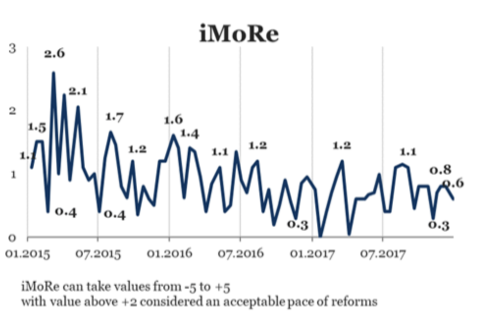

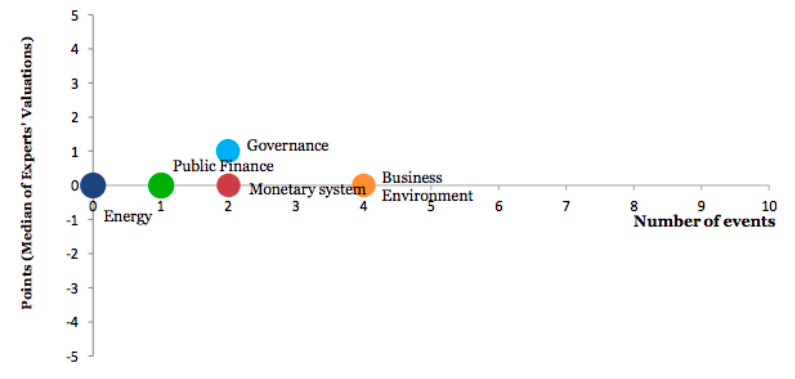

Reform Index is +0.6 points for the period from December 18 – December 24, 2017 (+0.8 in the previous round on a scale of -5.0 to +5.0). Positive developments were recorded in legislation regarding the sphere of governance and the monetary system. There were no reformist legislative changes affecting public finance, business environment and energy sector.

The major events of the round is the memorandum that launches a development of an electronic financial reporting system for the financial sector and a resolution on escrow accounts.

Chart 1. Reform Index dynamics*

Chart 2. Reform Index and its components in the current round

The major events of the release

A memorandum that launches a development of an electronic financial reporting system, +2.0 points

An electronic system for receiving, processing, verifying and disclosing information in a unified electronic format will be created for the enterprises that submit financial statements according to international standards. This format, XBRL (eXtensible Business Reporting Language) is an open standard for the exchange of business information. In many countries, this standard has long been used to submit financial statements.

The Memorandum, concluded by the National Commission on Securities and Stock Market, the National Bank, the Ministry of Finance and the National Commission, which carries out state regulation in the field of financial services markets, defines the procedure for the establishment of such electronic system. In the system a single window for reporting will be created and a process for exchanging business information provided. In particular, this will allow banks to receive financial statements from economic entities in accordance with international standards in an automatic mode.

Chart 3. Value of Reform Index components and number of events

Resolution on introducing of escrow accounts, +2.0 points

Escrow accounts have not previously been used in Ukraine, but have long been widespread in international practice, in particular for transactions with assets. From this account, money is transferred when a certain condition is fulfilled.

The NBU resolution #133 of 12/18/2017 defines the procedure for the use of such accounts.

Expert’s Comment

“The changes introduced by NBU primarily aim at regulating operation of escrow accounts. Such accounts are used internationally in M&A transactions when the business are being sold, as well as in certain other settings. They make transaction more secure and increase trust of the parties. One of the party deposits an amount with the bank. If certain conditions are met (i.e. the transfer of the company to the buyer is registered with the state register), the bank releases the money to the seller of the business. If not, it returns the money to the buyer. The Ukrainian Parliament finally approved the changes to the laws permitting creation of such accounts, the amendments became effective in June 2017. NBU had 6 months to update the regulations making the use of such accounts practically possible.”.

– Zoya Milovanova, Editorial board of VoxUkraine Law

Please see other charts on the website

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations