The Russian full-scale invasion of Ukraine, which started on February 24th, 2022, has had detrimental consequences for Ukraine’s agricultural sector and its newly founded farmland market. Russia’s blockade of sea trade in mid-February resulted in the collapse of agricultural exports, and the land market ceased all operations on the day of the invasion. However, despite the challenges of the first months of the war, Ukraine, with the help of the international community, partially restored its agricultural exports and kept its position as one of the largest global grain suppliers. Moreover, Ukraine’s land market resumed operations with land prices comparable to the pre-war levels two months after the invasion. This article looks into the recent trends in Ukraine’s farmland market and the measures the Ukrainian government took to support the agricultural sector during the war.

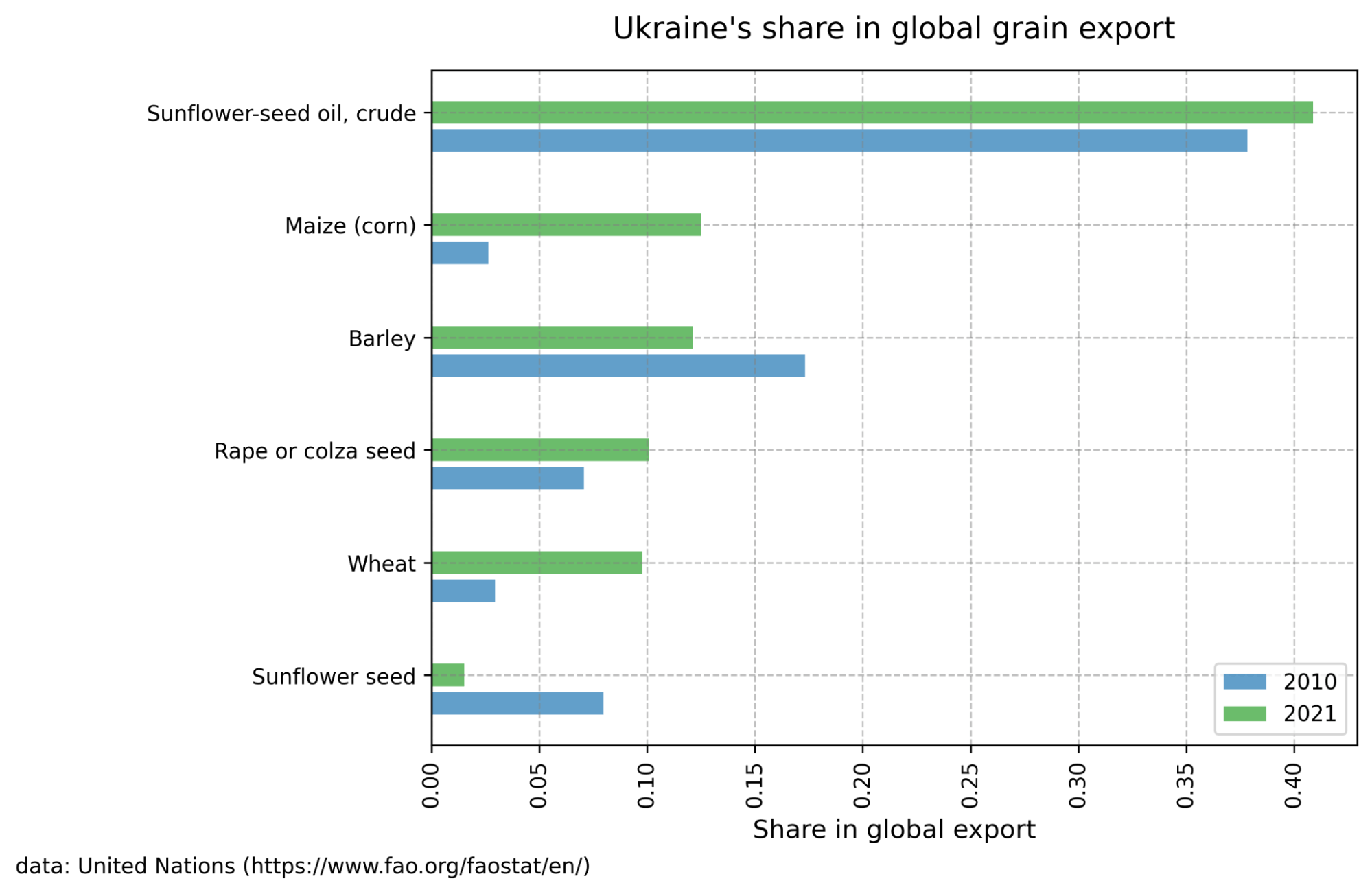

The agricultural sector is one of the most sizable sectors of Ukraine’s economy. In 2021 approximately 14% of the country’s population was employed in the agricultural sector, contributing 10.9% to its GDP and 41% to its exports. Ukraine is one of the major world grain exporters, and its global share has increased over the past decade. As of 2021, Ukraine accounted for more than 40% of global export of sunflower oil, more than 10% of corn and barley, and about 10% of wheat and rapeseed (Figure 1).

Figure 1

The full-scale Russian invasion of Ukraine has been detrimental to Ukraine’s agricultural sector. The areas directly affected by the war accounted for about 36% of the country’s crop production before the war [1]. About 30% of Ukraine’s territory could be mined. Moreover, the Black Sea blockade and the damage to agricultural facilities increased the costs and risks to grain production and exports. The Ukrainian government and international community are putting enormous effort into preserving the logistic routes of grain export. For example, the Black Sea Grain Initiative eased the logistic constraints of shipment by the Black Sea, which helped partially restore grain export. However, even with these efforts, grain export decreased by about 13% compared to the previous market year, according to the Ministry of Agrarian Policy and Food as of April 2023.

Small-scale producers also suffer from the adverse effects of the war. According to the FAO survey, 44% of producers report a detrimental increase in production cost, and one in four respondents reports reducing or stopping production due to war [2]. As of February 2023, the overall losses for Ukrainian agriculture are estimated at $40.2 billion, from which direct losses constitute $8.7 billion.

2. Ukraine’s farmland: structure of ownership and use

Less than one year before the invasion, in June 2021, Ukraine opened its agricultural land market after two decades of a moratorium, which prohibited the trade of agricultural land. The government introduced the moratorium on the sale of agricultural land in 2001, following the decade of initial land privatization after the collapse of the Soviet Union (agricultural land was traded for a brief period in the late 1990s, but the market was very small at that time). The complex process of initial land privatization and a 20-year moratorium resulted in a fragmented land ownership structure with many small plots of land scattered across the country, making it challenging to consolidate Ukraine’s agricultural sector. By 2020, private ownership accounted for 31 mln ha or 75% of Ukraine’s agricultural land, with about 6.9 million private landowners. However, landowners cultivate only 29% of the land, while most agricultural land is employed under rental agreements, according to the State Land Cadastre.

VoxUkraine has consistently supported introduction of a liberal land market explaining its benefits or that the moratorium results in low rental rates for land and shadow schemes.

By 2020, 117 largest companies controlled 16% (or 6,45 mln ha) of all agricultural land, predominantly through rental contracts. According to estimates of the Land Matrix Database, the foreign control of Ukraine’s agricultural land through foreign direct investment amounts to at least 3.3 mln ha, constituting about 10% of Ukraine’s arable land. The Land Matrix Database tracks only the largest land lease deals and hence gives the lower bound estimate for the percent controlled by foreigners. The concentration of land within large agricultural enterprises is often a natural consequence of the increasing returns to scale inherent in the food crops industry. According to official government statistics, large enterprises have more than 20% higher productivity than the country’s average productivity value [3].

In 2018, Ukraine’s government introduced a reform decentralizing public land. Specifically, the Law on Collective Ownership of Land started transferring some government-owned land to local community ownership; this transfer accounts for about 3.7 mln ha (1.7 ha in 2018-2019 and 2 ha in 2020).

3. The newly established farmland market: legal framework

The start of the agricultural land market was rather calm, with prices remaining relatively stable during 2021. The reason is that Ukraine’s market of agricultural land in its current form remains heavily regulated, excluding virtually all significant potential buyers. According to the law establishing and regulating the land market, the right of purchase is granted exceptionally to individuals starting in 2021; firms must wait until 2024 to participate. Additionally, the law excludes government and public-owned lands from the market. Until January 1st, 2024, the upper bound of the size of land ownership by individuals is fixed at 100 ha; for the firm land ownership, it will be 10 000 ha starting in 2024. Notably, the total individual land ownership includes shares in public companies which own land. The law prohibits foreigners and companies with foreign participation from the market; the question of foreign access is postponed to a referendum, whose date is yet to be determined.

Even though the law restricts land purchases by firms until 2024, the firms still have some degree of control over the leased land they cultivate. For instance, the law on land rental guarantees the priority right of purchase of the rented land by the current tenant. Through this law, the current land user can effectively choose the new owner and ensure that the new owner is interested in continuing the lease.

Notably, a legal price floor exists in Ukraine’s farmland market. The law on land market establishes that until 2030 land transaction price should be no smaller than the legally established Normative Money Value (NMV – Нормативна грошова оцінка). The NMV is an estimate of the value of Ukraine’s land computed by the State Land Cadastre (Держгеокадастр) using the methodology established by the Cabinet of Ministers. This estimate is mainly based on soil quality and varies from region to region.

Ukraine’s land valuation has historically relied on NMV estimates without a fully functioning land market. These estimates are employed to compute land taxes, but they also provide a base for the legally established minimum rental price and, since 2021, the minimum sales price. According to the Law on Social Protection of Rural Population, the rental rate should be no smaller than 3% of NMV. Moreover, according to the Ukraine Tax Code, the maximum rental price of state-owned land cannot exceed 12% of NMV in peaceful times. Furthermore, the Agricultural Land Market Law establishes that the purchase price of agricultural land plots allocated in kind to land share owners should be no smaller than NMV until 2030.

4. Impact of war on Ukraine’s farmland market

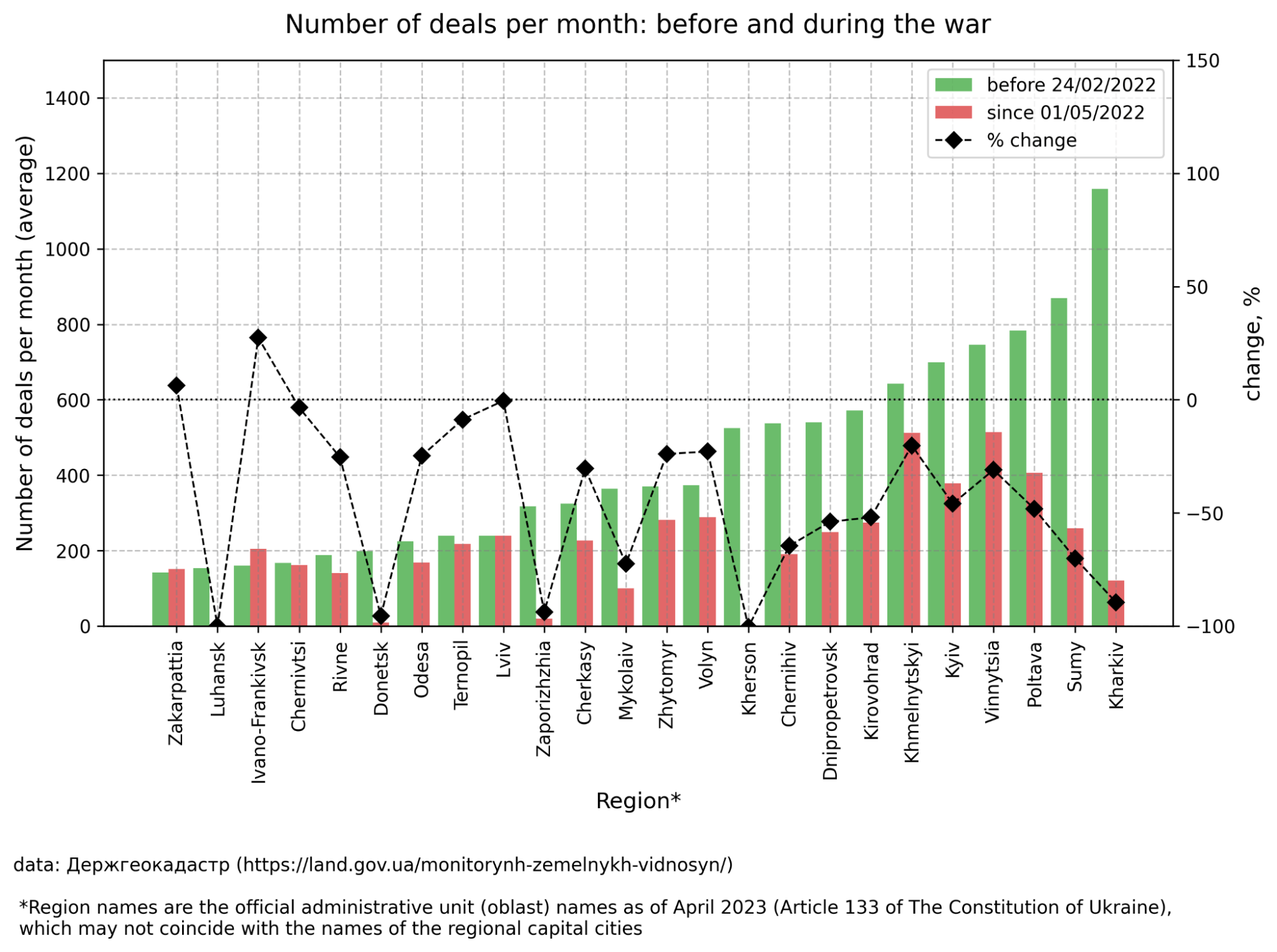

The full-scale war has affected the work of Ukraine’s newly established agricultural land market. During March-April 2022, the market was closed, as the government had restricted access to the land ownership database. In May 2022, the Ukrainian government issued the war-time regulation for the land ownership register, and the land market slowly resumed its operations. In 2021, the monthly volume of operations was about 10 000 deals per month. This number has halved due to the war (Figure 2).

In its current setting, Ukraine’s agricultural land market is characterized by a legal price floor, meaning that when the market price approaches the minimum price, land owners cannot lower their prices further to find buyers. The regional analysis below reveals that land is traded close to the minimum legal price in many oblasts of Ukraine (see regional analysis section below). As a result, the trade volume in most areas might be determined mostly by the quantity of land investors are ready to buy at the minimum price, which is less than landowners are ready to sell.

The war has caused considerable uncertainty regarding land valuation, leading investors to adopt a wait-and-see approach and resulting in a decreased market volume. Those investors who nevertheless decide to buy prefer smaller-sized deals compared to pre-war levels: before the war, the average deal size was 2.5 ha, while since the beginning of the war, it has decreased to approximately 2 ha.

Figure 2

The trade volume provides only a partial picture of the market operations. Price is another important piece of information. However, the analysis of the price data comes with a caveat that for many deals price data is not available – only half of the recorded deals reported the price before the war, and currently, only a quarter of deals report their prices [4]. Since not all prices are reported, potential concerns about the validity of the analysis arise. These concerns include self-selection in reporting the price of a deal, implying that reported prices may not represent the true prices. The usual source of self-selection relates to underreporting for tax-evasion reasons. Hence, before proceeding with the price analysis, it’s worth briefly describing the tax framework in place.

The current Tax code states that the first sale of land in three years is not taxed if the plot size is below the maximum size eligible for free transfer (2 ha) or if the ownership rights were obtained in the privatization process. Moreover, the tax on land ownership is based not on price but on the NMV, meaning that the reported market price does not affect the land ownership tax. As a result, only a limited number of deals (parcels larger than 2 ha which were purchased not more than 3 years ago) are subject to taxation based on the reported market price, which reduces the possible severity of selection in the reported sample.

Figure 3

Figure 3 plots the median reported farmland price over time. Surprisingly, when the market reopened in May 2022, the price of land in UAH was higher than the pre-war price despite harsh economic conditions. In particular, before the war, the median price level was around 30 000 UAH/ha, while during 2022 median price of land was around 35 000 UAH/ha and remained relatively stable in the subsequent months. However, prices measured in US dollars started falling in July 2022 as the National Bank of Ukraine devalued the Ukrainian hryvnia by 25%. After this devaluation, the US dollar-denominated price stabilized at values slightly smaller than the pre-war values. Overall, the war has had only a moderate effect on farmland prices. One possible explanation can be that before the full-scale invasion, the market only started to develop, and, using product life-cycle terminology, only the “innovators” (i.e., risk-takers) entered it. Another possible explanation is that market restrictions before the war had a similar effect on the market as the increased uncertainty during the war. In any case, lifting restrictions would help attract more market participants and positively affect investment in Ukrainian agriculture.

4.1 Regional trends in Ukraine’s farmland markets

The impact of the full-scale war on the farmland market has been non-uniform across regions, with two main features shaping the regional trends: 1) the shift of trade volume to the central Ukraine regions and 2) little effect of the war on regional land prices in the majority of regions. We elaborate on these points below.

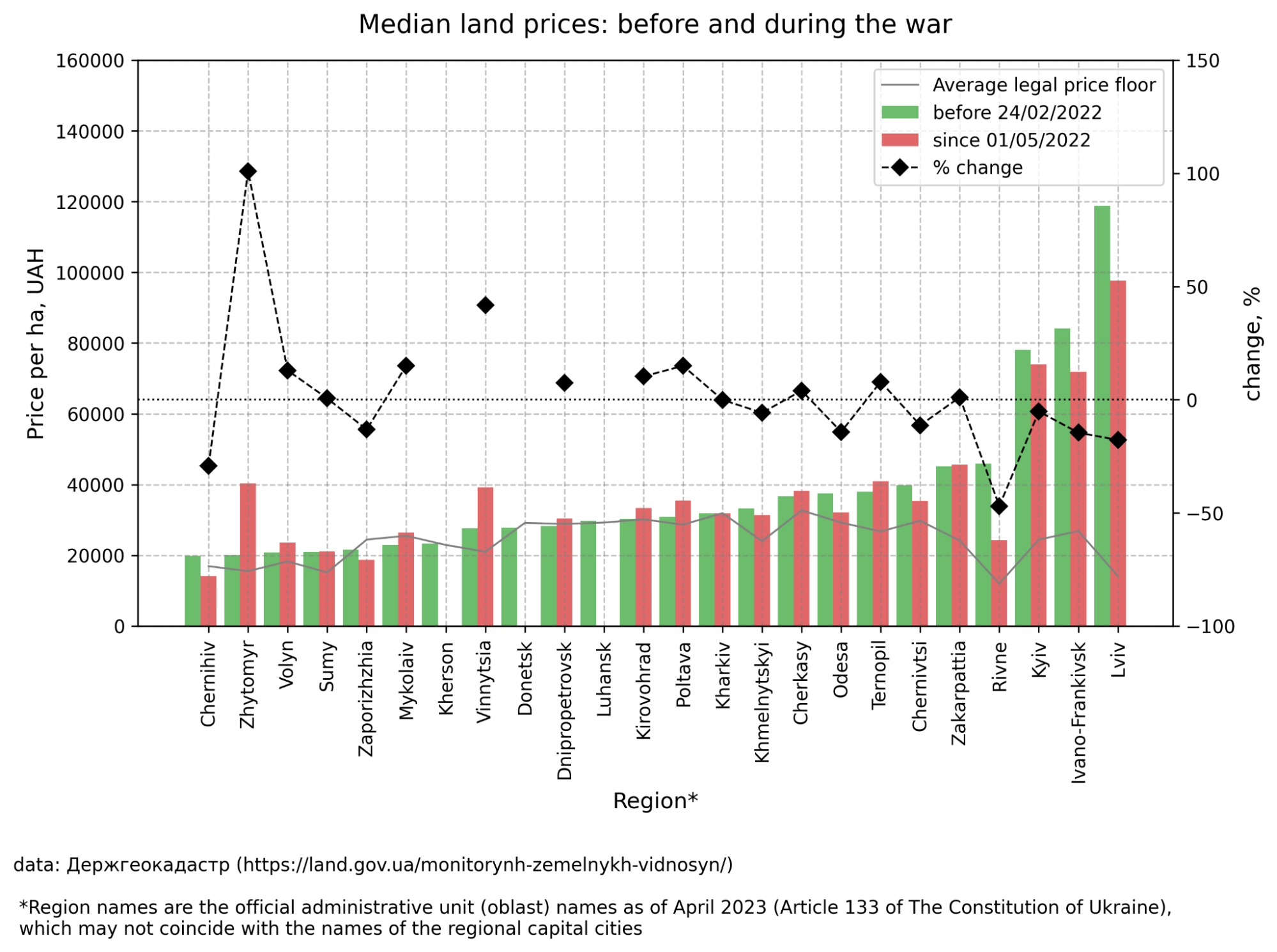

Despite the war, regional land prices have remained relatively stable in many areas and have even increased in some regions of central Ukraine (Figure 4). Before the full-scale Russian invasion, Lviv, Ivano-Frankivsk, Rivne, Zakarpattia, and Kyiv regions had the highest median land price, significantly exceeding the legal price floor. In the rest of the country, agricultural land traded relatively close to the price floor, suggesting that the demand side dominates the Ukraine land market (however, we should remember the poor reporting of prices discussed above and the possibility that some reported prices may be lower than actual prices to lower the tax payment).

Figure 4

The legal price floor might have prevented many regional prices from dropping at the onset of the war – prices dropped only in western regions of Ukraine, where the price floor was less binding initially (in regions where prices were close to the floor we can expect a drop in volume instead). Moreover, the median land price has increased in several regions of central Ukraine: by 100% in Zhytomyr, 40% in Vinnytsia, and 15% in Poltava as regional demand for land has shifted toward these regions. Impressive price growth in Zhytomyr and Vinnytsia regions has exceeded hryvnia depreciation rates suggesting that despite the overwhelming uncertainty of the war, investors find Ukrainian farmland to be an attractive asset in oblasts that are relatively far from the frontlines.

Unlike prices, trade volume has dropped sharply in most regions (Figure 5). Before the war, the northeast regions of Ukraine, such as Kharkiv and Sumy, had the largest trade volume measured as the number of deals per month, followed by Poltava and Vinnysia regions in central Ukraine; the western areas of Zakarpattia and Ivano-Frankivsk showed the smallest trade volumes. Since the start of the full-scale war, trade in the eastern provinces of Luhansk and Donetsk and the southeast regions of Zaporizhzhya and Kherson has dropped practically to zero as these regions suffered most from military actions on the ground.

Figure 5

The trade volume in northeast Ukraine has reduced dramatically: more than 85% drop in Kharkiv and more than 70% in Sumy and Chernihiv regions. The volume has also fallen for the central Ukraine regions, however, the reduction has been less severe: Poltava region has suffered a 50% decrease in volume, while Vinnytsia, Cherkasy, and Zhytomyr regions have experienced a 25% decline in the number of deals per month. The regional trade volume patterns support the above conclusion that investors shift their focus from northeast areas that are close to the Russian border and the frontline towards central Ukraine, which balances good soil fertility and location risks.

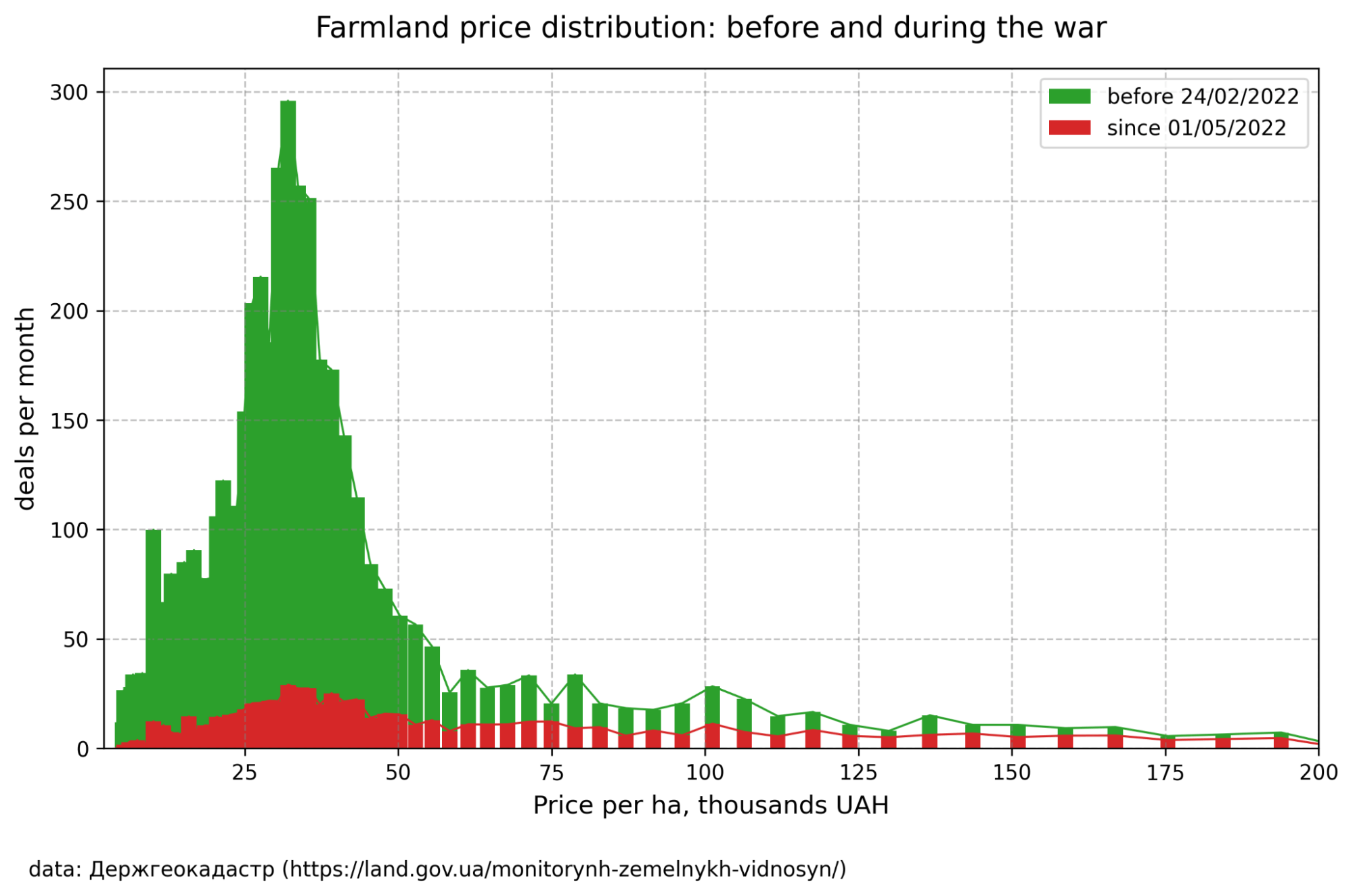

4.2 Effect of war across price distribution

Figure 6 shows how the war has affected the distribution of farmland prices. Before the war, we observed a large concentration of deals below the level of 50 000 UAH/ha. During the war, this core share of relatively cheap deals decreased substantially – the current number of deals in this price range is about 10 times smaller than the pre-war level. In relative terms, 88% of the deals were below 50 000 UAH/ha before the war, and now this share is 69%. The number of deals with a price above 50 000 UAH/ha has also decreased but to a lesser extent. For instance, the monthly number of deals in the 50 000 – 75 000 UAH/ha range decreased by about 2.5 times compared to the pre-war levels. Overall, the price distribution has become less concentrated at the low price levels.

Figure 6

The sharp drop in the number of deals below 50 000 UAH/ha reflects mostly the lower demand for land caused by the war-related uncertainty – in the vicinity of the legal price floor, trade volume is largely shaped by the demand conditions. In contrast, for the price range above 50 000 UAH/ha, the volume change is determined by both demand and supply factors. On the demand side, investors’ preferences might have shifted toward exceptional land deals. Such deals include lands that are better than the average by specific parameters. With the start of the war, not only soil quality and logistics but also the distance from the current and potential frontline started to play an important role. This shift in demand may explain the relatively lower fall in trade volume for deals above 50 000 UAH/ha.

The other possible reason for a relatively moderate impact of war on trade above 50 000 UAH/ha lies on the supply side. Before the war, many owners of relatively good-quality land were reluctant to sell, expecting future price growth. Indeed, the market was previewed to be further deregulated in 2024, which would have expanded demand and increased prices. The war negatively affected these optimistic expectations and may have pushed some landowners to sell their land. Compared to the low-price segment, where prices are restricted from further drop and the supply side virtually does not affect the market, the prices in the high-price segment have more freedom of adjustment. As a result, an increase in supply possibly softened the impact of the war on this price segment.

The regional price analysis above provides a good illustration of the impact of possible increased willingness to sell in the high-price segment. Before the war, the median prices in Lviv and Ivano-Frankivsk regions were among the highest in the country – far above the legal price floor. Due to the war, prices in these regions dropped much more than in other regions while trade volume remained almost unchanged. Such a situation is possible when there is a simultaneous drop in demand and an increase in land supply, which might have happened in both these regional markets and the high-price segment in general.

4.3 The fundamental value of Ukraine’s land

Despite the formal presence of the land market, the fundamental value of Ukraine’s land is challenging to estimate. However, the well-known fact is that one of the world’s most fertile soils covers two-thirds of Ukraine’s territory, making Ukraine one of the countries most suitable for agriculture.

Figure 7

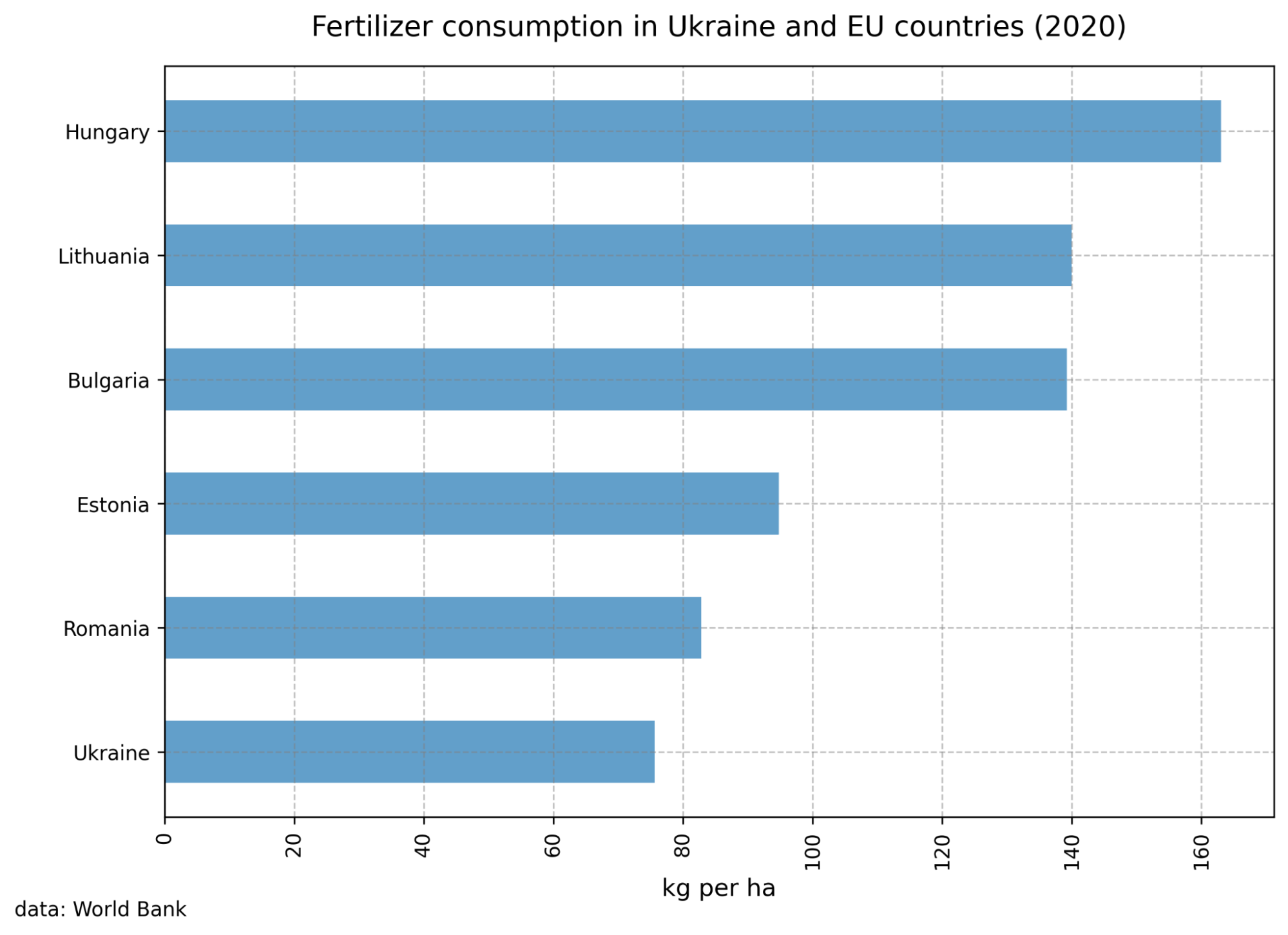

The abundance of fertile soil makes Ukraine an important contributor to global soil security and, as a result, to global food security. Ukraine’s current agricultural technology level is still lower than the EU level. For instance, Ukraine’s grain producers use less fertilizers per hectare compared to the neighboring countries (Figure 8). Despite the moderate fertilizer application, Ukraine’s land productivity remains comparable to the geographically closest EU countries (Figure 7).

Figure 8

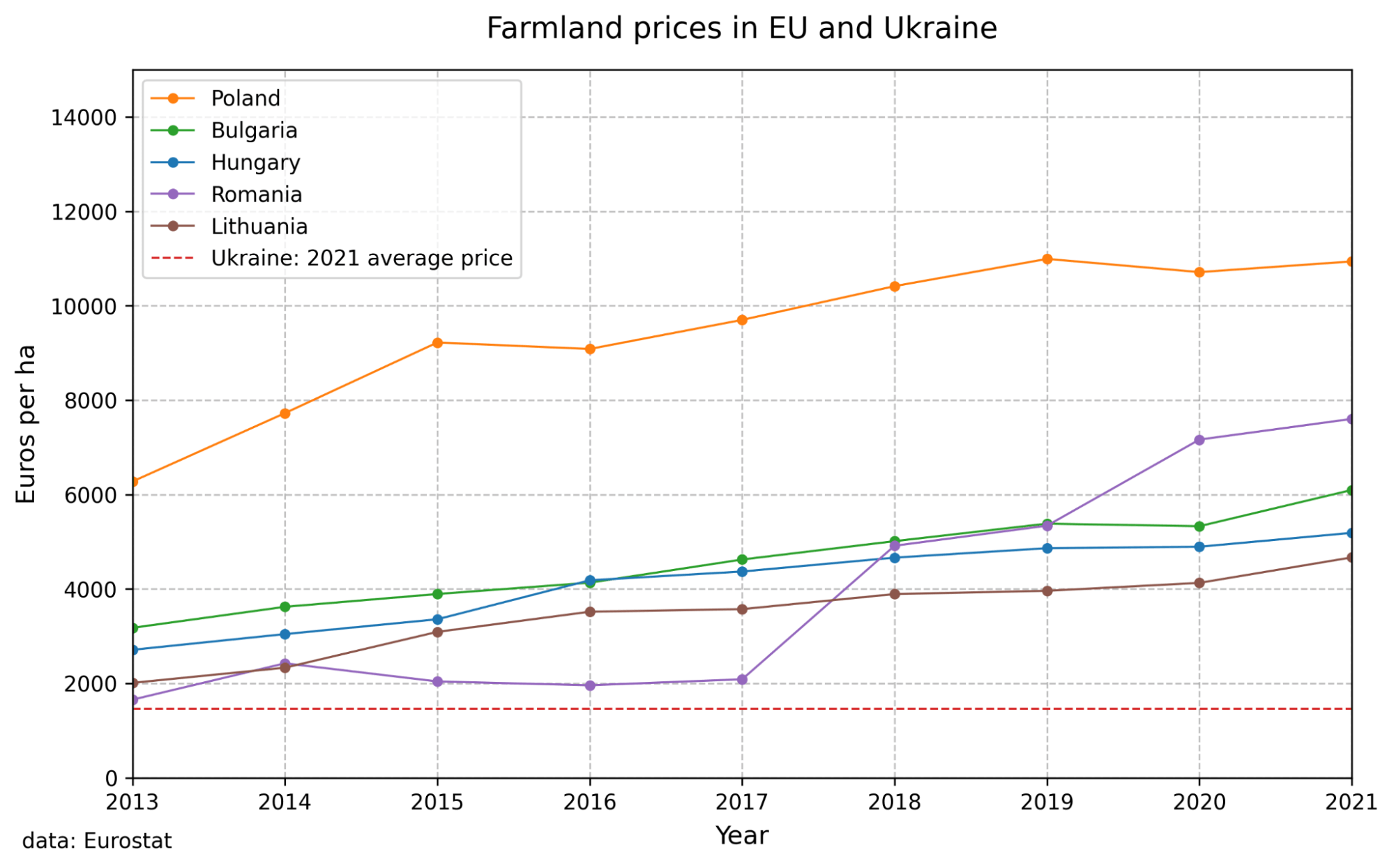

Since Ukraine’s agricultural land market operates with restrictions on the demand side, excluding companies, foreigners, and large deals, it tends to underprice Ukrainian land. The uncertainty related to regional geo-political tensions also distorts the existing price. As a result, the land price in Ukraine is much lower than in its closest EU neighbors (Figure 9). For example, the average cost of Ukraine’s land in euros is about 1464.9 EUR [5] which is lower than EU neighbors’ farmland prices in 2013.

Moreover, the farmland prices in the EU neighbors of Ukraine have been steadily increasing for the last ten years. For instance, the farmland price in Hungary has increased by around 65% from 2013 to 2021; in 2021, farmland in Hungary costs around three times more than farmland in Ukraine.

This suggests that, as predicted, heavy regulation of the Ukrainian land market results in lower prices and volumes of traded land. Thus lifting the restrictions would improve the situation even in the presence of large uncertainty created by the war.

Figure 9

5. Farmland and agricultural sector legislation during the war

The start of the full-scale war has posed an important challenge for the 2022 spring planting campaign. Those agrarians who have been able to sow and harvest during 2022 required assistance with logistic routes for exporting their product. The government has taken several measures to support agriculture during the war.

The main changes in legislation aimed to ensure access to land use for the spring sowing campaign. Several laws simplified land use for tenants (as mentioned above, most agricultural producers rent rather than own their land). The Law on Food Security in War Time adopted in April 2022 states that all the lease agreements are to be automatically extended by one year and that the current lenders could sub-lend the land for up to one year without the owner’s permission. Regarding the state-owned and public-owned land, this law states that the rent should be no higher than 8% of NMV, and the rent agreements can undergo a simplified registration procedure with the local administration. The priority rights of the lenders of state-owned land were suspended. This law suspended the trading of lease rights to state-owned lands, but the trading was renewed in October 2022. Finally, the Law on Land Regulation in Martial Time from May 2022 simplified the rent of state and public-owned land to accommodate evacuated infrastructure and temporarily relocate the population.

To support grain producers, Ukraine’s government has suspended import tariffs on materials used in grain storage, simplified the registration rules of farming machinery and trucks, and implemented a system of grants for small farming enterprises. Many intermediate inputs utilized in agriculture were included in the critical imports list (however, the list was abandoned in June 2022). The government loan program “accessible loans 5-7-9” was extended to cover more enterprises, including middle and large firms. The mechanisms and process for further support and damage coverage of the agricultural sector are under development and discussion as of March 2023. Given the extremely difficult situation in Ukraine’s agriculture, any support measures are needed and welcome. However, at this stage, it’s difficult to evaluate the effect of the already taken measures. Overall, ensuring smooth grain export should remain a priority for the Ukrainian government as stable grain export secures the country’s trade balance and contributes to macroeconomic stability.

Conclusions

Despite the war, Ukraine has managed to sustain its agriculture and remain a global grain supplier. The young and restricted land market, which operated for only about a year before the war, reopened after two months of downtime but with a substantially lower trade volume. Surprisingly, certain regions of central Ukraine showed a significant increase in land prices, indicating that despite the war, investors can see through war uncertainty and recognize the long-term value of the investment in Ukraine’s farmland.

The price floor might have prevented a price drop by making it impossible for some landowners to sell their land – finding land buyers in the areas affected by the war at the current price floor levels has been a challenge. On the other hand, the price floor keeps the price before the next step in market deregulation of 2024, which will permit firms to buy farmland.

Future developments in Ukraine’s land market will depend on resolving war-related uncertainty.

With the support of

[1] Author’s calculations based on Table 4.33 of The Statistical Yearbook “Agriculture of Ukraine” for 2021.

[2] FAO. 2022. Ukraine: Impact of the war on agriculture and rural livelihoods in Ukraine – Findings of a nation-wide rural household survey, December 2022. Rome. https://doi.org/10.4060/cc3311en

[3] Author’s calculations based on Table 4.12 of The Statistical Yearbook “Agriculture of Ukraine” for 2021.

[4] Deininger,Klaus W.; Ali,Daniel Ayalew. Land and Mortgage Markets in Ukraine : Pre-War Performance, War Effects, and Implications for Recovery (English). Policy Research working paper; no. WPS 10385 Washington, D.C.: World Bank Group.

[5] The average over all reported sales deals from land.gov.ua in 2021; converted to EUR using the official 2021 EUR-UAH exchange rate.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations