The Q2 was marked by two long-awaited reforms — laws on insolvency of banks and on the circulation of agricultural land, which brought to Ukraine a new program with the International Monetary Fund and a $2.1 billion tranche. Unfortunately, the political pressure towards the NBU and letting go it’s head, Yakiv Smoliy, put the continuation of the cooperation with the IMF into question. Therefore, Ukraine has once again taken a step back on the path of reforms.

The main events of the 2nd quarter of 2020:

Land market:

- law on the circulation of agricultural land (+3.0 points, IMoRe 133). For the first time since 2001, Ukrainians have been given the right to fully dispose of their land: to sell it or pledge. But there are restrictions on the purchase of land: the total area of land owned by one person can not exceed 10 hectares, legal entities with Ukrainian owners will be able to buy land only starting from 2024, and foreigners will be able to buy land in Ukraine only if it supported by an all-Ukrainian referendum. State and communal land still cannot be sold.

- law on national geospatial data infrastructure (+3.0 points, iMoRe 134). From now on, the boundaries of territorial communities, rivers, roads and even buildings will be determined by geographical coordinates. This will allow for the accounting of state and community resources and reduce the risk of disputes over the location or geographical affiliation of facilities. Another positive consequence of the law is the unification of all these data into one information system. However, it will be important to ensure its security from cybercriminals and raids.

Bank regulation:

- law on appealing against decisions on insolvency of banks (+2.0 points, IMoRe 135). Now banks that have been declared insolvent by the NBU can no longer return to the market by court order. The maximum that their owners can claim is monetary compensation for a wrong decision of the National Bank. Earlier, after a bank was declared insolvent and the Deposit Guarantee Fund paid to depositors within the guaranteed amount, such banks could return to the owner with all their assets, effectively settling part of the debt at the expense of the state. As there was no mechanism for returning such banks to the market, they found themselves in the status of “zombies”: without a license, no longer in the status of a bank, but in the status of a limited liability company.

- resolution on management of problem assets of state banks (+2.0 points, iMoRe 133). The share of bad assets in state-owned banks is about 50%. The NBU regulated their treatment, in particular allowing the sale of such assets through an open auction at a price below their book value.

The most controversial reform of the quarter

The Cabinet of Ministers will determine the administrative centers and territories of communities on the basis of long-term plans (the range of estimates from -3.0 to +2.0 points, the overall score of 0.1 points, iMoRe 134). As of January 10, 2020, 1,029 amalgamated territorial communities with a population of 11.7 million people were created in Ukraine. In the spring, in order to prepare for the local elections scheduled for the fall, the Verkhovna Rada passed a law that shifted the decentralization process from a voluntary to a forced stage. Now the united territorial communities will be formed on the basis of long-term plans approved by the Cabinet of Ministers. According to experts, about 120 communities that do not meet the requirements of the Methodology for Forming Capable Territorial Communities have not been included in the updated long-term plans of the Cabinet of Ministers. Based on the Government’s decision on community boundaries, the Central Election Commission is to form constituencies for the October 2020 elections.

Experts have reservations about the validity of the criteria in the Methodology of community formation. In particular, is the population and the distance from the center to remote parts of the community so important (it should be no more than 20 km or no more than 30 minutes of ambulance or fire)? In mountainous areas, these two requirements may contradict each other. And Mykolayiv and Dnipropetrovsk regions are leaders among violators due to poor quality roads, which make it impossible to transport from the center of ATC to remote villages faster than 30 minutes. Another controversial issue is the share of local taxes in the budget. Communities are not responsible for the administration of local taxes (this is done by the tax authorities), and the maximum rates of local taxes and fees are set at the national level. Thus, following the Capacity Methodology, the CMU can disband those communities that were pioneers of decentralization and set an example for others. This will reduce people’s confidence in both the central government and reform in general.

Another controversial issue is the fate of districts — whether to leave an auxiliary unit of administrative structure between the levels of communities and districts. Opinions of experts differed (on July 17, the Verkhovna Rada adopted a resolution on the formation and liquidation of districts which reduced the number of districts from 490 to 138).

It is for these reasons that we have recorded such a discrepancy in estimates.

What has changed in key areas?

Monetary policy

In this area, 12 important regulations were adopted, 9 of which were initiated by the National Bank of Ukraine. The average score of the reforms is +1.3 points. In addition to the law on appeals against decisions on insolvency of banks and the decision on the management of troubled assets of state-owned banks, experts noted the following important events:

- improvements for banks :

- the license to transfer funds in the national currency without opening accounts became electronic (+2.0 points, iMoRe 134). Now you do not need to wait for a signed paper license to start providing such services, the company gets this right with the entry in the Electronic Register of licenses for the transfer of funds in national currency without opening accounts.

- improvements for banking users:

- bank advertising should disclose the basic terms of service and be understandable (+2.0 points, iMoRe 134). In particular, for the loan the real annual interest rate, total consumer costs (including not only interest but also bank fees, as well as payments for related and additional services if available), the maximum loan amount and its term must be specify. For the deposit — interest rate, term of deposit, currency and minimum amount.

- the employee will independently choose the bank for the getting wages (+2.0 points, iMoRe 133). By law, this could have been done before. But the employer spent a lot of time due to the need to transfer money to different banks on different details. Now, even when paying salaries to accounts in different banks, the employer will form a single document, and the employer’s bank will make payments by itself, including to accounts in other banks. But it is worth remembering that the transfer of money to other banks is carried out through the electronic payment system of the NBU, and it charges a fee for such an operation. Banks are likely to transfer this commission to their customers. Therefore, employers will still be more convenient to pay money to accounts in one bank.

Governance

In the two months of spring and early summer, the government and parliament passed 11 laws and regulations driving public administration reforms. The main reformer in this area was the Cabinet of Ministers of Ukraine — on its account 6 regulations. The average score of the normative act was +0.9 points. Among the main, in addition to the above-mentioned regulations on troubled assets of state-owned banks and the law on geospatial data, are:

- a new procedure for concluding a contract with civil servants — with a list of achievable tasks and the deadline for their implementation (+1.5 points, iMoRe 137). An additional advantage of the resolution was the permission for remote work for civil servants, which is especially important during quarantine restrictions.

- permission to visit government buildings with e-passports (+1.5 points, iMoRe 133). The decree states that Ukrainians and foreigners can enter government buildings if they carry a smartphone with a mobile application of the Unified State Web Portal of Electronic Services “Portal Action ”, where their passport is downloaded.

- a law restricting “legislative spam” of deputy amendments (+1.0 points, iMoRe 133). After deputies generated about 16.3 thousand amendments to the “anti-Kolomoisky” law and another 4 thousand amendments to the law on land circulation, a law was passed that bills to which an influx of amendments is submitted (5 times or more than articles in the original bill, but not less than 500 amendments), may be considered under a special procedure. Each deputy group has the right to determine no more than 5 amendments that it insists on.

Public finance

In the second quarter of 2020, 9 laws and regulations were adopted that affected the sphere of public finances, 6 of which were initiated by the Cabinet of Ministers. The average score of the normative act was +0.9 points.

Thanks to them:

- Prozorro’s procurement appeal has become more accessible to small and medium-sized businesses (+1.5 points, iMoRe 133). The decree established that the value of the complaint matched the purchase price in order to stop “spam” from complaints at attractive auctions. The minimum cost of a complaint will be UAH 3,000, the maximum — UAH 170,000. Another innovation is that the fee for a satisfied complaint will be returned to the applicant.

- it will be harder to hide from paying taxes in “tax havens” (+1.0 points, iMoRe 135). Ukraine has finally joined the BEPS (Base Erosion and Profit Shifting) plan, which aims to combat the erosion of the tax base and the withdrawal of profits from taxation. In particular, Ukraine will introduce a “business purpose test” to determine whether there is a real purpose in a particular transaction with a non-resident, or whether this action is taken to minimize taxation. If the goal cannot be determined, the amount of payments for such an operation will be taxed.

Initiators of reforms

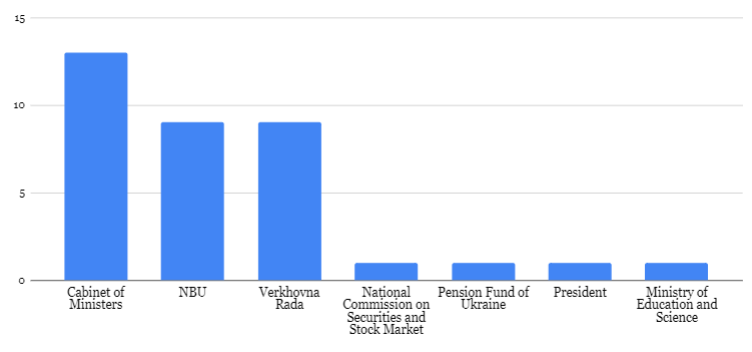

In the second quarter, the National Commission on Securities and Stock Market and the Pension Fund of Ukraine joined the traditional initiators of significant changes — the NBU, the Cabinet of Ministers and the Verkhovna Rada.

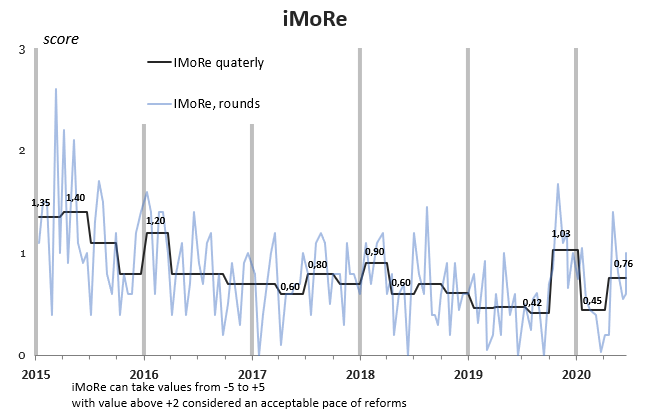

Thanks to the joint efforts of the authorities, the pace of reforms has almost doubled: the average score of the round increased from +0.45 (in the previous quarter) to +0.76 points. The reform index during the period ranged from 0.2 points to 1.4 points.

Among a number of regulations signed during this period, the experts of the Reform Index selected 35 that should significantly change the “rules of the game” in the country (32 regulations were selected in the 1st quarter). The average score for the reform was +1.2 points from the range of —5 to +5 (+1.0 points in the previous quarter). The greatest progress in terms of assessments of individual reforms has been made in the area of Monetary Policy. Public finances and Governance lagged slightly behind. In the second quarter of 2020, we did not record any anti-reform.

Most of the reforms were implemented by regulations of the Cabinet of Ministers of Ukraine — 13, 9 more reforms were initiated by the Verkhovna Rada and the National Bank per each. For the first time in a long time, the list of reforms includes separate initiatives of the Ministry of Education and Science, the Pension Fund and the National Commission on Securities and Stock Market.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations