It has been widely recognised that on the way to success entrepreneurs usually face a couple of challenges. The pressure to balance work and life, financial uncertainty, and peer competition are among some typical struggles for running a business. These difficulties, in turn, affect the well-being of entrepreneurs. Given the fact that entrepreneurs’ well-being is closely related to their business performance and the development of the whole economy, economists and policy makers have paid more attention to the factors that can improve entrepreneurs’ satisfaction.

Researchers have long shown that entrepreneurship can bring happiness to individuals due to the autonomy, job self-efficacy and job security related to self-employment (Benz and Frey, 2008; Lange, 2012; Millán et al., 2013). Entrepreneurial satisfaction in its turn is related to the level of financial development as greater financial development allows entrepreneurs to enjoy a higher level of job independence (Bianchi, 2012). However, these existing studies provide limited evidence on entrepreneurs’ well-being in emerging markets where the business environment is different from the one in developed countries.

Recently, Pham et al. (2017) shed a new light on the entrepreneurs’ satisfaction in three emerging economies including China, Russia and Ukraine. They first examine the levels of entrepreneurs’ job satisfaction and life satisfaction by employing data from 2012 Ukrainian Longitudinal Monitoring Survey (ULMS), 2013 China Household Income Project (CHIP) and 2013 Russian Longitudinal Monitoring Survey (RLHS).

The results show that being self-employed is negatively related to job satisfaction. In other words, Ukrainian entrepreneurs are generally less satisfied with their jobs than salaried workers (Table 1). The negative effect is more pronounced among rural entrepreneurs. The dissatisfaction among Ukrainian entrepreneurs suggests the existence of “necessity”, or “pushed” entrepreneurs who enter self-employment due to the lack of paid jobs rather than their intrinsic motivations. It to some extent also reflects the fact that for some reasons like tax payment, Ukrainian individuals might be forced to enter self-employment despite their unwillingness.

Table 1. Self-employment and satisfaction in Ukraine

| Job satisfaction | |||

| Full sample | Urban | Rural | |

| (1) | (2) | (3) | |

| Self-employed | -0.142*** | -0.103*** | -0.168*** |

| (0.022) | (0.030) | (0.031) | |

| Female | 0.026** | 0.019 | 0.042** |

| (0.013) | (0.018) | (0.019) | |

| Married | 0.046*** | 0.037* | 0.044* |

| (0.015) | (0.021) | (0.023) | |

| Education | |||

| High school or college | 0.033** | 0.027 | 0.035 |

| (0.016) | (0.025) | (0.025) | |

| Bachelor or higher | 0.081*** | 0.054* | 0.113*** |

| (0.023) | (0.031) | (0.035) | |

| Health | |||

| Average | 0.077*** | 0.075* | 0.126** |

| (0.025) | (0.044) | (0.053) | |

| Good | 0.146*** | 0.130*** | 0.209*** |

| (0.026) | (0.045) | (0.054) | |

| Working hour | -0.039** | -0.035 | -0.030 |

| (0.020) | (0.026) | (0.031) | |

| Observations | 3,342 | 1,756 | 1,538 |

Average marginal effects are presented in the table. Standard robust errors are in parentheses. ∗, ∗∗, and ∗∗∗ denote 10%, 5%, and 1% significance level, respectively.

Inspired by this finding, the authors then examine whether financial development could improve entrepreneurs’ satisfaction. Ukraine provides an ideal example to explore this matter for several reasons. First, Ukrainian entrepreneurs often report limited external finance as one of the major obstacles during venture development as they are less likely to have significant personal wealth for business. Second, the level of financial development is different across regions in Ukraine and entrepreneurs are located in both more and less financially developed regions. This provides an interesting setup to investigate the link between the variation in access to credit and local entrepreneurs’ well-being.

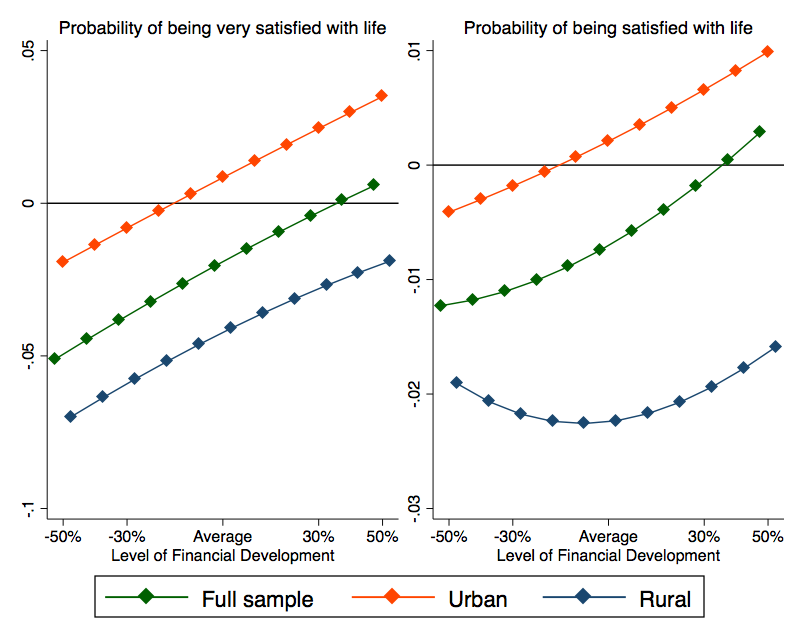

The financial development is found to increase the life satisfaction of entrepreneurs in Ukraine (Figure 1). In addition, both rural and urban entrepreneurs can benefit from financial development. The result suggests that a higher level of financial development could lead to better credit allocation and greater credit availability, thus easing the financial constraints faced by entrepreneurs. As a result, entrepreneurs located in more financially developed regions are more satisfied. For example, if the entrepreneur moves from a region where the level of financial development is 50 percent below the average to another region where financial development level is 50 percent above the average, the probability of being very satisfied with life will increase by around six percentage points.

Figure 1. Marginal effects of self-employment on satisfaction at different levels of financial development in Ukraine

Further investigation shows that greater financial development is not related to the probability of becoming self-employed while negatively related to the likelihood of moving out of self-employment in Ukraine (Table 2). This to some extent indicates that entrepreneurship in Ukraine might be driven by some “push” factors, such as unemployment duration or low earnings from paid jobs, rather than opportunities brought by relaxed financial constraints. However, once an individual enters entrepreneurship, better access to credit could keep him/her in self-employment longer.

Table 2 Financial development and enter/exit entrepreneurship in Ukraine

| Enter entrepreneurship | Exit entrepreneurship | |

| (1) | (2) | |

| Δ Financial development | 0.010 | -0.026* |

| (0.016) | (0.014) | |

| Female | -0.034*** | 0.012 |

| (0.010) | (0.009) | |

| Married | -0.028** | 0.015 |

| (0.013) | (0.010) | |

| Education | ||

| High school or college | -0.036* | -0.059*** |

| (0.020) | (0.018) | |

| Bachelor or higher | 0.022 | 0.019 |

| (0.015) | (0.011) | |

| Health | ||

| Average | 0.019 | 0.039*** |

| (0.016) | (0.014) | |

| Good | 0.073*** | -0.006 |

| (0.023) | (0.012) | |

| Working hours | -0.018 | -0.040*** |

| (0.015) | (0.015) | |

| Observations | 1,699 | 1,620 |

Results for China and Russia show a different picture. In particular, Chinese and Russian entrepreneurs are happier than paid workers. Moreover, Chinese entrepreneurs, who are likely to rely on informal finance, do not benefit from the development of the formal financial sector. More interestingly, in Russia, financial development could reduce job satisfaction of urban entrepreneurs while increase life satisfaction of rural and low-income entrepreneurs.

In general, these results suggest that financial development could affect entrepreneurs’ well-being through both monetary and nonmonetary channels. On the one hand, financial development could boost the economic growth, thereby making people better off and happier in life. On the other hand, higher financial development could provide better access to finance, thus relaxing the financial constraints faced by startups. In this case, competition in the market will become fiercer as more individuals will be encouraged to start own businesses. For entrepreneurs who are already in the market, enhanced competition could make them less satisfied with their job.

Based on these findings, the study offers several implications concerning entrepreneurial well-being. First, the formal financial sector should be reformed to become more attractive – for example, lending process could be shortened and streamlined. Hence, individuals would use more formal credit and benefit more from its development. Second, banks should consider expanding services and credit in rural and less financially developed areas to benefit individuals living in those areas. Third, government assistance in the form of financial support or advanced training and education should be provided for rural entrepreneurs, especially “pushed” entrepreneurs. The latter is to ensure the sustainable growth of the business even after the assistantship is withdrawn.

Reference

Benz, M., Frey, B.S., 2008. Being independent is a great thing: Subjective evaluations of self‐employment and hierarchy. Economica 75(298), 362-383.

Lange, T., 2012. Job satisfaction and self-employment: autonomy or personality? Small Business Economics 38(2), 165-177.

Millán, J.M., Hessels, J., Thurik, R., Aguado, R., 2013. Determinants of job satisfaction: a European comparison of self-employed and paid employees. Small Business Economics 40(3), 651-670.

Pham, T., Talavera, O. and Zhang, M., 2017. Self-employment, financial development and well-being: Evidence from China, Russia and Ukraine.

Main photo: depositphotos.com / GaudiLab

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations