Key findings

- The government has prepared the medium-term Budget Declaration only for the second time, although it should have been doing so since 2019, according to the Budget Code. The first Declaration was adopted in 2021, while in other years, political reasons, the COVID-19 pandemic, and the onset of full-scale invasion hindered the implementation of medium-term budget planning norms. However, in response to challenges and obligations to international partners this year, Ukraine has resumed medium-term budget planning. This restoration is an important step in strengthening financial discipline and enhancing predictability in state policy.

- Indicators of the Budget Declaration are based on a macro-forecast, according to which nominal GDP will increase from UAH 8.4 trillion in 2025 to UAH 11.8 trillion in 2027, with real GDP growth at 2.7% in 2025, 7.5% in 2026, and 6.2% in 2027. The trade balance will remain negative, although its size will significantly decrease by 2027, and expected inflation will be 9.7% in 2025 and 8.6% in 2027 (on average over the previous year), which exceeds the NBU’s target range of 5% ± 1%.

- Forecasted macroeconomic and social indicators for 2025–2027 are calculated under conditions of maximum uncertainty, driven by constant changes in both external and internal influencing factors. Uncertainty regarding the further development of the security situation, international financial assistance, dynamics of migration processes, and other external factors allows for the realization of various economic development scenarios. Due to the high variability of the socio-economic situation, these forecasts may be adjusted either upwards or downwards.

- The key factor – the duration of active combat operations – is anticipated to last at least throughout 2025. The need for expenditures related to war will remain high throughout the entire three-year period, as indicated by forecasted levels of defense spending, reduction of non-military expenditures, and other indirect indicators, such as the maintenance of allocations from military personnel income tax to the state budget. However, in 2026-2027, defense expenditures are planned to decrease by approximately one-third from the 2025 level, with freed-up funds allocated, in part, to infrastructure projects such as road construction and repair. This creates the impression that the Ministry of Finance retains maneuverability. In the event of continued military action, funds earmarked for roads could easily be redirected to defense needs, as was done this year (reallocating protected social expenditures would be more politically challenging). In the event of the cessation of hostilities, part of the freed-up funds could be directed towards social programs while retaining part to further enhance the country’s defense capabilities.

- Social standards for 2025-2027 will remain at the 2024 level: the subsistence minimum (SM) of UAH 2920 and the minimum wage (MW) of UAH 8000. Due to limited fiscal space, the government fixes the SM and MW to reduce social expenditures currently financed by international aid. Inflationary increases will decrease the purchasing power of the population, worsening the living standards primarily for vulnerable groups, as social benefits and allowances will not increase.

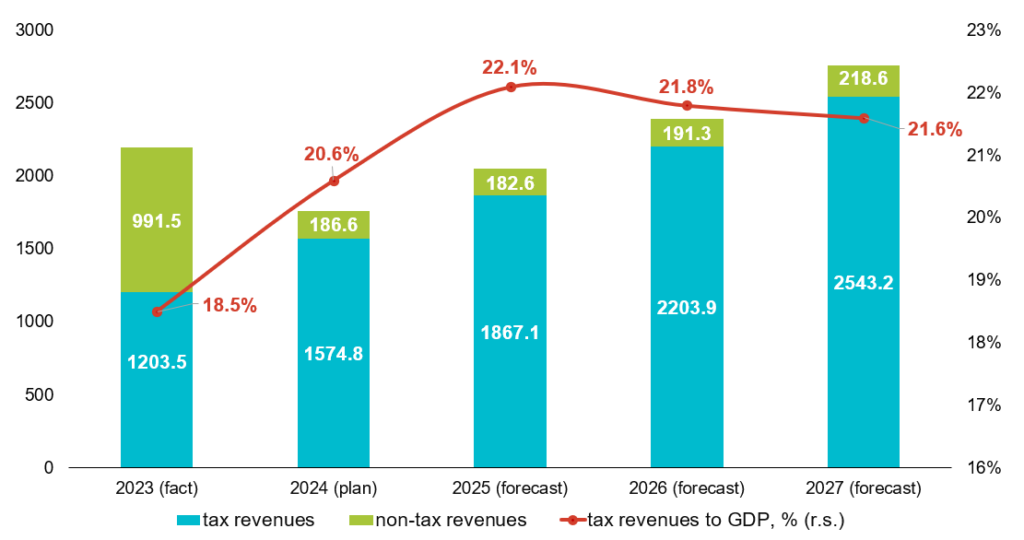

- In 2025-2027, the majority of state budget revenues will come from tax revenues, the share of which in total revenues will increase (77.3% in 2025, 79.9% and 81.2% in 2026 and 2027 respectively). The government does not include a significant amount of non-tax revenues in the forecast, including defense aid receipts (for comparison, in 2023, under the corresponding category “Own revenues of budgetary institutions,” these revenues accounted for 30% of all state budget revenues). This practice was also observed in preparing budgets for 2023 and 2024, as such expenditures are difficult to predict accurately and should not be disclosed in advance for security reasons.

- During 2025–2027, the share of tax revenues in GDP will increase by 3.1 percentage points to 21.6% of GDP by 2027. Starting from 2025, the rates of major taxes (excluding excise) will remain fixed. Therefore, tax revenues will increase on average by 17.3% annually, driven by increases in excise taxes to align with EU Directives, reform of the military levy, continuation of directing military PIT to the state budget, and improved tax administration efficiency as per Ukraine’s National Revenue Strategy until 2030.

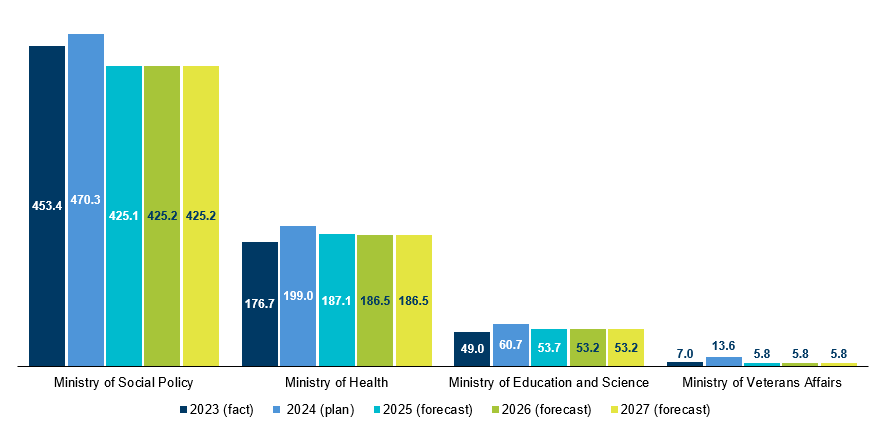

- Funding for other “non-defense” budget funds managers will decrease starting in 2025 and remain at this level throughout 2026-2027. The largest absolute reductions will be seen in the Ministry of Social Policy (UAH -45.2 billion), Ministry of Infrastructure (UAH -16.3 billion), Ministry of Health (UAH -11.9 billion), and Ministry of Economy (UAH -10.5 billion).

- The Declaration does not specify the amount of capital expenditures, as they will only be carried out to implement public investment projects according to a prioritized list approved by the Strategic Investment Council (excluding major spenders in the security and defense sector). It is expected that the reform of the public investment management system will be carried out in accordance with the Roadmap for Reforming the Public Investment Management System. The total resources allocated to finance public investment projects in 2025–2027 will include:

- Receipts from foreign states and organizations (UAH 59 billion in 2025),

- Component II under the Ukraine Facility (EUR 6.97 billion by 2027),

- Funds from the general fund of the state budget (UAH 25 billion annually).

The State Road Fund is also partially restored (planned at UAH 43.8 billion in 2025, UAH 124 billion UAH in 2026, and UAH 233.8 billion in 2027).

- The main fiscal risk will remain the duration and intensity of hostilities in Ukraine. Other risks include a trade blockade on western borders and at sea, a worsening demographic situation and emigration of labor resources abroad, acceleration of inflationary processes, and reduced demand for domestic debt instruments.

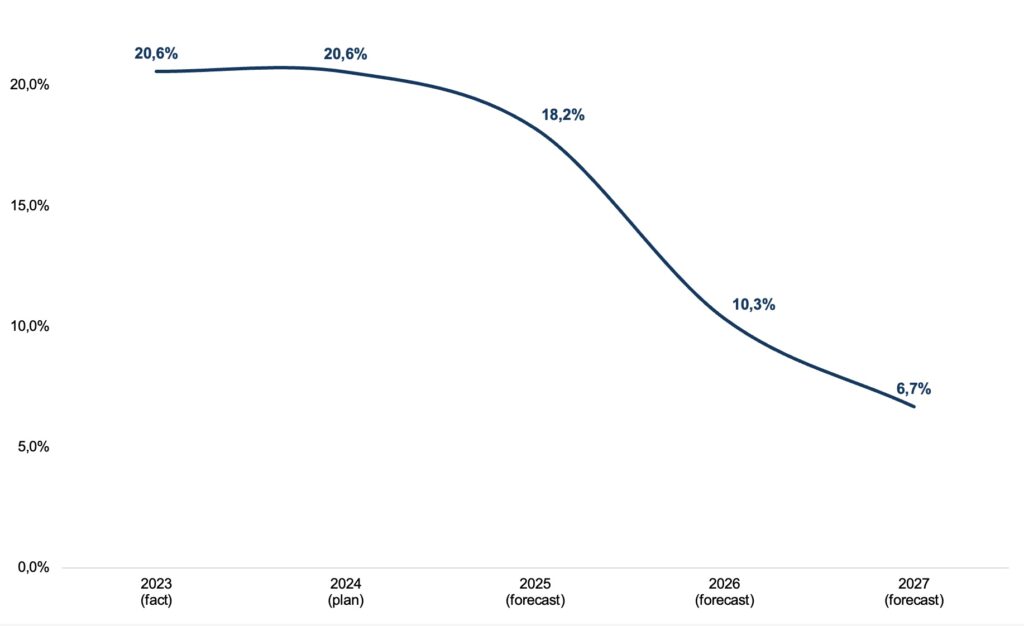

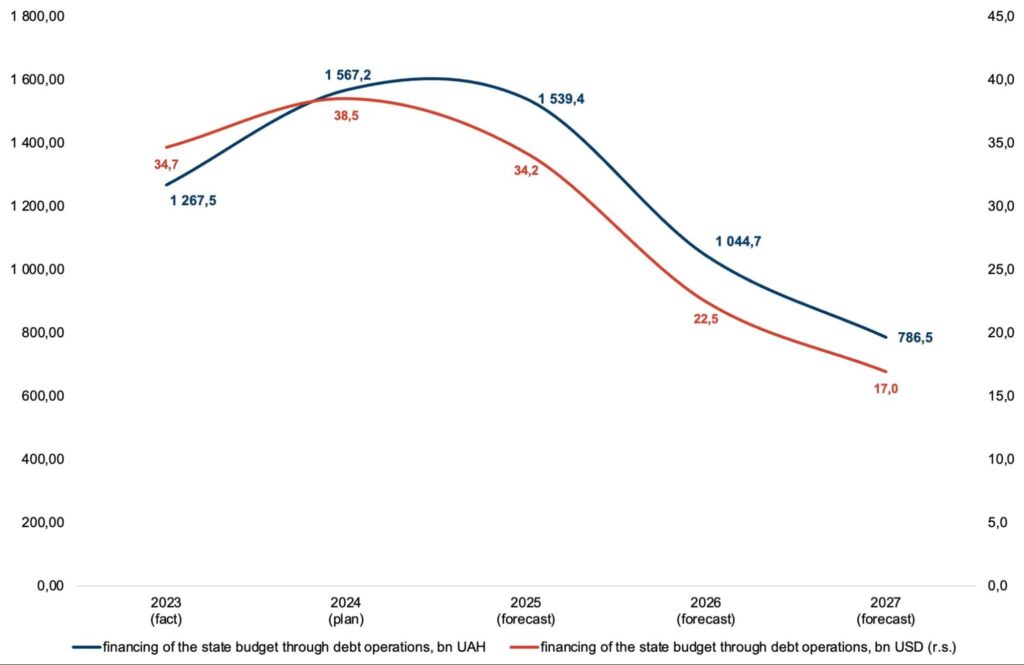

- In 2025-2027, a sharp reduction in the state budget deficit is projected, from an actual 20.6% of GDP in 2023 to 6.7% in 2027 (achieving this will be extremely challenging even in the event of cessation of active hostilities). If the deficit reduction occurs organically through gradual revenue growth and expenditure cuts due to economic recovery, it will positively impact Ukraine’s financial stability. However, the government should avoid “forced” deficit reduction. Nevertheless, the deficit level will still remain above 3% of GDP (a fiscal rule defined by the Budget Code of Ukraine). Accordingly, budget financing through borrowing operations should decrease from UAH 1.3 trillion (equivalent to USD 34.7 billion) in 2023 to UAH 0.8 trillion (equivalent to USD 17.0 billion) in 2027.

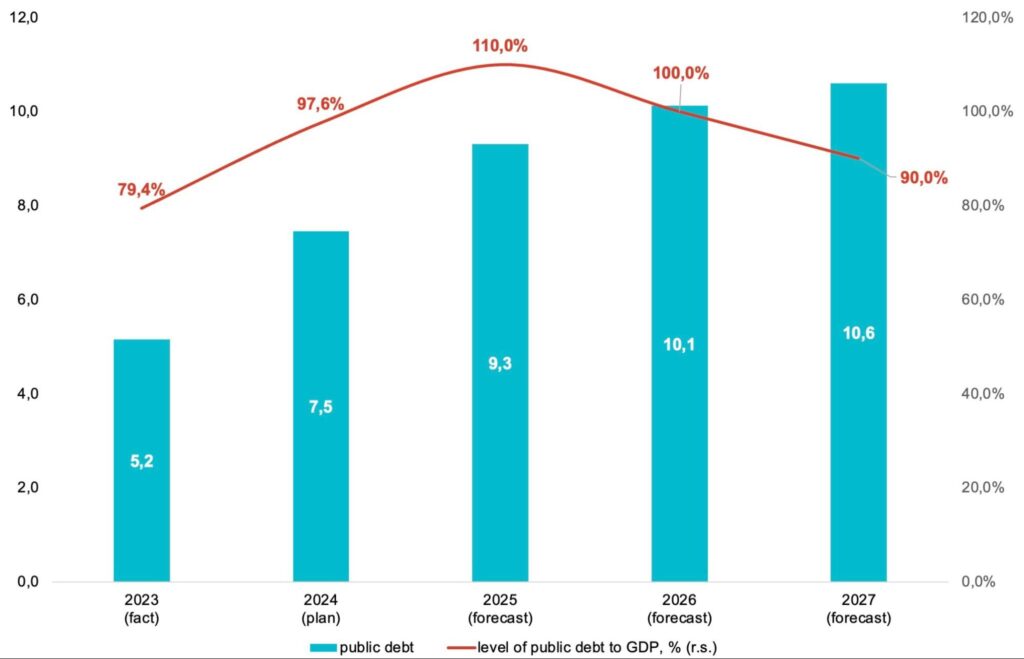

- The main strategic goal of the government’s debt policy will be to reduce the level of state and state-guaranteed debt to 90% of GDP by 2027. The strategic directions for managing the state debt will continue to include cooperation with international partners to attract long-term concessional financing and develop the domestic market for government securities.

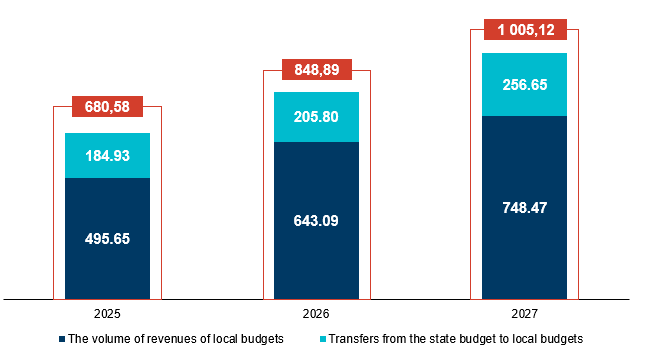

- The total financial resources of local budgets will continue to increase in the coming periods, and in 2027, for the first time, will exceed UAH 1 trillion. Meanwhile, local own-source revenues will grow faster than transfers from the state budget (by 51% and 39%, respectively), indicating the government’s anticipation that the positive effects of decentralization will persist. More details follow.

Main changes in macroeconomic indicators

When preparing the Budget Declaration, the government relied on an updated macroeconomic forecast from the Ministry of Economy (Table 1), which now significantly differs from the estimates of the National Bank of Ukraine and other organizations (being more pessimistic for 2025 and more optimistic for 2026-27). Firstly, nominal GDP is expected to grow from UAH 8.5 trillion in 2025 to UAH 11.8 trillion in 2027. This growth will be driven by increased investment demand (dependent directly on the security situation and support from international partners), which is necessary for the reconstruction of destroyed infrastructure, as well as increased household demand. Real GDP is projected to grow by only 2.7% in 2025 due to the destruction of energy infrastructure. However, growth is expected to accelerate to 7.5% in 2026 and 6.2% in 2027 as security risks decrease, full logistics are established, and a gradual but steady economic recovery takes place.

After a sharp rise of inflation to 26.6% in 2022, its decrease to 5.1% in 2023 had a positive impact on macroeconomic stability. Inflation is expected to average 8.6% in 2025-2027, significantly above the NBU’s target range of 5% ± 1 percentage point. There is a significant risk of inflation increasing due to complex security and migration situations, as well as high uncertainty regarding international aid.

The trade balance is expected to remain negative due to the significant need for imports and limited opportunities for exporting major trade items. However, the government anticipates a drastic reduction in the trade deficit, from USD 40.7 billion in 2025 to USD 21.1 billion in 2027.

The macroeconomic forecast includes the assumption that the average annual exchange rate of hryvnia to the US dollar will slowly devalue from 45 UAH/USD in 2025 to 46.4 UAH/USD in 2027. In 2022, the exchange rate of the hryvnia increased by nearly a third (from UAH 27.3 to 36.6 per USD), and in 2023, it increased by 3.8% (from UAH 36.6 to 38 per USD). By the end of the first half of 2024, under conditions of managed flexibility that the NBU adopted in October 2023, the exchange rate increased by 6.6% (from UAH 38 to 40.5 per USD).

Table 1. Main forecast macroeconomic indicators of economic and social development of Ukraine and certain assumptions for 2025-2027

| Indicator | 2024* | 2025 | 2026 | 2027 | Average value for 2025-2027 |

| GDP, nominal, billion UAH | 7515.4 | 8466.3 | 10123.2 | 11782.8 | 10124.1 |

| GDP, real change, percent, y/y | 3.6 | 2.7 | 7.5 | 6.2 | 5.5 |

| CPI, on average from the previous year, percent, y/y | 107.4 | 109.7 | 109.9 | 108 | 109.2 |

| CPI, December to December of the previous year, percent, y/y | 108.5 | 109.5 | 110.4 | 105.9 | 108.6 |

| Trade balance surplus, determined by the balance of payments methodology, million USD | -32 800 | -40 675 | -27 234 | -21 058 | -29 655,7 |

| Unemployment rate for the population aged 15-70 years according to the International Labor Organization methodology, percentage of the corresponding age group’s labor force | 18.2 | 17.7 | 17.4 | 16.5 | 17.2 |

| Assumptions of the forecast | |||||

| Exchange rate, UAH per USD | |||||

| average for the period | 40.3 | 45 | 46.5 | 46.4 | 46 |

| at the end of the period | 41.7 | 45.6 | 45.9 | 46.2 | 45.9 |

*Consensus forecast data as of April 2024

Source: forecast of the Ministry of Economy of Ukraine

Social standards for 2025-2027 are set at the level of the end of 2024: the total amount of the subsistence minimum will be UAH 2,920, and the minimum wage will be UAH 8,000 (see Table 2). This decision is linked to budgetary savings. However, fixing social standards for three years amid relatively high inflation will reduce the purchasing power and well-being of the most vulnerable population groups. This situation could partially be balanced through the introduction of progressive taxation, as outlined in the National Revenue Strategy until 2030 (despite debates over its fiscal effectiveness, this approach may contribute to a more comprehensive approach to shaping social policies to support the most vulnerable).

Table 2. Living wage size in 2024-2027

| Indicator | Size of the minimum wage, UAH |

| Minimum subsistence level per person | 2 920 |

| For children up to 6 years old | 2 563 |

| For children aged 6 to 18 years | 3 196 |

| For non-disabled individuals | 3 028 |

| For non-disabled individuals, it is used to determine the basic salary for judges, official salaries for employees of other state bodies under special laws, and employees of tax and customs authorities. | 2 102 |

| For non-disabled individuals, it is used to determine the salary of the prosecutor of the district prosecutor’s office. | 1 600 |

| For individuals who have lost their ability to work | 2 361 |

Source: Law on the State Budget of Ukraine for 2024

In 2023, the minimum wage in Ukraine remained unchanged from 2022 levels. This reduced the tax burden on businesses but simultaneously limited the growth of tax revenues and expenditures for the state budget.

A slight decrease in the forecasted unemployment rate by 1.2% to 16.5% in 2025-2027 will have a modest impact on increasing tax revenues and reducing social expenditures from the state budget. The unemployment rate is decreasing slowly and remains critically high. High unemployment in Ukraine is associated with structural unemployment, where the skills of the unemployed do not match employers’ requirements. Therefore, programs that upgrade skills and retrain workers are needed to adapt the labor market to modern conditions and demands. The “Skills Alliance for Ukraine” initiative, launched at the Ukraine Recovery Conference, aims to train and upgrade the qualifications of over 180,000 Ukrainians over the next three years, particularly in sectors such as construction, transportation, IT, engineering, and healthcare.

State budget revenues

From 2025 to 2027, government budget revenues are forecasted to gradually increase in nominal terms from UAH 1.8 trillion in 2024 to UAH 3.1 trillion in 2027 (Table 3). In 2025, revenues are expected to grow by 36.6% compared to 2024 and by 14.2% and 13.6% in 2026 and 2027, respectively.

As in previous years, tax revenues will continue to constitute the main portion of government budget revenues. Their share in total budget revenues is planned to decrease to 77.3% in 2025 from 89% in 2024 but will gradually increase again to 79.9% in 2026 and 81.2% in 2027. For comparison, in 2023, tax revenues accounted for only 45% of all state budget revenues.

Actual tax revenues are expected to significantly increase by 2027 compared to 2023 and 2024. In 2027, it is projected to collect UAH 2.5 billion in tax revenues, a 111.3% increase from the amount accumulated in 2023 and a 61.5% increase from the planned collection in 2024. Starting from 2025, tax revenues are forecasted to grow annually by an average of 17.3%.

Table 3. State budget revenues in 2023-2027, billion UAH

| Indicators | 2023

fact |

2024

plan |

2025

forecast |

2026

forecast |

2027

forecast |

| Revenues | 2672.5 | 1768.5 | 2415 | 2757.1 | 3130.9 |

| Tax revenues | 1203.5 | 1574.8 | 1867.1 | 2203.9 | 2543.2 |

| Non-tax revenues | 991.5 | 186.6 | 182.6 | 191.3 | 218.6 |

| Share of tax revenues in GDP, % | 18.5% | 20.6% | 22.1% | 21.8% | 21.6% |

| Share of tax revenues in state budget revenues, % | 45.0% | 89.0% | 77.3% | 79.9% | 81.2% |

Source: Budget Declaration for 2025-2027

Overall, from 2023 to 2027, there will be an increase in the fiscal role of tax revenues. Taxes contributing to the state budget will constitute around 22% of GDP in 2025-27, compared to 18.5% in 2023 and 20.6% in 2024 (Figure 1).

Figure 1. State budget revenues in 2023-2027, billion UAH

Source: Budget Declaration for 2025-2027

The increase in the share of taxes in state budget revenues is planned to be achieved through the following measures:

- Gradual increase in excise tax rates on tobacco, alcohol products, and fuel to approximate EU levels. For instance, excise rates on tobacco products will rise from EUR 45 per 1000 units (UAH 1,881.17 per 1000 units) in 2024 to EUR 64 per 1000 units in 2027. The minimum tax liability over the same period should increase from approximately EUR 60 per 1000 units (UAH 2,516.54 per 1000 units) to EUR 86 per 1000 units. Excise taxes on gasoline will increase from EUR 213.5 per 1000 liters in 2024 to EUR 329.9 per 1000 liters in 2027, and on diesel from EUR 139.5 per 1000 liters to EUR 291.9 per 1000 liters.

- Continuing the redirection of military PIT from local budgets to the special fund of the state budget.

- Restoring the allocation of 4% of PIT to the state budget, which was temporarily directed to community budgets in 2022-2024.

- Strengthening control over the circulation of alcoholic beverages and tobacco products.

- Introducing an excise tax on beverages with sugar content.

- Reforming the military levy.

In the Budget Declaration, revenue calculations have been made assuming that the rates of the major taxes—VAT, PIT, and corporate income tax—will remain unchanged and set at their current levels: 18%, 20%, and 18% (25% for bank profits), respectively. However, the Declaration also mentions that “for stable and continuous funding of priority needs in the security and defense sector against armed aggression, it is necessary to develop an additional package of measures for 2025-2027 with regard to the priority tasks of tax policy for those years, which would provide the state finances with approximately UAH 340 billion annually.” These measures could potentially include increases in the rates of major taxes, which are not currently reflected in the document.

Additionally, according to the Budget Declaration, the government will continue implementing the provisions of the National Revenue Strategy until 2030 by improving tax administration and abolishing certain tax privileges, including those related to corporate income tax.

Table 4. Measures included in state budget revenues for 2025-2027, billion UAH

| Indicators | 2025 | 2026 | 2027 |

| Restoration of the personal income tax share allocated to the state budget | 11.4 | 15.9 | 18.7 |

| Gradual approximation of excise rates on tobacco products to the level of the EU | 27.5 | 38.9 | 45.0 |

| Gradual approximation of excise rates on fuel to the level of the EU | 58.7 | 105.1 | 153.0 |

| Package of additional measures (requires further development) | 340.0 | 340.0 | 340.0 |

Source: Budget Declaration for 2025-2027

In 2025-2027, it is forecasted to accumulate no more than UAH 218.6 billion in non-tax revenues (see Table 3). One of the sources of non-tax revenues during 2025-2027 will continue to be the profit transferred to the state budget by the National Bank of Ukraine (NBU). In 2024, such funds amounted to UAH 38.6 billion. According to projections, the NBU will transfer UAH 34.4 billion in 2025, UAH 36.3 billion in 2026, and UAH 58.9 billion in 2027 to the state budget. The amounts of profit transferred by the NBU to the state budget in 2025-2027 are based on the regulator’s forecasts used during the preparation of the budget declaration.

The primary fiscal risks that will continue to exert pressure on financial stability in Ukraine during 2025-2027 include:

- Uncertainty regarding the duration and intensity of combat operations in Ukraine.

- Trade blockade by our Western neighbors.

- Maritime situation: blockade of ports and destruction of port infrastructure by the Russian aggressor.

- Complex demographic situation and outflow of labor resources abroad.

- Decrease in agricultural crop yields.

- Acceleration of inflationary processes and reduced demand for domestic debt instruments.

These risks may significantly impact the achievement of fiscal targets outlined in the Budget Declaration and could have an overall negative effect on Ukraine’s socio-economic situation.

Expenditures from the state budget on defense and reconstruction

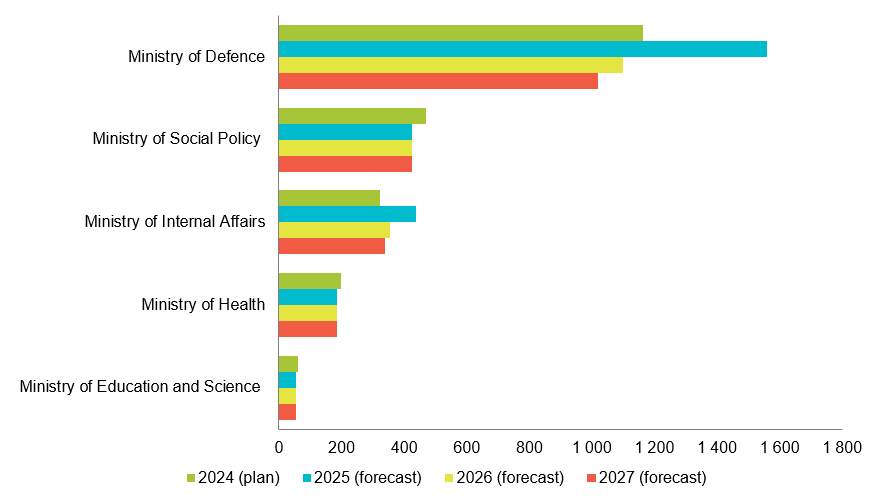

In 2025, total expenditures are set to increase to nearly UAH 4 trillion from the planned UAH 3.3 trillion in 2024, maintaining this level throughout 2026-2027.

Priority sectors include defense and security (50% of all expenditures on average during 2025-2027), general state functions (23.9%), and the social sphere (12.2%).

In 2025, the primary funding focus will remain on the defense and security sector, comprising 57.2% of all expenditures or UAH 2.2 trillion. Specifically, the Ministry of Defense is slated to receive UAH 1.56 trillion in 2025, which is 34% more than currently planned in the 2024 state budget (although spending for this year is likely to be higher). This increase in defense spending is driven by higher-intensity mobilization (60% of the Ministry of Defense funding goes towards military pay) and potentially more active procurement of military equipment and weaponry.

A similar situation is observed in the Ministry of Internal Affairs, part of the security sector, with funding projected at UAH 436.5 billion for 2025 (a 34% increase compared to 2024). This increase is likely due to the expansion of the National Guard personnel and increased procurement of armaments, as well as potentially higher funding for the State Emergency Service due to possible expansions in personnel and specialized equipment purchases.

Overall, an increase in funding in 2025 is observed across most defense structures (see Figure 2).

Figure 2. Top 5 ministries by expenditure volume in 2024-2027, billion UAH

Source: OpenBudget, Budget Declaration for 2025-2027

Funding for major non-defense agencies remains at 2025 levels. However, there are some exceptions. In 2026, the State Reconstruction Agency will receive 64% more funding compared to 2025 — UAH 86.2 billion (in 2025, its funding will also increase by 49% to UAH 52.5 billion), and an additional UAH 68.9 billion in 2027, bringing its total funding to UAH 155.1 billion. This increase may be linked to the gradual restoration of the Road Fund. The Ministry of Infrastructure will also receive increased funding, by UAH 900 million in 2026 and another UAH 1 billion in 2027, raising total funding to UAH 8.4 billion annually.

These changes in 2026-2027 may indicate that the government, while not expecting the war’s end by late 2025, hopes for a reduction in combat intensity and the beginning of reconstruction. At the same time, the government retains maneuverability: if needed, it can swiftly redirect “road” expenditures to defense needs (without international assistance, this would be more challenging with social spending).

Social expenditures in the state budget

During 2025-2027, significant reductions in social sector expenditures are planned in Ukraine. These cuts will affect funding for the social protection system, support for veterans, education, healthcare, youth and sports, as well as culture. The changes reflect economic and demographic challenges exacerbated by war and extensive migration. According to UNHCR data, as of June 2024, the total number of Ukrainian refugees worldwide is rising and stands at 6.6 million. In the EU alone, 1.06 million new decisions on granting temporary protection were registered in 2023, and 197,000 in the first quarter of 2024. Migration from Ukraine will likely continue due to security risks and potential energy crises in winter.

The government will focus on optimizing and increasing spending efficiency by enhancing the targeting of social support and reforming the social protection and benefits system. These measures are expected to lead to a more targeted use of resources and provide support to those who need it most.

The government plans to reduce social spending by 9.6% or UAH 45.2 billion in 2025 compared to 2024, amounting to UAH 425 billion. Social spending is expected to remain at this level in 2026-2027. The irrelevance of social standards and the complexity of their financing necessitate a review of approaches to providing social assistance, focusing on increased targeting and meeting the needs of vulnerable groups through social services.

The activity of the Pension Fund of Ukraine (PFU) will continue to depend on transfers from the state budget, but the government plans to decrease the volume of these transfers. Measures to increase the revenue side of the PFU and social insurance budget are intended to be expanded. This could involve broadening the tax base, combating contribution evasion, promoting voluntary insurance, optimizing administration, and securing additional funding sources. Additionally, pension reform is anticipated.

Fixing the subsistence minimum (SM) will restrain increases in expenditures on pensions and social payments funded by the state budget. The minimum pension will remain at UAH 2,361 (1 SM for disabled persons), while the maximum will be UAH 23,610 (10 SM). Annual pension indexation from March 1 is planned, but increases will be within the maximum level, thereby limiting growth in pension expenditures. Failure to index pensions will increase economic vulnerability for pensioners due to inflation and rising prices. The projected decrease in the number of pensioners from 10.5 million to 10.3 million people in 2025-2027 will not lead to a significant reduction in PFU spending.

Figure 3. Social expenditures in 2023-2027 by main budget funds managers, billion UAH

Source: Budget Declaration for 2025-2027

In 2025, the number of service members receiving financial assistance after discharge from military conscription will decrease tenfold (from 9,074 to 890 individuals). These payments will no longer be provided from 2026, as there are plans to change approaches to supporting veterans.

Expenditures for the Ministry of Veterans Affairs (including general state funding and loans) will decrease by 57.5% in 2025, amounting to UAH 5.8 billion (a reduction of UAH 7.8 billion compared to 2024). In 2026-2027, spending will remain at the 2025 level. The significant decrease in expenditure is largely due to the absence of compensation for housing purchases. A new state veteran policy will be formulated to transition from preferential living provisions to promoting self-realization in civilian life for veterans and those affected by the Revolution of Dignity and their families. Key objectives for 2025-2027 include comprehensive rehabilitation, employment support, development of sports for veterans, and honoring the memory of fallen Defenders of Ukraine.

In 2025, the Ministry of Health (MOH) will receive 6% less funding, amounting to UAH 187.1 billion (a reduction of UAH 11.9 billion compared to 2024). This expenditure level will be maintained at UAH 186.5 billion in 2026-2027.

Efforts of the MOH during 2025-2027 will focus on adapting medical services to new challenges, ensuring access to healthcare for civilians and military personnel, and developing rehabilitation services and prosthetics. Plans include establishing a unified healthcare space (i.e., funding all medical institutions through the National Health Service of Ukraine), fully financing the medical guarantees program, increasing medication availability, improving the quality of medical services, responding to infectious diseases, promoting motherhood and parenthood, centralized procurement of medical products, developing public health systems, and digitalizing healthcare for efficient management and transparent use of funds.

In 2025, spending on education and science will decrease by 11.5%, totaling UAH 53.7 billion (a reduction of UAH 7 billion compared to 2024). This expenditure will further decrease by 1% in 2026-2027 to UAH 53.2 billion. The planned reduction in education spending is linked to a decline in the number of children and youth (according to Eurostat data, as of April 30, 2024, approximately 1.4 million children from Ukraine had temporary protection status in EU countries).

In 2025, expenditures of Ukraine’s Ministry of Culture and Information Policy will decrease by 11.7%, amounting to UAH 9.5 billion (a reduction of 1.3 billion UAH compared to 2024). They will remain at UAH 9.4 billion in 2026-2027. The main goals of cultural institutions will include creating high-quality Ukrainian-language products and promoting Ukrainian culture worldwide. During 2025-2027, there are plans to preserve cultural heritage, support the Ukrainian language, develop professional arts, integrate Ukrainian culture into the global arena, and combat disinformation.

Gender Equality and Social Inclusion (GESI) context in the forecasted expenditures of the state budget

In the context of promoting gender equality and social inclusion, the Budget Declaration pays special attention to reviewing expenditures in social protection, education, and healthcare sectors. These areas are crucial due to the representation of women and vulnerable population groups. The government proposes optimizing spending in these areas by focusing on greater targeting and personalized approaches.

According to the Strategy for Reforming the Public Finance Management System for 2022-2025, the main budget funds administrators at the national and local levels are increasingly integrating gender approaches into the budgetary process. However, gender inequality remains noticeable both in income distribution and in social welfare measures.

The budget declaration includes continuing policies supporting socially vulnerable population groups, such as internally displaced persons, through the implementation of various programs.

State social policy will focus on targeted support for citizens, considering the individual needs and interests of different groups of people (women and men, vulnerable population groups, rural populations). Plans are also in place to improve the mechanism for delivering social services to better meet the needs of people with disabilities and other vulnerable populations.

An important aspect of state policy regarding veterans is the shift from preferential living benefits to a system that motivates and supports veterans’ self-realization (employment/self-employment through grants and professional adaptation measures). This approach aims to provide opportunities for self-development, social inclusion, and realization for both male and female veterans.

State policy in the sphere of national security and defense includes directly integrating a gender approach in the recruitment of the Armed Forces and other defense components on a contractual basis. This ensures equal rights and opportunities for women and men during military service.

Expanding the network of preschool educational institutions according to community needs, including the introduction of new forms of organizing preschool education as outlined in the Budget Declaration, will have a positive impact on increasing women’s employment. This initiative will help alleviate the workforce shortage because childcare for preschool-aged children and the lack of alternatives for such care is a leading cause of female unemployment.

State policy in the field of education will focus on providing educational services to veterans and individuals from temporarily occupied territories of Ukraine and on building a safe and inclusive education system. This includes maximizing the proximity of educational services to students with special educational needs to their place of residence, taking into account their individual needs and capabilities.

The Budget Declaration includes plans for active digitalization of processes in the social protection, healthcare, and education sectors. This will help vulnerable populations access essential services, including internally displaced persons and refugees. To achieve this goal, the Declaration includes provisions for the development and access to high-speed internet and affordable education in digital literacy. This is particularly relevant for vulnerable populations and people living in rural areas, who may greatly benefit from increased digital access and skills.

Funding the state budget deficit

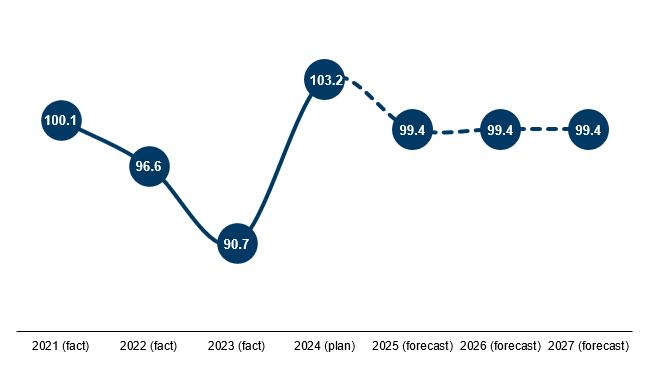

For the years 2025-2027, a gradual reduction of the state budget deficit is forecasted through increased revenues and cuts in certain expenditures. The deficit is projected as follows: UAH 1.5 trillion (18.2% of GDP) in 2025, UAH 1.0 trillion (10.3% of GDP) in 2026, and UAH 0.8 trillion (6.7% of GDP) in 2027. By comparison, the actual deficit in 2023 was UAH 1.3 trillion (20.6% of GDP), and for 2024, it is planned to be nearly UAH 1.6 trillion, which equates to 20.6% of GDP. Reducing the state budget deficit will positively impact Ukraine’s financial stability, though it will still be far from the maximum allowable 3% of GDP stipulated by the Budget Code.

Figure 4. State budget deficit as a percentage of GDP in 2023-2027

Source: Budget Declaration for 2025-2027

The deficit (expressed in US dollars) will also significantly decrease from the planned USD 38.6 billion in 2024 to USD 17 billion in 2027. This reflects a strategic goal to reduce dependence on external borrowing and enhance Ukraine’s own financial capacity.

Against the backdrop of reduced state budget deficits and external financing volumes, the government plans to shift focus toward domestic borrowing. The government will aim to maximize receipts from domestic government bonds from 2025 to 2027. However, the government also expects timely inflows from external sources, ensuring sufficient state budget funding over the next three years.

Figure 5. Financing of the state budget through debt operations

Source: Budget Declaration for 2025-2027

Debt policy

Key strategic directions in managing the state debt in 2025-2027 will continue to include close cooperation with international partners to secure long-term concessional financing, domestic market development for government securities, and efforts to secure funding at the lowest cost. Therefore, it can be forecasted that during 2025-2027, external borrowing will mainly be sourced from donors under existing programs: IMF (Extended Fund Facility), World Bank, EU (Ukraine Facility), USA, and others.

A primary focus of the debt management policy in 2025-2027 will be reducing the debt-to-GDP ratio. After reaching 110% in 2025, the ratio is expected to begin declining in 2026 (Figure 6).

Figure 6. State and guaranteed state debt, trillion UAH

Source: Budget Declaration for 2025-2027

If the state and guaranteed debt reaches 90% of GDP in 2027, in absolute terms, it will amount to UAH 10.6 trillion or USD 228.5 billion. For comparison, at the end of 2023, the size of the state and guaranteed debt was UAH 5.5 trillion (USD 145.3 billion); by the end of May 2024, it was UAH 6.1 trillion (USD 151.0 billion). Essentially, over the next three years, the debt will increase by UAH 4.5 trillion.

Relations with local budgets

The total financial resources of local budgets are expected to continue growing in the coming periods. In 2027, they will exceed one trillion hryvnias for the first time. At the same time, local own-source revenues will increase faster than transfers from the state budget (by 51% and 39%, respectively). This indicates the government’s expectation that the positive effects of decentralization will continue, particularly in terms of increased revenues from PIT and local taxes and fees.

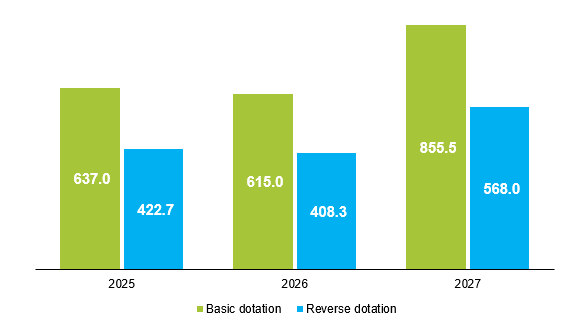

Figure 7. Financial resources of local budgets in 2025-2027, billion UAH

Source: Budget Declaration for 2025-2027

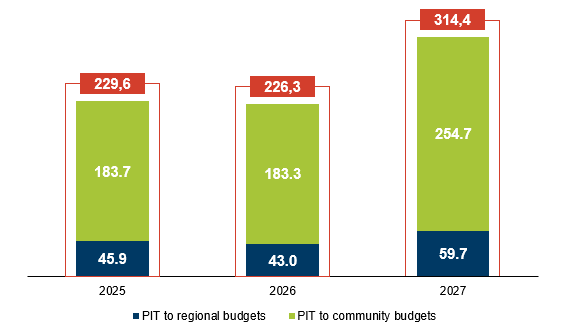

The primary source of revenue for local budgets will remain a portion of the personal income tax (UAH 183.7 billion in 2025, UAH 183.3 billion in 2026, and UAH 254.7 billion in 2027). Over the next three years, it is planned to continue directing funds from the “military PIT” to the special fund of the state budget instead of local budgets, as was the case until the fourth quarter of 2023. Additionally, there are no plans to extend the provision directing an additional 4% of PIT to community budgets, which was in effect from 2022 to 2024. This latter decision is expected to lead to losses for local budgets, amounting to UAH 11.4 billion in 2025 and increasing to UAH 18.7 billion in 2027.

Figure 8. Forecast of PIT revenues to local budgets for 2025-2027, billion UAH

Source: Budget Declaration for 2025-2027

Horizontal equalization of tax capacity will continue under the current rules. However, unlike the current year, the reverse subsidy from local budgets to the state budget will be restored (UAH 19 billion in 2025-2026 and UAH 26.4 billion in 2027).

Figure 9. Indicators of horizontal fiscal equalization in 2025-2027, billion UAH

Source: Budget Declaration for 2025-2027

The largest transfer, the educational subsidy, is expected to total UAH 99.4 billion annually, which is 3.6% less than planned for the current year, 2024. The government attributes this reduction to a decrease in the number of students and their internal and external migration. It is anticipated that communities will continue optimizing the school network, or if they avoid these unpopular decisions, they will need to finance schools using their own budgets. Consequently, there are plans to cease providing the educational subsidy to schools with fewer than 45 students starting September 1, 2025, and those with fewer than 60 students starting September 1, 2026.

Figure 10. Amounts of educational subsidies in 2021-2027, billion UAH

Source: OpenBudget, Budget Declaration for 2025-2027

The government also intends to maintain the second-largest transfer — an additional subsidy for carrying out the powers of local self-government bodies in liberated, temporarily occupied, and other territories affected by Russia’s full-scale armed aggression — at the level of UAH 33.4 billion annually, consistent with the amount allocated in 2024. The funds will provide flexible support to communities that have endured adverse effects from military aggression, including losses in local budget revenues.

Considering martial law in Ukraine, initiated after Russia’s full-scale invasion, and the medium-term budgetary constraints, the Budget Declaration does not provide funding for the State Regional Development Fund.

Conclusions

Implementing medium-term budget planning in Ukraine is crucial for ensuring the stability and predictability of state financial policy. The COVID-19 pandemic and full-scale invasion have significantly complicated this process. Reinstating this planning in 2024 aligns with Ukraine’s commitment to international partners and represents an important step toward strengthening financial discipline and enhancing the predictability of state financial policy.

Despite the conditions of maximum uncertainty, three-year planning facilitates more efficient resource allocation and increases transparency in the budgetary process. Moreover, its outcomes will be beneficial post-stabilization of the economic situation and improvement of the investment climate in the country, which will be particularly relevant after active combat operations cease. Aligning Ukraine’s budgetary processes with international standards fosters trust from foreign investors and donors while affirming Ukraine’s aspirations for European integration.

However, there are risks that could affect the implementation of this forecast. Primarily, these include the security situation, unstable political conditions, economic challenges related to post-war reconstruction, and potential external economic and financial shocks. The government has likely attempted to account for these risks and incorporate their impact on key indicators in the Declaration. This is crucial for successfully implementing medium-term budget planning in Ukraine both now and in the future. Nevertheless, it is important to remain mindful of our starting point: maximum uncertainty persists, underscoring the need for readiness to adjust the budget in response to changes in the military and political situation, as well as potential risks.

This version maintains the original content and intent while slightly enhancing clarity and readability.

Authors: Yuliia Markuts, Lina Zadorozhnia, Taras Marshalok, Inna Studennikova, Dmytro Andriyenko, Tetiana Lutai, Liudmyla Mykhalyk, and Vladyslav Iyerusalymov

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations