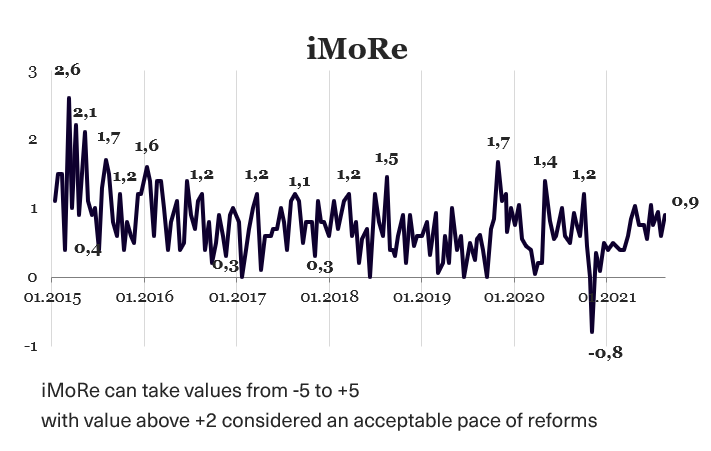

Reforms Index is +0.9 points for the period from July 19 to August 1, 2021, with possible values ranging from -5.0 to +5.0. In the previous round, the index was +0.6 points.

Chart 1. Reforms Index Dynamics

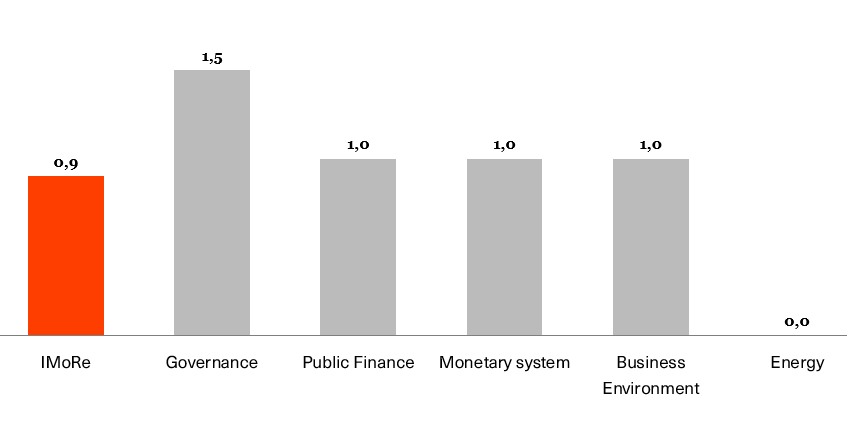

Chart 2. Reforms Index and its components in the current round

Law on state support for agricultural insurance, +2.0 points

Agricultural activities carry high risks associated with natural conditions or other forces majeures. For example, drought, bad weather, flooding, frosts, or excessive reproduction of pest insects can lead to significant crop losses, while outbreaks of infectious diseases can lead to cattle deaths. In 2010-2020, value added in agriculture ranged from 4.4% to 12.1% of GDP, basically due to weather conditions. To mitigate the damage that may occur under such circumstances, it makes sense for farmers to insure risks. However, insurance products for agricultural producers are extremely limited in supply.

Insurance companies offer agricultural producers insurance against very few, unlikely risks. The level of insurance payments for these products (4.2%) are significantly lower than the average for other products (24-27%). Therefore, farmers use these services little. As a result, losses incurred due to a force majeure are mainly borne by agricultural producers themselves.

Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

To encourage insurance companies to work more actively with agricultural producers, Parliament passed a law on providing state support through the agricultural insurance pool in 2012. However, this approach proved ineffective.

Law 1601-IX is another attempt to encourage the development of agricultural insurance with the help of government support.

Now, agricultural producers who have arranged insurance for their products can be compensated by the state for part (up to 60%) of the cost of insurance payment (insurance premium). This support covers crops, agricultural yield including perennial crops, as well as livestock.

Agricultural producers can arrange insurance for their products against such risks as severe or light frosts; strong winds, dust storms, hail, lightning strikes and fires; heavy rains and flooding; heat or drought; outbreaks of mass reproduction of plant pests, secondary plant diseases; infectious disease of cattle or enforced slaughter of livestock in connection with efforts to combat infectious diseases, etc.

Law on criminal liability for false declarations, +2.0 points

Liability for inaccurate declarations filed by individuals authorized to perform state or local self-government functions (civil servants, MPs, judges, etc.) was established by Law 1074 of December 4, 2020. The law provided for fines, community service, deprivation of the right to hold certain positions, and so on. No criminal penalties were provided for these violations.

Experts believed that existing types of punishment were rather lenient and insufficient to make all those authorized to perform state functions file declarations stating their real income.

It was the second attempt to establish liability for false declarations. The first attempt was made by Parliament in October 2014, when it passed respective amendments to the Criminal Code. In 2020, the Constitutional Court declared the provisions unconstitutional. Law 1074-IX restored liability for false declarations, but without criminal liability.

Law 1576-IX established criminal liability when the declaration did not show UAH 4.5 million or more of income.

Law on the village headmen institution development, +1.5 points

Village headmens (starostas) must represent the interests of the residents of some settlements within local government. The current legislation had a number of gaps relating to forming starosta districts and the starostas’ activities. Specifically, the powers of local councils to form districts, approve regulations on starostas, and make decisions on early termination of starostas’ power extended only to the ATCs formed under the law on Voluntary Amalgamation of Territorial Communities (157-VIII of February 5, 2015). These provisions did not apply to hromadas formed under the law On the Definition of Territories and Administrative Centers of Territorial Communities (562-IX of April 16, 2020).

Law 1638-IX regulates these issues stipulating that a starosta district can be established by local councils in any hromada. They will also approve the regulations on starostas and make decisions on early termination of starostas’ power.

Law on payment services, + 1.0 points

The law regulating payment services was passed in 2001. It already did not match the current level of technology and the need of the hour hampering the development of these services. To tackle the issue, Parliament passed the new Law On Payment Services (1591-IX) of June 30, 2021.

This law establishes an exclusive list of payment services and categories of their providers. Specifically, these services can be provided by banks, payment institutions, electronic money institutions, postal operators, public authorities, local governments, etc. Non-bank payment service providers will be able to open payment accounts, issue payment cards and electronic money (currently only banks can do it). The NBU will be able to issue its own digital currency.

The law also obligates payment service providers to open up their APIs so that others can connect to their interfaces and exchange data. This solution will allow Ukraine to implement the so-called “open banking” concept that allows third-party companies to get access to financial information necessary to develop new apps and services for the account holders.

Law on simplification of connection to gas networks, +1.0 points

The law on tax amnesty, -2.0 points

Law 1524-IX allows individuals to declare their assets on which they have not paid taxes. To do this, one has to submit a one-time voluntary declaration and pay a one-time fee. The amnesty will be in effect for one year: from September 1, 2021, to September 1, 2022.

It will be possible to enter in the declaration movable or immovable property, money deposited in bank accounts or securities. The law does not require to declare an apartment with a total area of no more than 140 square meters, a house with a total area of no more than 240 square meters, a plot of land handed over at no cost (privatized, received as a gift, or inherited), and one vehicle. To declare cash or precious metals, it is necessary to deposit them in the bank.

The one-time fee is:

- 5% of cash parked in Ukrainian banks and the value of assets in Ukraine,

- 9% (7% until March 1, 2022) of the value of assets abroad and money held in foreign banks,

- 2.5% of the money paid by the declarant to purchase domestic government bonds.

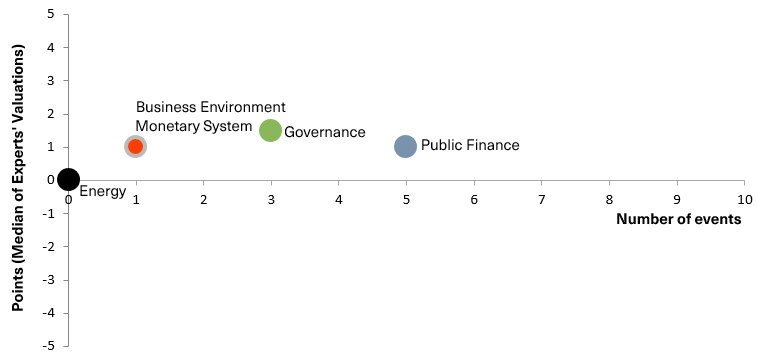

Chart 3. Value of Reforms Index components and number of events

Reforms Index from VoxUkraine aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations