Among the main events of the round are the laws on authorized economic operator on customs, judicial self-government and the single tax account.

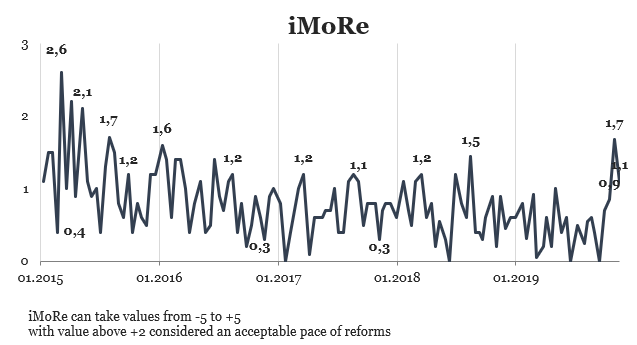

The index for the previous round was +1,7 points.

Chart 1. Reform Index Dynamics

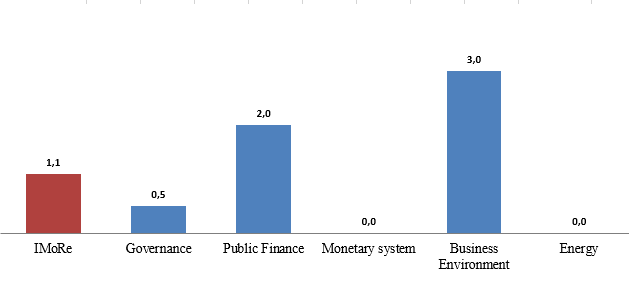

Chart 2. Reform Index and its components in the current round

Main events of the round

Law on authorized economic operator on customs, +2.0 points

Authorized economic operator (АЕО) is an enterprise allowed to simplify the customs procedures. This right can be given to the enterprise by the revenue and duties agencies. If a company fulfills certain conditions, it will receive a certificate.

EU already has a similar institution. The Customs Code as of 2012 contained provisions for an authorized economic operator, but they remained on paper at the time. To make this institute effective, in 2017 the Cabinet of Ministers introduced a bill to amend the Customs Code, and the previous convocation of the parliament adopted them in the first reading. The IX convocation of the Verkhovna Rada had finally succeeded in introducing this institute.

Law #141-IX from 02.10.2019 introduced the institute of authorized economic operator and established specific procedures for its establishment.

An authorized economic operator is a Ukrainian enterprise that is a part of the international supply chain. It can be a manufacturer, exporter, importer, customs representative, carrier, freight forwarder, warehouse keeper.

In order to become an authorized economic operator, an enterprise must comply with the requirements of customs and tax law, and have no record of criminal charges. It must have a transparent system of accounting, commercial and transport documentation, have a sound financial standing, maintain the standards of competence or professional qualifications of responsible officials, and comply with the standards of safety and reliability.

Authorized economic operator can skip the line while performing customs formalities, use special lanes, self-seal goods about to be moved across the border, etc.

Law on judicial self-government, +1,0 point

The High Council of Justice (HCJ) is a collegiate body of judicial governance that plays a key role in shaping the judicial corps. The previous convocation of the parliament had introduced this body through amendments to the Constitution, and set out the basic principles of its activity in the law on HCJ in 2016.

The purpose of these changes was to strengthen the independence of the judiciary and reduce corruption in the courts. However, in practice, this body was not effective enough: the positions were held by unscrupulous judges, not all judges passed the qualification evaluation procedures, and the procedures for selecting judges for vacant positions started in 2017 were not completed.

Law #193-IX from 10/16/2019 should address these issues.

Although the intentions declared by the initiators of the draft law are good, some experts of iMoRe gave it positive, and some — negative evaluations.

Among the successes of the law experts have listed:

- Evaluation of acting members of the High Council of Justice on their integrity. Integrity and Ethics Committee is responsible for the evaluation and may decide on the dismissal of the HCJ member. The commission will include three international experts (a list of delegated experts has already been determined).

- Elimination of the quota principle of formation of the High Qualifications Commission of Judges and holding of a new competition. The competition commission will consist of 3 persons delegated by the Council of Judges of Ukraine and 3 international experts.

The fallbacks of the law mentioned by experts are:

- Lack of justification for the reduction of the maximum number of judges of the Supreme Court from 200 to 100.

- Absence of a clearly defined procedure for the selection of judges of the Supreme Court from among the existing judges of cassation courts of the Supreme Court.

- Setting a time limit for disciplinary proceedings against judges.

- The risk that the activities of the High Qualifications Commission of Judges will depend on the High Council of Justice, as it determines the basis of the competition. There are also risks that the High Council of Justice will influence the Commission on Integrity and Ethics, since the latter will include representatives of the High Council of Justice.

Law on the introduction of a single account for the payment of taxes, fees and SSC (single social contribution), +1,0 point

Entrepreneurs pay taxes and fees to the state or local budgets on a monthly or quarterly basis. Each tax has to be transferred to a separate account. Filling your tax documents takes a lot of time.

Law #190-IX solves this problem. It allows, at the request of the entrepreneur, to use a single account to pay all the taxes and fees.

The single tax account will allow you to pay taxes on corporate income, personal income, a single social contribution, a single tax and rent. However, a single tax account cannot be used to payVAT and excise tax on fuel and alcohol, since there are other, specific e-administration systems for those.

The taxpayer will submit a document on the transfer of the required amount to a single account, to the bank. Then the tax service will create lists of accounts to which the funds should be transferred, and the Treasury will transfer them.

In order to start using a single tax account or to opt out of using it, an entrepreneur needs to notify the tax authority through the e-cabinet. One can start using a single account or opt-out once a year.

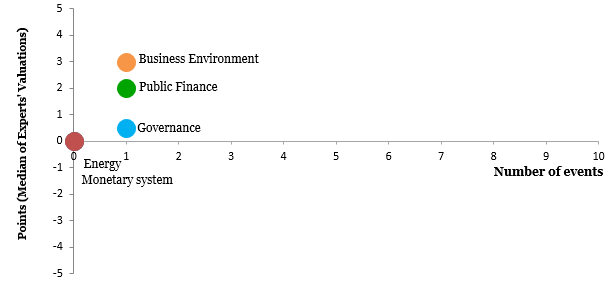

Chart 3. Value of Reform Index components and number of events

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations