The Russian invasion led to terrible human losses and suffering, bringing catastrophic consequences for Ukraine’s economy. Large parts of the country’s territory were occupied, with many key enterprises and businesses harmed or completely destroyed. Towards winter, Russia launched a series of massive missile attacks on Ukraine, ruining critical infrastructure and killing civilians. Millions of Ukrainians were forced to move to safer regions within or abroad. In these conditions, it was essential to ensure financial stability, the smooth operation of the banking and payment systems, and state finances and the financial system in general. It was necessary to conduct monetary policy to achieve the main goals: maintain control over inflation, finance the wartime budget deficit, and keep up the level of international reserves and exchange rate stability. This article examines how the National Bank coped with these tasks in 2022.

A temporary change in the monetary policy framework in the conditions of war. With the start of full-scale hostilities, the National Bank announced it remained committed to inflation targeting going forward. At the same time, in a situation of high uncertainty and extraordinary economic and financial conditions, the NBU forcibly introduced administrative restrictions, particularly on the foreign exchange market. With the economy collapsing and uncertainty and financial risks growing, market monetary instruments, particularly the discount rate, could not play a significant role in the functioning of money and foreign currency markets. Therefore, fixing the exchange rate by the National Bank made it possible to avoid uncertainty for the population and businesses and keep devaluation and inflationary expectations under the control. The exchange rate became a price stabilizer or “nominal anchor” for the entire economy, preventing excessive inflation that could have further destabilized the macroeconomic situation.

The wartime monetary policy of Ukraine’s National Bank primarily aimed to fully meet the country’s defense needs, ensure the reliable operation of financial markets, the uninterrupted operation of the banking and payment systems, control inflationary processes, stabilize the exchange rate, and maintain the necessary level of international reserves.

Table 1. Main macroeconomic indicators, 2019-2022

|

Year |

2019 |

2020 |

2021 |

2022 |

|

Real GDP (% of the previous year) |

3.2 |

-3.8 |

3.4 |

-33 (grade) |

|

Inflation (%, end of year) |

4.1 |

5.0 |

10 |

26.6 |

|

Exchange rate (UAH/$ average for the year) |

25.8 |

27 |

27.3 |

31.8 |

|

The budget deficit (% of GDP) |

-2.1 |

-5.9 |

-3.9 |

-20 |

|

Current account (% of GDP) |

-2.7 |

3.3 |

-1.6 |

2.7 |

|

International reserves ($ billion as of December 31) |

25.3 |

29.1 |

30.9 |

28.5 |

Source: NBU, IMF

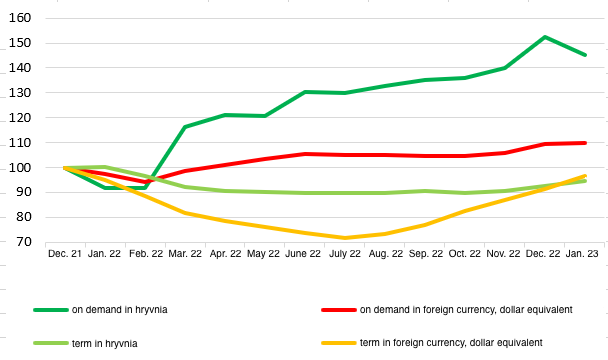

Interest rate policy. From the war’s beginning until June, the NBU kept the discount rate at 10%. Due to growing inflation, the real interest rate became more and more negative, and uncertainty grew to provoke an outflow of deposits, putting pressure on the exchange rate and generally increasing the risk of financial destabilization. On June 2, the NBU sharply increased the discount rate to 25%, expanding the interest rate corridor from +/- 1% to +/-2%. The purpose of such a sharp rate increase was an attempt to stop the outflow of deposits from the banking system and reduce the demand for foreign currency. On the other hand, this led to an increase in the price of loans for economic entities and the cost of servicing the debt, including for the Government.

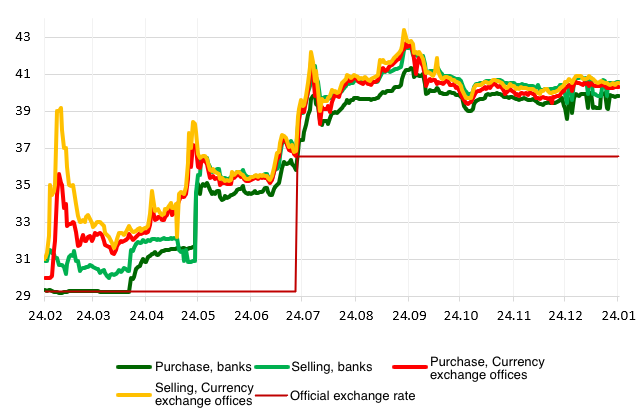

Before deciding on the interest rate, the NBU faced a classic central bank dilemma of finding a trade off between curbing inflation and supporting the production of goods and services (and limiting the burden on the budget), among other things. There was no perfect solution at the time. Other tactical moves were possible, such as a lower rate increase with a simultaneous devaluation of the hryvnia or a rate increase in several stages. However, the decision to raise the interest rate was strategically correct. As subsequent events showed, the flow of deposits, especially time deposits, stopped (Fig. 1). After a one-time devaluation, the exchange rate stabilized at a new level (Fig. 2).

Figure 1. Household deposit dynamics, December 2021 = 100

Source: NBU, own calculations

From the regulator’s point of view, at the time of this decision, the risk of financial destabilization seemed much more threatening to the economy than a reduction in lending, which had not been too active even during low rates. In the current environment, high-interest rates might further inhibit production. However, the main reason for the decrease in output is military aggression and the destruction of enterprises and infrastructure – not the higher cost of loans.

Provisions of the Law on the National Bank of Ukraine (Article 6) also supported the decision to raise the interest rate, defining the central bank’s primary task of maintaining price and financial stability.

Economic growth should be supported only when this does not interfere with the central bank’s first two tasks.

Exchange rate policy of the National Bank. Since the beginning of the military aggression, the NBU fixed the hryvnia exchange rate and introduced a set of measures to limit capital outflow. Later in July, the new exchange rate was fixed at UAH 36.6 to the US dollar. Such efforts made it possible to stabilize the market exchange rate, stop the outflow of deposits from the banking system, and reduce the demand for foreign currency (Fig. 2).

Figure 2. Exchange rate of hryvnia to US dollars on the cash market during martial law

Source: finance.ua, NBU.

Fixation of the hryvnia exchange rate played the primary role in maintaining the controllability of inflationary processes. Despite adjusting the official hryvnia exchange rate in July 2022, its fixation, thanks to interventions on foreign exchange market and measures to control of capital flow and foreign currency transactions, significantly limited the growth of the cost of goods and services, including due to imported components. The significant impact of this factor manifested itself in curbing inflationary and exchange rate expectations of citizens and businesses, reducing the risk of financial destabilization.

Currency regulation and international reserves. Immediately after the Russian invasion of Ukraine’s territory on February 24, the National Bank introduced restrictions on the foreign exchange market to protect Ukraine’s financial system and ensure its reliable and stable operation. The National Bank also banned most cross-border currency payments except for payments and cash withdrawals using payment cards abroad (with restrictions).

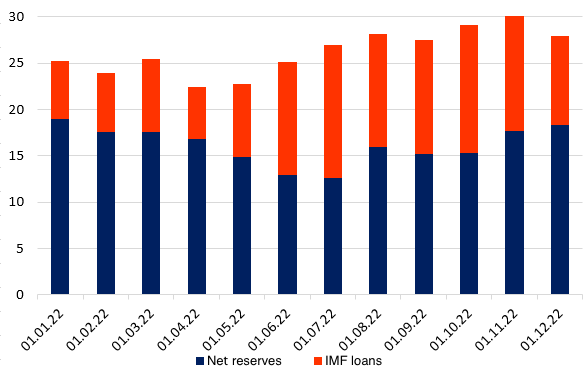

Figure 3. International reserves of the NBU in 2022, billion dollars

Source: NBU

As of January 1, 2023, Ukraine’s international reserves amounted to $28.5 billion (29.9 billion as of early March 2023, see Figure 3), mainly thanks to funding from international partners. This is 88% of the IMF’s composite indicator for the required level of international reserves of IMF member countries. In 2022, it was enough to fulfill Ukraine’s obligations and carry out Government and National Bank operations.

Interaction of monetary policy with the budget. Given the need to support the Armed Forces, defense, and social budget spending during hostilities and under martial law inforsment, the Verkhovna Rada (Parliament) suspended the provisions of the law prohibiting the NBU from directly supporting the state budget and enterprises (i.e., buying their securities on the primary market). According to the law’s new version, the practicality and scope of such operations are determined by separate National Bank decisions based on the balance between inflation control and Ukraine’s budget needs and taking into account the possibilities of filling the budget from other sources, mainly external (at the same time, the NBU is obliged to maintain maximum transparency of such transactions). In 2022, the National Bank of Ukraine bought government bonds worth UAH 400 billion and raised financing of UAH 564 billion (in equivalent) from external sources. Aid from international partners became the second factor (together with currency restrictions) that helped curb inflation. But after the victory and the beginning of the Ukrainian economy’s recovery, it is important to return to inflation targeting and normal operating conditions of the Ukrainian financial system.

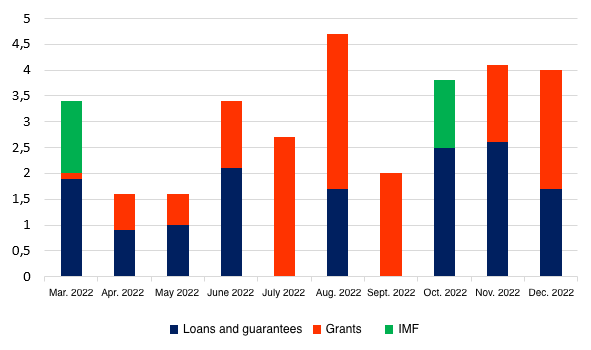

Financial support from MFIs and partner countries and monetary policy. In 2022, Ukraine received unprecedented financial support from international partners amounting to $32 billion (Figure 4). The United States ($12 billion), the European Union ($9.6 billion), Canada ($1.9 billion), and the IMF ($2.7 billion) provided the most aid. In addition, Ukraine received $3.1 billion thanks to the placement of currency bonds. These currency receipts made it possible to finance the budget deficit and compensate for a significant part of the NBU’s foreign exchange interventions ($25 billion) to balance the foreign exchange market and support the fixed hryvnia exchange rate. At the same time, the Government spent UAH 605 billion on servicing and repaying the state debt, of which 14% was foreign debt (in July, the Government agreed with creditors on postponing payments).

Figure 4. International financial assistance since the beginning of the full-scale war, billion dollars

Source: NBU

International organizations and partner countries promised to continue allocating significant funding to strengthen defense capabilities, support Ukraine’s economy, and resolve humanitarian issues. In particular, Ukraine’s largest financial partners (the USA and the European Union) approved providing financial assistance to Ukraine as part of their own budgets.

Cooperation programs with the IMF. In the current challenging conditions, it is crucial to continue cooperation with the International Monetary Fund both to get direct financial support and as a “signal” for other donors. Thus, in April 2022, the IMF approved an RFI (Rapid Financial Instrument) for Ukraine of $1.4 billion to finance necessary expenses and mitigate the negative financial shock caused by the war. Simultaneously with the RFI, the World Bank provided Ukraine with $700 million worth of assistance. In October, the Fund’s Board of Directors approved the second emergency financial aid program during the year (Emergency Financing Support, EFS). The financial assistance in 2022 totaled $2.7 billion from the IMF and $1 billion from the World Bank. Such cooperation significantly helped in meeting the monetary policy goals.

Just as essential for the performance of Ukraine’s main financial functions and the preservation of macroeconomic stability was the introduction in December 2022 of the Program Monitoring with Board involvement (PMB), which provided a strong anchor for macroeconomic policy and contributed to further donor support. In fact, the monitoring program became a prologue to a broad, full-fledged IMF financial program in the near future. The NBU and the Ministry of Finance are currently working together with the IMF mission. (Figure 5)

Figure 5. Meeting of NBU Chairman Andrii Pyshnyi with IMF Managing Director Kristalina Georgieva during her visit to Kyiv to discuss prospects for further cooperation

The main effects of the NBU’s monetary policy in 2022

Inflation turned out to be even lower than the July forecast. In July 2022, the NBU issued an inflation report predicting a year-end inflation rate of 31%, while the actual inflation was at 26.6% at the end of the year. (Table 1).

Foreign exchange reserves were kept at a reasonably safe level reaching the pre-war levels at the end of the year (Figure 3).

The stable hryvnia’s exchange rate against the dollar was a nominal anchor affecting the outflow of deposits, containing inflationary expectations, and keeping inflation within forecast limits.

The financial system’s stability and the payment system’s effectiveness were ensured in wartime conditions. All banks continued to provide full banking services to the population and businesses, and the payment system worked almost without disruptions ensuring payments in the warring country.

The central bank’s institutional stability remains high. Despite partially going online and significant staff changes, the National Bank thoroughly ensured price and financial stability.

Attracting funding from the IMF and cooperation with other central banks (swap agreements) supported financial stability during the year.

Problems for monetary policy

The weakness of monetary transmission and high uncertainty reduced the effectiveness of monetary instruments. Therefore, improving the transmission mechanism is an important factor in increasing the effectiveness of monetary instruments;

The banking system’s significant structural liquidity surplus became a serious challenge in carrying out monetary policy. It substantially contributed to the growth of inflation and the imbalance of inflationary expectations;

Insufficient coordination of the NBU’s interest policy and the Government’s debt policy resulted in the NBU being the sole internal creditor for the Government for some time due to the significant difference in the discount rate and the domestic government bonds’ rates;

Maintaining a fixed exchange rate alongside high inflation reduced the price competitiveness of the Ukrainian economy. Therefore, the NBU should return to the flexible exchange rate policy in the future.

De-facto formal participation of the NBU Council in developing the National Bank’s strategic decisions raises many questions. On the one hand, the current version of the law on the NBU significantly limits the Council’s possibilities of participating in developing strategic issues on monetary policy. The lack of a control mechanism (legally, the Council’s function) makes it impossible to even provide recommendations to the Board, which should be an integral part of regular communications with other branches of of Ukrainian authorities and society by the Council. On the other hand, a significant qualitative strengthening of the professional composition of the Council by introducing an effective and transparent procedure for appointing Council members, preferably with the participation of leading international experts, is an urgent task to increase the NBU’s institutional capacity.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations