November 19 is the International Day of Quitting Smoking. And on November 14, three years have passed since Bill 6776-d, initiated by 12 deputies, was registered in the Verkhovna Rada of Ukraine. In just over a month, the bill became a law that established a seven-year plan to increase excise taxes on tobacco products. Such a date is a good reason to look at what happened to tobacco consumption in Ukraine and try to predict further developments.

The “Seven-Year Plan” approved by the Parliament and signed by the President of Ukraine in December 2017 changed several aspects of the Tax Code of Ukraine. The law increased the specific rate of excise tax on cigarettes in 2018 and approved its annual further growth from 2019 to 2025 (Table 1). In 2018, the first year of the “seven-year plan”, the specific excise tax on cigarettes increased by 30%. In 2019, the specific excise tax increased in two stages – by 20% from January 1, 2019 and by 9% from July 1, 2019. The excise tax has also increased by 20% since January 1, 2020.

According to the current schedule, the excise tax will increase by 20% annually during the next 5 years (from January 1, 2021 to January 1, 2025). As of January 1, 2020, cigarettes (with or without a filter) are under a mixed system of excise taxation, which includes a specific excise tax (UAH 907.2 per 1,000 cigarettes) and an ad valorem tax (12% of the retail price). Besides, the minimum total excise tax is set at UAH 1,213.61 per 1,000 units. Consequently, in 2025 the specific excise tax will be UAH 2,257.4 per 1,000 cigarettes, and the minimum total excise tax will be UAH 3,019.85 per 1,000 cigarettes (about EUR 93.2).

Table 1. Rates of excise duties on tobacco products.

| Excise duty on tobacco products | Unit | 2017 | 2018 | I half of 2019 | II half of 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| Specific excise duty | |||||||||||

| Tobacco waste | UAH for 1 kg | 560 | 726 | 871 | 950 | 1,140 | 1,368 | 1,641 | 1,970 | 2,363 | 2,836 |

| Cigars and cigarillos containing tobacco | UAH for 1 kg | 560 | 726 | 871 | 950 | 1,140 | 1,368 | 1,641 | 1,970 | 2,363 | 2,836 |

| Cigarettes (with or without filter) | UAH for 1000 pcs | 446 | 578 | 694 | 756 | 907 | 1,089 | 1,306 | 1,568 | 1,881 | 2,257 |

| Homogenized or reconstituted tobacco; tobacco extracts and essences | UAH for 1 kg | 560 | 726 | 871 | 950 | 1,140 | 1,368 | 1,641 | 1,970 | 2,363 | 2,836 |

| Ad valorem excise duty | |||||||||||

| Cigarettes (with or without filter) | % | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 12 |

| Minimum excise duty | |||||||||||

| Cigarettes (with or without filter) | UAH for 1000 pcs | 596 | 773 | 928 | 1,011 | 1,214 | 1,456 | 1,748 | 2,097 | 2,517 | 3,020 |

Sources: Tax Code of Ukraine, Proposal of the tobacco industry.

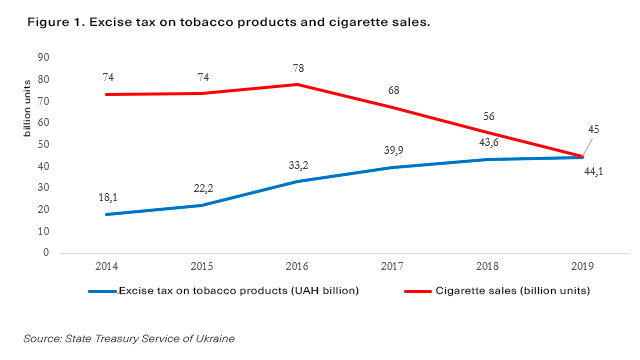

Where is Ukraine now? From 2017 to 2019, sales of cigarettes as the main tobacco product consumed in Ukraine decreased from 68 to 45 billion units (Figure 1). During the same period, revenues from excise tax on tobacco products produced in Ukraine and imported into the customs territory of Ukraine increased from 39.9 to 44.1 billion hryvnias, and the prevalence of smoking in Ukraine (i.e. the share of 12+ smokers) decreased from 23% to 16.8 %.

Where will Ukraine be moving next? In October 2020, VoxUkraine, Kyiv School of Economics and Campaign for Tobacco Free Kids published the joint study on the taxation of cigarettes and tobacco products for electric heating.

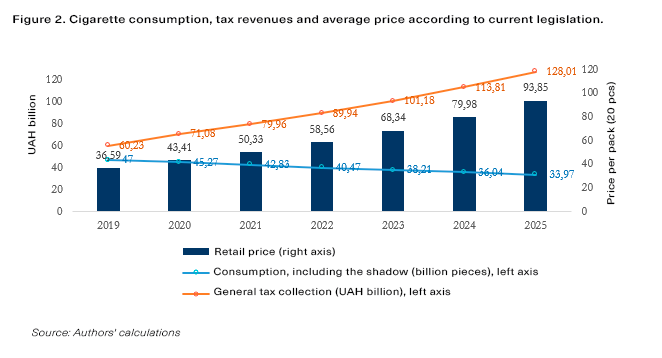

We simulated changes in cigarette prices, consumption and taxes (VAT, tobacco excise tax and local retail tobacco excise tax) on cigarette sales, depending on the change in excise taxes in accordance with the current plan to increase excise tax rates (detailed methodology can be found in the full report).

According to the results of the study, over the next 5 years, the current schedule will reduce cigarette consumption by an average of 5.6% per year (from approximately 45.3 billion cigarettes in 2020 to almost 34 billion cigarettes by 2025) and increase overall tobacco products tax revenues by about 12.5% annually (up to UAH 128 billion in 2025, in 2020 prices).

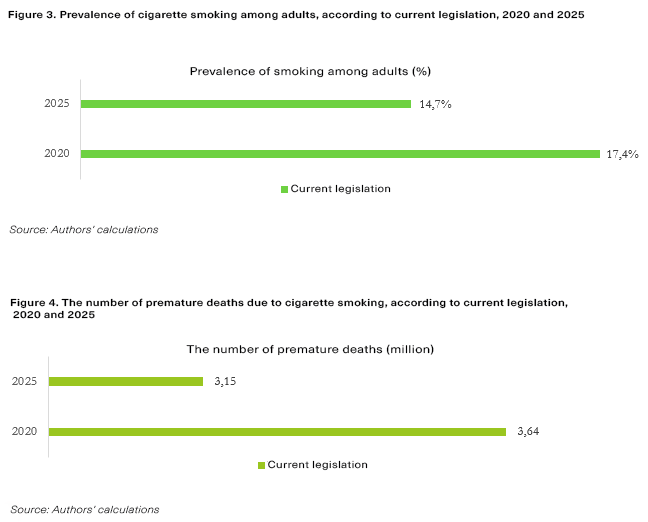

In addition to the impact on tax fees, the increase in excise rates will also affect the health of the population. First, over the next 5 years, raising excise taxes under the current law will significantly reduce cigarette consumption — our model assumes that the current schedule will reduce the prevalence of smoking among adults (16 years and older) from 17.4%, or 6.1 million adult Ukrainians in 2020 to 14.7% or 5.2 million adults in 2025 (Figure 3).

Second, meeting the current schedule for the next 5 years (2021-2025) will save 588,000 smokers’ lives from deaths directly related to lifelong smoking (Figure 4). Saving lives will happen because people who smoke now will stop smoking and less young people will start smoking. Accordingly, among these two groups, mortality from tobacco-related diseases will decrease.

Thus, Ukraine demonstrates positive trends related to the increase in excise tax rates. This study predicts that the implementation of current legislation in this area will continue these trends.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations