In this article, we consider the experience of countries in the (partial) conversion of transport to biofuels in order to reduce CO2 emissions. Countries that have succeeded in this policy have used the “carrot and stick” method. On the one hand, they introduced mandatory quotas for the content of bioethanol or biodiesel in fuel, and on the other – provided tax benefits and subsidized loans to producers of biofuels and cars that can run on “diluted” fuel.

Transport is the main “producer” of greenhouse gases

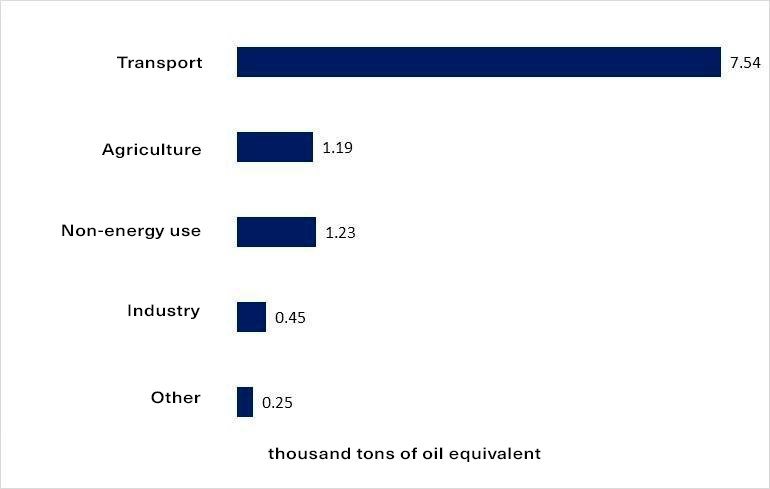

Petroleum production, refining and consumption cause significant environmental pollution. 95% of crude oil is used to produce fuel for vehicles. In Ukraine, transport is also the largest consumer of petroleum products (Graph 1). In addition, transport is one of the main “producers” of greenhouse gases. Thus, in 2017, it was responsible for 24% of global CO2 emissions (for Ukraine this share is 14%, for Europe 30%). Therefore, states have long been working to force car manufacturers and owners to switch to fuels that leave a smaller environmental footprint.

Graph 1. Consumption of petroleum products in Ukraine in 2018, by sectors

Source: State Statistics Service

Ukraine has long been a part of a wide range of international treaties governing harmful carbon emissions. The main ones are the Paris Agreement, the Kyoto Protocol, the Copenhagen Climate Agreement and the EU Renewable Energy Directive (RED II), signed within the framework of the Association Agreement between Ukraine and the European Union. However, internal normative acts are quite confusing.

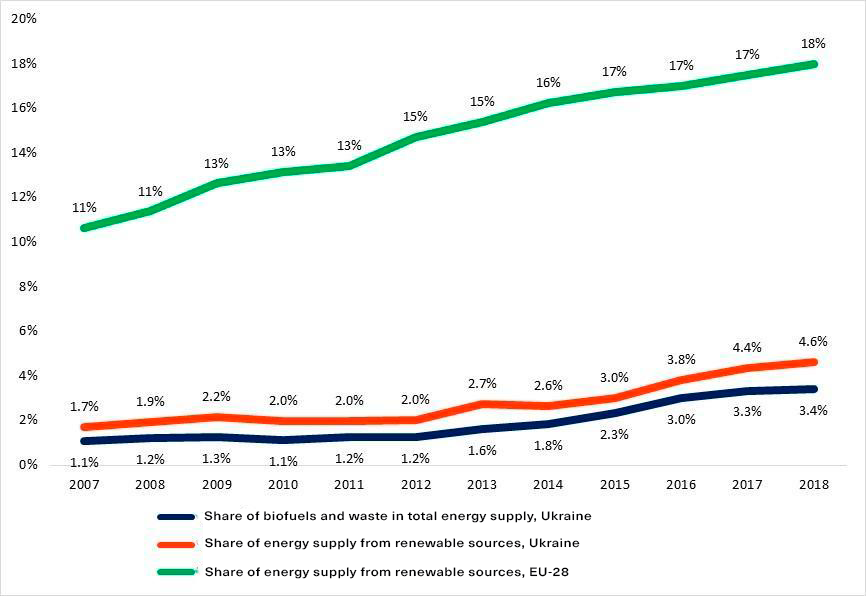

In 2019, the Presidential Edict approved the Sustainable Development Goals of Ukraine until 2030. They stipulate that the share of energy from renewable sources in the energy balance should be 17.1% in 2030. According to the Voluntary National Review of the Sustainable Development Goals for 2018, 7% of Ukraine’s energy was produced from renewable sources (by the end of 2020, this share should reach 11%). For comparison, the RED II Directive provides for an increase in the share of “clean energy” to 32% for European countries, and also contains a sub-goal – to set the share of energy from renewable sources in transport at 14% by 2030. Graph 2 shows how Ukraine lags behind the EU countries in achieving the goals.

Graph 2. Dynamics of the share of energy from renewable sources in the EU-28 and Ukraine for 2007-2018

Source: Eurostat, State Statistics Service

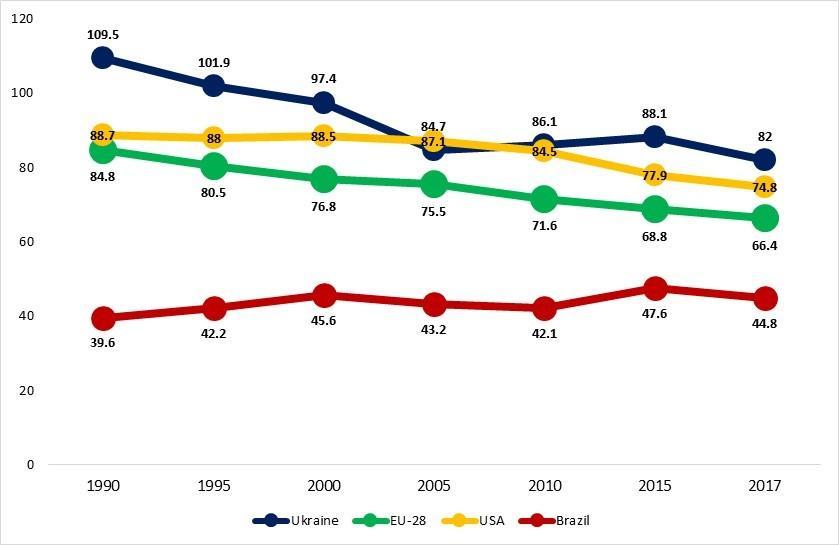

The low efficiency of the state policy on reducing carbon emissions can be traced in the dynamics of the ratio of CO2 emissions to final energy consumption. Although this figure has fallen by 25% over the last 30 years, it is not constantly declining and continues to be higher than in the US and the EU (Graph 3).

Graph 3. Dynamics of CO2 emissions to final energy consumption for 1990-2017

Source: International energy agency: CO2 emissions from fuel combustion. Highlights 2019

Historically, the development of the biofuel market has been one of the world’s key levers for reducing CO2 pollution from transport. However, today there is an active transition of the market to electric cars and hybrid models.

Biofuel is an ecological source of energy, which depending on the raw material can be represented by three types: liquid, solid and gaseous.

International experience

The countries of the European Union, the USA and Brazil have long been actively developing the market for liquid biofuels, namely bioethanol (alcohol made from vegetable raw materials – sugar beet or cane, wheat, corn). Of course, even such an alternative is not completely safe for the environment, primarily because the energy used to grow, process and transport crops is also a source of CO2 emissions. Table 1 shows the calculations of such emissions provided in the EU Directive, as a basis for the possibility of calculating the actual reduction of carbon pollution.

Table 1. List of crops, grown in Ukraine, that can be used for biofuel production and CO2 emissions associated with their production

| Crop name | CO2 emissions as a result of the cultivation, processing, use and supply

(g CO2eq / MJ) |

Carbon emission reduction percentage (default value)* |

| Ethanol | ||

| Sugar beet | 22,5-50,2 | 61% |

| Wheat | 15,7 | 32-69% |

| Corn | 30,3-56,8 | 56% |

| Biodiesel | ||

| Rape-seed | 50,1 | 45% |

| Sunflower | 44,7 | 58% |

| Soy | 47,0 | 40% |

| Jatropha | not defined by the directive | |

Source: REDII Directive

*The percentage of reduction of carbon emissions when using biofuels of a certain blend (90%, 85%, 80%, etc.) is calculated in proportion to the value of this indicator for 100% concentration of biofuels. For example, if sugar beet ethanol reduces carbon emissions by 61%, the corresponding E85 blend reduces CO2 emissions by 51.85%.

The energy crisis of the 1970s and the desire to gain independence from oil imports for the world’s two largest ethanol-producing countries, the USA and Brazil, were the push for the active development of the bioethanol market. Both countries have introduced a mandatory share of ethanol in gasoline. Thanks to what these countries managed to become leaders in the world market of biofuels?

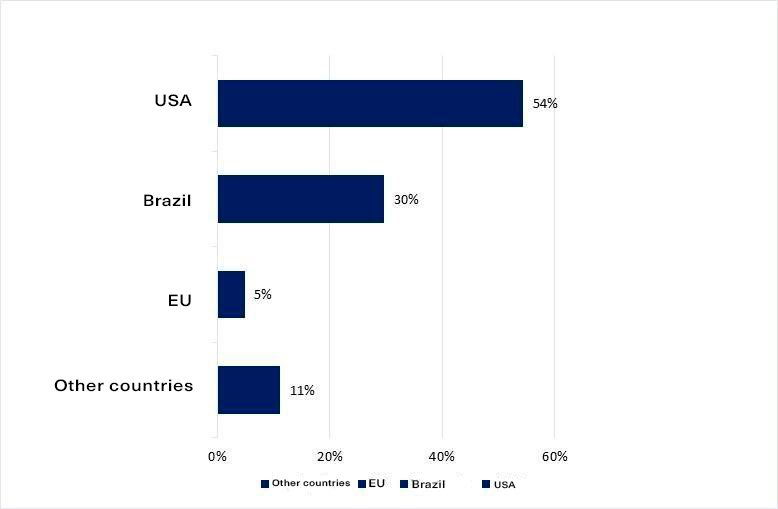

Graph 4. Distribution of the world’s ethanol production in 2019 by producers,%

Source: Statista

In Brazil, the raw material base is cane sugar. Its cultivation does not conflict with the food sector, as the country has a lot of unused land. The PROALCOOL program has been running for almost half a century to regulate the development of the ethanol market in the country. Its key points are:

– guaranteed purchases of raw materials from farmers so that they are not afraid of losing investment;

– subsidized loans for ethanol producers;

- state guarantee that the price of petroleum products will not fall below the price of ethanol (today the state no longer interferes in pricing).

Currently, in this country it is not possible to buy fuel that has the ethanol content of less than 18-25%, and the engines of most cars are adapted to use E100, i. e. almost 100 percent ethanol (flex-fuel transport). Brazil’s experience is an example of a successful transition from petroleum products to the “green energy”, reduction of dependence on fuel imports, development of the domestic agricultural sector and strengthening of its position in the international biofuel market.

The production of biofuels from corn is less efficient, although this practice has led the United States to become a world leader in the bioethanol market. In 2019, the USA accounted for 15.8 billion gallons (54%) of world ethanol production (Graph 4). In addition to direct economic benefits, the production of own biofuels also brings social benefits (reduction of air pollution and dependence on oil imports, economic development of rural areas). Therefore, the US government has stimulated ethanol production through a tax credit for producers, an increase in import tariffs on ethanol imports, and the exemption of biofuel producers from excise duty on fuel. Moreover, Congress has introduced government loans for “flex-fuel” car manufacturers, as well as guaranteed government purchases of vehicles that use fuel from alternative sources. By setting a target level of ethanol in the fuel of 10-15% depending on the state, the US government is acting through the reduction of the tax burden and government guarantees.

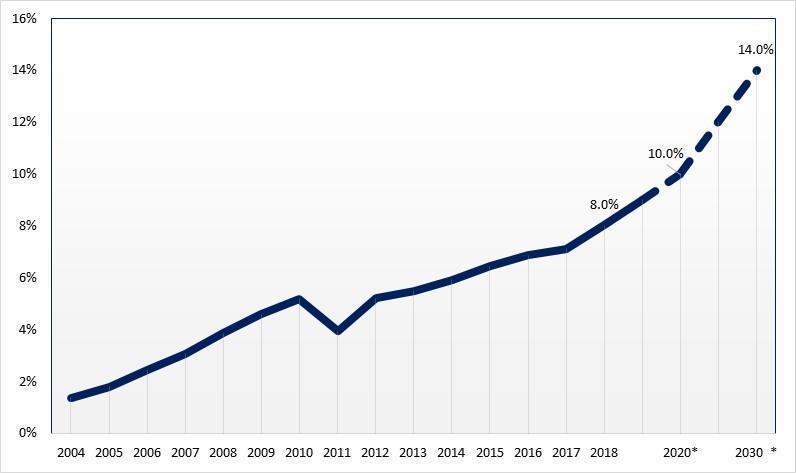

For Ukraine, which strives for European standards, the experience of the European Union countries is the nearest. In these countries, the share of renewable energy in total consumption and in the transport sector is constantly growing – up to 20% and 10%, respectively (Graph 5). In Ukraine, the share of energy from renewable sources in total consumption was 4.6% in 2018.

Graph 5. Share of alternative energy in the transport sector, 2004-2018 (%), EU-28

Source: Eurostat

*target indicator

The success of European countries is due not only to state support for energy efficiency, but also largely through close cooperation between the agricultural sector and vehicle manufacturers. The countries participating in the Directive have established by law that 5-10% of fuel sold on the domestic market must be biofuels. The percentage is determined by the country’s potential for biofuel production or imports. It also takes into account the condition of the vehicle fleet and the ability to adapt it to mixed or “green” fuel. Thus, each EU country legally sets the percentage of biofuels (separately for biodiesel and ethanol), the achievement of which is realistic, and independently determines the policy of achieving the set goals.

The World Trade Organization (WTO) recently noted that the reorientation of part of the agricultural market to the industrial sector has led to rising food prices. In fact, it is a question of land use. The WTO urges not to give areas, where food crops were grown, for industrial plants. To comply with WTO recommendations, the new RED II Directive of 2018 included iLUC (indirect land use factors) risk factors. EU countries have already agreed to implement this recommendation by setting a mandatory share of “progressive biofuels” in the total use of transport fuel (3.5% by 2030). Therefore, Ukraine should develop the production of fuel from biomass, which does not replace food. These are, for example, agricultural waste, straw, algae, etc.

Recent trends in the world and in Ukraine

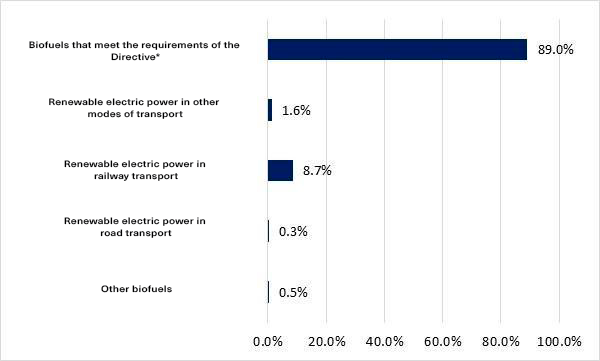

Today, the world is moving towards the use of electric transport. Countries such as Germany, Norway and the Netherlands are already actively supporting this sector. However, in the EU in 2018, 89% of “green” energy was accounted for by biofuels (Graph 6). Therefore, even with the aggressive support of electric vehicles, a rapid renewal of the fleet in the European Union is unlikely to happen. It is no coincidence that in the Directive the EU stipulates that a significant part of cars will be replaced by electric ones only by 2030.

Graph 6. Structure of energy use from renewable sources in the transport sector in 2018, EU-28 (total – 18 646 tons of oil equivalent**)

Source: Eurostat: SHARES 2018 summary results

*Fuel complying with Articles 17 and 18 of the Directive 2009/28/EU

** tons of oil equivalent

Another problem with electric cars is that they are difficult to use for long distances. In the European Union, this issue is addressed by supporting environmentally friendly hydrogen fuel. Thus, on July 8, 2020, the European Commission presented the “Hydrogen Strategy for a Climate-Neutral Europe”. It highlights the direction of cooperation with neighboring countries, in particular with Ukraine, in order to facilitate their transition to clean energy. Among the possible tools of cooperation are investments in the sector of research, innovation and development of clean energy. And this is a significant potential for grants and direct funding from the European Union. As the goals for the development of hydrogen fuel in European countries are ambitious: by 2024 it is planned to achieve the production of 1 million tons of renewable hydrogen, and by 2030 this volume should reach 10 million.

For a number of years, the Ukrainian government has been trying to force gas stations to dilute gasoline with ethanol. 2020 was no exception. However, in June, the Verkhovna Rada sent Draft Law №3356, which introduces a mandatory gradual increase in the share of liquid biofuels in motor gasoline to 7% in 2023, for revision.

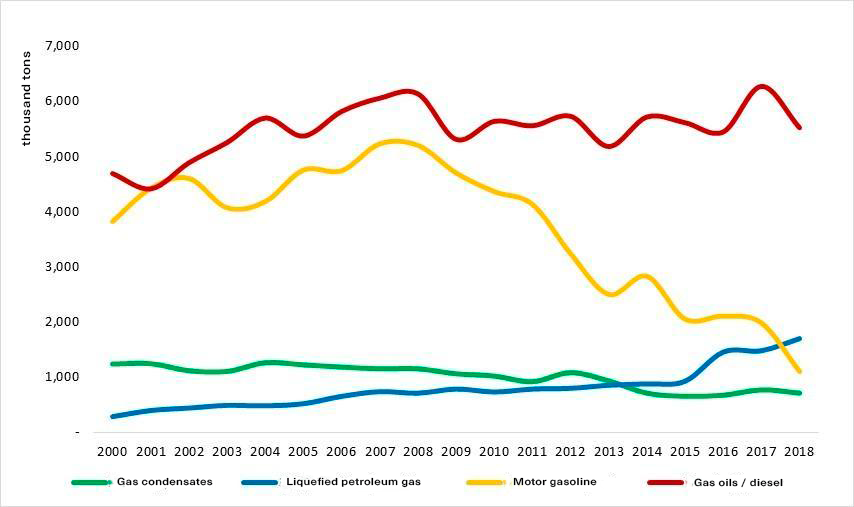

The mandatory share of ethanol in gasoline contributes to the growth of demand for it, and thus stimulates the production of its own fuel, reducing dependence on imports. But, unlike other countries that develop the industry in an integrated manner, Ukraine focuses only on bioethanol, forgetting about other types of biofuels, such as biodiesel. Although, according to UkrAvtoprom, half of the cars registered in 2019 are equipped with diesel engines, and diesel consumption significantly exceeds gasoline consumption (Graph 7). Besides, the question arises whether car owners will be harmed by the situation when, under the pressure of a fine, gas stations will start selling diluted gasoline? After all, the innovation will affect all types of gasoline with an octane number below 98, which significantly limits the choice for consumers.

Graph 7. Domestic consumption of petroleum products in Ukraine, 2000-2018

Source: State Statistics Service

Conclusions and recommendations for Ukraine

The UN recently prepared a report in which the carbon-neutral economy is among the six promising areas for the future. The world is moving towards sustainable development and is constantly opening up new opportunities for this. Among them is the development of “green” and environmentally friendly alternatives to petroleum products. With the development of the bioethanol industry, Ukraine lags behind European countries by 10 years. However, given that in our country the agricultural sector is developing very dynamically, and electric cars are not so many, in our opinion, it is worth encouraging the use of biofuels by transport.

Incentives can the following:

- CO2 emissions tax. According to Climate Scorecard estimates, in March 2020 Ukraine had the lowest level of this tax in Europe – 10 UAH / ton. European countries act in achieving the goals of the Directive specifically through the high rates of CO2 emissions tax. In Europe, they range from $9 / t in Iceland to $119 / t in Sweden.;

- Establishing a mandatory percentage of fuel from renewable sources in total sales;

- Reduction of excise duties on alternative fuels. In 2014, with the introduction of the excise tax on alternative motor biofuels and biodiesel, according to the Ukrbiofuel Association, the capacity for the production of ethanol-containing fuel additives in Ukraine decreased by 85%.

- Subsidies (subsidized loans or loan guarantees) for the re-equipment of gas stations for the sale, storage and quality control of new fuels;

- Assistance to consumers in re-equipment of vehicles (re-equipment is required if the share of ethanol in gasoline exceeds 5%); subsidies to transport companies for the re-equipment of rolling stock for the use of more environmentally friendly fuel; € 700-100 thousand / engine

- Support for “green” fuel producers, especially modern biofuels that do not compete with food production. Such biofuels are produced from crop residues (straw, cake, wood biomass), industrial waste (used cooking oil, animal fats) and non-edible plants (algae, grass).

These incentives will affect several industries of farmers, carriers, importers and distributors of fuel, importers and transport manufacturers. Therefore, stakeholder positions will need to be agreed upon during policy development. The impact on each of the stakeholders is given in more detail in Table 2.

Table 2. Positive and negative sides of stimulation of the bioethanol market in Ukraine

| Positive aspects | Negative aspects |

| Attracting investments: as a result of the privatization reform of Ukrspirt (total capacity of 1650 thousand dal of bioethanol), private investors will invest in production. Ensuring guaranteed demand, in turn, creates an attractive investment climate | Additional costs for gas stations:

tanks in which gasoline is stored in Ukraine are not adapted to ethanolomic products, which by their chemical properties are hygroscopic substances. |

| Reduction of dependence on gasoline imports (+ UAH 1.6 billion *) | Additional costs for consumers:

1) with the existing rate of excise duty on a mixture of ethanol and gasoline, they are more expensive than other fuels; 2) if they do not want to switch to ethanol, consumers are forced to buy more expensive gasoline with an octane number above 98 (for 1/10/2020 the average price for A-95 – 23.97 UAH / l, for A-98 – 28.05 UAH / l) |

| No guarantee of quality for consumers:

there is no transparency and proper control over the quality of mixtures in the country, and due to corruption, even specially created control services will not inspire trust |

|

| Agricultural products, which are raw materials for bioethanol, will create added value in the country instead of low-margin exports | If food is used as a raw material, it will provoke criticism from international organizations and the EU |

| Positive impact on the environment; support for Ukraine’s sustainable development | Lack of quality control of CO2 emissions in the agricultural sector: in order for bioethanol production to be environmentally friendly, all stages of growing and transporting raw materials must comply with the Directive |

Source: compiled by the author

* calculated by the author on the basis of indicators of 2019: 1.03 million imports of gasoline (Consulting “A-95”); average world gasoline prices $ 0.91 / liter (IEA); the average NBU exchange rate is 25.8455 UAH / USD; the share of bioethanol is 5%.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations