How will this affect their financial performance? Will they still be able to meet their budget targets? To answer these questions, we analyzed the impact of the legislative changes on local budgets in 75 communities (hromadas) partnering with the USAID / DOBRE Program.

For several years now, the hromadas have been working based on new inter-budget relations, awaiting the next phase of the decentralization reform. The ATC budgets are among the most vulnerable local budgets. The Law of Ukraine On Amendments to the Tax Code of Ukraine and Other Laws of Ukraine on Support of Taxpayers for the Period of Measures to Prevent the Occurrence and Spread of Coronary Virus Disease (COVID-19) has a direct impact on the budgets of the ATCs. Specifically, from March 1 to April 30, 2020, no payment is to be charged for land and there is no tax liability for non-residential property estate.

In trying to effectively re-allocate budgetary resources, the state often starts by looking in the pocket of the population and then in the local budgets, ending up revisiting the funding of state programs. This time is no different: the local budget revenues will decrease by the amount of two months’ revenue from non-residential real estate tax and land payments. Contrary to Article 142 of the Constitution of Ukraine, no compensatory mechanisms for revenue loss are offered by the government.

According to the Open Budget data and our own estimates, the losses of all local budgets will account for about 2% of the tax revenue of the local budgets’ general funds in 2020 (Table 1).

This concerns around 9,139 local budgets, i.e. the budgets of oblast cities, districts, ATCs, towns, settlements and villages. Our assumptions are based on the following considerations: (1) according to the 2020 plan, these revenue sources account for 13% of the general fund’s tax revenue and (2) the corresponding share of the 2019 revenue (no local budgets’ data for 2020 are available) is also 13%, excluding the city of Kyiv that distorts statistics.

Table 1. Local budget revenue data (general fund), UAH million

| Indicators: | Local budgets | Local budgets excluding Kyiv | Local budgets |

| Adjusted annual budget for 2019, UAH million | Adjusted annual budget for 2019, UAH million | Adjusted 2020 annual plan, UAH million | |

| Total local budget tax revenues, including: | 268 307.1 | 224 327.2 | 285 674.6 |

| Tax on real estate other than land paid by legal entities owning residential real estate | 135.8 | 78.7 | 161.1 |

| Tax on real estate other than land paid by individuals owning residential real estate | 498.1 | 404.0 | 570.9 |

| Tax on real estate other than land paid by individuals owning non-residential real estate | 553.6 | 515.2 | 657.5 |

| Tax on real estate other than land paid by legal entities owning non-residential real estate | 3 332.3 | 2 357.7 | 3 924.5 |

| Tax on land paid by legal entities | 11 086.0 | 8 686.0 | 11 276.8 |

| Rent paid by legal entities | 17 193.5 | 14 062.1 | 17 146.5 |

| Tax on land paid by individuals | 1 779.2 | 1 702.7 | 1 862.9 |

| Rent paid by individuals | 2 237.6 | 2 211.7 | 2 246.6 |

| Percentage of the revenues impacted by the Law in the General Fund tax revenues for the year | 13.7% | 13.4% | 13.3% |

| Percentage of the revenues impacted by the Law during the two-month quarantine in the General Fund tax revenues | 2.3% | 2.2% | 2.2% |

Hromadas’ losses. At the same time, we predict that the losses incurred by hromadas will be greater than the national average. We analyzed data for 2019 on the actual revenues of 75 USAID / DOBRE partner hromadas in 7 regions (Dnipropetrovsk, Ternopil, Ivano-Frankivsk, Mykolaiv, Kherson, Kharkiv and Kirovograd Oblasts). The 2020 estimates should be more or less comparable since the hromadas rely on actual 2019 data when planning revenues for 2020. Further information is provided for each area separately.

Dnipropetrovsk Oblast

The 14 program partner hromadas in Dnipropetrovsk Oblast may lose up to UAH 34.6 million for the period of two months. On average, one hromada loses UAH 2.5 million, i.e. 3% of the budget revenue, excluding transfers. Hrechanopodivska ATC is the most vulnerable to the impact of the Law in that it may lose about UAH 8 million, i.e. 11% of the budget revenue, excluding transfers. Potentially bigger losses of Hrechanopodivska ATC relate to this hromada’s dependence on one large taxpayer – PJSC ArcelorMittal Kryviy Rih that makes substantial land rent payments.

For detailed information with regard to each hromada see Table 2.

Table 2. Data with regard to the hromadas of Dnipropetrovsk Oblast

| ATC | Revenues impacted by the Law for the 2-month period according to the actual revenues in 2019 in UAH thousand | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of the General Fund of the 2019 budget, excluding transfers, % | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of 2019, excluding transfers,% |

| Apostolivska ATC | 2 418.3 | 2.8% | 2.3% |

| Vasylkivska ATC | 3 111.0 | 4.2% | 2.7% |

| Hrechanopodivska ATC | 8 054.0 | 14.0% | 11.1% |

| Zelenodolska ATC | 1 658.9 | 2.4% | 1.7% |

| Mykolayivska ATC | 1 565.3 | 2.5% | 2.4% |

| Myrivska ATC | 721.4 | 2.7% | 2.1% |

| Mohylivska ATC | 485.2 | 2.6% | 2.5% |

| Novooleksandrivska ATC | 2 310.0 | 2.4% | 2.2% |

| Petrykivska ATC | 864.5 | 2.4% | 2.1% |

| Pishchanska ATC | 2 426.0 | 2.9% | 2.9% |

| Pokrovska ATC | 1 247.3 | 1.9% | 1.7% |

| Slobozhanska ATC | 6 810.1 | 1.9% | 1.9% |

| Sofiyivska ATC | 1 490.6 | 3.1% | 2.9% |

| Tsarychanska ATC | 1 397.7 | 2.5% | 2.4% |

| Average | 2 468.6 | 3.4% | 2.9% |

| Total | 34 560.3 | х | х |

Ternopil Oblast

The 18 hromadas of Ternopil region we analyzed stand to lose UAH 17.8 million for the 2-month period. Over UAH 2 million (2% of tax revenue) will be lost by Terebovlya town ATC, which is the largest figure among the hromadas in this region. This hromada is working effectively with its property tax and land tax payers, so the losses will be significant.

On average, the hromadas of Ternopil region we analyzed will lose 2.1% of the 2019 budget revenue, excluding transfers (Table 3). This is less than in the hromadas in Dnipropetrovsk region (2.9%) due to a smaller number of industrial enterprises in Ternopil region.

Table 3. Data with regard to the hromadas of Ternopil Oblast

| ATC | Revenues impacted by the Law for the 2-month period according to the actual revenues in 2019 in UAH thousand | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of the General Fund of the 2019 budget, excluding transfers, % | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of 2019, excluding transfers,% |

| Husyatynska ATC | 558.8 | 1.4% | 1.2% |

| Zavodska ATC | 732.3 | 4.5% | 3.8% |

| Mykulynetska ATC | 594.1 | 2.5% | 2.3% |

| Skala-Podilska ATC | 615.0 | 2.8% | 2.4% |

| Baykovetska ATC | 1 512.0 | 1.3% | 1.3% |

| Ivanivska ATC | 199.3 | 1.3% | 1.0% |

| Shumska ATC | 873.0 | 1.8% | 1.4% |

| Skalatska ATC | 1 406.6 | 3.5% | 3.2% |

| Terebovlyanska ATC | 2 281.5 | 2.4% | 2.0% |

| Vyshnivetska ATC | 232.4 | 1.9% | 1.4% |

| Zolotopotitska ATC | 243.1 | 2.1% | 1.9% |

| Velykohayivska ATC | 1 008.9 | 1.9% | 1.6% |

| Pidvolochyska ATC | 1 474.0 | 2.0% | 1.8% |

| Zolotnykivska ATC | 774.7 | 3.6% | 3.2% |

| Borshchivska ATC | 1 869.5 | 3.1% | 2.7% |

| Khorostivska ATC | 1 538.2 | 3.7% | 3.5% |

| Lanovetska ATC | 1 247.9 | 2.9% | 2.2% |

| Zborivska ATC | 728.9 | 1.4% | 1.2% |

| Average | 993.9 | 2.5 | 2.1% |

| Total | 17 889.8 | х | х |

Ivano-Frankivsks Oblast

The 10 hromadas we analyzed in this region stand to lose UAH 2.8 million (Table 4) for the 2-month period. In this region, the DOBRE partners are mostly small village communities, and the percentage of revenue impacted by the Law is small. The biggest losses will be incurred by Tlumatsk town ATC – about UAH 500 thousand (1.2% of tax revenue) for 2 months.

Table 4. Data with regard to the hromadas of Ivano-Frankivsk Oblast

| ATC | Revenues impacted by the Law for the 2-month period according to the actual revenues in 2019 in UAH thousand | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of the General Fund of the 2019 budget, excluding transfers, % | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of 2019, excluding transfers,% |

| Biloberizka ATC | 78.7 | 1.6% | 1.4% |

| Balshivtsivska ATC | 276.8 | 2.8% | 2.2% |

| Verkhnyanska ATC | 322.4 | 2.1% | 1.8% |

| Dzvynyatska ATC | 176.5 | 2.0% | 1.8% |

| Lanchynska ATC | 286.5 | 2.8% | 2.5% |

| Nyzhnyoverbizka ATC | 245.7 | 2.5% | 1.7% |

| Pyadytska ATC | 422.9 | 3.8% | 3.2% |

| Pechenizhynska ATC | 291.9 | 1.5% | 1.2% |

| Starobohorodchanska ATC | 165.5 | 1.7% | 1.6% |

| Tlumatska ATC | 500.5 | 1.4% | 1.2% |

| Average | 276.7 | 2.2% | 1.9% |

| Total | 2 767.3 | х | х |

Mykolayiv Oblast

The 11 hromadas we analyzed in this region stand to lose UAH 17.7 million for the 2-month period. The two largest urban communities in the region – Voznesenska and Bashtanska – will lose the most, over UAH 3.6 million each. Since the region is agrarian, with respective land payments accounting for a large portion of the budget revenues, almost all the hromadas we analyzed will lose over UAH 1 million (Table 5). The smallest loss of over UAH 500 thousand will be incurred by the Arbuzin ATC, which nearly equals the largest loss in Ivano-Frankivsk Oblast.

Table 5. Data with regard to the hromadas of Mykolayiv Oblast

| ATC | Revenues impacted by the Law for the 2-month period according to the actual revenues in 2019 in UAH thousand | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of the General Fund of the 2019 budget, excluding transfers, % | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of 2019, excluding transfers,% |

| Arbuzynska ATC | 516.9 | 1.7% | 1.6% |

| Bashtanska ATC | 3 606.1 | 3.7% | 3.4% |

| Buz’ka ATC | 1 328.3 | 5.5% | 5.1% |

| Voznesenska ATC | 3 628.7 | 2.4% | 2.1% |

| Halytsynivska ATC | 1 278.0 | 1.3% | 1.1% |

| Domanivska ATC | 1 595.7 | 5.7% | 4.9% |

| Kamyanomostivska ATC | 718.0 | 5.2% | 4.4% |

| Mostivska ATC | 1 383.4 | 6.7% | 5.4% |

| Oleksandrivska ATC | 1 274.7 | 4.5% | 3.8% |

| Prybuzhanivska ATC | 1 225.8 | 4.7% | 4.4% |

| Shevchenkivska ATC | 1 204.7 | 3.3% | 3.0% |

| Average | 1 614.6 | 4.1% | 3.6% |

| Total | 17 760.2 | х | х |

Kherson Oblast

The 10 hromadas we analyzed in Kherson region stand to lose UAH 8.1 million for the 2-month period. Specifically, the agrarian hromadas will be impacted the most (Table 5). The champion among them is the Chaplyn ATC with almost UAH 2 million loss for the 2 months.

Table 6. Data with regard to the hromadas of Kherson Oblast

| ATC | Revenues impacted by the Law for the 2-month period according to the actual revenues in 2019 in UAH thousand | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of the General Fund of the 2019 budget, excluding transfers, % | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of 2019, excluding transfers,% |

| Askaniia-Nova ATC | 745.3 | 4.4% | 4.1% |

| Velykopanivska ATC | 839.2 | 4.9% | 4.5% |

| Vysokopilska ATC | 700.6 | 3.2% | 3.0% |

| Kochubeyivska ATC | 547.4 | 5.0% | 4.2% |

| Muzykivska ATC | 1 276.0 | 4.9% | 4.6% |

| Novorayska ATC | 597.5 | 2.9% | 2.8% |

| Prysyvaska ATC | 453.4 | 2.6% | 2.1% |

| Stanislavska ATC | 375.2 | 2.9% | 2.4% |

| Tavrychanska ATC | 623.6 | 2.4% | 2.1% |

| Chaplynska ATC | 1 976.9 | 2.9% | 2.7% |

| Average | 813.5 | 3.6% | 3.2% |

| Total | 8 135.0 | х | х |

Kirovohrad Oblast

The 8 hromadas we analyzed in this region stand to lose UAH 13.5 million for the 2-month period. The record holder for losses is Dmytrivska ATC with nearly 6%, excluding transfers. The losses are related to the hromada’s agricultural specialization and its dependence on the ground rent payments from their largest payer “Agroholding Kolo”. Most hromadas we analyzed will lose over UAH 1 million.

Table 7. Data with regard to the hromadas of Kirovohrad Oblast

| ATC | Revenues impacted by the Law for the 2-month period according to the actual revenues in 2019 in UAH thousand | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of the General Fund of the 2019 budget, excluding transfers, % | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of 2019, excluding transfers,% |

| Bobrynetska ATC | 1 328.7 | 2.8% | 2.6% |

| Dmytrivska ATC | 2 093.5 | 6.5% | 6.4% |

| Kompaniyivska ATC | 952.4 | 2.8% | 2.7% |

| Malovyskivska ATC | 1 751.1 | 3.1% | 2.8% |

| Novopraz’ka ATC | 1 656.6 | 4.2% | 4.1% |

| Novoukrayinska ATC | 3 429.4 | 3.6% | 3.4% |

| Pomichnyanska ATC | 1 821.5 | 2.9% | 2.7% |

| Smolinska ATC | 533.7 | 1.3% | 1.2% |

| Average | 1 695.9 | 3.4% | 3.2% |

| Total | 13 567.0 | х | х |

Kharkiv Oblast

The 4 hromadas we analyzed in Kharkiv region stand to lose UAH 7.3 million for the 2-month period. The average loss in the region is 3.1%, i.e. a total of almost UAH 7.4 million. Potential losses of the Starosaltivska and Zolochivska ATCs are related to their agricultural specialization and loss of land rent income.

Table 8. Data with regard to the hromadas of Kharkiv Oblast

| ATC | Revenues impacted by the Law for the 2-month period according to the actual revenues in 2019 in UAH thousand | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of the General Fund of the 2019 budget, excluding transfers, % | Percentage of the revenues impacted by the Law for the 2-month period of quarantine in the tax revenues of 2019, excluding transfers,% |

| Zolochivska ATC | 2 478.8 | 2.4% | 2.2% |

| Malynivska ATC | 847.1 | 1.8% | 1.7% |

| Merefyanska ATC | 1 416.0 | 1.8% | 1.6% |

| Starosaltivska ATC | 2 613.8 | 7.7% | 6.9% |

| Average | 1 838.9 | 3.4% | 3.1% |

| Total | 7 355.7 | х | х |

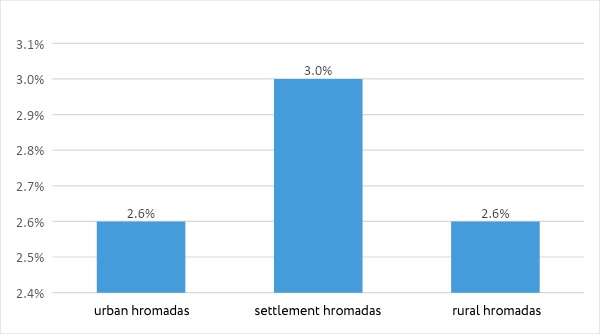

Figure 1. Calculation of budget losses by hromadas’ type

The average budget loss for urban, settlement and rural hromadas are similar (Fig. 1). However, rural ATCs are most vulnerable to the innovations, with losses of up to 3% of budget revenue, excluding transfers. This means that, unless compensatory mechanisms are in place for these hromadas, it will be problematic for them to perform the functions delegated to them in serving the population. In these circumstances, the hromadas plan on funding only the protected items of expenditure and health care, suspending all capital expenditures. This means no future development projects, cuts in staff and communal bodies, social infrastructure expenditure, and a revision of project co-financing commitments. For instance, the DOBRE’s partner hromadas are required to show their co-financing share for joint projects. We are already getting calls that these obligations will be difficult to fulfill for the hromadas. In the event of a protracted crisis, other hromadas think about revisiting the costs of maintaining their administrations and canceling the previously planned refurbishment of schools.

Indirect effects that cannot be measured

The budget revenue structure is similar in most ATCs, with about 95% coming from tax revenues. There is almost no income from non-tax revenues or income from the operations with capital. At the same time, the risks of fluctuations in the amount of budget revenues as a result of changes in national legislation are high. The two largest taxes in the income structure, excluding transfers, on average account for about 70% (PIT and, depending on the hromada’s economy, excise tax or simplified (unified) tax).

Personal income tax and fee. 60% of this tax goes to the hromadas’ budget. It is budget-forming. The PIT revenues, as a rule, amount to 50-60% of ATC budget revenues. With the exception of the hromadas, where big enterprises with a large number of employees are located that ensure higher PIT revenues. A decline in business activity can lead to the dismissal of employees and a subsequent decrease in PIT receipts. Consequently, the ATCs will have to cut their costs. For many, this will be a real challenge since most of them are current rather than capital expenditures, and there is not much to cut.

The unified tax accounts for 10-15% of the ATC budgets’ revenues. Due to the downturn in business activity and the forced halt of small businesses during quarantine, the unified tax on private entrepreneurs may not be collected. However, no significant change is expected with regard to taxes paid by PEs of I and II groups, as the unified tax will be paid until the PE closes down, even if the individual does not work during quarantine.

The excise tax on excisable goods (products) made in Ukraine is significant for the hromadas that have gas stations on their territory, but, as a whole, it makes up 6% of local revenues. Travel restrictions for the population and decline in business activity will negatively affect fuel consumption. Therefore, we anticipate a decrease in local budget revenues from this tax.

In most partner hromadas of DOBRE, quarantine measures and downturn in business activity will have little or no impact on the revenue from such taxes (because very little of them is collected):

- tax on income of communal enterprises and financial institutions, and part of the net profit (income) of communal enterprises received by communal enterprises established with the participation of an amalgamated territorial community (hromada). Most hromadas have operating communal enterprises (or have decided to create them) whose income should in part go to the hromada’s budget. In the vast majority of DOBRE’s partner hromadas, such businesses are not profitable and receive budget transfers to operate. Therefore, quarantine measures will not significantly affect the income tax collected from these enterprises. However, even during this period, most hromadas will see to it that they continue working to carry out important social and economic functions, in most cases the provision of public amenities.

- tourist tax – this tax revenue is insignificant in most hromadas. Even the ATCs with tourist bases, hotels and other infrastructure will not feel the loss.

- fee for the parking of vehicles is not common to most rural and urban hromadas. It can be administered in urban hromadas, but these revenues are not significant, so quarantine measures will not affect revenue;

- transport tax, payment for the temporary use of a communally owned advertisement location – similarly, these revenues are negligible and no specific changes are expected.

- rent payment and fee for other natural resources – very few hromadas have significant revenues of this sort, and so the overall impact of quarantine on them will be small.

- environmental tax – there are no changes with regard to its administration, but a downturn in business activity may have an impact on the revenues from this tax in the long term. However, a very small number of hromadas collect this tax. These are the hromadas that have large industrial plants on their territory. It is important for them that the industrial enterprises will operate smoothly.

Rents and environmental taxes together account for less than 1% of the hromadas’ tax revenue

Reduced tax receipts will make it necessary to reconsider the ATCs’ expenditure

The health care sector will require the most additional spending, due to insufficient public funding needed for the proper functioning of health facilities. That is why most ATCs provide health facilities with additional budgetary funding.

The situation is further exacerbated by the expected decrease in budget revenues due to the impact of quarantine measures, specifically the PIT revenues, if the enterprises start laying off their employees.

Compensatory mechanisms at hromada level are virtually absent

The only thing left to the hromadas is revisiting their expenditure. The budget revenues of the 75 DOBRE (USAID) partner hromadas are highly dependent on government transfers, with the latter accounting for 60-80% of revenues, on average. Due to the hromadas’ being subsidized from the budget, they lack resources for social and economic development, and most spending goes on supporting ongoing activities.

Compensatory mechanisms, such as the fee for breaching quarantine measures, will not be effectively applied due to political risks in the year of local government election. The energy savings with regard to educational institutions for 2 months will not help much either, since the heating season is almost over and part of this spending was financed by additional subsidies from the state budget.

Possible solutions to the problem

- Not a complete cancellation, but installment payments with regard to land and real estate tax other than land plot. The same position was expressed by the Association of Ukrainian Cities, and we share it. Delayed revenue is better than lost revenue.

- Auditing the government programs and reallocating ineffective programs to make up for local budget losses. This would allow for fulfillment of Article 142 of the Constitution of Ukraine. Similar proposals are made by the Accounting Chamber of Ukraine, proposing to redirect at least UAH 5 billion from the state budget to fight the coronavirus. For instance, funds could be obtained from the following sources:

- the state budget’s reserve fund, i.e. the funds still not allocated as of today, in the amount of UAH 1.4 billion;

- the funds meant for the Bureau of Financial Investigations, the state program “Statistical Observations”, the funds saved from compensations, subsidies, and payment for some services will provide together UAH 2.6 billion;

- UAH 1 billion from spending on leadership development, trade missions abroad, the administration and management of the national debt management policy, and for the comprehensive state program of training civil servants.

In this difficult time, when hromadas are virtually at the forefront of combating coronavirus trying to support their health facilities on their own, it is important to help and support, not take away. We look forward to a review of state policy and proving support to regions.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations