What happened to the budget in May? Which tax plan failed to meet its target again and why? What risks could affect the regularity of international support? What changes in budget legislation can be expected and how might it impact the budget system? For these and other details on budget execution, read the Budget Barometer for May 2023.

What was achieved?

- In May, the revenue plan of the general fund was exceeded by 10.4%. Overall, the revenue of the general fund amounted to UAH 184.0 billion (UAH 21.2 billion more than in April). Excluding international assistance, the revenue amounted to UAH 138.3 billion (planned UAH 125.3 billion).

- The Ministry of Finance of Ukraine achieved the revenue targets of the general fund of the state budget through both the State Tax Service and the State Customs Service. The State Tax Service exceeded the plan by 9.1% (UAH +8.4 billion), while the State Customs Service exceeded it by 0.2% (UAH +73 million).

- Ukraine successfully passed the first review of the four-year IMF program. This will allow the country to receive the second tranche (USD 900 million) after the approval of the agreement and continue to avoid monetary emissions.

What wasn’t achieved?

- In May, once again, the planned targets for revenue from rent payments for the use of subsoil resources were not achieved (almost half of the projected amount). This is likely due to a greater decrease in global natural gas prices than anticipated in the budget. However, lower gas prices also mean reduced compensation for Naftogaz, which supplies gas to consumers at a price lower than the market price.

What’s next?

- The EU has extended the duty-free trade regime with Ukraine for another year, which will support Ukrainian exporting companies.

- The government has initiated further changes to the Budget Code, necessary for improving the state of public finances and as outlined in the IMF program. The proposed changes include:

- The proposed amendments to the Budget Law, submitted to the parliament by any initiator, should receive the expert endorsement of the Ministry of Finance prior to the voting in the chamber.

- The usual requirements for making changes to the state budget procedure are reinstated, with special simplified requirements only remaining for changes related to the security and defense sectors.

- Medium-term budget planning (preparation of the Budget Declaration) is reintroduced from 2024, which is a crucial component of state finance reform.

- Requirements regarding the volume of government debt are suspended (the rule of not exceeding 60% of GDP is suspended for 2023).

- The fiscal rule concerning the maximum volume of state guarantees has been updated: they cannot exceed 3% of the planned revenue of the general fund, except for those provided based on international agreements (the “usual” rule of a maximum of 3% of general fund revenue was suspended for 2021-2022).

Key risks:

- Non-compliance with conditions affecting the volume of international assistance could result in a loss of predictability in financial support from international partners. Funding from the EU will no longer be unconditional but will depend on the fulfillment of obligations outlined in the memorandum, which include reforms in the areas of justice, energy, effective governance, and macrofinancial stability (low risk).

- Failure to meet the structural benchmarks outlined in the agreements with the IMF relates to the first reading approval of a draft law amending the Tax Code of Ukraine and other Ukrainian laws regarding taxation during the period of martial law to restore the pre-war tax system, which was scheduled to take effect from July 1 (low risk).

Details:

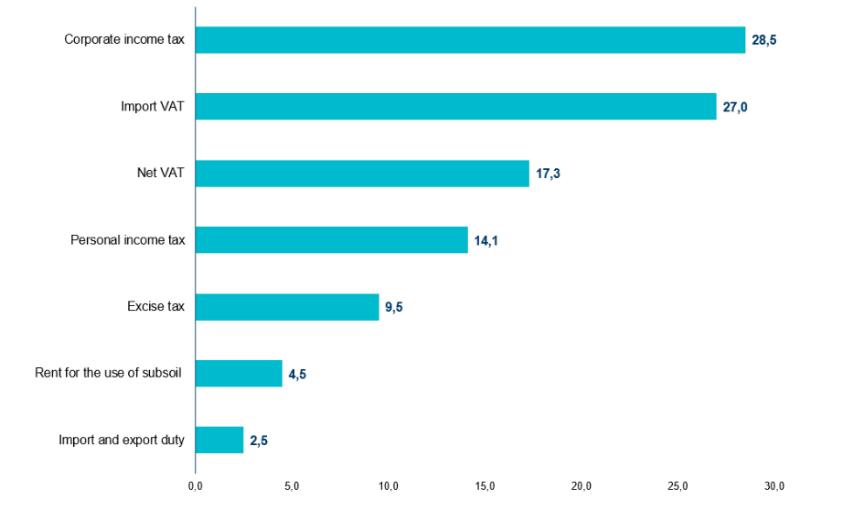

(1) In May, the general fund of the state budget received UAH 184.0 billion (planned UAH 125.3 billion) including international assistance and dividends from PJSC “PrivatBank” (the last amounted to UAH 24.2 billion). The grant amount from the United States in May was the same as in April, totaling UAH 45.7 billion. According to the Ministry of Finance’s plan, tax revenues to the general fund of the state budget were expected to reach UAH 97.4 billion. However, in fact, the general fund was replenished with UAH 103.4 billion from main taxes (Fig. 1).

Figure 1. Main tax revenues to the general fund of the state budget in May 2023, UAH billion

Source: Ministry of Finance of Ukraine.

In May, revenues from most of the budget-forming taxes were exceeded, except for rent payments. The excise tax showed the highest overperformance at 23.4% (reaching UAH 9.5 billion), which could be attributed to some taxpayers paying off their obligations in advance and increased market control over tobacco product legalization. Additionally, it is expected that the revenue from excise taxes and special funds will also exceed the plan due to the collection of previously unpaid taxes by former owners of PJSC “Ukrnafta” and PJSC “Ukrtransnafta” (UAH 1.2 billion).

Furthermore, there was a 19.0% overperformance in revenue from taxes on international trade (primarily import duties), amounting to UAH 2.5 billion. This may be attributed to a higher-than-expected volume of imports, although the import volume was lower than in April.

Personal income tax (PIT) revenues exceeded the plan by 13.8%, reaching UAH 17.5 billion. Besides the traditional military reasons, this can be explained by the completion of the annual income declaration campaign, with some individuals fulfilling their tax obligations (tax obligations for PIT and military fee from citizens are estimated at UAH 2.7 billion, with a final payment deadline of August 1st).

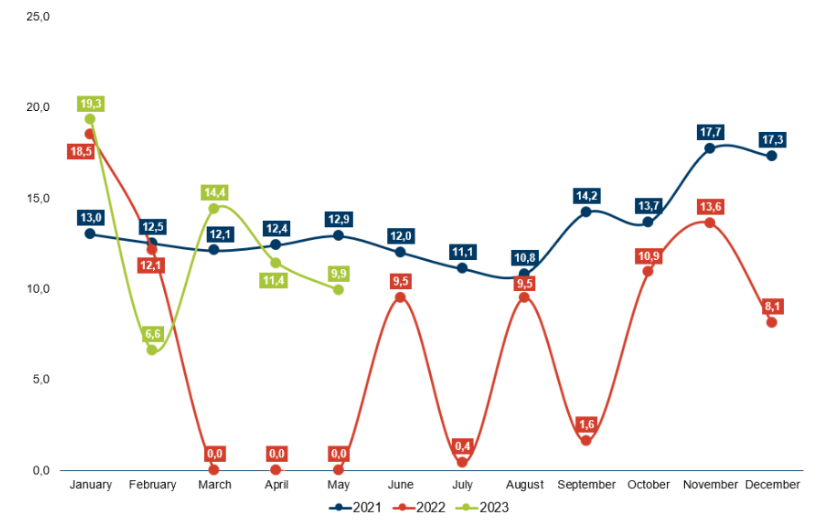

The planned indicators for value-added tax (VAT) revenues were achieved in May. Specifically, import VAT amounted to UAH 27.0 billion , nearly meeting the planned amount of UAH 27.1 billion. Moreover, revenues from VAT net significantly exceeded the planned targets, reaching UAH 17.3 billion compared to the expected UAH 14.8 billion (+16.9%). VAT refunds in May amounted to UAH 9.9 billion, which is UAH 1.5 billion less than the previous month (Figure 2).

Figure 2. VAT refunds in 2021-2023, UAH billion

Source: Ministry of Finance of Ukraine

Revenues from rent payments amounted to only UAH 4.5 billion (according to the estimate, it was expected to be UAH 8.3 billion, which means a deviation of 45.8%). For comparison, a total of UAH 25.4 billion was received to the state budget from rent payments for the use of subsoil in January-May 2023.

(2) On April 28, 2023, the government issued an order approving PrivatBank’s annual report and providing for the allocation of UAH 24.2 billion for dividend payments to the state budget. The bank transferred this amount to the general fund of the state budget in May (the total profit exceeded UAH 30 billion).

(3) The expenditures from the general fund of the state budget in May amounted to UAH 277.7 billion or 98.2% of the planned amount for the reporting period. Expenditures were planned at the level of UAH 282.7 billion, and the largest amount was the financing of programs of the Ministry of Defense of Ukraine (UAH 108.7 billion), of which 47.5% was for labor costs (UAH 51.6 billion). In addition, a record UAH 50.6 billion was planned for servicing the state debt, of which UAH 44.9 billion was for servicing the domestic state debt. The Ministry of Social Policy programs were planned to receive UAH 39.6 billion (of which UAH 22.7 billion or 57.3% was allocated to the Pension Fund of Ukraine). The Ministry of Health programs were allocated UAH 13.7 billion, of which UAH 12 billion, or 87.6%, was intended for the state guarantees program of medical services. In total, according to the planned indicators, over 50% of all expenditures from the general fund of the state budget were intended for the defense and security sector in May, 14.3% for the Ministry of Social Policy programs, and an additional 18.3% for servicing the state debt.

(4) The actual deficit of the state budget in May amounted to UAH 88.3 billion, and a total of UAH 341.2 billion for the first five months of 2023. The deficit of the general fund in May was UAH 91.6 billion, which is 1.7 times less than the planned indicator of UAH 155.7 billion. In January-May, the general fund of the state budget was executed with a deficit of UAH 401.9 billion, which is 1.8 times less than the planned amount of UAH 713.9 billion. The lower deficit of the state budget in May compared to the planned indicator was achieved, partly, by attracting funds in the form of grants – USD 1.25 billion or UAH 45.8 billion, which accounted for 24.9% of the general fund’s revenues in May.

(5) In May, the state budget received UAH 73.4 billion (equivalent to $2 billion) of financial assistance in the form of concessional loans. In particular, more than USD 300 million in equivalent (UAH 12.4 billion) came from the World Bank, and EUR 1.5 billion (UAH 61 billion) from the European Union.

(6) In addition to external financing, in May, the Ministry of Finance raised UAH 68.6 billion from the placement of domestic government bonds, of which UAH 22 billion or 32.1% were benchmark bonds. The maximum interest rate in May was 19.75%, compared to 19.6% in April. In May, 39.3 billion was also raised from foreign currency-denominated bonds, which accounted for 57.3% of the total amount raised from bond sales. Overall, UAH 30.4 billion more was raised from domestic government bonds in May than in April, and UAH 16.4 billion more than the payments for servicing and repayment of bonds, which amounted to UAH 52.2 billion.

(7) The total borrowing in May amounted to UAH 142 billion, which is UAH 41.2 billion more than the expenses for servicing and repayment of debt (in April, this excess was UAH 133.4 billion). The servicing of domestic government debt amounted to UAH 38.9 billion, and external debt was UAH 6.8 billion. UAH 52.5 billion was allocated for the repayment of domestic government bonds, and UAH 2.6 billion for external debt. The low expenses for external debt are due to Ukraine’s agreement to freeze payments on many external obligations, including payments for eurobonds.

(8) In May 2023, revenues of local budgets from sources administered by the State Fiscal Service amounted to UAH 39.3 billion (+19.2% compared to May 2022). This is mainly due to significant overperformance of revenue plans in relatively safe regions of the country (for example, local budgets of Lviv region exceeded the plan by 15% in January-May of this year, receiving an additional UAH 1.8 billion). The main factors are the revenue from personal income tax withheld from military personnel, as well as the collection of minimum tax liabilities and personal income tax from specialists-residents of Diia City.

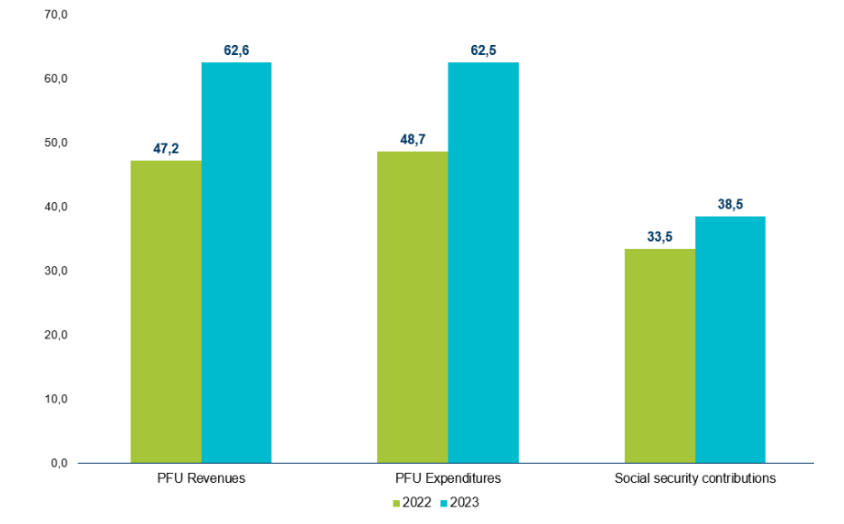

(9) The total revenues from the social security contributions (SSC) in May 2023 increased by 14.9% or UAH 5 billion compared to the corresponding period in 2022, amounting to UAH 38.5 billion (Figure 3). The growth is associated with higher contributions paid for military personnel due to an increase in their number and a higher minimum wage in May 2023 compared to May 2022. The minimum wage is UAH 6,700 compared to UAH 6,500 in 2022.

(10) In May 2023, the revenues of the Pension Fund increased by 32.6% compared to the same period last year, amounting to UAH 62.6 billion, both due to increased own revenues from the SSC and new powers of the Fund in providing housing and communal subsidies and assistance within the social insurance framework. The Pension Fund received UAH 2.6 billion from the state budget for the payment of subsidies and benefits for housing and communal services, and UAH 2.4 billion from SSC revenues for social insurance payments. The state budget allocated UAH 20.4 billion to the Fund for financing pension and other related payments in May 2023, which is 40.7% more than last year. In May, the Pension Fund allocated UAH 57 billion for pension payments, which is 17% more than in the same period last year (Figure 3).

Figure 3. Revenues and expenditures of the Pension Fund of Ukraine and the SSC in May 2022-2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Table 1. Plan and fact of the state budget (general fund) in 2023, UAH billion

| Indicators | January | February | March | April | May | |||||

| Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | |

| Revenue, including | 69,6 | 104,4 | 77,0 | 132,2 | 101,8 | 152,2 | 112,4 | 162,8 | 125,3 | 184,0 |

| Personal income tax | 10,6 | 11,3 | 11,6 | 13,0 | 11,9 | 13,3 | 11,8 | 13,4 | 12,0 | 14,1 |

| Corporate income tax | 1,4 | 1,2 | 4,1 | 7,4 | 22,1 | 26,2 | 1,5 | 2,3 | 24,7 | 28,5 |

| Rent for the use of subsoil | 5,2 | 5,6 | 7,0 | 2,7 | 6,7 | 7,7 | 7,1 | 4,9 | 8,3 | 4,5 |

| Excise tax | 4,7 | 5,3 | 6,1 | 7,0 | 7,1 | 9,8 | 7,4 | 9,9 | 7,7 | 9,5 |

| Net VAT | 20,0 | 11,8 | 14,8 | 15,1 | 16,7 | 10,0 | 16,1 | 16,6 | 14,8 | 17,3 |

| Import VAT | 22,6 | 24,4 | 26,8 | 27,1 | 31,0 | 29,3 | 27,1 | 25,1 | 27,1 | 27,0 |

| Import and export duty | 1,7 | 2,0 | 2,2 | 2,3 | 2,4 | 2,7 | 2,0 | 2,2 | 2,1 | 2,5 |

| Expenditures | 227,7 | 183,6 | 245,6 | 226,7 | 246,1 | 225,2 | 220,2 | 229,7 | 282,7 | 277,7 |

| Deficit (-) / surplus (+)* | -158,6 | -78,9 | -168,0 | -93,2 | -144,6 | -72,6 | -106,6 | -65,6 | -155,7 | -91,6 |

| Sources of deficit financing | ||||||||||

| Net borrowings | 279,4 | 147,3 | 55,6 | 31,8 | 37,8 | 127,8 | 195,1 | 147,3 | 67,9 | 86,9 |

| Loans | 292,5 | 160,1 | 93,3 | 66,7 | 96,3 | 176,8 | 233,2 | 193,3 | 125,0 | 142,0 |

| Repayments | -13,1 | -12,8 | -37,7 | -34,9 | -58,5 | -49,0 | -38,1 | -46,0 | -57,1 | -55,1 |

* The size of the deficit is not equal to the arithmetic difference between revenues and expenditures since the size of the deficit is additionally affected by the volume of loans from the state budget and their repayment

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 2. Main indicators of budget financing, UAH billion

| Indicators | January | February | March | April | May | Cumulative (Jan-May) | |

| Financing, including | 160,1 | 66,7 | 176,8 | 193,3 | 142,0 | 738,9 | |

| in % to the plan (for the entire period) | 54,7 | 71,5 | 183,5 | 82,9 | 113,6 | 87,9 | |

| From the placement of domestic government bonds (total), including | 41,4 | 42,6 | 53,7 | 34,0 | 68,6 | 240,3 | |

| in UAH | 38,8 | 30,5 | 36,3 | 25,1 | 29,3 | 160 | |

| in foreign currency in UAH billion (USD million + EUR million) | ₴2,6

($40,2+€29,4) |

₴12,1

($268,5+€57,5) |

₴17,4

($476,4) |

₴8,9

($242,6) |

39,3

($616,4+€418) |

₴80,3

($1644,1+€504,9) |

|

| From external sources | 118,7 | 24,1 | 123,1 | 159,3 | 73,4 | 498,6 | |

| Public debt repayments | 12,8 | 34,9 | 49,0 | 46,0 | 55,1 | 197,8 | |

| In % to the plan for the full period | 97,7 | 92,6 | 83,8 | 120,7 | 96,5 | 96,7 | |

| Debt service payments | 0,6 | 12,0 | 11,6 | 13,9 | 45,7 | 83,8 | |

| In % to the plan for the full period | 28,6 | 114,3 | 78,4 | 101,5 | 90,3 | 91,4 | |

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 3. External financial resources* attracted in January-May

| Resources | Amount, UAH billion

(EUR million; USD million; CAD million) |

| Macro-Financial Assistance in accordance with the Memorandum of Understanding between Ukraine and the EU | ₴297,1

(€7500) |

| Loans from the Government of Canada | 64,2

(CA$2400) |

| IMF funds under the four-year Extended Fund Facility program | ₴99

($2700) |

| Loan from the IBRD within the framework of the Fourth additional financing of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴18,3

($499,3) |

| IDA loans within the framework of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴13,6

(€341,3) |

| Loan from the IBRD within the project “Strengthening the Healthcare System and Saving Lives” | ₴1,3

(€33,4) |

| Loan from the IBRD within the project “Accelerating Investments in Ukraine’s Agriculture” | ₴4,8

($132) |

| Loan from the IBRD within the project “Additional Financing for the Health System Improvement Project” | ₴0,2

($6) |

*excluding grants

Source: Ministry of Finance of Ukraine

Table 4. Monthly dynamics of state budget financing

| Indicators | January | February | March | April | May |

| Total borrowing, UAH billion | 160,1 | 66,7 | 176,8 | 193,3 | 142,0 |

| Total borrowed, % for January-May | 26,8 | 11,2 | 29,6 | 32,4 | 19,2 |

| From the placement of domestic government bonds, % for January-May | 24,1 | 24,8 | 31,3 | 19,8 | 28,5 |

| Borrowed from external sources, % for January-May | 27,9 | 5,7 | 29,0 | 37,5 | 14,7 |

| Debt repayment payments, % for January-May | 9,0 | 24,5 | 34,4 | 32,2 | 27,9 |

| Servicing payments, % for January-May | 1,6 | 31,5 | 30,5 | 36,5 | 54,5 |

| Difference between borrowed financial resources and expenses for debt repayment and servicing, UAH billion | 146,7 | 19,8 | 116,1 | 133,4 | 41,2 |

Source: Ministry of Finance of Ukraine, Center`s calculations

Attention

Автори не є співробітниками, не консультують, не володіють акціями та не отримують фінансування від жодної компанії чи організації, яка б мала користь від цієї статті, а також жодним чином з ними не пов’язаний