The Georgian government did not start the reform by sharply reducing the tax rates. Before anything else, it reviewed the motivation system within the tax service. It was impossible to fire all the tax inspectors instantly, as it was done with the police. Therefore, the government decided to alter their mindset by restructuring the system of their motivation. First changes in the tax legislation were adopted already in 2005, when a new tax code and a law on tax amnesty were introduced.

High tax rates, a complicated corruption-inducing system, kickbacks for securing VAT refund, tax benefits in exchange for bribes, collusion between business and tax inspectors, shake-downs on the companies that were not willing to pay kickbacks. This is all about Georgia before 2004. One of the most favourable tax legislations in the world, the tax service offers highest quality services via electronic systems, businesses are convinced that they have to pay taxes. This is all about Georgia after 2011.

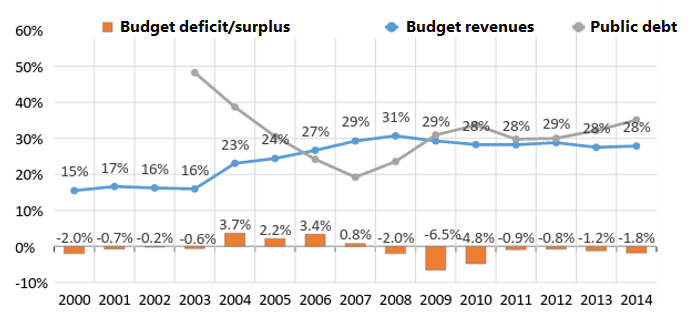

There is no doubt that the tax reform carried out by the Mikhael Saakashvili’s team after its ascend to power in 2004 was a success. As a result, Georgia climbed 100 places in the Doing Business ranking, from the 111th place in 2005 (the 2005 ranking reflected the situation in the second half of 2003 and the first half of 2004, i. e. before the “Rose revolution”) to the 12th place in 2011. The share of the companies that paid taxes (compliance rate) rose to 78-85% from 35%. The ratio of budget revenues to GDP almost doubled, rising from 16% in 2003 to 31% in 2011.

The Georgian government did not start the reform by sharply reducing the tax rates. Before anything else, it reviewed the motivation system within the tax service. It was impossible to fire all the tax inspectors instantly, as it was done with the police. Therefore, the government decided to alter their mindset by restructuring the system of their motivation. Harsh sentences given to tax inspectors on corruption charges were combined with widely broadcast arrests of corrupt officials, and quickly discouraged most of them from taking bribes. Authorities arrested numerous former officials and businessmen suspected of corruption. They were given an option of buying themselves out of prison by paying substantial amounts of money to the treasury (the payments sometimes equalled tens of millions of dollars). These methods were condemned by human rights organisations, yet they clearly demonstrated to the society and bureaucrats that the rules of the game had changed and the country started a new way of living.

First changes in the tax law occurred already in 2005, when a new tax code and a law on tax amnesty were introduced. There were three stages of the tax reform. The main achievements of the first stage (2005-2006) were the decrease in a number of taxes from 22 to 7, the simplification of tax procedures and the expansion of the tax base. Only a few of the tax rates were reduced. The social security contribution changed the most – from 33 to 20%. The later stages (2007-2009 and 2010-2011) saw radical reductions in tax rates. In 2008, the social security contribution was merged with the personal income tax. The combined tax rate was lowered from 32% to 25% in 2008, and further to 20% in 2009. Also in 2008, the corporate income tax rate was decreased from 20% to 15%, and in 2009, the dividend and interest tax rate was reduced from 15% to 5%. Moreover, the 100% depreciation of fixed assets investment was introduced, with an opportunity to report losses during five years.

Table 1. Key tax system indicators in Georgia in 2004-2011

| First stage | Second stage | Third stage | ||||||

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

| Number of taxes | 22 | 7 | 7 | 7 | 6 | 6 | 6 | 6 |

| VAT rate (%) | 20 | 20 | 18 | 18 | 18 | 18 | 18 | 18 |

| Personal income tax rate (%) | 12-20 | 12 | 12 | 12 | 25 | 20 | 20 | 20 |

| Social security contribution (%) | 33 | 20 | 20 | 20 | ||||

| Corporation income tax (%) | 20 | 20 | 20 | 20 | 15 | 15 | 15 | 15 |

| Dividend and interest income tax (%) | 10 | 10 | 10 | 10 | 10 | 5 | 5 | 5 |

Source: Ministry of Finance of Georgia, IMF

Tax rates were lowered simultaneously with broadening the tax base, which included the cancellation of tax benefits, and with introduction of a stricter control over tax evasion. One of the unpopular steps included prohibiting the street trade without a licence (and accordingly with no taxes paid). Small street vendors went to the streets to protest against the measure that could deprive them of their only source of income. The provision that required all enterprises to use cash registers to record VAT collected on each transaction caused massive discontent and the resistance of businesses. The government did not make any concessions. Moreover, it enforced the new rules by means of controlled purchases made by secret customers. It punished all the disobedient enterpreneurs with hefty fines, which often exceeded the price of a cash register by several times.

At the same time, the Georgian government streamlined the tax administration system. In order to improve the business environment and to minimise contacts between businesses and bureaucrats, authorities introduced a system of electronic tax reporting in 2007. They also established the risk-based system of tax audits based on clear criteria. Since 2011, only those companies that were deemed at risk of evading taxes were subject to tax inspections.

Thanks to the comprehensive tax reform, Georgia managed not only to create a favourable business environment, but also to improve its fiscal situation. It is notable that the state budget revenues grew most before the changes in the tax laws. The ratio of budget revenues to the GDP was equal to 23% already in 2004, in comparison to only 16% in 2003 (a 7.0 percentage points decrease). Tax revenues rose almost by 4.0 percentage points, to 16% of GDP. In the next years, revenues grew as well, yet at a lower speed: they grew by 8.0 percentage points in four years – up to 31% of GDP in 2011.

Graph 1. The dynamics of key budget figures in Georgia in 2000-2014 (% of GDP)

Source: IMF

The Georgian experience of tax reform has never been more relevant for Ukraine as it is today. Both governmental and non-governmental organisations that take part in designing changes to the Ukrainian tax code should analyse the reasons behind the success of the Georgian reforms and draw appropriate conclusions from it. In my opinion, the main reasons of the success are the following:

First, Georgian reformers were not only liberals, but pragmaticts as well. Their primary task was to increase the budget revenues. They were successful thanks to the active struggle against corruption, though their methods were not always ideal.

Secondly, tax rates were reduced gradually. This reduction was matched by the cancellation of tax benefits, which prevented a slump in budget expenditures and contributed to the creation of the same rules for all.

Thirdly, in addition to lowering tax rates, a lot was done to simplify the tax administration system.

Fourthly, a stricter control over paying taxes was introduced. A new system was created, which ensured that only those who actually evaded paying taxes were punished. At the same time, honest companies could work without fearing unwarranted and tiresome tax inspections. New strict rules caused discontent and even protests, yet were accepted by the business community because they applied equally to all, without any exemptions.

Finally, the comprehensive approach was very important. The main principles of the tax reform in Georgia are low tax rates, ease of paying, strict control over tax evaders, equal rules for all. If at least one ingredient is omitted, a cake called “tax reform” may prove to be not only inedible, but poisonous as well.

Tax Reform Week

Tax Reform – What’s On the Table (Pavlo Kukhta, member of the Editorial Board of iMoRe)

Pavlo Sebastianovich: Medium and Small Businesses Displaced From the Legal Field of High Tax Rates (Pavlo Sebastianovich, Civic Platform “Nova Kraina”)

Vladimir Dubrovskiy: 1-2% of GDP in Additional Revenues as a Result of a Crackdown on Simplified Taxation are Unrealistic Figures (Vladimir Dubrovskiy, RPR expert)

Tetyana Prokopchuk: Business Believes that the Priority is to Simplify the Administration of Taxes (Tetyana Prokopchuk, Vice President of Policy of the American Chamber of Commerce in Ukraine)

Robert Conrad: Tax Reform is not Simply Changing the Law (Robert Conrad, Duke University)

Anna Derevyanko: Cosmetic Changes will not Work for the Society (Anna Derevyanko, Executive Director, European Business Association)

Ukraine Needs a Radical but Sensible Tax Reform (Anders Åslund, Senior fellow at the Atlantic Council in Washington and author of the book “Ukraine: What Went Wrong and How to Fix It”)

Roman Zharko: Core Problem of the Ukrainian Tax System is Practice of Discretionary Use of Fiscal Mechanism to Reach the Established Revenue Targets (Roman Zharko, PhD, Tax Manager, Baker Tilly)

Tax Reform in Ukraine: How to Accomplish the Impossible (Vladimir Dubrovskiy, expert of the RPR group)

Tax Reform in the Light of Macroeconomic Stability: the NBU Perspective (Dmytro Sologub, Deputy Governor at National Bank of Ukraine, and Serhiy Nikolaichuk, Director of monetary policy and economic analysis department at NBU)

Macroeconomic Implications of the Tax Reform (Yuriy Gorodnichenko, UC Berkeley, co-founder of VoxUkraine)

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations