Investments in the Ukrainian economy are seen as a magic pill for all of Ukraine’s financial problems. Therefore, the Government returns again and again to the question of creating “the best conditions to attract foreign investors.” This time, it resulted in passing the Law On State Support of Investment Projects with Significant Investments (the so—called law on “investment nannies”).

According to the Law, the projects are deemed significant for investments starting from 20 million euros for a period of up to five years that create at least 80 new jobs with an average salary of at least 15% more than the previous year in a similar field in the region where the project is to be implemented. The priority areas of investment are processing industries, mining and quarrying, waste management, transport, warehousing, postal and courier services, logistics, education, research and development, healthcare, arts, culture, sports, tourism and recreation. Investment projects must provide for the construction, modernization, technical and/or technological re—equipment of the investment objects in those areas.

For its part, the State will provide support in the amount of up to 30% of the investment project, including:

- providing tax benefits, i.e. the funds that have not been paid into the budget as taxes remain at the disposal of the investors;

- reimbursing the costs of related infrastructure required to implement the investment project.

The law also provides for a special authorized government institution that will support the investment projects and provide assistance to the investors over the entire length of the project.

Exempting the investors from taxes and fees must be backed up by law. In this regard, 2 bills are currently under consideration in Parliament — 3761 and 3762 of July 1, 2020.

The former provides VAT tax exemptions until January 1, 2035 for “large” investors on goods imported into the territory of Ukraine; exemptions from corporate income tax for 5 years once a facility built as part of the investment project is operational; and also the possibility for local authorities to set lower land tax rates and land rents for such investors or exempt them from the land tax altogether.

The latter offers exemptions from import duties until January 1, 2035 for the equipment imported by the investor during the course of the investment project. The list and volumes of such goods are approved by the Government simultaneously with concluding a special investment agreement.

Thus, the adoption of the bills means introducing new tax benefits but also the risks of reduced state and local budget revenue. At the same time, the projects are not financially and economically grounded. There are no proposals on reducing budget spending and/or on sources of additional revenue to balance the budget.

International experience shows that developing countries usually provide tax benefits to compensate taxpayers for the significant shortcomings in economic policies and tax regulation (an inefficient tax system, weak physical and institutional infrastructure, macroeconomic instability, etc.). On the one hand, they cause inconvenience to businesses and increased spending, and on the other hand, — significant shortfalls in budget revenue due to tax evasion. Reducing tax rates should help the businesses cover the losses they incur as a result of such economic policy shortcomings. However, numerous studies of the outcomes from the introduction of tax benefits show that this tool does not achieve these goals (for more details see the study by Center of Public Finance and Governance, KSE).

However, tax legislation is not included among the significant obstacles to doing business in Ukraine. And tax holidays are not as important for attracting new investment as other reforms. This is stated in the researches by the European Business Association. According to them, the key problems for doing business in Ukraine in 2015–2019 were widespread corruption and distrust of the judiciary in Ukraine, the monopolization of markets and seizure of power by oligarchs. Significant obstacles to investment are the military conflict with Russia, as well as repressive actions taken by law enforcement bodies. An unstable currency and financial system come sixth. These structural problems are much more difficult to tackle. More comprehensive, long—lasting and persistent action is needed than introducing tax incentives.

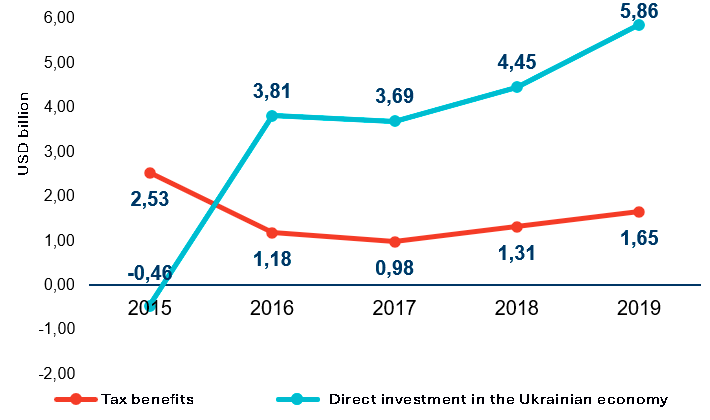

According to the NBU, from 2015 to 2019, the amount of foreign direct investment in Ukraine increased 5—fold to USD 5.86 billion, while the amount of tax benefits, on the contrary, decreased by a third, from USD 2.53 billion in 2015 to USD 5.86 billion in 2019 (Figure 1).

Figure 1. The amount of tax benefits and foreign direct investment in Ukraine in 2015-2019

Source: State Tax Service of Ukraine, National Bank of Ukraine

There is also evidence that there is no link between tax benefits (particularly in the form of tax—free zones and tax holidays) and attracting investment. In many cases, tax incentives did not bring additional investment, i.e. the same investment would have been made even without the benefits. Also, it is usually not possible to determine whether the investments simply were not transferred from one sector to another.

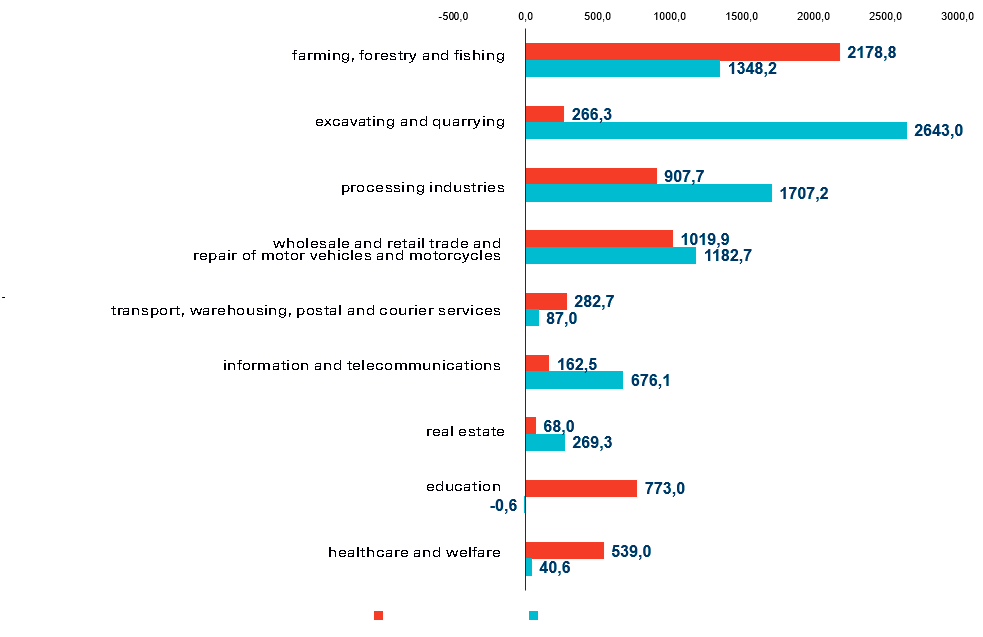

In 2015—2019, the largest amount of investment in Ukraine went to the mining, processing and agro–industry (Figure 2). However, these industries are not the largest tax benefit recipients over the 5 years, except for the farmers, but for them, too, the special VAT regime was ended in 2016.

Figure 2. Tax benefits and investment by industry in 2015–2019, USD million

Source: State Tax Service of Ukraine, National Bank of Ukraine

According to OECD research, tax privileges cannot make up for the poor investment climate leading to low investment. Non—tax factors such as macroeconomic conditions, infrastructure and powerful institutions are more important for attracting foreign direct investors than tax benefits. Overall, according to researchers, providing tax benefits is always a less profitable option for both the state and taxpayers than general reforms aiming to simplify the tax system and expand the tax base. Such reforms reduce tax rates for all, not just individual businesses. Low rates are the most effective stimulus for the economy.

By providing tax benefits, the Government is trying to compensate businesses for investment climate deficiencies caused by structural problems in Ukraine’s economy. Specifically, there is a lack of the rule of law (unreformed courts), corruption and the unpredictability of government policy. Consequently, tax benefits cannot persuade investors to put money into the country’s economy if other important sectors such as economic stability and investor protection are distorted. The Government, too, runs the risk of falling short in state and local budget revenue and, as a result, in socially important spending.

Photo: depositphotos.com/ua

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations