“Although domestic support for a new Ukraine is strong, pressures from populist forces and vested interests are growing. Moreover, the local elections in the fall pose a risk that the reform momentum could fade. Against this, the authorities need to garner the necessary support to prevent policy reversals and push ahead reforms that are so needed to achieve robust and sustainable growth.”

from the Memorandum

“Further substantial progress with structural reforms is essential to enable strong recovery of private activity. In this regard, efforts to fight corruption, improve the business climate, and reform state-owned enterprises should be stepped up.”

David Lipton, IMF first deputy managing director

In July 2015, IMF Board of Directors approved the second tranche ($1.7 billion) of the current program. This approval was based upon the assessment of implementation of the previous Memorandum performed in May-June by the IMF mission. The next review of the program is scheduled for September 2015.[1]

As concluded in our previous article, almost all planned reform measures have been implemented, but they form only the necessary minimum. In the face of a dangerous rise of populism and the strong opposition to reform, quick and more than revolutionary changes are needed.

This article looks at the revised IMF Memorandum to see how the tasks changed compared to what was planned six months ago, and what has been achieved since then.

The main aim of the planned reforms is reducing the role of the state in the economy (both as an obstacle to business and as a source of wealth) and introducing more competition into all spheres, which should lead to more efficient allocation and use of resources. The main reform tasks follow naturally from the efficiency criterion: transparent and prudent banking sector (more efficient allocation of savings and loans), reduced state ownership and more efficient use of government funds, increased energy efficiency, and, of course, judicial reform and anti-corruption measures that will lower transaction cost and otherwise reduce waste in the economy.

Below we list the main achievements in each area and provide some suggestions for further reform.

Monetary and exchange rate policy

Aim of the reform – introduce inflation targeting (and develop necessary monetary transmission mechanisms).

Main achievements. In July 2015, amendments to the Central Bank law were adopted that considerably strengthen Central Bank independence and streamline the decision-making process. Implementation of this revised law will ensure development of the National Bank of Ukraine (NBU) as a classical institution formulating and implementing monetary policy. The revised IMF Memorandum does not contain additional reform actions for this sphere.

Suggestions. Due to the still strained economic conditions and continuing external aggression, monetary policy remains tight and capital controls are in place, which results in a relatively stable Hryvnia exchange rate. Unfortunately, for the majority of Ukrainians UAH/USD rate is the main indicator of economy “health”, which results in overreaction to exchange rate fluctuations. To gradually change this, the National Bank, together with the government, could start an “economic/financial literacy” campaign for the general public. Such a campaign would pay off with lower probabilities of bank runs caused by UAH exchange rate changes, and generally by more prudent behavior with respect to individual savings and borrowing.

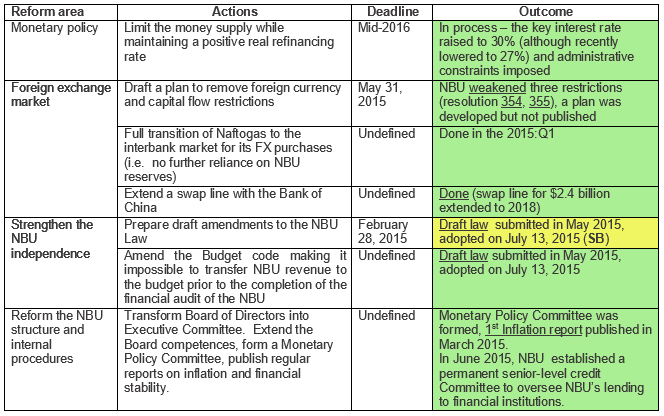

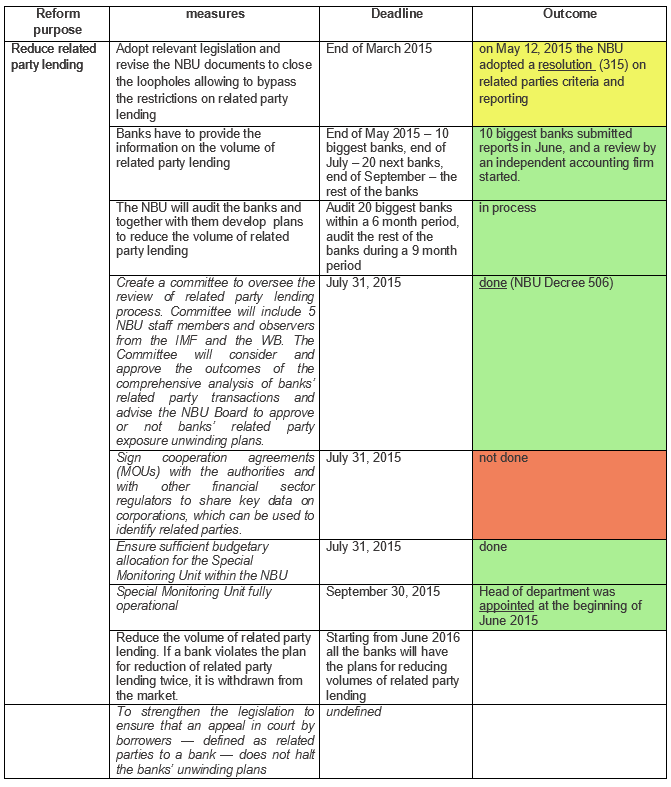

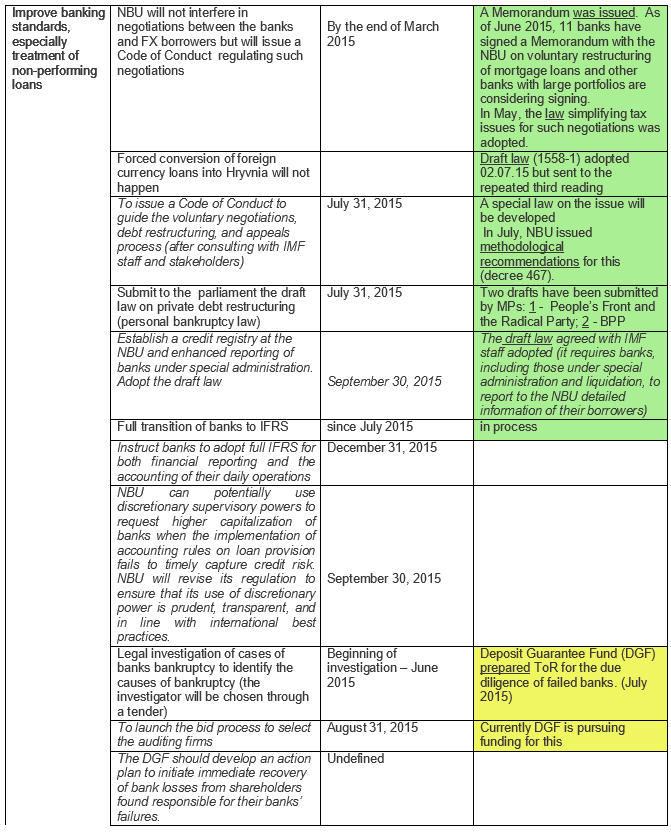

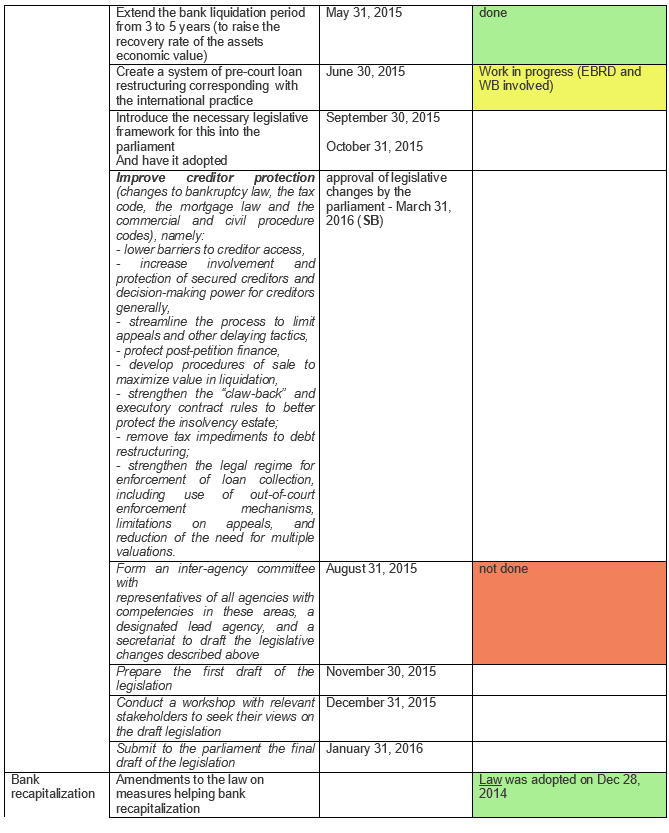

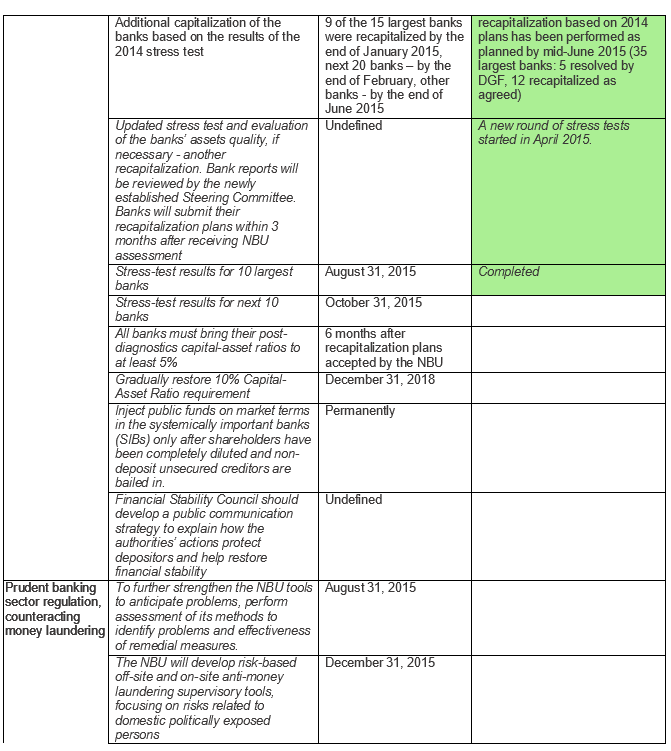

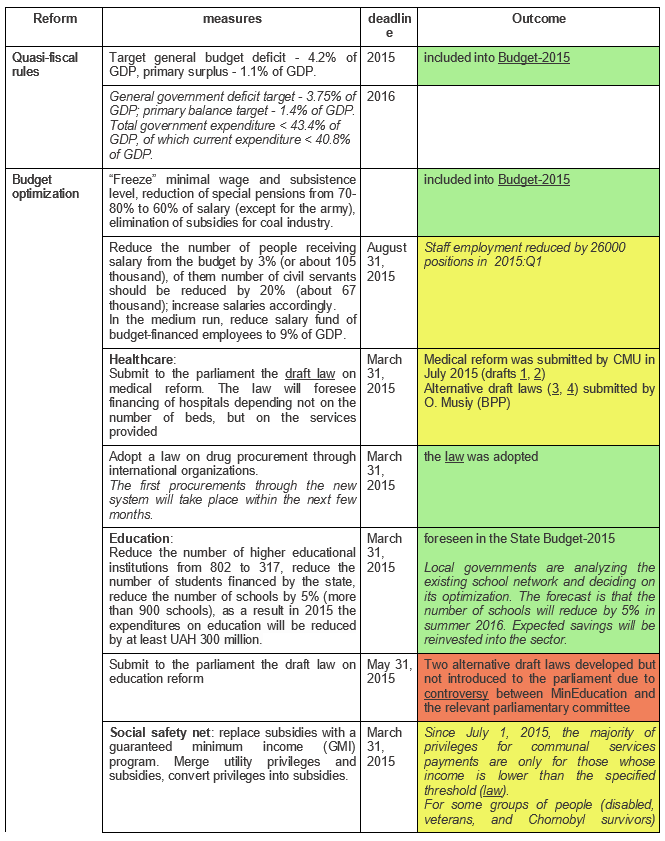

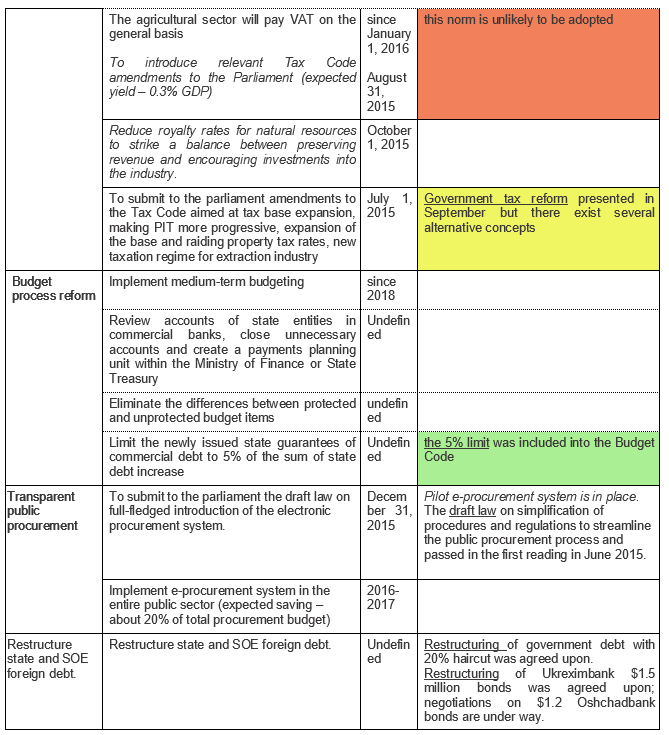

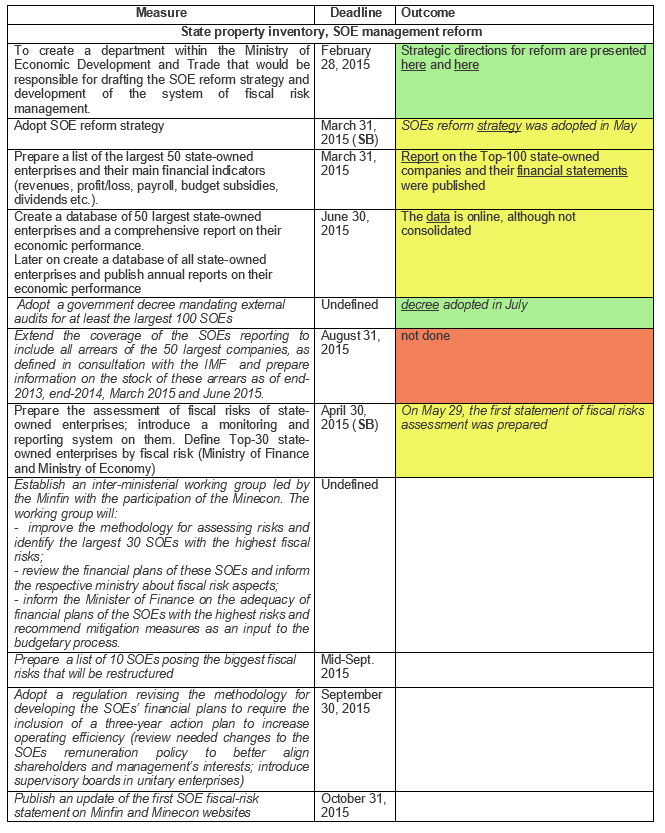

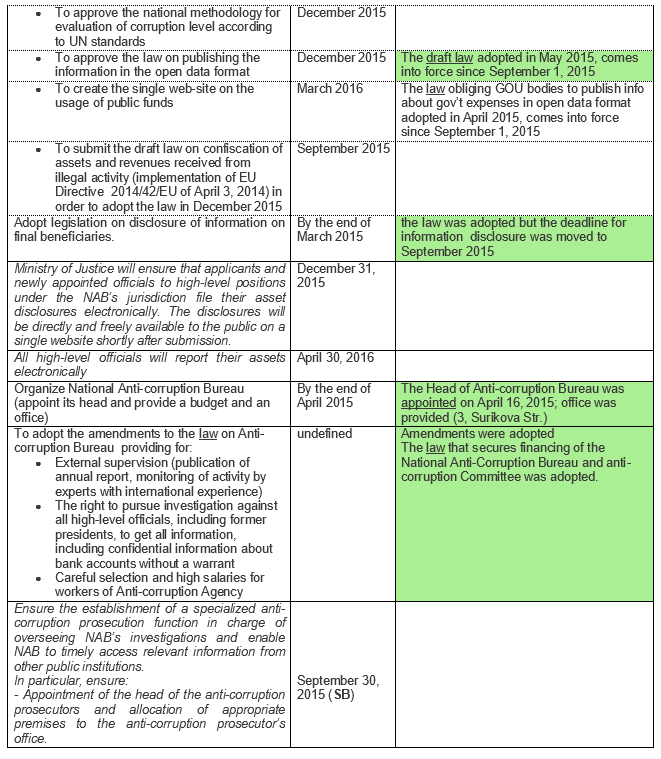

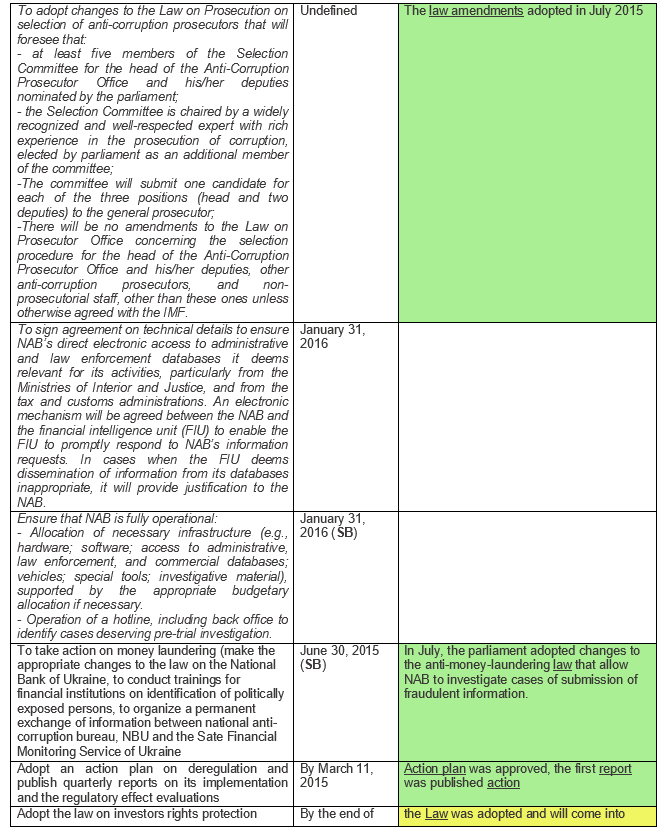

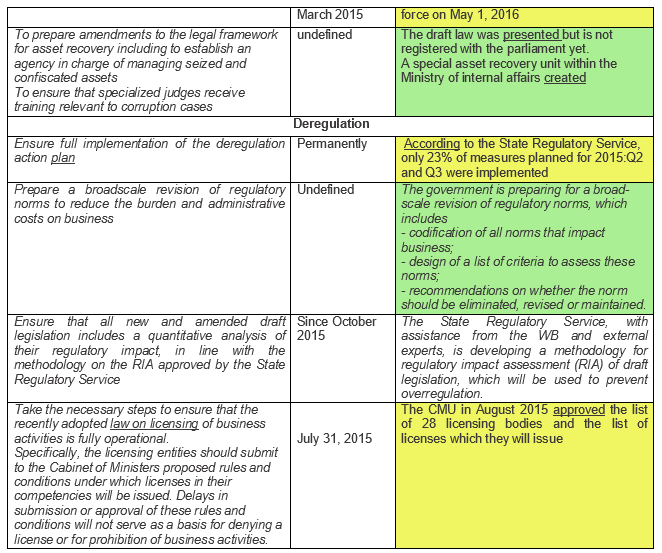

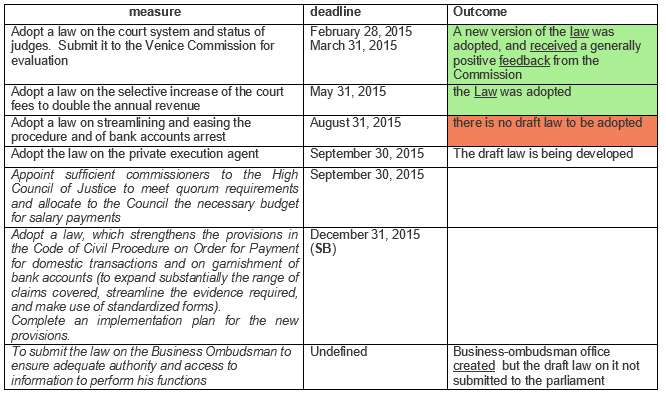

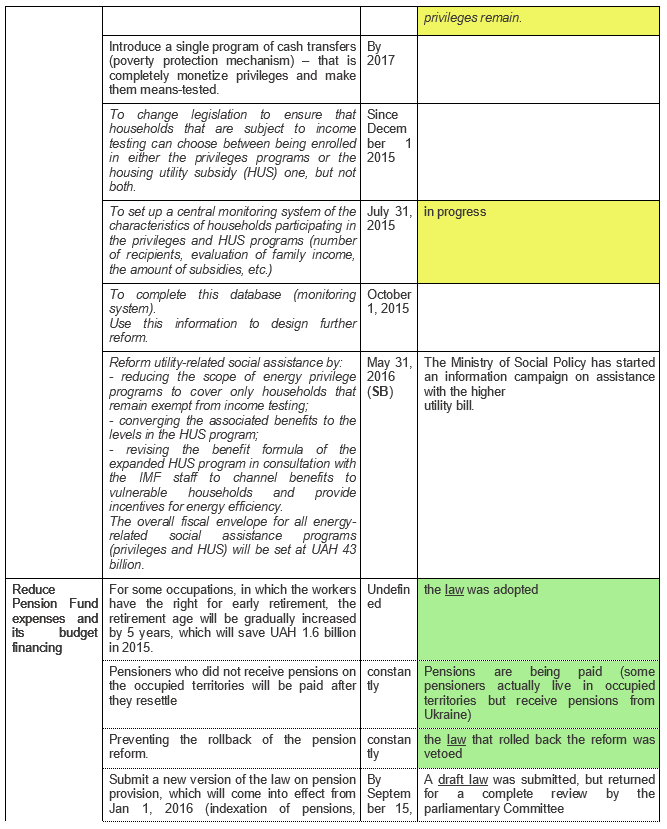

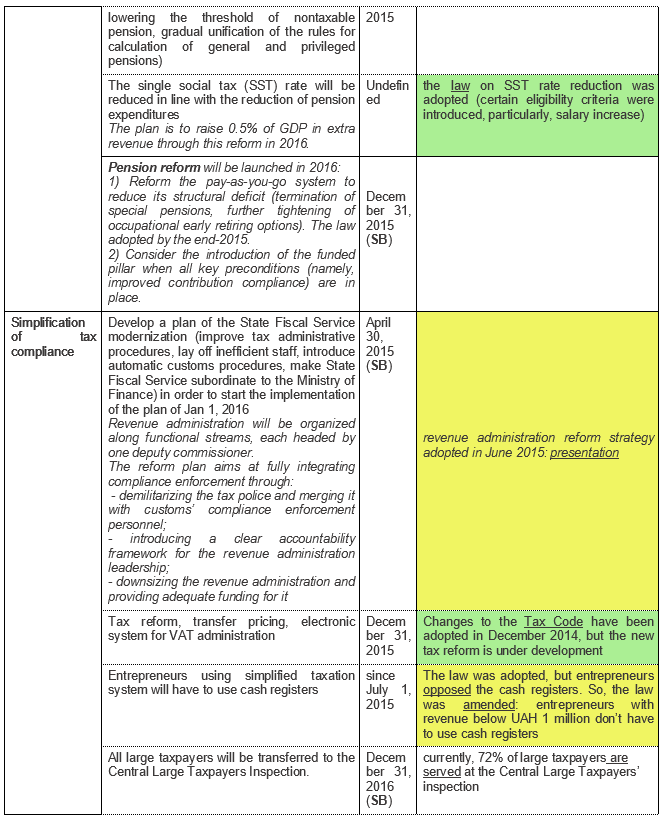

Below we provide tables with detailed description of planned measures, respective deadlines and implementation.

Note: areas marked in green denote measures that were implemented in time, yellow – implemented partially or with a delay, red – measures for which the deadline has passed. Newly introduced measures are in italics. SB means “Structural benchmark”, implementation of which is necessary for the successful review of the program.

Table 1. Reform of the monetary and exchange rate policy

Banking system reform

Aim of the reform – raise average quality of banking institutions and their ability to perform the main function of an intermediary between savers and borrowers by “cleaning” the banking sector, making it more transparent, reducing related party lending, increasing bank capitalization and raising creditors’ protection.

Main achievements. In May 2015, the NBU introduced new, stricter requirements to disclosure of bank ownership information (and made it public) and required banks to supply monthly reports on related party lending. The new stress tests are in progress, as well as development of the new legislation that would strengthen creditor protection and increase transparency of the sector. The law increasing the responsibility of banks’ owners was adopted in the early 2015 but we have not seen the instances of its application yet.

Suggestions from the previous section fully apply here. Besides, it is possible to raise responsibility of both banks and lenders by changing deposit insurance regulation. Now, the Deposit Guarantee Fund (DGF) fully pays out deposits of up to UAH 200 thousand (about USD 9 thousand) to clients of insolvent banks. Knowing this, some people deliberately deposit funds to problematic banks in order to earn high return on their savings – as long as their deposit is lower than UAH 200 thousand, this is a high-yield zero-risk investment. To change this, either banks offering significantly higher than market interest rates should pay increased contributions to DGF, or guaranteed coverage of deposits for such banks should be lower.

Table 2. Banking system reform

Fiscal policy

Aim of reform – optimization of state budget spending, namely, reducing waste and theft of budget funds. Areas where the biggest economy can be achieved are: (1) the system of privileges and subsidies (making those means-tested rather than categorical); (2) pension system (increasing pension age, and later on introducing funded pension schemes); (3) public procurement (making it electronic and the data publicly available). Another direction for reform is fiscal decentralization – if local governments are accountable to the community rather than the central government, this will increase their incentives to spend wisely. On the revenue side, the government plans to simplify the taxation system and reduce compliance cost in order to create incentives for business to operate legally and thus widen the tax base and increase revenues.

Main achievements. Starting from July 1st, 2015, the majority of privileges (e.g. communal payments discounts) are means-tested, and privileges for some categories are cancelled (however, quite many of them remain). Local governments received more freedom in planning their budgets, collecting revenues and spending funds (however, subsidies from the State budget remain substantial). Pension age for some categories of workers is being increased but the major pension reform is under development, as well as the new, comprehensive tax reform.

After long negotiations, the government stroke a restructuring deal with external creditors of Ukraine. They agreed to 20% ($3.8 billion) haircut and extended the maturity by 4 years. However, the interest rate was increased on average by 50b.p. to 7.75%. In addition, a VRI offering increased payments if Ukrainian economic growth exceeds 3% (probability of which is quite high) was signed. This deal still needs parliamentary approval to come into effect.

Suggestions. In view of the local elections scheduled for the end-October, it is essential to explain to people the new (increased) powers and responsibilities of local governments that they are electing (this could increase incentives to vote wisely). Also, the mechanisms of control of community members over the local government other than elections should be established. One possible mechanism is public hearings, which already have been functioning – albeit with little real impact. To empower local communities, local governments should be obliged to conduct public hearings and to take their decisions into account. Another possible mechanism is recently introduced e-petitions.

Table 3. Fiscal policy

State-owned enterprises (SOEs)

Aim of the reform – restructure or privatize absolute majority of SOEs, except for those crucial for national security (such as nuclear power plants). Now the majority of SOEs in Ukraine are either inactive or loss-making (their net loss was 2.3% of GDP in 2014), so getting rid of them will save budget funds in the short run and may result in additional tax revenues in the medium term.

Main achievements. Ukrainian SOEs have been a “troubled water” where it was very easy to divert some “fish” from the state to managers’ pockets mainly because the information on them was hidden from the public (and, perhaps, from the government too). Hence, in this area the reforms began with transparency – the government published financial statements of 100 largest state-owned companies, and started their audit. Currently, the government is working on identification of fiscal risks for the largest 30 companies and on privatization plans for 5 of them.

Suggestions. While restructuring/privatization of large state companies will bring not only revenues to the budget but also political tensions, there is an easy way to reduce unnecessary budget expenses without much fuss. About 3000 medium and small state-owned companies can be sold quickly and painlessly – revenues probably will not be impressive but at least taxpayers will stop financing their losses. The main issue here is organizing transparent auctions – a task which can be easily outsourced.

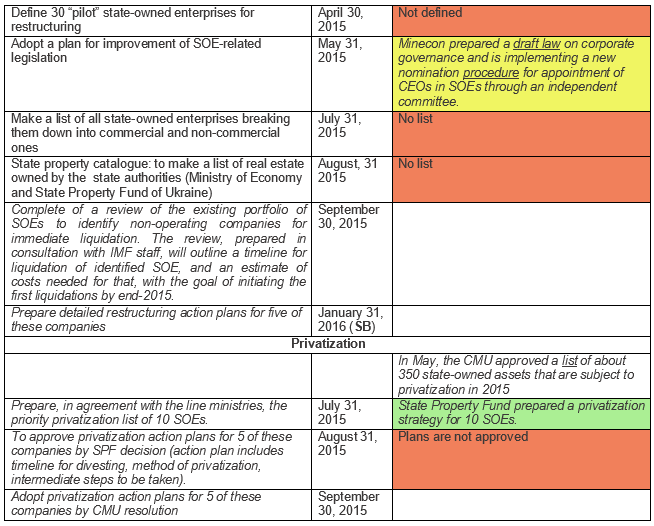

Table 4. Restructuring of state-owned enterprises (SOE)

Energy sector

Energy sector is perhaps one of the greatest challenges in Ukraine – for an energy-importing country its inefficiency is startling. First, an outworn infrastructure results in huge loss of resources on the way to consumers[2]. Second, obsolete production technologies and old housing fund lead to increased consumption of energy by both industry and households. Due to the very low “politically acceptable” communal tariffs (the lowest in the region until April 2015), people did not have incentives to insulate their homes or install gas and heat meters (as of spring-2015, only 36% of households had heat meters and 70% had gas meters installed). Third, the twofold difference in tariffs between industrial and communal/household consumers created vast opportunities for arbitrage. Therefore, to increase energy efficiency of the country, it is essential to make energy sector less political and more market-regulated.

Main achievements. As the first step, the plan for raising household energy tariffs to the market level until April 2017 was developed and is being implemented. Also, the law on natural gas market (based on EU Third Energy Package norms) was adopted and comes into force starting October 2015. Several steps toward raising Naftogaz (state energy monopoly) transparency and improving collection of payments have been made. The next logical step is splitting Naftogaz into extraction and distribution companies.

In April 2015 the legislation enabling operation of energy saving companies was adopted[3] but further actions to raise sector efficiency (installment of meters, modernization of infrastructure, insulation of homes etc.) will require much more time and funding[4].

Suggestions. To protect poor households from increased utilities tariffs, the government introduced income-based energy subsidies and considerably simplified the procedure for obtaining them. However, the subsidies are not payed directly to people (who could use them, say, for installation of meters or for insulation of homes) but automatically transferred to heating-energy and other utiity companies. Besides, to reduce government expenditure on subsidies, the normative consumption (which enters the subsidy formula) was reduced. This lowered incentives for households which are not eligible for subsidies to install meters and save energy in other ways (i.e. if the normative is higher than my real consumption, it would be beneficial for me to install a meter and save, but if the normative is low – lower than my real consumption – I will not do that). This reasoning suggests that normative consumption should be raised, while subsidies should be provided to people’s accounts rather than to energy companies, and partly could be spent on provision of meters for poor households.

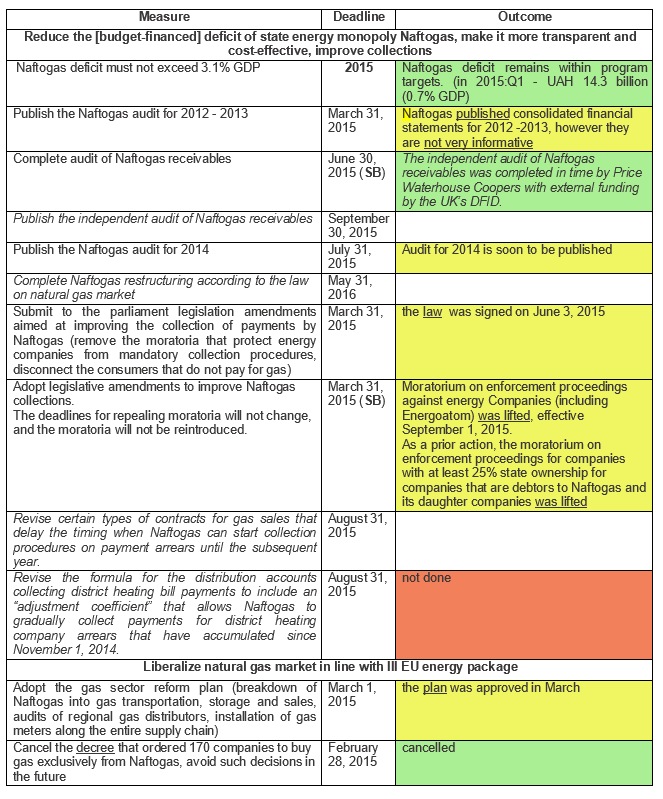

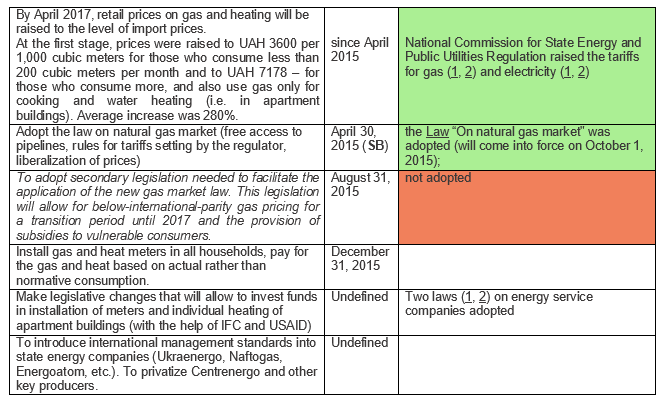

Table 5. Energy sector

Business climate and anti-corruption

Aim of reform – make corruption episodic rather than systemic. This is a nontrivial task – like pulling someone from the swamp by his own hair – since the police, prosecution and judicial system are perhaps the most corrupt parts of the state. Unfortunately, top Ukrainian politicians are no exception either – so we should not expect a “Georgian miracle” here. Ukrainian civil society has been very active in revealing the cases of corruption. However, since it does not have the mechanisms of bringing to book high level officials, it requires international support with this. Simply not dealing with doubtful assets originating from Ukraine would be very helpful. Apart from prosecution of corrupt officials, deregulation and general reduction of state involvement into the economy is an essential part of anti-corruption policy.

Main achievements. Within the course of this year, National Anti-Corruption Bureau and National Corruption Prevention Agency were created (though not yet operating). In July, the law on prosecution was changed to allow injection of some “fresh blood” into the system and appointment of an anti-corruption prosecutor. Laws “On the State Service” that would allow a wide administrative reform and “On the State Bureau of Investigation” that would set the ground for fighting high-level corruption are still waiting for the parliamentary approval.

Deregulation advances faster than prosecution. The first deregulation law was adopted as early as spring 2014, and in 2015 a law simplifying licensing, and several government decrees on deregulation have been adopted. However, as of 2015:Q3, the deregulation plan approved in March 2015 has been fulfilled by only 23%.

Suggestions. Government strategies for fighting corruption and for deregulation are pretty good, but their implementation is not easy because both oligarchs and the deeply-rooted bureaucracy are either opposing or sabotaging changes. VoxUkraine has suggested a number of ways to push forward the reforms: (1) focus on incentives; (2) dual-track approach; (3) maximal disclosure of information available to the state; (4) qui-tam laws; (5) outsourcing some state functions or attracting outside professionals (1, 2). But our main suggestion is – practice zero tolerance for corruption, don’t preach it.

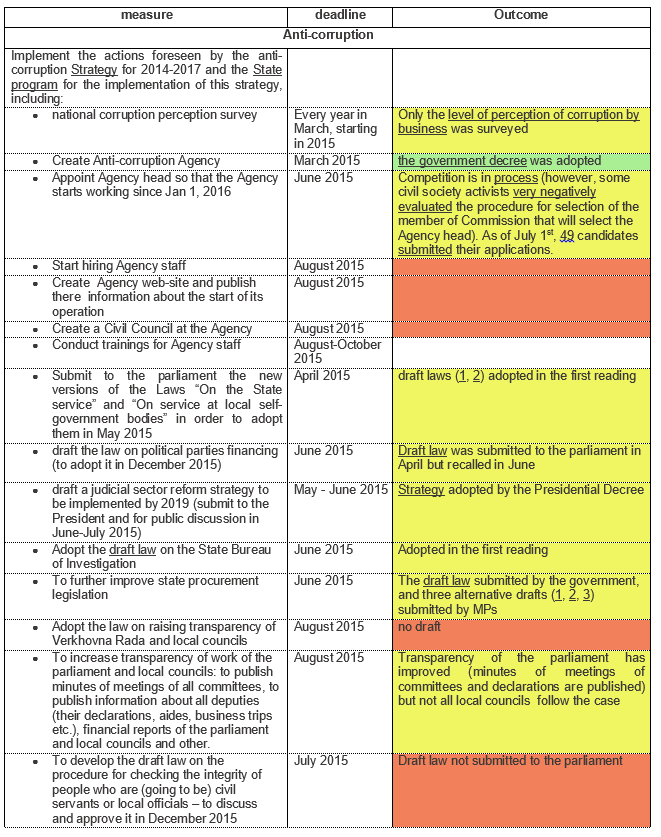

Table 6. Business climate and fight against corruption

Judicial system

Aim of the reform – impose the supremacy of the law on all occasions. As noted above, this is a non-trivial task, which is further hardened by the need to strike a balance between independence of the judicial system and accountability of judges.

Main achievements. The law “On restoring trust to judicial system” adopted in March 2014 required re-election of heads of all primary-level courts. However, only 20% of all heads were actually replaced. This law also terminated the office term of 17 of 20 members of the High Council of Justice (HCJ) essential for appointing and firing of judges. Since new members from the parliament were not appointed, HCJ is inoperational since March 2014 (perhaps, this was the reason for inclusion of appointment of the missing members into the new IMF memorandum). Among the main 2015 achievements in this sphere is the new law on court system approved by the Venice Commission and opening of the Business Ombudsman office, which has been operating quite efficiently despite the fact that the law on it is still to be adopted.

Suggestions. The Judicial Reform Strategy for 2015-2020 contains the main directions for improvement of the system (better professional training and selection of judges, wider participation of jury etc.), but it does not include any specific measures or deadlines. In some countries, for the sake of accountability, lower level judges are elected by the communities. Such system has its pros and cons but we believe this option should at least be discussed in Ukraine.

Table 7. Judicial system

Conclusion

It seems that the government has reaped the low-hanging fruit for quick reforms. To proceed, it will need to step on many toes. Therefore, it will have to win support of the society by introducing popular (although not populist) changes. The most obvious thing seems to be fighting corruption – either by highly publicized cases against the “big fish” or by eliminating petty corruption in administrative services (such as cancelling unnecessary permits/certificates, introducing electronic services and/or “single windows”).

As noted earlier, the next two months until the local elections is the best time to relay more responsibility on voters by explaining the main points of the fiscal decentralization and opportunities it provides. The results of local elections will to a great extent define the development of the country during the coming years, so it’s important to convince people to choose wisely. At the same time, a countrywide usage of Chernihiv electoral methods would mean that the main political players in Ukraine aim at imitation of reform (and redistribution of resources) rather than genuine reforms that will limit their share but increase the size of the pie.

By Editorial Board of VoxUkraine:

Olena Bilan (Dragon Capital), Volodymyr Bilotkach (Newcastle U.), Tom Coupé (KSE), Yuriy Gorodnichenko (UC Berkeley), Veronika Movchan(IER), Tymofiy Mylovanov (U. of Pittsburgh), Ilona Sologoub (KSE), Oleksandr Talavera (U. of Sheffield), Oleksandr Zholud (International Center for Policy Studies)

Notes

[1] Note that the IMF program is the main but not the only part of international aid package provided to Ukraine. Another important part is the agreement with the EU under which Ukraine is promised EUR 1.8 billion conditional on reforms pretty similar to those included into the IMF Memorandum, although without specified deadlines (a nice description of what needs to be done can be found here). Under this agreement, Ukraine already received EUR 600 million. Worldbank, EBRD, IFC will finance specific infrastructure/public services projects.

[2] In Ukraine, 12-14% of electric energy is lost in the networks, about 30-35% of heat and up to 40% of water. Normative losses of gas in the networks are set at 2-2.5%, although in reality they may be higher.

[3] Draft law on energy efficiency in buildings included into the EU aid agreement, was submitted to the parliament in December 2014 but rejected by the parliamentary committee

[4] E.g. – draft national energy efficiency action plan until 2020 foresees energy efficiency measures at SOE and communal sphere worth UAH 56.6 billion.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations