What happened to the budget in February? Is the revenue plan meeting the deficit financing target? What are the expected changes in the public finance system and potential risks? Discover these and other details of the budget’s implementation in the Budget Barometer for February 2023.

What was achieved?

- In February, the Government managed to fulfill its revenue plan by surpassing the plan for most taxes. With the grant received from the USA, the total revenue amounted to UAH 132.2 billion, which is 72% more than the planned UAH 77.0 billion. The budget was implemented with a deficit that was half less than the planned amount due to lower-than-planned expenditures.

- Negotiations with significant donors resulted in a significant reduction of the risk of underfunding the annual deficit of the state budget. During the gathering of finance ministers from the G7 countries, it was agreed to provide Ukraine with USD 39 billion in 2023, which aligns with the anticipated budget deficit level. Furthermore, the latest round of negotiations with the IMF ended positively, and a new multi-year major program with a total volume exceeding USD 15 billion is anticipated. The program will comprise of two parts: immediate financial support and backing for structural reforms aimed at contributing to the country’s recovery.

What wasn’t achieved?

- In February, the planned expenditures could not be fully financed once again, with cash expenditures totaling UAH 226.7 billion, a 7.7% shortfall from the planned UAH 245.6 billion.

- The voluntary asset declaration campaign (tax amnesty) concluded this month with less than 1% of the planned amount being collected. Nonetheless, UAH 2.6 billion was declared in February, representing roughly 30% of the total amount declared.

- Budgetary discipline continues to fall short of the necessary standards. Out of 434 budget program passports, only 302 were developed and approved by the Ministry of Finance on time, representing a compliance rate of just 70% among key spending units. Adhering to the principles of the program-target method is a crucial precondition for the effective execution of the budget and serves as a demonstrative indicator of the budget system’s development to international partners.

What’s next?

- Ensuring the sustainability of public finances will heavily depend on the anticipated macroeconomic assistance and its consistent receipt. During the Government’s meeting on February 10, a resolution was reached to acquire a grant worth almost USD 2.7 billion for budget support from the Multi-Donor Trust Fund, with USD 2.5 billion originating from the United States, and the remainder from Germany, Spain, Finland, Ireland, Switzerland, Belgium, and Iceland.

- The first changes to the State Budget 2023 have been made. Funding has been allocated for two recently established institutions, the Ministry for the Restoration of Ukraine and the State Reconstruction Agency. Additionally, the financing for the Fund for the Elimination of the Consequences of Armed Aggression program within the State Budget has been transferred from the Ministry of Finance of Ukraine to the Ministry for the Restoration of Ukraine. The funding for this program will be provided from a special fund with a total value of UAH 52.5 billion. In addition, the changes include:

- increase in budget expenditures by UAH 8.3 billion (a large part of expenditures are planned to be directed to grants for business and modernization of health care facilities);

- increase of budget revenues from the special fund by UAH 446 million due to the receipt of grants (+ UAH 80 million) and aid programs from the EU, governments of foreign states, international organizations, and donor institutions (+ UAH 366 million);

- increase in repayment of loans by UAH 3 billion;

- increase in the budget deficit by UAH 3.8 billion, which is planned to be financed at the expense of external borrowings (and, accordingly, an increase in the state debt by the same amount).

- In the first reading, the draft law was adopted, which proposes to abolish the simplified system of taxation at the rate of 2%, to restore the mandatory payment of a single tax for taxpayers of groups I and II, to return tax audits, and responsibility for non-use of registrars of settlement operations and non-payment of the social security contributions (SSC). According to the draft law, these changes should take effect after the end of the martial law period but no later than July 1, 2023. The government’s submission of this draft law to the Parliament was one of the structural beacons of the current IMF Program.

- The reduction of certain “combat” surcharges will result in lower personal income tax revenues for all levels of the budget. Previously, all employees of the Defense Forces (including non-military personnel such as police) received additional payments. However, the proposed changes now limit the additional payments to military personnel who are engaged in combat tasks by orders. Ultimately, the amount of payments to military personnel will depend on the level of hostilities.

Key risks:

- The escalation of hostilities, repeated large-scale offensives by russia, attacks on critical infrastructure, and other war-related risks. The level of economic activity and, consequently, the execution of the state budget will depend on the intensity of the war, including the level of damage to infrastructure and businesses, as well as its duration (medium risk).

- Tax revenues may fall below the planned levels, depending on the exchange rate. The strengthening of the hryvnia on the cash market, due to the stabilization of external support, improvement of logistics, and the beginning of sowing season, among other factors, could maintain the official exchange rate at its current level, which is lower than that set in the state budget (average 42.2, and at the end of the year 45.8) (medium risk).

- The growth of tax debt is expected to persist due to the challenges of doing business in the context of the ongoing war. As of February 1, 2023, the debt amount reached UAH 146.6 billion (Fig. 1). This amount is nearly equivalent to the tax revenues collected for the general fund of the state budget for January and February 2023. However, a substantial portion of this debt is considered “dead” and dates back to previous years, making it unlikely to be recovered (medium risk).

Figure 1. Dynamics of tax debt for 2021-2023, UAH billion

Source: State Tax Service of Ukraine

Details:

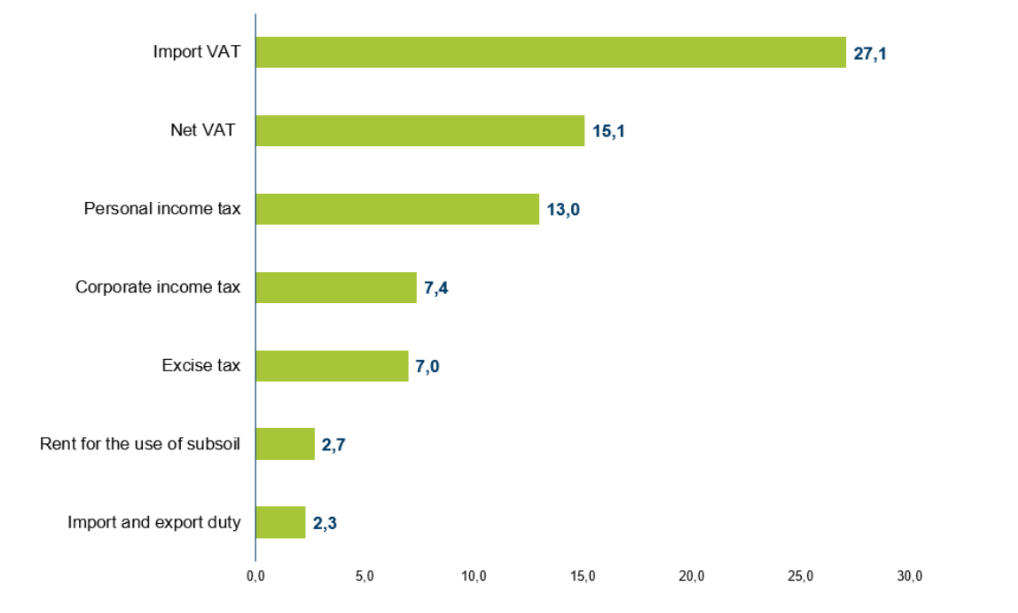

(1) In February, the general fund of the state budget exceeded its planned revenue by receiving UAH 132.2 billion (UAH 77.0 billion was planned), of which UAH 51.4 billion was from a grant received from the USA. The Ministry of Finance had planned tax revenues to be at UAH 73.5 billion, but the state budget was actually replenished by UAH 74.6 billion solely from main tax revenues, as the revenue plan for all taxes, except rent payments, was overachieved (Fig. 2).

Figure 2. Main tax revenues to the general fund of the state budget in February 2023, UAH billion

Source: Ministry of Finance of Ukraine

The most noteworthy revenue surplus was observed in the corporate income tax, which exceeded planned figures by 78.7%. Specifically, the general fund of the state budget received UAH 7.4 billion instead of the planned UAH 4.14 billion. This remarkable increase could potentially be attributed to advanced payments of this tax.

Furthermore, there was also a substantial overpayment of excise tax, which exceeded the planned amount by 15%. Instead of UAH 6.1 billion, UAH 7 billion was collected. This could be attributed to the possibility of a part of the tax being prepaid, as the sum of prepaid excise tax payments as of the beginning of the year was over UAH 7 billion. The revenue generated from personal income tax amounted to UAH 13 billion, surpassing the planned indicators by 12%. This increase is conventionally related to payments to military personnel.

In February, the rent payment plan, totaling UAH 4.3 billion, equivalent to 61.6%, was not met. The non-payment was caused by individual payers (JSC Ukrgazvydobuvannya). However, these funds are expected to be received in the upcoming months.

(2) The voluntary declaration of assets campaign, also known as the tax amnesty, has concluded. Initially, it was anticipated that the budget would receive approximately USD 1 billion in revenue (based on approximately USD 20 billion of amnesty income). However, only 547.5 million hryvnias, which is less than 15 million US dollars, was received by the state. This result is less than 1% of the projected amount. One of the key reasons for such a low outcome is the lack of trust in regulatory bodies. Additionally, there have been alternative methods to legitimize income, such as registering as a sole proprietor and paying a 2% tax.

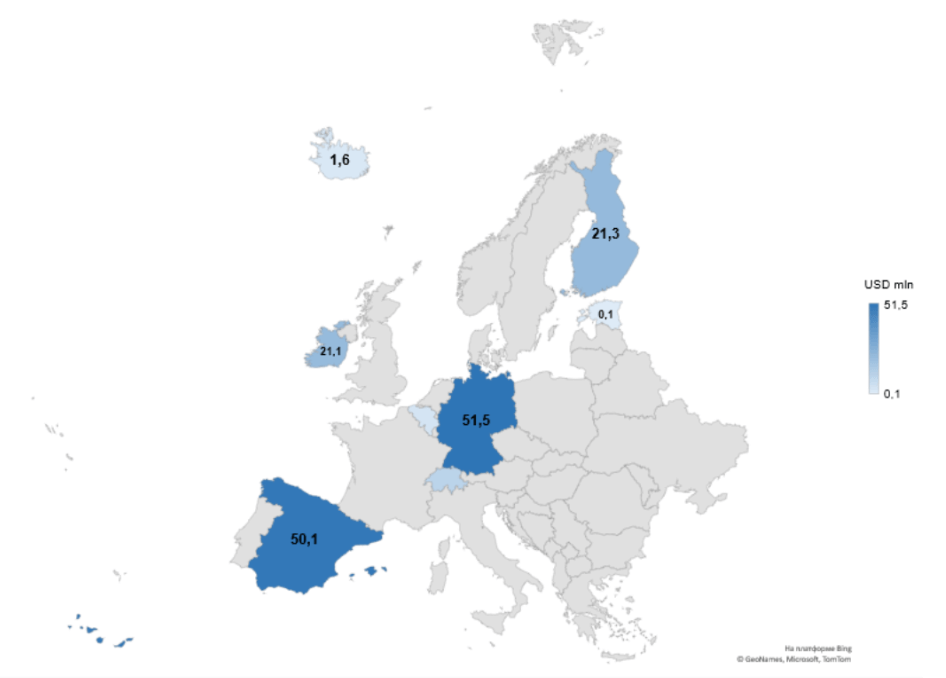

(3) In February, Ukraine obtained USD 1.44 billion, equivalent to UAH 51.4 billion, in grants to the general fund of the state budget. Specifically, the United States provided USD 1.25 billion (UAH 45.7 billion) in grant aid through the Multi-Donor Trust Fund of the World Bank. This represents the initial portion of USD 9.9 billion in total assistance to be provided in 2023. Moreover, using the same mechanism, funds were also received from European countries (Fig. 3).

Figure 3. Grants provided by European countries in February 2023, USD million

Source: Ministry of Finance of Ukraine

(4) The expenditures of the state budget reached UAH 252.9 billion in February, with UAH 226.7 billion attributed to the general fund, accounting for 92.3% of the planed amount for the reporting period. The general fund expenditure for February was estimated at UAH 245.6 billion. The most crucial expense was the financing of programs by the Ministry of Defense of Ukraine, amounting to UAH 117 billion, of which 48.4% constituted wages (UAH 56.6 billion). The programs of the Ministry of Social Policy were allocated UAH 39.5 billion, of which UAH 22.7 billion (57.5%) was set for transfers to the Pension Fund for pensioners and payment of housing, communal benefits, and subsidies. The Ministry of Internal Affairs programs received UAH 30.3 billion, with UAH 5.6 billion for the State Border Service, UAH 10.9 billion for the National Guard, UAH 3.7 billion for the State Emergency Service, and UAH 9.2 billion for the National Police. As per the planned indicators, 60% of all expenses were targeted towards the defense and security sector, and more than 15% were assigned to social policy programs.

(5) The actual budget deficit in February was UAH 88.8 billion (for January-February, it was UAH 161.1 billion). However, the deficit of the general fund was UAH 93.2 billion, which was 1.8 times lower than the planned indicator of UAH 168 billion. In the first two months of the year, the general fund of the state budget had a deficit of UAH 172.1 billion, which was only half of the planned amount of UAH 326.1 billion. This was partly due to the receipt of grants totaling USD 1.44 billion or UAH 51.4 billion, which accounted for 39% of the general fund’s revenues in February. Additionally, the underfunding of expenditures by UAH 18.9 billion or 7.7% of the planned also contributed to the lower deficit.

(6) During February, the state budget received concessional loans totaling UAH 24.1 billion (equivalent to USD 659 million). Of this amount, USD 498 million (UAH 18.2 billion) came from Great Britain, while the World Bank contributed USD 161 million (UAH 5.9 billion).

In February, representatives from the Ministry of Finance and the National Bank of Ukraine (NBU), along with experts from the IMF, reached an agreement to revise the Monitoring Program, with the aim of involving the Fund’s Board of Directors. This development paves the way for a comprehensive program with the IMF, which is expected to provide USD 15 billion of multi-year financial aid to Ukraine, as well as support for structural reforms that can help the country’s economic recovery. According to Minister of Finance Sergii Marchenko, the state budget currently requires USD 10 billion in funding to cover the deficit for 2023, and the majority of these needs will be met through the new program with the IMF.

(7) In addition to external financing, in February, the Ministry of Finance raised UAH 42.6 billion from the sale of domestic government bonds of Ukraine, slightly more than the previous month’s UAH 41.4 billion. The maximum placement rate remained at 19.75%, as in January. The trend of raising significant sums from government bond sales continued due to the NBU allowing commercial banks to cover up to 50% of required reserves with benchmark government bonds. Out of the UAH 42.6 billion raised, UAH 20.4 billion came from domestic government bonds. February saw a greater attraction of funds in foreign currency compared to January, with UAH 12.1 billion raised versus UAH 2.6 billion in January, likely due to a higher offer of foreign currency-denominated securities. The government raised UAH 22.3 billion more than bond payments in February, with no emission conducted, and no direct financing from the NBU planned for this year.

(8) Overall, in February, the amount of internal and external borrowings exceeded the amount for repayment and service of Ukraine’s state debt by UAH 19.8 billion. In comparison, this surplus was UAH 146.7 billion in January. The reason for this change is that in February, UAH 93.4 billion less was raised than in January, while expenses for debt repayment and servicing were UAH 33.5 billion higher.

(9) In February 2023, local budget revenues amounted to UAH 34.5 billion, representing an increase of UAH 0.7 billion or 2% compared to February 2022. Local budgets received UAH 66.5 billion in the first two months of the year, which is UAH 5.9 billion or 9.8% more than in January-February 2022. The growth in income was supported by higher personal income tax revenues, primarily from military personnel, which offset lower revenues to budgets in communities directly affected by aggression.

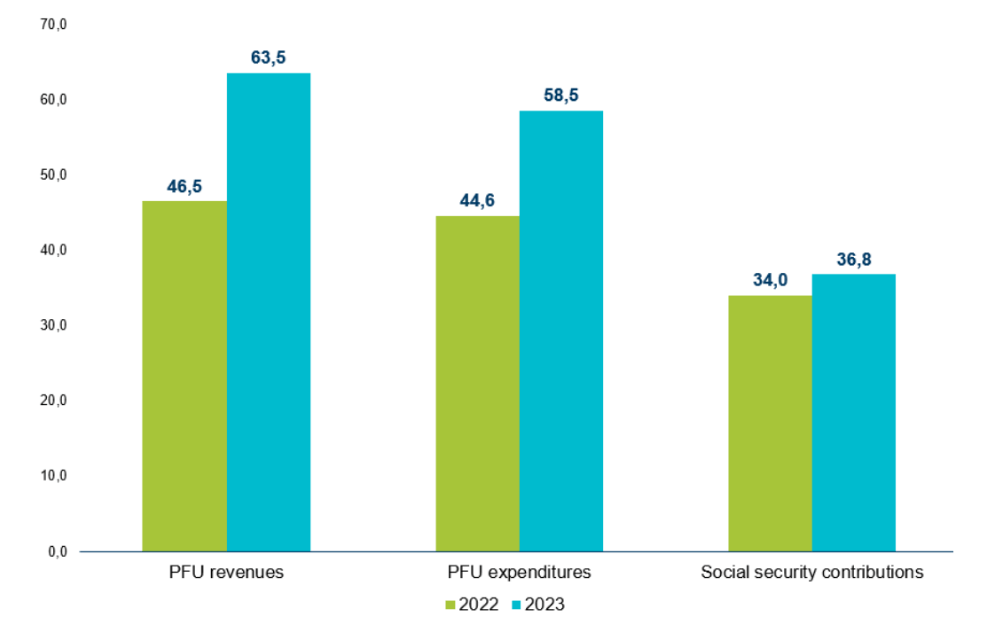

(10) In February of this year, the total amount of social security contributions (SSC) received increased by UAH 2.8 billion, or 8.2%, compared to the same period last year, reaching UAH 36.8 billion (Fig. 4). The increase is primarily attributable to contributions paid by military personnel. The growth of SSC is also supported by an increase in the minimum wage to UAH 6,700, effective from January 2023. Currently, individual entrepreneurs are not required to pay SSC during martial law, although not all individuals take advantage of this right. However, this obligation is expected to be reinstated in the second half of 2023.

(11) In February 2023, the Pension Fund’s revenue grew by UAH 17 billion (or 36.6%) compared to the same period in 2022, reaching UAH 63.5 billion. The growth was attributed to an increase in PFU’s revenue from SSC and the new powers granted to the fund for payment of housing and communal subsidies and social insurance benefits. Specifically, the PFU received UAH 5.2 billion from the state budget for paying subsidies and benefits for housing and communal services and UAH 2.1 billion for social insurance payments. The state budget also allocated UAH 20.7 billion to the Fund for financing pensions and related payments, which is 41.8% more than the previous year. In February 2023, the Pension Fund disbursed UAH 51 billion for pension payments, which is 14.3% higher than the same period in the previous year (Fig. 4).

Figure 4. Revenues and expenditures of the Pension Fund of Ukraine and the SSC in February 2022-2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Table 1. Plan and fact of the state budget (general fund) in 2023, UAH billion

| Indicators | January | February | ||

| Plan | Fact | Plan | Fact | |

| Revenue, including | 69,6 | 104,4 | 77,0 | 132,2 |

| Personal income tax | 10,6 | 11,3 | 11,6 | 13,0 |

| Corporate income tax | 1,4 | 1,2 | 4,1 | 7,4 |

| Rent for the use of subsoil | 5,2 | 5,6 | 7,0 | 2,7 |

| Excise tax | 4,7 | 5,3 | 6,1 | 7,0 |

| Net VAT | 20,0 | 11,8 | 14,8 | 15,1 |

| Import VAT | 22,6 | 24,4 | 26,8 | 27,1 |

| Import and export duty | 1,7 | 2,0 | 2,2 | 2,3 |

| Expenditures | 227,7 | 183,6 | 245,6 | 226,7 |

| Deficit (-) / surplus (+)* | -158,6 | -78,9 | -168,0 | -93,2 |

| Sources of deficit financing | ||||

| Net borrowings | 279,4 | 147,3 | 55,6 | 31,8 |

| Loans | 292,5 | 160,1 | 93,3 | 66,7 |

| Repayments | -13,1 | -12,8 | -37,7 | -34,9 |

* The size of the deficit is not equal to the arithmetic difference between revenues and expenditures since the size of the deficit is additionally affected by the volume of loans from the state budget and their repayment

Source: Ministry of Finance of Ukraine

Table 2. Main indicators of budget financing, UAH billion

| Indicators | January | February | Cumulative (Jan-Feb) | |

| Financing, including | 160,1 | 66,7 | 226,8 | |

| in % to the plan (for the entire period) | 54,7 | 71,5 | 58,8 | |

| From the placement of domestic government bonds (total), including | 41,4 | 42,6 | 84,0 | |

| in UAH | 38,8 | 30,5 | 69,3 | |

| in foreign currency in UAH billion (USD million + EUR million) | ₴2,6

($40,2+€29,4) |

₴12,1

($268,5+€57,5) |

₴14,7

($308,7+€86,9) |

|

| From external sources | 118,7 | 24,1 | 142,8 | |

| Public debt repayments | 12,8 | 34,9 | 47,7 | |

| In % to the plan for the full period | 97,7 | 92,6 | 93,9 | |

| Debt service payments | 0,6 | 12,0 | 12,6 | |

| In % to the plan for the full period | 28,6 | 114,3 | 100,0 | |

Source: Ministry of Finance of Ukraine

Table 3. External financial resources* attracted in January-February

| Resources | Amount

(UAH billion; EUR million; USD million) |

| Macro-Financial Assistance in accordance with the Memorandum of Understanding between Ukraine and the EU | ₴118,7

(€3000) |

| Loan from the IBRD within the framework of the Fourth additional financing of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴18,2

($498) |

| IDA loans within the framework of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴5,9

(€150) |

*excluding grants

Source: Ministry of Finance of Ukraine

Table 4. Monthly dynamics of state budget financing

| Indicators | January | February |

| Total borrowing amount (in billions of UAH) | 160,1 | 66,7 |

| Total borrowed at % for January-February | 70,6 | 29,4 |

| From the placement of domestic government bonds at % for January-February | 49,3 | 50,7 |

| Borrowed from external sources at % for January-February | 83,1 | 16,9 |

| Debt repayment payments at % for January-February | 26,8 | 73,2 |

| Servicing payments at % for January-February | 4,8 | 95,2 |

| Difference between borrowed financial resources and expenses for debt repayment and servicing (in billions of UAH) | 146,7 | 19,8 |

Source: Ministry of Finance of Ukraine

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations