In the summer, the President of Ukraine announced an increase in the minimum wage from UAH 4,723 to UAH 5,000 in September 2020 and its rapid growth in 2021: to UAH 6,000 from January 2021 to UAH 6,500 in July next year. The expediency of this step was discussed by all: both politicians and experts. The September increase has already occurred. The first version of the budget for 2021 provided for a further increases too.

However, increasing the minimum wage means higher labor costs for both the public sector and private companies. At the same time, higher expenditures from the state and local budgets must have stable sources of funding. Therefore, in the draft budget for the second reading, the Government still proposed to postpone the second stage of raising the minimum wage until December, which was advised to do by many Ukrainian and international experts.

Will the delay help significantly reduce budget expenditures and, consequently, the deficit?

The main increase in the minimum wage, by 20%, will take place from January 1, 2021. Therefore, the direct effect of the delay will be limited. But structurally it will help reduce the negative effect of increasing the minimum wage on development of the economy.

According to our calculations, the net increase in national budget expenditures due to the increase of the minimum wage to UAH 6,000 from January and to UAH 6,500 from December 2021 will amount to over UAH 15.5 billion. Additional expenditures of local budgets will amount to UAH 12.6 billion. At the same time, the Pension Fund’s revenues will increase by about UAH 3 billion more than its expenditures.

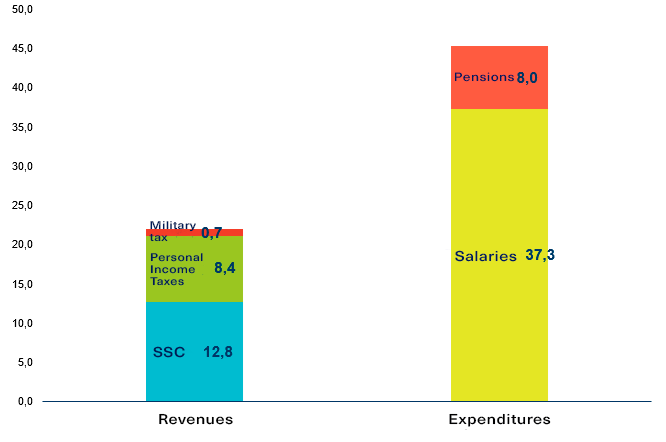

In this article, we consider only the direct budgetary effect of increasing the minimum wage — that is, the growth of revenues from personal income tax and increased budget expenditures for the payment of salaries to civil servants and public sector employees. We also assess the impact on the growth of SSC income, as it is a source of the Pension Fund’s own income, and the need for additional expenditures of the Fund.

However, raising the minimum wage will also have a significant “second wave” effect. On the one hand, it will increase consumption in nominal terms (due to an increase in the purchasing power of the population and slightly higher inflation), and thus — revenues from indirect taxes (VAT, excise duties) in following periods. On the other hand, business costs of labor will increase. So, some will reduce investment, some will go into the shadows, and some will be forced to shut down.

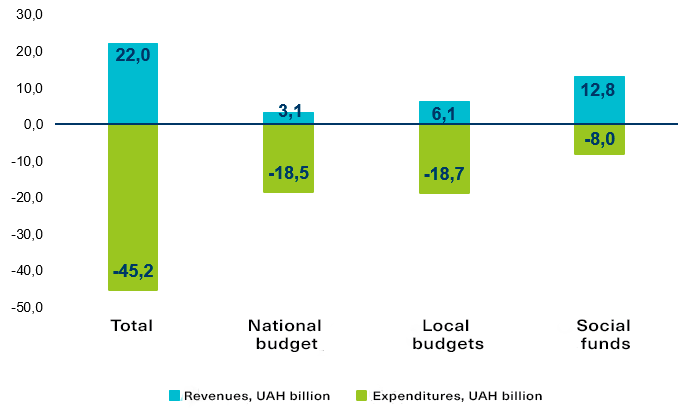

Figure 1. Direct impact of the increase in the minimum wage on budgets and extrabudgetary funds in 2021, UAH billion

Source: own calculations based on data from the State Treasury and the Ministry of Finance

Revenues will increase by UAH 22 billion

According to our calculations, due to the increase in the minimum wage next year, the total additional revenues from personal income tax, military tax and SSC will reach UAH 22 billion. In particular, additional revenues from personal income tax will amount to about UAH 8.4 billion. Of these, the national budget will receive an additional UAH 2.4 billion, local budgets — UAH 6 billion.

Slightly less than UAH 700 million will additionally go to the national budget due to the increase in revenues from the military tax.

Most of all the additional revenues from SSC will grow, by UAH 12.8 billion. And since 86% of this fee goes to the Pension Fund, it will be the one to benefit from the increase in the minimum wage.

Growth of expenditures: where and by how much

However, raising of the minimum wage means increase in both revenues and expenditures of national and local budgets.

First, expenditures on salaries of public sector employees and civil servants will increase. At the same time, the subsistence level set for January 1 of each year is used to determine the salaries of these employees. This level has already been increased from December 1, 2020 by 20%, which corresponds to the growth of the minimum wage.

The increase in salaries will lead to an increase in the amount of accruals for salaries of public sector employees and civil servants (SSC). That is, in fact, the state will transfer part of the funds from the national budget / local budgets to the budget of the Pension Fund in the form of SSCs paid for the respective employees.

Of course, not everyone’s salaries will increase. For example, in the draft law on the national budget for 2021 (Article 26), the Government offers to freeze the basic salary for all government employees at the level of September 2020. This means an increase in wages for this category of workers only for those whose wage is less than the minimum one. The amount of salaries for judges and prosecutors is regulated separately (and in the draft budget before the second reading it was proposed to increase significantly the subsistence level to which their salaries are tied, from UAH 1,000 to UAH 1,600).

A “side effect” of a significant increase in the minimum wage is a narrowing of the differentiation of different qualifications workers’ salaries, as no employee can receive a salary below the minimum one. So, not everyone who receives a salary from the budget will be satisfied with raising of the minimum wage.

However, if the growth rate of salaries is commensurate with the growth rate of the minimum wage, according to our estimates, this means UAH 37.3 billion of additional expenditures of national and local budgets on wages due to the increase in the minimum wage in 2021. Namely:

(1) UAH 18.3 billion will be “pulled” by additional expenditures for the payment of increased salaries of employees who receive salaries from the national budget, including the amount of paid personal income taxes and SSCs. According to the Ministry of Finance, as of January 1, 2020, there were 957.4 thousand full-time positions of employees whose payment is made on the basis of the United Tariff Scale (UTS) and is financed from the national budget.

(2) An increase in salaries will cost local budgets UAH 18.7 billion.

The increase in salaries will lead to a growth in various types of allowances paid to employees in the public sector. However, because of the absence of public information on the level of allowances in various bodies, it is impossible to calculate the impact of salary increases on them. Thus, the calculations presented here are the lower limit of additional expenditures of budgets and revenues of the Pension Fund.

Also, the amount of benefits for some pensioners — those who have reached the age of 65 and have at least 35 and 30 years of work experience under insurance, respectively, for men and women — depends on the size of the minimum wage. For this category of pensioners, the minimum pension is 40% of the minimum wage.

If, as in September 2020, pensions will be transferred to 1.6 million pensioners, the Pension Fund’s expenditures only on the payment of pensions to this category of pensioners due to the higher minimum wage will increase by an additional UAH 8 billion (excluding inflation). Thus, these expenditures will almost completely “eat” the additional funds that the Pension Fund will receive as a result of increased revenues from SSC.

In general, additional government expenditures related to the growth of the minimum wage and salaries of the tariff scale in 2021 will amount to about UAH 45.3 billion.

There will also be other additional costs for the general government sector, as the increase in the minimum wage affects the amount of temporary disability benefits, hospital and maternity benefits. But, first, these expenditures will be borne by social insurance funds, and not directly by the state budget. Second, their impact on budget expenditures will be insignificant compared to labor and pension expenditures and may be offset by an increase in SSC revenues.

The net effect of the increase in the minimum wage on the revenues and expenditures of the consolidated budget and social funds, according to our calculations, will be “minus” UAH 23.3 billion.

Net growth of state budget expenditures will exceed UAH 15.5 billion. This amount, for example, could reduce the budget deficit (which would mean reducing the deficit by 0.3% of GDP).

Additional expenditures of local budgets will amount to about UAH 12.6 billion. And only the income of social funds will increase by UAH 4.8 billion more than expenditures (excluding the impact of additional expenditures on increasing the amount of various types of benefits).

The January increase in the minimum wage is “responsible” for the largest increase of these expenditures — from UAH 5,000 to UAH 6,000. The delay of the second stage of the increase in the minimum wage (from UAH 6,000 to UAH 6,500) from July to December next year will save the 2021 budget about UAH 3.6 billion.

Figure 2. Revenues and expenditures from the increase of the minimum wage, UAH billion

Photo: depositphotos.com/ua

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations