What happened to the budget in December? Was the revenue plan for the main taxes achieved? Was there enough international financing to cover the traditionally largest expenditures at the end of the year? What risks emerge for budgetary stability and what can be expected further? Read more about these and other budget issues in the Budget Barometer for December 2023.

What was achieved?

- In December, slightly over UAH 20.5 billion in grants were attracted, and the volume of external loans was the highest for the entire year of 2023 (UAH 169.8 billion), which was particularly important for financing the government’s non-defense expenditures at the end of the year.

- The government approved the National Revenue Strategy 2024-2030, outlining the main priorities of tax and customs policies, thereby fulfilling one of the IMF’s structural benchmarks.

- In December, amendments were signed to the Memorandum of Understanding on the suspension of payments on official debt with a group of official creditors of Ukraine from G7 countries and the Paris Club. This will allow the extension of the Memorandum until the end of March 2027, when the current IMF Extended Fund Facility (EFF) program is also set to conclude.

- By the end of 2023, 97% of local councils had approved budgets for 2024.

What wasn’t achieved?

- In December, the revenue plan was not met – receipts to the general fund of the state budget amounted to UAH 127.1 billion, which is 10.6% less than expected, despite the receipt of UAH 20.5 billion in unplanned grants. This is due to lower revenues from rent for the use of subsoil, “import” VAT, and personal income tax.

What’s next?

- Japan will provide Ukraine with assistance amounting to USD 4.5 billion, of which USD 1.5 billion is expected in January 2024. This will support macro-financial stability in anticipation of assistance from the EU and the USA.

- In total, in 2024, the Government expects to receive approximately USD 37.5 billion in external financial assistance. Agreements have already been made with 11 countries that will provide assistance to Ukraine in 2024. In January, the US Congress is expected to consider a package of financial support for Ukraine, and on February 1, the European Council at its meeting will likely consider providing EUR 50 billion over 2024-2027 as part of the Ukraine Facility (of which EUR 39 billion are direct budget support for four years).

- In December, the Memorandum with the IMF was updated within the second review of the Extended Fund Facility (EFF) program. Twelve new structural benchmarks were added, including, by the end of February 2024, the government needs to prepare short-term measures to increase tax and non-tax revenues of the state budget by at least 0.5% of GDP. Already in January, the development of a conceptual note on the creation of a comprehensive system of insurance against war risks (by the National Bank of Ukraine, Ministry of Economy, and Ministry of Finance) is expected. The creation of such a system will reduce the risk of sudden fiscal burden on the state budget, contribute to increasing the trust of international partners, and thus the inflow of foreign capital and loans (including from the private sector), and will also play an important role in post-war economic recovery.

Key risks:

- Uncertainty regarding budgetary support from the USA and EU poses a threat to the country’s macro-financial stability (medium risk).

- Lower receipts from tax and customs payments due to a potential decrease in business activity: according to a National Bank of Ukraine survey, businesses have lowered their expectations for profits and employment in the near future (medium risk).

- Lower customs payments due to the ongoing blockade of the Ukrainian-Polish border by Polish carriers (high risk).

Details:

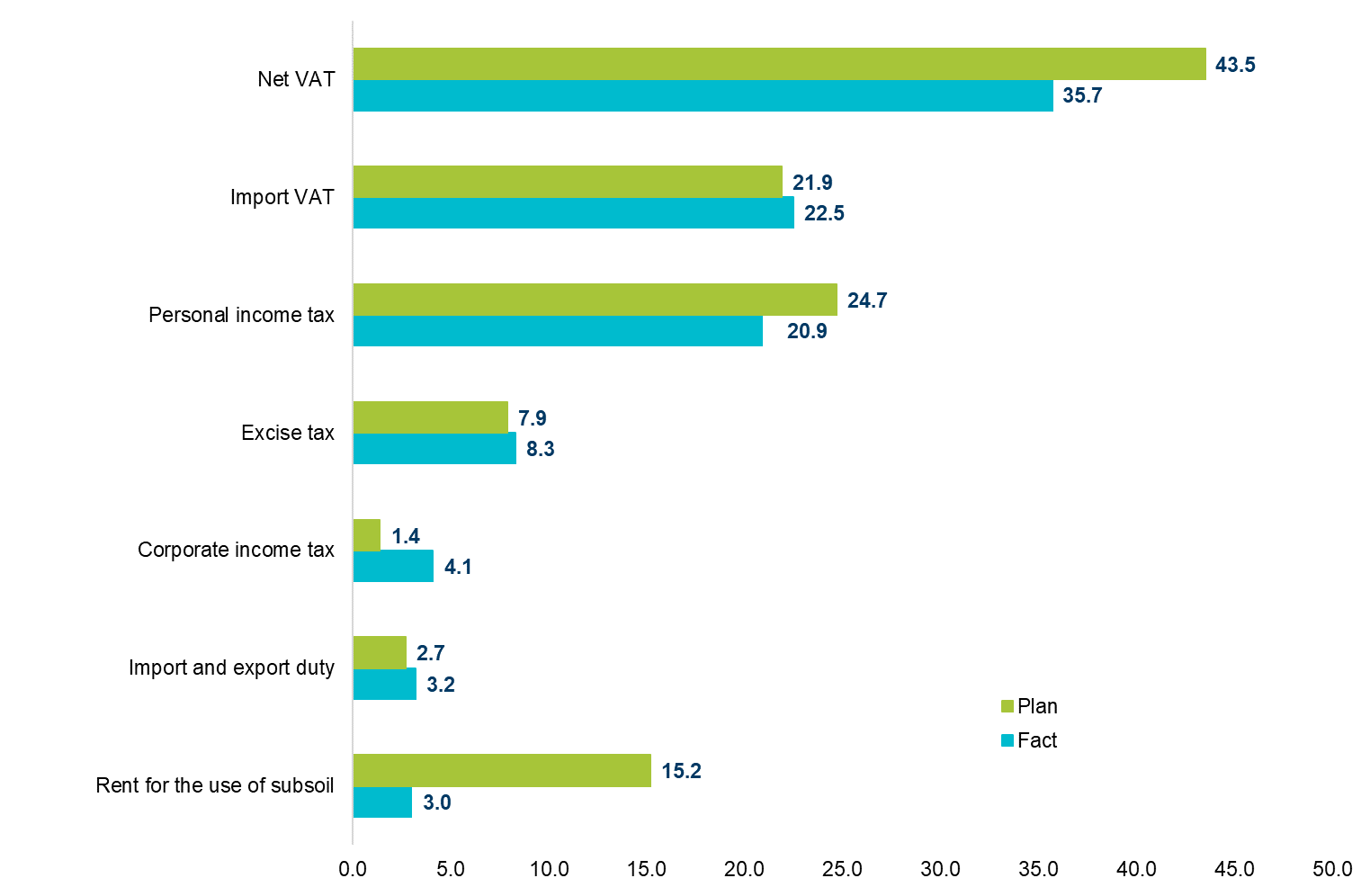

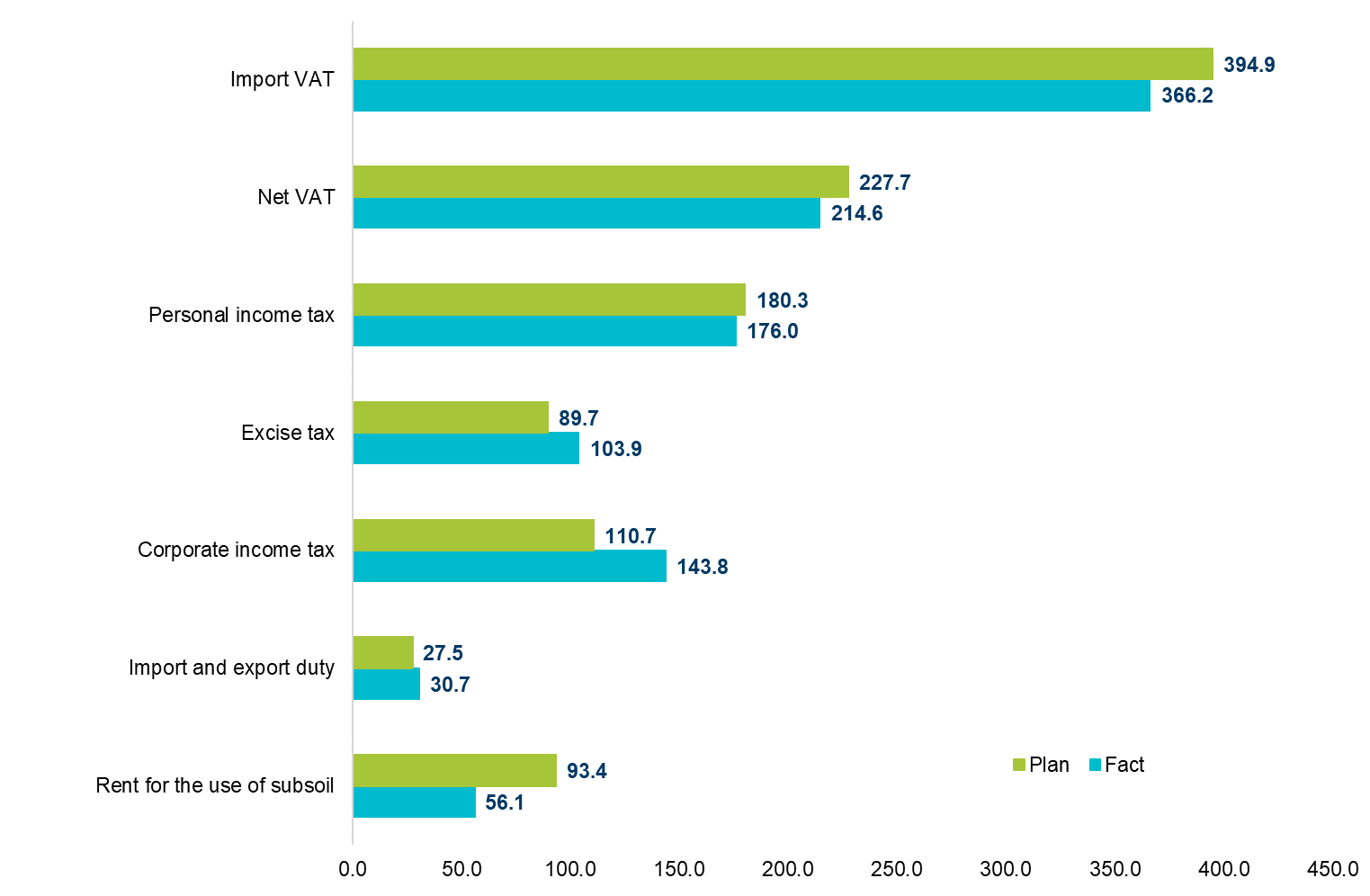

(1) In December, payments to the general fund of the state budget amounted to UAH 127.1 billion. The revenue part of the budget was under-executed by 10.6%, despite the receipt of UAH 20.5 billion in unplanned grants. The plan was to collect UAH 117.3 billion in main taxes (for the general fund), but actually, UAH 17.8 billion less was received (see Fig. 1). In total, in 2023, UAH 1,663.1 billion was collected in revenues, of which UAH 1,098.5 billion were tax revenues, and UAH 122.8 billion were non-tax revenues.

Figure 1. Main tax revenues to the general fund of the state budget in December 2023 (left) and total for the year 2023 (right), in billion UAH

a) December 2023

b) Total for 2023

Source: Ministry of Finance of Ukraine

Actual revenues from corporate income tax (CIT) exceeded expectations almost threefold and reached UAH 4.1 billion. The primary reasons for this are likely the high profits of state banks and certain state enterprises. Overall, annual revenues from this tax exceeded the target by a third.

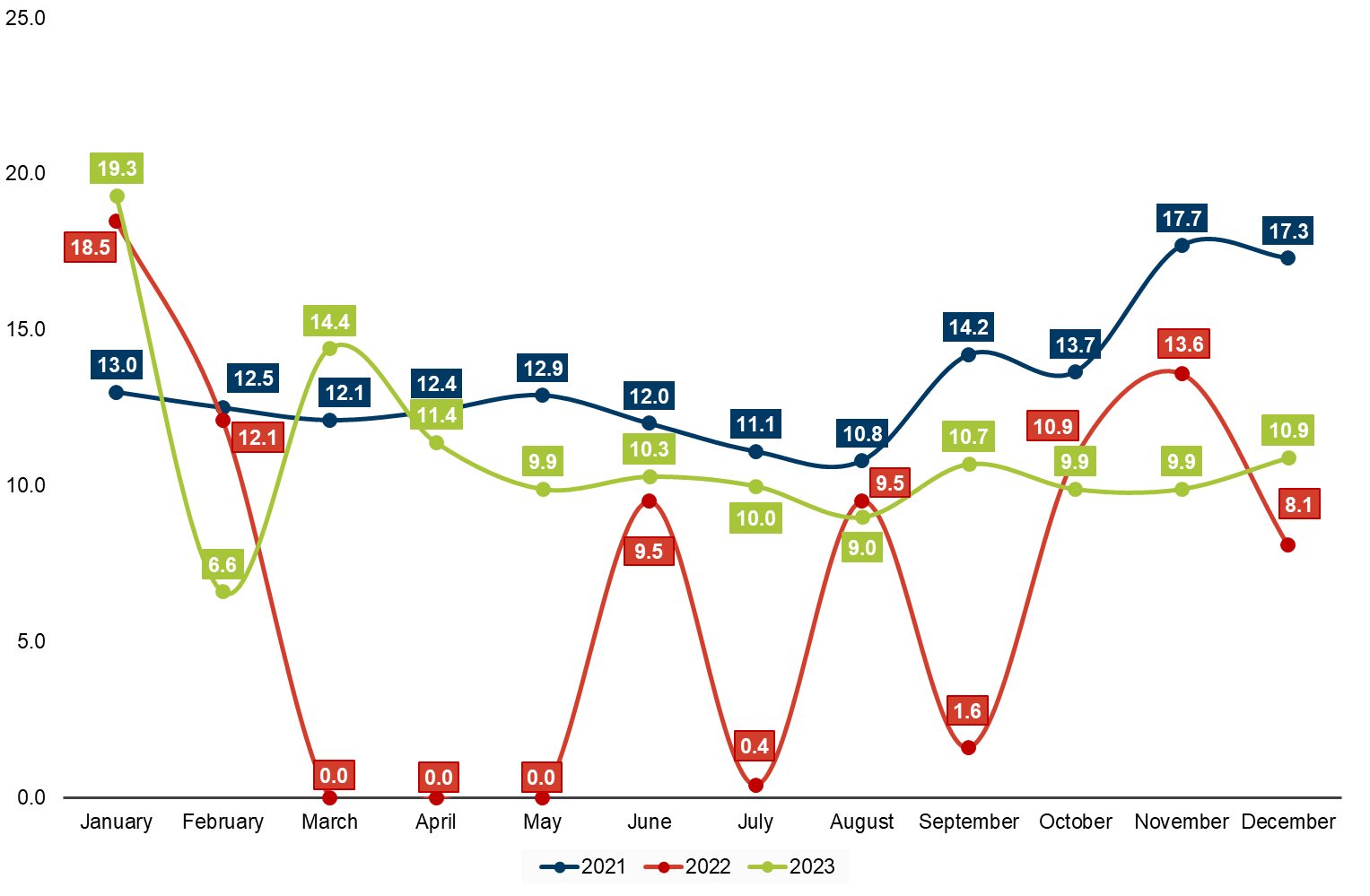

Net revenues from domestic VAT in December were UAH 22.5 billion, which is 2.7% higher than planned. This surplus in planned revenues may be linked to higher-than-expected consumption volumes. Additionally, taxpayers were reimbursed VAT amounting to UAH 10.9 billion (of which UAH 108.7 million was due to court decisions) against claimed reimbursements of UAH 11.7 billion, which is UAH 700 million more than in December 2022, but significantly less than before the full-scale invasion (see Fig. 2). The largest VAT reimbursements based on individual tax invoices in December were claimed by LLC “Kernel-trade” – UAH 534.1 million, subsidiary enterprise with foreign investment “Suntrade” – UAH 397.5 million, and PJSC “ArcelorMittal Kryvyi Rih” – UAH 377.1 million. Net annual revenues from domestic VAT were 5.7% below the planned amount.

The over-fulfillment of the plan for receipts to the general fund of the state budget from excise tax amounted to 5.1% or UAH 400 million – revenues reached UAH 8.3 billion. This could be linked to the over-fulfillment of the excise tax from the production of liquor and spirits, as well as due to the pre-purchase of excise tax stamps in anticipation of a planned 20% increase in the minimum excise tax obligation on cigarettes. Annual indicators were over-fulfilled by 15.9%. In this context, the most fiscally significant category – tobacco and tobacco products, liquids used in electronic cigarettes (accounting for 74.7% of excise tax revenue in 2023) – ensured 26.9% higher internal excise tax revenues, but the “import” excise tax decreased by 21.6%. Despite consistently higher-than-planned excise tax revenues, studies by Kantar indicate an increase in the illegal share of the cigarette market, leading to significant revenue losses for the state budget (estimated at UAH 23.5 billion for 2023 as of October).

In December, UAH 3.2 billion in import and export duties were received, which is 18.5% higher than the monthly plan. The plan for these revenues was exceeded due to underestimated planned figures (December’s plan – 9.8% of the annual figure, while last year it was actually 11.6%). Overall, annual figures for import and export duties were exceeded by 11.7%.

Figure 2. VAT refunds in 2021-2023, UAH billion

Source: Ministry of Finance of Ukraine

In December, there was significant under-fulfillment of planned figures for revenues from certain taxes:

- There was considerable under-fulfillment of the plan for rent for the use of subsoil (-80.3%), primarily due to the actual selling price of natural gas being twice lower – UAH 14.4 thousand per 1,000 m³ in November 2023 compared to UAH 28.9 thousand in November 2022, when the budget was adopted.

- “Import” VAT to the general fund of the state budget amounted to UAH 35.7 billion, which is 17.9% lower than the plan. The shortfall is likely related to the blockade of the border by Polish carriers.

- Revenues from personal income tax (PIT) in December were UAH 20.9 billion, significantly higher than the average monthly figures for 2023 at UAH 14.1 billion (due to traditional bonus payments), but 15.4% less than the plan. One reason for the under-fulfillment of the plan could be the overly optimistic target of UAH 24.7 billion.

Meanwhile, annual figures for rent for the use of subsoil were under-fulfilled by 40%, “import” VAT – by 7.3%, and PIT – by 2.4%.

(2) In December, the state budget successfully attracted grants amounting to USD 546.3 million or UAH 20.5 billion from:

- Japan – USD 232.4 million (UAH 8.8 billion);

- Norway – USD 190 million (UAH 7.1 billion);

- KfW – EUR 50 million (UAH 2 billion);

- USA – USD 50 million (UAH 1.9 billion);

- Switzerland – USD 20 million (UAH 751 million).

(3) In December, expenditures from the general fund of the state budget were a record UAH 397.7 billion or 151.5% of the December budget, consistent with Ukrainian budgetary traditions where expenditure levels are typically highest at the end of the year. For the entire year of 2023, state budget cash expenditures exceeded UAH 4 trillion, including UAH 3.03 trillion from the general fund or 98% of the annual budget.

Regarding the plan, the largest planned item was the funding of programs of the Ministry of Defense of Ukraine (UAH 101.3 billion), of which 60% was for salaries (UAH 60.4 billion). The second-largest expenditure item in the plan was programs of the Ministry of Social Policy, for which UAH 42.5 billion was planned in December (of which UAH 22.7 billion were to be allocated to the Pension Fund for pension payments and supplements). Expenditures of the Ministry of Internal Affairs in December were planned at UAH 37.6 billion, primarily for structures subordinate to the ministry:

- National Guard – UAH 14 billion;

- National Police – UAH 9.7 billion;

- State Border Service – UAH 9.2 billion;

- State Emergency Service – UAH 3.4 billion.

UAH 23.6 billion was planned for servicing the public debt – the average level. The Ministry of Health’s programs were planned to receive UAH 13.7 billion, of which UAH 11.9 billion were to be allocated to the state medical service guarantee program.

Overall, according to the planned figures, in December, about 53% of all budget expenditures were to be directed to the defense and security sector, 16.2% to social security, and another 9% to servicing the public debt.

(4) The actual deficit of the state budget in December amounted to UAH 285 billion, with the general fund at UAH 274.4 billion, which is 2.3 times higher than the planned figure of UAH 121.4 billion. The reason for the actual deficit exceeding the planned one is the record high expenditures of the state budget in December.

For the entire year of 2023, the state budget was executed with a deficit of UAH 1.33 trillion, with the general fund at UAH 1.36 trillion, which is 1.3 times less than the budgeted UAH 1.83 trillion. This figure was achieved over the entire period of 2023 due to the attraction of international financial aid in the form of grants amounting to UAH 424.8 billion.

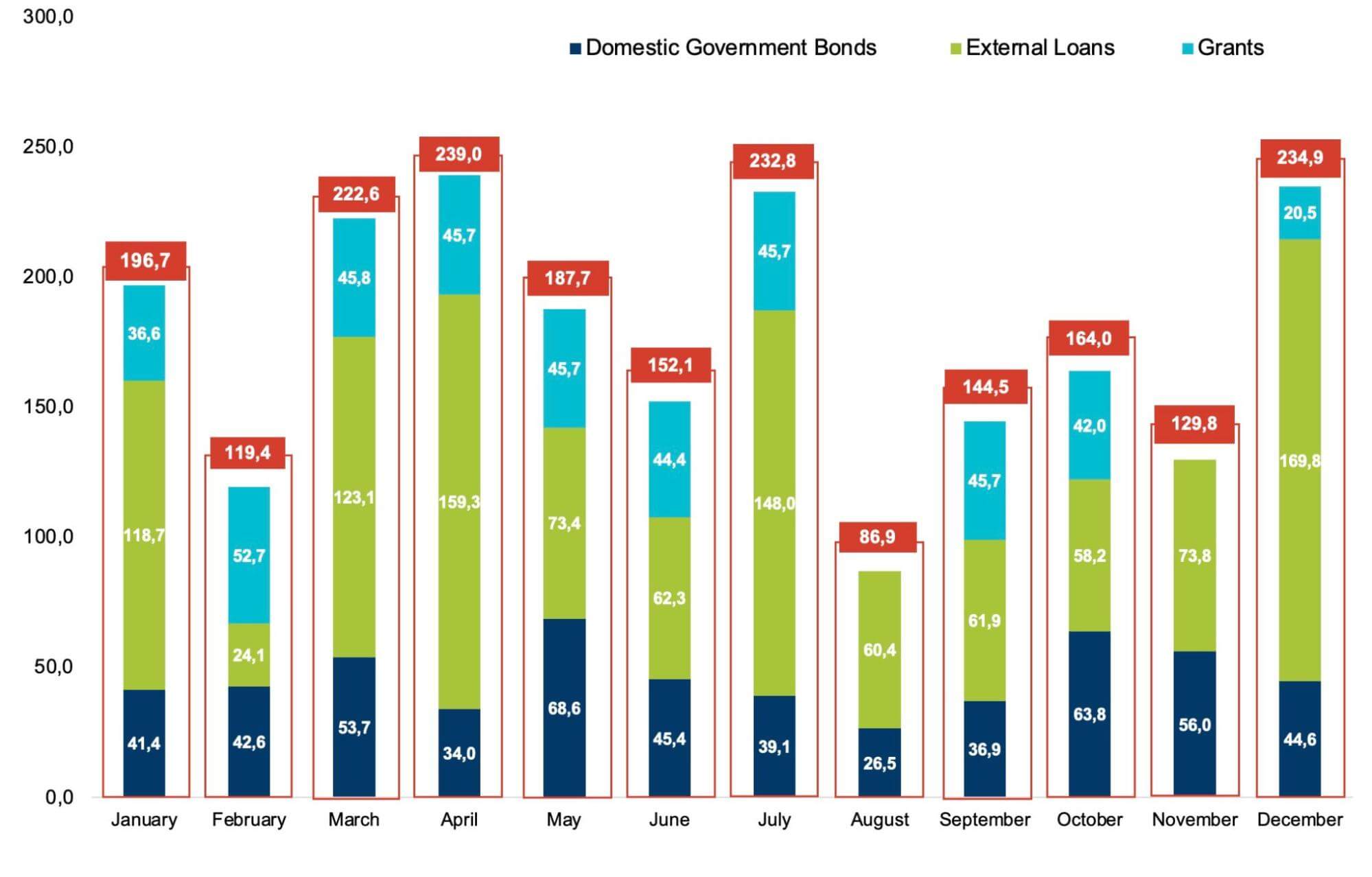

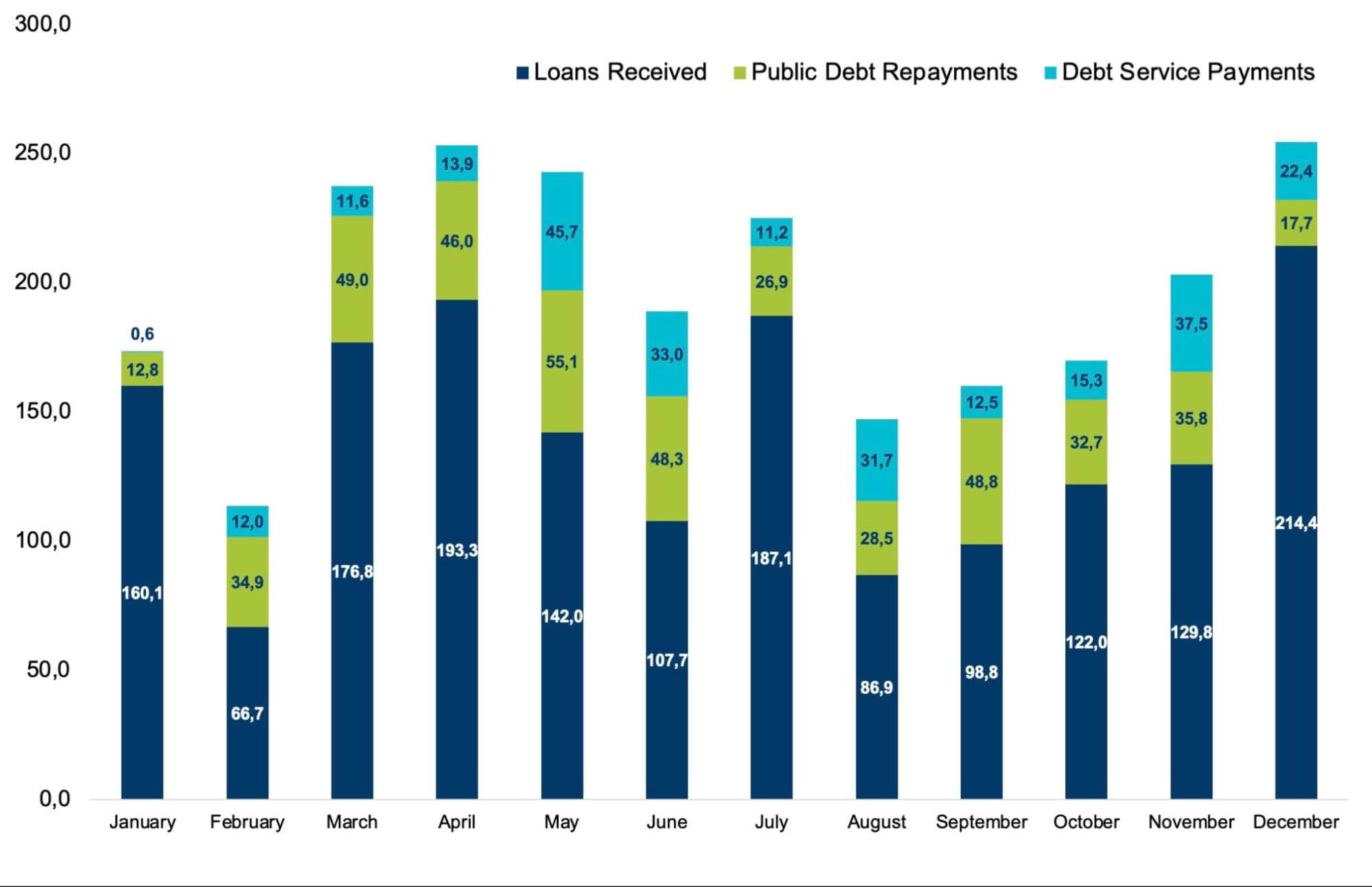

Figure 3. Budget financing in 2023, UAH billion

Source: Ministry of Finance of Ukraine

(5) In December, the state budget received USD 4.5 billion or UAH 169.8 billion in concessional loans. Among these was the eleventh and final tranche of macro-financial assistance from the EU for 2023, amounting to EUR 1.5 billion (UAH 61.6 billion). The funds were directed towards financing priority non-military expenditures of the state budget, supporting macroeconomic stability. Throughout 2023, the Ukrainian budget received the entire expected EU macro-financial assistance for the year, amounting to EUR 18 billion.

In December, USD 1.1 billion (UAH 40.8 billion) was received from the World Bank under guarantees from the Government of Japan. Additionally, in December, Japan provided a loan of USD 900 million (UAH 33.8 billion) as part of the “Investing in Social Protection for Inclusion, Resilience, and Efficiency (INSPIRE)” program. Following the second successful review of the Extended Fund Facility (EFF) program between Ukraine and the IMF, USD 900 million (UAH 33.3 billion) was received from the IMF. Furthermore, a loan of USD 8 million (UAH 0.3 billion) was received from the World Bank under the “Serving People, Improving Health” program.

(6) In addition to external financing, in December, the Ministry of Finance attracted UAH 44.6 billion from the placement of domestic government bonds, of which UAH 6.1 billion or 13.7% was from benchmark bonds and UAH 12.2 billion (USD 303 million and EUR 26.5 million) from bonds denominated in foreign currency. As noted by the Ministry of Finance, the funds raised from the placement of domestic government bonds in 2023 were fully sufficient to make payments for the redemption of domestic government bonds. Borrowing on the domestic debt market in 2023 exceeded domestic government bonds payments by UAH 204.1 billion, and in December, this excess amounted to UAH 39.1 billion. Overall, the rollover investment in domestic government bonds for the 12 months of 2023 is 150%, which is a fairly positive result of the government’s work in the domestic debt market.

(7) In December, internal and external borrowings reached UAH 214.4 billion, while UAH 40.1 billion was spent on debt repayment and servicing.

Over the 12 months of 2023, the lion’s share of expenditures on repayment and servicing was directed to the repayment and servicing of domestic debt – 83% or UAH 569.5 billion of all funds allocated for such needs, as for most of the external debt there was an agreement to postpone all payments.

Figure 4. Volume of borrowings, repayments and servicing of public debt of Ukraine in 2023, UAH billion

Source: Ministry of Finance of Ukraine

(8) Revenues of local budgets from payments administered by the State Tax Service amounted to UAH 33.4 billion. In December, the Government allocated an additional subsidy of UAH 1.3 billion to 235 local budgets for the exercise of local self-government authorities’ powers in the IV quarter of 2023, of which:

- UAH 1.14 billion to compensate 43 local communities adversely affected by the full-scale armed aggression of Russia,

- UAH 175 million to compensate 192 local budgets for under-receipt of Personal Income Tax (excluding military PIT) to ensure expenditures of territorial communities.

(9) In 2023, local budgets’ general funds (excluding inter-budgetary transfers) received UAH 441.9 billion (+11% compared to 2022). According to current data, the execution of the annual approved indicators of general fund revenues of local budgets amounted to 102.2% of the plan, including:

- Personal Income Tax – 99.2%;

- Single Tax – 106.7%;

- Land Fee – 106.4%;

- Real Estate Tax – 107.4%;

- Excise Tax – 108.4%;

- Corporate Profit Tax from private sector enterprises – 123.2%.

As of the end of 2023, 1545 local budgets were approved – 97% of their total number (93.6% on time). The most budgets were not approved in Poltava (8 budgets) and Zaporizhzhia regions (7 budgets).

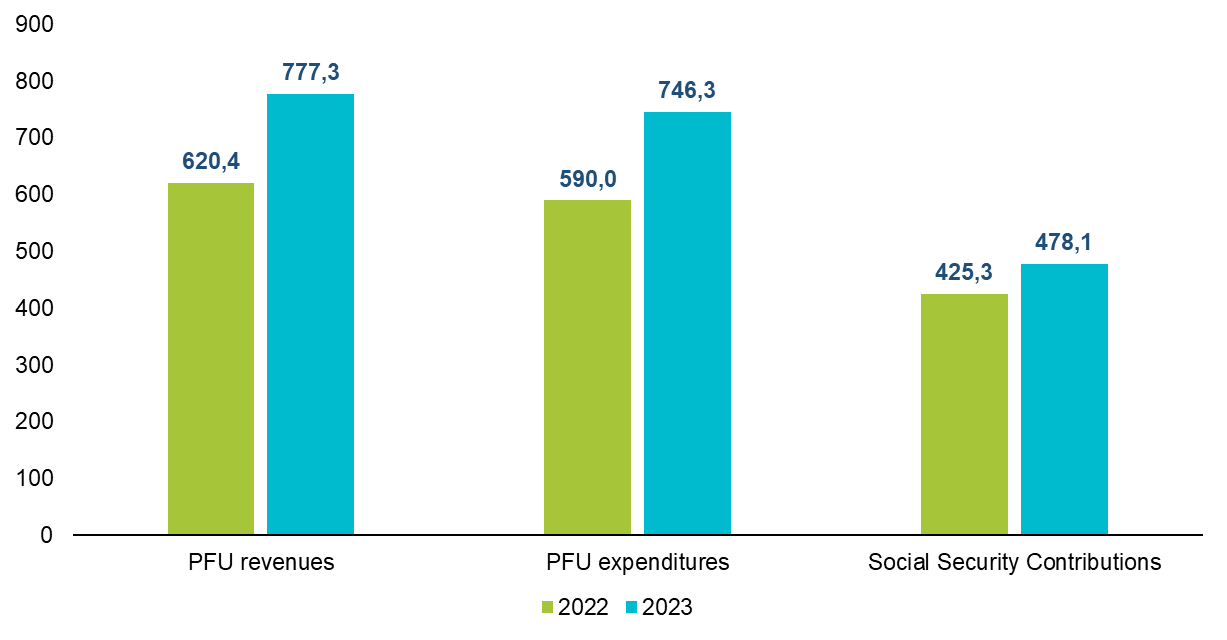

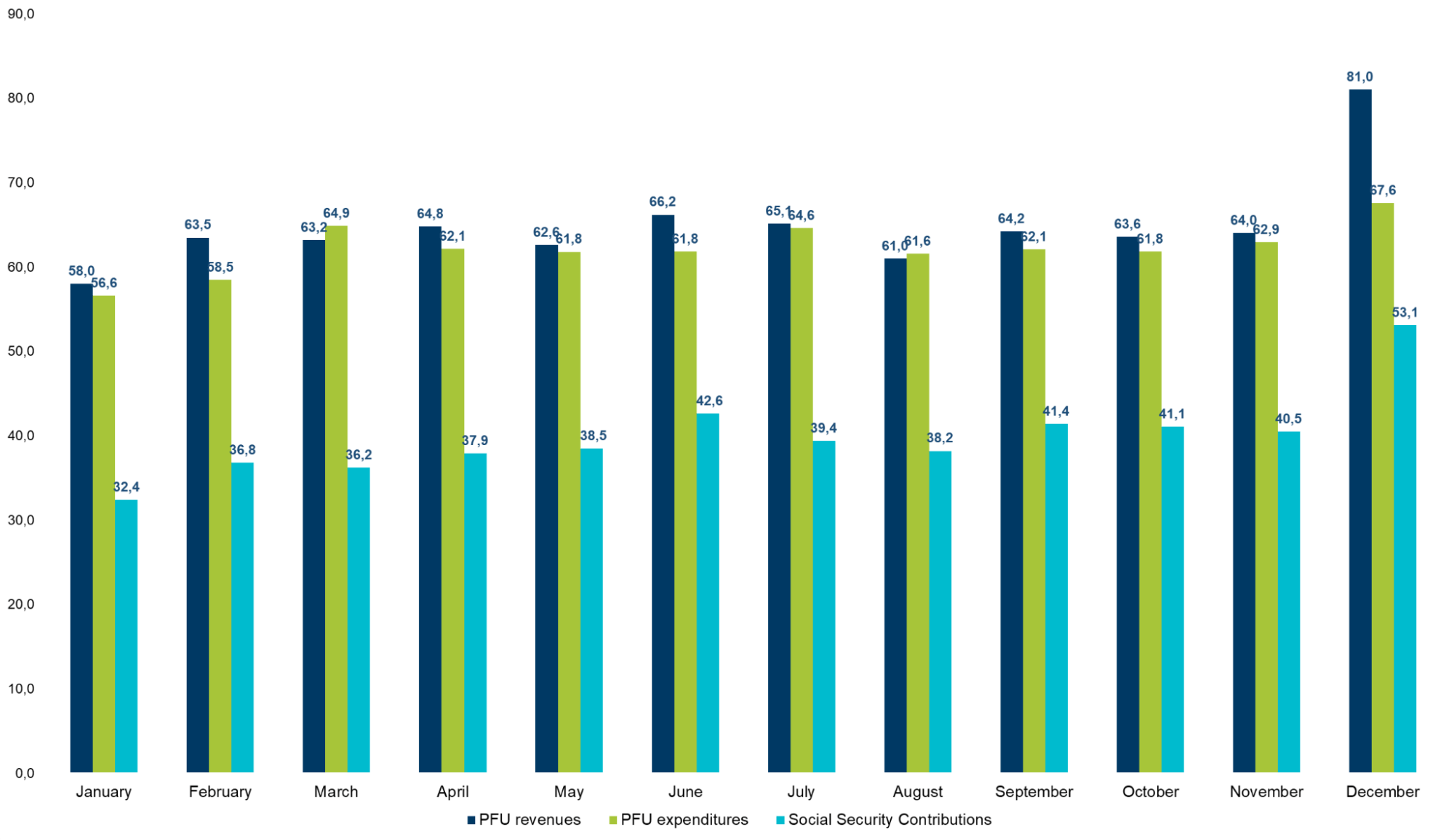

(10) Total revenues from Social Security Contributions (SSC) in 2023 increased by 12.4% or UAH 52.8 billion compared to 2022, amounting to UAH 478.1 billion (see Fig. 5). In December 2023, revenues from SSC were UAH 53.1 billion, which is UAH 3.4 billion or 6.4% more than in December 2022. The increase in SSC revenues in 2023 is associated with higher payments to military personnel and the gradual recovery of the economy.

(11) Revenues of the Pension Fund of Ukraine in 2023 increased by 25.3% or UAH 156.9 billion compared to 2022, reaching UAH 777.3 billion (see Fig. 5); in December, the Pension Fund’s revenues amounted to UAH 81 billion. The growth occurred both through an increase in the Fund’s own revenues from SSC and through the Fund’s authority in social insurance payments and subsidies and benefits for housing and utility services. The state budget directed 15.6% more to the Fund in 2023 than the previous year for pension and related payments, specifically UAH 249.4 billion, of which UAH 21.2 billion in December. Also, in 2023, the Pension Fund received UAH 35.5 billion from the state budget for subsidy payments and benefits for housing and utility services, and UAH 27.9 billion from SSC revenues for social insurance payments.

UAH 58 billion was allocated for pension financing in December 2023, which is UAH 6.6 billion or 12.8% more than in the same period last year. The Pension Fund’s total expenditures in 2023 were UAH 746.3 billion, which is UAH 156.2 billion or 26.5% more than the previous year (see Fig. 5).

At the end of 2023, the Pension Fund had a surplus of UAH 31 billion, which is 1.9% or UAH 563.3 million more than in 2022. The surplus of the Pension Fund was due to an increase in the Fund’s own revenues.

Figure 5. Revenues and expenditures of the Pension Fund of Ukraine, revenues of the Social Security Contributions in 2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Figure 6. Monthly dynamics of revenues and expenditures of the Pension Fund of Ukraine, revenues of the Social Security Contributions in January-December 2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Table 1. Plan and fact of the state budget (general fund) in 2023, UAH billion

| Indicators | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan-Dec | |||||||||||||

| Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | |

| Revenue, including | 69,6 | 104,4 | 77,0 | 132,2 | 101,8 | 152,2 | 112,4 | 162,8 | 125,3 | 184,0 | 84,1 | 133,7 | 89,4 | 136,7 | 124,7 | 124,7 | 99,7 | 144,1 | 94,9 | 139,4 | 129,3 | 121,7 | 142,2 | 127,1 | 1250,4 | 1663,0 |

| Personal income tax | 10,6 | 11,3 | 11,6 | 13,0 | 11,9 | 13,3 | 11,8 | 13,4 | 12,0 | 14,1 | 17,2 | 15,0 | 14,8 | 15,2 | 16,3 | 14,6 | 16,9 | 15,2 | 15,2 | 14,8 | 17,4 | 15,1 | 24,7 | 20,9 | 180,4 | 175,9 |

| Corporate income tax | 1,4 | 1,2 | 4,1 | 7,4 | 22,1 | 26,2 | 1,5 | 2,3 | 24,7 | 28,5 | 2,9 | 2,3 | 1,3 | 3,2 | 24,1 | 30,9 | 1,3 | 4,2 | 1,4 | 2,6 | 24,6 | 31,1 | 1,4 | 4,1 | 110,8 | 144,0 |

| Rent for the use of subsoil | 5,2 | 5,6 | 7,0 | 2,7 | 6,7 | 7,7 | 7,1 | 4,9 | 8,3 | 4,5 | 7,1 | 4,5 | 7,0 | 5,4 | 8,7 | 4,2 | 7,7 | 6,7 | 2,5 | 2,4 | 10,7 | 4,5 | 15,2 | 3,0 | 93,2 | 56,1 |

| Excise tax | 4,7 | 5,3 | 6,1 | 7,0 | 7,1 | 9,8 | 7,4 | 9,9 | 7,7 | 9,5 | 8,3 | 8,8 | 8,6 | 8,7 | 8,4 | 10,1 | 8,6 | 10,9 | 7,4 | 8,2 | 7,5 | 7,6 | 7,9 | 8,3 | 89,7 | 104,1 |

| Net VAT | 20,0 | 11,8 | 14,8 | 15,1 | 16,7 | 10,0 | 16,1 | 16,6 | 14,8 | 17,3 | 15,6 | 17,5 | 19,1 | 18,7 | 24,0 | 20,0 | 20,7 | 19,4 | 22,3 | 22,8 | 21,7 | 22,9 | 21,9 | 22,5 | 227,7 | 214,6 |

| Import VAT | 22,6 | 24,4 | 26,8 | 27,1 | 31,0 | 29,3 | 27,1 | 25,1 | 27,1 | 27,0 | 27,3 | 28,7 | 30,0 | 30,8 | 36,1 | 34,0 | 38,0 | 34,5 | 39,6 | 38,6 | 39,7 | 30,8 | 43,5 | 35,7 | 388,8 | 366,0 |

| Import and export duty | 1,7 | 2,0 | 2,2 | 2,3 | 2,4 | 2,7 | 2,0 | 2,2 | 2,1 | 2,5 | 2,0 | 2,6 | 2,3 | 2,4 | 2,5 | 2,8 | 2,5 | 2,8 | 2,7 | 2,9 | 2,5 | 2,2 | 2,7 | 3,2 | 27,6 | 30,6 |

| Expenditures | 227,7 | 183,6 | 245,6 | 226,7 | 246,1 | 225,2 | 220,2 | 229,7 | 282,7 | 277,7 | 303,9 | 264,7 | 251,0 | 231,9 | 279,8 | 248,2 | 255,2 | 230,2 | 220,3 | 228,1 | 366,7 | 286,3 | 262,7 | 397,7 | 3161,9 | 3030,0 |

| Deficit (-) / surplus (+)* | -156,6 | -78,9 | -165,7 | -93,2 | -130,5 | -72,6 | -102,7 | -65,6 | -152,6 | -91,6 | -215,2 | -130,8 | -152,8 | -94,9 | -150,7 | -122,2 | -126,9 | -85,6 | -123,4 | -87,7 | -236,2 | -162,5 | -121,4 | -274,4** | -1834,7 | -1360** |

| Sources of deficit financing | ||||||||||||||||||||||||||

| Net borrowings | 279,4 | 147,3 | 55,6 | 31,8 | 37,8 | 127,8 | 195,1 | 147,3 | 67,9 | 86,9 | 169,3 | 59,4 | 82,4 | 160,2 | 67,3 | 58,4 | 50,3 | 50 | 155,9 | 89,3 | 128,4 | 94 | 538,9 | 196,7 | 1828,3 | 1249,1 |

| Loans | 292,5 | 160,1 | 93,3 | 66,7 | 96,3 | 176,8 | 233,2 | 193,3 | 125 | 142 | 219,7 | 107,7 | 112,9 | 187,1 | 97,1 | 86,9 | 100,6 | 98,8 | 183,4 | 122 | 163,3 | 129,8 | 566,9 | 214,4 | 2284,2 | 1685,6 |

| Repayments | -13,1 | -12,8 | -37,7 | -34,9 | -58,5 | -49 | -38,1 | -46 | -57,1 | -55,1 | -50,4 | -48,3 | -30,5 | -26,9 | -29,8 | -28,5 | -50,3 | -48,8 | -27,5 | -32,7 | -34,9 | -35,8 | -28 | -17,7 | -455,9 | -436,5 |

* The size of the deficit is not equal to the arithmetic difference between revenues and expenditures since the size of the deficit is additionally affected by the volume of loans from the state budget and their repayment

** approximate value, as official detailed data will be available later

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 2. Main indicators of budget financing, UAH billion

| Indicators | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan-Dec | |

| Financing, including: | 160,1 | 66,7 | 176,8 | 193,3 | 142 | 107,7 | 187,1 | 86,9 | 98,8 | 122 | 129,8 | 214,4 | 1685,6 | |

| in % to the plan (for the entire period) | 54,7 | 71,5 | 183,5 | 82,9 | 113,6 | 49 | 165,7 | 89,5 | 98,2 | 66,5 | 79,5 | 37,8 | 73,8 | |

| From the placement of domestic government bonds (total), including: | 41,4 | 42,6 | 53,7 | 34 | 68,6 | 45,4 | 39,1 | 26,5 | 36,9 | 63,8 | 56,0 | 44,6 | 552,6 | |

| in UAH billion | 38,8 | 30,5 | 36,3 | 25,1 | 29,3 | 28,3 | 30,8 | 25,7 | 22,8 | 42,9 | 45,6 | 32,4 | 388,5 | |

| in foreign currency in UAH billion (USD million + EUR million) | ₴2,6

($40,2+€29,4) |

₴12,1

($268,5+€57,5) |

₴17,4

($476,4) |

₴8,9

($242,6) |

₴39,3

($616,4+€418) |

₴17,1

($319,7+€136) |

₴8,3

($227,3) |

₴0,8

(€20) |

₴14,1

($334,6+€48,4) |

₴20,9

($572,6) |

₴10,4

($286,9) |

₴12,2

($303 +$26,5) |

₴ 164,1

($3688,2 + €735,8) |

|

| From external sources, UAH billion | 118,7 | 24,1 | 123,1 | 159,3 | 73,4 | 62,3 | 148,0 | 60,4 | 61,9 | 58,2 | 73,8 | 169,8 | 1133 | |

| Public debt repayments, UAH billion | 12,8 | 34,9 | 49,0 | 46,0 | 55,1 | 48,3 | 26,9 | 28,5 | 48,8 | 32,7 | 35,8 | 17,7 | 436,5 | |

| In % to the plan for the full period | 97,7 | 92,6 | 83,8 | 120,7 | 96,5 | 95,8 | 88,2 | 95,6 | 97 | 118,9 | 102,6 | 63,2 | 95,7 | |

| Debt service payments | 0,6 | 12,0 | 11,6 | 13,9 | 45,7 | 33,0 | 11,2 | 31,7 | 12,5 | 15,3 | 37,5 | 22,4 | 247,4 | |

| In % to the plan for the full period | 28,6 | 114,3 | 78,4 | 101,5 | 90,3 | 84,0 | 151,4 | 101,9 | 91,9 | 340,0 | 69,2 | 94,9 | 93,2 | |

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 3. External financial resources* attracted in 2023

| Sources | Amount, UAH billion (EUR million; USD million; CAD million) |

| Loans from the Government of Canada | ₴64,2 (2400 канад. дол) |

| Programs of macro-financial assistance from the EU for 2023 | ₴714,9 (€18000) |

| IMF funds under the four-year Extended Fund Facility program | ₴164 ($4496) |

| Loan from the IBRD within the framework of the Fourth additional financing of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴18,3 ($499,3) |

| Loan from the IBRD within the framework of the Fifth additional financing of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴18,1 ($500) |

| Loan from the IBRD within the framework of the Sixth additional financing of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴37,5 ($1000) |

| IBRD Loan for Development and Recovery Policy | ₴54,9 ($1500) |

| Loan from the IBRD within the project “Investing in Social Protection for Inclusion, Resilience, and Efficiency (INSPIRE)” | ₴33,3 ($900) |

| IDA loans within the framework of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴16,1 (€404,3) |

| Loan from the IBRD within the project “Strengthening the Healthcare System and Saving Lives” | ₴1,8 (€47,0) |

| Loan from the IBRD within the project “Accelerating Investments in Ukraine’s Agriculture” | ₴4,8 ($132) |

| IBRD funds under the Second Additional Financing for COVID-19 Response | ₴1,3 ($35,0) |

| Loan from the IBRD within the project “Social Safety Nets Modernization Project” | ₴1,2 ($33,5) |

| Loan from the IBRD within the project “Additional Financing for the Health System Improvement Project” | ₴0,5 ($14) |

*excluding grants

Source: Ministry of Finance of Ukraine

Table 4. Monthly dynamics of state budget financing

| Indicators | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| Total borrowing, UAH billion | 160,1 | 66,7 | 176,8 | 193,3 | 142,0 | 107,7 | 187,1 | 86,9 | 98,8 | 122,0 | 129,8 | 214,4 |

| Total borrowed, % for January-December | 9,5 | 4,0 | 10,5 | 11,5 | 8,4 | 6,4 | 11,1 | 5,2 | 5,9 | 7,2 | 7,7 | 12,7 |

| From the placement of domestic government bonds, % for January-December | 7,5 | 7,7 | 9,7 | 6,2 | 12,4 | 8,2 | 7,1 | 4,8 | 6,7 | 11,5 | 10,1 | 8,1 |

| Borrowed from external sources, % for January-December | 10,5 | 2,1 | 10,9 | 14,1 | 6,5 | 5,5 | 13,1 | 5,3 | 5,5 | 5,1 | 6,5 | 15,0 |

| Debt repayment payments, % for January-December | 2,9 | 8,0 | 11,2 | 10,5 | 12,6 | 11,1 | 6,2 | 6,5 | 11,2 | 7,5 | 8,2 | 4,1 |

| Servicing payments, % for January-December | 0,2 | 4,9 | 4,7 | 5,6 | 18,5 | 13,3 | 4,5 | 12,8 | 5,1 | 6,2 | 15,2 | 9,1 |

| Difference between borrowed financial resources and expenses for debt repayment and servicing, UAH billion | 146,7 | 19,8 | 116,2 | 133,4 | 41,2 | 26,4 | 149,0 | 26,7 | 37,5 | 74,0 | 56,5 | 174,3 |

Source: Ministry of Finance of Ukraine, Center`s calculations

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations