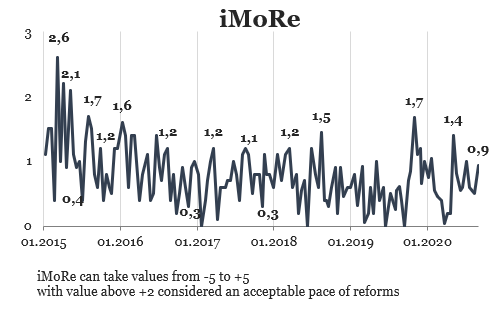

In the previous round, the index was +0.5 points.

Chart 1. Reform Index Dynamics

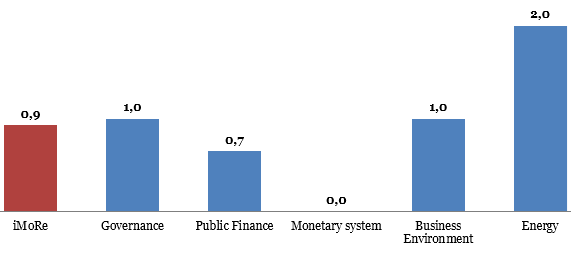

Chart 2. Reform Index and its components in the current round

Law on cutting the “green” tariff rates, +2,0 points

“Green” tariff was established in Ukraine in 2009 to stimulate the development of renewable energy. Eventually, this tariff became very commercially beneficial, especially for solar energy producers. As solar power stations’ production costs decreased significantly, the industry began to develop rapidly, with the investors building more and more production facilities.

The rapid production growth using renewable energy sources resulted in a number of technical and financial problems.

In 2019, Parliament passed the law that was supposed to tackle this problem. According to the new rules, the state would stimulate the development of green energy through “green” auctions instead of “green” tariffs. The Government would set a quota for the electricity production volumes under state support, while the producers would be able to purchase it in a “green” auction. However, these measures were not enough.

Parliament made another attempt to get the situation under control in July 2020 by passing Law 810-IX. Specifically, the Law:

- reduced the “green” tariffs by 2.5 – 50% for different facilities depending on the time of their being put in operation,

- if the estimated and actual electricity supply volumes differ, the producer will have to make up for a share of the costs of resolving the imbalance,

- if the electricity transmission system operator gave the producer the dispatch command to reduce or limit the load, the operator will have to compensate the producer for the losses.

Law abolishing the obligatory ledger book for individual entrepreneurs, +1.0 point

Law 786-IX makes bookkeeping easier for individual entrepreneurs to a certain degree, as well as facilitates tax auditing.

Specifically, it abolishes the requirement that individual entrepreneurs keep a ledger for recording their earnings. Now, entrepreneurs may decide for themselves on how to keep books: whether on paper or electronically. The Law will also help make the taxpayer e-cabinet more convenient, broadening its functionality.

During tax audits, the tax authorities will no longer have the right to interview company employees or employers about the passive income paid, or other additional benefits and compensations.

New fees per air passenger and per ton of air cargo, 0.0 points

One of the funding sources for the State Aviation Administration – a body overseeing the use of Ukrainian airspace and exercising state supervision over the safety of civil aviation and air navigation services – is state fees. According to law, they used to be set by the Cabinet of Ministers. This was unconstitutional, because such charges could only be established and regulated by law.

Law 759-IX sets a number of fees for passenger carriage, and of charges for freight and passenger carriage.

Some experts assessed the law negatively as affecting the cost of air transportation, with some providing a positive assessment because it resolved a legal conflict. The score ranges from -1.0 to +2.0 points, with the median score being 0.0 points.

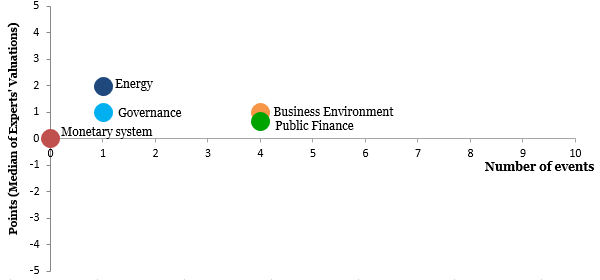

Chart 3. Value of іMoRe components and number of events

Note: Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations