We went to the capital of the State that’s just recovering from a deep economic crisis and arrived in the city where the first thing that you see is a construction boom. These are the first words, more or less, that foreign colleges use to describe their impressions from Kyiv. It’s not a surprise: in 2017 Ukraine for the first time in a new history surpassed the EU (2.9 against 2.8) in the amount of completed dwellings per 1000 citizens. The capital city was especially notable because the previous year 28 200 new apartments were built here: Kyiv and region accounts for 43% of all commissioned residential buildings.

What is happening on the real estate market, what we should expect from the real estate prices, what impacts for Ukrainian cities may cause today’s construction boom and what conditions may lead to the “bright future”?

A short history

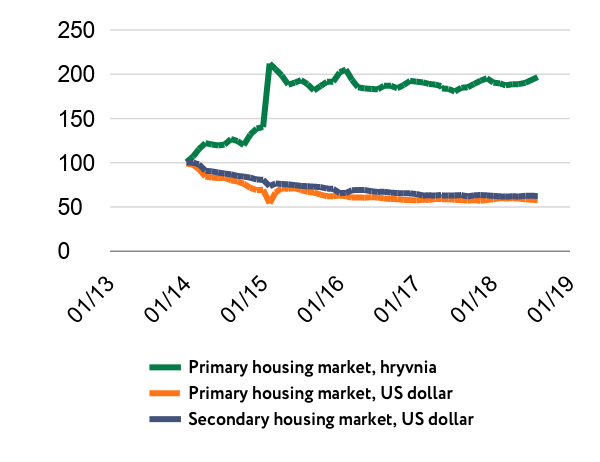

A real estate building construction became more intense after industry’s deregulation in 2013 by virtue of implementation of provisions of law “On the regulation of urban development” from 2011. An economic crisis of 2014-2015 didn’t stop but rather supported this tendency – against the backdrop from bank crisis a part of costs funds extracted from banking system transferred to the real estate market. The expansion of supply was accompanied by a reduction of prices decline in dollar equivalent because even such factors as internal migration and increasing popularity of buying apartments as an alternative to the foreign-currency deposit couldn’t ensure a sufficient demand. Falling prices was an additional factor of market uptake: the owners of foreign-currency savings could have found attractive pricing.

A sharp increase in the number of new buildings in the midst of descending price dynamic and adverse economic situation – it is a very unusual phenomenon. To understand is it whether it is good or bad, let’s take a look at this tendency from different points of view.

Housing Availability. From this position, the higher is the construction and the lower are the prices, the better for potential house buyers. By virtue of price reduction those people who’ve been saving money for the first home could realize their plans. Also, it’s favorable situation for those people who have incomes in foreign currency or with the pegged to the currency rate (for example, representatives of the IT outsourcing). The householders with sufficient savings could improve their living conditions by selling apartments in the old housing stock and investing in the new buildings. It’s worth noting that own housing remains unaffordable for people with below average income, the financing of housing affordability programs for citizens on the housing lists has reduced.

Housing prices in Kyiv, December 2013 = 100%

Source: real estate agencies, own calculations

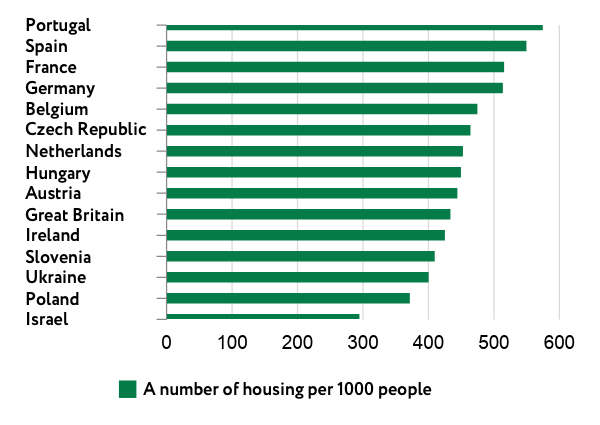

Housing per capita in different countries

Source: statistical offices, Deloitte Property Index

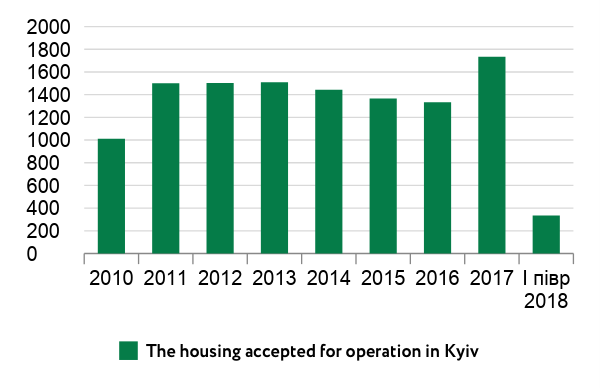

How many houses in Ukraine?

Ukraine is still failing to keep pace with the EU in the number of dwellings per 1000 people citizens (400 as against 486 per 1000 citizens in the European Union – fig. 2). In addition, a part of the population that lives in the old or hazardous houses is understated because of stricter criteria for the housing stock classification. All these factors contribute to the demand for high-quality housing. And the increase of supply of the least is a positive tendency. But the bad thing is that people face high legal risks when investing in the primary housing market.

A comfort and investment attractiveness of the city. Ideally, a new construction must make the city more comfortable for living and increase the total value of its real estate. In practice, in Kyiv, you can notice a chaotic housing densification in the center and dormitory areas that is not followed by infrastructure development. For example, an active housing development of the dormitory area without building a subway will enhance transport problems that eventually lead to price cuttings even for a new and high-quality real estate in this district. An excessive urban density is also not providing the comfort conditions. (In accordance to the data of the deputy minister of regional development, building, and public utility sector Lev Partskhaladze, in recent years the new housing estates had a density of 1000-2000 people per hectare at a standard of 540 people per hectare). The concrete jungle with the lack of parking spaces, schools, kindergartens, recreation areas cannot remain attractive for living in a long-term perspective. The more dangerous situation can be noticed in the suburbs of the capital where the multi-storey residential construction often was carried out without a proper development of the engineering networks.

Because of the fact that the construction is not carried out comprehensively and is not held in accordance with the long-term urban planning, there is a constant redistribution of incomes welfare in favor of developers and owners of the newly built housing. The owners of the apartments who paid for a favorable location and a perfect view from the windows are at a disadvantage because despite the promised infrastructure facility next to their house they got a view on the construction of another multistoried building.

Financial stability. One of the tasks of the central banks is to prevent the “bubbles” on the real estate market. If one of these “bubbles” burst it may cause a financial crisis. Of course, the increase of supply helps to prevent these “bubbles”.

In summer representatives of the central Bank of Sweden visited a National Bank of Ukraine and shared their experience in monitoring risks on the real estate market. Their case is interesting because it is a total opposite to ours.

In Sweden, the construction is low because of the strict regulations in the sector. For example, there are requirements for noise isolation and comfort housing for people with reduced capabilities. Because of quality requirements and complicated licensing procedures, a prime cost of the construction is higher than in any other EU country. A low volume of construction combined with growing demand inevitably leads to higher prices. According to data of the researching company Svensk Mäklarstatistik, in January 2018 an average price for a square meter in the center of Stockholm was 10 800 dollars. And the only opportunity to buy a dwelling is to get a bank loan. In Sweden, the rise in prices price and indebtedness of households were so significant that regulators had to take measures (for example, to increase capital requirements for financial institutions) to prevent the threats for financial stability.

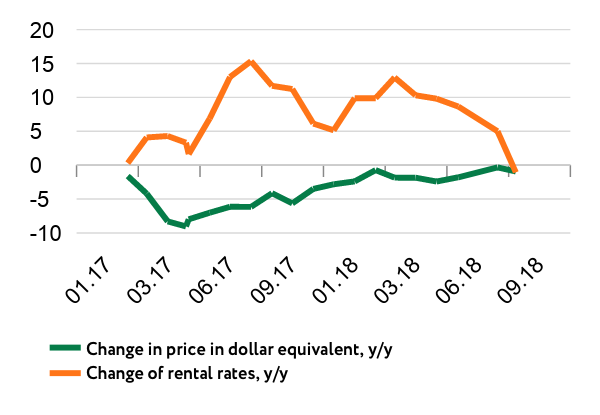

Thus we have two opposite situations – the first one when the construction is high-volume and chaotic without special requirements to the quality, the second one when the construction is low and in accordance with high standards. The first case is more favorable from the perspective of the risks of a price bubble and the overheating of the real estate market. A “bubble” is considered a rapid rise in the real estate prices caused by feverish demand and affordable mortgage. There is a simple rule of thumb: you can talk about the bubbles in the cases when the rate of price increases outrun the rate of rent price increases. In Ukraine, it has not been noticed in recent years. As we can see in figure 3, the rent price in Kyiv has grown while prices have declined.

Change in price and rental rates in Kyiv, %

Source: real estate agencies, own calculations

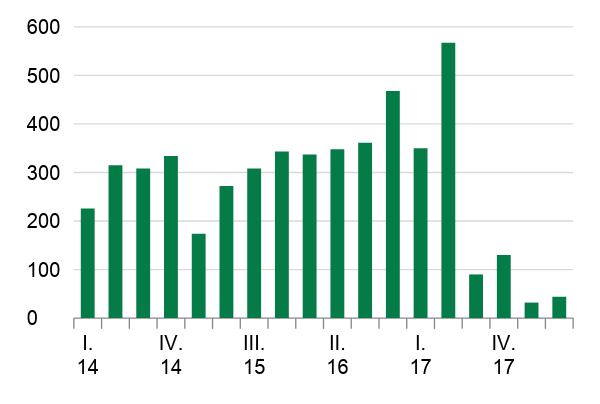

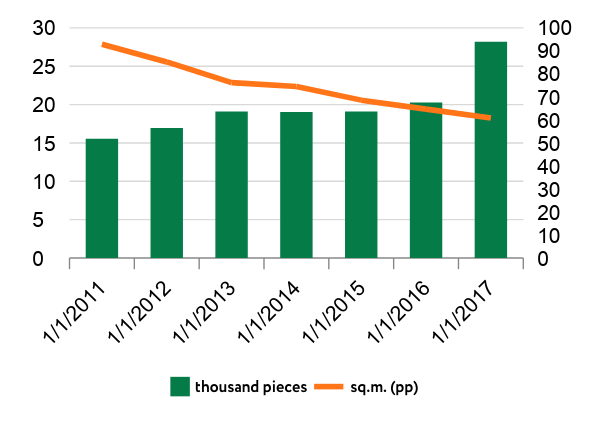

A number of multi-apartment buildings that received the construction permit

Source: SSSU

A profitability and perspectives of the construction industry. In the first place, a heavy increase in demand is unfavorable for real estate developers who lose their profit because of the increased competition. As of January 1, 2018, the Ministry for Regional Development of Ukraine estimated an average forecasted prime cost per square meter of housing in Kyiv at 13 047 hrn. (an increase of 15,8% year-on-year). At the same time, according to data of the searching service lun.ua, in January a minimum cost per square meter in the primary housing market of Kyiv was 15 500 hrn. (an increase of 5,4% year-on-year). Reducing the prices in a process of competition for a customer the real estate developers reached the limit in the budget segment that leads to the scenario when new constructions becomes unprofitable. In such conditions companies try to cut down expenses and prime cost saving on materials, project works, engineering communications and arrangement of outdoor space. That leads to the degeneration of quality of budget segment housing (it’s about two-thirds of the capital market). However, considering the competition and customer’s exactingness developers can save on quality till the defined limit. This year a rise of prime cost caused a breach of the price trend.

The further decrease of profitability creates the risks for weak developers with a lack of own funds and significant debentures. This may cause the increase in the number of frozen objects and delayed constructions, and the worsening of the financial status of the banks that actively provide loans both to real estate developers and housing buyers.

A number and an average price for housing in Kyiv

Source: The Main Department of Statistics in Kyiv

The offer of new housing in multi-apartment buildings in Kyiv, thousand sq.m.

Source: SSSU

The best case scenario that helps to develop the situation on the Kyiv real estate market provides the increase of demand and the deceleration of the supply growth. In the first six months of 2018, the number of commissioned housing buildings that in Kyiv declined on 67% year-on-year (that is partly explained by the unusually high base of comparison). The number of building permissions that might presage the tendency to decrease a new supply significantly reduced. At the same time an average price per square meter on the primary market in August in hryvnia rose by 9% year-on-year, and in dollar equivalent, there are practically no changes (-0.6% year-on-year).

All this happens at a time of the regulatory changes in the industry. As of September 1, the new state building norms came into force. They were accepted by the Ministry for Regional Development of Ukraine to raise the constructions’ quality and to prevent chaotic buildings without infrastructure development. In particular, the density of development is limited to 540 people per hectare and the permissible percentage of the development of the location depending on the height of the buildings, the height limited depending on the number of people in the inhabited locality.

Price barometer

It is good if the market gets itself regulated by decreasing a volume of constructions. But it’s quite obscurely yet if we observe a temporary phenomenon or the beginning of long-term tendency. If the augmentation of the new supply will slow down and demand will continue to grow, the market is going to find its balance.

To identify is there a gap between demand and supply, the apartment offers and an amount of the apartments that were sold at the end of the quarter are compared, and the number of quarters necessary for selling the rest of the apartments is calculated. If the estimated time for selling the stock is less than a year it shows that demand is higher than supply and the prices will increase. If it takes a year or a year and a half to sale the rest of the apartments it shows a balance on the market. If it takes more than two years there’s an excess supply and the prices will come down.

We can’t do such a comparison because we don’t have data about the number of agreements on the primary market.

There is data from Ministry of Justice on the total number of agreements on the real estate market that are notarially registered. This number in common consists of the secondary market agreements, including the contracts for purchase and sale of private houses, and a part of the primary market agreements, for example, those that are the subject for preliminary contracts for purchase and sale. In general, investment in the apartments on the primary market takes places without notarial registration.

In this case, we can make a conclusion about the supply-and-demand situation in Kyiv only based on the indirect feature – a price behavior. Even if a supply growth become slower essentially because of earnings dilution and strengthening of regulations it doesn’t mean an immediate increase in prices. The market has a supply stock both in the form of unsold apartments and apartments that were purchased for investment purposes.

In recent years, there has been formed a swath of beneficiaries who buy apartments in new buildings in a large number for rent and/or resale in the future. An investment demand is created both by wealthy Ukrainian citizens that recognize such investment as an alternative to a foreign-currency deposits, and foreigner customers. Today this demand is a delayed supply in the future. In other words, it creates a pressure to direct prices to the downside.

If the supply growth will be ahead of demand growth there is a high risk for certain developers. This scenario designates risks both in economic (loss in value of collateral, risks of non-fulfillment the obligations), and infrastructure sphere (increasing traffic problem, impacts on utility networks), especially if urban planning requirements are not met.

Conclusions

For a positive development of a real estate market it is important:

- A long-term urban planning – a transfer from chaotic to a complex and cautious housing development.

- A development of mortgage lending. The first-order conditions for this are a reasonable balance between the defense of rights of credit grantors and borrowers, regulation of legal relations on the primary housing market in terms of legislation.

- It’s important that the development of mortgage lending contributes to the housing availability, to the growth of a number of the agreements and progressive increase of an overall value of the whole city, rather than speculative price rises in its certain areas. According to the research, the development of the infrastructure facilities simultaneously contributes to the new constructions and increases the welfare of the housing owners.

- Improvement of market statistics that will allow developers, customers, bankers to take more balanced decisions.