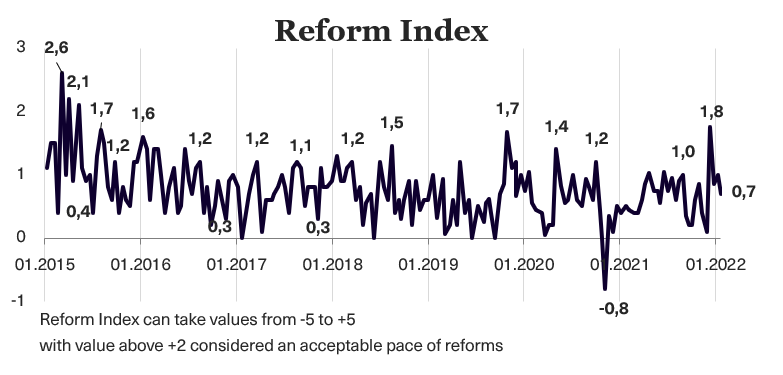

Reform Index is +0.7 points for the period from December 20, 2021, to January 2, 2022, with values ranging from -5.0 to +5.0. In the previous round, the index was +1 points.

Chart 1. Reform Index Dynamics

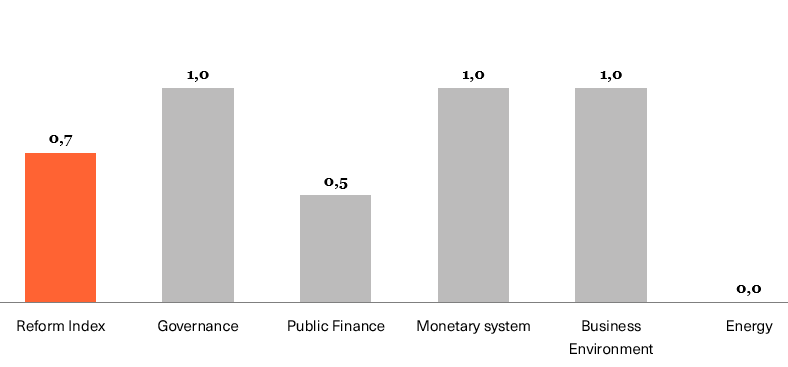

Chart 2. Reform Index and its components in the current round

Changes in licensing rules, registration, and operations of non-bank financial institutions: +1.3 points

The National Bank of Ukraine continues to improve the regulation of non-bank financial institutions. Its resolution No.153 of December 24, 2021, streamlines bureaucratic procedures before the start of operations of financial institutions and entities entitled to provide financial services. In particular, such institutions will now have the right not to re-submit the documents to the National Bank that they submitted earlier if their information is still accurate. Financial institutions will now also be entered into registers when they get their license, which will reduce the period from submitting the documents to the start of operations.

Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

New rules for providers of ancillary services in the financial leasing market: +0.8 points

The National Bank has developed regulations for the providers of intermediary (e.g., information services) and ancillary (e.g., insurance) financial leasing services. Resolution No.156 of December 29, 2021, aims to protect the rights of all parties, providing and receiving such services. It requires detailed contract provisions between the lessor and the agent (an intermediary service provider) and the availability of information (specified in the contract or on the lessor’s website) about the intermediaries with whom they cooperate.

A law that will make it possible to challenge the transfer of seized property to the ARMA: +0.5 points

Law 1942-IX of December 14, 2021, makes it possible to return seized property to the owner based on a prosecutor’s or court’s decision to cancel the seizure of managed assets and/or transfer them to the National Asset Recovery and Management Agency (ARMA). The law also allows the ARMA chairperson to decide on the number of and appoint deputies by their order, provided they meet the criteria set for the Agency’s chairperson: Ukrainian citizenship, higher legal education, government and international organizations experience, and knowledge of the state language. Experts gave the law mixed reviews: both negative and positive. Their median was +0.5 points.

Law on special tax conditions for Diia City residents: 0.0 points

In August, the President signed a law introducing the Diia City legal framework for IT companies. However, this special framework could not be used without amending the Tax Code that establishes the taxation regime for the platform’s residents. Law 1946-IX of December 14, 2021, amended the Tax Code stipulating that residents of the Diia.City legal framework can choose one of two options to pay corporate tax: the 9% exit capital tax, or the 18% income tax. Special tax conditions apply to employees of companies that have joined Diia City, similarly to those of individual entrepreneurs using the simplified tax system: 5% personal income tax (cf. the rate of 18% for regular employees in Ukraine), the unified social contribution of 22% of the minimum wage, and the 1.5% military tax. If an employee receives over EUR 240 thousand per year, PIT is 18% on the amount above the limit. The law received mixed reviews from experts, with a median of 0.

The government has exempted entrepreneurs working in rural areas from the mandatory use of cash registers, 0.0 points

Since adopting the law package that introduced cash registers for entrepreneurs opting for the simplified tax system in 2019, there have been occasional rallies in Ukraine to cancel or postpone the implementation of these laws. In the fall of 2021, the Verkhovna Rada tried to pass a law abolishing the need for cash registers for some types of individual entrepreneurs, but the law failed in its first reading. In December, the Cabinet of Ministers resolution No.1359 abolished the need to use cash registers when selling goods in rural areas (except excise goods) if settlement books and ledgers are used, and the annual volume of transactions does not exceed UAH 1.09 million.

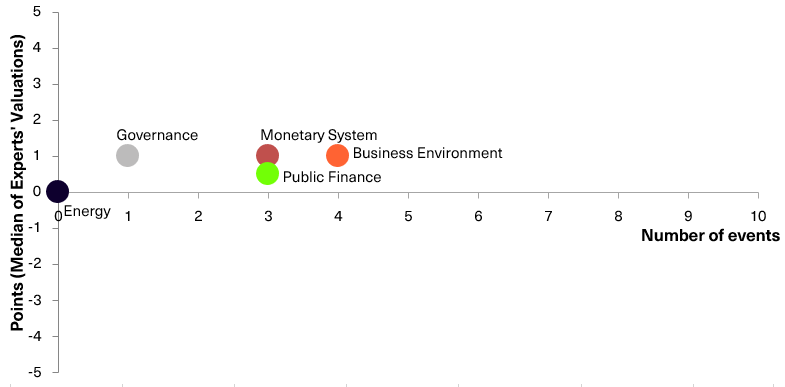

Chart 3. Value of Reform Index components and number of events

Reform Index from VoxUkraine aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas: Governance, Public Finance, Monetary system, Business Environment, Energy.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations