2025 became another test of institutional resilience for local self-government. The war continued to shape security conditions, demographic dynamics, and fiscal capacity; yet governance and decision-making capacity were maintained at the local level.

Updates to the decentralization framework, confirmation of the continuity of local authorities’ mandates, stability in key budget parameters, and the launch of public investment management unfolded in parallel with large-scale destruction, growing pressures on communities, and the expanding network of military administrations. Under these conditions, local self-government is increasingly emerging not only as an implementer of state policy but also as an independent pillar of national resilience.

Regional policy: key developments of the year

Results achieved

- In December, the Cabinet of Ministers of Ukraine updated the local self-government reform framework by adopting the Special Provisions for Implementing the Concept of Local Self-Government Reform and Territorial Organization of Power under Wartime Conditions and EU Integration. The document adapts the 2014 baseline Concept to the realities of the full-scale war and Ukraine’s path toward EU membership, reaffirming decentralization as a core state priority. This establishes the political and methodological foundation for the next phase of reform—preparing legislative amendments, strengthening community capacity, and integrating decentralization into national recovery. For local self-government bodies, this provides political certainty and sends a clear signal that the institutional development of communities will remain a focus of state policy.

- In October, the Verkhovna Rada confirmed the continuity of local self-government mandates by adopting a dedicated resolution. With local elections in 2025 impossible, this decision removed the risks of political uncertainty, internal speculation, and external information attacks targeting the legitimacy of local authorities. This is critical for governance stability, budget decision-making, and protection against domestic and foreign attempts to delegitimize local government.

- In November, following lengthy and complex negotiations between central and local authorities, Parliament adopted a law on oversight of the legality of decisions by local self-government bodies. The compromise model—focusing supervision on delegated powers—preserved community autonomy while establishing safeguards against abuse. This enabled Ukraine to meet an overdue Ukraine Facility benchmark and restore access to €560 million in macro-financial assistance.

- In the 2026 state budget, the government retained 64% of personal income tax (PIT) for communities, reaffirming the stability of their revenue base even under wartime conditions. This signaled a return to a strategic approach to regional policy and public investment, including the use of international partner resources and Ukraine Facility mechanisms. For local self-government bodies, this provides a predictable revenue base and the ability to plan medium-term expenditures, including capital investment, despite high wartime uncertainty. In parallel, the State Fund for Regional Development was reinstated—in a reduced format, with only UAH 2 billion allocated, compared with UAH 30 billion envisaged for 2026 in the Budget Declaration.

- The government introduced a unified system of functional territorial types, approving both the typology and the indicators used to classify communities. This marks a shift toward targeted state policy, under which support takes into account security conditions, demographics, and territorial economic potential—an approach long embedded in the EU. A practical outcome of this framework has been large-scale financial assistance to war-affected communities.

- Throughout the year, Parliament and the government expanded practical tools available to communities by adopting a package of laws on local democracy, simplified recovery procedures, and inter-municipal cooperation. These measures enable communities to more actively engage residents in decision-making, carry out reconstruction without excessive permitting, use humanitarian transport for passenger services, and launch joint services with lower administrative costs. In addition, Parliament passed a draft law on administrative service fees in its first reading. For communities, this opens the door to predictable financing for Administrative Service Centers and service infrastructure—an essential component of service quality during wartime and the post-war period.

- In 2025, Ukraine took another step toward European standards in municipal asset management by repealing the Commercial Code of Ukraine effective 28 August. Despite concerns raised by local government associations, the practical implementation of these changes did not result in systemic legal conflicts, giving communities time and space to adapt to the new rules.

Key challenges

- In 2025, the state failed to move from intentions to systemic solutions to strengthen the financial base of communities. Key issues—including the place of PIT payment (by place of residence or place of work), improvements in local tax administration, and the horizontal equalization formula—remained at the discussion stage, with no legislative proposals formally registered. The government also failed to present a clear delineation of powers across levels of government, despite established Ukraine Facility deadlines. For local self-government bodies, this means the persistence of structural fiscal imbalances and the postponement of decisions that directly affect communities’ medium- and long-term resource sustainability.

- Changes in the composition of the Cabinet of Ministers in July led to a loss of institutional momentum in advancing legislative initiatives critical to local self-government bodies. The automatic withdrawal of government bills that had not passed their first reading stalled consideration of several issues, including community renaming and certain aspects of the administrative-territorial organization. For communities, this translates into delays in legislative decisions due to the need to “restart” the legislative process—raising transaction costs and reducing reform predictability.

- The suspension of USAID program funding in 2025 created a gap in external institutional support for local self-government. The pause in programs such as DOBRE, HOVERLA, and SOERA reduced the level of advisory and project-based assistance critical to addressing gaps in management capacity, strategic planning, and service quality. For local self-government bodies, this increased pressure on their own resources precisely at a time of complex reforms and wartime instability.

Next steps

- In 2026, it will be important to move from discussion to substantive revisions of approaches to PIT and local tax administration, taking into account both European practice and wartime realities. Shifting PIT payment to the employee’s place of residence is standard across Europe: people live in a community where they vote for local authorities, pay taxes into its budget, and use the services that community provides—from early childhood education and public amenities to municipal services. For local self-government bodies, this implies potential changes in financial incentives and revenue structures. Under current wartime conditions and mass population displacement, such a shift could significantly affect frontline and liberated communities; therefore, these changes require careful balancing and compensatory mechanisms that take into account security and socioeconomic factors.

- Updating the budget equalization formula and rethinking the reverse grant remain key priorities for the near term, given the war-driven reshaping of Ukraine’s economic geography. It is important to take into account the interests of communities that have lost taxpayers or production capacity, or have experienced prolonged population outflows—particularly frontline territories. If translated into concrete policy decisions, these approaches will affect interbudgetary flows already in the medium term, directly shaping communities’ ability to sustain basic services.

- State policy toward frontline territories, recovery, and regional development instruments needs to be strengthened through dedicated programs and funds. Priority areas include support measures for frontline territories, expansion of the State Fund for Regional Development, and further development of the Side by Side initiative. For local self-government bodies, this will open new opportunities to access resources, while simultaneously raising requirements for project capacity, the quality of strategic planning, and readiness to operate under more competitive selection rules.

- In 2026, several Ukraine Plan indicators under the Ukraine Facility—directly or indirectly linked to the regional dimension—are scheduled for implementation:

- Adoption and entry into force of framework and sectoral legislation on the division of powers across levels of government. This package—currently being developed by the relevant parliamentary committee together with the line ministry—is intended to establish a new architecture of competencies across key public policy sectors and eliminate chronic duplication of functions between local self-government bodies and executive authorities. However, as of end-2025, even the framework bill has not reached the plenary floor, while the deadline for this indicator is Q1 2026. A particular challenge will be the adoption of sectoral legislation and amendments to budget law, which are meant to ensure a clearer allocation of powers across levels of government and between local self-government and executive authorities, primarily based on the principle of subsidiarity.

- Establishment of fiscal responsibility and risk management at the local level (Q4 2026). The Ukraine Facility provides for the entry into force of amendments to budget legislation introducing formalized procedures for managing fiscal risks in local budgets and clearly defining the roles of central and local authorities. This applies to situations where local budget revenues or expenditures may change sharply—for example due to war, crisis, natural disaster, municipal enterprise debt, or failure to meet revenue targets even in the absence of force majeure. Introducing these procedures is essential for assessing the potential impact of such risks on local budget indicators and ensuring planning of measures to prevent fiscal risks and mitigate their consequences.

- Interim reporting on compliance with the Ukraine Facility requirement to channel funds to the local level (Q2 2026). Under the “Regional Policy and Decentralization” chapter, regulations stipulate that at least 20% of non-repayable financial assistance must be directed to regions over a four-year period, with a minimum interim benchmark of 5% for the first two years (2024–2025). Achieving this indicator does not involve a dedicated financial instrument or special budget line and is implemented through standard budget procedures—primarily via subventions (and, since 2025, through investment projects under the public investment management reform). Actual compliance is ensured through financing in education, healthcare, human capital, and territorial community infrastructure recovery, which formally fall under other Ukraine Facility investment indicators. The interim report in Q2 2026 is expected to aggregate results from 2024–2025 spending and confirm achievement of the 5% minimum threshold—which, given the scale of relevant programs, is likely to be exceeded.

- Practical integration of regional and territorial community strategic planning with the public investment system. Over the year, the government and local authorities are to align national, regional, and local development strategies with financing mechanisms through the State Fund for Regional Development, state investment programs, and the Unified Project Portfolio within the DREAM system. Delivery of this indicator should demonstrate a shift from fragmented financing to a strategically oriented public investment model, in which access to resources depends on alignment with development priorities, project quality, and local management capacity.

Security situation in communities: status and dynamics

- In 2025, the impact of hostilities on Ukraine’s territorial communities exhibited a clear spatial pattern: the heaviest losses were borne by communities located closer to the front line, where high attack intensity coincided with significant casualties[1] (Figure 1).

Figure 1. Intensity of hostilities in 2025

Source: KSE calculations based on ACLED data

- In 2025, more than 70,000 attacks affecting territorial communities were recorded, along with over 72,000 civilian and military casualties [2]. Hostilities directly affected 556 communities, and 293 communities reported casualties.

- The highest concentration of casualties was recorded in the Donetsk region (~34,000) and the Kherson region (~27,000). Together, these two regions account for more than 84% of all recorded casualties. In the Donetsk region, the primary impact hotspots were the Pokrovsk (~10,000 casualties), Hrodivka (~5,400), Udachne (~3,000), Velyka Novosilka (~2,600), and Illinivka (~2,300) communities. The Kherson community stands out with an exceptionally high number of casualties—over 25,500—and is the hardest-hit community in Ukraine by this measure.

- The northern regions (Sumy and Chernihiv) display a markedly different profile: despite high attack intensity (~15,000 combined), casualty figures remain relatively low (~1,600). Communities such as Semenivka, Krasnopillia, Esman, and Seredyna-Buda were under regular fire, but losses were lower due to smaller population concentrations.

Source: KSE calculations based on ACLED data

- In 2025, most infrastructure damage was concentrated near the front line; however, several large cities also suffered significant losses. More than 5,900 incidents of infrastructure damage were recorded across 378 communities. Housing was hit hardest (~4,200 facilities damaged), followed by energy (~1,000), education (420), and healthcare infrastructure (290).

- The largest infrastructure losses were recorded in the Donetsk region (~1,500 damaged facilities), primarily in the Kostiantynivka, Lyman, Pokrovsk, and Dobropillia communities. The Kherson community leads among individual communities in infrastructure losses (~307 incidents).

- In 2025, rear strategic centers also sustained significant infrastructure damage, including the Nikopol (301), Odesa (103), Kharkiv (102), Zaporizhzhia (98), and Dnipro (58) communities.

- Northern border communities, despite high combat intensity, experienced less infrastructure damage than the Donetsk and Kherson regions.

Military administrations within the local self-government system

- As of end-December 2025, 214 military administrations operate in Ukraine’s territorial communities, up from 184 at the beginning of 2024. They are concentrated primarily in the Zaporizhzhia (48), Kherson (49), Donetsk (47), Luhansk (26), and Kharkiv (27) regions—that is, in areas of active hostilities, occupation, or elevated security risks—forming a specific geography of temporary administrative arrangements. In these regions, problems with local council quorum and the ability of local self-government bodies to operate safely arise most frequently.

Source: KSE Institute data

Click on the image to access the interactive version of this map

- Since March 2022, the number of military administrations has been gradually increasing. This means that the state is increasingly temporarily assuming local government powers in territories where local self-government bodies cannot function fully. In effect, elected governing bodies are being replaced by state authorities. As a result, a distinct “transitional” format of local governance has emerged, in which military administrations play a key role: providing basic services to the population, ensuring security, and implementing state decisions under wartime conditions.

- At the same time, military administrations have also been introduced in several communities that are not formally classified as frontline territories but host critically important national infrastructure—primarily nuclear power plants. These include communities hosting Rivne NPP (Varash community), Khmelnytskyi NPP (Netishyn community), and South Ukraine NPP (Yuzhnoukrainsk community). Thus, the criterion for establishing military administrations is not only direct military threats to territory but also the need to ensure the security of strategic facilities.

- In October 2025, a city military administration was established in Odesa. Under martial law, it assumed the executive functions of municipal governance and is primarily responsible for defense, security, and coordination of essential city services. At the same time, the city military administration did not receive the expanded powers provided for under Article 10 of Ukraine’s Law On the Legal Regime of Martial Law, and the Odesa City Council was not dissolved. This preserves representative and regulatory powers for local self-government bodies, including approval of the local budget and amendments thereto, adoption of council regulatory acts, and setting policy on municipal asset management. A similar model is already in place in 17 other communities and provides for integration of the military administration into the existing governance system rather than its full replacement.

- In December 2025, the government established six city and settlement military administrations, and the President appointed their heads. Five of these administrations were formed in the Synelnykove district of the Dnipropetrovsk region—in the Velykomykhailivka, Malomykhailivka, Mezhova, Pokrovsk, and Sloviansk communities. In the Donetsk region, the Mariupol City Military Administration was established. All of these communities are located in territories where the front line may potentially advance or that are already under occupation. In all six cases, the heads of military administrations were appointed from among incumbent city mayors or settlement heads elected in the 2020 local elections. This model makes it possible to preserve continuity of governance at the community level, maintain trust in local authorities, and draw on the experience of current leaders during the transition to a special governance regime under martial law. As previous KSE research shows, such appointments are typical: about 30% of city military administration heads previously served as heads of the respective communities, while approximately 60% had prior experience in the local self-government system as mayors, deputy mayors, or heads of executive bodies.

Financial condition of communities: 2025 trends

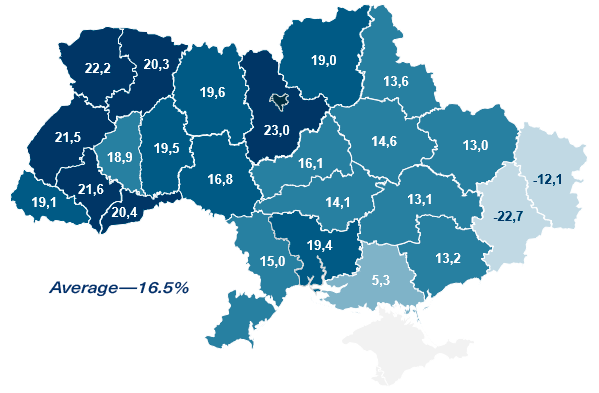

- Over the first ten months of 2025, compared with the same period in 2024 (all comparisons in this section refer to this period), general fund revenues of local budgets (excluding interbudgetary transfers) increased by 16.5%, exceeding the inflation rate of 10.9% (October 2025 compared with October 2024). As of 1 November, revenues totaled UAH 292.82 billion. In 13 regions, local budget revenues (excluding transfers) grew faster than the national average.

Figure 4. Growth rate of actual general fund revenues (excluding transfers) in 2025 compared with 2024, %

Source: OpenBudget

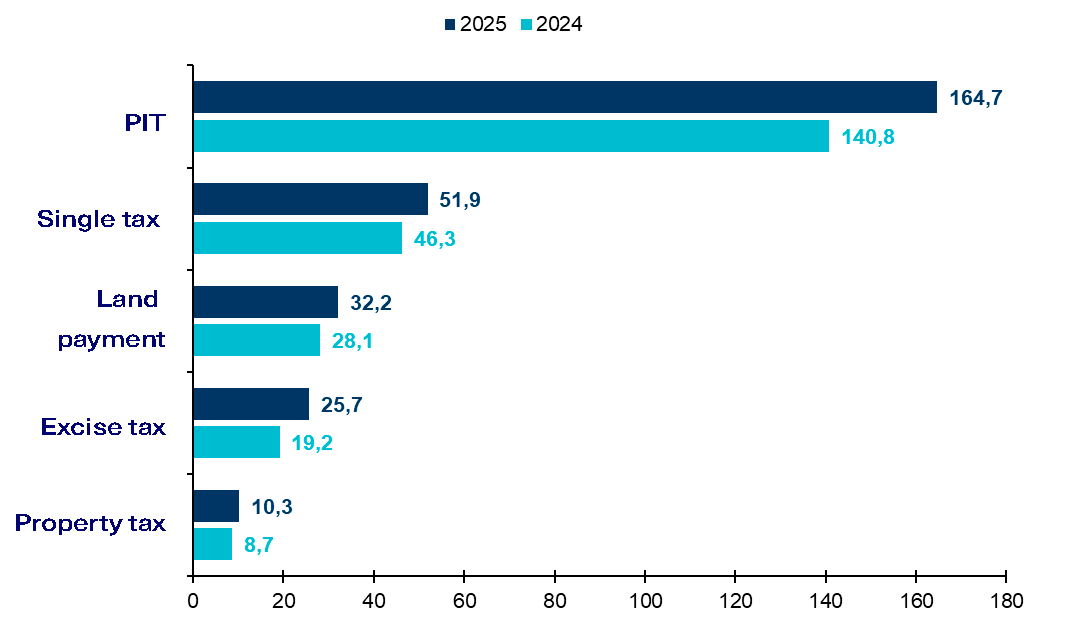

- PIT traditionally accounts for the largest share of general fund local budget revenues (excluding transfers)—56.3%. PIT receipts in 2025 totaled UAH 164.74 billion (+17%). This was driven primarily by growth in average wages. According to work.ua, wages increased by 16.8% between January and October 2025—from UAH 22,500 in January to UAH 26,300 in October, exceeding the level projected in the 2025 budget (UAH 24,389). According to the National Bank of Ukraine, the challenging security environment also exerted significant pressure on the labor market, constraining business activity while sustaining high rates of private-sector wage growth. This led to an expansion of the tax base for PIT and the military levy. Research also indicates that labor shortages remained a significant challenge for businesses in 2025.

- The single tax ranks second in the general fund revenue structure (excluding transfers), with a 17.7% share. Receipts increased by 12% compared with 2024, supported in part by growth in the number of taxpayers. According to YouControl.Market, 77.4 thousand new sole proprietors (FOPs) were registered in Q3 2025—the highest quarterly figure in at least the past two years. Closures remained roughly at the previous quarter’s level—about 52.2 thousand (0.4% lower than in Q2). As a result, there were only 67 closures for every 100 registrations, generating a substantial net increase in the number of entrepreneurs. Growth in the number of FOPs may partly reflect tax-avoidance schemes used by medium-sized and large businesses through the single tax regime. At the same time, active debate around an IMF program condition on introducing mandatory VAT for FOPs with turnover above UAH 1 million starting in 2027 creates risks of increased closures and, consequently, lower community budget revenues.

- Land payment revenues amounted to UAH 32.2 billion (+14.4% compared with 2024). Land payments are a mandatory component of the property tax and include the land tax as well as rent for state and municipally owned land plots. Revenues increased due to a 12% rise in the indexation coefficient of normative monetary land valuation at the start of the year and increased activity in auctions for leasing state[3] and municipal land.

- Actual property tax receipts increased by 17.3% year on year to UAH 10.3 billion. This growth reflects an increase in the minimum wage, which as of 1 January 2025 was 12.7% higher than a year earlier (the minimum wage is used to calculate tax liabilities for legal entities), as well as the fact that individuals paid tax for 2024, when the minimum wage had also risen compared with 2023 (by 6%).

- Excise tax revenues reached UAH 25.7 billion (+34.2%, or UAH 6.54 billion compared with 2024), driven by overall inflation and higher excise rates. The excise tax administration mechanism was also improved—electronic excise stamps were introduced in pilot mode in March 2025 and will become mandatory in 2026.

Figure 5. Revenues from major taxes to the general fund of local budgets in 2025 and 2024, billion UAH

Source: OpenBudget

- In 2025, the government transferred 7% more in interbudgetary transfers to local budgets than in the same period of 2024, while the basic grant increased by 9.2%. At the same time, additional grants for local self-government bodies affected by the full-scale armed aggression of Russia declined by 29.1% over the first ten months compared with last year. The decrease reflects changes in the methodology for calculating this additional grant: in 2025, community revenue losses are no longer compared against a three-year baseline (2021–2023)—which included the prewar and early-war period when revenues were higher—but against already reduced 2024 figures. In addition, indexation for minimum wage growth was removed from the formula. In 2025, allocation is carried out quarterly based on actual revenue losses (PIT, property tax, and the single tax).

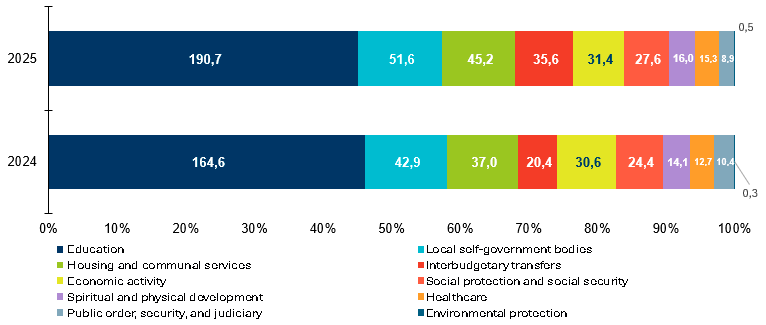

- Total expenditures of territorial communities increased by 18.3% year on year—to UAH 422.58 billion. In particular, general fund expenditures were 17.6% higher than in the corresponding period in 2024, while special fund expenditures rose by 22%. The main spending areas of territorial community budgets in 2025 are:

- Financing of budget-funded institutions—59% (education—45.1%, healthcare—3.6%, social protection and social security—6.5%, spiritual and physical development—3.8%)

- Local self-government bodies account for 12.2% of total expenditures

- Housing and communal services—10.7%

- Economic activity—7.4%

- Interbudgetary transfers—8.4% (+74.9% year on year, reflecting the resumption of reverse grant transfers to the state budget in 2025, as well as community allocations to support the Armed Forces of Ukraine)

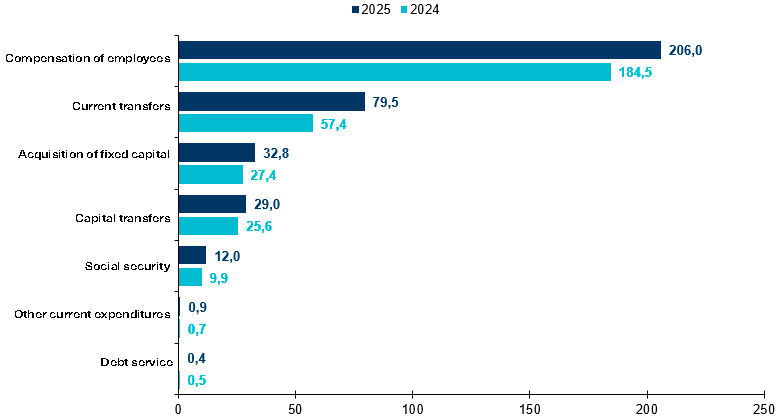

- In the overall structure of local budgets, current expenditures account for 85.4%, or UAH 360.73 billion (+18.6% compared with the corresponding period in 2024). Capital expenditures make up 14.6%. Over the first ten months of the year, local budgets in effect financed UAH 61.85 billion in capital expenditures—16.6% more than last year.

Figure 6. Structure of community budget expenditures by sector, January–October 2024–2025, UAH billion

Source: OpenBudget

Figure 7. Community budget expenditures by economic classification, January–October 2024–2025, UAH billion

Source: OpenBudget

Public investment management: progress, challenges, and early results

- For territorial communities, 2025 marked the simultaneous rollout of two systemic changes—the return of medium-term budget planning and the launch of the public investment management (PIM) reform. The pilot nature of the reform, tight timelines, and delayed adoption of secondary legislation by central authorities created significant uncertainty regarding practical steps at the local level. At the same time, the reform highlighted the importance of the quality of community strategic planning, as it is intended to become the foundation for investment decisions under the new PIM framework.

- As of end-2025, most territorial communities are formally integrated into the PIM system: over the year, 22 regional strategies were updated, and about 95% of communities completed or nearly completed their own development strategies in line with state policy. According to the Ministry for Development of Communities and Territories, local investment councils have been established in 1,146 territorial communities; 975 communities have medium-term public investment plans; 487 communities are at the stage of expert appraisal of investment projects and programs for forming a unified project portfolio; and in 401 communities, unified community and regional project portfolios have already been approved. Overall, about 80% of communities are engaged in the new public investment management system.

- Key challenges in implementing the public investment management reform at the community level:

- Difficulty in determining ceilings for public investment volumes and their sources, especially with regard to the state budget and international assistance (local finance officials often do not understand the logic behind estimating “forecast amounts” from sources other than the local budget)

- Practical misalignment of the Budget Code requirement to allocate at least 70% of investment to “ongoing” projects in the first year of operating under the new system

- Inability to amend the medium-term public investment plan once it has been approved during the budget year

- Constraints imposed by ceiling indicators that prevent exceeding predefined investment volumes within specific priority areas

- Complex methodology for prioritizing investment projects and, as a result, more complicated budget planning

- Discretion exercised by local self-government bodies when classifying certain capital expenditures as public investments, particularly in recovery (for example, communities may choose not to treat capital repairs as investment projects; however, if property is destroyed by the Russian army, its reconstruction is classified as an investment project, even though communities cannot plan such projects in advance)

- Institutional and staffing weaknesses in small communities, including the absence of development strategies and designated PIM focal points

- Lack of practical expertise in reviewing preliminary feasibility studies

- Occasional insufficient engagement of chief spending units and project initiators in ongoing work within the DREAM system

- Excessive concentration of public investment management functions in a single official in communities with limited staffing capacity and/or executive structures designed so that most local and state policies are implemented by one chief spending unit (the executive committee)

- The government, together with the expert community, is working to systematically address the identified problems. A number of draft regulatory acts are currently under review, aimed at resolving some of these issues and clarifying procedures for practical implementation of the reform (for example, a draft law refining the regulatory framework, including methodological guidance on prioritizing lists of public investment projects and programs for territorial communities, as well as on long-term budget commitments). According to the Ministry of Finance, the PIM reform is 35% complete, meaning that many additional regulatory acts are still required to finalize the reform. This is important because public investment management reform matters not only for improving the efficiency of current investment decisions, but also as a tool for building institutional capacity for high-quality strategic planning of capital expenditures. Such capacity will be critical in the medium term—particularly as Ukraine moves toward EU membership and gains access to structural funds and other European Union financial programs.

The 2025 results show that the local self-government system has, overall, adapted to the conditions of a protracted war, but its future resilience depends directly on the quality of state decisions. Deferred issues around the financial base of communities—including alignment of powers with the corresponding financial resources required for their implementation—along with unfinished budget equalization reform and uneven practical implementation of reforms, constrain development potential even amid rising community revenues. Without a shift toward systemic, predictable rules, communities risk remaining in crisis-response mode for an extended period, awaiting a future reconfiguration (likely consolidation). At the same time, with clear state policy and access to investment instruments, communities themselves can become key platforms for recovery and for Ukraine’s genuine European integration.

[1] All calculations were conducted by the KSE Institute based on ACLED data

[2] The report presents casualty figures based on ACLED data and methodology

[3] In May 2024, amendments to Ukraine’s Budget Code established that 90% of the starting lease price for state-owned land (the starting price equals 12% of the land’s normative monetary valuation) is allocated to the state budget, while 10% is directed to local budgets as an additional revenue source.

Photo: depositphotos.com/ua/

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations