What happened to the Ukrainian budget in January? How did 2023 begin in the realm of public finance? What was the role of international aid, both refundable and non-refundable? How much were domestic tax revenues, and how much was received in customs payments? Discover these and other details of the budget’s implementation in the Budget Barometer for January 2023.

What was achieved?

- In January, the government exceeded the revenue plan by 50% – revenues amounted to UAH 104.4 billion against the planned UAH 69.6 billion due to receiving a grant from the USA.

- It was possible to fulfill the payments administered by the State Customs Service (SCS): UAH 31.5 billion of customs payments were transferred against the planned UAH 28 billion (over-execution by 12.6%). For comparison: in January 2022, the SCS exceeded the revenue plan by 19.8% (UAH 37.2 billion was received against the planned UAH 31 billion). January’ revenues have been exceeded for the third year in a row.

- The deficit of the state budget’s general fund amounted to UAH 78.9 billion or 49.7% of the plan since part of the financing, precisely USD 1 billion, was received as a grant, not a loan. In January, the budget received a loan for UAH 118.7 billion (EUR 3 billion) of macro-financial assistance from the European Union. Funds were raised on very favourable terms – the repayment period is 35 years, and the European Union will pay interest and other payments related to debt service if Ukraine implements the promised reforms and reports on it quarterly.

- In January, the government borrowed UAH 146.7 billion more than it spent on repaying and servicing Ukraine’s public debt. At the same time, only 27.2% of the planned amount was spent on dept servicing. The reason for this may be the agreement reached between the governments of Ukraine and Japan to postpone payments on debt obligations of USD 50 million until 2027-2031.

What wasn’t achieved?

- In January, it failed to finance all the planned expenditures – cash expenditures amounted to UAH 193.7 billion (including the general fund – UAH 183.6 billion against the planned UAH 227.7 billion, a shortfall of 19.4%).

- The volume of loans involved is only 54.7% of the planned amount, or UAH 160.1 billion, from the planned UAH 292.5 billion. The government attracted the entire planned amount from the sale of domestic government bonds of Ukraine (UAH 41.4 billion). But UAH 118.7 billion (the mentioned EUR 3 billion from the EU) were attracted from external sources, compared to the planned UAH 251.1 billion.

What’s next?

- In 2023, financial support from foreign countries will continue to arrive (agreement on EUR 18 billion from the EU and USD 10 billion from the USA). The government is also working on the launch of a full-fledged cooperation program with the IMF (Upper-Credit Tranche), which involves attracting financing for budget needs. The total volume of the program may reach USD 16 billion, with a receipt of USD 5-7 billion already in 2023. Also, according to the results of the Ukraine-EU Summit, our country received a clear signal about financial support from the EU countries according to the principle “for as long as it takes”. This allows to assume a stable inflow of financial resources from our allies throughout 2023. These funds will contribute to the fiscal stability of Ukraine.

- The European Union’ integration vector of the development of Ukraine will determine the parameters of future tax reform. Presumably, the main innovations relate to the field of tax administration (in particular, a technical mission of the Tax and Budget Department of the IMF has worked with the State Tax Service of Ukraine on issues of tax policy and tax administration), there is a need to stabilise and increase tax revenues, but an increase in tax rates is unlikely.

Key risks:

- There are tensions over the possibility of another large-scale russian offensive, attacks on critical infrastructure, and other risks associated with war. Economic activity and, as a result, the level of implementation of the state budget will depend on the intensity of the war (including the level of damage to infrastructure and business) and its duration (high risk).

- A slowdown in inflation to a lower level than in the calculations of the state budget may lead to a decrease in revenues. The National Bank of Ukraine expects inflation to slow to 18.7% in 2023 (with the budgeted 28.4% on average until the previous year) (medium risk).

Details:

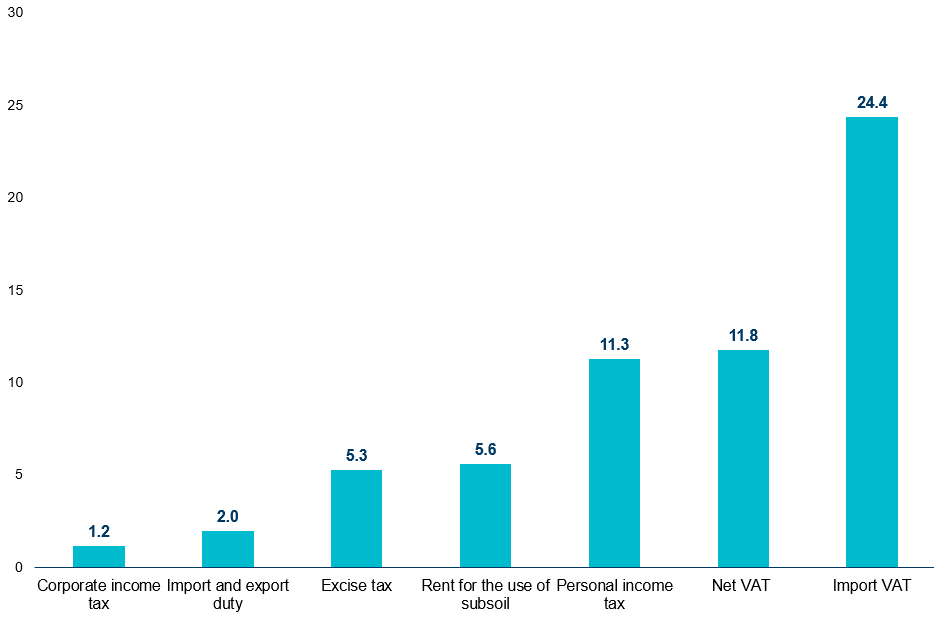

(1) In January, the general fund of state budget received UAH 104.4 billion (UAH 69.6 billion was planned) since a grant of UAH 36.6 billion was received from the USA and included in the revenues. According to the Ministry of Finance’ monthly plan, tax revenues were expected at UAH 66.5 billion, and the state budget was replenished by UAH 61.6 billion based on the main tax revenues alone (Fig.1).

Figure 1. Main tax revenues to the state budget’s general fund in January 2023, UAH billion

Source: Ministry of Finance of Ukraine

There was an overpayment of some tax revenues. In particular, the largest overachievement of the revenue was due to the following taxes:

- “imported” VAT (+ UAH 1.8 billion or 8% above the plan), which may be due to the inaccuracy of revenue forecasts,

- personal income tax (+ UAH 0.7 billion or 6.6%) due to the maintenance of military personnel, the number of which may be higher than what was included in the calculations,

- excise tax (+ UAH 0.6 billion or 12.8%) due to a change in the size of excise tax rates (specific excise tax rates and the minimum excise tax obligation for payment of excise tax on tobacco products increased by 20%, as well as the increase of excise tax on liquids used in e-cigarettes. Although the increase occurred in January, taxpayers often react to such legislative changes and buy part of the excise tax stamps in advance).

There was also a significant shortfall in net VAT by UAH 8.2 billion or 41% of the planned UAH 20 billion, probably related to the decline in consumption. At the same time, there was a significant VAT refund of UAH 19.3 billion, including for last year’s transactions (the balance of the amounts declared for tax refund at the beginning of 2023 amounted to UAH 40.1 billion).

In January, the rent revenue plan exceeded UAH 0.4 billion or 7.7%, with most of the revenues coming from natural gas production. The Government also allowed Naftogaz to attract a grant from the EBRD (EUR 189 million) for the purchase of additional gas (there are 11.1 billion cubic meters of natural gas in storage at the level of January 2022), which can further stimulate gas production companies to increase production.

(2) In January, Ukraine received USD 1 billion (UAH 36.6 billion) of grant aid from the USA through the World Bank Trust Fund. This is the last tranche of the USD 4.5 billion package. The other USD 3.5 billion arrived in 2022. In addition, in 2023, Ukraine expects USD 9.9 billion in grant aid from the USA.

(3) Expenditures of the state budget in January amounted to UAH 193.7 billion (including the general fund – UAH 183.6 billion), or 80.6% of the monthly plan. In January, expenditures of the general fund of the state budget were planned as UAH 227.7 billion, and the biggest part was the financing of the Ministry of Defense (UAH 115 billion), of which 54.7% was paid for labor (UAH 62.9 billion). It was planned to allocate UAH 39.4 billion to the Ministry of Social Policy (of which UAH 22.7 billion, or 58.1%, was transferred to the Pension Fund of Ukraine for pensioners (UAH 20.7 billion) and the payment of utilities benefits and subsidies), and for the Ministry of Internal Affairs – UAH 28.9 billion. In January, it was revealed that the budget program under which assistance payments are made to internally displaced persons (IDPs) is underfunded. Therefore, about 400,000 IDPs did not receive assistance on time. To solve the problem, the amount of payments for January was increased for February by almost UAH 1.3 billion.

(4) The actual deficit of the state budget in January amounted to UAH 72.3 billion, including the general fund – UAH 78.9 billion, which is twice less than the monthly plan – UAH 158.6 billion. The deficit turned out to be smaller than planned, not only due to lower-than-planned expenditures but also due to the receipt of USD 1 billion in the form of a grant from the USA, which is counted as revenue.

(5) In January, the state budget received a loan of UAH 118.7 billion (EUR 3 billion) within the scope of the macro-financial assistance program from the European Union. The Memorandum of Understanding between Ukraine and the EU provided the aid, dated January 16, 2023. The total amount from the EU will be EUR 18 billion during 2023. Within the framework of the Memorandum, Ukraine undertook several obligations, in case of fulfillment of which, the EU will pay interest and the remaining payments for debt service. In particular, Ukraine has to return to the pre-war model of the tax system – to gradually cancel the extraordinary measures in taxation adopted during the war.

(6) in January, in addition to external financing, the Ministry of Finance of Ukraine attracted UAH 41.4 billion from placing government bonds. All funds were obtained from the sale of bonds at auctions. It is worth reminding that in 2022, in addition to raising funds from the sale of government bonds on the free debt market, the National Bank of Ukraine carried out an emission by buying war bonds of UAH 400 billion. In the current year, according to the state budget plan, no emissions are foreseen, and according to government officials, the state will make every effort to avoid emission in 2023. Therefore, the National Bank of Ukraine did not buy war bonds in January.

In January, it is important that the bonds were sold at a record high yield – the highest set rate for government bonds with a term of 840 days was 19.75%. This is 0.25 per cent above the maximum rate for government bonds sold at the last auction in December 2022. An increase in yield can makegovernment bonds more attractive to investors. Additional demand for separate government bondss issues due to changes in the NBU’s requirements for mandatory reserving by commercial banks, which were allowed to partially use benchmark of government bonds for these purposes.

(7) In January, interbudgetary transfers to local budgets amounted UAH 10.7 billion. The basic grant (UAH 2.4 billion) and the educational subvention (UAH 6.8 billion) were fully financed. In addition, local budgets received UAH 32 billion in tax revenues, which is UAH 5.4 billion (or 20%) more than in January last year.

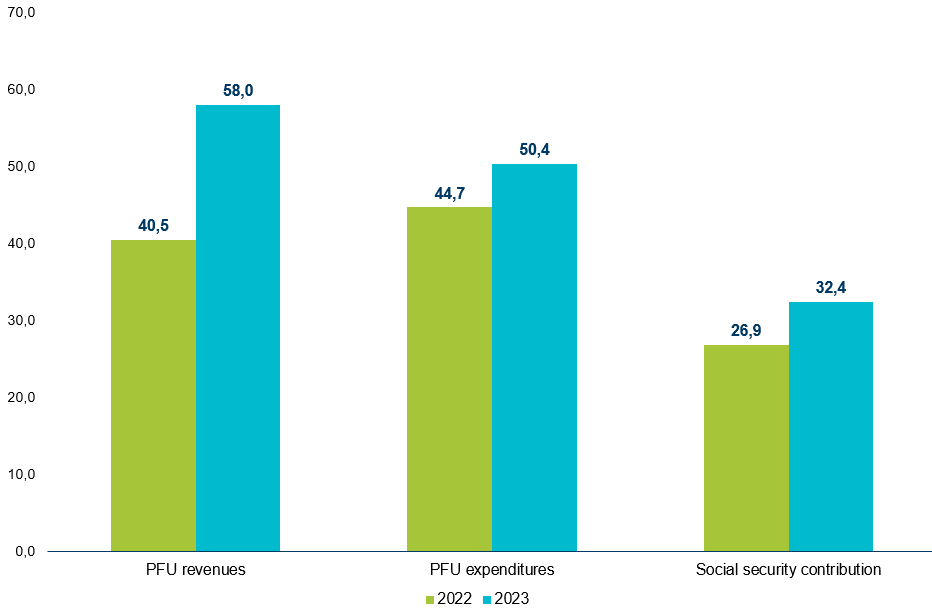

(8) In January 2023, the total revenues of the social security contribution (SSC) increased by 20.4% or UAH 5.5 billion compared to January 2022 (up to UAH 32.4 billion) (Fig. 2). The increase was due to the payment of contributions for military personnel. Otherwise, SSC revenues would have to decrease due to a significant rise in migrants and the unemployed population. In addition, there is still the right for individual entrepreneurs of all groups on the simplified taxation system not to pay the SSC during martial law. However, those individual entrepreneurs who have decided to pay the SSC must do so based on the quarter’s results until January 20, which also affected the SSC increase.

(9) From January 1, 2023, the functions of the administrator of social insurance payments have been fully transferred to the Pension Fund of Ukraine (PFU) from the Social Insurance Fund of Ukraine. In January 2023, the revenues of the PFU increased by UAH 17.5 billion (or 43.2%) compared to the corresponding period of 2022 and amounted to UAH 58 billion, including UAH 1.9 billion or 3.3% for payments on social insurance, carried out by the Social Insurance Fund of Ukraine. In January, UAH 26.6 billion was allocated to the fund from the state budget, which is 59.3% more than last year. Already in January, the PFU allocated UAH 2 billion to social insurance payments and UAH 50.4 billion to pension payments, which is 12.8% more than in the same period last year (Fig. 2).

Figure 2. Revenues and expenditures of the Pension Fund of Ukraine, and the SSC in January 2022-2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Table 1. Plan and fact of the state budget (general fund) in 2023, UAH billion

| Indicators | January | |

| Plan | Fact | |

| Revenue, including | 69,6 | 104,4 |

| Personal income tax | 10,6 | 11,3 |

| Corporate income tax | 1,4 | 1,2 |

| Rent for the use of subsoil | 5,2 | 5,6 |

| Excise tax | 4,7 | 5,3 |

| Net VAT | 20,0 | 11,8 |

| Import VAT | 22,6 | 24,4 |

| Import and export duty | 1,7 | 2,0 |

| Expenditures | 227,7 | 183,6 |

| Deficit (-) / surplus (+)* | -158,6 | -78,9 |

| Sources of deficit financing | ||

| Net borrowings | 279,4 | 147,3 |

| Loans | 292,5 | 160,1 |

| Repayments | -13,1 | -12,8 |

* The size of the deficit is not equal to the arithmetic difference between revenues and expenditures since the size of the deficit is additionally affected by the volume of loans from the state budget and their repayment

Source: Ministry of Finance of Ukraine

Table 2. Main indicators of budget financing, UAH billion

| Indicators | January | |

| Financing, including | 160,1 | |

| in % to the plan (for the entire period) | 54,7 | |

| From the placement of domestic government bonds (total), including | 41,4 | |

| in UAH | 6,7 | |

| in foreign currency in UAH billion (USD million + EUR million) | ₴2,6 ($40,2+€29,4) | |

| From external sources | 118,7 | |

| Public debt repayments | 12,8 | |

| In % to the plan for the full period | 98,2 | |

| Debt service payments | 0,6 | |

| In % to the plan for the full period | 27,2 | |

Source: Ministry of Finance of Ukraine

Table 3. External financial resources* attracted in January

| Sources | Amount

(UAH billion; EUR million) |

| Program of macro-financial assistance from the EU for 2023 | ₴118,7 (€3000) |

*excluding grants

Source: Ministry of Finance of Ukraine

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations