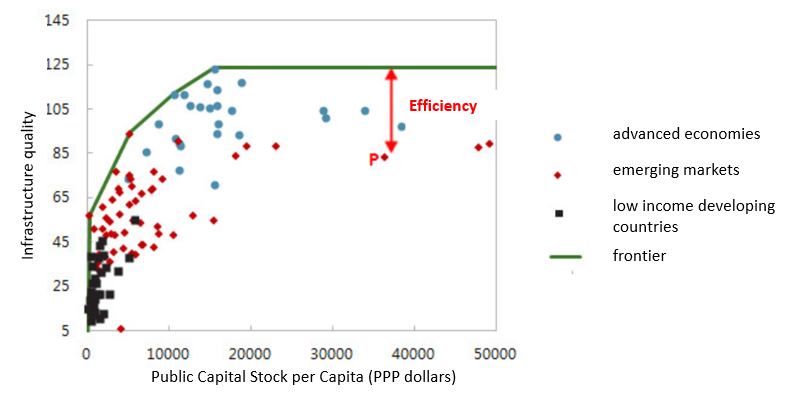

The efficiency gap emerges when investment volume into capital assets is high but the return is low or insignificant. In the low income developing countries this gap amounts to 40%, in emerging markets (including Ukraine) it is 27%, while in advanced economies it is 13% (IMF study “Making Public Money More Efficient”, p.15).

Fig. 1 illustrates the efficiency gap. The emerging economy country in point P has invested more in its infrastructure than most of advanced countries. But the quality of its infrastructure is on the same level as in advanced economies which have invested four times less. The main reason for this gap is the inefficiency of public investment management.

Figure 1. Assessment of public investment efficiency

Source: International Monetary Fund

In Ukraine, the efficiency gap of public investment is 32% as of late 2019. It means we are losing a third of the potential benefits from the investment. It is higher than the average index for the countries of our group. So how do we close the efficiency gap?

The efficiency of public investment is based on three pillars:

- Strategic planning and investment prioritization

- Allocation of investment by sectors and projects

- Quality project implementation according to planned deadlines and budget

Strategic investment planning is the foundation for all the other efficiency factors. For instance, even if public investment projects are implemented in time and within the budget but without a strategy and a plan, what we will get are separately implemented projects with no systemic impact, which will not lead the country to sustainable development. Strategic investment planning and its coordination between different stakeholders is definitely the area where Ukraine is falling behind.

Prioritization of investment is closely linked to strategic planning. If we have clearly identified strategic goals and have the plan to achieve them, it will be easier for us to determine which of the projects is the most relevant, which can be postponed, and which should not be implemented at all.

Prioritization of investment together with strategic planning is the basis of the public investment management system. But in Ukraine it has not been properly developed.

Allocation of investment is a process that involves deciding on what projects will receive funding. It is based on a strategic vision of the direction the country is taking. Prioritization instruments make the selection of projects and the allocation of investment easier.

In the past 5 years executive bodies did a lot for quality implementation of projects:

- The Ministry of Economic Development and Trade developed guidelines for the development of public investment projects and a monitoring procedure for their implementation (pursuant to Decree 571);

- Public-Private Partnership Agency has been created with the main function of support in the development and implementation of PPP projects;

- The Ministry of Infrastructure has developed guidelines for the appraisal and selection of investment projects in transport sector, as well as their monitoring within the framework of EU project Assistance for Improvement of the Infrastructure Cycle Management;

- an e-procurement system for project works has been developed etc.

However, the implementation of projects is the final stage of investment management. The initial stages are strategic planning and prioritization of projects. Unfortunately, they are not developed in Ukraine at present.

International practices of public investment planning

In the long run, public investment should increase the speed of economic growth. It should be planned accordingly. The United Kingdom, South Korea, and Chile are the most successful examples of strategic investment planning. In these countries, a plan of public capital investment with a breakdown by sectors is developed and published. So each citizen can see how much the state plans to invest in education, health care, transport infrastructure, etc.

In 2010 the United Kingdom published its first National Infrastructure Plan (HM Treasury, Infrastructure UK, National Infrastructure Plan 2010), which contained information on investment needed to ensure economic growth. In September 2013 national infrastructure pipeline was published, (National Infrastructure Pipeline), which consists of over 600 public and private investment projects in seven sectors identified as strategic. The plan helped identify projects which can be funded from the state budget and by private partners.

Among the developing countries, Brazil is one that can share its experience. In 2007 the country introduced four-year investment planning (IMF study, Making Public Money More Efficient, p.26). The plan coordinates public investment projects and public-private partnership projects implemented by central and local government, including investment of state-owned enterprises.

Investment planning in Ukraine

Strategic planning of public investment in Ukraine does not comply with the best international practices. On the one hand, it seems that everything is not that bad as we have some strategic documents giving us direction (for instance, Sustainable Development Strategy), there are industry-specific strategies which outline the objectives more clearly, there are implementation plans for said strategies.

For instance, National Transport Strategy 2030 and its Implementation Plan contain specific amounts of planned investment for identified infrastructure projects. The Plan includes the Development of the Transit Infrastructure of Boryspil Airport project, which costs 300 mln euros; it specifies sources of financing and the deadlines of project implementation. Other strategies, however, do not contain such information.

Thus, Implementation Plan for the Energy Strategy 2035 includes implementation of construction projects (construction of centralized storage of spent nuclear fuel of nuclear power plants; technical refurbishment and construction of energy blocs of heat power stations to decrease the dependence on hard coal; reconstruction of the hydroelectric power plants and pumped-storage hydroelectricity, etc). Yet, no one knows how much money has been spent or will be spent on these measures.

The long-term Strategy of Ukrainian Culture Development, approved in 2016, foresees the introduction of information technologies at museums, modernization of libraries, support of the publishing industry, and others. Obviously, all this requires funding. However, we were not able to find the implementation plan for the strategy and understand which activities have been planned and where the funding came from.

Said variety of strategic documents and plans does not let Ukraine do quality public investment planning. In our opinion, it is necessary to create a single plan of investment projects, which can be used to plan further steps and set priorities.

Another specific feature of the Ukrainian system of public investment management is the availability of different funds and different procedures for investment management, which in fact do not coordinate their activities. For instance, there is a separate procedure for regional project management, a different procedure for national project management; we have projects of international financial organizations, Road Fund, Energy Efficiency Fund, and others. Each of them has their own guidelines and direction but lack coordination, dialogue, and impact analysis.

Thus, transport infrastructure projects are funded both from the Road Fund and from the state budget according to the procedure specified by the Decree 571 as well as funds of international organizations. A question arises – do transport infrastructure projects have such a vast selection of funding sources because we have a clear strategy and roads are prioritized above hospitals and schools? In each of the industry-based strategies, we see that each sector is extremely important for Ukraine. Can we objectively ground our investment decisions on such strategic documents? Can we balance public investment among various sectors without a consistent vision of the investment portfolio?

Lack of clear guidelines and frameworks may bring in dividends to certain interested parties. If any project can be “dragged by the head and ears” to the ambiguous phrase in a strategic document, then any project can be included into the budget without even thinking what it will bring to the society – loss or gain. Lack of strategic clarity eliminates responsibility for decision-making and enables not to assume responsibility.

Strategic planning as a way of closing the efficiency gap of public investment

Chaotic funding of projects which seem important to someone here and now are a road to nowhere. Any country which wants to grow needs to act strategically. And Ukraine is not an exception.

For the strategic investment to work in Ukraine, we first need to understand the current state of affairs: how many projects we have, the industries in which we have the projects and their value. No government agency provides comprehensive information on public investment. Each “manager” of the process discloses whatever information they see fit: The Ministry of Finance has created a Registry of Projects financed by IFIs, the Ministry of Economy publishes a List of Public Investment Projects pursuant to the Decree 571, the Ministry for Communities and Territories Development of Ukraine has its own database of regional development projects, etc.

State budget performance reports also do not give a clear picture of how much we invest and where. State Statistics Service of Ukraine publishes capital investment data, including those that are funded from the state budget. However, part of capital budget expenses is not disclosed under the Law of Ukraine On State Statistics due to the confidentiality of statistical data. Still, it seems quite suspicious when, for instance, Forestry and Harvesting or Publishing, Radio and TV Broadcasting that are funded from the state budget are shrouded in mystery. And these are only some of the examples out of many (Scope of capital investment per type of economic activities for 2019).

Consequently, the first thing we need to do is create a database of all investment projects financed from the state and local budgets or related to state-owned or municipal property. Decisions can be made based on such database analysis.

In a perfect world, the next stage would be to match project objectives with the strategic documents. Given the condition of these documents, this stage seems highly unlikely.

This being said, harmonization of the strategic documents should start sooner or later. Matching the existing objectives with current investment projects portfolio would show whether we actually follow strategic documents to a degree or whether the investment portfolio and strategic documents are two different things. The selection of objectives from the strategic documents and plans which require capital investment for their implementation, and the segmentation of the investment portfolio based on compliance with objectives, should push Ukraine towards a systemic approach in strategic planning on the national and industry levels.

Using the database, we can create a mid-term investment plan. With its help different funds and financing mechanisms can coordinate their activities, investors will understand which path the country is taking, while taxpayers will see where their money goes.

Upon implementation of the systemic approach to strategic planning, the investment plan will not serve as a mere list of ongoing projects, but as direct support towards the achievement of national and industry goals. Strategic documents are to become the foundation for investment prioritization.

The degree of closing the efficiency gap depends on the quality of initiative implementation. Perhaps, in the mid-term perspective, we will not overtake the emerging markets. But we will not be able to move forward efficiently if we don’t understand where our goals are and whether we have them at all.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations