Reform Index is a survey-based index. Reform Index tracks regulatory changes, which upon their successful implementation, will move the country forward towards (or backward from) the goal of a more efficient, more liberal and less corrupt state.

The Index is calculated once in two weeks based on an expert survey. Reform Index value for the third monitoring period (January 26th – February 8th 2015) stood at +1.5 points out of the possible range from -5.0 to +5.0 points.

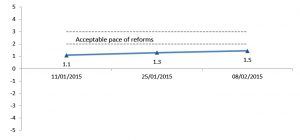

Chart 1. Reform Index dynamics

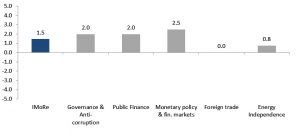

Chart 2. Reform Index and its components in current round

Reform Index value for the third monitoring period (January 26th – February 8th 2015) stood at +1.5 points out of the possible range from -5.0 to +5.0 points. Reform Index continues to demonstrate gradual acceleration compared to the previous rounds (the index value was +1.3 points in the second round and +1.1 points in the first round), however, the pace of reforms remains lower than the 2-3 points level which we consider acceptable.

The amendments to Joint Stock Companies Law that lowers from 60% to 50% the quorum for shareholder meetings at companies at least 50% owned by the state received the highest number of points: +5.3 (we remind that an event grade is the sum of grades this event receives along several directions of reforms and thus can exceed +5.0 points). According to experts, this step will allow strengthening public control over corporations, in which the state has a majority stake, and increasing public revenues.

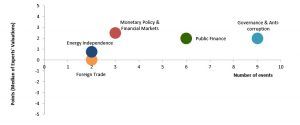

The second major event was Ministry of Infrastructure’s decision to provide online broadcasting of tenders for state enterprises’ (+4.5 points). Thanks to this decision and a number of other events, such as reinforcement of transparency requirements for Parliamentary Committees, overall progress in Governance and Anti-corruption sphere was evaluated at +2.0 points.

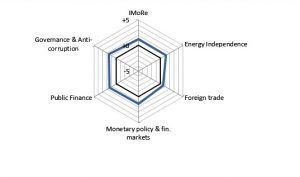

Chart 3. Average value of Index components since beginning of monitoring (January 1, 2015 to February 8, 2015)

According to experts’ assessments, the third and fourth most important events were resumption of two-sided quoting of public bonds by the NBU no significant events were observed and NBU decision to cancel currency auctions and indicative exchange rate (+3.0 points). Experts noted that resumption of two-sided quoting will stimulate the development of the secondary market for government bonds and increase flexibility of public debt management, while cancelation of currency auction and indicative exchange rate is considered as an important prerequisite for introduction of inflation targeting. These decisions ensured high grade of +2.5 points for the overall progress in Monetary Policy and Financial Markets direction.

Chart 4. Value of Reform Index components and number of events January 26 – February 8, 2015

The above-mentioned decisions to lower the quorum threshold at stakeholders meetings and introduce online tenders broadcasting received a moderately positive evaluation under the Public Finance direction. Also, the experts positively evaluated the decision on the new order of granting medical subventions to local budgets, which is a step towards implementation of the previously adopted decision to reform budgetary financing of the healthcare. Overall progress in Public Finance direction was evaluated at +2.0 points.

Energy independence direction received +0.8 points thanks to the decision to reduce quorum threshold at stakeholder meetings. No significant events were observed n External Trade direction over monitoring period (0.0 points).

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance and Anti-Corruption

- Public Finance and Labor Market

- Monetary Policy and Financial Markets

- Industrial Organization and Foreign Trade

- Energy Independence

For details please visit reforms.voxukraine.org

Main media partner Project partners

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations