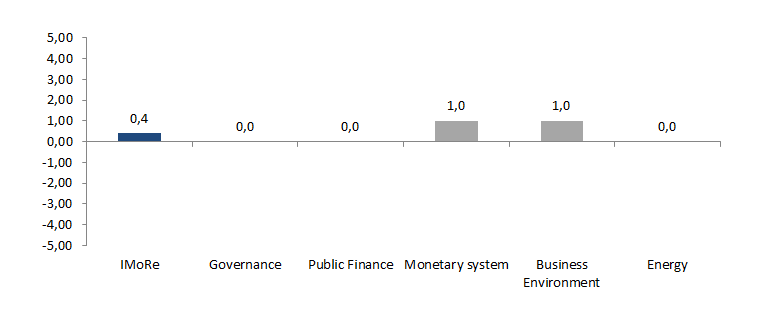

In the last two weeks of August a summer mood, not the spirit of reforms, dominated in the country. Reform Index fell to +0.4 points – the minimum, which has been recorded only several times within the whole observation period. Some progress took place in the business environment and monetary system. The reforms did not move ahead in governance, public finance, and energy sector.

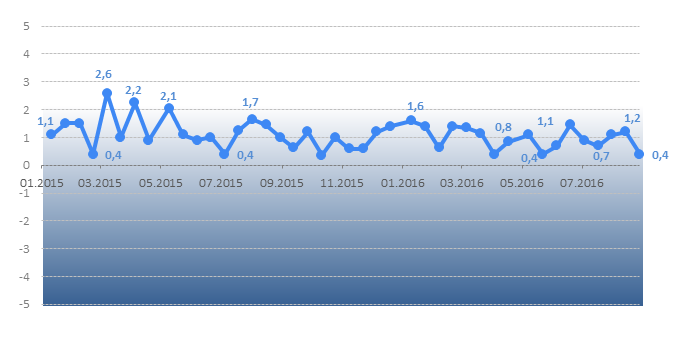

Chart 1. Reform Index dynamics*

* Reform Index team considers index value of at least 2 an acceptable pace of reform

In the second half of August, the progress of reforms was minimal. Reform Index declined to +0.4 points (from +1.2 points in the previous round). This is the minimal index value, which has already been recorded several times within the observation period.

The number of reform actions in this round is only 3 adopted and published regulations – a kind of anti-record, which occurred only once, at the beginning of June 2015 (round #13).

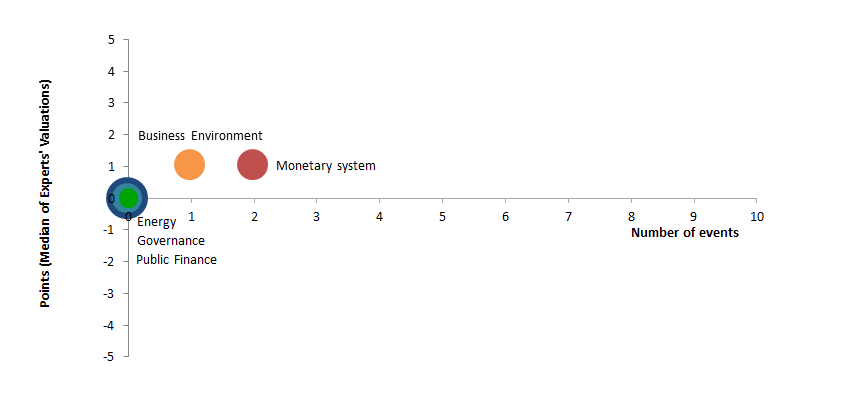

Three events influenced on the reforms pace in last several weeks of summer include a removal of price verification certificate for service imports, a simplification of information exchange between the banks and State Financial Monitoring Service, and a permission for the NBU to trade in corporate bonds at the stock exchanges auctions.

Chart 2. Reform Index and its components in the current round**

**Titles of components were shortened for convenience, while their content remained the same

The positive developments

1. Price verification certificate for service imports was removed: +2 points

To pay for service imports constituting above 50 thousand euros, a company had to obtain a price verification certificate from the State Information and Analytical Center for Monitoring International Commodity Markets (Derzhzovnishinform). This document had to certify compliance of contract and market prices. It was believed that this document helps to combat capital flight. The practice proved that this tool was inefficient and created unnecessary bureaucratic barriers to honest businesses.

The NBU Resolution №372 of 18.08.2016 removed this requirement. The NBU believes that it will not result in the weakening of foreign trade operations control since the National Bank tightens the financial monitoring policy using the indicators of suspicious financial transactions.

“As part of currency regulation liberalization and de-bureaucratization, the NBU softens or removes requirement that lost its effectiveness as the tools for capital flight combat and foreign exchange market stabilization. The price verification certificate became one of these [inefficient] requirements after the NBU strengthened financial monitoring using indicators of suspicious financial transactions. That is why this decision will not weaken the control over services imports or destabilize the currency market. On the other hand, it will reduce bureaucratic procedures for such operations”

—Serhiy Ponomarenko, NBU

Chart 3. Value of Reform Index components and number of events August 15 – 28, 2016

Reform Index experts have noted that this decision regarding foreign trade control liberalization will positively influence the business environment.

“This decision is another deregulation step, which will help to simplify and make cheaper service imports. At the same time, this decision removes the Derzhzovnishinform monopoly on price verification for service imports”

—Veronika Movchan, the Institute of Economic Research and Policy Consulting, Editorial board, VoxUkraine

2. Information exchange between banks and the State Financial Monitoring Service was simplified: +1 point

The NBU Board resolution N373 of 18.08.2016 introduced the new guidelines regarding files compilation for the information exchange between the State Financial Monitoring Service and banks. It gives banks the opportunity to compile message files automatically.

“These amendments will facilitate freeing up banks’ human resources currently used to manually perform the task of assigning codes to transactions. This will enable banks to pay more attention to risk-based approaches when carrying out internal financial monitoring. This step became possible thanks to the successful cooperation between representatives of the International Monetary Fund, the State Financial Monitoring Service of Ukraine, the Ministry of Finance of Ukraine, and the Independent Association of the Banks of Ukraine.”

—Ihor Bereza, the NBU

3. The NBU added corporate bonds to the list of bonds available for trading at stock exchanges auctions: +1 point

The NBU Resolution №370 of 16.08.2016 introduced the procedure for trade in corporate bonds at stock exchanges auctions.

“The NBU had the possibility to sell only government and international financial companies bonds at the stock exchanges auctions. This decision will give the NBU the opportunity to sell corporate bonds and it will helpful in two situations. First, in case of insolvency of a bank, which is indebted to the NBU with the corporate bonds collateral. Second, to sell the corporate bonds from the NBU portfolio to regulate liquidity.”

—Mykola Selemkhan, the NBU

“This document provides the NBU with the opportunity to trade in corporate bonds, which are collateral on the loans from the NBU. The possible positive consequence of this decision is more active trade in corporate bonds, which will contribute to the stock market development”.

—Victoria Strakhova, National Reforms Counsil

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations