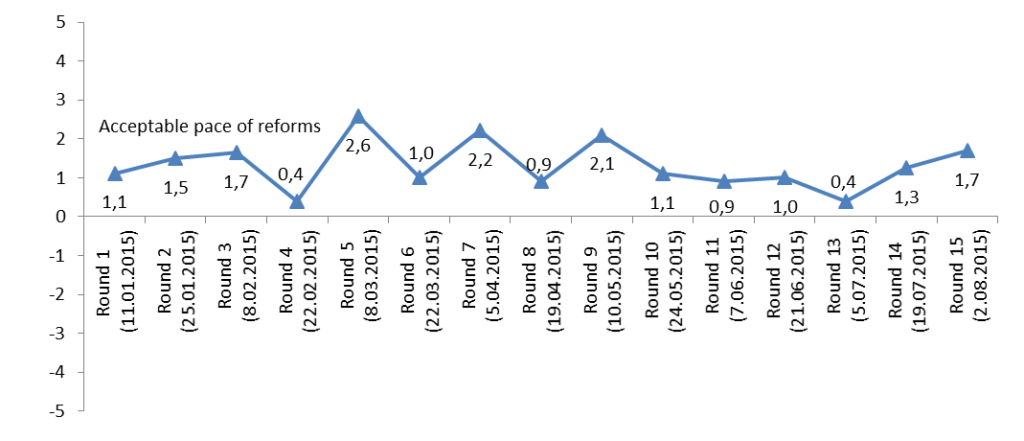

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas. Reform Index value for the 15th monitoring period (July 20th –August 2nd, 2015) reached +1.7 points out of a possible range from -5.0 to +5.0 points.

Reform Index value for the 15th monitoring period (July 20th–August 2nd, 2015) reached +1.7 points out of a possible range from -5.0 to +5.0 points. Significant progress has occurred in three spheres: “Governance and Anti-Corruption”, “Public Finance”, and “Monetary Policy”. The acceleration of reforms to a large extent can be attributed to the fulfillment of requirements in the context of cooperation with the IMF.

Chart 1. Reform Index dynamics

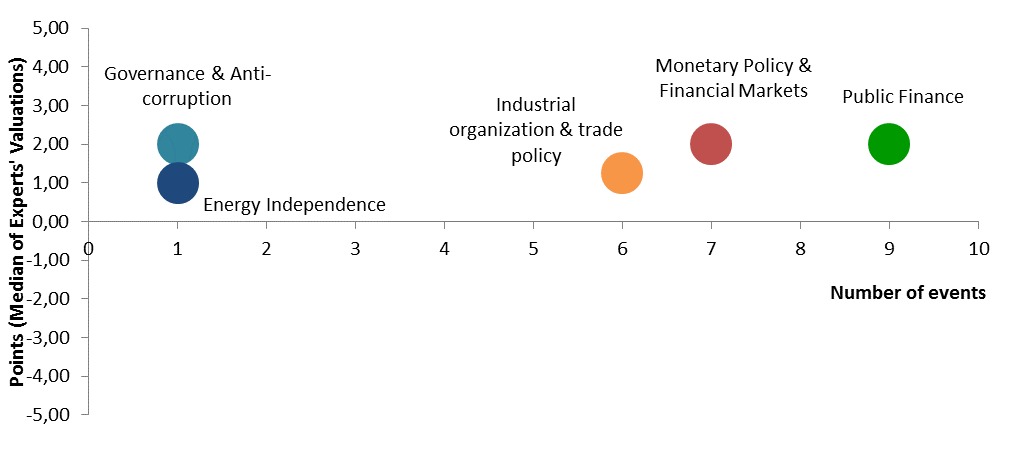

Chart 2. Reform Index and its components in the current round

The law on the national police (580-VIII of 02.07.2015) received one of the highest scores – +4.0 points. This high grade was provided not only for changes in legislation, but also for the quality of implementation, which made the police reform the benchmark for reforms in Ukraine. As Agnieszka Piasecka from the Open Dialogue Foundation noted,

It is evident that not only change in regulation is important, but also implementation of reforms. New police officers are more than the paper on which their powers are written.

The same high grade was assigned to cancelling the moratorium on sale of property of state-owned enterprises (SOE) where government share is over 25%, with respect to the debtors of NJSC “Naftogaz Ukraine” (627-VIII of 16.07.2015) – +4.0 points as a sum of grades in “Public Finance” and “Industrial Organization and Trade Policy” sub-indices. Lifting the moratorium was one of the IMF and World Bank requirements. As Taras Kachka from Ukraine Reforms Communication Taskforce put it,

removal of the moratorium on the collection of debts from state-owned enterprises is a real revolution. Obviously, if this is possible for Naftogaz, it must be possible for other companies too. Therefore, it is necessary to lift the moratorium altogether.

+3,5 points received another law from the “IMF package” – on unified tariff-setting methodology in the sphere of communal services (626-VIII of 16.07.2015). Experts greeted the ban on setting prices lower than economically justified cost of communal services, which will foster more efficient use of natural resources and solve the problem of non-payments among enterprises. It will also reduce budget expenditures on compensation of low tariffs.

Several positive developments were observed in the public finance sphere. The highest grade (+2.0 points) was given to the merger of accounts for EPT payments (Ministry of Finance order # 651 of 20.07.2015), which will help reduce profit tax overpayments and thus pressure on business. +1.8 points received the law (643-VIII of 16.07.2015) which settled the problematic issues of electronic VAT accounts. Experts greeted the compromise between government and business but doubted the necessity of electronic VAT accounts per se.

Quite a few positive developments were observed in the Monetary Policy sphere. The highest grade (+2.8 points) was assigned to simplifying access to Ukrainian market for international payment systems (NBU Decrees 480 and 481 of 24.07.2015). Another positive development was some liberalization of currency regulation: +2.0 points were assigned to simplification of the procedure for registration of operations in the contract approval system on the interbank currency market (NBU Decree 473 of 24.07.2015) and +2.0 points were assigned to simplification of the licensing procedure for individuals (NBU Decree 479 of 24.07.2015), which will facilitate the transfer of remittances for Ukrainians working abroad.

Experts provided high grades to recommendations for banks on restructuring of individual FX loans (NBU Decree 467 of 21.07.2015), developed by the National Bank with technical assistance from the IMF (+2,0 points). +1,3 points were assigned to centralization of currency operations control and licensing functions (NBU Decree 478 of 24.07.2015) within the framework of the NBU restructuring. Finally, experts greeted the NBU decision (NBU Decree 493 of 30.07.2015) to increase from one to two the number of stock exchanges where it will conduct its operations with internal government bonds (+1.5 points).

In the current (15th) round, reform progress in three spheres – “Governance and Anti-Corruption”, “Public finance” and “Monetary Policy and Financial Markets” – reached +2.0 points. Reforms in “Industrial Organization and Trade Policy” sector were evaluated at 1.3 points due to a number of incremental changes. Energy sector got +1.0 points because of the law on tariff-setting from the “IMF package”.

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance and Anti-Corruption

- Public Finance and Labor Market

- Monetary Policy and Financial Markets

- Industrial Organization and Foreign Trade

- Energy Independence

For details please visit reforms.voxukraine.org

Chart 3. Value of Reform Index components and number of events July 20– August 2, 2015

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations