Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas.

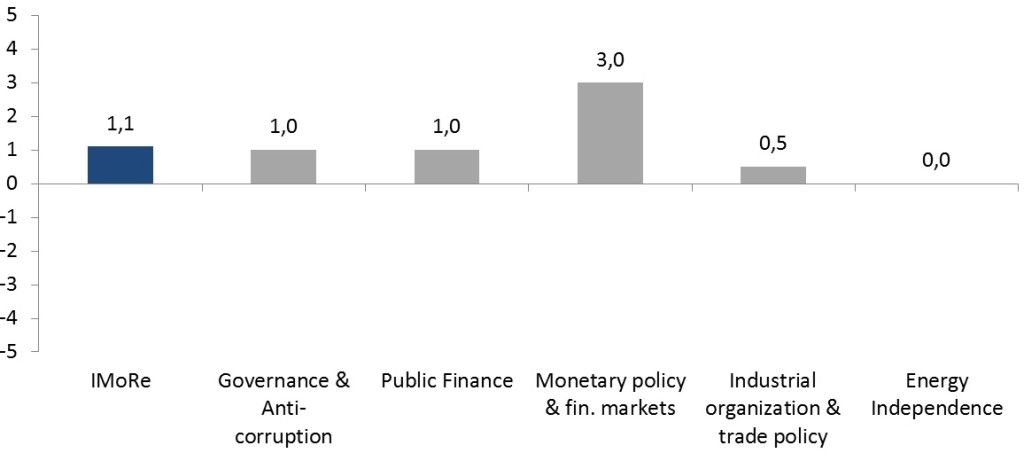

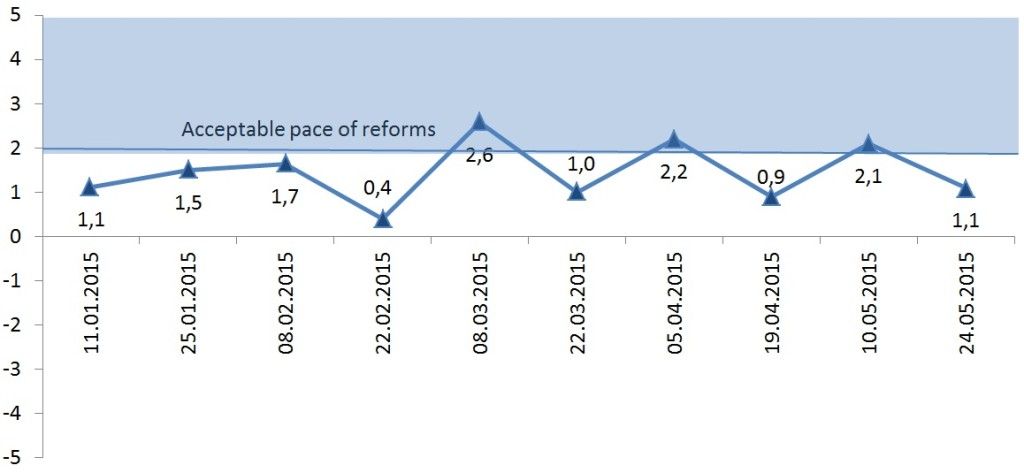

Reform Index value for the 10th monitoring period (May 11th –24th, 2015) has reached +1.1 points out of a possible range between -5.0 to +5.0 points. This time around the index value has dipped below the desired pace of reform amid sluggish progress with anti-corruption, deregulation, public finance, and the energy sector. On the other hand, developments in the banking sector have fueled the index value thanks to the National Bank of Ukraine’s (NBU) efforts.

Chart 1. Reform Index dynamics

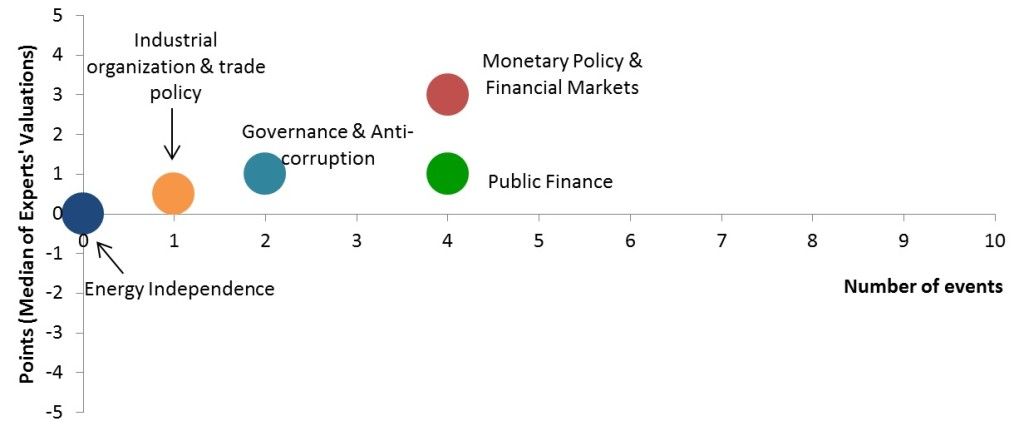

Chart 2. Reform Index and its components in the current round

The direction of country’s Monetary Policy and Financial Markets scored +3.0 points, which is the highest grade among sectors in the 10th monitoring period. As Borys Bordiuh, expert in monetary policy, mentioned, ‘NBU is taking significant measures that will contribute to a substantial improvement of the banking system stability in the long run.’

There were three important regulations in the Monetary Policy sector. First, experts gave +3.0 points for a tightening up of the requirements for the transparency of banks’ ownership structure. The new regulation makes functioning of banks with non-transparent ownership structure hardly possible.

Second, the same high grade (+3.0 points) was given to another document issued by the NBU, which establishes the requirement and procedures for disclosure of information on operations with related entities. The NBU obliges banks to provide a list of related parties on a monthly basis and clarifies the related-party definition. Experts noted that this regulation will improve the stability of the banking system by reducing the extent of related lending in it, but some of its provisions can be used to put additional pressure on some banks.

Third, the NBU announced the introduction of new bank capital requirements as well as specific requirements to systemically important banks (+2.3 points). Tier 1 capital adequacy ratio for banks will be introduced at 7% starting in 2019. This regulation corresponds with the Memorandum of Cooperation between Ukraine and the IMF. Capital buffers, which are designed to reduce the probability of bank failures, will be introduced in 2020. However, as experts note, since this regulation will be applied only in 2019-2020, it can be reversed or postponed. Therefore, it is difficult to perceive any immediate gains.

As for developments with Public Finance, experts assigned +2.0 points for the pilot electronic goods procurement project of the Economic Development and Trade Ministry, highlighting it as a positive step in limiting corruption. The Ministry of Defense’s experiment with an electronic accounting of subsistence support in two military units received +1.3 points. At the same time, inconsistent decision to increase pensions for working scientists, as well as the “decommunisation” laws brought the overall Public Finance sector grade to +1.0 points total.

Only minor changes were recorded with Governance and Anti-Corruption. As a part of decentralization reforms, the transfer of state architecture and construction control to the local level garnered it +1.0 point. The same grade was given to the sector as a whole. Experts estimated progress in Industrial Organization and Trade Policy even lower (+0.5 points) on the back of the minor recent news about time of the issuance of documents on the normative monetary valuation of land, which has been reduced from seven to three days. Finally, without any events of note, the rating for Energy Independence received 0.0 points.

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance and Anti-Corruption

- Public Finance and Labor Market

- Monetary Policy and Financial Markets

- Industrial Organization and Foreign Trade

- Energy Independence

For details please visit reforms.voxukraine.org

Chart 3. Value of Reform Index components and number of events May 11–24, 2015

Main media partner Project partners

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations