Countries have many instruments to extend their power across the world – from culture and food to educational and scientific exchange to loans and foreign direct investment (FDI). In dictatorships such as Russia or China these initiatives are rarely private – most often there is a coordinated policy implemented with the long-term goal of controlling critical resources and creating leverage over other countries. One prominent example is the use of energy and food as weapons by Russia. Other sectors may be less obvious, but in this article we catalog Chinese and Russian FDI in Africa and its strategic goals.

Asian tigers leap to Africa?

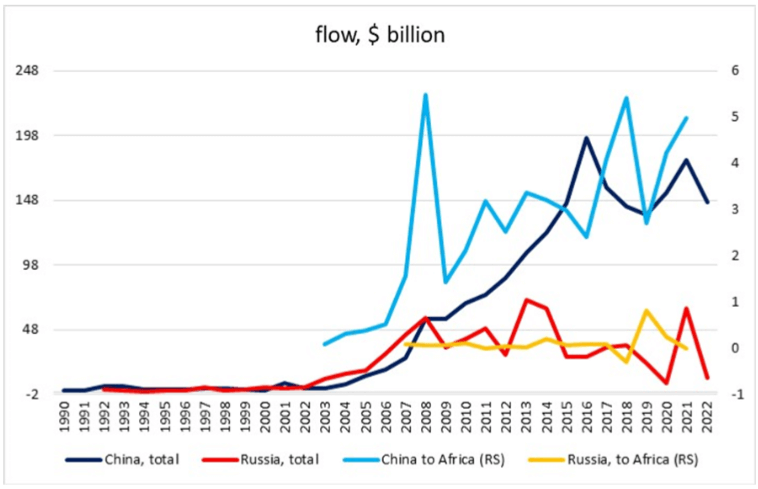

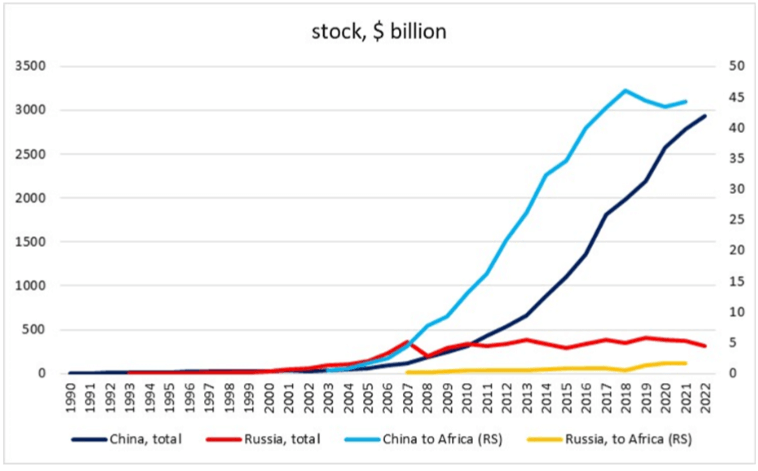

There are two ways to look at FDI: from the perspective of the investor and from the perspective of the investment target. From the perspective of the investor, the share of Chinese and Russian FDI that has been going to Africa has been relatively small (Figure 1).

In 2003-2021 China invested nearly $51 billion in African countries, while Russia invested $1.7 billion. This corresponds to only 1.6% of China’s total FDI in 2021 (down from a maximum of 4.2% in 2008), and less than 0.5% of Russia’s total FDI in any year. However, these relatively inexpensive investments carry a disproportionately large political impact.

Figure 1. Outflow of FDI from Russia and China

Data sources: UNCTAD, China Africa Research Initiative, Central Bank of Russia, own calculations. Note: total FDI is shown on the left scale, FDI to Africa on the right scale.

Looking from the perspective of the investment target (i.e., individual African countries), China is a disproportionately large FDI source (Figure 2). For countries such as Eritrea, Kenya, Zambia or Zimbabwe, China accounts for about 20% of their total FDI stock.

Figure 2. Share of China in FDI stock per country, 2021, %

Data sources: UNCTAD, China Africa Research Initiative

South Africa and the Democratic Republic of Congo are the primary recipients of China's foreign direct investment (accounting for 12% and 10% of China’s total FDI in Africa, respectively), due to their vast reserves of valuable minerals such as lithium and uranium. These resources are crucial for the advancement of energy transition and technological development. The increasing dominance of China over these resources has the capacity to alter global energy dynamics and strengthen its negotiating leverage in the world.

China's strategy demonstrates its aspiration to become an essential part of Africa's economic structure. As Figure 3 shows, China primarily invests into construction and mining, less so in manufacturing or other sectors.

Figure 3. China’s FDI stock by sector, USD billion

Data source: China Africa Research Initiative

The sustained investment in mining suggests that China may be focusing on acquiring access to critical raw materials, potentially including strategic resources like lithium and uranium. The persistent investments in these sectors indicate a strategic positioning by China to capitalize on Africa's rich resource base and to secure long-term supply chains for its industries.

China's investment in lithium, a crucial component for the clean energy sector, has been particularly aggressive, with Chinese mining and battery companies investing $4.5 billion in lithium mines over the last two years, leading many of Africa's lithium projects in countries including Namibia, Zimbabwe, and Mali. China is on track to secure a significant share of the world's lithium mining capacity by 2025, potentially controlling one-third of it. This control over lithium, coupled with a substantial share of cobalt production – China Moly, Zijin Mining, and other Chinese companies control around 30% of African copper production and 50% of cobalt production – positions China at a critical juncture that could influence global supply chains. Although China controls less than 7% of the total African value of mine production, its influence is notably strong in these strategic sectors.

The potential hazards of Chinese control over lithium, copper, and cobalt are multifaceted. Economically, the dominance of China in these sectors can lead to a dependency where African countries may not have the leverage to negotiate equitable terms, as seen in the case of the Democratic Republic of Congo's attempts to renegotiate an infrastructure-for-minerals deal with Beijing. Politically, the increased reliance on Chinese investments can lead to Chinese interests significantly influencing the governance and policymaking in these African nations. Moreover, environmental and safety standards often take a back seat in Chinese-owned mining operations. The lack of stringent regulations and oversight can lead to environmental degradation and poor labor conditions, raising ethical and sustainability concerns.

As China strengthens its grip on refining and processing critical minerals, the call for diversifying supply chains grows louder. The international community, particularly Western nations, seeks to form a critical mineral supply chain that is free from Chinese influence, but China's head start in building infrastructure and financing operations across Africa poses a significant challenge.

Russia's Approach

Russia's FDI in Africa is strategically selective and relatively small in terms of volume, yet significant in terms of geopolitical influence. Its main FDI destinations (at least judging from the scarce data published by the Russian Central Bank) are Cogno, Zimbabwe, and Angola (see Figure 4). The 2023 Russia-Africa summit highlighted Moscow's ambition to expand its economic footprint, targeting sectors like agriculture, mining, and energy, and aiming to double trade figures by 2030. However, Russia's actual FDI remains less than 1% of the total FDI in Africa.

The Russian state and its enterprises, such as Rosatom in the energy sector and Rusal in mining, have engaged in projects that, while not massive in investment scale, carry significant political and strategic weight. These projects often involve critical resources such as uranium, which is pivotal for nuclear energy, and can lead to Russia exerting considerable control over these resources. For instance, Rosatom has been active in expanding its uranium reserves, including a $1.15 billion acquisition of a project in Tanzania. Russia's control over uranium is not just about the raw material itself but also about the entire nuclear fuel cycle. Despite being a relatively small producer of raw uranium, Russia has a substantial share of the world's uranium conversion and enrichment infrastructure, at 40% and 46%, respectively. These capabilities are critical since they turn raw uranium into a form that can power nuclear reactors. Additionally, Russia is a dominant exporter of nuclear power plant development, having initiated the construction of 19 nuclear reactors between 2012 and 2021, with 15 of these abroad – far more than any other country during the same period. Russia’s control over nuclear reactor technology, such as VVER reactors, and fuel (the only authorized supplier of the necessary fuel for these reactors is a Russian company) creates a dependency for countries using nuclear technology. If African nations adopt Russian nuclear technology, they will face a dependency on Russia and propagate wider implications through Russian control of significant uranium resources within the continent.

Moreover, Russia is the leading arms supplier to Africa, controlling half of the market. This dominance in the defense sector, coupled with Russia’s leveraging of asymmetric tools such as private military contractors, bolsters its influence across the continent.

While Russia's economic presence is not as vast as China’s, its role in the supply of strategic commodities and military hardware to African nations presents a nuanced challenge. If Russia were to gain control over critical resources like lithium or uranium, it could create dependencies, influence market prices, and ultimately use these dependencies for political leverage – a pattern that has historical precedents in other regions. The potential risks of such engagements are profound. Control over critical resources by a foreign power (especially an aggressive state such as Russia or China) not only affects the sovereignty of African nations but also poses a strategic challenge on a global scale, as these materials are essential for clean energy transition and technological development worldwide.

Conclusion

The chessboard of African resources is dynamic, with every move by Russia and China potentially tipping the balance of global power. The outcome of this geopolitical game will reverberate beyond the African continent, shaping the contours of international relations for years to come. Russia’s and China’s actions in Africa demand our attention and a strategic response that champions sustainable and equitable development.

Figure 4. Distribution of Russian and Chinese FDI stock by African countries, %, 2021

Data sources: UNCTAD, China Africa Research Initiative, Central Bank of Russia, own calculations. Note: numbers present shares of FDI by a specific country, for example, 42.6% of Russian FDI stock and 2.2% of Chinese FDI stock went to Congo Republic.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations