 billion in state guarantees can be provided based on international agreements of Ukraine.

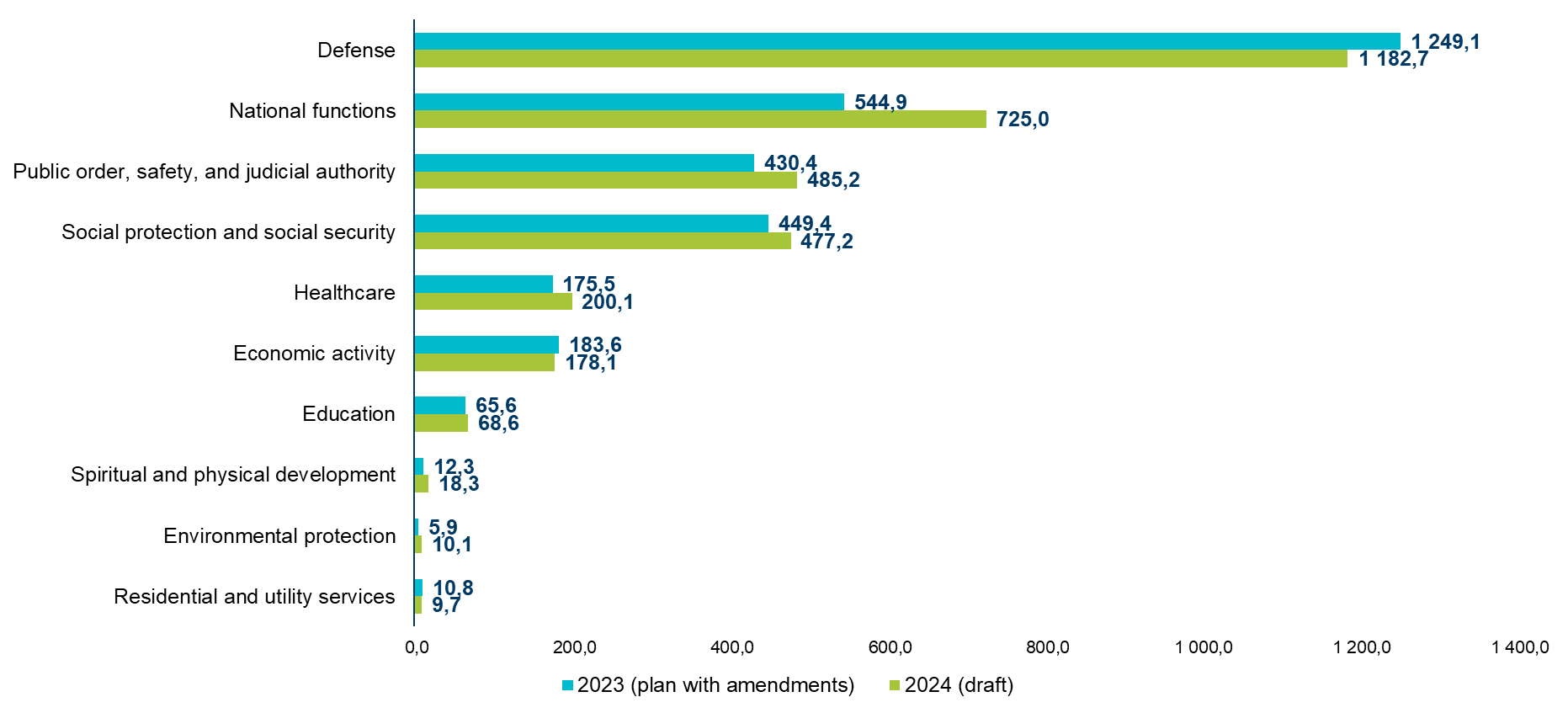

Budget Expenditures

(1) In the Budget Draft for 2024, expenditures are planned at the level of UAH 3.4 trillion, which is UAH 279 billion (+9%) more than the updated plan for 2023. The priorities remain defense and security, as well as the social sphere (Figure 4). Almost 60% of expenditures are concentrated in three ministries: the Ministry of Defense – UAH 1,164 billion (-5.6% or -UAH 68 billion compared to the plan with amendments for 2023), the Ministry of Internal Affairs – UAH 324 billion (+5.1% or +UAH 16 billion compared to the plan with amendments for 2023), and the Ministry of Social Policy – UAH 470 billion (+5.1% or +UAH 23 billion compared to the plan with amendments for 2023).

Figure 4. Expenditures by functional classification* (general and special funds), billion UAH

*Including all-state expenditures and loans.

Source: State Budget for 2023 (with amendments), State Budget Draft for 2024

(2) The key priority for 2024 is the financing of defense and security expenditures, totaling UAH 1,697.9 billion (21.7% of GDP and 51.3% of the total expenditure). Of this amount, UAH 30 billion represents state guarantees, while the rest is allocated to budget programs of defense agencies.

Out of the overall funding for the budget programs of the Ministry of Defense (UAH 1,164 billion), 99% of all funds are traditionally allocated to two budget programs:

- UAH 882.8 billion – salaries, healthcare, assistance to families of military personnel in the Armed Forces of Ukraine.

- UAH 265.4 billion – procurement and repair of weapons and military equipment.

It is expected that over UAH 1 trillion from the general fund will be allocated for the monetary support and salaries of Defense Forces personnel.

(3) Expenditures on social security in the budget draft for 2024 amount to UAH 469.7 billion (+ UAH 22.9 billion or 5.1% compared to the 2023 amended plan). The reasons for the increase include a growth in expenditures on benefits and housing subsidies by UAH 12 billion, social protection for citizens facing difficult life circumstances by UAH 2.6 billion, social protection for persons with disabilities by UAH 2.6 billion, and the introduction of the new program “Development of the Social Services System” by UAH 1.1 billion. An increase in the number of people in need of social assistance is expected, as well as the introduction of new forms of social protection.

Transfers from the state budget to the Pension Fund for pension payments will amount to UAH 271.9 billion (57.9% of the total funding of the Ministry of Social Policy), which is UAH 1.8 billion less than in 2023.

The state budget for 2024 includes a significant increase in expenditures on veteran policy – UAH 13.6 billion, which is twice as much as in the current year. Among the areas of financing are support for the rehabilitation and adaptation of veterans, housing provision, financial support for veteran projects, the creation of a military memorial cemetery, and other measures.

(4) For most ministries, an increase in budget allocations is planned. The Ministry of Economy will receive an increase of UAH 29 billion (7.4 times) through six new programs totaling UAH 11.4 billion, including support for investment projects with significant investments (UAH 3 billion) and compensation for the costs of humanitarian demining of agricultural land (UAH 2 billion). The Ministry of Strategic Industries expects a budget increase of UAH 48 billion (over 7 times) for the reform and development of the defense-industrial complex (from UAH 7.7 billion to UAH 55.8 billion). The Ministry of Veterans Affairs will increase funding from UAH 500 million to UAH 2.6 billion through increased financing of programs for mental, sports, physical, psychological rehabilitation, and professional adaptation. The Ministry of Digital Transformation will receive an additional UAH 1.8 billion (3 times more than the current budget) for the Innovation Development Fund (UAH 1.5 billion) and the development of e-governance (UAH 300 million). The Ministry of Reintegration will receive twice as much as the current budget: an additional UAH 500 million for the financing of programs for social and legal protection of persons who were in Russian captivity and their families, as well as internally displaced persons (IDPs).

(5) At the same time, some ministries are expected to see a decrease in funding. The planned expenditure has decreased (relative to the plan with changes for 2023) for the Ministry of Defense: a reduction of UAH 68 billion or -5.6% due to decreased funding for the development, procurement, modernization, and repair of weapons, military equipment, and machinery. The Ministry of Ecology will see a reduction of UAH 2 billion or -17%, primarily due to reduced funding for the State Agency of Water Resources of Ukraine, from UAH 5.8 billion to UAH 3.9 billion. The Ministry of Finance will see a reduction of UAH 8 billion or -23.8% due to the transfer of the Entrepreneurship Development Fund to the Ministry of Economy.

Significant cuts in budget allocations are planned for the State Agency for Infrastructure Development and Reconstruction of Ukraine (UAH 22 billion) due to the absence of a program for road maintenance and repair. This year, the agency will receive UAH 23 billion for payments on previous loans for road construction obtained under state guarantees and UAH 3 billion for rapid recovery (repair and reconstruction of critical infrastructure).

(6) In the 2024 budget draft, 22 budget programs that were included in the 2023 budget have been canceled or restructured, with a total amount of UAH 86.6 billion. The government has abandoned some road infrastructure projects, but there are still 11 capital expenditure programs remaining with a total amount of UAH 7.5 billion.

(7) In the 2024 budget, the Fund for the Elimination of Consequences of Armed Aggression will transform from a budget program into part of the special fund of the state budget. The fund’s funding is expected to come from balances accumulated during 2022-2023 and confiscated Russian assets. Decisions on allocating funds from this fund will be made by the Cabinet of Ministers in consultation with the Budget Committee.

Additionally, there will be a new program within the State Agency for Infrastructure Restoration and Development of Ukraine called “Support for the Rapid Recovery of Ukraine” with a budget allocation of UAH 3.2 billion. The budget also includes several other programs aimed at restoration, including: Restoration of critical infrastructure objects under the joint project with the World Bank “Urban Infrastructure Development Project – 2” (UAH 500 million), Implementation of projects under the Extraordinary Credit Program for Ukraine’s Recovery (UAH 2.3 billion), Implementation of the “Housing Repair for People’s Empowerment (HOPE)” project (UAH 200 million).

(8) The government plans to continue supporting businesses in the conditions of a state of war. In the 2024 budget draft, there is an allocation of UAH 1.4 billion for a grant support program for the creation and development of businesses. The funding for the Entrepreneurship Development Fund (Program 5-7-9) has been increased by UAH 2 billion, bringing it to a total of UAH 18 billion. Additionally, there is a plan to allocate UAH 2 billion for compensating the costs of the agricultural sector for humanitarian demining of agricultural land.

Social standards and of social funds budgets

(1) As of January 1, 2024, the living wage will increase by UAH 331 to UAH 2,920 and will remain unchanged throughout the year. The minimum wage in 2024 will increase twice: on January 1, 2024, by UAH 400 to UAH 7,100, and on April 1, by an additional UAH 900 to UAH 8,000.

(2) In the budget of the Pension Fund of Ukraine for 2024, an increase in revenues by UAH 125.3 billion (16.3%) to UAH 896.1 billion is projected. This growth will be influenced by the expected increase in the social security contributions by UAH 115.1 billion (25.5%). The government plans to carry out annual indexation of all pensions in the following year.

(3) The revenues of the Unemployment Fund in 2024 will increase by UAH 8.7 billion to UAH 27 billion. Despite the increase in revenues, the Fund’s expenditures will remain at the 2023 level, at UAH 17 billion. It appears that due to the decrease in the actual unemployment rate from 18.8% to 13.4%, the Fund expects a reduction in both actual and registered unemployment, which has always been significantly lower than the actual rate.

Intergovernmental Relations

(1) The draft budget for 2024 includes 28 programs of intergovernmental transfers from the state to local budgets. The volume of transfers has increased by UAH 3.2 billion to UAH 189.4 billion (1.7% more than the plan for 2023 with amendments). The State Fund for Regional Development is absent, and there are no “infrastructure” subventions.

(2) Additional subsidies for local budgets are planned to carry out the powers of local self-government bodies in territories affected by the aggression of the Russian Federation, in the amount of UAH 33.4 billion (+40%). These funds are intended to compensate for the loss of revenues in de-occupied territories, in communities near combat zones, and those that will have significantly lower financial capabilities due to the transfer of military personal income tax to the state budget and will not be able to independently fulfill their own and delegated powers. In addition, the share of the personal income tax that remains in communities will return to the level of 60% (in 2022-23 it was 64%).

(3) In 2024, there is a planned increase in the educational subvention by UAH 15.3 billion (+17.5% compared to the current plan for 2023). Taking into account the increase in the salaries of public sector employees, these funds may not be sufficient to pay teachers’ salaries. This means the need for additional financing from local budgets, which will, at the same time, have lower revenues from personal income tax. In 2024, the subvention for the new Ukrainian school (UAH 1.5 billion) and the subvention for equipment for school cafeterias (UAH 1.5 billion) are being reintroduced, while subventions for bomb shelters in schools (UAH 2.5 billion) and the purchase of school buses (UAH 1 billion) remain. The latter is important as in 2022, many buses were transferred for military needs, and due to the reduction in the school network, there is an increasing need for transporting students.

In conclusion

The budget for 2024 will not differ significantly from the 2023 budget. According to the plan, tax revenues will increase slightly, but the budget deficit and the need for external financing will remain substantial. However, the government plans a significant increase in the minimum wage, salaries of civil servants, and pensions. Expenditures on social support will also increase, including support for veterans (with a more personalized approach). Funding for education is on the rise, with partial restoration of funding for the New Ukrainian School, allocation of funds for bomb shelters, and the purchase of school buses to ensure as many children as possible have in-person learning. The most noticeable changes include the transfer of the Entrepreneurship Support Fund (5-7-9 program) from the Ministry of Finance to the Ministry of Economy and the transfer of arms production programs from the Ministry of Defense to the Ministry of Strategic Industries. The Unemployment Fund will spend over UAH 10 billion on projects that are not typical for it, such as financing the purchase of domestic agricultural machinery, industrial parks, and subsidizing projects with significant investments (the necessity of such programs is questionable).

In 2024, there is no planned funding for road construction and repair from the Road Fund. Overall, capital expenditures have been minimized, and there will be no State Fund for Regional Development next year (although it was also allocated for defense purposes in 2023).

Since in 2024, like in 2022-2023, almost all domestically collected funds will be spent on defense, the support of Ukraine’s international partners remains vital. However, it comes with conditions related to implementing reforms (which are necessary primarily for Ukraine’s economic stability and progress toward the EU). Additionally, it would be unusual to take out loans and grants in the midst of a war to repay current creditors. Therefore, the most important tasks for the government in the coming year are reform implementation and negotiations regarding the write-off and restructuring of the state debt.

Authors: Yuliya Markuts, Dmytro Andriyenko, Inna Studennikova, Taras Marshalok, Lina Zadorozhnia, Klym Naumenko, Vladyslav Iierusalymov, Center for Public Finance and Governance, Kyiv School of Economics

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations