What happened to the budget in August? Was the revenue plan achieved? Which types of economic activities contributed the most to corporate income tax? What risks are emerging for budget stability, and what can we expect in the future? Read about these and other budgetary issues in the Budget Barometer for August 2023.

What was achieved?

- The revenue plan for the general fund of the state budget was fully executed, with a total of UAH 124.7 billion received.

- The budget deficit remains lower than expected. In August, it amounted to UAH 130.7 billion (for the general fund – UAH 122.2 billion), which is 1.3 times less than the planned figure of UAH 154.2 billion.

- The government continues to finance not only protected expenditure items but also programs related to supporting businesses and recovery.

What wasn’t achieved?

- Tax revenues administered by the State Customs Service once again did not reach the planned indicators: in August, the plan was executed by 95.3%. This is due, in particular, to a stronger hryvnia than was assumed in the forecast used for preparation of the state budget.

- Failed to complete the plan for some taxes. In August, revenues of domestic and “imported” VAT, personal income tax and rent payments were lower than expected.

- For the first time since the beginning of 2023, no grants were received by the state budget in August.

What’s next?

- In September, the Government will submit the draft State Budget 2024 to the Parliament. It is expected that the difference between budget revenues and expenditures will remain at approximately the same level as the current year, therefore, according to the assessment of the Ministry of Finance, financial assistance to Ukraine next year should amount to at least USD 42 billion.

- The number of individual entrepreneurs is increasing, which may be one of the signs of a slow but steady recovery of the economy. In August, 30.8 thousand individual entrepreneurs were registered, and in total, as of the beginning of September 2023, 2.1 million individual entrepreneurs were operating in Ukraine (for comparison: there were 1.996 million individual entrepreneurs at the end of 2021). However, this may also indicate the erosion of the tax base and affect the reduction of personal income tax, military fee and social security contributions.

- In August, the second round of consultations with the delegation of the European Union regarding joint work on the Ukrainian Plan provided for by the Ukraine Facility program for 2024-2027 was completed. The Ukraine Facility program will become the foundation for the recovery and European integration of Ukraine, will ensure the transformation of the state, the implementation of economic reforms and the stimulation of the development of priority sectors. It foresees financing in the amount of EUR 50 billion, EUR 39 billion (according to the plan of the European Commission) of which will be directed to support the state budget.

Key risks:

- Underfunding of defense expenditures. Due to the continuation of the war, there is still a need for significant additional expenditures until the end of the year, since according to the plan of the Ministry of Finance, expenditures were planned at the level of UAH 180-190 billion for October-November and UAH 146 billion for December. Such indicators are significantly lower than the monthly average during the year (UAH 250 billion). Moreover, this decrease is due to a decline in spending on the Ministry of Defense (UAH 62 billion in October, UAH 26 billion in November, UAH 24 billion in December), a reduction in needs that is not expected. Given the fact that the average monthly funding of the Ministry of Defense remains at UAH 110 billion, we should expect changes to the state budget, which the Budget Committee is already planning in the amount of UAH 300 billion (medium risk).

- Decrease in the frequency of international support due to Ukraine’s non-compliance with obligations. The final version of Law 3219 (draft law 8401) on the return of the pre-war taxation system in terms of the return of tax audits does not meet the terms agreed with the IMF (structural benchmark). However, a new bill on canceling the moratorium on tax audits has already been registered in the Parliament (low risk).

Details:

(1) For the first time in 2023, in August, Ukraine did not receive international grants, which are included in budget revenues. However, the government managed to fully implement the plan of revenues to the general fund of the state budget in the amount of UAH 124.7 billion, since the payment of the corporate income tax (CIT) falls on this month. However, revenues for August are UAH 12 billion lower than in July, when the government received grants in the amount of UAH 45.7 billion.

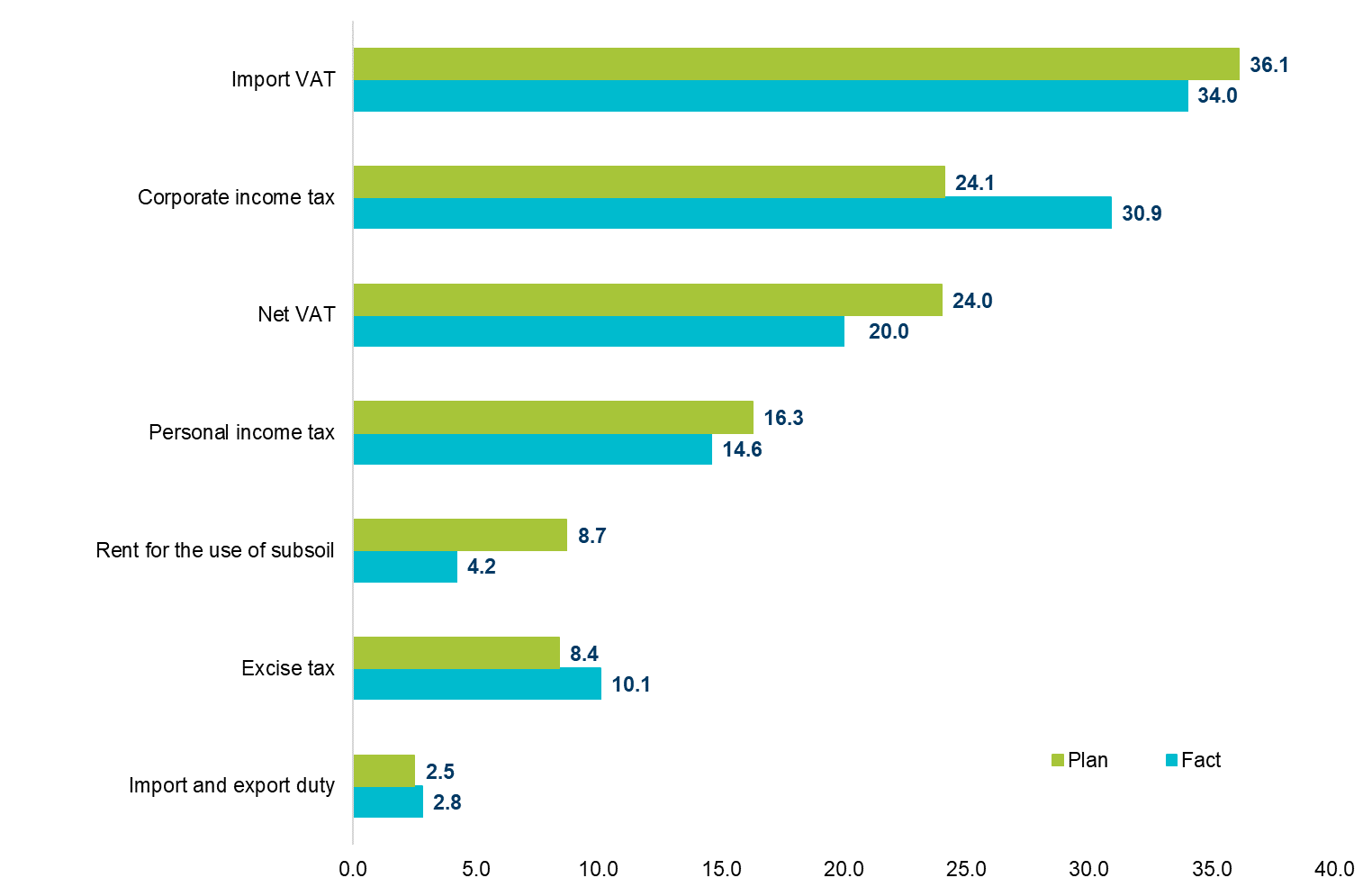

According to the plan of the Ministry of Finance, the general fund of the state budget was expected to be replenished by 120.1 billion UAH from main taxes, but in fact UAH 116.6 billion was received (fig. 1).

Figure 1. Main tax revenues to the general fund of the state budget in August 2023, UAH billion

Source: Ministry of Finance of Ukraine

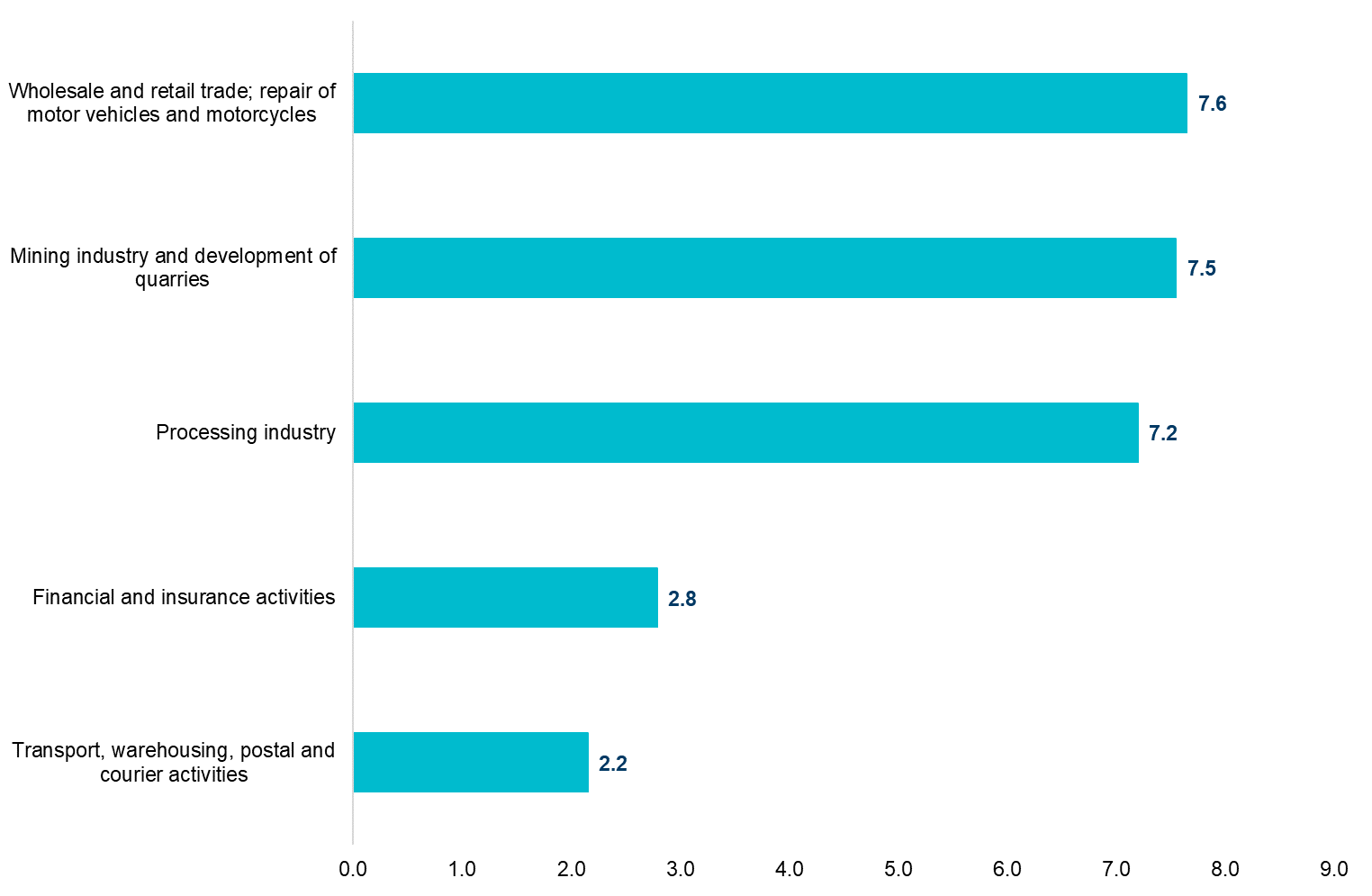

Actual CIT revenues were the largest since the start of full-scale war. They exceeded expectations by 28.2% and reached UAH 30.9 billion, which, however, is lower than the revenues in August 2021 (UAH 37 billion). This may indicate a still difficult situation in the economy, although some sectors have started to recover. Thus, 80.1% of the paid CIT fell on the main 5 types of economic activity (fig. 2).

Figure 2. TOP-5 types of economic activity by payment of corporate income tax in August 2023, UAH billion

Source: State Tax Service of Ukraine.

Excise tax overpayment amounted to 20.2% (revenues to the general fund amounted to UAH 10.1 billion against the planned UAH 8.4 billion; these amounts do not include excise taxes on fuel, which are sent to the special budget fund). The general fund also received UAH 2.8 billion from taxes on international trade (mainly import duties), which is 12.0% higher than planned. This is likely due to the higher volume of dutiable goods in the import structure in August.

In August, for the first time, there was a significant underperformance of the planned indicators for 4 of the 7 main taxes:

- the largest failure to fulfill the plan concerned rent payments (-51.7%). The shortfall may decrease with the beginning of the heating season, when the consumption of natural gas increases;

- income from personal income tax did not reach the planned indicator and amounted to UAH 14.6 billion, which is 10.4% less than the plan). The key component of revenues from this tax remains taxes on the financial support of military personnel;

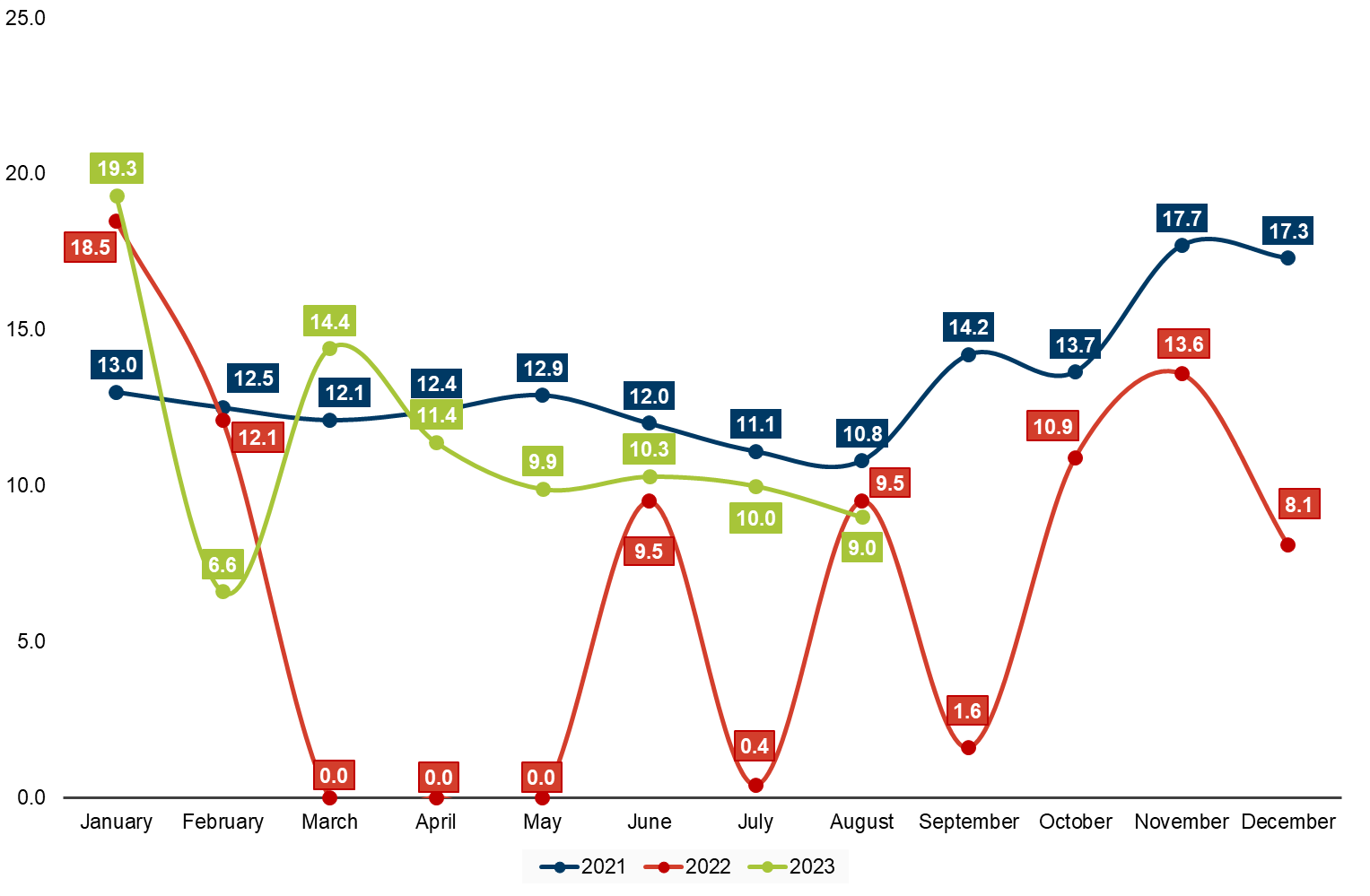

- domestic VAT revenues amounted to UAH 20.0 billion, which is 16.7% lower than planned. Presumably, this is due to lower inflation than was laid down in the budget parameters. At the same time, taxpayers got UAH 9 billion in VAT refunds. UAH 34 billion was received from the “import” VAT to the general fund of the state budget, which is 5.8% less than the plan, which is most likely due to a stronger hryvnia than was foreseen when preparing the state budget-2023.

Figure 3. VAT refunds in 2021-2023, UAH billion

Source: Ministry of Finance of Ukraine

(2) In August, expenditures of the general fund of the state budget amounted to UAH 248.2 billion, or 88.7% of the plan for the reporting period. Expenditures of the general fund of the state budget in August were planned at the average annual level – UAH 279.8 billion.

The largest planned expenses in August are on:

- The Ministry of Defense of Ukraine – UAH 127.6 billion, of which 45% – wages (UAH 57.3 billion).

- Ministry of Social Policy – UAH 36 billion, of which UAH 22.7 billion – a transfer to the Pension Fund.

- The Ministry of Internal Affairs – UAH 28.2 billion, primarily for structures subordinate to the Ministry, namely, UAH 10 billion is earmarked for the National Guard, UAH 7.3 billion for the National Police, UAH 4.3 billion for the State Border Service and another UAH 5 billion – for the State Emergency Service.

- Ministry of Health – UAH 14 billion, of which UAH 11.9 billion – for the program of state guarantees of medical care.

- Servicing of the state debt – UAH 7.4 billion.

In general, according to the planned indicators, about 55% of all expenditures were to be directed to the defense and security sector in August, 12.8% to social security, and another 11.1% to servicing the public debt.

(3) The actual deficit of the state budget in August was UAH 130.7 billion, from which to the general fund – UAH 122.2 billion, which is 1.3 times less than the planned figure – UAH 154.2 billion.

In general, in the first eight months of 2023, the state budget was implemented with a deficit of UAH 714.6 billion, according to the general fund – UAH 749.8 billion, which is 1.7 times less than provided for in the plan – billion 1237.4 billion. Such an indicator for the entire period of 2023 was achieved, in particular, due to the involvement of financial assistance in the form of grants in the amount of UAH 316.7 billion (grants are not included in the state budget plan).

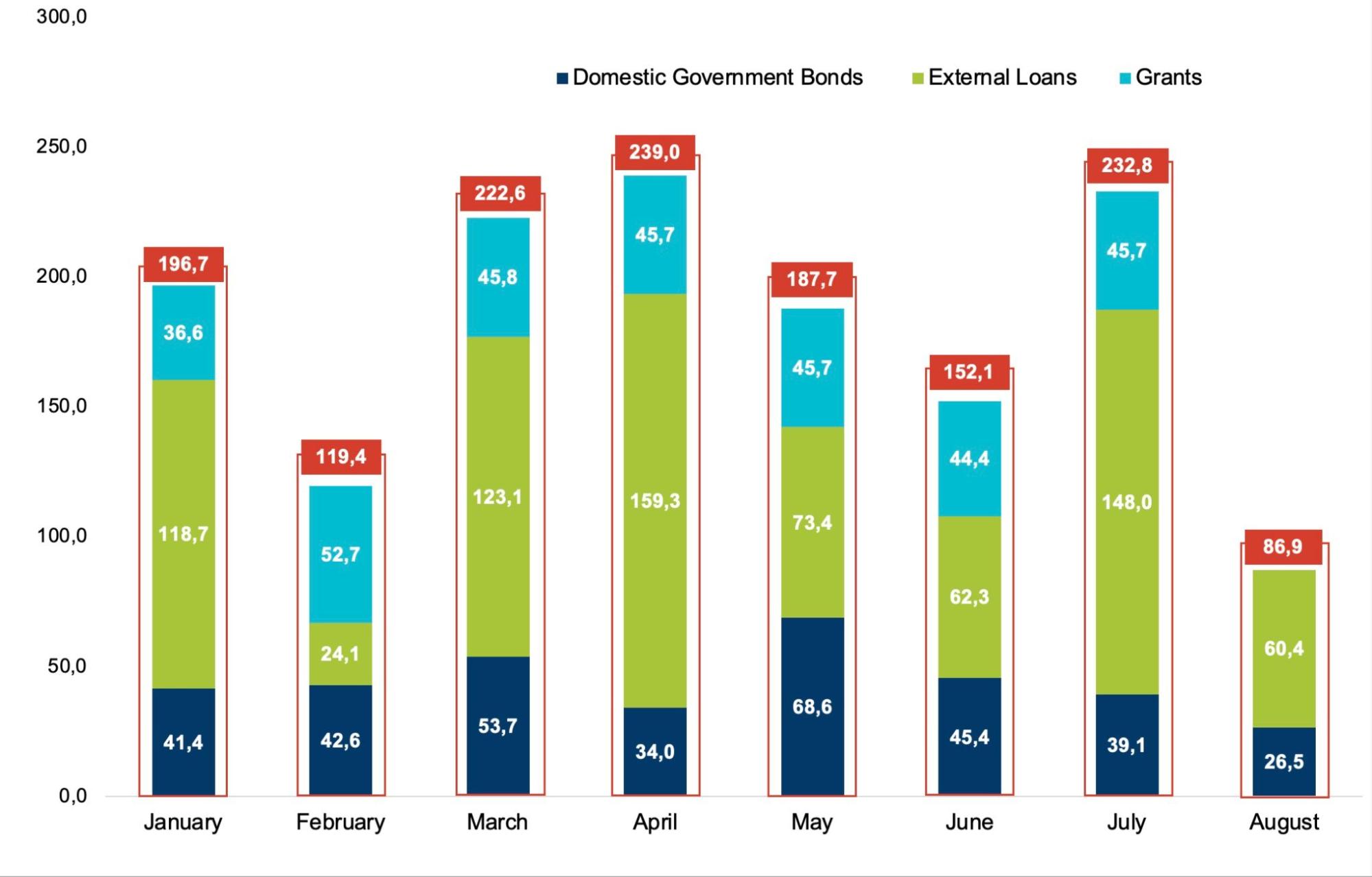

Figure 4. Budget financing for January-August 2023, UAH billion

Source: Ministry of Finance of Ukraine

(4) In August, the state budget received the seventh tranche of macro-financial assistance from the EU in the amount of EUR 1.5 billion (UAH 60.4 billion). These funds are directed to the financing of social and humanitarian expenditures of the state budget, in particular for health care, education, pension payments, social assistance programs and salaries of civil servants.

(5) In addition to external financing, in August the Ministry of Finance attracted UAH 26.5 billion from the placement of bonds, of which UAH 20.5 billion or 77.4% were benchmark bonds. The maximum nominal level of yield on bonds, as in previous periods, is 19.75%, however, due to the reduction of the NBU discount rate from 25% to 22%, the maximum yield on bonds decreased slightly during the month – to 19.5%. In August, UAH 800 million (EUR 20 million) was also raised from bonds denominated in foreign currency. This is only 3% of the total amount of funds raised from bonds in August, while in July this share was 21.2%. The reason for such a sharp drop may be that in August the Ministry of Finance placed significantly fewer bonds denominated in foreign currency. Funds raised as a result of placement of bonds in January-August were fully sufficient to make payments for repayment of bonds. At the same time, UAH 3.6 billion is aimed at financing the state budget deficit. The NBU did not conduct additional financing.

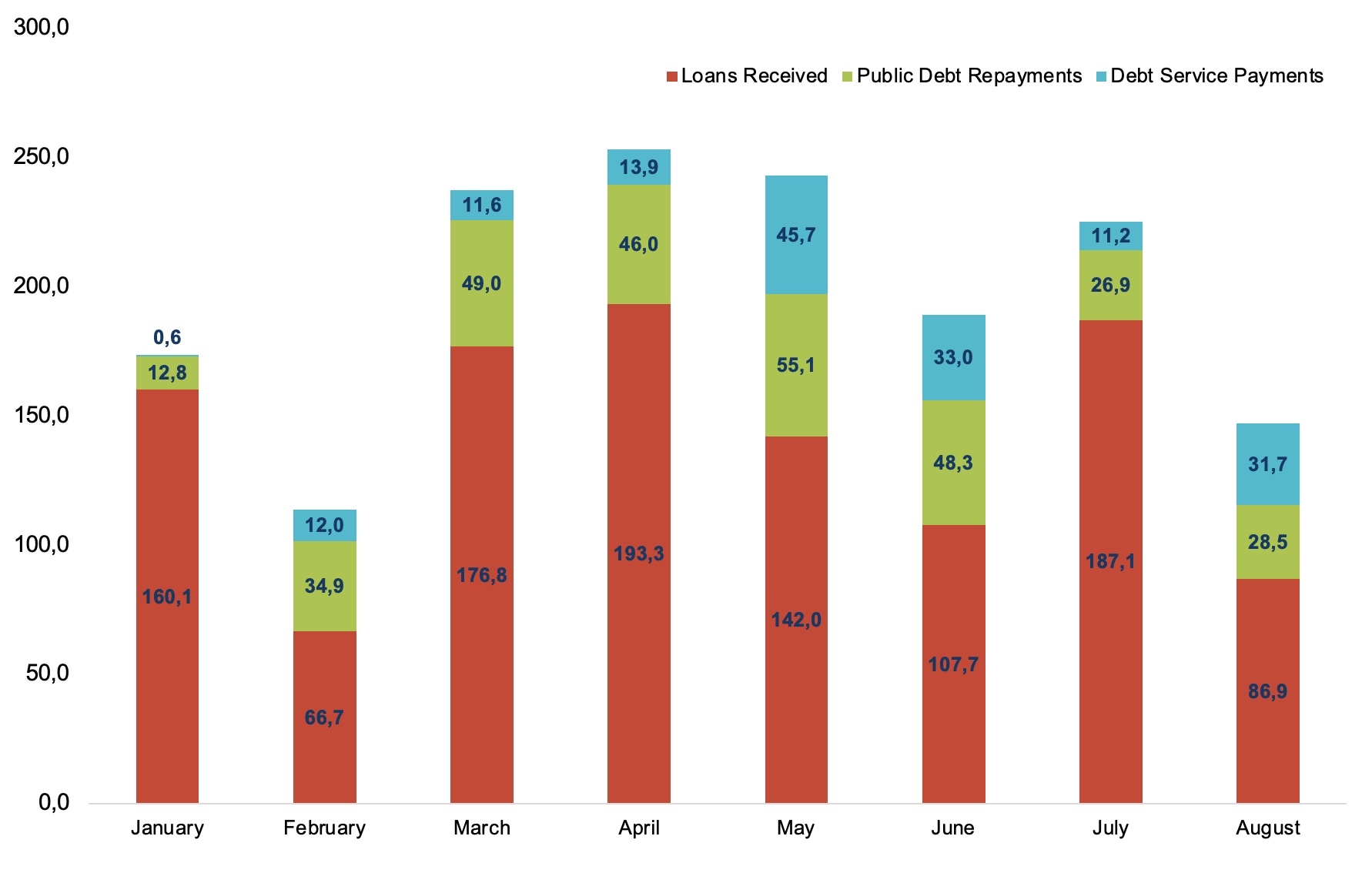

(6) In August, UAH 26.7 billion was borrowed more than was spent on repaying and servicing the state debt of Ukraine, which is one of the lowest figures for eight months of 2023. The reason is the lower volume of soft loans from international partners (Fig. 5). In August, only UAH 86.9 billion was raised, while in July – UAH 187.1 billion. UAH 60.2 billion was spent on servicing and repaying the state debt in August, of which 73.3% or UAH 44.1 billion was spent on servicing and repaying the domestic state debt.

Figure 5. Amount of borrowed loans and funds spent on repaying and servicing the state debt of Ukraine for January-August 2023, billion UAH

Source: Ministry of Finance of Ukraine

(7) Revenues of local budgets from payments administered by the State Tax Service amounted to UAH 41.3 billion, which is 15.4% more than in August 2022. In August, the Government approved the distribution of an additional subsidy for the II quarter of 2023 in the amount of UAH 1.3 billion. These funds are directed to the needs of the regional budgets of Donetsk, Luhansk and Kherson regions and 113 budgets of territorial communities, taking into account the actual receipts to local budgets of personal income tax for January-June 2023.

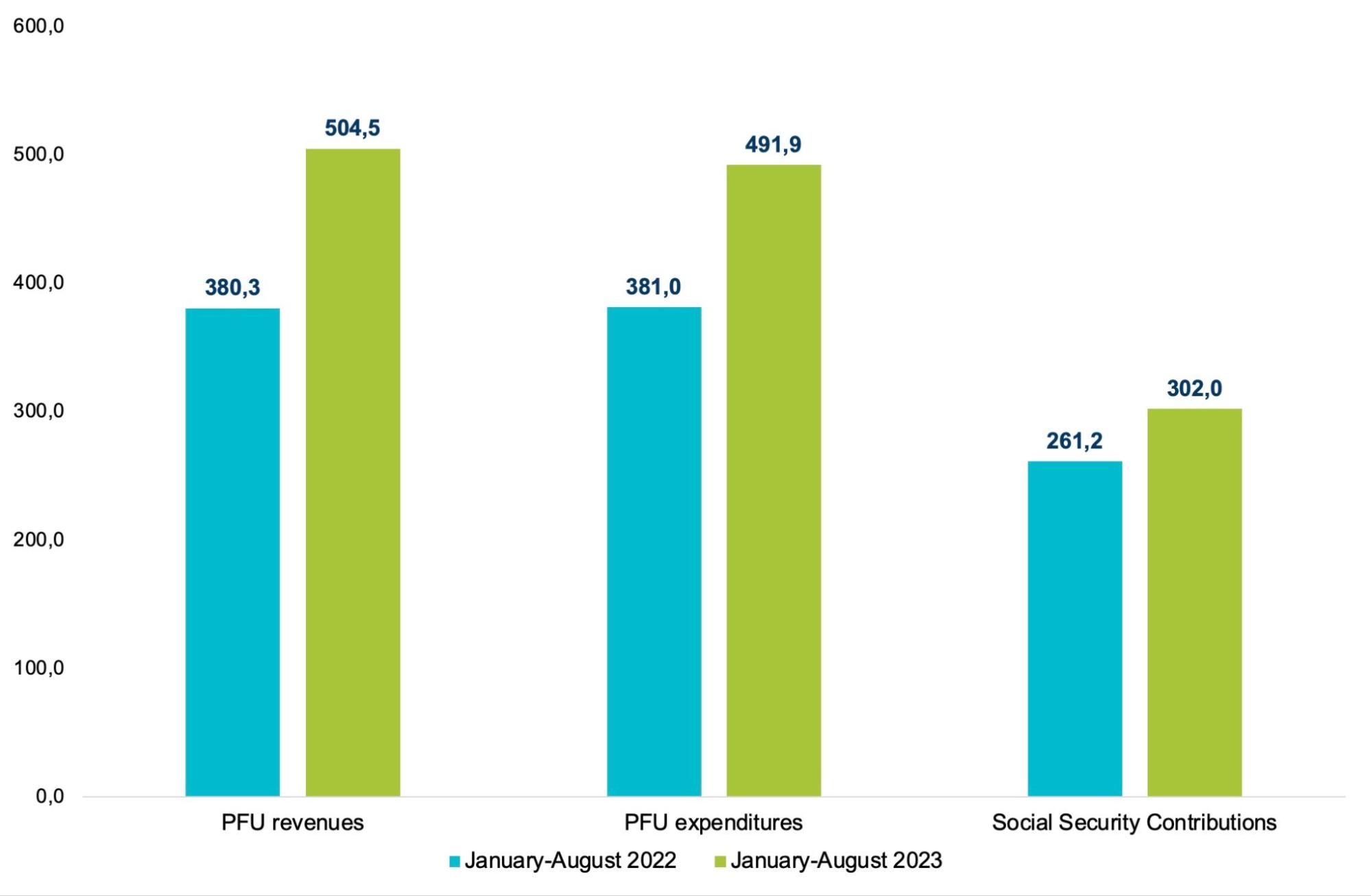

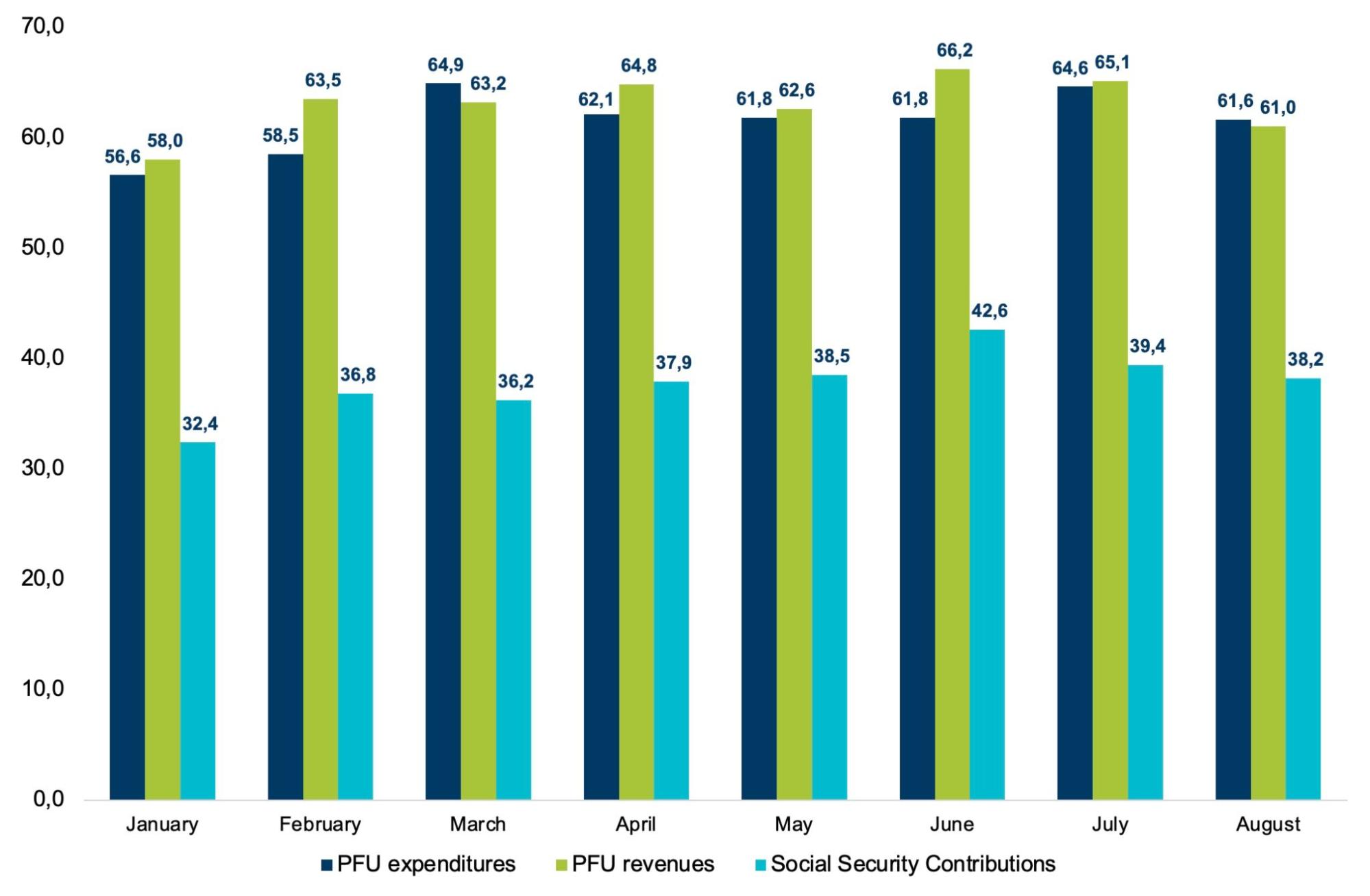

(8) Cumulative Social Security Contributions (SSC) revenues in August 2023 increased by 3% or UAH 1.1 billion compared to the corresponding period of 2022 and amounted to UAH 38.2 billion (Fig. 6). The increase is due to the gradual recovery of the economy, a higher minimum wage in August 2023 than it was in August 2022 (UAH 6,700 compared to UAH 6,500), and higher revenues from payments to military personnel.

(9) In August 2023, revenues of the Pension Fund of Ukraine (PFU) increased by 9.5% or by UAH 5.3 billion, compared to the same period last year, reaching UAH 61.0 billion, both due to the increase in the PFU’s own revenues from the SSC and the Fund’s authority to pay benefits within of the social insurance (Fig. 7). In August 2023, UAH 20.6 billion was allocated from the state budget to the Fund for financing pension and other related payments, which is 4.6% more than the same period last year. The PFU received UAH 800 million from the state budget for the payment of subsidies and benefits for housing and communal services, and UAH 2.2 billion from SSC revenues for social insurance payments. In August, UAH 58 billion was allocated to pension financing, which is UAH 6.6 billion or 12.8% more than in the same period last year. The total expenditures of the PFU in August 2023 amounted to UAH 61.6 billion, which is UAH 12 billion or 24.2% higher than the previous year (Fig. 7)

Figure 6. Revenues and expenditures of the Pension Fund of Ukraine, revenues of the Social Security Contributions in January-August 2022-2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Figure 7. Monthly dynamics of revenues and expenditures of the Pension Fund, revenues of the Social Security Contributions in January-August 2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Table 1. Plan and fact of the state budget (general fund) in 2023, UAH billion

| Indicators | January | February | March | April | May | June | July | August | January-

August |

|||||||||

| Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | |

| Revenue, including | 69,6 | 104,4 | 77,0 | 132,2 | 101,8 | 152,2 | 112,4 | 162,8 | 125,3 | 184,0 | 84,1 | 133,7 | 89,4 | 136,7 | 124,7 | 124,7 | 784,3 | 1130,7 |

| Personal income tax | 10,6 | 11,3 | 11,6 | 13,0 | 11,9 | 13,3 | 11,8 | 13,4 | 12,0 | 14,1 | 17,2 | 15,0 | 14,8 | 15,2 | 16,3 | 14,6 | 106,2 | 109,9 |

| Corporate income tax | 1,4 | 1,2 | 4,1 | 7,4 | 22,1 | 26,2 | 1,5 | 2,3 | 24,7 | 28,5 | 2,9 | 2,3 | 1,3 | 3,2 | 24,1 | 30,9 | 82,1 | 102,0 |

| Rent for the use of subsoil | 5,2 | 5,6 | 7,0 | 2,7 | 6,7 | 7,7 | 7,1 | 4,9 | 8,3 | 4,5 | 7,1 | 4,5 | 7,0 | 5,4 | 8,7 | 4,2 | 57,1 | 39,5 |

| Excise tax | 4,7 | 5,3 | 6,1 | 7,0 | 7,1 | 9,8 | 7,4 | 9,9 | 7,7 | 9,5 | 8,3 | 8,8 | 8,6 | 8,7 | 8,4 | 10,1 | 58,3 | 69,1 |

| Net VAT | 20,0 | 11,8 | 14,8 | 15,1 | 16,7 | 10,0 | 16,1 | 16,6 | 14,8 | 17,3 | 15,6 | 17,5 | 19,1 | 18,7 | 24,0 | 20,0 | 141,1 | 127,0 |

| Import VAT | 22,6 | 24,4 | 26,8 | 27,1 | 31,0 | 29,3 | 27,1 | 25,1 | 27,1 | 27,0 | 27,3 | 28,7 | 30,0 | 30,8 | 36,1 | 34,0 | 228,0 | 226,4 |

| Import and export duty | 1,7 | 2,0 | 2,2 | 2,3 | 2,4 | 2,7 | 2,0 | 2,2 | 2,1 | 2,5 | 2,0 | 2,6 | 2,3 | 2,4 | 2,5 | 2,8 | 17,2 | 19,5 |

| Expenditures | 227,7 | 183,6 | 245,6 | 226,7 | 246,1 | 225,2 | 220,2 | 229,7 | 282,7 | 277,7 | 303,9 | 264,7 | 251,0 | 231,9 | 279,8 | 248,2 | 2057,0 | 1887,7 |

| Deficit (-) / surplus (+)* | -156,6 | -78,9 | -165,7 | -93,2 | -130,5 | -72,6 | -102,7 | -65,6 | -153,7 | -91,6 | -217,8 | -130,8 | -156,2 | -94,9 | -154,2 | -122,2 | -1237,4 | -749,8 |

| Sources of deficit financing | ||||||||||||||||||

| Net borrowings | 279,4 | 147,3 | 55,6 | 31,8 | 37,8 | 127,8 | 195,1 | 147,3 | 67,9 | 86,9 | 169,3 | 59,4 | 82,4 | 160,2 | 67,3 | 58,4 | 954,8 | 819,1 |

| Loans | 292,5 | 160,1 | 93,3 | 66,7 | 96,3 | 176,8 | 233,2 | 193,3 | 125 | 142 | 219,7 | 107,7 | 112,9 | 187,1 | 97,1 | 86,9 | 1270,0 | 1120,6 |

| Repayments | -13,1 | -12,8 | -37,7 | -34,9 | -58,5 | -49 | -38,1 | -46 | -57,1 | -55,1 | -50,4 | -48,3 | -30,5 | -26,9 | -29,8 | -28,5 | -315,2 | -301,5 |

* The size of the deficit is not equal to the arithmetic difference between revenues and expenditures since the size of the deficit is additionally affected by the volume of loans from the state budget and their repayment

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 2. Main indicators of budget financing, UAH billion

| Indicators | January | February | March | April | May | June | July | August | Cumulative (Jan-Aug) | |

| Financing, including: | 160,1 | 66,7 | 176,8 | 193,3 | 142,0 | 107,7 | 187,1 | 86,9 | 1120,6 | |

| in % to the plan (for the entire period) | 54,7 | 71,5 | 183,5 | 82,9 | 113,6 | 49,0 | 165,7 | 89,5 | 88,2 | |

| From the placement of domestic government bonds (total), including: | 41,4 | 42,6 | 53,7 | 34,0 | 68,6 | 45,4 | 39,1 | 26,5 | 351,3 | |

| in UAH billion | 38,8 | 30,5 | 36,3 | 25,1 | 29,3 | 28,3 | 30,8 | 25,7 | 244,8 | |

| in foreign currency in UAH billion (USD million + EUR million) | ₴2,6

($40,2+€29,4) |

₴12,1

($268,5+€57,5) |

₴17,4

($476,4) |

₴8,9

($242,6) |

₴39,3

($616,4+€418) |

₴17,1

($319,7+€136) |

₴8,3

($227,3) |

₴0,8

(€20) |

₴ 106,5

($2191,1+ €660,9) |

|

| From external sources, UAH billion | 118,7 | 24,1 | 123,1 | 159,3 | 73,4 | 62,3 | 148 | 60,4 | 769,3 | |

| Public debt repayments, UAH billion | 12,8 | 34,9 | 49,0 | 46,0 | 55,1 | 48,3 | 26,9 | 28,5 | 301,5 | |

| In % to the plan for the full period | 97,7 | 92,6 | 83,8 | 120,7 | 96,5 | 95,8 | 88,2 | 95,6 | 95,7 | |

| Debt service payments | 0,6 | 12,0 | 11,6 | 13,9 | 45,7 | 33,0 | 11,2 | 31,7 | 159,7 | |

| In % to the plan for the full period | 28,6 | 114,3 | 78,4 | 101,5 | 90,3 | 84,0 | 151,4 | 101,9 | 94,2 | |

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 3. External financial resources* attracted in January-August 2023

| Resources | Amount, UAH billion

(EUR million; USD million; CAD million) |

| Programs of macro-financial assistance from the EU for 2023 | ₴477,7 (€12000) |

| Loans from the Government of Canada | ₴64,2 (CA$2400) |

| IMF funds under the four-year Extended Fund Facility program | ₴131,4 ($3590) |

| Loan from the IBRD within the framework of the Fourth additional financing of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴18,3 ($499,3) |

| IBRD Loan for Development and Recovery Policy | ₴54,9 ($1500) |

| IDA loans within the framework of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴16,1 (€404,3) |

| Loan from the IBRD within the project “Strengthening the Healthcare System and Saving Lives” | ₴1,7 (€42,3) |

| Loan from the IBRD within the project “Accelerating Investments in Ukraine’s Agriculture” | ₴4,8 ($132) |

| Loan from the IBRD within the project “Additional Financing for the Health System Improvement Project” | ₴0,2 ($6) |

*excluding grants

Source: Ministry of Finance of Ukraine

Table 4. Monthly dynamics of state budget financing

| Indicators | January | February | March | April | May | June | July | August |

| Total borrowing, UAH billion | 160,1 | 66,7 | 176,8 | 193,3 | 142,0 | 107,7 | 187,1 | 86,9 |

| Total borrowed, % for January-August | 14,3 | 6,0 | 15,8 | 17,2 | 12,7 | 9,6 | 16,7 | 7,8 |

| From the placement of domestic government bonds, % for January-August | 11,8 | 12,1 | 15,3 | 9,7 | 19,5 | 12,9 | 11,1 | 7,5 |

| Borrowed from external sources, % for January-August | 15,4 | 3,1 | 16,0 | 20,7 | 9,5 | 8,1 | 19,2 | 7,9 |

| Debt repayment payments, % for January-August | 4,2 | 11,6 | 16,3 | 15,3 | 18,3 | 16,0 | 8,9 | 9,5 |

| Servicing payments, % for January-August | 0,4 | 7,5 | 7,3 | 8,7 | 28,6 | 20,7 | 7,0 | 19,8 |

| Difference between borrowed financial resources and expenses for debt repayment and servicing, UAH billion | 146,7 | 19,8 | 116,2 | 133,4 | 41,2 | 26,4 | 149,0 | 26,7 |

Source: Ministry of Finance of Ukraine, Center`s calculations

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations