In 2023, the government significantly reduced the share of short-term (one-year) Domestic Government Bonds (DGBs) in the total volume of domestic borrowings. This policy does not align with the theory, which suggests that as interest rates rise, the share of short-term DGBs should increase. This may suggest that the government is expecting high inflation in the future.

Debt crises in emerging market countries convincingly demonstrate that the debt structure plays a crucial role in maintaining macrofinancial stability. Structural reforms in the financial sector and inflation reduction helped deepen debt markets and enhance their liquidity. This allowed for larger borrowing in domestic markets thus reducing vulnerability to currency crises. At the same time, the importance of effective public debt management has increased. Yield curve and the maturity profile of borrowings should ensure minimization of debt service cost while aligning with market conditions.

Similar processes were unfolding in Ukraine. However, the full-scale war changed the functioning of the DGB market. The emitent’s experiments in the first months of the war gave way to a more reasonable approach to dealing with borrowers. The NBU policy rate hike from 10% to 25% and extensive sterilization to manage excess liquidity stabilized the situation. The increase of the domestic borrowing cost was seen as a painful but necessary step in line with the new market fundamentals. However, today questions arise about the consistency of the emitent’s decisions. To what extent do the yield curve and maturity profile of borrowings demonstrate consistency in reactions to changing conditions? Has the lasting martial law influenced the logic of debt-related decisions?

What does theory tell us of debt market peculiarities in middle-income economies?

The structural differences between emerging markets and developed countries are so evident that their analysis has become a separate avenue of theoretical research. Due to structural reforms these differences are diminishing, but the long shadow of the past remains quite visible. What do economic studies say about the structural constraints of debt policy in emerging markets?

First, these markets are characterized by the so-called “original sin” – a situation when due to high and unstable inflation, vulnerability to currency shocks, and weak institutions in lower-income countries only foreign currency borrowing is available at low interest rates and for longer terms (over one year). In other words, borrowing in the national currency for more than one year becomes possible only after a certain period of reduced inflation, stronger trust in policies, and financial sector reform. The original sin problem is a key structural feature of financial markets in many countries, leading to their high vulnerability to external borrowing conditions and capital flow reversals.

Second, the EM term premium is significantly higher than in developed countries. The theoretical approach based on rational expectations does not allow for significant differences in the yields of instruments with different maturities. Research on emerging markets spurred a revision of this theory and recognition of the term premium as a fundamental characteristic of bond markets. However, for lower-income countries, the term premium is more pronounced due to more acute reaction of these markets to shocks. Ceteris paribus, the yield curve in such countries should look steeper compared to developed countries. During shock moments, spreads between short- and long-term instruments in emerging market countries also increase.

The reaction of the yield curve to a monetary shock depends on trust to the central bank. If the markets trust the price stability policy, then an increase in the key rate does not necessarily lead to an increase in interest rates across the entire yield curve. The yield curve tends to flatten, with short-term rates increasing approximately to the level of long-term rates. In this case, if policy is credible, inflation is expected to decrease, and therefore, there is no need to raise rates at the long end of the yield curve. To the contrary, when policy has low or no trust, the yield curve in response to a monetary shock moves vertically upwards. In cases of chronically high inflation or when the market of long-term instruments is absent, a ‘flat’ yield curve can persist for a long time. In other words, the higher the expected inflation, the higher the term premiums.

The shallow debt market in poorer countries makes intertemporal fiscal resilience highly sensitive to effective debt policy. Due to the sensitivity of public finance to debt service payments, the yield curve behaviour is more significantly influenced by decisions on the maturity of instruments issued on the market. When interest rates rise, the supply of shorter-term instruments should dominate. In other words, maturity and interest rates should be directly related. When interest rates fall, the emitent may opt for a longer-term borrowing. However, in the first case, there is a problem with rolling over short-term instruments, whereas in the second case there is a risk of excessive long-term payments if rates continue to decline.

Opening of debt markets in the national currency to global investors affects debt markets behaviour. Global capital flows can lower predictability of the relation between short- and long-term interest rates. Global shocks mostly affect yield levels and term premiums, while local factors are more responsible for the slope and curvature of the yield curve.

Consistency of domestic borrowing is questionable

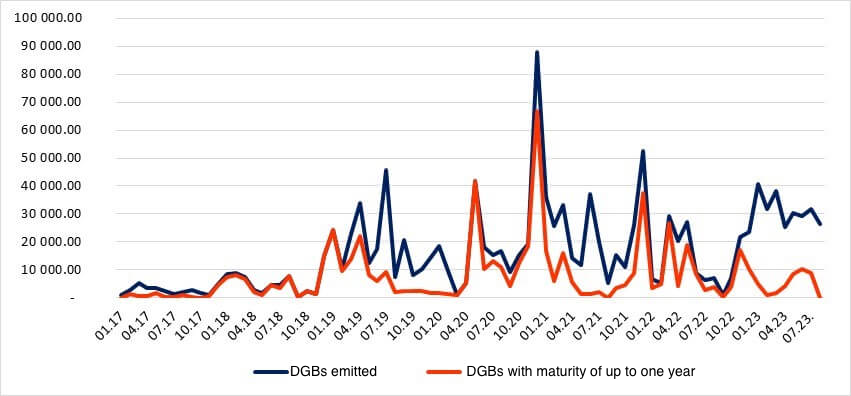

Since 2015, the environment for the government as a DGBs emitent has clearly changed. The NBU policy rate became an effective monetary policy instrument, and the establishment of monetary transmission required the emergence of a genuine market environment for domestic debt. However, the DGB market still retains visible characteristics of the original sin. Data in Figure 1 show that DGBs with a maturity of up to one year dominated the bond structure. The dominance of short-term instruments in the market suggests that the emitent doesn’t want to overpay due to a monetary or term premium shock.

Figure 1. Placement of domestic government bonds on the primary market, million UAH.

Source: NBU data.

Note that an increase in volume of short-term instruments until 2023 coincided with peak bond emissions. Since 2019, the emitent has increased the volume of longer-term instruments, apparently in response to the decrease in inflation, as predicted by economic theory. However, for a more accurate assessment of decisions regarding the maturity of the issued instruments, we need to look at the dynamics of yields and changes in the risk premium.

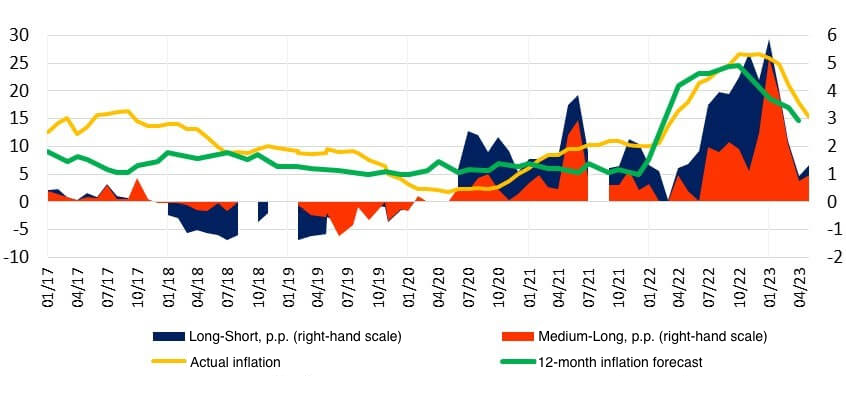

Figure 2 shows that in the long run the slope of the yield curve (measured as the difference between yields of the longest/weighted average and the shortest instruments for the respective period) adequately responds to inflation expectations, even if the yield level does not fully reflect expected inflation.

Figure 2. Yield curve slope, risk premium (the difference between yields on “long”/ weighted-average and “short” government bonds), and inflation forecast

Source: NBU data, author’s calculations

Figure 2 suggests that before the full-scale war, DGB emitent (the government) pursued a rather consistent policy aimed at optimizing future debt payments. Some deterioration of inflation forecasts in the late 2017 – early 2018 was accompanied by the yield curve inversion (i.e., yields on long-term DGBs were lower than yields on short-term ones, as inflation was expected to decline on the over one year horizon). Improvement of the inflation situation together with a significant influx of funds from non-residents in 2019 kept the yield curve inverted. Convergence of inflation forecasts and actual inflation towards the NBU 5% target during 2020 returned the yield curve to its “normal” shape.

The COVID-19 shock changed the landscape. As predicted by theory, during shocks the risk premium significantly increases: the difference between the interest rates at the long and short ends of the yield curve widens. 2020 and 2021 are a typical example of this. Unlike in 2018, in 2021 the worsening inflation situation was no longer accompanied by an inverted yield curve. Most likely, this was due to the fact that the acceleration of inflation in 2021 was perceived as being driven by global factors. Therefore, the positive and significant term premium reflected expectations of prolonged inflation.

There are several peculiarities of the 2022-2023 market reaction. During wartime, a sharp increase in the term premium should be expected. No inversion in response to the rising inflation is also a natural market reaction. The improvement of inflation outlook in 2023 stabilized the term premium. However, due to the high level of uncertainty during wartime, the yield curve did not become inverted.

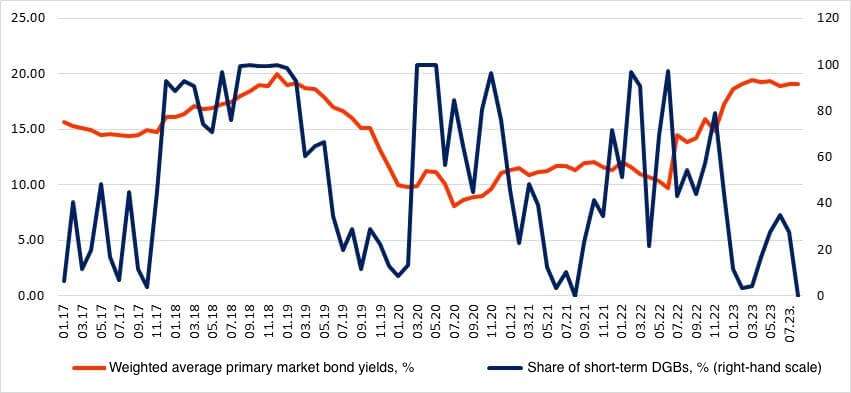

Despite the theoretical consistency of the yield curve behavior, the decisions of DGB emitent regarding domestic debt maturity do not seem consistent over the entire analyzed period. Data in Figure 3 indicates that domestic bond maturity policy more or less consistent with theory was interrupted in 2023.

Figure 3. Yields of government bonds and the share of short-term borrowings

Source: NBU data, author’s calculations

As evident from Figures 2 and 3, in 2022 the share of short-term borrowings clearly increased in response to rising interest rates and the expanding risk premium. This suggests that the emitent was pursuing a policy of optimizing debt payments. However, from 2023 the emitent’s actions deviated from this pattern. Despite persistently high yields consistent with the fundamentals, the share of short-term issues sharply decreased. This pattern contradicts the theoretical assumptions of a more favorable debt structure to reduce debt payments. It also differs from the entire previous period when the emitent consistently demonstrated a clear orientation toward optimizing debt payments under prevalent market conditions.

What can explain the “anomaly” of the maturity of government bond issues in 2023?

If the emitent’s behavior does not fit into traditional theoretical frameworks, is it possible that it is driven by other considerations? One possible explanation for the “anomalous” reduction of short-term issues is that the emitent perceives rollover risk (the ability to refinance already issued debt) as higher than the risk of increased debt payments in the future. This logic could stem from an assessment of the high level of uncertainty regarding the ability to offer instruments to the market at rates that would be acceptable to the emitent in terms of future expenses and acceptable to buyers in terms of risk levels at the time of rollover. However, 2022 was worse in this respect. On the other hand, the emission of UAH 400 billion by the central bank created more confidence for the government. Without guarantees of further emission, rollover risk indeed appears to dominate the government market strategy. This is not entirely logical considering the still significant liquidity surplus in the banking sector, the option to form a part of the mandatory reserves with benchmark government bonds, and the importance of non-emissionary financing of the budget deficit for the NBU, i.e., the ability of the Ministry of Finance to borrow in the market.

Is the emitent overestimating rollover risk by opting for longer-term instruments and deviating from the potentially better option of future payments? After all, if inflation is expected to decrease in the future, it would make sense to issue short-term government bonds today to reduce future payments. The strategy of issuing long-term instruments today, when interest rates are high, may indicate that the government expects high inflation and possibly even more Hryvnia emission if foreign aid volumes are insufficient to cover the budget deficit in the coming years. Such expectations undermine the NBU ability to soften monetary policy more quickly. Greater transparency in the motives of the government behavior in the primary market could clarify the situation.

Conclusions

Debt markets in low-income countries (including Ukraine) are insufficiently deep and vulnerable to term premium shocks. In Ukraine, the term premium reacts significantly to exogenous shocks, and shorter terms of bond issues correspond to deterioration in the inflation situation and the steepness of the yield curve. In other words, the emitent of government bonds consistently attempted to optimize future debt payments by adjusting bond issues to market conditions. However, in 2023 we observe an anomalous decline in the share of short-term issues despite improvement of the inflation situation. It is likely that the emitent’s perception of rollover risk dominates over the risk of increased future debt payments. However, this prioritization of risk estimates may reveal the problem with the emitent’s confidence in monetary policy.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations