In December last year, the Ukrainian president submitted to the parliament the draft law “On economic passport” which proposes establishing a sovereign wealth fund (similar to the one that many oil-exporting countries have) that would accumulate government money on personal accounts of children born after January 1, 2019 and make lump-sum payments to these children when they turn 18. We explain what is wrong with this idea and how the government can find a more efficient use for taxpayers’ money.

The idea that the current generation should pass on some bonanza derived from non-renewable natural resources to future generations in principle makes sense. However, the devil as usual is in the details. Let’s look at what the president’s draft law and three alternative draft laws suggest. First, we discuss general caveats of this idea, then perform a counterfactual example calculating how much a Fund would pay to 18-year-olds in 2020 if it were established in 2002, and then look at the risks in the governance model suggested by the draft law.

The idea of a sovereign wealth fund has been circulating in the Ukrainian public discourse for quite a while. In 2016 we published a post suggesting that if Ukraine increased gas extraction (which it did not), in 2020 it would be able to accumulate about $3 billion of rents and invest them into infrastructure, pension savings or ‘blue chip’ stocks.

General considerations: trying to reach many ambitious goals with one wrong instrument

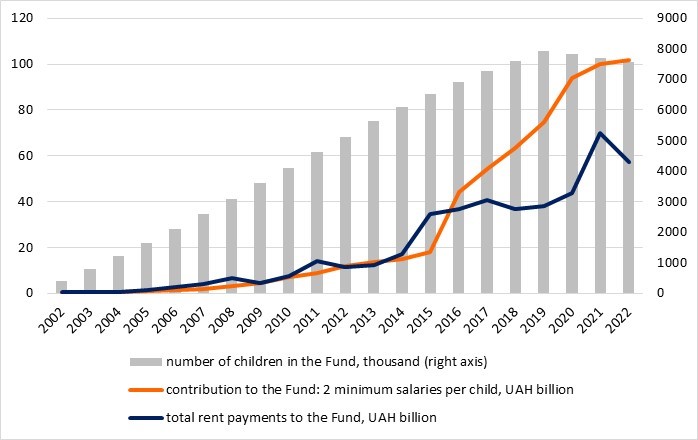

The draft law (or in fact three complementary draft laws) suggests accumulation of rent payments derived from extraction of natural resources into the Future Generations Fund (hereafter the Fund) and investing them into Ukrainian government bonds and unspecified “other assets”. At the same time, it sets the government contribution to the Fund at two minimum monthly wages per person per year. In this way it links minimum wage which is set in December for the next year to rent payments that depend on prices of natural resources and thus cannot be precisely forecasted. The explanatory note to the main draft law suggests that the preference is given to the minimum wage formula. Thus, the government will need to additionally finance the Fund if rent revenues fall short of two-minimum-wage per person contribution (see Figure 3). Lowering the minimum wage when prices for natural resources fall seems a much less probable scenario.

In 2037, when children born after January 1st 2019 turn 18, the Fund should start providing lump-sum payments to these children, or, to be more precise, start paying for their education, housing or pensions (a child may receive payment before 18 for treatment of a serious disease. If a child dies before 18, this money is inherited by his/her relatives). To be eligible for the money, when a child is 13-17, he/she will have to permanently live in Ukraine, i.e. spend no more than 180 days per year abroad (of them not more than 90 days in a row) if that is not for studies, treatment, vacation or business.

According to the draft law authors, its purposes are:

- raising the economic wellbeing of Ukrainian citizens;

- stopping emigration from Ukraine;

- forming an efficient system of social protection;

- increasing the supply of ‘long money’ which should lower interest rates;

- providing state investment into long-term projects.

In addition, draft law authors expect:

- development of the housing market and instruments for pension savings;

- increase of private financing of higher education and thus reduction of government spending for it.

It is very doubtful that all these goals can be achieved with the Fund. First, the expected payments likely will not fully cover education or housing. Thus, if a person cannot co-finance these purchases, he/she will not buy them. Second, an efficient system of social protection should target the ones that need it most rather than everyone who is 18. Finally, having a large state-owned buyer of government bonds is likely to crowd out private players from this market.

Ukrainian economists called for the parliament to not adopt the draft law providing the following arguments:

First, Ukraine doesn’t have windfall revenues as the above-mentioned oil-exporting countries. In fact, although Ukraine extracts some oil, gas and coal domestically, it has to import these resources: Ukraine imports about ⅓ of its gas consumption, about 70% of oil products, and since Russia occupied much of its coal-producing region in 2014, it also has to import coal. Ukraine is a net exporter of iron ore, iron and steel. However, with ever tighter environmental regulations this industry will have to invest massively into new technologies if it wants to stay afloat. This will undermine its ability to pay rents.

Second, the idea to provide money to all 18-year olds contradicts the means-tested social support which Ukraine has been proclaiming for the last 25 years (some 18-year olds will not need this money at all while others would need much more). Moreover, the Expert Department of the Parliament says that the draft law contradicts Article 24 of the Constitution which prohibits all kinds of discrimination. Channeling rent payments to just one group of people (youth) discriminates against others since all the people have equal rights to these revenues (today rent payments are pooled into the general fund of the state budget and used for general purposes). By the way, the Budgetary committee of the parliament recommends filling in the Fund simply with State Budget money, without tying rent payments to it.

Third, if the government wants to provide better homes, higher quality education or healthcare to future generations, it should change regulation of these industries to promote quality and competition rather than pour more money into them. The healthcare reform that started in 2017 is based on the ‘money follows the patient’ principle (although recent government decisions undermine it), while higher educational institutions continue to get money for quantity of students rather than quality of education. Housing market does not have clear rules and is a large source of corruption.

Fourth (and this argument is supported by the Expert Department of the Parliament), the draft law is not accompanied by detailed calculations on how much public money this Fund will require and whether it will generate sufficient returns to provide the promised payments. A back-of-the-envelope calculation shows that Fund revenues will not be enough to cover its expected payments. Explanatory note to the draft law provides just a few numbers. Thus, if adopted, the Fund will need UAH 21.8 billion of the initial government contribution in 2023, and in 2037 the Fund will have UAH 1,832 billion in assets and will spend UAH 191 billion to pay UAH 626,125 to each 18-year-old Fund participant (note that if we assume a discount factor of just 5%, which is very low for Ukraine, present value of this sum will be slightly more than UAH 300 thousand – enough for about 10 square meters of real estate in Kyiv or 20-40 square meters in an oblast center). The authors of the draft law do not explain how they arrived at these numbers. But we can question their calculations because they needed at least forecasts of the minimum wage and interest rates until 2037. And if they wanted to tie Fund’s revenues to rent payments, they needed to forecast those too. These are highly uncertain, yet the authors do not provide any confidence intervals or scenario analysis. Interestingly, the draft law prohibits all the administrators and managers of the Fund to guarantee growth of income to participants.

Finally, the million-dollar question is “Where will this Fund invest?”. The draft law allows three types of assets for the Fund: cash, Ukrainian government bonds and “other assets not prohibited by law”. At the same time, it limits repos and deposits to under 5% and 10% of the Fund’s assets respectively. From these clauses, we can infer that about 80-85% of the Fund’s assets will be Ukrainian government bonds. Thus, the government will not only contribute annually two minimal salaries per person to the Fund but also provide interest payments on this amount. Needless to say that this will increase the government debt, and levy higher debt service payments on future generations. To provide a few examples: Norwegian Sovereign Wealth Fund invests in over 9000 companies, none of which is in Norway, and sovereign wealth funds from the Middle East invest into “green” technologies and start-ups around the world. Russia uses its SWF to finance the budget deficit and replenish capital of state-owned banks but it is not the best example to follow. And, unlike Ukraine, it benefits from high energy prices.

To sum up, the Fund looks like an overcomplicated scheme of transferring money from one pocket to another and incurring a transaction cost on the way. If the government wants to finance some long-term investment projects, a more efficient way to do so would be to reduce other expenses or borrow funds. And if the government has some ‘spare’ money it’s better to invest it into creation of the second tier of the pension system, prospects of which at the moment are rather dismal.

Now let’s do some back-of-the envelope calculations to support the arguments provided above.

Fund’s revenues and expenditures. A counterfactual numerical exercise

We calculated revenues and expenditures of the Fund if it were established in 2002 (hence, it would have started payments to 18-year-olds in 2020).

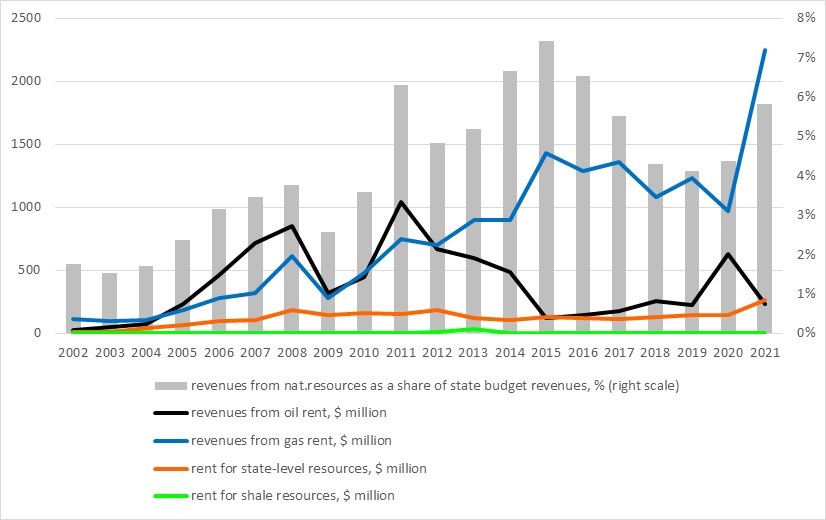

Figure 1 shows how much Ukraine derives from rents on natural resources. One can see that for the last decade these revenues constituted on average 5% of State Budget revenues, or 1.3% of GDP. One can also see that oil and gas rents provide a lion’s share of these revenues.

Figure 1. Budget revenues from oil, gas and other resources

Source: Treasury reports data

Note: actual revenues converted to USD at annual average rates. In 2011-2014 there was a special add-on to gas and electricity tariffs, later phased out.

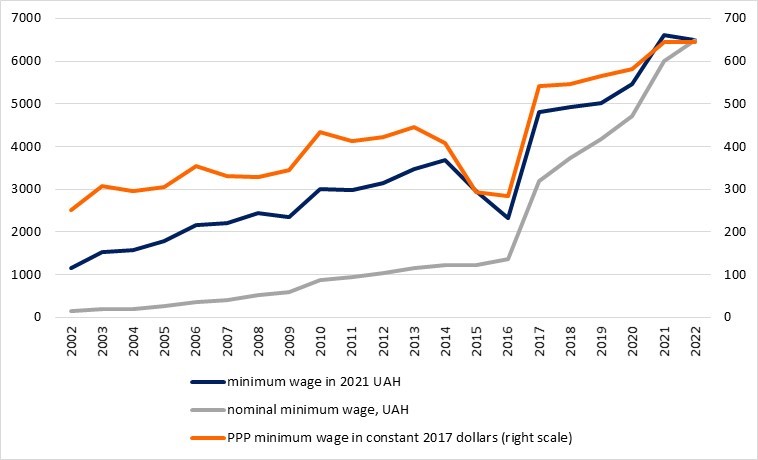

One can also see that revenues from natural resources are rather volatile. Indeed, the coefficient of variation for both oil and gas prices is about 60%. The correlation between the oil price and oil rent is 0.79 for the considered period (2002-2021), and the correlation between the gas price and gas rent is 0.2 for the entire period but 0.82 after 2014, when Ukraine moved to a more market-based price setting. At the same time, the minimum wage, another determinant of the Fund’s contributions, has been constantly growing (figure 2). In real terms, it has grown by 5.6 times during the last 20 years.

Figure 2. Minimum wage in nominal and real terms

Source: Ukrstat and IMF data, own calculations

Figure 3 illustrates that had the Fund been launched in 2002, the government would not have afforded doubling the minimum wage in 2016 (or it would have to finance the Fund from other revenues).

Figure 3. Fund revenues and the number of children (nominal terms)

Source: Ukrstat and Treasury data, own calculations. Rental revenues for 2022 – plan, for other years – fact. Projection for the number of children born in 2022 is 318 thousand, based on calculations of the Explanatory note for the draft law. Rental revenues are calculated taking into account the schedule prescribed by the draft law – with gradual increase of the share of revenues that go into the Fund.

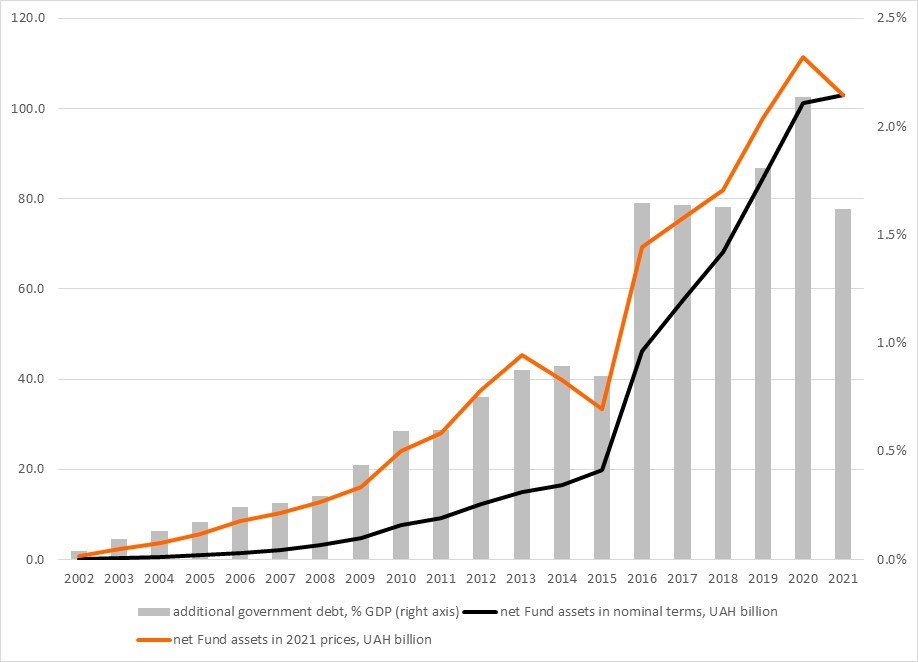

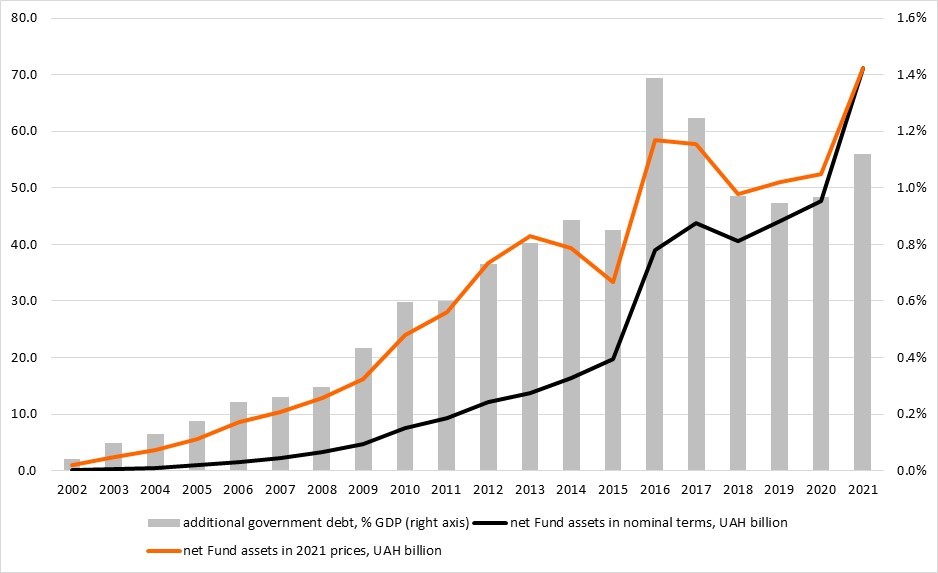

The next figure presents Fund assets calculated under the assumption that the Fund invested 85% of its net assets into government bonds and received historical returns (had the Fund been present on the market, interest rates might have been lower, thus interest payments from the government to the Fund would have been lower too). In this scenario we assume that the government made annual contributions to the Fund in the amount of 2 minimum monthly wages per person per year. We also assume that management fees are equal to 0.5% of assets, as prescribed by the draft law.

Under these assumptions the Fund would have reached UAH 101.3 billion or 2.4% of GDP in 2020, when it would have to make the first payment totaling UAH 5.2 billion or about 13.3 thousand Hryvnia per child born in 2002. In 2021 the Fund would pay UAH 5.7 billion to children born in 2003 – or about UAH 14 000 per child.

The cost of that would be additional government debt of 2.1% of GDP in 2020. In addition, since the money would have been hoarded in the Fund, government expenditures during that period would have been lower. After 2020 the number of children in the Fund and the additional government debt would decline because early cohorts of children would start leaving the Fund.

By the way, if in 2002 a family invested UAH 1000 (2.5 average salaries at the time) into a bank deposit, by 2020 it would have slightly more than UAH 13,000 without any additional contributions. Thus, perhaps it’s better to promote financial literacy than start another state-owned financial behemoth? Of course, macroeconomic stability and proper bank supervision are also needed so that people don’t lose their savings due to inflation or bankruptcies of banks.

Figure 4. Fund’s net assets and additional government debt: scenario 1

Source: Ukrstat, NBU data, own calculations. Note that our calculations are very simple and do not take into account secondary effects, such as lower GDP because of lower government spending which would lead to even higher debt-to-GDP ratio.

Let’s look at another scenario – when the Fund “lives within its means”, i.e. when annual government contribution to it is equal to either 2 minimal wages per person or to rent revenues – whichever is lower. In this case the Fund’s total assets and additional debt created by it would be lower. But payments to 18-year-olds would also be lower – UAH 6.3 and UAH 9.5 thousand per child in 2020 and 2021 respectively.

Figure 5. Fund’s net assets and additional government debt: scenario 2

Source: Ukrstat, NBU data, own calculations

These calculations also show that children born in different years will receive different lump-sum payments – depending on decisions on minimum salary made by different governments during 18 years. And also depending on the interest rate situation and investment decisions of asset management companies during 18 years. Since neither children nor their parents can impact these decisions (and they cannot withdraw their money and invest into other things either), creation of the Fund will stimulate paternalism rather than financial literacy. And it will also create a strong incentive for current governments to use minimum wages not as a labour market tool but as an easy way to increase their popularity by injecting more money into personal accounts of children in the Fund (additional cost of this decision will be borne by future governments anyway). This scheme is perfect for populists.

Now let’s look at the governance structure of the so-called “Economic passport system” (i.e. the Fund and accompanying institutions).

Economic passport system: governance risks

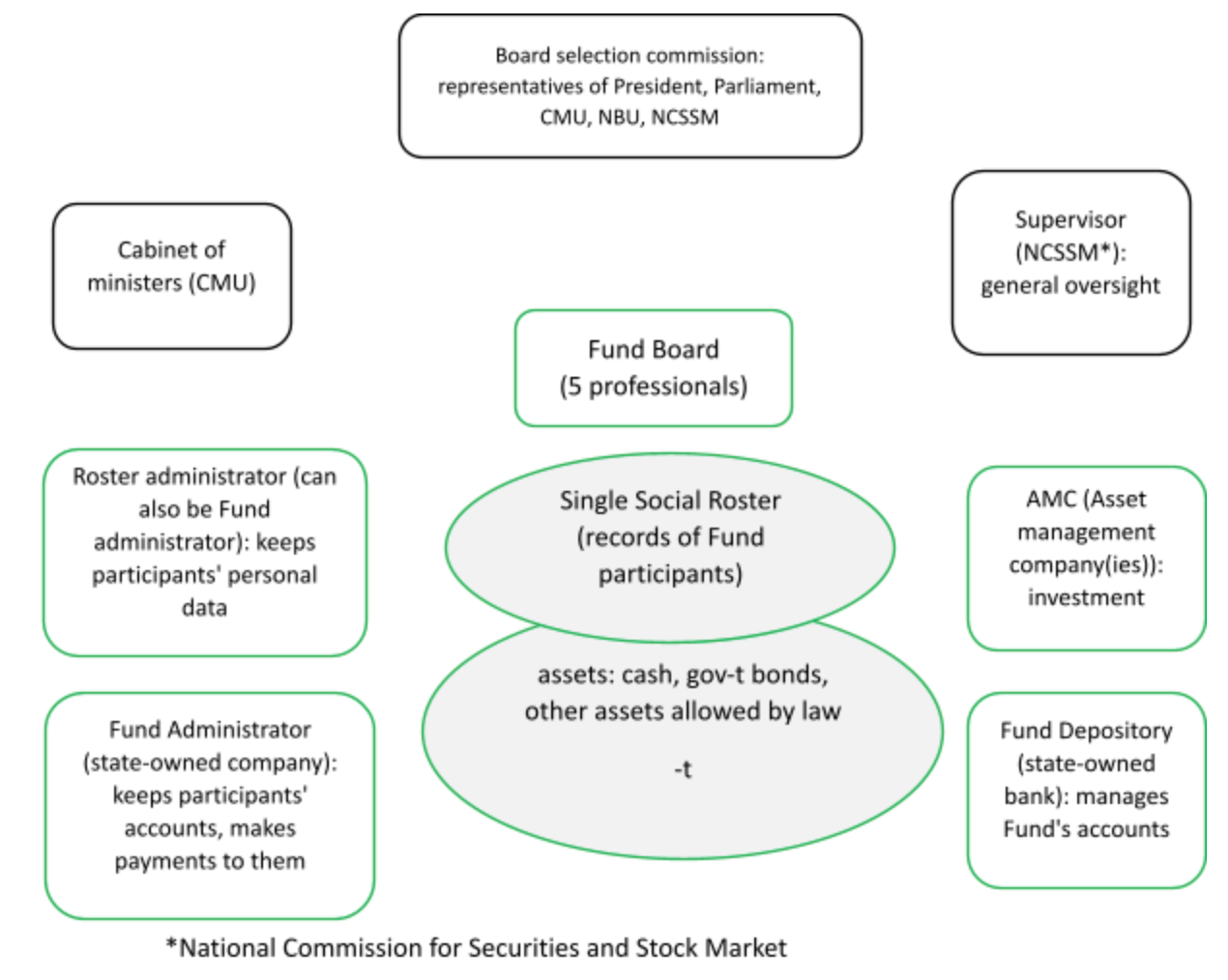

Figure 6 presents the general system of the “Economic passport”, i.e. the Fund itself and accompanying agencies. Note that although the Cabinet of Ministers, Stock Market Commission and other political institutions formally do not belong to the Economic passport system, in practice they will play a decisive role in the Fund’s processes which we discuss next.

Figure 6. Economic passport system and additional agencies

Note: green contours show the elements of the Economic passport system as defined by the draft law. Black contours show other agencies that are formally not a part of the system but play a big role in it.

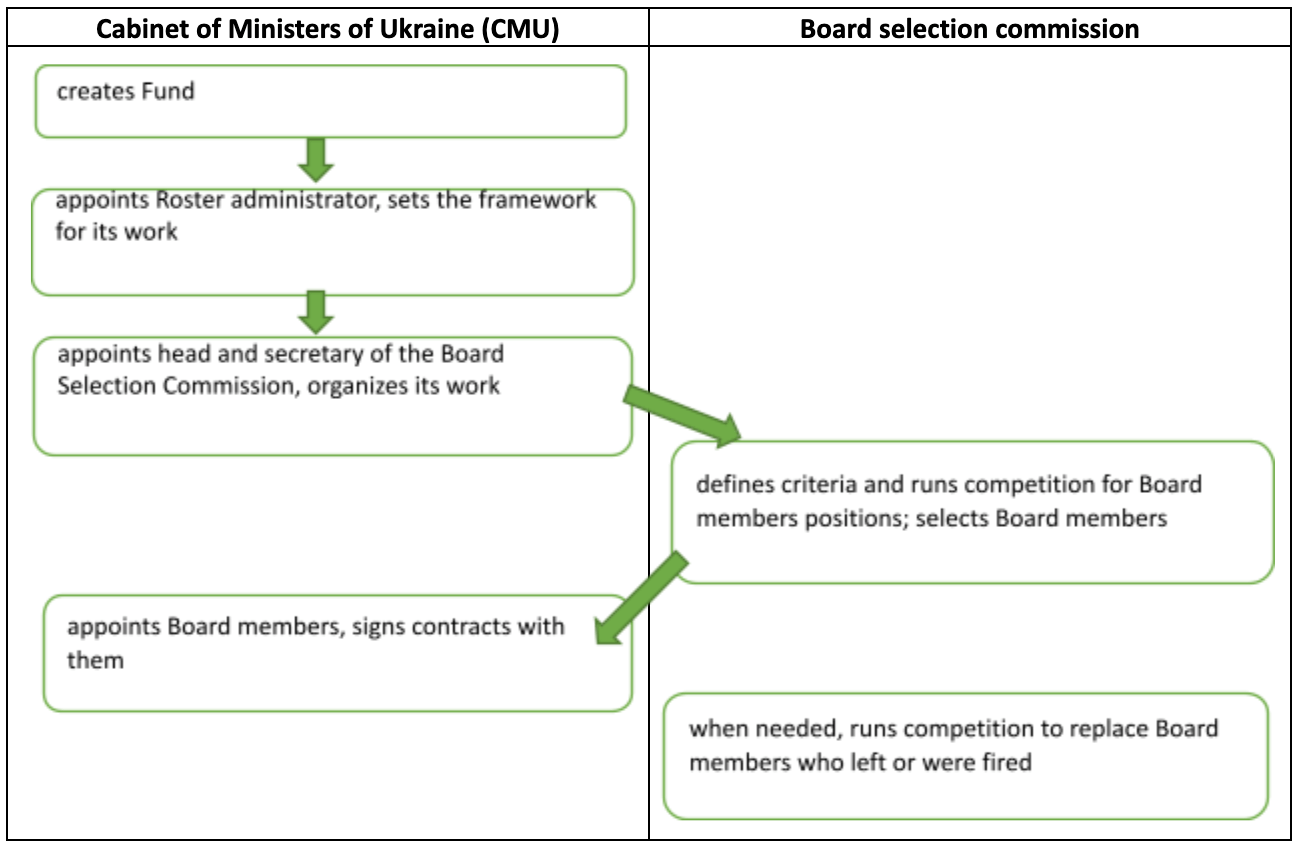

Thus, the Cabinet of Ministers (CMU) will need to initiate the Fund and organize the selection process for the Board members. And the selection itself will be the result of a compromise between many political players. Thus, although the draft law sets a very high bar for professionalism and independence of the Board members, this bar will likely be impossible to reach in practice. Moreover, it is quite possible that the Cabinet does not sign contracts with Board members selected via the competition for an indefinite period – the draft law does not discuss this situation.

Figure 7. Fund initiation Process

Source: own compilation based on the draft law

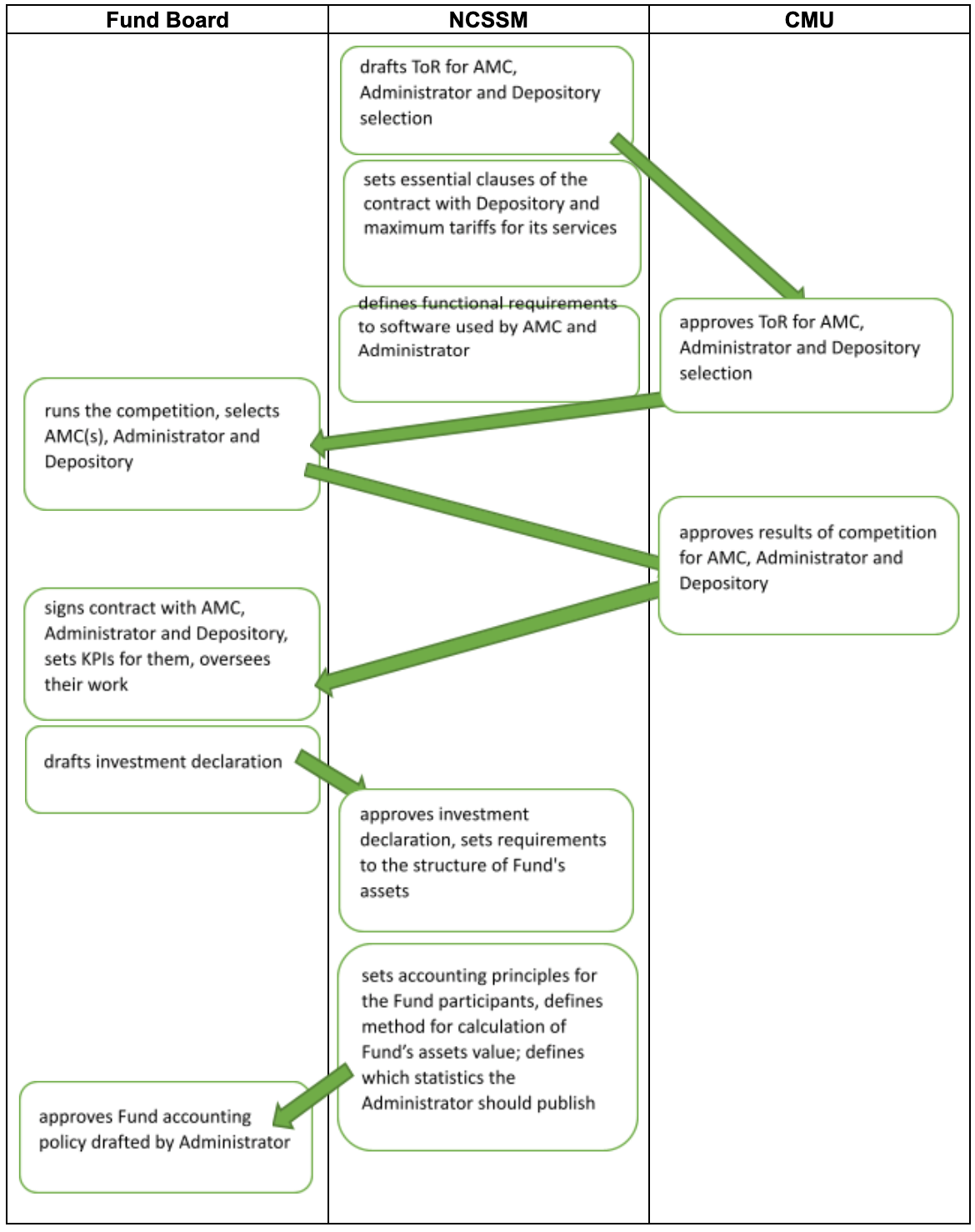

Figure 8. Fund setup: Selection of Asset management company (ACM), Fund Administrator and Depository

Source: own compilation based on the draft law

Figure 8 shows the key role of political leadership (CMU) and regulator (NCSSM) in the Fund’s operations. Namely, asset-management companies, Administrator and Depository of the Fund cannot be selected without the involvement of CMU and NCSSM. CMU approves AMC, Administrator and Depository companies selected by the Board via the competition and thus it’s quite possible that the Board will select those likely to be approved.

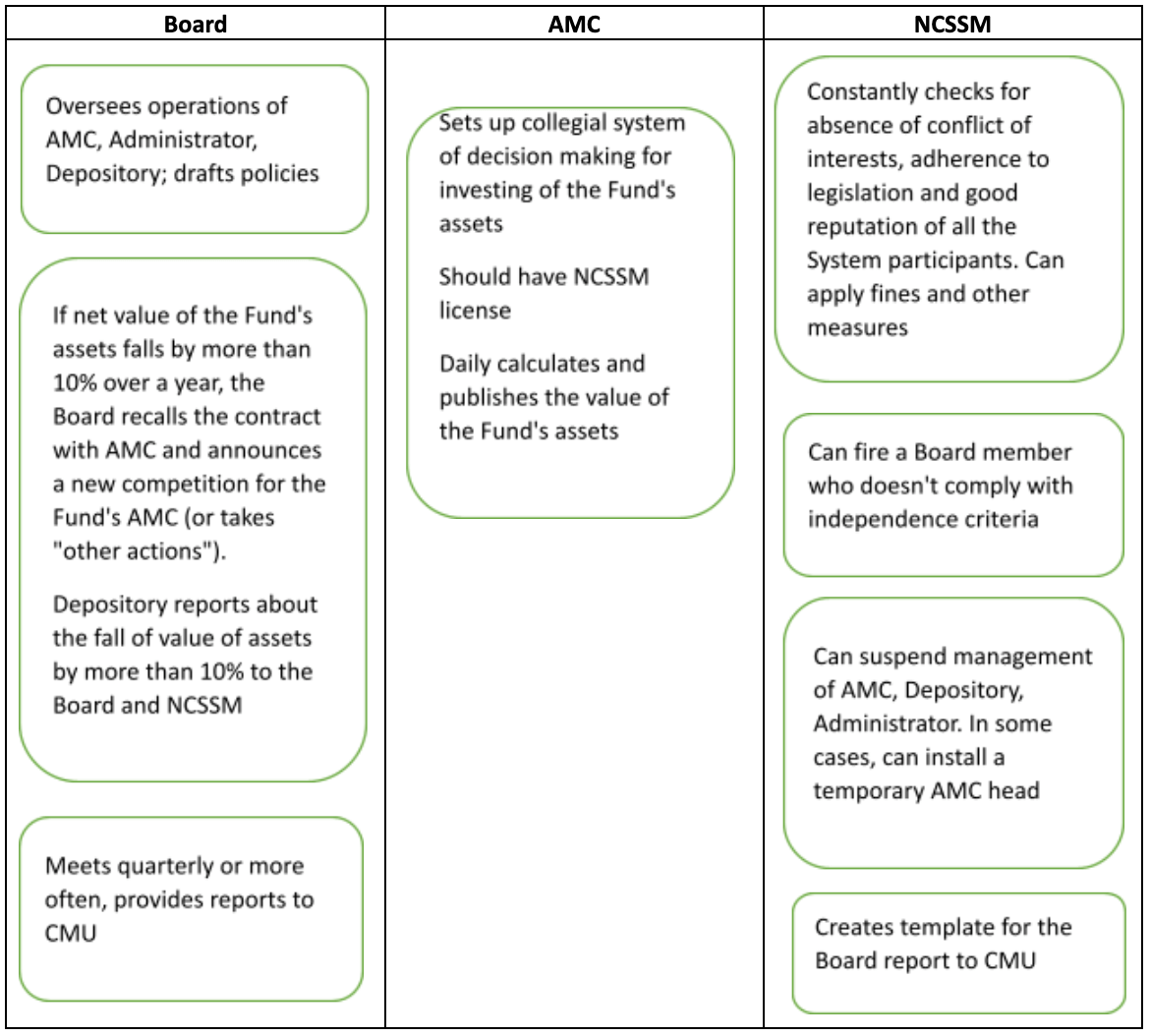

NCSSM will be also tightly involved into oversight of the Fund’s operations, including the opportunity to fire a Board member or replace an AMC head in the defined cases (Figure 9).

Figure 9. Operations and oversight

Source: own compilation based on the draft law

Overall, the Fund’s Board will likely play a smaller role in the Fund’s management than political leadership. Even if the government selects truly independent and professional people to the Board, political influence on the Fund will be substantial. This may deter professionals from running for these positions in the first place.

What else is on the table?

President’s draft law is not the only one suggesting conversion of rent revenues to lump-sum payments to citizens. There are three more draft laws – the differences between them as well as opinions of different government agencies on them are provided in the following table, as discussed in the note of the parliamentary committee on public finance that recommends to vote the president’s draft law in the first reading. A quick view on these draft laws suggests that they are even more populistic than the president’s proposal and most likely were submitted to get some public attention during the discussions of this topic.

| draft law packages | Zelenskyi | Yuzhanina (European Solidarity party) | Tsymbaliuk (Batkivshchyna) | Korolevska (Opposition Bloc) |

| Main differences with the president’s draft law | *** | To pay revenues from rents in a given year to people who turn 18 in the same year | Forbids buying government bonds, funds need to be used to support entrepreneurs | Allows additional sources of revenues for the Fund – contributions of people, companies, international organizations |

| Comments of government agencies to the draft laws | ||||

| Ministry of Finance | More rigorous calculations are needed | The draft contradicts the Budget Code | There is no money for this initiative | Doesn’t support this initiative (calculations are needed) |

| Ministry of Justice | Some articles contradict the Constitution and IPR

protection |

– | – | – |

| Ministry of social policy | Generally supports the idea, but it discriminates against children born before 01.01.19. Single social registry already exists | – | – | Doesn’t support |

| Ministry of Economic Development | Supports the law but provided some comments | – | – | – |

| NBU | Supports the initiative, will provide comments after the draft law is adopted in the first reading | Supports some clauses but conceptually supports president’s draft law | It’s the same as the president’s draft law | Draft law proposes to finance what’s already financed by State Budget programs |

| NCSSM | – | Doesn’t support – the law offers solidary system | Generally ok but has a few comments | Doesn’t support – the law offers solidary system |

| Expert Department of the Parliament | There is no money for the Fund, and the draft law violates the Constitution (rent payments should be used for all people, not for a group of people) | The same as for the president’s draft | The same as for the president’s draft | The same as for the president’s draft + state functions should be financed by the budget, not via this fund |

Source: explanatory note of the parliamentary committee on public finance to the draft law

Conclusion

As the above discussion suggests, creation of an SWF as currently envisioned is a bad idea on many levels – from the absence of windfall revenues from natural resources to the creation of small individual benefits at the cost of a large burden for the state (moreover, the increased government debt will “punish” future generations which the Fund is proclaiming to help). There are better uses of government resources (e.g., reform of the pension system).

My conclusion is that the main purpose of this draft law is a public relations campaign (PR). Thus, a wise solution for the parliament would be not to adopt this draft law since its PR dividends have already been reaped. Instead, both MPs and the president should concentrate on truly important things – such as judicial reform and enabling the work of the anti-corruption system. Because corruption and absence of justice are the main obstacles to long-term investment.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations